Dental Flap Surgery Market Size and Growth 2025 to 2034

The global dental flap surgery market size was estimated at USD 5.98 billion in 2024 and is predicted to increase from USD 6.41 billion in 2025 to approximately USD 11.95 billion by 2034, expanding at a CAGR of 7.17% from 2025 to 2034. The factors that drive the industry growth include a rise in the prevalence of periodontitis disease globally and a rise in demand for triangular flap surgery.

Dental Flap Surgery Market Key Takeaways

- The global dental flap surgery market was valued at USD 5.98 billion in 2024.

- It is projected to reach USD 11.95 billion by 2034.

- The dental flap surgery market is expected to grow at a CAGR of 7.17% from 2025 to 2034.

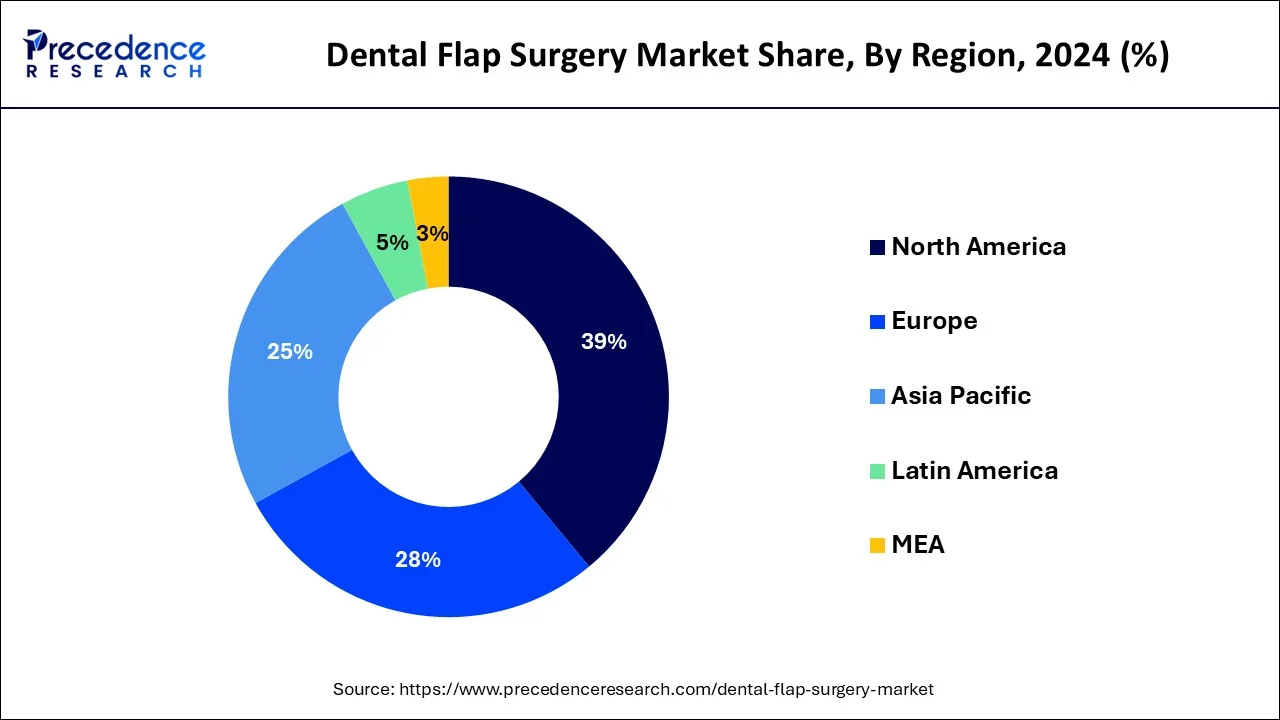

- North America led the market with the largest market share of 39% in 2024.

- Asia Pacific is poised to experience the fastest growth from 2025 to 2034.

- By surgery type, the triangular flap segment has contributed more than 29% of market share in 2024.

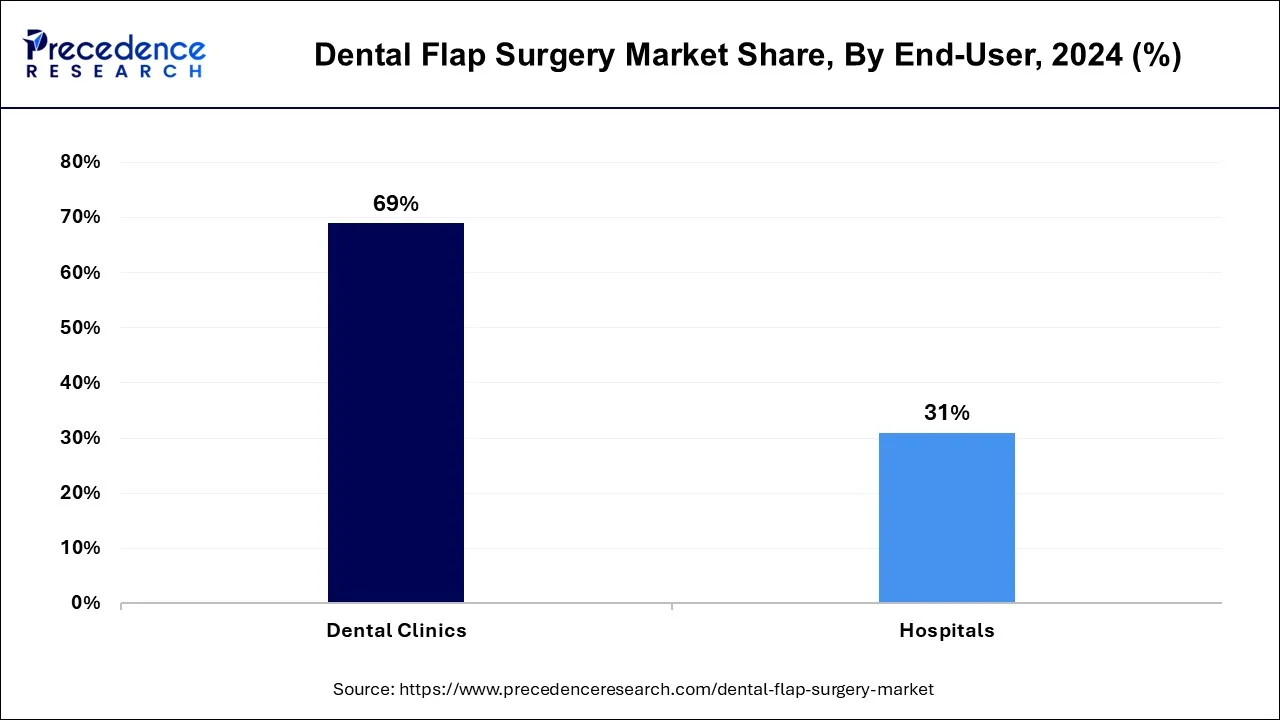

- By end use, the dental clinic segment dominated the market with the major market share of 69% in 2024.

- By end use, the hospital segment is growing at a significant rate over the forecast period.

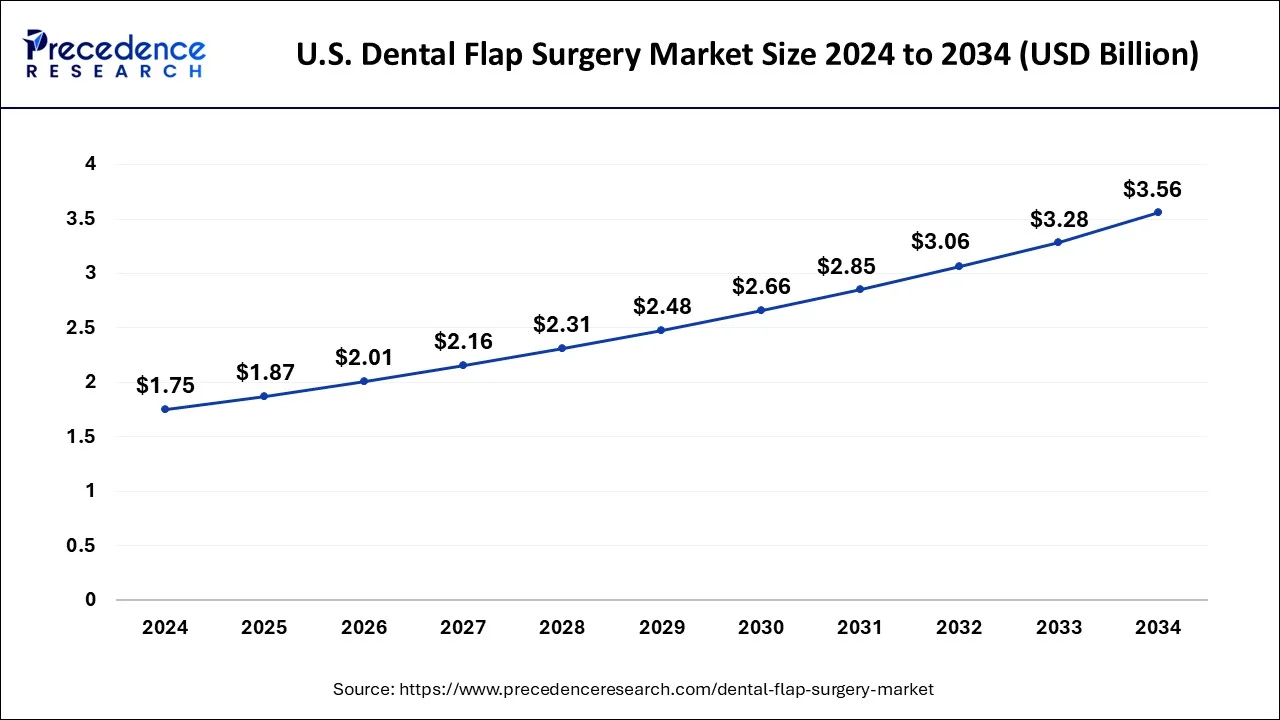

U.S.Dental Flap Surgery Market Size and Growth 2025 to 2034

The U.S. dental flap surgery market size reached USD 1.75 billion in 2024 and is expected to be worth around USD 3.56 billion by 2034 at a CAGR of 7.36% from 2025 to 2034.

North America dominated the dental flap surgery market in 2024.The region benefits from a well-equipped and advanced healthcare infrastructure, which fosters the growth of the dental flap surgery market. Additionally, factors such as emphasis on preventive oral care and hygiene, the presence of private dental clinics, and rising research and development efforts in dentistry are expected to drive market growth. Government funding for dental treatment plans is also anticipated to support industry expansion. The growing demand for routine dental care, especially among the elderly population worldwide, is a key driver of market growth.

- In February 2024, Nexa3D, the ultrafast 3D printing leader, announced ahead of Lab Day Chicago the addition of two new dental partners in North America - CAD-Ray and Harris Discount Dental Supply. Nexa is also introducing three new resins from dental industry juggernaut Pac-Dent, Inc., enabling validated workflows for new surgical and restorative applications for labs and practices using Nexa3D's XiP desktop printer, powered by LSPc™ technology.

Asia Pacific (APAC) is poised to experience the fastest growth from 2025 to 2034 due to several factors. These include an increase in the number of dental clinics, a rise in dental tourism, and greater awareness among patients about oral hygiene. Moreover, the high prevalence of periodontitis disease, the growing number of dental procedures, and increasing public awareness about dental surgeries contribute to this growth. Most dental clinics in APAC are privately owned, and the healthcare infrastructure in the region is expanding with advanced equipment and technology. Various dental companies and countries like India and China are launching awareness programs to promote dental care.

- In March 2024, Colgate released Optic White Purple Toothpaste in APAC Markets. This beauty hack instantly color-corrects yellow tones with purple brighteners, per the company.

The dental market in China is experiencing growth due to several factors. These include an increase in the number of dental procedures and a surge in public awareness about dental surgeries. Various dental companies in China are also implementing awareness programs to promote dental care. Most dental clinics in China are privately owned, and the healthcare infrastructure in the country is advancing with the introduction of advanced equipment and technology. As a result, the dental flap surgery market in China is expanding.

Market Overview

Dental flap surgery, which is also called periodontal flap surgery or periodontal pocket reduction surgery, is a dental treatment used for treating severe gum disease. The demand for periodontal procedures could increase in developed countries where the population is aging. The dimensions of the dental flap surgery market rely on several facets, including the overall healthcare infrastructure, access to dental care, and the prevalence of gum disease. Dental product and equipment manufacturers may also provide the necessary tools for these procedures. The competition in this market is likely to be intense, with dental professionals and oral surgeons offering these services.

Dental Flap Surgery Market Growth Factors

- Dental tourism is witnessing a rise in developing economies, which can fuel the growth of the dental flap surgery market.

- Rise in awareness about oral health can further boost the dental flap surgery market over the forecast period.

- Technological advancements in dental surgeries are propelling the growth of the dental flap surgery market.

- The number of patients suffering from periodontitis is increasing, which can contribute to market expansion further.

- Increasing gum-related diseases are also driving the dental flap surgery market growth shortly.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.17% |

| Market Size in 2025 | USD 6.41 Billion |

| Market Size by 2034 | USD 11.95 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Surgery Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increase in gum-related problems

The rise in gum-related issues is driving the demand for the dental flap surgery market. Many individuals experience gum problems at some point in their lives, which can lead to increased opportunities for dental flap surgery. The necessity for these surgeries has grown due to conditions like periodontitis. Periodontal pockets, which are bacterial-infected spaces below the gum line resulting from detached gum tissue, provide breeding grounds for bacteria. Dental flap surgery involves separating the infected gum tissue from the teeth and folding it back. This allows for the removal of tartar and disease-causing bacteria before suturing the gums back in place, ensuring a snug fit around the teeth. These surgeries are typically conducted under local anesthesia.

- In May 2023, Bausch Health Companies Inc. and its oral healthcare business, OraPharma, announced its collaboration with World Series Champion Alex Rodriguez to launch a national awareness campaign about the prevalence and impact of gum disease. The campaign launch is timed to Oral Health Month, recognized throughout June, and features Alex as a patient ambassador.

Restraint: High cost

The high cost of dental treatments and surgeries poses a significant challenge for the dental flap surgery market. Additionally, many health insurance plans do not cover dental issues, further complicating matters. This lack of coverage creates barriers to the growth of the dental flap surgery market. Limited awareness in underdeveloped regions is impeding market expansion. However, there are some drawbacks to this surgery, including the vertical incision that penetrates the alveolar mucosa, the severing of gingival attachment, and the creation of tension.

Opportunity

Innovation in the dentistry field

Advancements in dentistry are revealing connections between oral health issues and medical conditions like diabetes, certain cancers, heart disease, and rheumatoid arthritis. As a result, dental and medical professionals are collaborating more closely to ensure optimal care, especially for patients with medical complications. Technological advancements worldwide are creating lucrative opportunities for market players in the forecast period. Furthermore, emerging technologies are being increasingly integrated into dentistry, making the industry more patient-focused and building greater trust among patients. This trend is expected to accelerate the dental flap surgery market growth rate soon.

- In January 2024, DBridge India Pvt. Ltd., a subsidiary of South Korea's Dental Bridge Co. Ltd., launched their platform “Doctorbridge” in India to link medical device manufacturers with end-users, especially doctors. Their unique strategy involves establishing a robust online ecosystem and prioritizing continuous clinical education and knowledge exchange among doctors on a global scale.

Surgery Type Insights

The triangular flap segment dominated the dental flap surgery market in 2024 and is anticipated to maintain its dominant position over the forecast period. Triangular flap surgery is beneficial for repairing mid-root perforations and performing periapical surgery on short roots and mandibular posterior teeth. It's considered a traditional method because it avoids lifting soft tissue from the buccal aspect of the second molar.

Increased patient awareness and the growing demand for dental surgical procedures for periodontal disease contribute to the growth of this technique. Triangular flap surgery is seen as conservative because it involves minimal tissue reflection. Its main advantages include no papilla retraction, no gingival recession, and minimal scarring.

- In November 2023, ICPA Health, a Mumbai-based pharmaceutical company in the oral healthcare sector, unveiled its latest innovation- Plakoff, a premium electric water flosser. The instrument, designed as a handheld oral care device, Plakoff utilizes a powerful jet of water to effectively cleanse the interdental space between teeth and gums.

End-user Insights

The dental clinic segment dominated the dental flap surgery market in 2024. This can be attributed to a rise in the number of dental flap surgeries performed in clinics, which fuels the segment growth. However, dental clinics give greater emphasis on advanced modes of treatment, which are then estimated to cut costs and raise the adoption of dental services across the globe. Dental clinics also focus more on patient counseling to prevent oral disorders and offer better treatment options for gum disease.

- In April 2024, SEO Dentals, an upscale dental marketing company in the U.S., announced the launch of its AI platform for patient acquisition, retention, and practice expansion. The acclaimed dental marketing company has been operating for many years now and supports more than 1,600 dental practices in the country. The company is also on a mission to help dentists expand their patient base with AI-backed solutions.

The hospital segment hais expected to grow at a significant rate over the forecast period. Dental hospitals play a vital role in providing comprehensive dental care, combining clinical services, teaching, and research crucial for the advancement of dental healthcare. These hospitals are commonly affiliated with larger healthcare institutions and dental schools, offering a wide range of services from preventive care to advanced procedures. Along with regular visits to hospitals, there are additional measures we can take to uphold good oral hygiene. By adhering to these practices, we can safeguard your teeth and gums, ensuring a healthy smile.

Dental Flap Surgery Market Companies

- Aspen Dental Management, Inc.

- Apollo White Dental

- Coast Dental

- Dr. Joy Dental Clinic

- Smiles by Dr. Santos, LLC

- Axis Dental

- Great Expressions Dental Centers

- HM Hospital Madrid

- Humanitas Hospital

- Partha Dental Clinics

Recent Developments

- In November 2023, Keystone Dental Holdings announced today the market launch of Nexus Connect, a unique software system that utilizes proprietary technology and a machine-learning model to analyze implant scans performed with an intraoral scanner.

- In Jun 2022, Orthocell Ltd soared on inking a globally exclusive licensing and manufacturing agreement with Bio Horizons Implant Systems Inc. for the supply of Striate+, a resorbable collagen membrane used for dental-guided bone and tissue regeneration procedures.

- In Jun 2022, Medicover signed an agreement to acquire 100% of the business of MeinDentist and enter the German dental market. The acquisition is subject to customary merger control and regulatory approvals and is expected to be consolidated.

Segments Covered in the Report

By Surgery Type

- Triangular Flap

- Rectangular Flap

- Envelope Flap

- Submarginal Flap

- Others

By End-user

- Hospitals

- Dental Clinics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting