What is Dental Turbines Market Size?

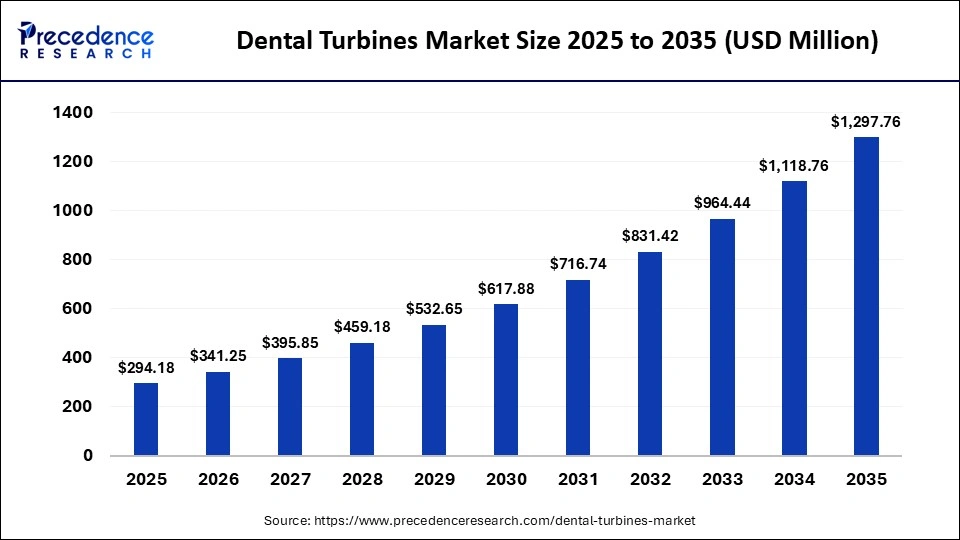

The global dental turbines market size was calculated at USD 294.18 million in 2025 and is predicted to increase from USD 341.25 million in 2026 to approximately USD 1,297.76 million by 2035, expanding at a CAGR of 16.00% from 2026 to 2035. The market is expanding due to rising dental procedures, growing oral health awareness, and technological innovations in high-speed, durable equipment, enhancing efficiency and clinician comfort.

Market Highlights

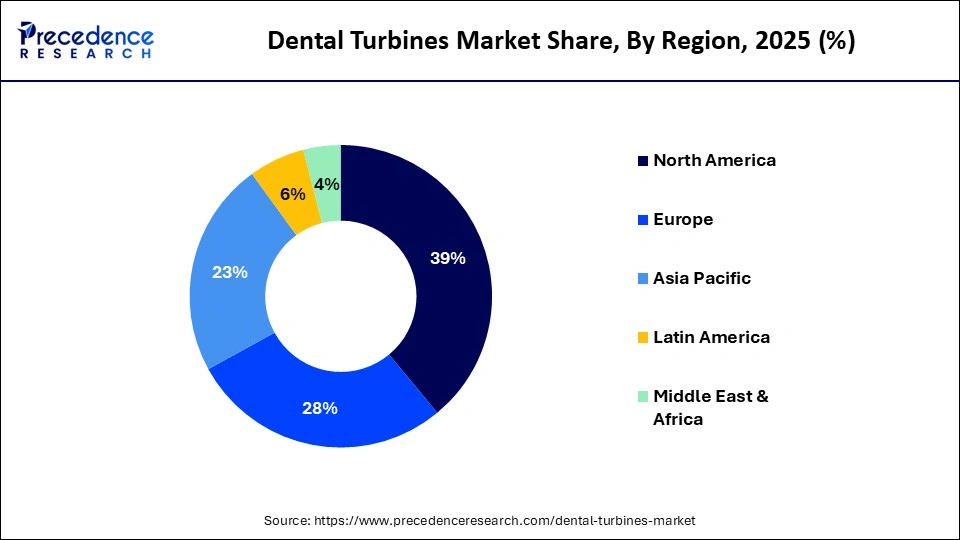

- North America led the dental turbines market with a share of approximately 39% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR of 16.5% in the market between 2026 and 2035.

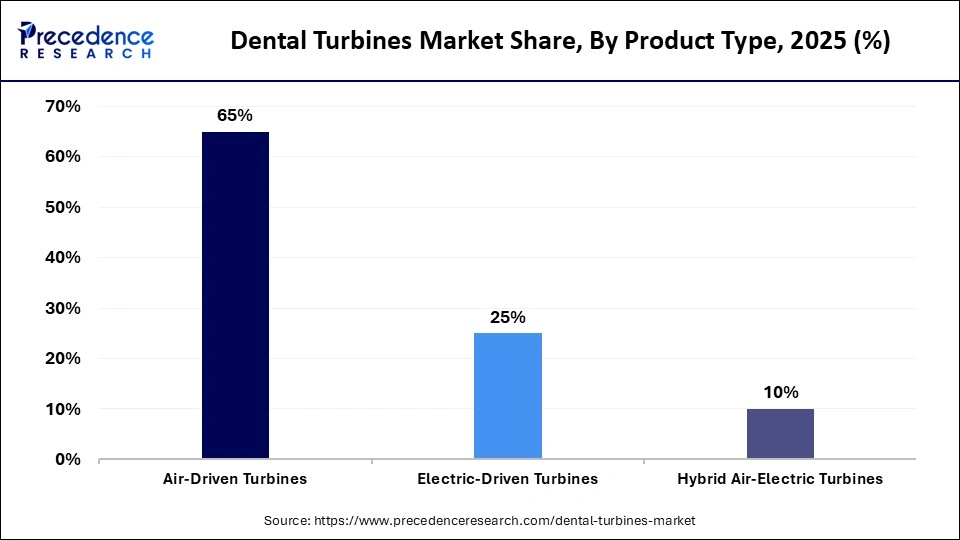

- By product type, the air-driven turbines segment dominated the market with a share of approximately 65% in 2025.

- By product type, the electric-driven turbines segment is expected to grow at a strong CAGR of 14.7% during 2026 to 2035.

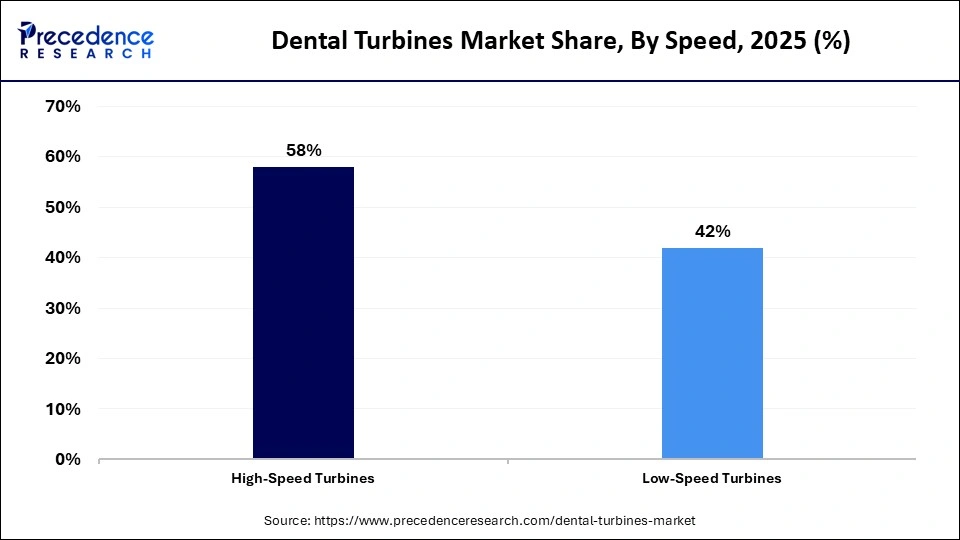

- By speed, the high-speed turbines segment captured the highest market share of approximately 58% in the market in 2025.

- By speed, the low-speed turbines segment is expected to expand at the fastest CAGR of 14.5% during the forecast period.

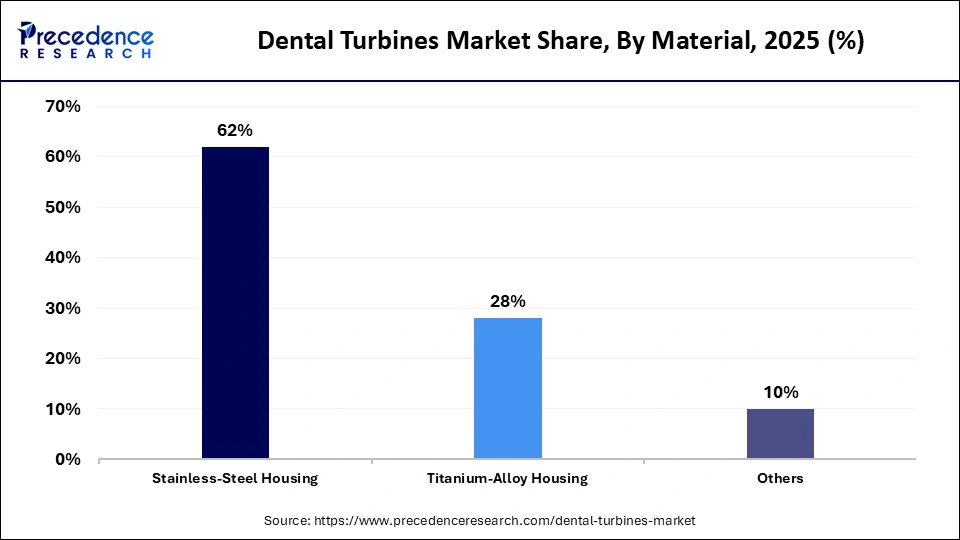

- By material, the stainless-steel housing segment led the dental turbines market with a share of approximately 62% in 2025.

- By material, the titanium-alloy housing segment is expected to grow at a solid CAGR of around 14.8% in the coming years.

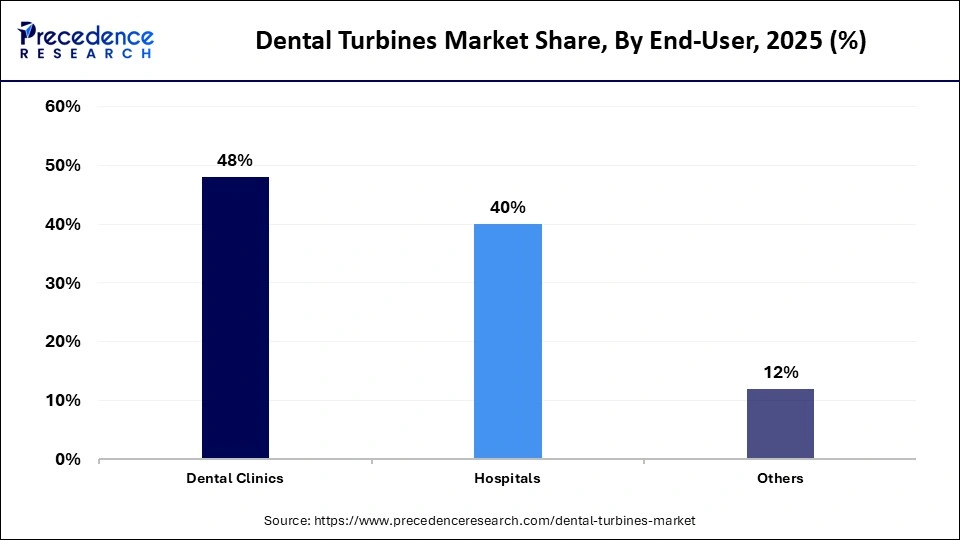

- By end-user, the dental clinics segment accounted for the largest market share of around 48% in 2025.

- By end-user, the hospitals segment is projected to grow at a solid CAGR of 15.3% over the studied period.

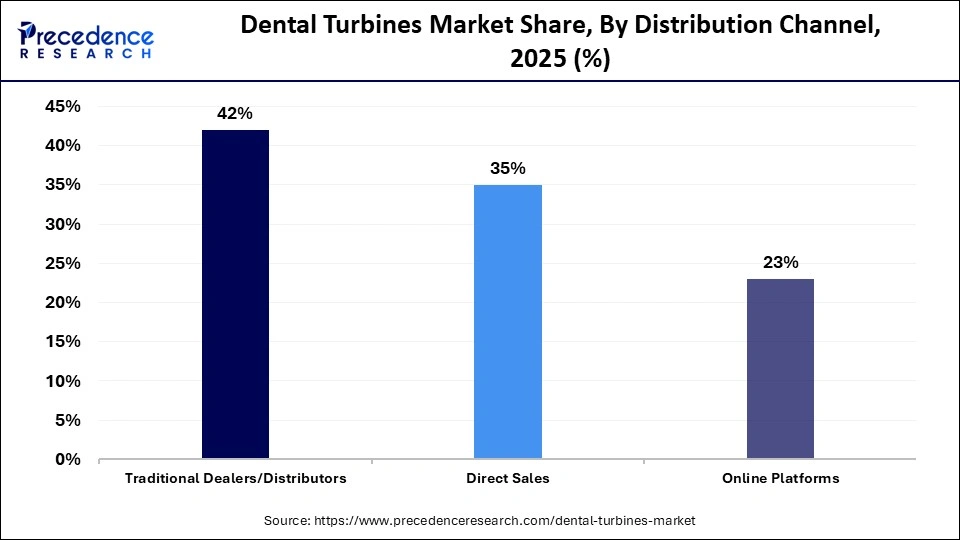

- By distribution channel, the traditional dealers/distributors segment held a major market share of approximately 42% in 2025.

- By distribution channel, the online platforms segment is expected to expand rapidly at a CAGR of 15.1% in the foreseeable period.

Are Dental Turbines Driving Modern Dentistry?

The dental turbines market refers to the development, manufacturing, and distribution of an instrument used to drill out cavities and place crowns, etc., in the mouth. It is a major component of a dental drill and is designed to have faster speeds, greater accuracy, and be ergonomically designed for the dentist/clinician to use. There are several factors contributing to market growth, including an increase in the number of procedures being performed each year, more people having dental care, and the increasing number of private dentists worldwide. In addition, improved technology has led to an increase in the replacement of existing dental turbines with more expensive models.

As a result of these trends, many manufacturers are now developing lighter-weight and energy-efficient, air-powered dental turbines for better clinician comfort while performing dental procedures, providing clinicians with more accurate results. The demand for cosmetic dentistry continues to create opportunities for new and improved dental turbine manufacturing and sales in both developed and emerging countries.

AI-Powered Precision Driving Growth in the Dental Turbines Market

Artificial Intelligence is transforming the market by providing accurate, effective, and predictive insights that add value to dental practices. AI-enabled diagnostic tools and planning systems analyze actual usage data, optimum torque, and speed settings, predicting the need for maintenance, thereby minimizing maintenance downtimes and lifecycle costs of high-speed turbines. In recent years, clinics have invested heavily in new, smart turbines and electric handpieces that use AI-based workflows to enhance reliability and improve patient outcomes.

As the adoption of AI continues to grow, many manufacturers will be able to use AI-backed performance improvements and sensor analytics to create unique selling propositions for their products. According to industry analysts, there is a growing trend in the dental sector adopting AI for equipment management, along with the analysis and optimization of turbine performance, to improve the way they operate and to achieve a competitive edge via technology-based productivity improvements.

Key Trends Shaping the Dental Turbines Market

- Electrical Turbines: With their constant torque and quieter operation, electronic dental turbines are becoming more popular. They allow more complex procedures to be performed, give the clinician additional control, and align with the trend toward exciting new digital dental workflows.

- Noise Reduction: Companies are working hard at developing low-noise designs for turbines to meet the needs of both practitioners and patients who want to have less noise during dental visits and procedures. An advanced bearing system, paired with optimized & airflow technology are helping to create calm treatment environments and enhance patient experiences.

- Infection Control: Many companies are adding more hygienic features to their turbines, such as anti-retraction valves and improved sealing mechanisms to help control cross-contamination, so they can improve upon existing protocols of sterilization and comply with the constantly changing regulations regarding dental safety.

- Ergonomic Design: Increasingly, dentists are choosing lighter-weight, smaller, and better-balanced turbines for their fit in the hand and to produce less vibration, allowing them to perform longer for patients, with more comfort and less chance of hand strain or injury.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 294.18 Million |

| Market Size in 2026 | USD 341.25 Million |

| Market Size by 2035 | USD 1,297.76 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type,Speed,Material,End-User,Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Outlook

Product Type Insights

Why Did the Air-Driven Turbines Segment Dominate the Dental Turbines Market?

The air-driven turbines segment held a major revenue share of approximately 65% in the market in 2025, as a result of long-time clinical practice acceptance, low-to-moderate costs, and compatibility with existing dental unit configurations. Air-driven turbines are very popular with dentists performing routine procedures in many small-to-medium-sized practices because these devices provide adequate performance, have low maintenance requirements, and provide a reasonable initial purchase price. The ongoing reliability and availability of air-driven turbine devices provide a strong demand across developed and emerging markets.

The electric-driven turbines segment is expected to grow at the fastest CAGR of 14.7% in the market between 2026 and 2035, as they have been actively developed and marketed in response to demand for increased precision and torque consistency from operators, along with greater control by the user. As more dental practices are performing advanced restorative and cosmetic dental work, the demand for electric turbine devices will continue to increase due to their quieter operation, lower vibration levels, and improved cutting efficiency, ultimately promoting improved clinical outcomes and greater patient comfort.

Speed Insights

How the High-Speed Turbines Segment Dominated the Dental Turbines Market?

The high-speed turbines segment accounted for the highest revenue share of approximately 58% in the market in 2025, as they provide preparation of cavities, cutting of crowns, and removing enamel compared to low-speed turbines. Because they can operate at very high RPMs, which shortens the overall time of each procedure, they are the preferred type of dental tool in most high-volume dental offices. In addition, the ongoing improvements to products, including better cooling mechanisms and quieter operation, continue to create a greater market for high-speed turbines in general dentistry.

The low-speed turbines segment is expected to grow with the highest CAGR of 14.5% in the market during the studied years, due to their increasing use in preventive care, polishing, finishing, and routine dental procedures. The increased use of low-speed turbines is driven by the growing focus on minimally invasive dentistry and regular oral care, where having controlled speed and accuracy are much more important than cutting power.

Material Insights

Which Material Segment Led the Dental Turbines Market?

The stainless-steel housing segment led the global market with a share of approximately 62% in 2025, due to its pricing affordability, resistance against corrosion, and tensile strength. These dental instruments are quite durable and are expected to last throughout the daily clinical usage period because of their ability to endure multiple sterilizations during the glycolic acid and ethylene oxide sterilization process. They are cost-effective; hence, required by several economically constrained clinics located in developing countries, boosting the segment's growth.

The titanium-alloy housing segment is expected to expand rapidly in the market with a CAGR of 14.8% in the coming years. This growth is primarily due to the lightweight of the titanium turbines, which allows increased strength, durability, and ergonomically designed properties compared to stainless-steel houses, resulting in decreased fatigue for dentists while performing lengthy procedures, as well as providing for greater strength and precision, particularly in the areas of specialty and cosmetic dentistry.

End-User Insights

How the Dental Clinics Segment Dominated the Dental Turbines Market?

The dental clinics segment held the largest revenue share of approximately 48% in the market in 2025, because they are the main source of routine, cosmetic, and preventive care in the dental industry. The high number of patient visits, along with the continued replacement of equipment, potentiates the demand for turbines in dental clinics. Independent and group clinics are also more likely to buy equipment in a flexible way, which supports their overall market position and total turbine consumption.

The hospitals segment is expected to witness the fastest growth in the market with a CAGR of 15.3% over the forecast period, due to new infrastructure, an increase in dental departments within hospitals, and a greater emphasis on performing complex procedures. Additionally, the fastest population growth is occurring in multi-specialty hospitals, which is a good indication of the future trend for advanced dental treatment, precision apparel, and standardization of equipment.

Distribution Channel Insights

Which Distribution Channel Segment Dominated the Dental Turbines Market?

The traditional dealers/distributors segment registered its dominance over the global market with a share of approximately 42% in 2025, due to their established relationships with dentists and a strong, supportive after-sales service. Many dentists prefer to buy as they can see the product demonstrated, are confident that the services provided by the dealers will be reliable, and have access to the means of maintaining or getting spare parts for the products they have selected.

The online platforms segment is expected to witness the fastest growth in the market with a CAGR of 15.1% over the forecast period as a result of digital procurement trends, transparent pricing & a broader product universe. The e-commerce boom, together with dentists' increasing comfort with online purchasing of medical equipment, will be major drivers to accelerate the adoption of online purchasing, especially among younger dentists and small practices.

Regional Insights

How Big is the North America Dental Turbines Market Size?

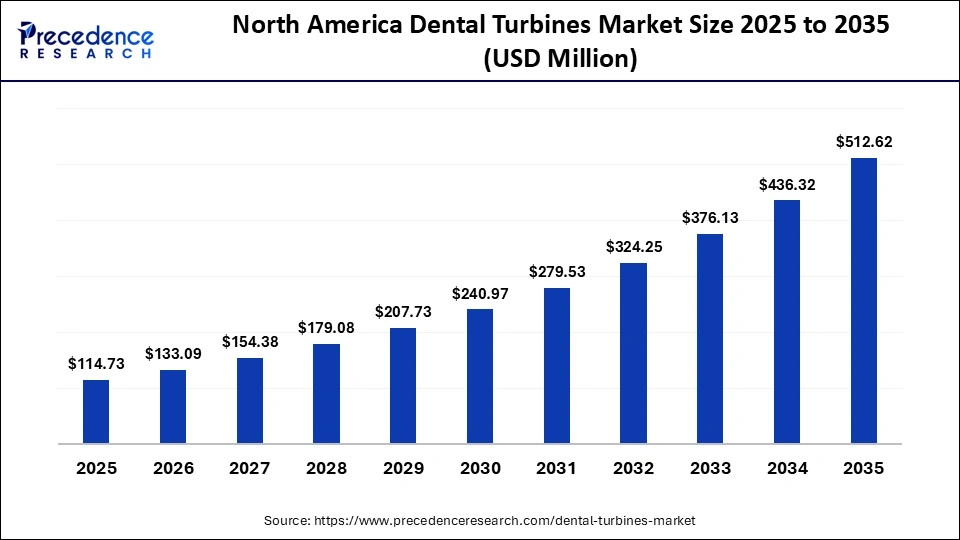

The North America dental turbines market size is estimated at USD 114.73 million in 2025 and is projected to reach approximately USD 512.62 million by 2035, with a 16.15% CAGR from 2026 to 2035.

Why North America Dominated the Dental Turbines Market?

North America held a major revenue share of approximately 39% in 2025, because of the advanced dental care infrastructure within this area. The major growth factors include high-level usage of precision instruments and emphasis on quality standards. Hence, dental turbine instruments in North America are designed with high-end, durable, reliable, and ergonomic features to be used for complex procedures and a continuous contribution of innovative product improvements by local manufacturers and strong established distribution networks, which allow customers to consistently receive products. Moderately high professional development and regular technology upgrades supported by clinics also encourage high-end dental turbine purchases for dentists.

What is the Size of the U.S. Dental Turbines Market?

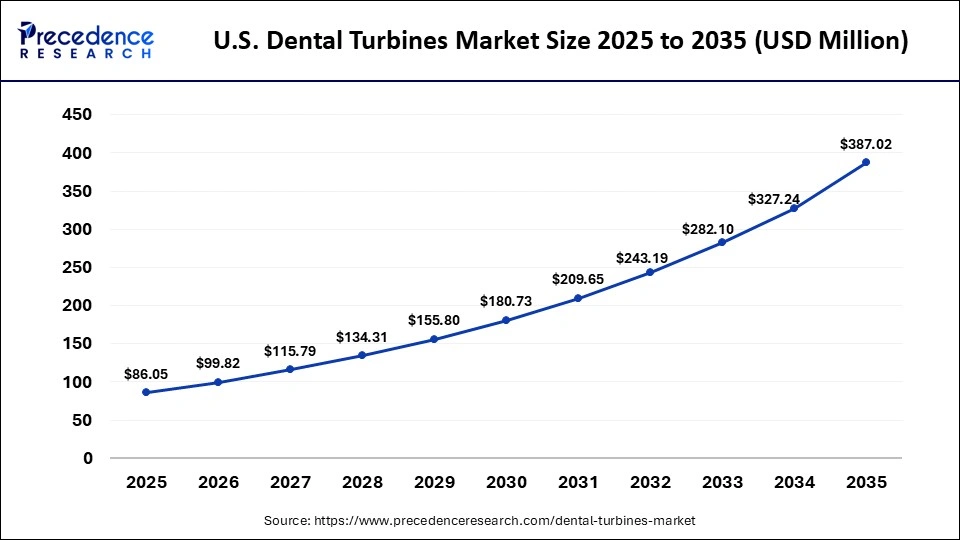

The U.S. dental turbines market size is calculated at USD 86.05 million in 2025 and is expected to reach nearly USD 387.05 million in 2035, accelerating at a strong CAGR of 16.22% between 2026 to 2035.

U.S. Market Trends

The U.S. is recognized as having a high number of dental technology manufacturers and repeatedly is at the forefront of research for new turbine solutions. As such, many clinicians utilize innovative, high-end dental turbines to improve precision and, more importantly, decrease patient procedure time. As seen through the level of education and strict adherence to quality standards, U.S.-based manufacturers also continually strive to improve upon their products, which have a broader impact on North American manufacturers.

How is Asia-Pacific Growing in the Dental Turbines Market?

Asia-Pacific is expected to witness the fastest growth with a CAGR of 16.5% during the predicted timeframe, due to increasing investments in dental health care, greater public awareness of oral health, and growing interest in modern dental treatment options. The increased middle-class population and improved access to dental care in urban and semi-urban locations will drive the adoption of advanced turbine technologies.

Manufacturers in the region are continually investing in expanding their production capabilities, enabling them to provide competitively priced and customized products that meet regional requirements. Through increased collaboration between dental professionals and manufacturers, greater adoption of high-speed, efficient handpieces occurs, creating a dynamic environment for continued technological growth and diffusion of dental practice tools within the region.

China Market Trends

China is the leading country in the Asia-Pacific due to its continued expansion of dental care systems and proactive efforts to modernize clinical tools. A large number of dentists in China are now routinely using advanced turbines to enable them to provide high-quality dental services to their patients. Investments by local manufacturers in expanding their production operations provide customized products that meet local market needs, while partnerships with global technology suppliers help these companies improve their products, making China the dominant player.

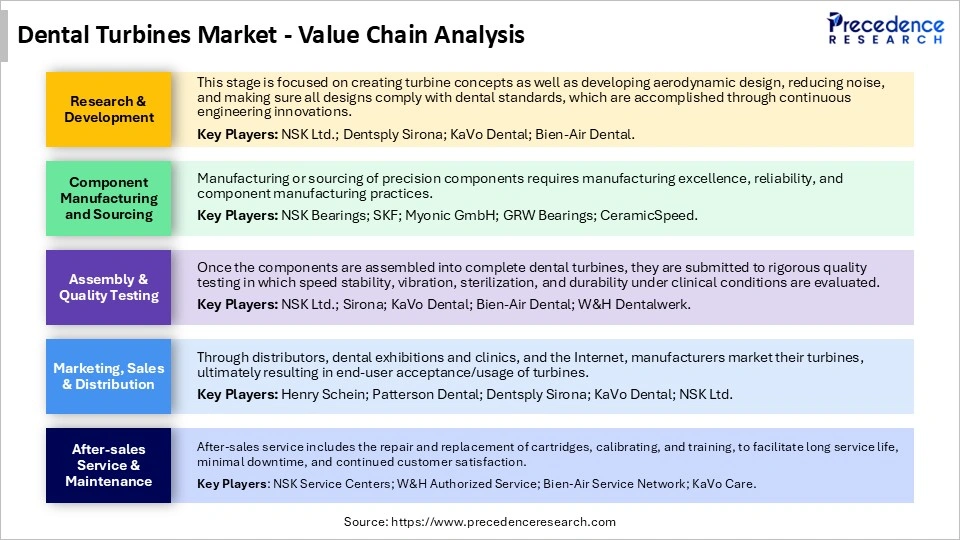

Dental Turbines MarketValue Chain Analysis

Who are the major players in the global dental turbines market?

The major players in the dental turbines market include Dentsply Sirona, Inc., Nakanishi Inc. (NSK), KaVo Dental, W&H Dentalwerk International, Bien-Air Dental, Guilin Woodpecker Medical Instrument, Fona, Yoshida Dental, Dentamerica, Dentalaire, Stern Weber, Micro-Mega, MK-dent, Chirana, and Sirona Dental Systems

Recent Developments in the Dental Turbines Market

- In February 2026, Quality Dental Services highlighted the importance of precision mechanical components in modern oral care, emphasizing reliable dental handpiece bearings and turbines that support clinical efficiency and reduce costly equipment failures.(Source: https://www.accessnewswire.com)

- In January 2026, Bespoke Dental in Lutz, Florida, expands its cosmetic dentistry and oral surgery care with advanced digital imaging technology to improve diagnosis accuracy, surgical planning, and patient outcomes.(Source: https://www.freep.com)

Segments Covered in the Report

By Product Type

- Air-Driven Turbines

- Electric-Driven Turbines

- Hybrid Air-Electric Turbines

By Speed

- High-Speed Turbines

- Low-Speed Turbines

By Material

- Stainless-Steel Housing

- Titanium-Alloy Housing

- Others

By End-User

- Dental Clinics

- Hospitals

- Others

By Distribution Channel

- Traditional Dealers/Distributors

- Direct Sales

- Online Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting