What is Dental Compressors Market Size?

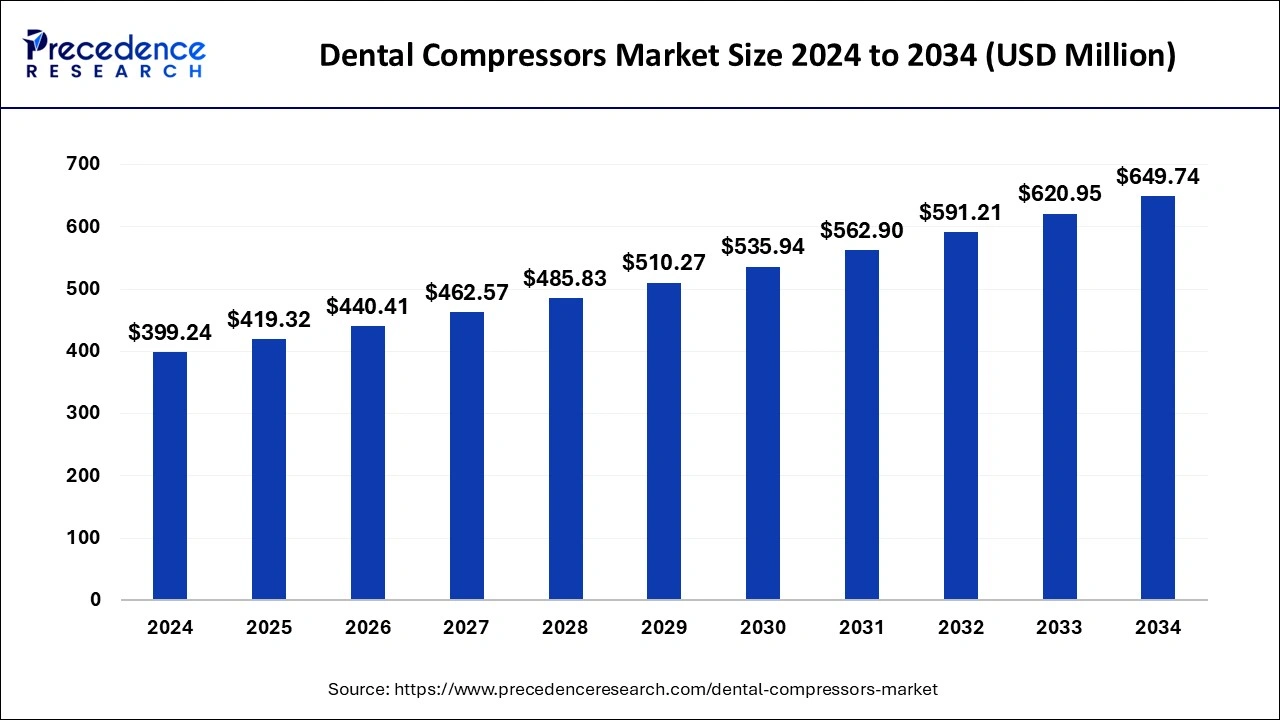

The global dental compressors market size is estimated at USD 419.32 million in 2025 and is predicted to increase from USD 440.41 million in 2026 to approximately USD 649.74 million by 2034, expanding at a CAGR of 4.99% from 2025 to 2034. The dental compressors market is driven by the global increase in the frequency of dental problems.

Market Highlights

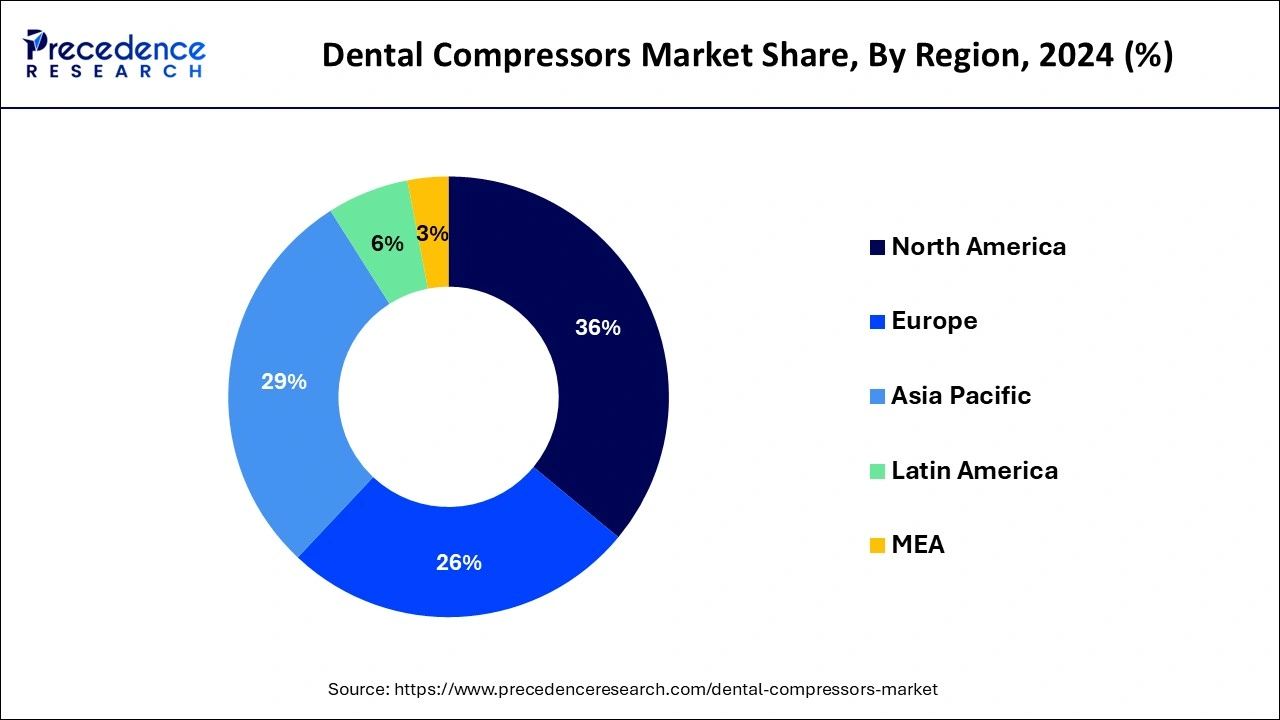

- North America dominated the market with the largest market share of 36% in 2024.

- Asia Pacific is expected to expand at a CAGR of 6% during the forecast period.

- By type, the dental oil-free compressors segment has captured more than 61% of market share in 2024.

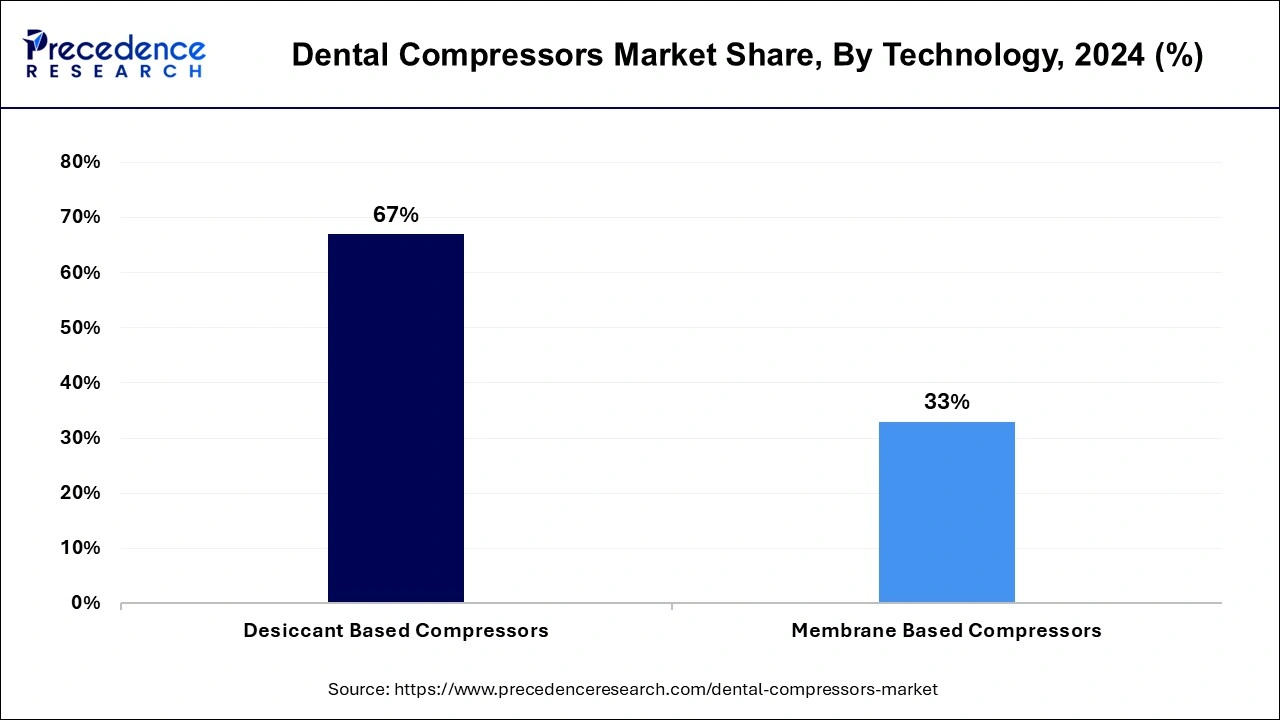

- By technology, the desiccant based compressors segment has held the biggest market share of 67% in 2024.

- By application, the hand pieces segment led the market with the highest market share of 51% in 2024.

Market Overview

An apparatus that raises ambient air pressure so that it is appropriate for use in dental operations is called a dental compressor. Since contamination can harm the equipment and the patient's health, these compressors are usually oil-free to guarantee the purity of the compressed air. Dental equipment requires a steady and dependable supply of compressed air, which dental compressors offer.

Any disruption to the air supply can cause dental procedures to be delayed, which will cause the patient and the dentist to be inconvenienced. A well-functioning dental compressor enhances dental practices' production and efficiency by reducing downtime and ensuring seamless equipment operation. This eliminates the need for equipment breakdowns to interfere with dentists' ability to provide high-quality care.

An estimated 2.5 billion people worldwide suffer from untreated dental caries, making it the most prevalent ailment worldwide. One billion people worldwide are thought to be afflicted with severe gum disease, which is a critical factor in complete tooth loss.

Dental Compressors Market Data and Statistics

- According to WHO, 514 million children worldwide suffer from primary tooth caries, whereas an estimated 2 billion adults worldwide suffer from caries of permanent teeth.

- Shocking data indicates that 66% of people in the UK have visible dental plaque. If dental plaque is not effectively eliminated by routine brushing and flossing, it can cause gum disease and tooth decay.

- Every year, the UK reports more than 8700 new instances of oral cancer. A key factor in good therapy and results is early identification.

- According to the studies conducted, there are around 3.5 billion oral health disorders worldwide. Even though they are mostly preventable, oral diseases impact people at all stages of life and can be fatal. They can cause pain, discomfort, deformity, and other health problems in many nations.

Dental Compressors Market Growth Factors

- More people require dental care due to unhealthy lifestyles and increased oral health knowledge.

- This trend favors sophisticated compressor technology because treatments require high-quality compressed air.

- The need for appropriate compressors will increase as new dental equipment and procedures that require compressed air to operate develop.

- More dental compressors are needed due to the increased number of hospitals and dental clinics worldwide.

- More individuals were visiting dentists regularly due to public health campaigns and a greater emphasis on preventative care, which increased the demand for dental equipment.

Dental Compressors MarketTrends

- Rising demand for oil-free systems

Dental clinics are moving toward oil-free compressors to maintain cleaner air and meet strict hygiene and safety standards. - Preference for compact and low-noise models

Small dental setups and mobile units favor quieter, space-saving compressors that enhance patient comfort and clinic efficiency. - Adoption of smart and connected technologies

Modern compressors feature IoT-enabled monitoring, predictive maintenance, and real-time diagnostics for improved performance and reliability. - Strong growth in emerging regions

Expanding dental infrastructure and growing awareness of oral health in Asia-Pacific and Latin America are driving market growth. - Focus on energy efficiency and sustainability

Manufacturers are introducing eco-friendly compressors that reduce power consumption and carbon emissions while lowering operational costs.

Market Outlook

- Industry Growth Overview: The dental compressors market is growing steadily because compressed air that is dry and clean is necessary for almost all dental operations. Demand is being driven by an increase in dental clinic openings, more treatments, and the modernization of outdated equipment. The market is currently dominated by North America, but the Asia Pacific is expanding at the fastest rate because of rising infrastructure development and awareness of oral healthcare.

- Sustainability Trends: Modern dental compressors prioritize patient comfort, energy efficiency, and hygiene. Oil-free designs lower the risk of contamination, and smaller, quieter units fit better in clinics and enhance patient satisfaction. Some of the more recent models have smart features like predictive maintenance and air quality monitoring, and they are also less maintenance-intensive and more energy efficient. In general, compressors are becoming safer, more intelligent, and more dependable.

- Global Expansion: The market is growing globally. With its high adoption of cutting-edge equipment and stringent hygiene regulations, North America is at the forefront. With the opening of new clinics and the modernization of outdated equipment. Asia Pacific and other developing regions are experiencing rapid growth. Global demand for modern compressors is being driven by investments in clinic infrastructure as well as legal requirements for safe and clean air.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 419.32 Million |

| Market Size in 2026 | USD 440.41 Million |

| Market Size by 2034 | USD 649.74 Million |

| Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Technology, and By Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological breakthroughs

Significant technological breakthroughs have led to the development of more advanced dental instruments and equipment in dentistry. Dental practitioners strongly value modern dental compressors because of their sophisticated characteristics, which include energy economy, oil-free operation, and noise reduction. These developments raise the dental care standard and increase dental offices' general effectiveness.

Modern dental compressors are equipped with smart control and monitoring features, such as touchscreen interfaces, digital displays, and remote monitoring capabilities. Dentists and dental staff can easily monitor compressor performance, adjust settings, and troubleshoot issues in real-time using intuitive control panels or smartphone applications.

Presence of co-operative government policies

Dental compressors are required by law to adhere to strict quality and safety requirements. Clear criteria for the manufacture, installation, and operation of dental compressors are established through cooperative policies between government authorities and industry stakeholders. Following these rules guarantees dental equipment's dependability and security, boosting consumer confidence and promoting market expansion.

Restraint

High initial investment

The cost of purchasing and installing dental compressors can be significant for dental practices, particularly for smaller clinics or newly established practices. The initial investment required for high-quality compressors, along with installation and maintenance costs, may deter some dental practitioners from upgrading or investing in new compressor systems. In some regions, reimbursement policies may not cover the full cost of dental compressor purchases or upgrades. This limitation can pose a financial barrier for dental practices, especially in areas with limited access to dental insurance or government healthcare funding. As a result, some dental clinics may opt for lower-cost alternatives or delay investments in compressor technology.

Opportunity

Increased focus on infection control

Infection control procedures aim to stop diseases from spreading amongst dental personnel, patients, and the surrounding area. Dental compressors with cutting-edge filtration systems may efficiently eliminate impurities, moisture, and microbes from compressed air, lowering the possibility of cross-contamination during treatments. Dental practices may experience long-term cost benefits when they make the initial financial investment in high-quality dental compressors. Reliable compressors with effective filtering systems need less maintenance and are less likely to break down, which lowers downtime and related expenses. Additionally, practices can save money on additional patient care and liability costs by reducing infections and complications.

Segment Insights

Type Insights

The dental oil-free compressors segment dominated the dental compressors market in 2024. The chances of oil contamination in the compressed air stream is removed with oil-free compressors. Since air quality directly affects patient health, dental practices must maintain a clean and sterile atmosphere. It reduces the possibility of oil seeping into dental instruments, shielding patients from potential injury and preserving a clean working environment. In addition, it usually requires less maintenance than its competitors, which are lubricated with oil.

Dental professionals can save time and money by not having to make oil changes, filter replacements, and other maintenance procedures linked with oil-based systems. Small to medium-sized dental practices trying to reduce downtime and streamline operations will find this feature especially intriguing.

Technology Insights

The desiccant based compressors segment dominated the dental compressors market in 2024. Compressors based on desiccant perform exceptionally well at controlling moisture, which is crucial in dentistry applications where dry, oil-free air is necessary. Moisture can encourage the growth of microorganisms and damage dental supplies and equipment. Systems based on desiccant efficiently extract moisture from compressed air, guaranteeing a dry and hygienic supply for dental operations. Noise levels are critical in dentistry settings because they affect patient comfort and the ability of practitioners to concentrate.

Because desiccant-based compressors operate more quietly than conventional oil-lubricated compressors, they are a popular option for dental offices where preserving a serene and comfortable atmosphere is essential.

The membrane-based compressors segment is anticipated to grow in the dental compressors market during the forecast period. In the dentistry field, keeping the atmosphere sanitary is crucial. They provide a hygienic alternative because membrane-based compressors don't need lubricants, which could contaminate the compressed air. They are, therefore, a good fit for dental applications where infection prevention and hygiene are essential. Dental clinics seek equipment that meets or surpasses increasingly strict regulatory criteria in the healthcare sector. Membrane-based compressors are a solution that fits in with the changing regulatory landscape because of their hygienic design and regulatory compliance.

Application Insights

The hand pieces segment dominated the dental compressors market in 2024. As dental professionals are changing demands and preferences, manufacturers in the dental compressor market have expanded the range of products they provide. This includes introducing different handpiece types suited to procedures and applications, including electric, air-driven, low-speed, and high-speed variants. By offering a complete range of handpiece alternatives, manufacturers can efficiently grab a greater market share and meet the different expectations of dental practitioners worldwide.

The chair valves segment is anticipated to expand in the dental compressors market during the forecast period. The demand for dental procedures has steadily risen due to the development of oral health issues and tooth difficulties worldwide. Consequently, hospitals and dental clinics are expanding and modernizing equipment, such as dental compressors. Chair valves are in high demand because they are essential to efficiently operating dental chairs during various dental operations. During dental treatments, modern dental chairs are made with the comfort and safety of the patient in mind.

Chair valves are essential for regulating the movement and posture of the dental chair and guaranteeing the best possible comfort for the patient. The demand for dependable and effective chair valves is anticipated to increase as dental clinics emphasize improving patient experience and safety.

Regional Insights

U.S.Dental Compressors Market Size and Growth 2025 to 2034

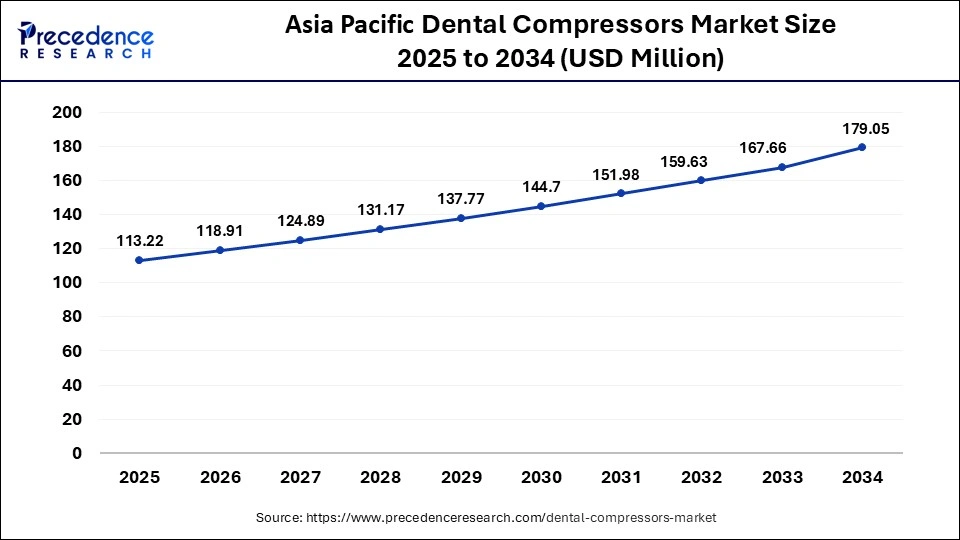

The U.S. dental compressors market size surpassed USD 113.22 million in 2025 and is expected to be worth around USD 179.05 million by 2034 at a CAGR of 5.21% from 2025 to 2034.

North America had the largest market share in 2024 in the dental compressors market and is observed to sustain throughout the predicted timeframe. Every year, many dental procedures are performed in the area, ranging from simple checkups to intricate surgery. The need for dental compressors is driven by the aging population's increased awareness of dental health and its ongoing need for dental treatments. In North America, people's understanding of dental health's significance has steadily grown. Compressors are among the equipment and dental facilities that are receiving more substantial investments due to the societal trend towards prioritizing dental care.

- In February 2024, Kilifi County and the United States collaborated to provide necessary dental care materials. The Kilifi County Health Administration in Kenya received USD 23,600 in dental supplies and equipment from US military personnel to help local healthcare practitioners better serve the community's dental needs.

Asia-Pacific is observed to be the fastest growing dental compressors market during the forecast period. In response to the increasing need for qualified dental practitioners in this area, dental education and training programs are being expanded. The establishment of dental clinics and practices rises with the number of dental schools, colleges, and training facilities. The market is growing because these new facilities need dental compressors to run necessary dental equipment.

Many countries in Asia Pacific are investing heavily in healthcare infrastructure development to meet the growing demand for dental services. This includes the construction of new dental clinics, hospitals, and specialty dental centers equipped with modern dental equipment and technology, including dental compressors.

Value Chain Analysis

- R&D This stage involves designing efficient, oil-free, low-noise compressors suitable for dental clinics. Companies like Kaeser Dental and Dürr Dental focus on improving energy efficiency, durability, and compact designs. R&D also explores smart monitoring features and quieter operation for better clinic usability.

- Clinical Trials & Regulatory Approvals Dental compressors must meet medical and safety standards, including ISO and regional healthcare regulations. Key players like Midmark and Air Techniques ensure products undergo rigorous testing, certification, and compliance verification before reaching the market.

- Customer Support & Services After installation, services include preventive maintenance, filter and dryer replacement, efficiency upgrades, and technical support. Dürr Dental, Gnatus, and Kaeser Dental provide training, maintenance contracts, and upgrades to ensure long-term reliability and compliance with dental clinic requirements.

Dental Compressors Market Companies

- Midmark Corporation

- Gnatus

- Air Techniques

- Aixin Medical Equipment Co, Ltd.

- Kaeser Dental

- Quincy Compressors

- General Air Products, Inc.

- Durr Dental

- Slovadent, Dental EZ Group

Recent Developments

- In February 2024, EKOM showcased new oil‑free dental compressors (models DK50‑10/M, DK50 4VR/M) featuring advanced adsorption dryers at the AEEDC Dubai 2024. These models are designed for one dental unit or labs and emphasise hygienic, modular construction with very low noise levels.

- In 2024,Atlas Copco launched its LFxD series dental air compressors certified Class 0 (100% oil‑free), targeting small dental practices. The LFxD units offer a compact footprint (1.02–2.53 l/s), dew point as low as ‑35 °C, and noise levels between 53‑65 dB(A), making them suitable for compact clinical settings.

Segments Covered in the Report

By Type

- Dental Lubricated Compressors

- Dental Oil-Free Compressors

By Technology

- Desiccant Based Compressors

- Membrane Based Compressors

By Application

- Hand Pieces

- Scalers

- Chair Valves

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting