Virtual Machine Market Size and Forecast 2025 to 2034

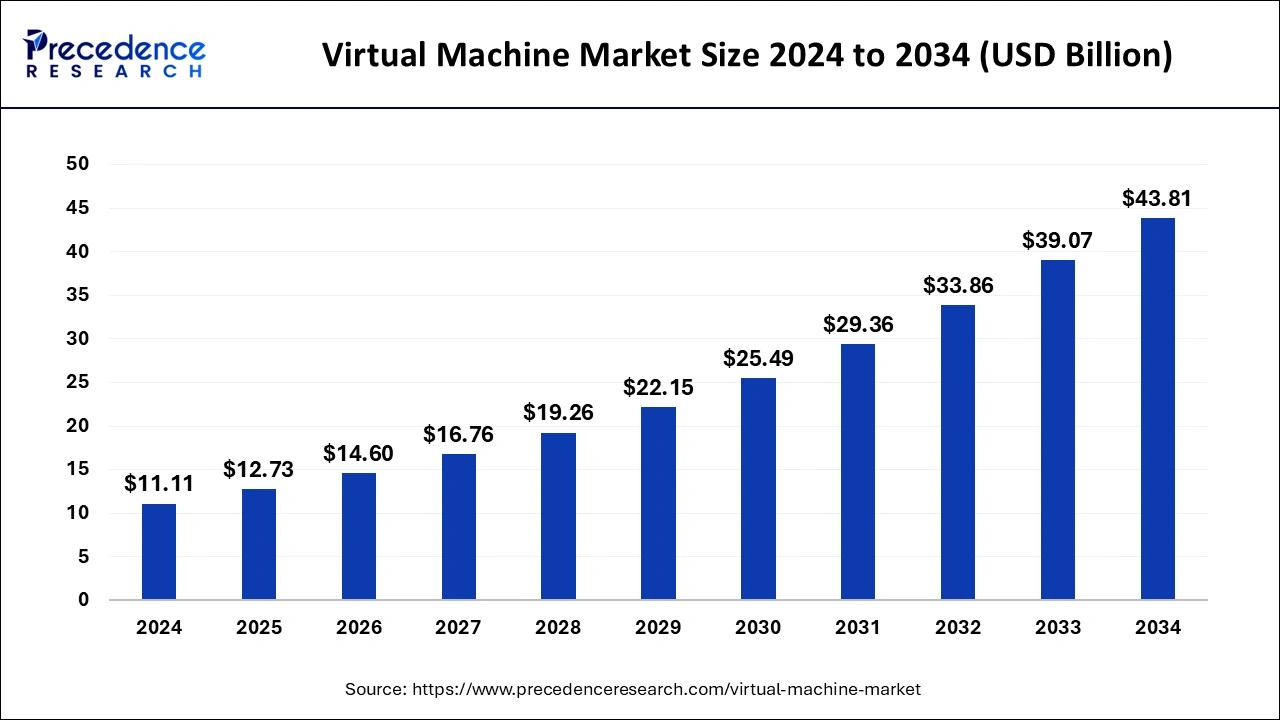

The global virtual machine market size accounted for USD 11.11 billion in 2024 and is predicted to increase from USD 12.73 billion in 2025 to approximately USD 43.81 billion by 2034, expanding at a CAGR of 14.71% from 2025 to 2034.

Virtual Machine MarketKey Takeaways

- The global virtual machine market was valued at USD 11.11 billion in 2024.

- It is projected to reach USD 43.81 billion by 2034.

- The virtual machine market is expected to grow at a CAGR of 14.71% from 2025 to 2034.

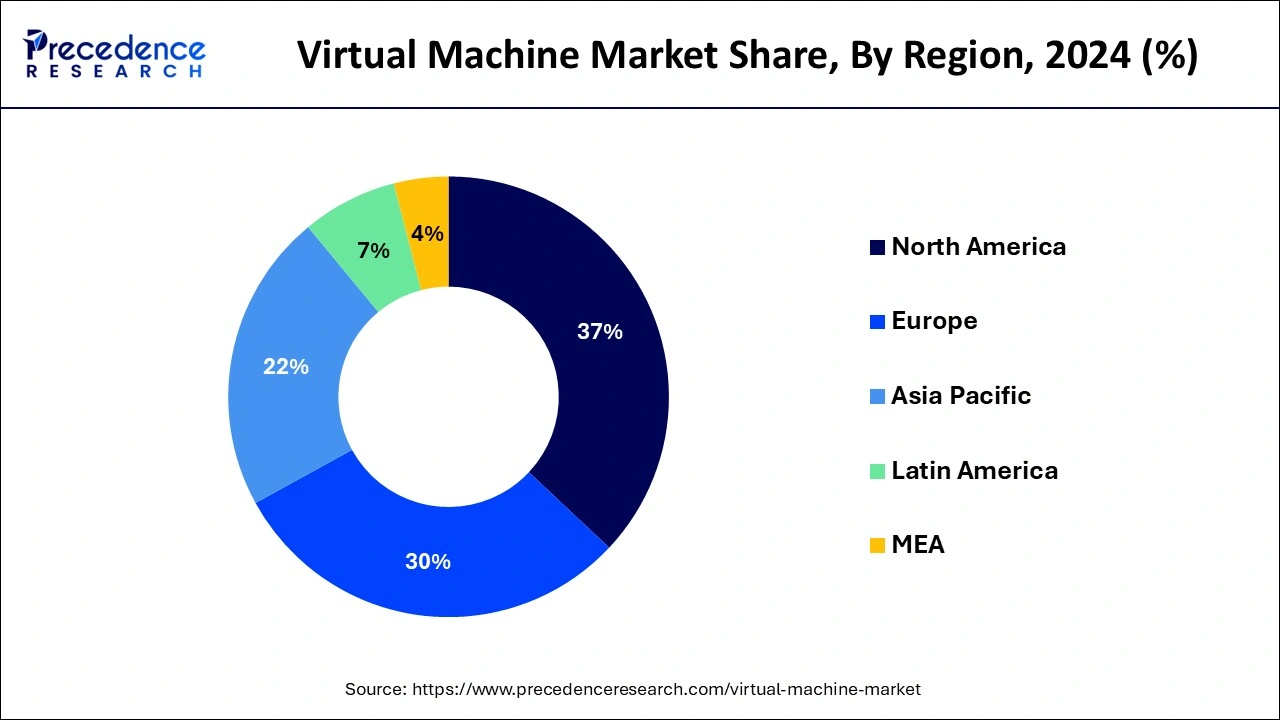

- North America contributed 37% market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

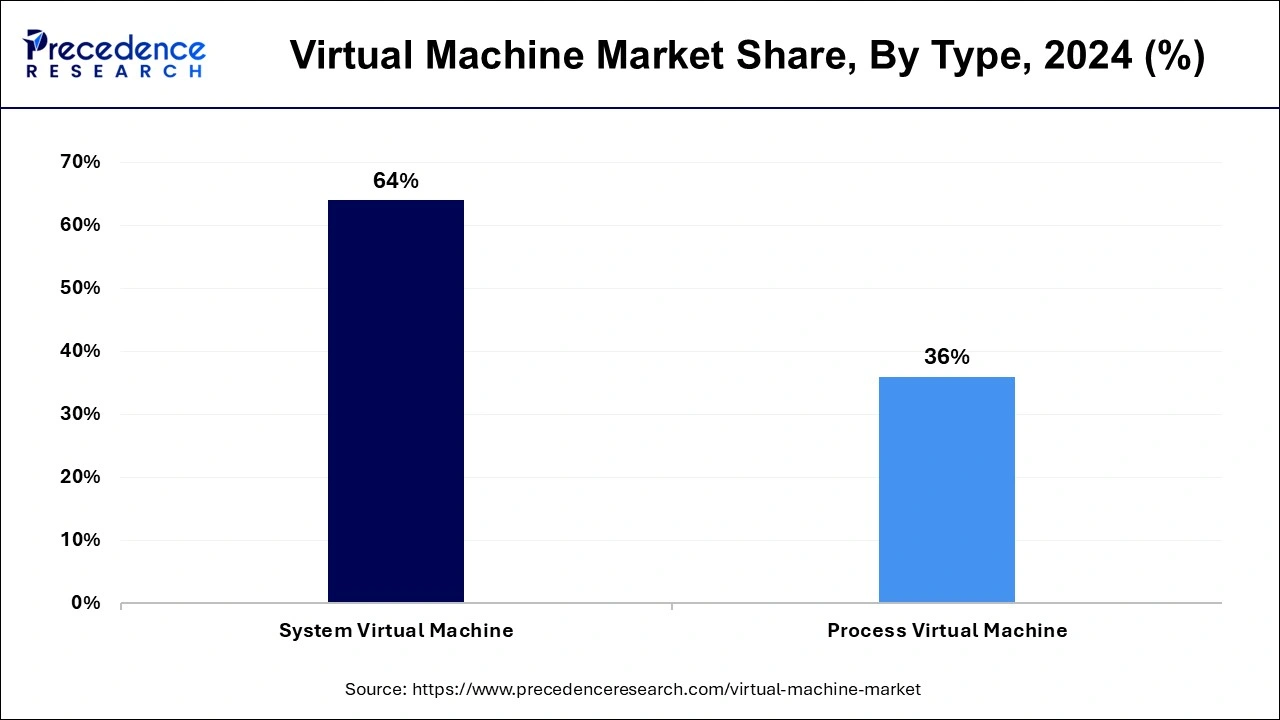

- By type, the system virtual machine segment has held the largest market share of 64% in 2024.

- By type, the process virtual machine segment is anticipated to grow at a remarkable CAGR of 16.12% between 2025 and 2034.

- By organization size, the SMEs segment generated over 73% of the market share in 2024.

- By organization size, the large enterprises segment is expected to expand at the fastest CAGR over the projected period.

- By vertical, the BFSI segment generated over 27% of market share in 2024.

- By vertical, the government & public segment is expected to expand at the fastest CAGR over the projected period.

U.S.Virtual Machine Market Size and Growth 2025 to 2034

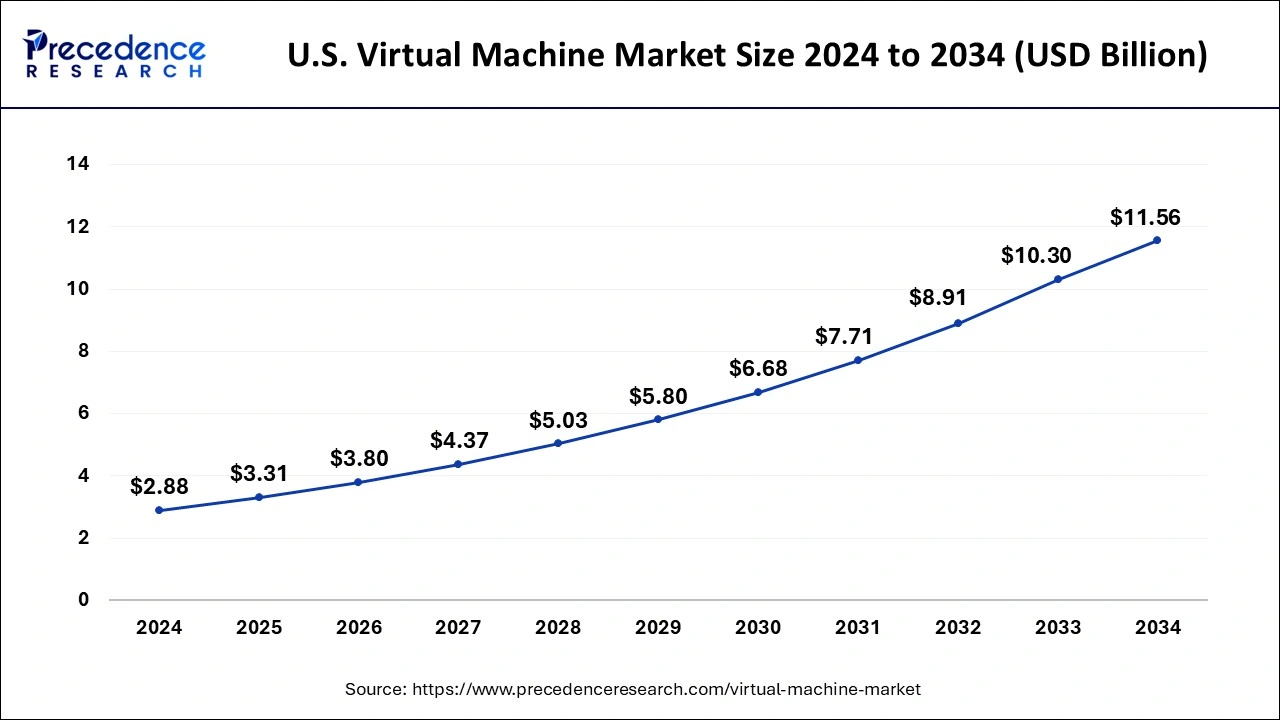

The U.S. virtual machine market size was evaluated at USD 2.88 billion in 2024 and is projected to be worth around USD 11.56 billion by 2034, growing at a CAGR of 14.91% from 2025 to 2034.

In 2024, North America held a share of 37% in the virtual machine market due to robust technological infrastructure, high IT spending, and widespread adoption of cloud computing. The region's advanced business ecosystem emphasizes efficiency through virtualization, driving the demand for virtual machines. Additionally, the presence of key industry players and early adoption of cutting-edge technologies contribute to North America's major market share. The region's proactive approach towards digital transformation, coupled with a mature IT landscape, positions it at the forefront of virtual machine adoption and innovation.

Asia-Pacific is projected to witness rapid growth in the virtual machine market due to increasing digital transformation initiatives, expanding cloud adoption, and a burgeoning IT landscape. Governments and businesses in the region are embracing virtualization technologies for enhanced scalability, flexibility, and cost-effectiveness. The rise of remote work and the need for efficient data management further contribute to the surge in demand for virtual machines. As the Asia-Pacific region continues to prioritize technological advancements, the virtual machine market is set to experience substantial expansion, driven by a dynamic and evolving digital ecosystem.

Meanwhile, Europe is witnessing notable growth in the virtual machine market due to increased emphasis on digital transformation, remote work, and efficient IT infrastructure. Organizations in the region are adopting virtualization technologies to enhance flexibility, optimize resource utilization, and improve overall business continuity. The push for cloud adoption, coupled with the rising demand for secure and scalable computing solutions, has driven the expansion of the virtual machine market in Europe, reflecting a broader trend of technological advancement and modernization across various industries in the region.

Market Overview

A virtual machine (VM) is a software-based emulation of a physical computer, allowing multiple operating systems to run on a single physical machine. It operates as an isolated environment, encapsulating the entire computing system, including the operating system, applications, and hardware components. This emulation enables users to run diverse software and perform various tasks on a single device, promoting resource efficiency and flexibility. VMs are commonly used for testing, development, and server consolidation. They provide a secure and scalable way to run multiple operating systems on a single piece of hardware, reducing the need for additional physical machines. Virtualization technology has become integral in modern computing, enabling more efficient resource utilization, and facilitating the deployment and management of diverse computing environments.

Virtual Machine Market Data and Statistics

- VMware, a key player in virtualization, reported in their annual report that by the end of 2020, approximately 80% of Fortune 100 companies were utilizing their virtualization solutions for data center efficiency.

- As per the Stack Overflow Developer Survey 2021, over 60% of developers worldwide used virtual machines for application testing and development, showcasing the integral role of VMs in the software development lifecycle.

- A survey by Cybersecurity Insiders revealed that 68% of organizations considered virtualization crucial for their disaster recovery strategies, emphasizing the role of VMs in enhancing IT resilience.

Virtual Machine Market Growth Factors

- The virtual machine market has experienced substantial growth due to the widespread adoption of cloud computing. Cloud services providers like AWS, Azure, and Google Cloud heavily rely on virtualization technologies to offer scalable and flexible computing resources to businesses and individuals.

- The rise of remote work has spurred the demand for virtual machines as they enable employees to access centralized computing resources from various locations. The COVID-19 pandemic accelerated this trend, with many organizations realizing the importance of virtualization for remote collaboration and productivity.

- Businesses are increasingly modernizing their data center infrastructure by adopting virtualization technologies. Virtual machines help organizations achieve better resource utilization, scalability, and agility within their data centers, leading to overall operational efficiency and cost savings.

- Virtual machines play a crucial role in the software development lifecycle, allowing developers to create, test, and deploy applications in isolated environments. This facilitates faster development cycles, efficient testing processes, and quicker time-to-market for software products.

- Virtualization contributes to cost savings by reducing the need for physical hardware, lowering energy consumption, and enhancing resource utilization. Organizations can run multiple virtual machines on a single physical server, leading to significant cost efficiencies and a smaller environmental footprint.

- The growing emphasis on cybersecurity and disaster recovery strategies has driven the adoption of virtual machines. Virtualization provides a secure and isolated environment for running applications and services, making it an integral part of business continuity and disaster recovery plans for many enterprises.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 14.71% |

| Market Size in 2025 | USD 12.73 Billion |

| Market Size by 2034 | USD 43.81 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Organization Size, and Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise in remote work

- A FlexJobs survey revealed that remote work has grown by 159% since 2005, emphasizing the need for flexible and accessible computing solutions.

The surge in remote work has significantly boosted the demand for virtual machines (VMs) as organizations seek flexible and accessible computing solutions. With employees working from diverse locations, VMs enable seamless access to centralized computing resources, allowing individuals to connect to a virtual desktop or server securely. This newfound reliance on remote work has accelerated the adoption of virtualization technologies, ensuring that employees can efficiently collaborate and access critical applications and data regardless of their physical location.

Virtual machines facilitate remote work by providing a virtualized environment that mirrors the functionalities of a physical computer. This not only enhances employee productivity but also streamlines IT management by centralizing resources. As businesses prioritize remote-friendly infrastructure, the virtual machine market continues to grow, offering a scalable and efficient solution to support the evolving landscape of modern work arrangements.

Restraint

Complexity and skill gap

The complexity associated with implementing and managing virtual machines (VMs) poses a restraint on the market demand. Setting up virtualization solutions requires specialized skills, and many organizations face challenges in finding professionals with the expertise to design and maintain virtualized environments. The intricacies of VM deployment, configuration, and troubleshooting can be overwhelming for businesses, particularly smaller ones lacking the resources for dedicated IT staff with the required skill set.

The skill gap exacerbates the complexity issue, making it difficult for organizations to fully harness the benefits of virtualization. Limited access to knowledgeable personnel can result in suboptimal implementation, potential security vulnerabilities, and slower issue resolution. As a result, the market demand for virtual machines may be constrained by the barriers posed by the complexity of virtualization technologies and the shortage of skilled professionals needed to navigate these complexities effectively. Efforts to simplify virtualization processes and provide accessible training can help address this challenge and promote broader adoption.

Opportunity

Edge computing integration

Edge computing integration is opening significant opportunities for the virtual machine (VM) market. As computing resources move closer to the edge of the network, VMs provide a scalable and flexible solution for managing workloads in distributed environments. This shift allows businesses to deploy VMs at the edge to process data locally, reducing latency and enhancing the overall performance of applications and services. VMs in edge computing enable the creation of dynamic and efficient computing environments, supporting real-time processing requirements.

This integration is particularly valuable in scenarios where low-latency and high-throughput are critical, such as in IoT (Internet of Things) applications and edge-based analytics. The ability of VMs to provide isolation, security, and easy management in edge computing environments positions them as a key technology for businesses looking to harness the benefits of distributed computing and capitalize on emerging opportunities in the evolving landscape of IT infrastructure.

Type Insights

The system virtual machine segment held the highest market share of 64% in 2024. System virtual machine, a key segment in the virtual machine market, refers to the emulation of an entire computer system. It enables the execution of multiple operating systems on a single physical machine, enhancing resource efficiency. A trend in this segment involves the rising demand for system virtual machines in cloud computing environments. As businesses increasingly adopt cloud services, the need for efficient system-level virtualization grows, allowing seamless management of diverse operating systems within a shared infrastructure, and promoting scalability and cost-effectiveness.

The process virtual machine segment is anticipated to grow rapidly at a significant CAGR of 16.12% during the projected period. Process virtual machines are a type of virtualization technology that allows the execution of individual processes or applications in isolated environments. This segment of the virtual machine market is characterized by its efficiency in running specific tasks independently, enhancing resource utilization and security. A notable trend in process virtual machines involves their integration into containerization technologies, such as Docker, contributing to the broader movement towards lightweight and scalable application deployment. This trend emphasizes the importance of process virtual machines in modern, agile software development practices and microservices architectures.

Organization Size Insights

The SMEs segment has held 73% market share in 2024.Small and medium-sized enterprises (SMEs) in the virtual machine market typically refer to businesses with a limited number of employees and resources. In recent trends, SMEs are increasingly adopting virtual machines to streamline IT infrastructure, enhance flexibility, and reduce costs. Virtualization allows SMEs to run multiple operating systems and applications on a single server, optimizing resource utilization. This trend aligns with the growing recognition among SMEs of the efficiency gains and scalability offered by virtual machines, contributing to their technological advancement and competitiveness.

The large enterprises segment is anticipated to grow rapidly over the projected period. In the virtual machine market, large enterprises represent organizations with extensive infrastructure needs. These companies typically deploy virtual machines to achieve efficient resource utilization, scalability, and cost savings. Trends in this segment include a growing emphasis on hybrid cloud solutions, where large enterprises leverage a combination of on-premises and cloud-based virtualization to enhance flexibility. Additionally, there's a focus on advanced security features and comprehensive management tools to meet the complex requirements of sizable IT environments within large enterprises.

Vertical Insights

The BFSI segment has held a 27% market share in 2024In the BFSI (Banking, Financial Services, and Insurance) segment, virtual machines (VMs) are pivotal for optimizing IT infrastructure. VMs enable secure and efficient operations, allowing financial institutions to manage vast amounts of data and applications. The trend in the BFSI sector involves an increased adoption of VMs to enhance scalability, improve resource utilization, and strengthen data security. As financial services increasingly rely on digital platforms, the virtual machine market in the BFSI vertical is poised to witness sustained growth, driven by the need for agile and resilient IT solutions in this dynamic industry.

The government & public segment is anticipated to grow rapidly over the projected period. The government and public sector vertical in the virtual machine market encompasses public institutions and agencies that leverage virtualization technologies for streamlined operations. Trends indicate a growing adoption of virtual machines for enhanced data security, cost efficiency, and scalable IT infrastructures. Governments worldwide are increasingly deploying virtualization solutions to optimize resource utilization, improve service delivery, and ensure the robustness of critical public services, reflecting a broader trend of leveraging virtual machines to meet the unique demands of the public sector.

Recent Developments

- In June 2020, Microsoft unveiled its enhanced Azure general-purpose and memory-optimized Virtual Machines, featuring the 2nd generation Intel Xeon Platinum 8272CL. These VMs promised around a 20% improvement in CPU performance compared to their predecessors, the Dv3 and Ev3 VMs.

- In December 2020, VMware launched an updated version of VMware vSphere 7, touted as the most robust iteration to date. The new release caters to the evolving needs of organizations, accommodating both traditional and modern applications and workloads.

- In November 2020, AWS introduced EC2 Mac instances, leveraging Mac mini computers. This innovation allows users to run macOS workloads on-demand in the AWS cloud, delivering enhanced flexibility, scalability, and cost benefits for Apple developers.

Virtual Machine Market Companies

- VMware

- Microsoft

- Oracle Corporation

- IBM Corporation

- Citrix Systems

- Red Hat, Inc.

- Amazon Web Services (AWS)

- Google Cloud

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Nutanix

- Cisco Systems

- Huawei Technologies

- Intel Corporation

- Parallels International GmbH

Segments Covered in the Report

By Type

- System Virtual Machine

- Process Virtual Machine

By Organization Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- Telecommunications & ITES

- Government & Public Sector

- Healthcare & Life Sciences

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content