What is the Dental Microsurgery Market Size?

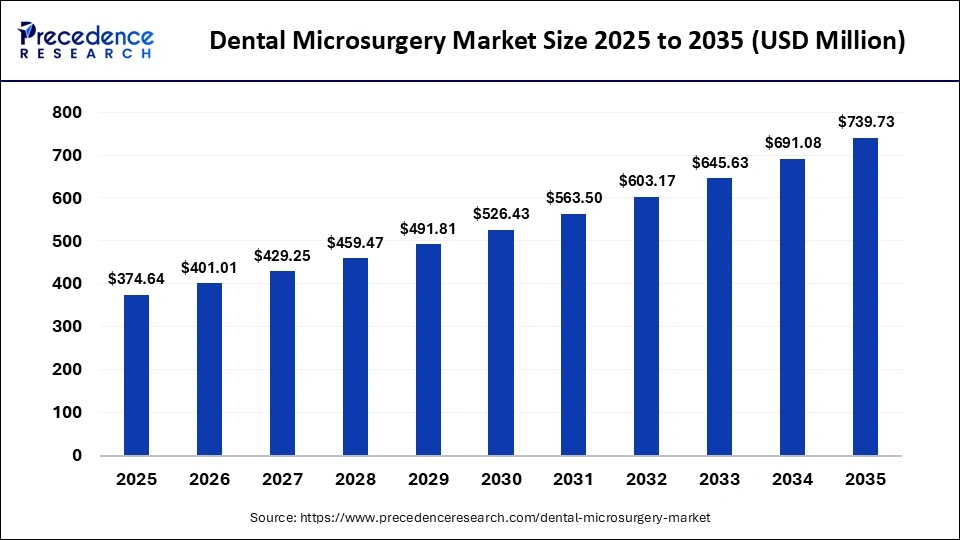

The global dental microsurgery market size accounted for USD 374.64 million in 2025 and is predicted to increase from USD 401.01 million in 2026 to approximately USD 739.73 million by 2035, expanding at a CAGR of 7.04% from 2026 to 2035. The dental microsurgery market is driven by rising preference for minimally invasive treatments, improved visualization technologies, and increasing adoption of precision-based procedures across advanced dental practices.

Market Highlights

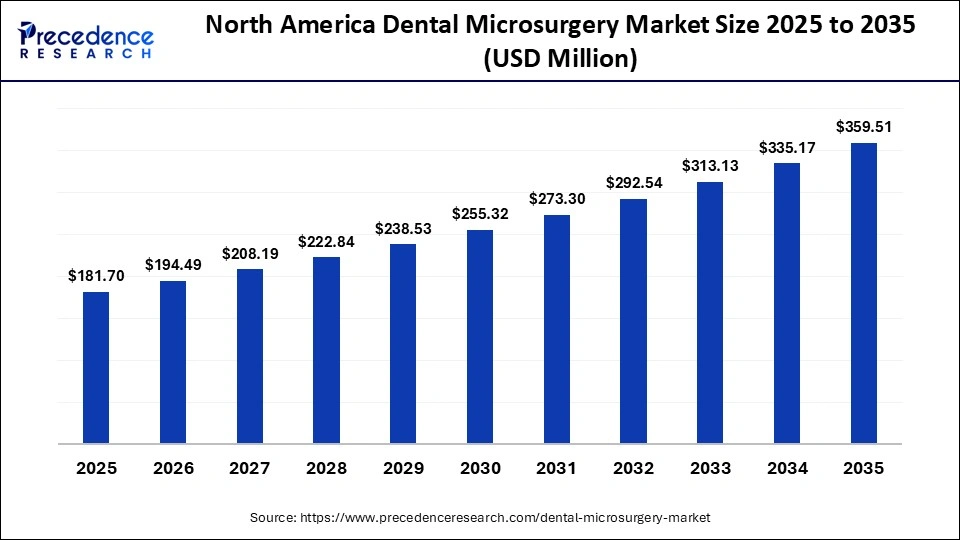

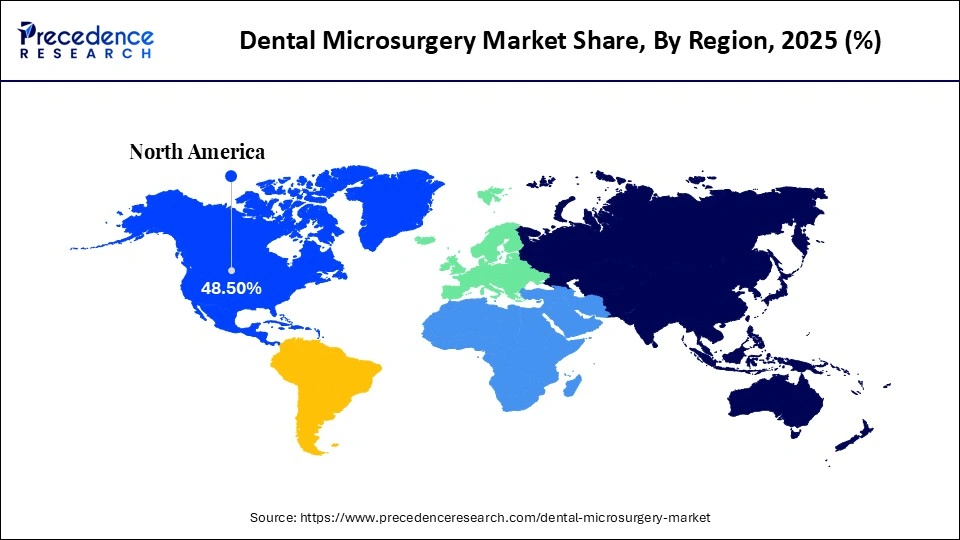

- North America led the dental microsurgery market with 48.5% share in 2025.

- Asia Pacific is expected to grow at a CAGR of 7.5% between 2026 and 2035.

- By product type, the dental operating microscopes segment captured around 36.8% of market share in 2025.

- By product type, the micro-instruments segment is growing at a CAGR of 6% between 2026 and 2035.

- By procedure type, the endodontic microsurgery segment held 38.9% of market share in 2025.

- By procedure type, the implant microsurgery segment is poised to grow fastest CAGR of 6.2% over the projected period 2026 and 2035.

- By technology, the optical microscopy segment contributed the highest market share of 52.2% in 2025.

- By technology, the digital microscopy segment is projected to grow at the highest CAGR of 6.3% between 2026 and 2035.

- By end-user, the dental clinics segment accounted for the biggest market share of 54.5% in 2024.

- By end-user, the academic & research institutes segment is expanding at a CAGR of 6.5% between 2026 and 2035.

- By distribution channel, the direct sale segment captured 67.5% of market share in 2025.

- By distribution channel, the online retail segment is expected to expand at the highest CAGR of 6.6% between 2026 and 2035.

Transforming Precision Care through Dental Microsurgery

Dental microsurgery is the use of highly magnified, minimally invasive methods to deliver precise treatment with operating microscopes and similar equipment. Dental microsurgery enables more complex procedures through better visualisation, greater accuracy, and improved tissue preservation. The market for dental microsurgery is showing consistent growth driven by rising demand for less-invasive treatments, improved patient outcomes, and shorter recovery times. Growth in endodontic retreatments, regenerative techniques, and micro-periodontal procedures has further driven growth in the dental microsurgery market.

The implementation of technologies such as 3D imaging, ultrasonic microsurgical tools, and high-resolution imaging has made precision dentistry increasingly popular among both practitioners and patients. The increased focus on function and aesthetics has led to more dental training programs and specialty clinics in both developed and developing countries, further driving the growth of the dental microsurgery market.

AI-Powered Innovations Are Changing How Dentists Perform Microsurgery

Artificial intelligence (AI) in the dental microsurgery market is improving accuracy, planning, and patient outcomes. Innovations such as robotic systems already capable of performing minimally invasive operations using 3D imaging and an AI-guided surgical plan have made it possible to complete surgeries more quickly and with greater accuracy. By utilizing AI to guide a surgeon as they navigate the mouth during surgery, the surgeon's ability to place implants consistently has improved, as the AI tracks how the implant was originally aligned based on the surgeon's previous actions.

- In November 2025, Neocis launches its next-generation AI-powered Yomi S robotic system for dental implants, offering enhanced precision, single-operator workflow, and AI planning to expand access and patient outcomes.

Robotic systems combined with AI will provide better data for surgeons and their patients, enabling the development of more personalized treatment plans for each individual based upon their unique anatomy and needs than is currently available. Although this industry continues to face many challenges, including regulatory issues and the high cost of implementation, the future of AI in Dental microsurgery appears bright as more AI-assisted technologies become available. Many dental clinics currently using AI-assisted technologies have reported improved operating room workflows, streamlined workflows, and higher patient satisfaction levels due to the ability to perform less invasive procedures.

Dental Microsurgery Market Outlook

- Market Overview: Nearly 3.7 billion individuals worldwide suffer from oral diseases, which creates a continually growing need for the use of precision-based dental microsurgery to more accurately, and with substantially fewer complications, treat complex Restorative Dentistry and Periodontal disease.

- Global Expansion: Untreated dental caries affects approximately 2 billion adults, while severe periodontal disease affects approximately 1 billion individuals worldwide; as such, dental microsurgical procedures continue to grow to treat these hard-to-treat or advanced oral conditions.

- Technology Integration: Due to an increasing number of patients with both dental pulp infections and endodontic failures, clinics have begun to utilize dental microscopes/micro instruments to obtain better vision, more accurate treatment, and improved long-term conservation of these tooth structures.

- Growing Clinical Needs: As Periodontal disease is now in the top ten most important health diseases globally, Dental Professionals are using microsurgery more frequently to enhance their ability to manage bone defects, gum recession, and soft-tissue regeneration with greater precision.

- Prevention Focus: Due to the emphasis placed on early intervention by many governments, Patients are requesting less invasive microsurgery techniques to provide them with less pain, better healing, and improved aesthetic results.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 374.64 Million |

| Market Size in 2026 | USD 401.01 Million |

| Market Size by 2035 | USD 739.73 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Procedure Type, Technology, End-user, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Why Dental Operating Microscopes Lead the Dental Microsurgery Market?

Dental Operating Microscopes: Dental operating microscopes dominate the dental microsurgery market, with a 36.8% share, as clinicians rely on magnification to make procedures more accurate and precise than ever before. Optics are clearer, ergonomically designed, and integrated with digital imaging systems to improve diagnostic and treatment outcomes. In addition, the emphasis on minimally invasive dentistry, the growing number of micro-surgical cases, and the upgrade of the clinic's infrastructure to advanced visualization equipment, such as dental operating microscopes, will lead to shorter chair times for the patients and improved treatment quality.

Micro-Instruments: Micro-instruments have become highly in demand, with the segment growing at a CAGR of 6% during the forecasted period. The need for increased dexterity and safety is growing, along with the need for greater precision. However, the availability of micro-instruments is improving through the development of new-generation high-strength titanium alloys, anti-corrosive coatings, and micro-engineered designs. The factors driving the adoption of micro-instruments include an increasing number of specialty procedures and a shift in preference toward instruments that cause the least tissue damage and improve postoperative recovery.

Procedure Type Insights

Why Does Endodontic Microsurgery Continue To Lead The Way?

Endodontic Microsurgery: Endodontic microsurgery is the dominant segment by procedure type in 2025 with a 38.6% share, driven by the increasing global prevalence of complicated root canal failures and periodontal lesions requiring high-precision retreatment. As cone-beam computed tomography (CBCT) systems, ultrasonically enhanced tips, and magnification systems allow improved access to the apical areas of a tooth, clinicians are increasingly turning to microsurgical methods in endodontics. The increased success rates, decreased healing times, and reduced need for extractions or implants associated with this type of endodontic approach are significant contributors to the increase in procedural volumes performed by clinicians worldwide.

Implant Microsurgery: The growth of implant microsurgery has been exponential, with the segment growing at the highest CAGR of 6.2%, driven by the increased adoption of flapless and minimally invasive (MIS) approaches to dental implant placement in general practice. With advances in technology, including guided surgery, piezoelectric (Implant) instruments, and three-dimensional (3D) anatomical mapping, implant positioning can become much more predictable; as a result, postoperative complications will decrease. Several factors contributing to the accelerated growth in the adoption of implant microsurgery by both specialist practices and multi-specialty dental facilities include increased aesthetic demands, improved long-term predictability of implants, and improved access to training.

Technology Insights

Why Does Optical Microscopy Dominate in Technology Segment?

Optical Microscopy: Optical microscopy has become the dominant technology type in the dental microsurgery market in 2025 with a 52.2% share, due to its long-standing professional reliability and affordability. Moreover, optical microscopy systems can be used in various dental microsurgery techniques that have developed over time. Because optical systems can provide immediate visualisation of tooth structure and depth of field, dental professionals rely on them to accurately cut and suture teeth in real time. Optical systems are also durable, require minimal maintenance, and are deeply entrenched in dental training; therefore, these factors support the continued growth of optical systems across all dental practices.

Digital Microscopy: This segment is rapidly evolving with the highest CAGR of 6.3%, as dentists migrate to digital technology toenablee enhanced visualisation, documentation, and integration into their work environment. Digital microscopy platforms have augmented reality overlays that make it easier for teams to collaborate; high-resolution sensors provide excellent visualisation and ergonomic benefits. Digital platforms enable dentists to educate patients, provide remote consultations, and store data, ultimately aligning with the current trend toward increased use of digital tools in dentistry. Ultimately, the enhanced capacity of dental digital systems to document, archive, and analyse microsurgical detail will make these products increasingly appealing to all contemporary dental practices.

End User Insights

Why Do Dental Clinics Hold Systematic Dominance in the Dental Microsurgery Market?

Dental Clinics: Dental clinics are expected to lead the dental microsurgery market in 2025, with a 54.5% share, as the rapid acceptance of minimally invasive surgery (MIS) has led to significant investment in equipment that enhances visualization. Patient comfort has become an important factor in selecting a treatment center, and shorter recovery times and increased accuracy during procedures have led to a significant increase in using microsurgery devices by dental clinics. In addition, the flexible purchasing options available to dental clinics and the speed with which they can implement new products are major reasons that dental clinics have adopted cutting-edge microsurgical equipment at a greater rate than hospitals.

Academic & Research Institutes: Growth has occurred at academic & research institutions with a 6.5% growth rate, as dental schools now include micro-surgery as part of their core curriculum, with additional emphasis on continued development of biomaterials, regenerative therapy & micro-guided surgical techniques. The growth of these Institutions is also due, in part, to the increasing number of dental schools and the expanding collaborations between academic/research institutions and Technology Providers to facilitate faster and better adoption of superior quality equipment and to further develop topics related to Microsurgeries.

Distribution Channel Insights

Why Direct Sales Channel Leading the Distribution Channel Segment?

Direct Sales: The direct sales distribution channel segment dominated the dental microsurgery market with a 67.5% share, because the high value of microsurgical devices necessitates tailored demonstrations, installation support, and customized training, which are best achieved through engagements with direct vendors. Manufacturers can build strong relationships with clinics and hospitals by providing maintenance contracts, bundled equipment packages, and rapid technical support. The dependence on and use of direct sales are driven more by manufacturers' ability to assure product reliability, prevent procurement delays, enable clinicians to assess how well the equipment will perform before purchase, and build trust and adoption.

Online Retail: Online retailing is rapidly growing rapidly with a 6.6% CAGR, as clinicians increasingly prefer simplified purchasing of consumables, accessories, and smaller microsurgical tools. There are many advantages to purchasing via digital platforms. Online retailers provide customers with clear and consistent pricing, expand product choice and availability, and enable comparisons between brands. The growth of online retail outlets has also been aided by the advent of the B2B e-commerce business model, advances in the development and implementation of faster delivery methods, and increased participation of suppliers on the internet. For smaller practices, purchasing via online channels accelerates the procurement process and provides a cost-effective solution.

Regional Insights

How Big is the North America Dental Microsurgery Market Size?

The North America dental microsurgery market size is estimated at USD 181.70 million in 2025 and is projected to reach approximately USD 359.51 million by 2035, with a 7.06% CAGR from 2026 to 2035.

Why is North America Dominating the Dental Microsurgery Market?

North America is the leader in the dental microsurgery market with a 48.5% share, owing to its robust clinical infrastructures, high volumes of dental procedures, and rapidly growing acceptance of minimally invasive dental technologies. Factors such as strong reimbursement channels, early access to precision devices, and the use of digital imaging have led to growing acceptance of these new technologies among dental practitioners.

As a result, a significant number of dental practitioners in North America are continually upgrading to more advanced visualization technologies, thereby driving an ongoing increase in microsurgery related to periodontal therapy, endodontic therapy, and implant surgery. Additionally, continuing education and training programs offered by professional associations and manufacturing companies further develop a skilled workforce in North America, reinforcing the region's position as a leader in dental microsurgery innovation and expertise.

What is the Size of the U.S. Dental Microsurgery Market?

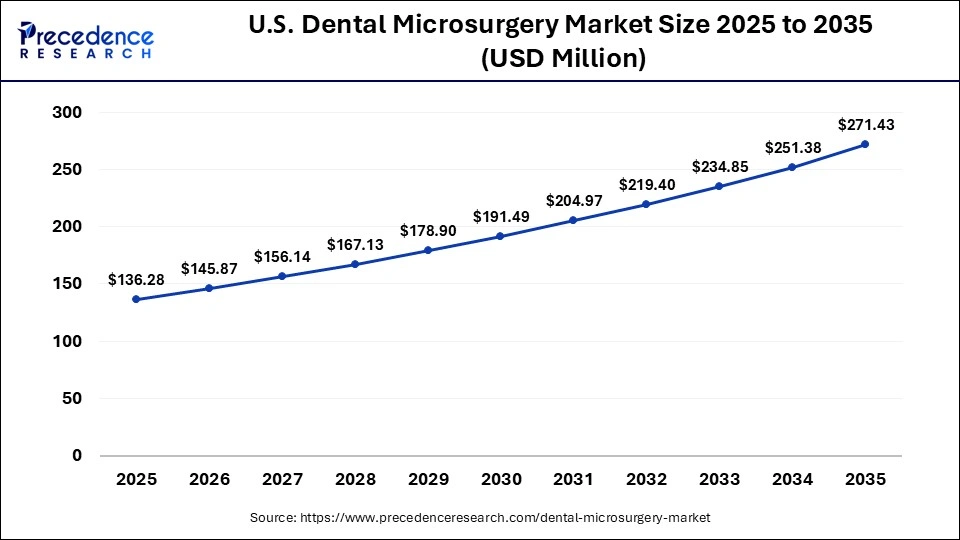

The U.S. dental microsurgery market size is calculated at USD 136.28 million in 2025 and is expected to reach nearly USD 271.43 million in 2035, accelerating at a strong CAGR of 7.13% between 2026 and 2035.

U.S. Dental Microsurgery Market Trends

The U.S. is the largest market in the region and has one of the highest concentrations of specially trained dental professionals in the world. Because of increased patient awareness of low-trauma procedures, widespread adoption of operating microscopes by endodontists and oral surgeons, and many device launches integrating AI-driven imaging, the U.S. has a highly standardized process for performing microsurgery. Its regulatory environment promotes innovative and safe procedures, leading to continual development of new clinical techniques and frequent enhancements to technology for use in microsurgery in the U.S. In December 2025, MMI wins FDA 510(k) clearance for NanoWrist robotic dissection instruments, enabling the Symani system to complete the first fully robotic microsurgical lymphovenous bypass in the U.S. at Tampa General.

Why is the Asia Pacific Experiencing Fastest Growth of the dental microsurgery market?

The increased workload of dental procedures drives the rapid expansion of the Asia Pacific region, which is set to grow at a 7.5% share over the forecast period; the growing interest in cosmetic/minimally invasive dentistry; and the growth of dental education in developing nations. Increasingly sophisticated surgical technology/microsurgical tools, the proliferation of privately owned dental practices, and increasing disposable income are all contributing factors to the increase in procedures performed.

In conjunction with this support from regional governments through investments in oral health programs, the way has been opened for a shift in the industry away from traditional restorative dentistry toward more advanced techniques that promote early detection and treatment of dental problems. International manufacturers are also expanding their presence through training partnerships in the Asia Pacific, allowing local companies to manufacture surgical optics products and, therefore, enhancing access to these tools.

China Dental Microsurgery Market Trends

The rapid modernization of dental practices, the emergence of China's growing middle class seeking increasingly complex procedures, and Chinese technology companies converting traditional multi-chair dental clinics into more advanced, technology-based clinics have positioned China at the forefront of this region. Increased emphasis on teaching microsurgical skills through universities and training programs has created a new level of clinician competency. Additionally, as more domestic manufacturers enter the space and develop cost-effective, high-quality microsurgical instruments, China is poised to become the center of growth for this type of dentistry in the Asia Pacific region.

How Europe is Entering a New Era of Dental Microsurgery?

Europe has grown rapidly, largely due to its established dental practices, high levels of competence among dentists, and extensive microsurgical training at dental training institutions. The focus throughout Europe has been to promote evidence-based dentistry, thereby encouraging earlier adoption of enhanced visualization technology, including operating microscopes and micro-instruments.

The establishment of preventive dental care programs and public health initiatives provides motivation and resources for earlier dental intervention and increases the use of less invasive dental procedures. The well-established dental system and rapid modernization of dental practices in Eastern Europe have created ample market opportunities for the continued growth of both practicing and clinical implementations.

Germany Dental Microsurgery Market Trends

Germany is the leader in dental technology and equipment due to its strong, advanced infrastructure in dentistry, the high number of technologically advanced, high-quality precision surgical tools, and the high level of adoption of microscopy in endodontics and periodontics. Dental Training Institutions in Germany train dentists in micro-methods and train future dentists to develop competency in micro-surgical techniques. German dental clinics also continue to invest in optical technologies, providing constant demand for high-performance microscopes and micro-instruments.

Why is the Middle East & Africa region accelerating the use of Dental Microsurgery Market?

As awareness of dental microsurgery increases and more specialty clinics are established in cities across the Middle East and Africa, the region has become highly attractive to investors. New, advanced technologies and techniques will expand the ability of microsurgeon specialists to provide treatment options locally and internationally. Many countries have begun creating training programs for anaesthetic and microsurgery specialists, as well as partnering with global dental product manufacturers to foster an environment in which dental specialists have access to the latest innovations in dentistry.

UAE Dental Microsurgery Market Trends

As a rapidly modernizing region, the UAE also has a significant percentage of private dental facilities. The UAE is currently the leader in managing the growing presence of high-value premium dental facilities, and at the same time has a greater demand for these services among its population than in all other Gulf Cooperation Council countries. Furthermore, as medical tourism grows in the UAE and investment in digital and microsurgical technologies increases in the region, the UAE continues to accelerate the development of these procedures to become the world's leader in providing precision-based and cosmetic surgeries.

Top Key Players in the Dental Microsurgery Market and their Offerings

- Carl Zeiss Meditec

- Leica Microsystems

- Global Surgical Corporation

- Zumax Medical

- Labomed

- Seiler Instruments

- Hu-Friedy

- Dentsply Sirona

- NSK

- KaVo Kerr

- Acteon Group

- Bicon

- DenMat

- Orascoptic

- Aesculap (B. Braun)

Recent Developments

- In January 2024, A Nvidia-backed dental surgery robot developed by Neocis received a $20 M funding boost, accelerating development and adoption of its FDA-approved robotic system for dental implant surgery.(Source: https://www.iotworldtoday.com)

- In April 2025, ZimVie Inc., a dental implant and medical technology company in Florida, announced the U.S. release of its Immediate Molar Implant System. This Immediate Molar Implant System expands ZimVie's TSX and T3 PRO Implant platforms by incorporating a solution specifically for immediate placement in molar sites.(Source: https://www.compendiumlive.com)

Segments Covered in the Report

By Product

- Dental Operating Microscopes

- Micro-Instruments

- Microsurgical Sutures

- Illumination & Visualization Systems

- Micro-Needles & Blades

- Consumables

By Procedure Type

- Endodontic Microsurgery

- Periodontal Microsurgery

- Implant Microsurgery

- Restorative/Prosthodontic Microsurgery

- Cosmetic Microsurgery

By Technology

- Optical Microscopy

- Digital Microscopy

- 3D Visualization

- Fluorescence-Based Microsurgery

By End-user

- Dental Hospitals

- Dental Clinics

- Academic & Research Institutes

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Online Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting