What is the Virtual Desktop Infrastructure Market Size?

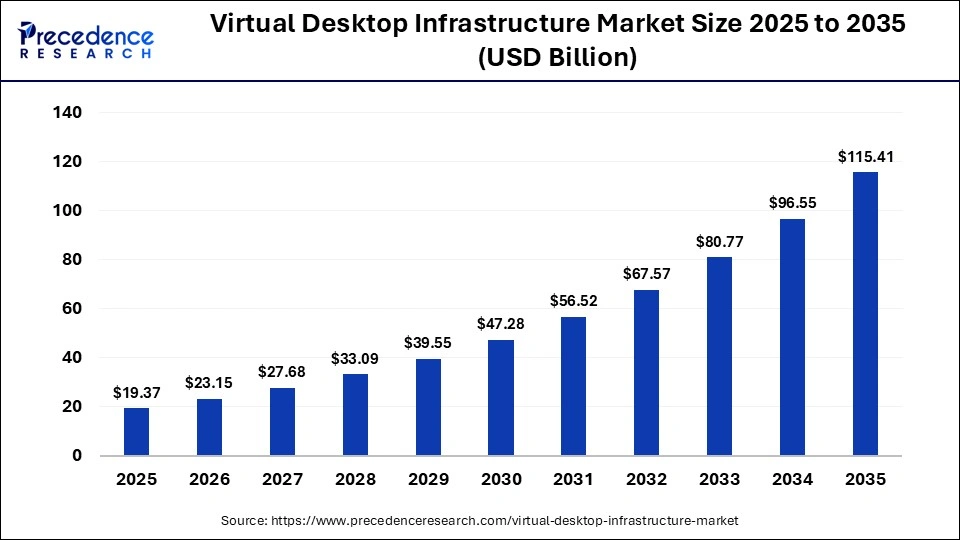

The global virtual desktop infrastructure market size accounted for USD 19.37 billion in 2025 and is predicted to increase from USD 23.15 billion in 2026 to approximately USD 115.41 billion by 2035, expanding at a CAGR of 19.54% from 2026 to 2035. The market is witnessing substantial growth due to the shift to hybrid work and cloud-based DaaS solutions, which offer heightened security, scalability, and cost-effective alternatives to traditional IT infrastructure.

Market Highlights

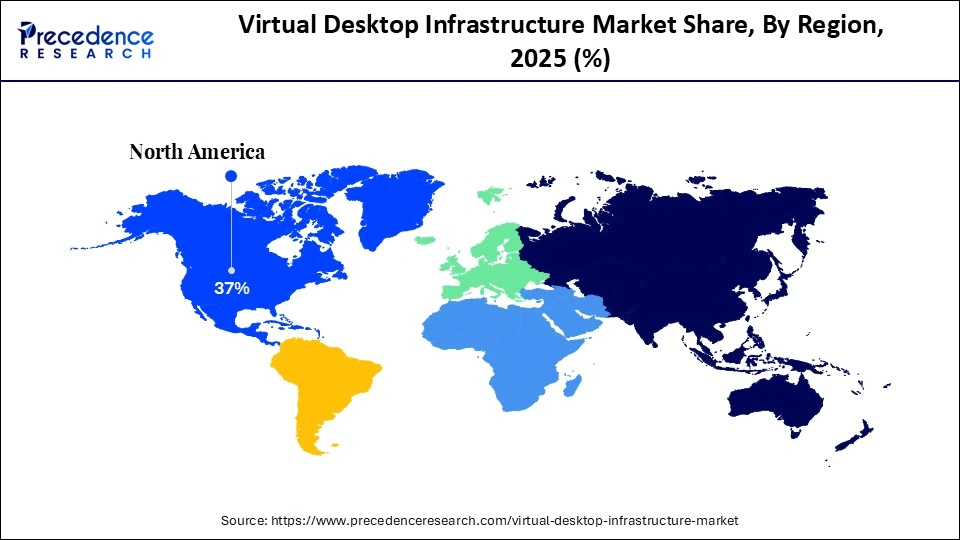

- North America dominated the market with a major market share of around 37% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

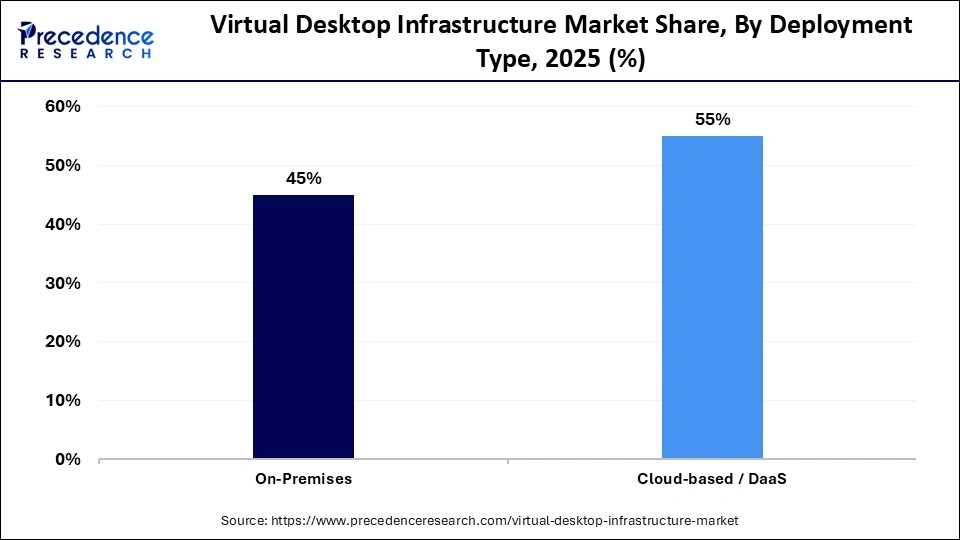

- By deployment type, the on-premises segment contributed the highest market share of around 45% in 2025.

- By deployment type, the cloud-based/ DaaS segment is expected to grow at a CAGR of about 27.1% between 2026 and 2035.

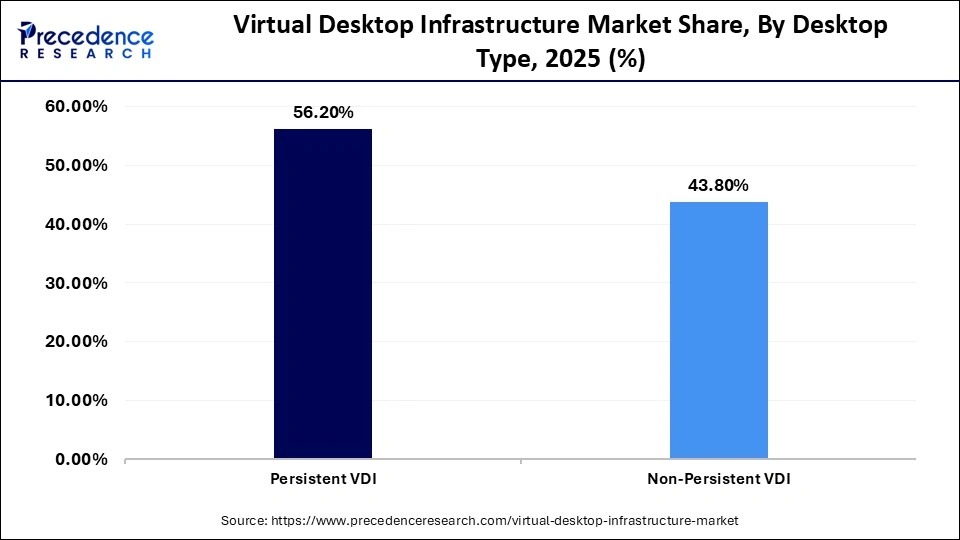

- By desktop type, the persistent VDI segment held a major market share of around 56.2% in 2025.

- By desktop type, the non-persistent VDI segment is expected to expand at a notable CAGR from 2026 to 2035.

- By vertical, the IT & telecom segment held a considerable share of around 18.0% in 2025.

- By vertical, the healthcare segment is expanding at the fastest CAGR between 2026 and 2035.

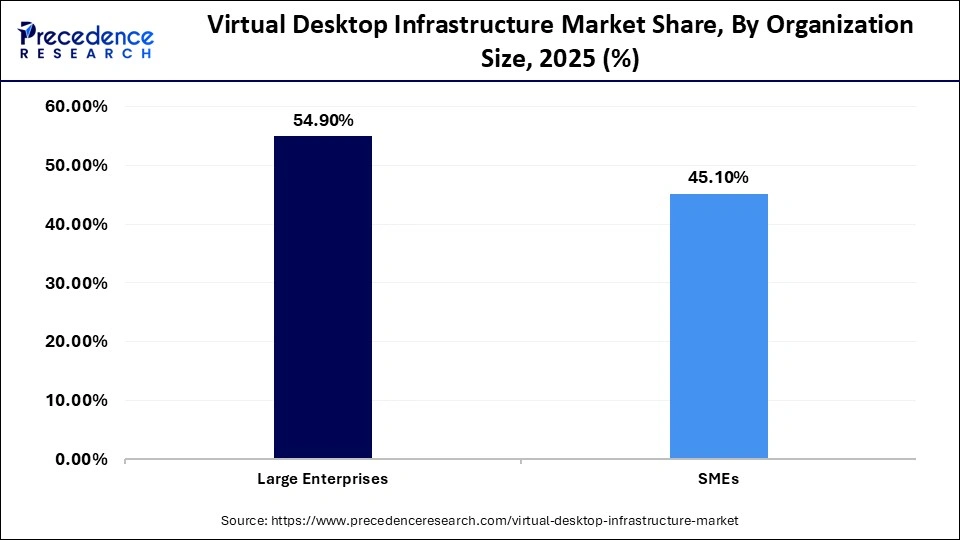

- By organization size, the large enterprises segment accounted for the largest market share of about 54.9% in 2025.

- By organization size, the SMEs segment is projected to grow at a solid CAGR between 2026 and 2035.

What is the Virtual Desktop Infrastructure?

Virtual desktop infrastructure (VDI) is a form of desktop virtualization in which the operating system runs within a virtual machine (VM) in a centralized, secure location rather than locally on a physical PC. Key components of this infrastructure include a hypervisor, the virtual desktops, and connection brokers, which allow users to access virtualized desktops from any device over a network. The market is expanding rapidly due to the surge in hybrid or remote work, the need to support Bring Your Own Device policies, improved security as data remains in the data center rather than on endpoint devices, and increasing integration with cloud computing, which is reducing the need for on-premises infrastructure.

How is AI Transforming the Virtual Desktop Infrastructure Market?

Artificial intelligence (AI) is transforming the virtual desktop infrastructure market by optimizing user experience and operational efficiency through predictive resource scaling, enhanced security, and automated troubleshooting via anomaly detection. AI analyzes usage patterns to dynamically adjust compute, storage, and network resources, improving performance and reducing costs. AI-powered chatbots and virtual assistants provide self-service troubleshooting, while AI boosts productivity with features like noise cancellation and virtual backgrounds. AI automates routine maintenance, application lifecycle management, and virtual machine provisioning.

Major Trends in the Virtual Desktop Infrastructure Market

- Rapid Shift to Cloud-Native VDI and DaaS: Enterprises are moving away from traditional on-premises, capital-intensive VDI toward cloud-based solutions, accelerated by the need for remote work, reduced hardware dependencies, and scalable, subscription-based models.

- AI-Driven Management and Optimization: AI and machine learning are increasingly integrated into VDI platforms to optimize performance and user experience, enhancing efficiency in remote work environments.

- Enhanced Security through Zero Trust Architecture: As remote work expands, security is paramount. VDI trends show a shift toward Zero Trust frameworks, where security is integrated into the virtual infrastructure rather than just the network perimeter.

- Adoption of Hybrid VDI Deployments: Organizations are adopting hybrid models that combine on-premises infrastructure for performance-sensitive tasks with public cloud flexibility, offering a balanced approach to cost and control.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.37 Billion |

| Market Size in 2026 | USD 23.15 Billion |

| Market Size by 2035 | USD 23.15 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 19.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Type, Desktop Type, Vertical, Organization Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Deployment Type Insights

What Made On-Premises the Dominant Segment in the Virtual Desktop Infrastructure Market?

The on-premises segment dominated the market by holding about 45% share in 2025. This is primarily due to the superior data security, high customization options, and complete control over IT infrastructure offered by this deployment, making it ideal for industries with strict compliance requirements. Organizations are able to keep sensitive data within their own firewalls, which is crucial for sectors that prioritize data sovereignty, as it ensures that data remains on internal servers rather than in public cloud environments. Additionally, on-premises solutions allow for extensive customization of hardware to meet specific regulatory standards.

The cloud-based/ DaaS segment is expected to grow at the fastest CAGR of approximately 27.1% in the upcoming period. This rapid expansion is attributed to the scalability of DaaS solutions, which allow businesses to scale their IT infrastructure easily and cost-effectively. By eliminating the need for large upfront investments in physical data center hardware, DaaS enables organizations to shift from capital expenditures to a more flexible, pay-as-you-go operational expense model.

The increasing demand for remote work solutions, especially in a post-pandemic world, is fueling the adoption of DaaS, as it enables employees to access their desktop environments securely from any location. DaaS providers typically offer built-in security measures and ensure regulatory compliance, making it easier for industries to integrate these solutions into their operations without worrying about complex infrastructure management or compliance risks.

Desktop Type Insights

How Did the Persistent VDI Segment Lead the Virtual Desktop Infrastructure Market?

The persistent VDI segment led the market with around 56.2% share in 2025. This dominance is attributed to its ability to provide personalized, user-specific environments and high performance. This makes persistent VDI particularly suitable for industries with complex requirements, such as finance, healthcare, and engineering, where tailored, secure workspaces are critical.

One of the key advantages of persistent VDI is its ability to retain user-specific data, settings, and applications across sessions, providing a seamless and dedicated desktop experience, especially for power users who need consistency and reliability in their work environments. Moreover, persistent VDI enhances compliance with stringent industry regulations, such as those in banking, financial services, and insurance (BFSI), as it allows for better control over data storage and user access, which is crucial for meeting data privacy and security requirements.

The non-persistent VDI segment is expected to grow at the fastest CAGR during the forecast period. This is largely due to its cost-efficiency, simplified management, and enhanced security features. Non-persistent desktops significantly reduce storage consumption, as user changes are not permanently saved on the desktop disk. These desktops can also be shared among multiple users, reducing the need for expensive, high-performance storage arrays. They reset to their original state after each session and provide heightened security by being easily wiped and reset in case of infection.

Vertical Insights

How Does the IT & Telecom Segment Dominate the Virtual Desktop Infrastructure Market?

The IT & telecom segment dominated the market with approximately 18.0% share in 2025. This leadership is attributed to rapid adoption driven by the demand for secure, scalable, and remotely accessible high-performance environments that support distributed workforces and digital transformation. The sector relies heavily on remote access for its dispersed workforce, necessitating secure and flexible virtual workstations to reach critical systems. VDI enables telecom companies to adapt quickly to changing business needs, seasonal demands, and rapid technological advancements.

The healthcare segment is forecasted to experience the fastest growth in the foreseeable future, primarily due to the urgent need for secure, HIPAA-compliant remote access to patient records, thus minimizing data breaches. With the rise in remote healthcare services, VDI allows medical professionals to securely access Electronic Health Records (EHR) and diagnostic applications from any location. The shift towards hybrid work models for administrative staff, along with the need for high-performance and secure access to data, is driving rapid VDI deployment to enhance operational efficiency and improve patient outcomes.

Organization Size Insights

What Made Large Enterprises the Leading Segment in the Virtual Desktop Infrastructure Market?

The large enterprises segment led the market with about 54.9% share in 2025, driven by the intense demand for secure, scalable, and flexible remote work environments. These enterprises leverage VDI for improved IT management, enabling centralized patching, rapid deployment of virtual desktops, and scalable infrastructure to accommodate fluctuating workforce sizes. The focus on strict data security, regulatory compliance, and protection against increasing cyber threats also propels large enterprises to centralize data on secure servers rather than on local or vulnerable remote devices.

The SMEs segment is expected to grow the fastest during the forecast period. This growth is largely driven by the rapid adoption of affordable DaaS models that eliminate significant upfront infrastructure costs and complex IT management needs. SMEs often lack dedicated IT teams, so VDI provides centralized management, reducing the burden of managing and updating individual employee workstations. The increasing need for secure remote access to company data from anywhere serves as a major driver, enabling SMEs to compete with larger organizations without substantial IT investments.

Regional Insights

How Big is the North America Virtual Desktop Infrastructure Market Size?

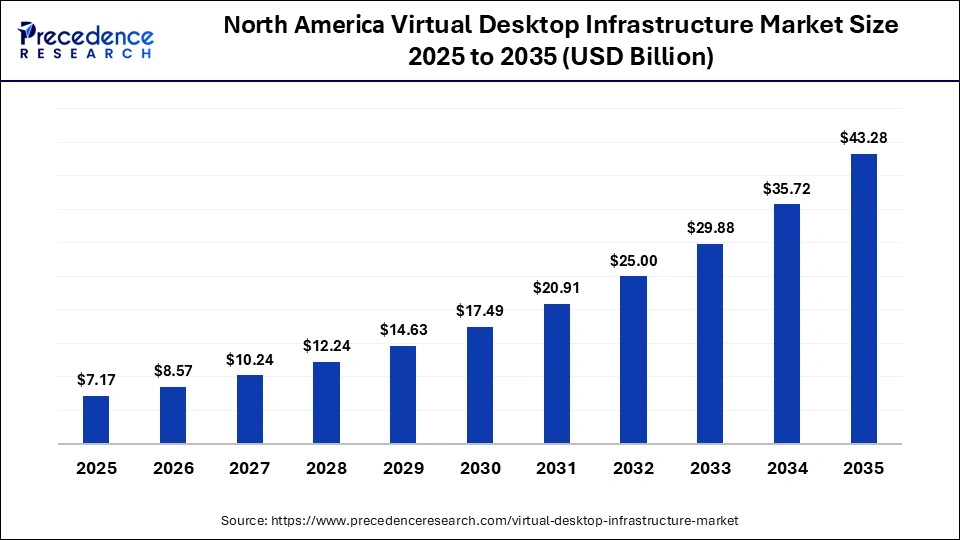

The North America virtual desktop infrastructure market size is estimated at USD 7.17 billion in 2025 and is projected to reach approximately USD 43.28 billion by 2035, with a 19.70% CAGR from 2026 to 2035.

How Did North America Dominate the Virtual Desktop Infrastructure Market?

North America dominated the market by holding about 37% share in 2025. This dominance is attributed to advanced IT infrastructure, high adoption of hybrid work models, and the strong presence of major market players. Early adoption of 5G and cloud-based technologies enables seamless VDI deployment. The region is home to a large number of data centers and cloud service providers. Additionally, major players headquartered in the U.S., such as Microsoft Corporation, VMware, Citrix Systems, and Amazon Web Services, are fostering innovation and providing mature solutions. Large enterprises in the region are making extensive investments to modernize their IT infrastructure and boost workforce productivity, ensuring the long-term growth of the market.

What is the Size of the U.S. Virtual Desktop Infrastructure Market?

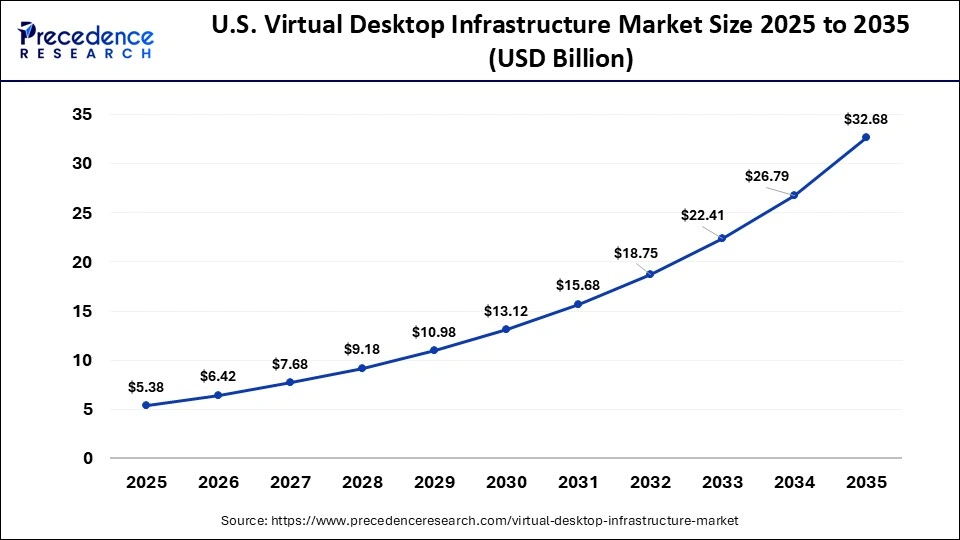

The U.S. virtual desktop infrastructure market size is calculated at USD 5.38 billion in 2025 and is expected to reach nearly USD 32.68 billion in 2035, accelerating at a strong CAGR of 19.77% between 2026 and 2035.

U.S. Virtual Desktop Infrastructure Market Trends

The U.S. plays a dominant role within the region, primarily due to higher demand for enhanced security for remote workers, compliance with industry regulations in BFSI, IT modernization, significant investments in and adoption of hybrid work models, strict security requirements, and digital transformation across large enterprises. Additionally, it is home to many prominent key players like VMware, Microsoft Corporation, Citrix, and Amazon Web Services, who drive innovation in cloud-based VDI solutions.

Why is Asia Pacific Considered the Fastest-growing Region in the Virtual Desktop Infrastructure Market?

Asia Pacific is anticipated to have the fastest growth during the forecast period. This growth is mainly driven by a massive digital transformation, robust investment in cloud technology, and increasing adoption of hybrid work models. Additionally, by following global shifts, companies in the region are rapidly adopting VDI to enable secure, consistent, and flexible remote work access for employees. Government-led projects and digitalization initiatives in countries like China, India, and Japan are accelerating the demand for modern IT infrastructure. The rapid rollout of 5G in China, Japan, and South Korea enhances the performance of virtual desktops by improving the user experience.

India Virtual Desktop Infrastructure Market Trends

India is an emerging market within the region, mainly due to the widespread adoption of remote and hybrid work, particularly within India's massive IT-Enabled Services and Business Process Management (BPM) sectors. Additionally, the BFSI and retail sectors in India are heavily adopting VDI for data security and efficient management. A rapid transition from on-premises to cloud-based VDI solutions is occurring to increase scalability and reduce IT costs, with regulatory compliance assured.

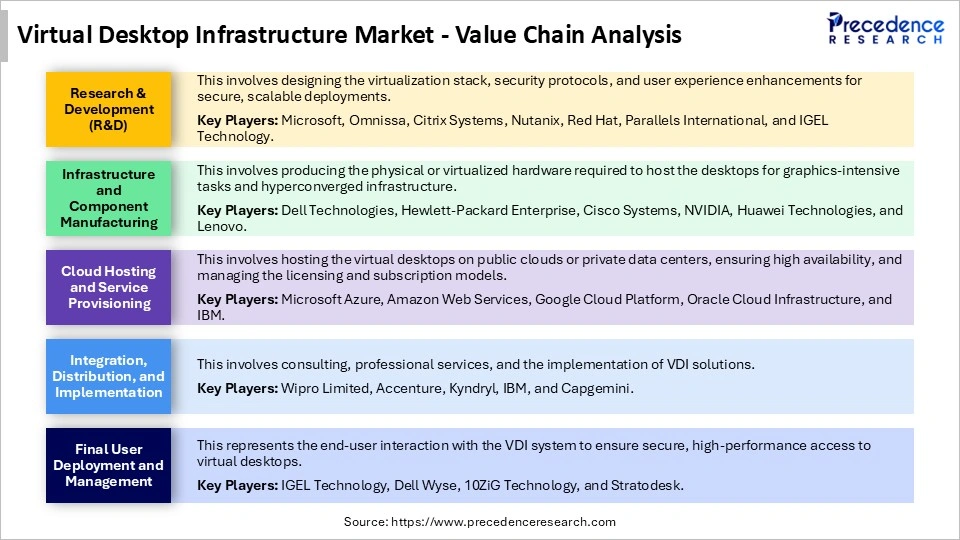

Virtual Desktop Infrastructure Market Value Chain Analysis

Who are the Major Players in the Global Virtual Desktop Infrastructure Market?

The major players in the virtual desktop infrastructure market include Microsoft, Omnissa, Citrix, Amazon Web Services (AWS), Nutanix, Inc., Cisco Systems, Inc., HPE (GreenLake), IBM Cloud, and Parallels (Alludo).

Recent Developments

- In September 2025, Creative ITC launched its Virtual Cloud Desktop Pod (VCDPod), designed for resource-intensive applications like Enscape, Rhino, and 3ds Max, offering a flexible and secure solution to access high-end computing resources remotely using laptops or tablets, enhancing productivity and enabling multi-screen capabilities without image degradation. John Dawson, Director of Creative ITC, emphasized that VCDPod meets the increasing demand for innovative designs to focus on design and innovation.

- In August 2024, Broadcom Inc. introduced VMware Cloud Foundation (VCF) 9, unifying IT architectures into a cost-effective private cloud platform. VCF 9 simplifies the deployment and operation of secure private clouds, providing public cloud scale with private cloud security with improving application development and security efforts. Krish Prasad from Broadcom noted that VCF 9 will revolutionize the private cloud landscape by delivering a modern, integrated platform for enhanced innovation and efficiency.

- In June 2024, Inevidesk launched a channel partner program in partnership with Scan to make high-performance VDI accessible to all clients. With a focus on organizations with demanding GPU needs, the program allows partners to offer affordable high-performance virtual desktops, overcoming the limitations of existing VDI solutions. Mark Adams, Co-Founder of Inevidesk, expressed excitement about collaborating with solution providers to enable flexible, collaborative working practices and unlock business value.

Segments Covered in the Report

By Deployment Type

- On-Premises

- Cloud-based/DaaS

By Desktop Type

- Persistent VDI

- Non-Persistent VDI

By Vertical

- IT & Telecom

- Healthcare

By Organization Size

- Large Enterprises

- SMEs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting