What is the Dental Insurance Market Size?

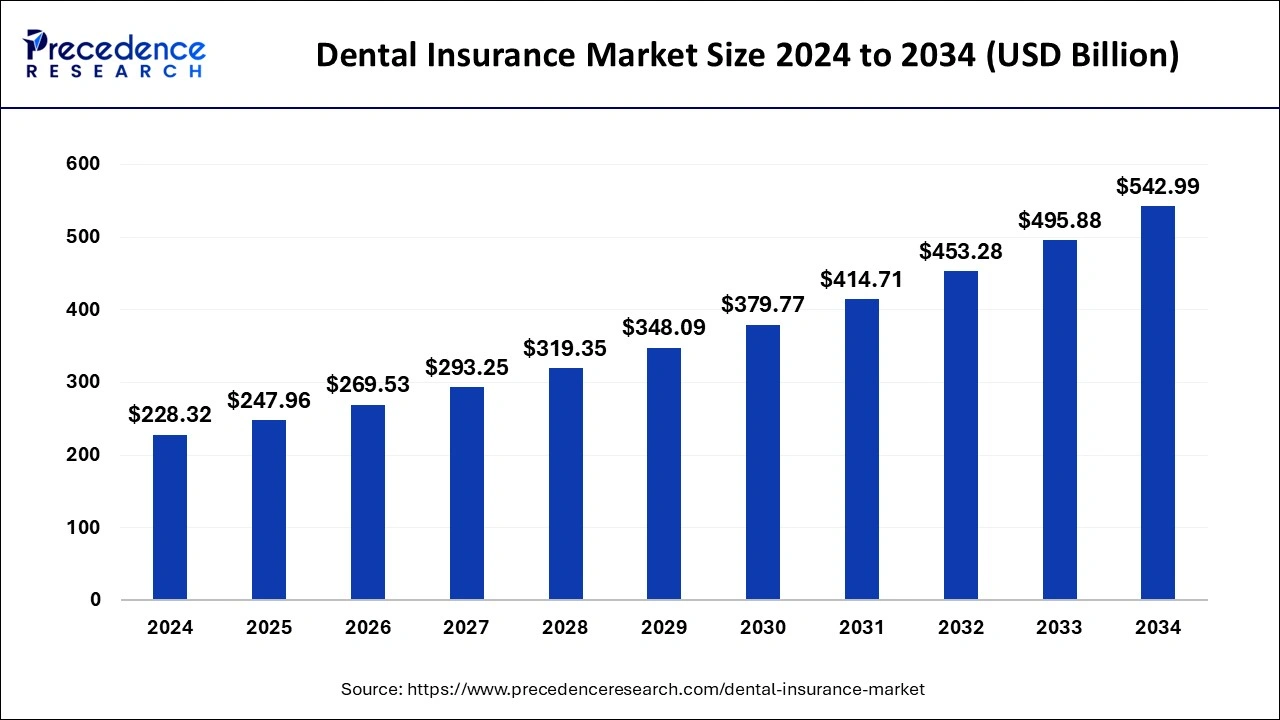

The global dental insurance market size accounted for USD 247.96 billion in 2025 and is expected to exceed around USD 542.99 billion by 2034, growing at a CAGR of 9.10% from 2025 to 2034. The growth of the dental insurance market is majorly driven by the increasing offerings of customized insurance plans by insurance companies, rising awareness regarding dental insurance, and rising incidence of various oral disorders like tooth decay, oral cancer, gingivitis, broken teeth, and others.

Market Highlights

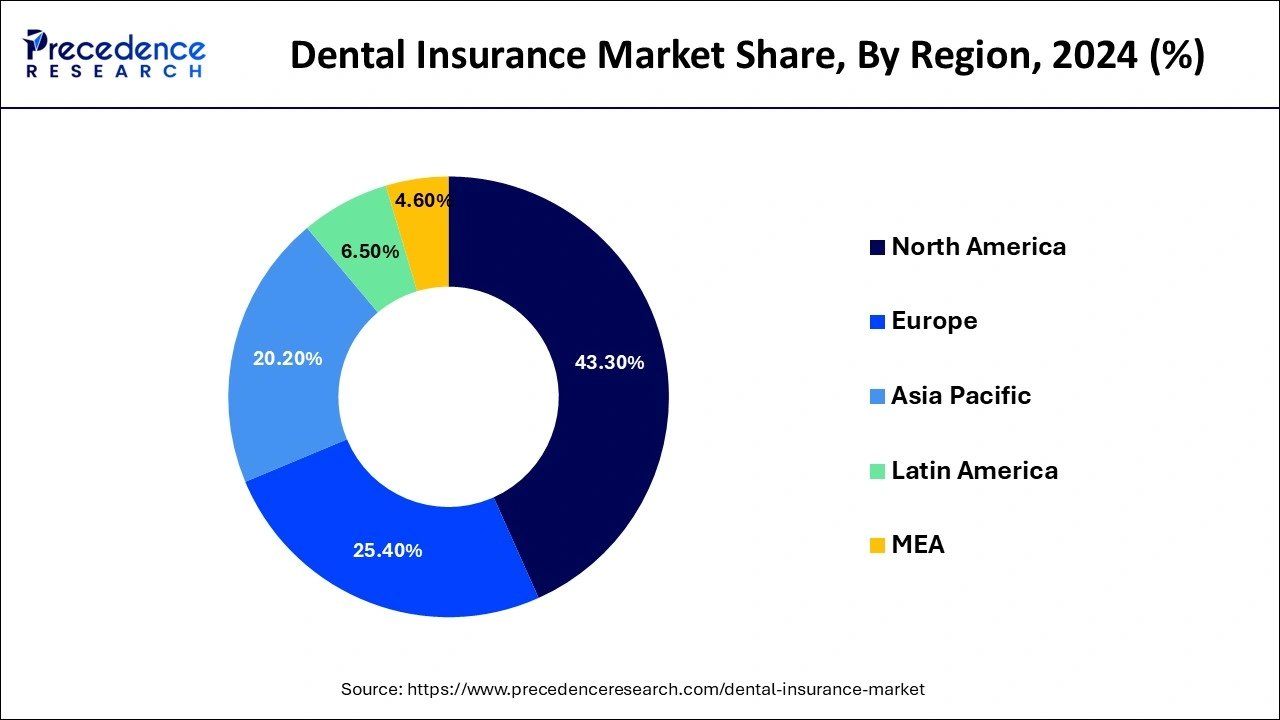

- North America held the dominant share of the minimally invasive surgical instruments market in 2024.

- Asia Pacific is observed to expand rapidly during the forecast period.

- By coverage, the dental preferred provider organizations (DPPO) segment accounted for the dominating share in 2024.

- By coverage, the dental health maintenance organizations (DHMO) segment accounted for considerable growth in the global minimally invasive surgical instruments market over the forecast period.

- By demographics, the senior citizens segment led the market in 2024.

- By type, the preventive segment accounted for the highest market share in 2024 and is anticipated to grow at a robust CAGR over the forecast period.

- By type, the basic plan segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 247.96 Billion

- Market Size in 2026: USD 269.53 Billion

- Forecasted Market Size by 2034: USD 542.99 Billion

- CAGR (2025-2034): 9.10%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Dental insurance is a health care policy that provides reimbursement for dental care and the expenditures incurred on the treatment. The reimbursement is provided by the payment of monthly premiums, partial payments or complete coverage against any of the dental procedures. It extensively covers root canals, fillings, preventative care, tooth extractions or even oral surgeries. Dental insurance policy helps paying for the unexpected dental emergencies. There are indemnity plans and direct reimbursement plans that come under the dental insurance.

Dental insurance is also called as a dental plan. It is a type of health insurance which are designed to take care of the dental health. Various types of insurances are provided like group dental insurance, family dental insurance and individual dental insurance. Due to the pandemic, there was a decline in the growth of this market there was a direct impact due to social distancing restrictions. Lockdown also impacted the movement of consumers and disrupted the businesses worldwide. The utilization of dental oral exams, cleanings, services that needed urgent X-rays had all been postponed due to the coronavirus outbreak.

How Artificial Intelligence (AI) integration is impacting the growth of the dental insurance market?

Artificial Intelligence (AI) integration has revolutionized the dental insurance sector. The crucial role of AI in supporting dental insurance and positively the landscape of dental care in the coming years. The AI in dental insurance processes has brought several remarkable improvements. Artificial Intelligence (AI) integration into dental insurance processes has resulted in several benefits including accurately automating dental insurance verification, impacting the workflow of dental insurance, and enabling real-time utilization. The utilization of AI in dental insurance has empowered insurers to explore new avenues and develop more advanced dental insurance plans, benefitting both policyholders and insurers. Artificial Intelligence (AI) tools assist in empowering brokers to deliver advanced dental plans that reduce costs for clients, ensure early detection and prevention, and enhance long-term retention. AI is shaping the future of dental insurance and is characterized by real-time data insights, scalability, and rising adoption of AI within dental insurance plans.

- In June 2024, Pearl, the global leader in dental AI solutions, announced the launch of Precheck, a groundbreaking new artificial intelligence (AI)-powered insurance eligibility and benefits verification tool. Leveraging natural language processing (NLP) to seamlessly compile and synthesize patient insurance data, Precheck™ streamlines the insurance verification process and provides dental practices and their patients with comprehensive coverage information.

Dental Insurance Market Growth Factors

- The rising investment in establishing sophisticated infrastructure in developing economies is positively influencing the market's growth during the forecast period.

- The rising awareness regarding oral hygiene has resulted in increasing demand for dental insurance, promoting the market's growth in the coming years.

- The rising implementation of advanced technologies in the dental insurance industry that helps in the seamless, clean process and avoids manual claim settlements, is expected to contribute to the overall expansion of the market in the coming years.

- The rising disposal income along with the increasing incidence of oral diseases such as gingivitis, oral cancer, tooth decay, and others, significantly increased the adoption of these insurance policies to cover oral-related treatments.

- The rising offerings of customized insurance plans and increasing accessibility of quality services in several developing and developed countries are anticipated to accelerate the growth of the dental insurance market.

- The rising collaboration of insurance companies and healthcare providers is projected to create immense growth opportunities for the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 247.96 Billion |

| Market Size in 2026 | USD 269.53 Billion |

| Market Size in 2034 | USD 542.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Dominating Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period2025 to 2034 | 2025 to 2034 |

| Segments Covered | Coverage, Procedure, Demographics, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for dental insurance

The rising demand for dental insurance is expected to accelerate the growth of the dental insurance market. Dental diseases are a major public health burden around the world causing several health issues such as causing pain, discomfort, disfigurement, and others. Dental insurance offers coverage protection for dental treatments for various oral disorders such as tooth decay, oral cancer, gingivitis, broken teeth, and others. For instance, ccording the WHO, It is estimated that oral diseases affect nearly 3.5 billion people. A dental insurance policy pays a portion of the costs associated with dental treatment and preventive dental care. It assists in paying for unexpected expensive dental emergencies. Over the years, Developing and developed economies have become increasingly concerned regarding oral health has led to an increasing demand for dental care. Therefore, the increasing importance of oral care and oral care products is anticipated to boost the growth of the market.

Restraint

High cost

The high cost associated with the insurance premiums is anticipated to hamper the growth of the market. In addition, several middle- and lower-income countries lack suitable healthcare infrastructure and lack dental insurance awareness may restrict the expansion of the global dental insurance market during the forecast period.

Opportunity

Rising government initiatives and policies

The increasing Government initiatives and policies to boost the growth of the dental insurance industry, are projected to offer lucrative growth opportunities to the minimally invasive surgical instruments market. Several governments around the world support dental insurance companies by protecting dental insurers and formalizing dental care services in both developed and developing nations. Government support has helped insurers to avail of dental insurance coverages with more alternatives and customized options in the market. For instance, The Indian government has launched a scheme 'Ayushman Bharat', an initiative that covers dental insurance and intends to offer dental services in the country. Such factors are fuelling the expansion of the dental insurance market in the coming years.

- In November 2024, the Canadian Government unveiled The Canadian Dental Care Plan (CDCP) intended to reduce financial barriers to oral health care for Canadians without a dental plan. It is applicable for seniors aged 65 and over, children under the age of 18, and adults with a valid federal Disability Tax Credit certificate for 2024. The program will provide a dental care subsidy for Canadian residents who do not have dental benefits and have an adjusted household income of less than $90,000 a year.

Segments Insights

Coverage Insights

In terms of the coverage, the dental preferred provider organization segment had the largest market share in the year 2022 and is expected to dominate the market during the forecast. It provides financial incentives for the DPPO members to stay in the network, and it is therefore expected to grow during the forecast. That DPPO segment provides the option to the customers to consult any licensed dentist or specialist. In the indemnity dental plans a percentage of the cost of services is paid to the dentist. In the dental health maintenance organization plans there are little or no waiting periods. While covering the major dental work the deep treatment is expected to hold the largest market share because it is cost effective and easy to use.

Procedure Insights

On the basis of the procedure, the dental insurance market can be segmented into preventive, major and basic. The preventive segment is dominated the market with largest revenue share in 2022. The basic procedure segment is expected to have the highest CAGR during the forecast. The various procedures lead dental insurance market. Teeth removal, treatment of the infected nerves, dental surgeries and removal of minor or major oral infections are leading to an adoption of dental insurance, which is expected to help in the market growth.

The basic procedural segment is anticipated to reach U.S. dollars 92 billion by 2023. The preventive segment has dominated the dental insurance market and is expected to maintain the dominance during the forecast period as it helps in providing 100% insurance coverage to the customers.

End User Insights

Due to growing adoption, dental insurance by companies that they provide to their employees, the enterprises segment is expected to grow during the forecast. Apart from enterprises, the individual segment is also expected to have a growth good growth rate During the forecast.

Demographics Insights

On the basis of demographics, the market can be segmented into minors, adults, and senior citizens. The minor segment is expected to have the fastest growth due to the prevalent dental issues in the minors. The adult segment is also expected to grow due to the rising awareness regarding dental insurance amongst them.

Regional Insights

U.S. Dental Insurance Market Size and Growth 2025 to 2034

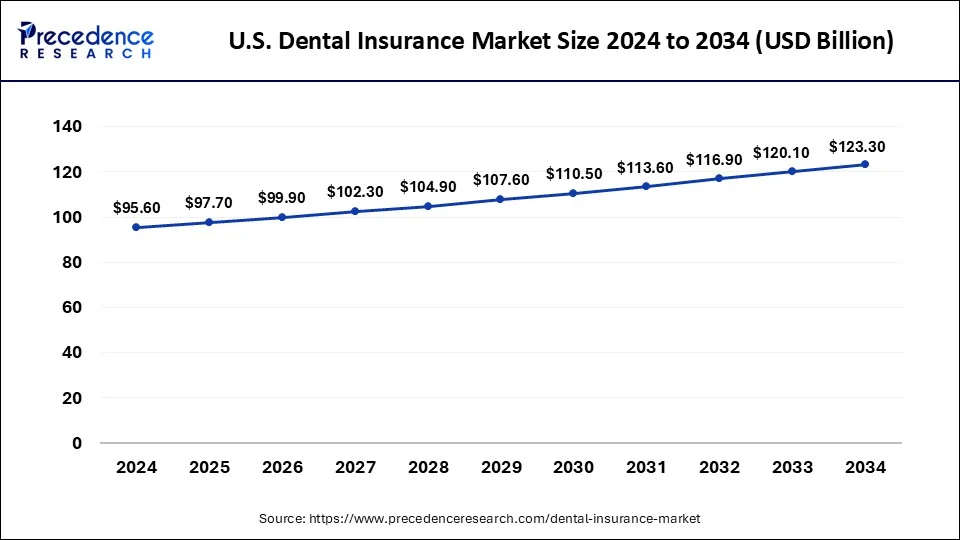

The U.S. dental insurance market size was exhibited at USD 97.7 billion in 2024 and is projected to be worth around USD 123.3 billion by 2034, growing at a CAGR of 2.62% from 2025 to 2034.

Based on the region, the North American market had the largest market share of 42% during therevent years due to adoption of dental insurance in this region. The second largest market share was held by the European region due to an awareness regarding the dental insuranceand the adoption of the same by thepeople in this region.

The AsiaPacific region is also expected to have significant growth due to an increased awareness regarding the same in the people. Due to an increased disposable incomewith the rise in awareness towards oral hygiene and health,security standardsof the dental insurersand the developments and advancements of medicines for the treatments ofthe teeth. There's a convergence of dental insurance coverages in the healthinsurance. According to the Centers for Disease Control and Preventionabout 50.2% of the adults in United Stateshave dental care coverage with their health insurance.

Dental Insurance MarketCompanies

- Delta Dental

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions, LLC

- United HealthCare Services, Inc.

- Aetna Inc.

- AFLAC INCORPORATED

- Allianz

- Ameritas

- AXA

- Cigna

Recent Developments

- In December 2024, DoseSpot expanded its offerings into the dental sector with pVerify for Dental, a software solution designed to streamline insurance eligibility verification for dental practices. This software allows dental professionals to instantly access patient insurance details. The system provides a customized overview of coverage rather than generic plan benefits. The software integrates with existing patient management systems and taps into a vast network of over 1,500 payers, including both medical and dental insurance providers, to quickly determine if specific treatments are covered.

- In December 2024, To improve the oral health of aging populations, the Delta Dental Community Care Foundation, the philanthropic arm of Delta Dental of California and affiliates, has awarded another year of funding to the Emory School of Nursing to recruit more students who are focused on medical-dental integration and to expand and evaluate the Oral Health in Communities and Neighborhoods (OH-I-CAN) smartphone application. The OH-I-CAN app provides an accessible way for health care providers to screen for oral health issues and assess the oral health-related quality of life, says Bussenius, who is principal investigator (PI) of the grant.

Segments Covered in the Report

By Coverage

- Dental Preferred Provider Organizations (DPPO)

- Dental Health Maintenance Organizations (DHMO)

- Dental Indemnity Plans

- Others

By Procedure

- Major

- Basic

- Preventive

By Demographics

- Senior Citizens

- Adults

- Minors

By End User

- Individuals

- Corporates

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting