Desktop Virtualization Market Size and Forecast 2025 to 2034

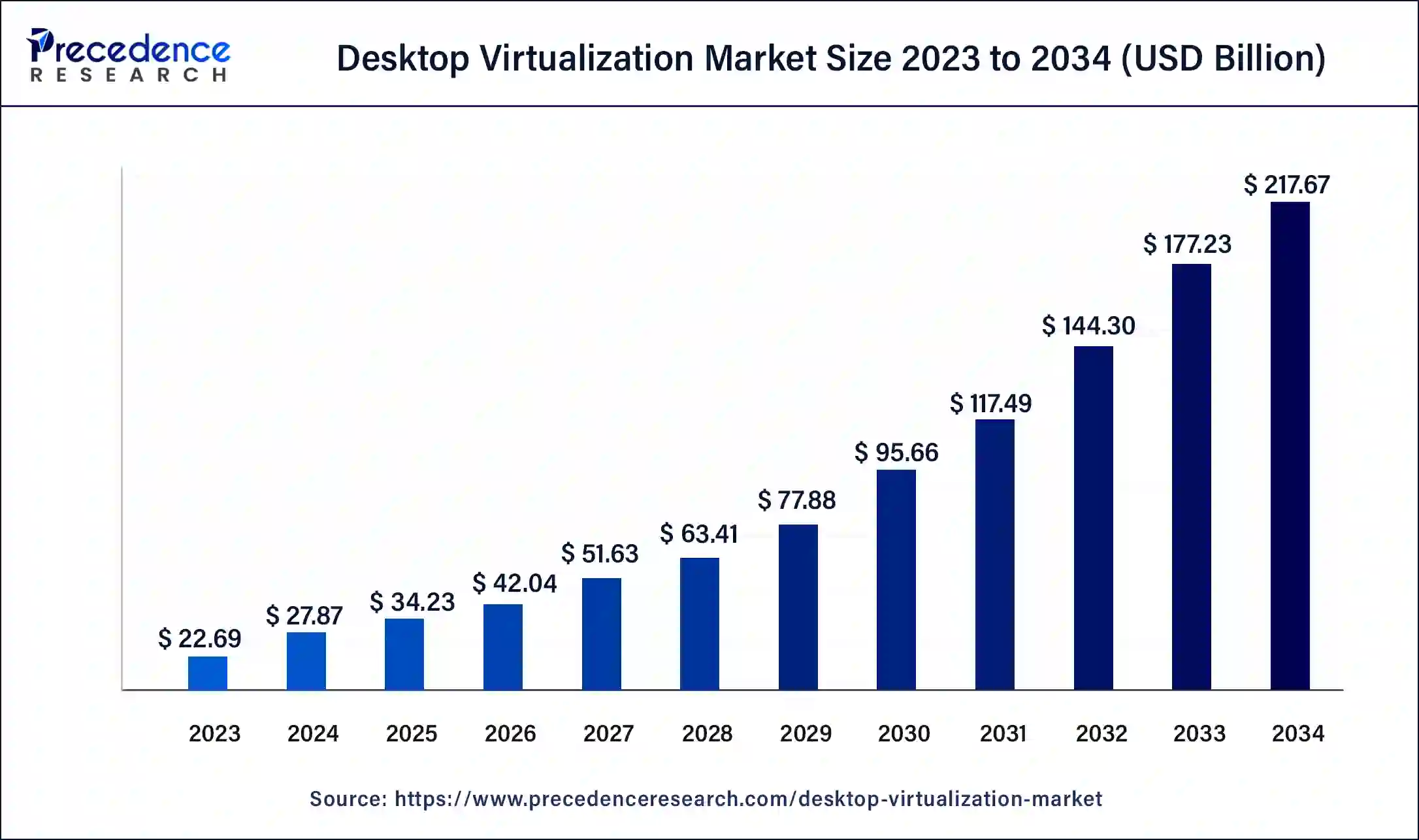

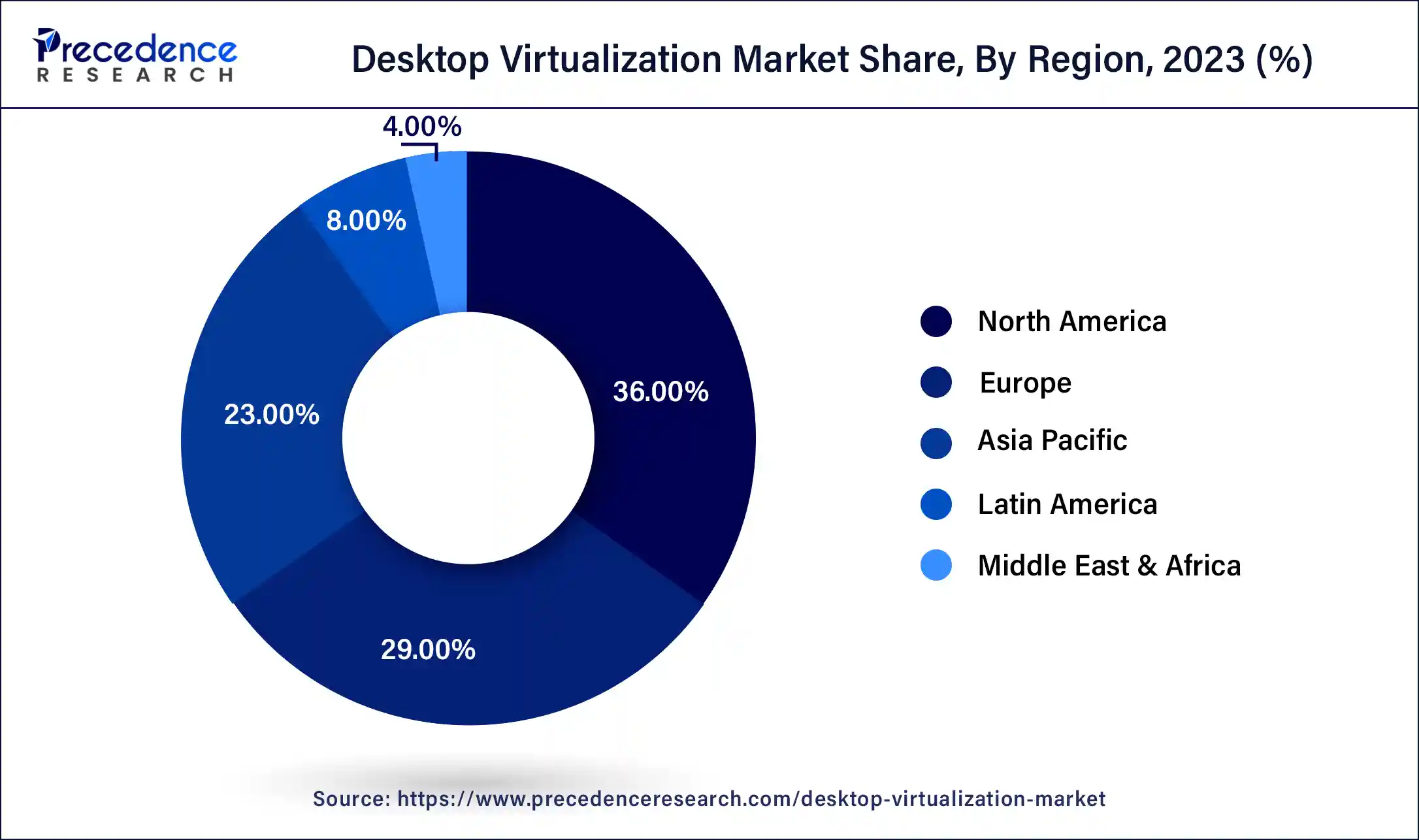

The global desktop virtualization market size is projected to be worth around USD 217.67 billion by 2034 from USD 27.87 billion in 2024, at a CAGR of 22.82% from 2025 to 2034. The North America desktop virtualization market size reached USD 10.03 billion in 2024. The increasing implementation of desktop virtualization by IT users is the key driver for the desktop virtualization market.

Desktop Virtualization Market Key Takeaways

- The global desktop virtualization market was valued at USD 27.87 billion in 2024.

- It is projected to reach USD 217.67 billion by 2034.

- The desktop virtualization market is expected to grow at a CAGR of 22.82% from 2025 to 2034.

- North America generated the largest market share of 36% in 2024.

- Asia Pacific is expected to show the fastest growth in the market during the forecast period.

- By type, the virtual desktop infrastructure (VDI) segment dominated the market in 2024.

- By type, the desktop-as-a-service (DaaS) segment is expected to grow at the fastest rate in the market over the forecast period.

- By enterprise type, the large enterprise segment led the global market in 2024.

- By enterprise type, the small & medium enterprises (SMEs) segment is projected to witness the fastest growth in the market during the forecast period.

- By industry, the IT & telecom segment contributed more than 20% of market share in 2024.

- By industry, the BFSI segment is anticipated to grow at the fastest rate in the market during the projected period.

How is AI Revolutionizing the Desktop Virtualization Market?

AI drives efficiency in the desktop virtualization market by redefining the way companies control and optimize their resources, which can lead to significant improvements in the automation and efficiency of operations. Furthermore, the advancements in artificial intelligence (AI) and its impact on all types of technologies utilized globally by users, such as desktop virtualization, are becoming popular among companies, which can present opportunities for the future.

- In November 2023, Amazon Web Services and NVIDIA announced an expansion of their strategic collaboration to deliver the most advanced infrastructure, software, and services to power customers' generative artificial intelligence (AI) innovations. Featuring next-generation GPUs, CPUs, and AI software, AWS Nitro System advanced virtualization and security, elastic fabric adapter (EFA) interconnect, and UltraCluster scalability that are ideal for training foundation models and building generative AI applications.

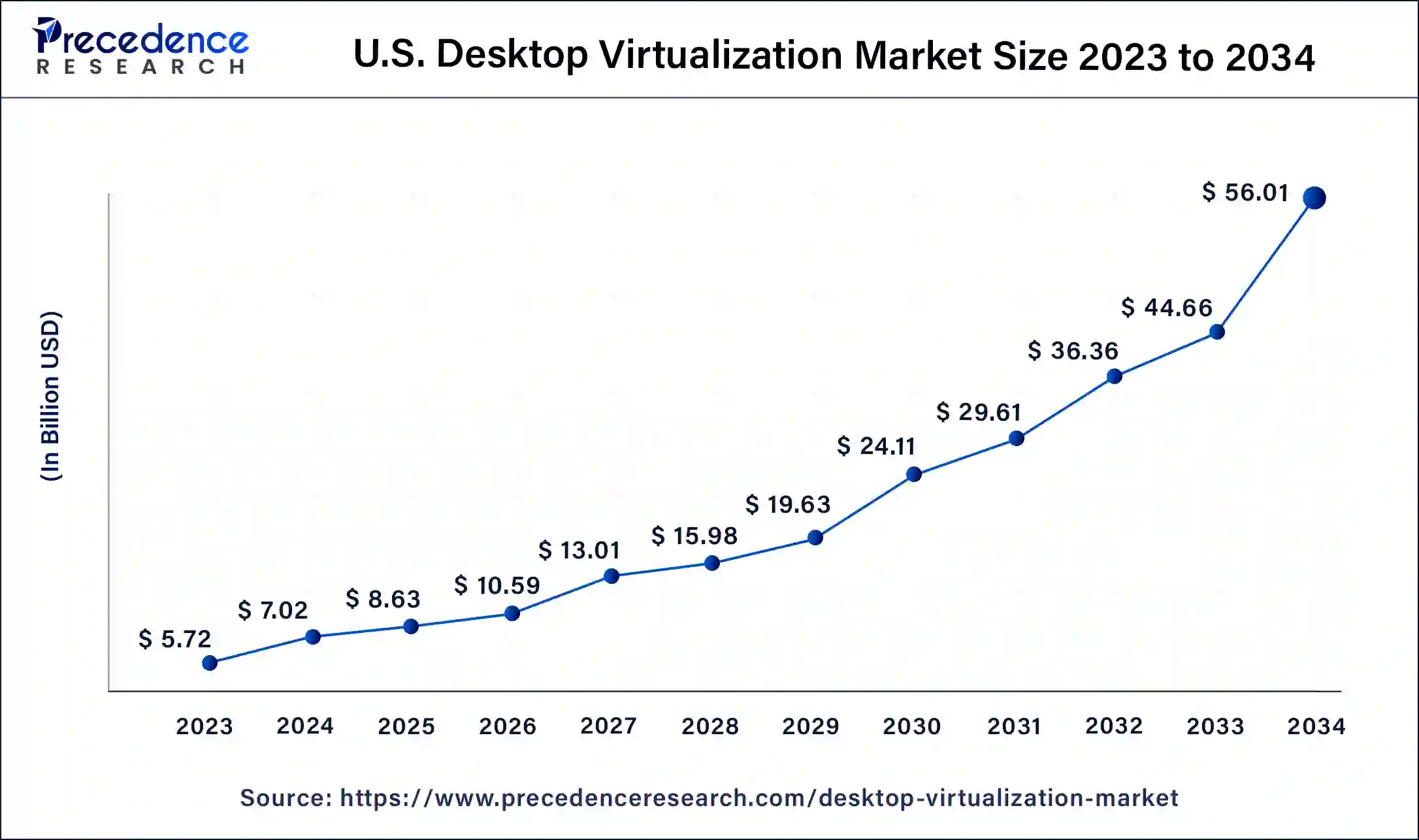

U.S. Desktop Virtualization Market Size and Growth 2025 to 2034

The U.S. desktop virtualization market size was exhibited at USD 7.02 billion in 2024 and is projected to be worth around USD 56.01 billion by 2034, poised to grow at a CAGR of 23.08% from 2025 to 2034.

North America dominated the global desktop virtualization market in 2024 as many North American corporations were quick adopters of this technology which can lead to the expansion of the market in the future. Furthermore, the region's exceptional IT infrastructure enables the easy management and implementation of virtual desktop solutions.

- In November 2023, Microsoft revealed the General Availability of its new Azure Virtual Desktop Web Client User Interface. Users can use this feature to Restore web client settings to their original values, select either light or dark themes, and view resources in grid or list formats.

Asia Pacific is expected to show the fastest growth in the desktop virtualization market during the forecast period, which can be attributed to the increasing requirement for cloud computing. Virtual machines are also becoming popular in the region, which is another significant factor fueling market growth. Moreover, there has been massive growth in cloud computing and the digitalization of numerous industrial operations.

List of Regions by number of Internet users (2023)

| Region | 2023 |

| Africa | 37% |

| Americas | 87% |

| Arab States | 69% |

| Asia and Pacific | 66% |

| Commonwealth of Independent State | 89% |

| Europe | 91% |

Market Overview

Desktop virtualization is a method that allows users to ingress their workstations from a remote location. Employees can access their company tools from any laptop, tablet, desktop, or smartphone regardless of device type or operating system. Remote desktop virtualization is a key factor in digital environments. This is due to programs and user data being saved on the desktop virtualization server instead of on other devices. The potential risk of lost or stolen devices is also reduced.

Desktop Virtualization Market Growth Factors

- A rising shift toward remote and hybrid work models is expected to drive the desktop virtualization market growth soon.

- Companies' implementation of improved security and data protection.

- Increasing application compatibility along with reduced hardware cost will likely contribute to the desktop virtualization market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 217.67 Billion |

| Market Size in 2025 | USD 34.23 Billion |

| Market Size in 2024 | USD 27.87 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Organization Size, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Simplified IT management system

The desktop virtualization market enables IT teams to automate security patches, software upgrades, and user access control. This method reduces the time and resources needed for IT help because IT personnel can access all virtual desktops from a centralized location, which can give more room for IT teams to focus on more strategic projects like tightening security standards, updating IT infrastructure, and developing new solutions for corporate expansion. From the rise of generative AI to evolving regulations and data sovereignty laws, developing solutions that prioritize resiliency and performance will help ensure regulatory compliance and secure innovation.

- In May 2024, Dizzion, the leader in Desktop as a Service, announced the launch of Dizzion DaaS on IBM Cloud Virtual Private Cloud (VPC). This is for organizations of all types, especially those across highly regulated industries.

Restraint

Network dependency

Desktop virtualization depends solely on stable network connection issues such as latency, lag, and bandwidth limits, which can significantly decrease the user experience and make it less suitable for places with sluggish or unpredictable connections. However, a constant and rapid network is essential to provide smooth and efficient access to virtual apps and desktops, and this can negatively impact the growth of the desktop virtualization market.

Opportunity

Cloud computing

The growing need for and utilization of cloud computing in most applications is expected to create opportunities in the global desktop virtualization market. Desktop services, accessibility, and storage solutions for the cloud are highly efficient. Many organizations are planning to integrate cloud computing for high efficiency. Additionally, there is a great demand for R&D in the virtualization concept. The desktop virtualization market solutions function well for medium and small enterprises.

- In August 2022, VMware released updates to Horizon Cloud to make the offering easier for companies to manage and scale. The company launched an improved version of Horizon Cloud on Microsoft Azure at VMware Explore in San Francisco. It also plans to launch a managed virtual desktop product to support the various needs of hybrid work.

Type Insights

The virtual desktop infrastructure (VDI) segment dominated the desktop virtualization market in 2024. The growth of the segment can be attributed to the growing adoption of the use-your-device concept. DI also uses virtual machines to provide and control virtual desktops. It offers various benefits like cost saving, centralized management, remote access, and robust security. In VDI, data is primarily stored on the cloud server rather than any device that can protect data if an endpoint device gets compromised.

The desktop-as-a-service (DaaS) segment is expected to grow at the fastest rate in the desktop virtualization market over the forecast period. The growing availability of high-speed internet along with security solutions is boosting the growth of the desktop-as-a-service segment, especially after the pandemic and throughout the forecast period. Moreover, DaaS can also offer many opportunities for resellers and channel partners to sell software and hardware solutions to consumers, which can drive the segment's growth soon.

- In October 2022, Amazon Web Services moved to bring desktop virtualization (VDI) into the age of desktop-as-a-service. VDI's share of all desktops has hovered below five percent for years because the tech is not trivial to deploy hefty servers in a well-groomed network, and often, a fast SAN is required. Some overprovisioning of that rig is all but assumed to cope with predictable peak loads that happen when most of the workforce fires up their PC at the start of the working day.

Enterprises Type Insights

The large enterprise segment led the global desktop virtualization market in 2024. The growth of the segment can be linked to the growing utilization of desktop virtualization systems by large organizations having complex IT environments and numerous user needs. Also, in large organizations, desktop virtualization can propel employee productivity and speed up application access by enhancing remote work capabilities.

- In October 2023, AWS unveils new enterprise hardware to provide businesses with easy-to-use virtual desktops. One of Amazon's most familiar consumer devices has been reinvented by AWS for the enterprise. At first glance, it may look like a Fire TV Cube, but the new Amazon Workspaces Thin Client is not for spending time watching Night Football or bingeing Invincible. As the name suggests, it's intended for enterprise workers to reduce an employer's technology costs and provide enhanced security.

The small & medium enterprises (SMEs) segment is projected to witness the fastest growth in the desktop virtualization market during the forecast period. The segment's growth can be credited to the increasing use of these systems in businesses with limited resources and a smaller workforce. They also have a single product, owner, and service to operate within a local market.

Industry Insights

The IT & telecom segment dominated the desktop virtualization market in 2024. The industry's emphasis is on ensuring employee productivity and offering a flexible work location. Modern telecommunications industry players have various communication equipment to deliver data and a set of voice and broadband services, which is expected to drive the segment growth in upcoming years.

The BFSI segment is anticipated to grow at the fastest rate in the desktop virtualization market during the projected period due to customers' rapid adoption of digital tools and platforms. Additionally, the growing revenue generation of the banking and financial sector to provide efficient services and solutions to customers can contribute to the market expansion shortly.

Desktop Virtualization Market Companies

- Cisco Systems

- Parallels International

- Citrix Systems

- HP Enterprises

- Ericom Software

- Huawei Technologies

- 7Commvault

- VmWare

- Microsoft Corporation

- Oracle Corporation

- Ncomputing

- RedHat

- Microsoft

- Evolve IP

Recent Developments

- In July 2023, Citrix partnered with Twilio, a top global provider of customer engagement software. This shows that Citrix is sincerely dedicated to offering integrated high-performance solutions through its DaaS, which would work well with the Twilio Flex operating environment.

- In April 2023, Virtual Cable and Huawei Cloud forged a partnership to catalyze public cloud adoption in digital workplaces to enhance the safety, productivity, and efficiency of businesses. Virtual Cable is a company that specializes in workplace digitalization using UDS Enterprise software that supports desktop virtualization, application virtualization, and remote device access.

Segments Covered in the Report

By Type

- Virtual Desktop Infrastructure

- Remote Desktop Services

- Desktop-ss-s-Service

By Organization Size

- Small & Medium Enterprises

- Large Enterprises

By Industry

- IT & Telecom

- Manufacturing & Automotive

- Education

- BFSI

- Healthcare

- Retail & Supply Chain Management (SCM)

- Government

- Media & Entertainment

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting