What is the DevSecOps Market Size?

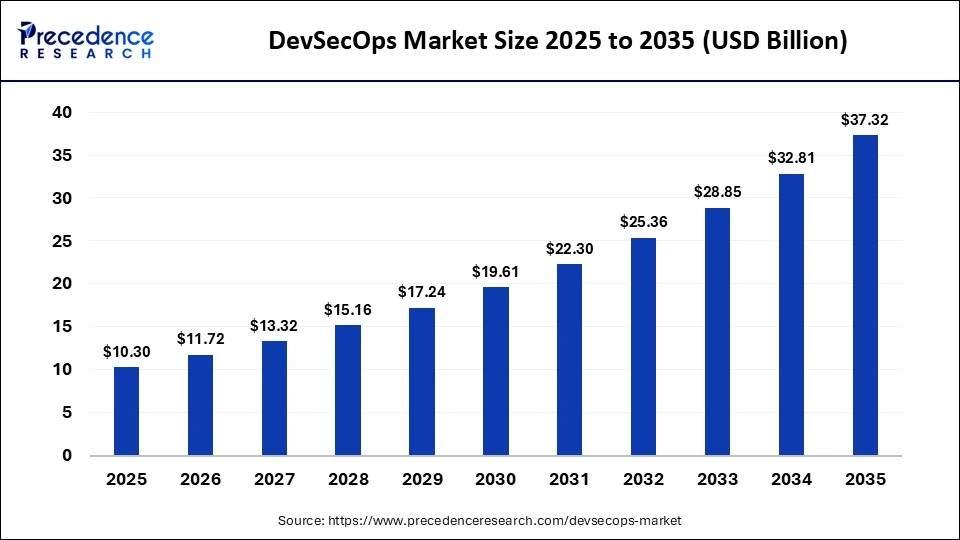

The global DevSecOps market size accounted for USD 10.30 billion in 2025 and is predicted to increase from USD 11.72 billion in 2026 to approximately USD 37.32 billion by 2035, expanding at a CAGR of 13.74% from 2026 to 2035. The market is driven by the growing frequency and sophistication of cyberattacks and the need to embed security early in the software development lifecycle.

Market Highlights

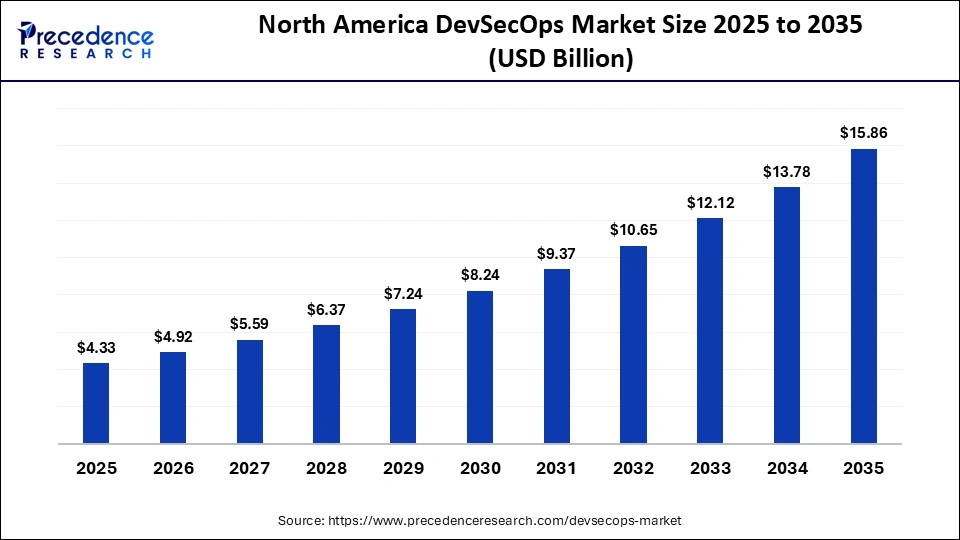

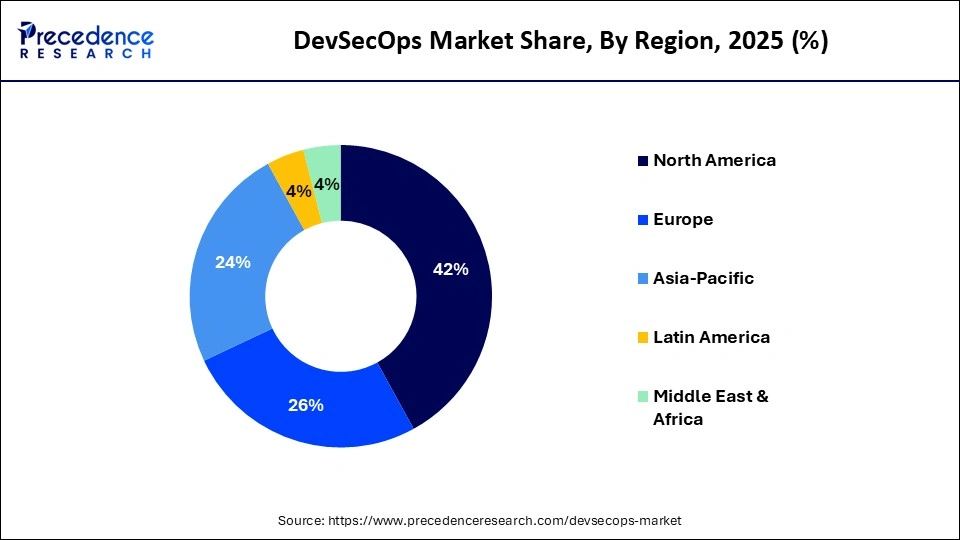

- North America dominated the global DevSecOps market with the largest share of approximately 42% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

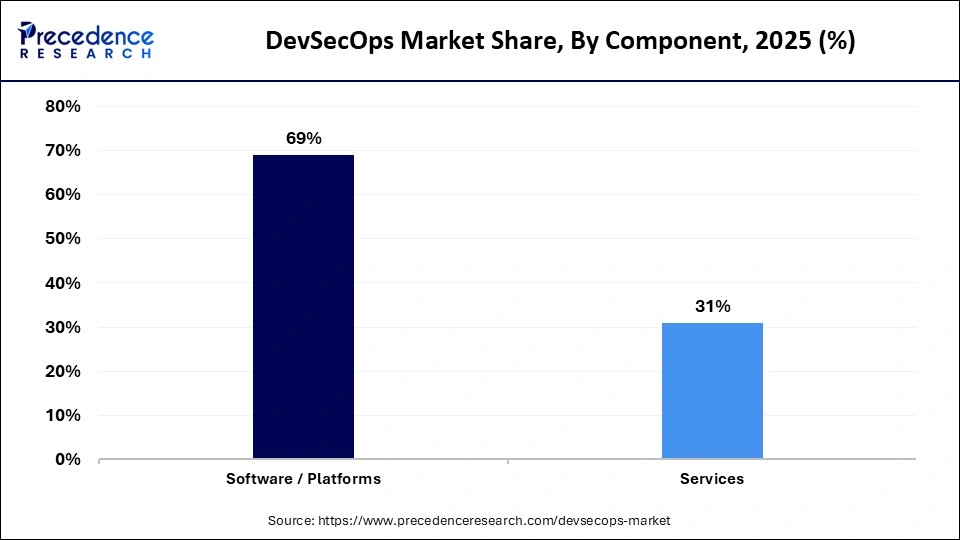

- By component, the software/platforms segment held a dominant position in the market with the largest share of approximately 69% in 2025.

- By component, the services segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

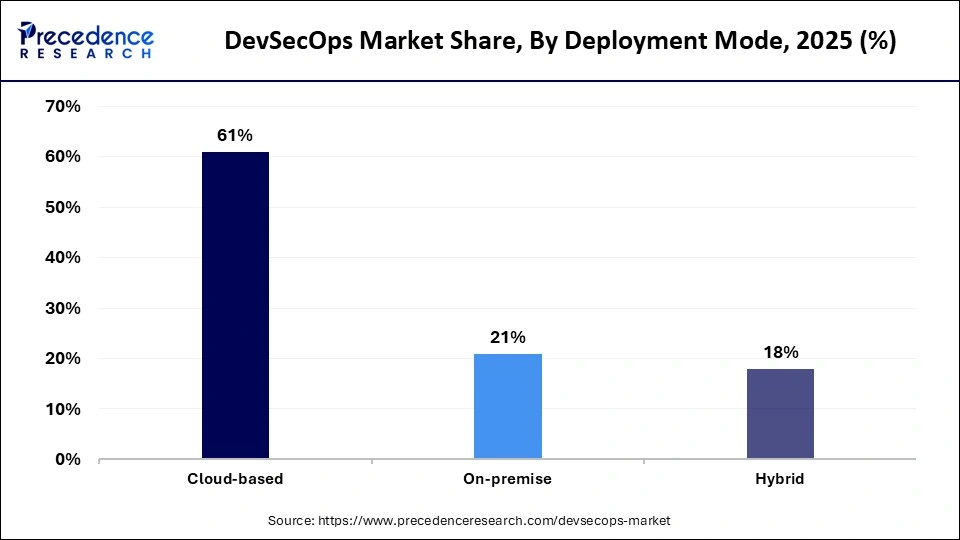

- By deployment mode, the cloud-based segment held a dominant position in the market with the largest share of approximately 61% in 2025.

- By deployment mode, the hybrid segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

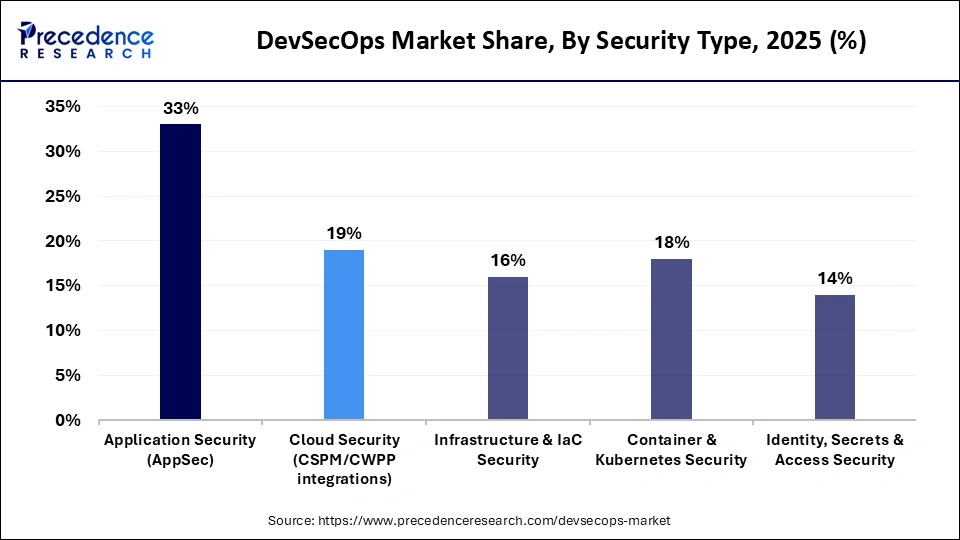

- By security type, the application security (AppSec) segment held a dominant position in the market with the largest share of approximately 33% in 2025.

- By security type, the container & Kubernetes security segment is expected to grow at the fastest CAGR in the DevSecOps market between 2026 and 2035

- By tool type, the SCA (software composition analysis) segment held a dominant position in the market with the largest share of approximately 21% in 2025.

- By tool type, the CI/CD security & policy-as-code tools segment is expected to grow at the fastest CAGR in the market between 2026 and 2035

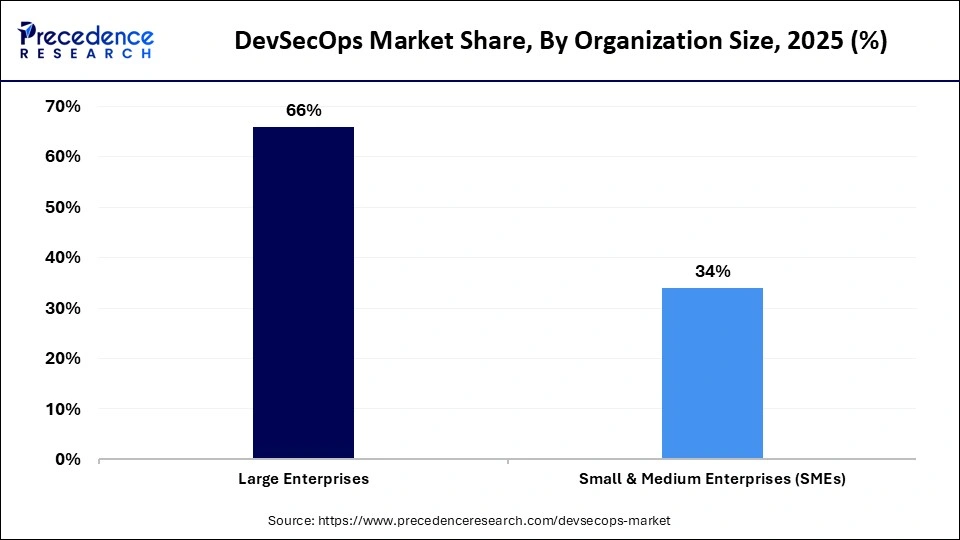

- By organization size, the large enterprises segment held a dominant position in the market with the largest share of approximately 66% in 2025.

- By organization size, the small & medium enterprises (SMEs) segment is expected to grow at the fastest CAGR in the market between 2026 and 2035

- By end-use industry, the IT & telecom segment held a dominant position in the market with the largest share of approximately 19% in 2025.

- By end-use industry, the government & defense segment is expected to grow at the fastest CAGR in the market between 2026 and 2035

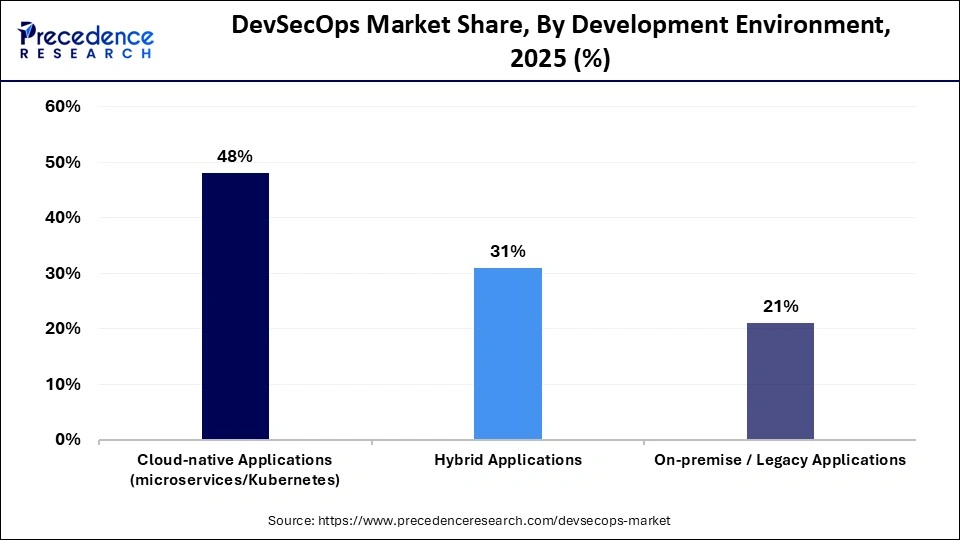

- By development environment, the cloud-native applications segment held a dominant position in the market with the largest share of approximately 48% in 2025, and is expected to grow at the fastest CAGR in the market between 2026 and 2035

- By use-case, the secure CI/CD pipeline automation segment held a dominant position in the DevSecOps market with the largest share of approximately 28% in 2025.

- By use-case, the supply chain security segment is expected to grow at the fastest CAGR in the market between 2026 and 2035

Where Code Meets Confidence: The Rise of DevSecOps

DevSecOps is the amalgamation of development, security, and operations to allow the more expeditious and safe provision of software. DevSecOps is being embraced by organizations in various industries to minimize vulnerabilities, enhance compliance, and speed up time-to-market without jeopardizing security. The market is growing fast, with businesses moving to agile development models and a continuous deployment environment.

Key Technological Advancements in the DevSecOps Market

There is a significant shift in the market to automated security testing that is part of CI/CD pipelines. AI and machine learning are becoming more popular in identifying vulnerabilities, ranking risks, and minimizing false positives. Container-native, microservice, and containerized security solutions and tools are becoming more popular. The concept of infrastructure as code (IaC) security scanning is a new trend to avoid misconfigurations. DevSecOps operations are implementing zero-trust security models to increase access management. There is also the policy-as-code and continuous compliance monitoring that is revolutionizing security governance.

Key DevSecOps Market Trends

- Increasing the use of shift-left security measures within development teams.

- Growing need to use combined DevSecOps systems with end-to-end visibility.

- Increased growth in managed DevSecOps services in small and mid-size enterprises.

- Firm emphasis on regulatory compliance and data protection by industries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.30 Billion |

| Market Size in 2026 | USD 11.72 Billion |

| Market Size by 2035 | USD 37.32 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Mode, Security Type, Tool Type, Organization Size, End-Use Industry, Development Environment, Use Case, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Component Insights

Why have software/platforms dominated the DevSecOps Market?

The software/platforms segment dominated the market by holding the largest share of approximately 69% in the year 2025, driven by a focus on integrated, end-to-end security throughout the software development lifecycle. These solutions have centralized vulnerability scanning and compliance monitoring, and automatic remediation that is centralized in CI/CD pipelines. Their scalability and capability to enable cloud-native and microservices-based architecture also enhance market dominance.

The services segment is projected to be the fastest-growing in the DevSecOps market because the implementation of security becomes more complicated, and there is a lack of skilled cybersecurity professionals. Organizations are turning to consulting, managed security, and integration services to speed up adoption and compliance. Small and mid-sized businesses that must switch to DevSecOps models also demand it, particularly.

Deployment Mode Insights

Why Cloud-Based Dominated the DevSecOps Market in 2025?

The cloud-based segment dominated the market by holding the largest share of approximately 61% in the year 2025, due to its scalability, flexibility, and compatibility with the current development environments. These solutions facilitate security monitoring in real-time, automatic updates, and fast deployment of dispersed teams. Pervasive use of cloud-native applications remains a factor of preference towards cloud-based platforms.

The hybrid segment is projected to be the fastest-growing in the DevSecOps market during the forecast period, as companies strike a balance between the deployment of cloud and on-premises infrastructure. Regulated industries are using hybrid models to retain control over data, but to use cloud-native DevSecOps features. This practice facilitates a slow-paced digital transformation without including security or compliance mandates.

Security Type Insights

Why Application Security (AppSec) Dominated the DevSecOps Market?

The application security (AppSec) segment dominated the market by holding the largest share of approximately 33% in the year 2025, dominated by ensuring that the code and applications are secured, since they are the main concern of secure software development. Breach prevention tools dealing with the weaknesses of source code, APIs, and runtime environments are necessary. Ongoing testing of the application security in the development cycles strengthens the leadership of this segment.

The container & kubernetes security segment is projected to be the fastest-growing in the DevSecOps market during 2026-2035 because microservices and containerized workloads are being rapidly adopted. Containers Image security, runtime behavior, and orchestration layer security are now important issues in cloud-native environments. There is a growing need to use special security tools as the rate of increasing dependence on Kubernetes to deploy on a large scale grows.

Tool Type Insights

Why SCA (Software Composition Analysis) Dominated the DevSecOps Market?

The SCA (Software Composition Analysis) segment dominated the market by holding the largest share of approximately 21% in the year 2025. In the DevSecOps tools arena are software composition analysis tools as organizations turn to the use of open-source components. SCA helps to see vulnerabilities, risks of licenses, and problems with dependencies at an early stage of the development process. Compliance and regulatory forces also contribute to the popularization of SCA solutions.

The CI/CD security & policy-as-code tools segment is projected to be the fastest growing in the DevSecOps market during the predicted timeframe, followed by automating the process of security enforcement in development pipelines. These tools also entrench security policies in workflows, facilitating governance and achieving ongoing compliance. The rapid adoption is being fuelled by a growing focus on shift-left security and infrastructure automation.

Organization Size Insights

Why Large Enterprises Dominated the DevSecOps Market in 2025?

The large enterprises segment dominated the market by holding the largest share of approximately 66% in the year 2025, driven by complex IT systems, high volumes of applications, and extreme security and compliance needs. These organizations implement DevSecOps to normalise security among various development units and worldwide operations. Platform deployment is also facilitated by large-scale deployment through strong budgets and in-house expertise.

The small & medium enterprises (SMEs) segment is projected to be the fastest growing in the DevSecOps market during the studied time period, because entering the market of DevSecOps implementation becomes less expensive with the use of cloud computing. SMEs are moving towards the adoption of automated security tools to secure applications without necessarily developing a large security staff. SaaS-based platforms and managed DevSecOps services are also accelerating the uptake within this segment.

End-Use Industry Insights

How the IT & Telecom Segment Dominated the Market in 2025?

The IT & telecom segment dominated the market by holding the largest share of approximately 19% in the year 2025, because of regular releases of software, the use of cloud-delivered services, and the high vulnerability to cyber-attacks. Such organizations use DevSecOps to achieve application security and still enjoy fast innovation cycles. Combination with massive CI/CD pipelines also promotes dominance in the market.

The government & defense segment is projected to be the fastest growing in the DevSecOps market, driven by government and defense, as the number of cybersecurity threats and national data protection requirements is increasing. Modernization of older systems and greater emphasis on secure digital infrastructure are leading to adoption. In this industry, DevSecOps assists in compliance, zero-trust, and secure software supply chains.

Development Environment Insights

Which Development Environment Dominated the Market in 2025?

The cloud-native applications segment dominated the DevSecOps market by holding the largest share of approximately 48% in the year 2025, and is expected to grow at the fastest CAGR during the forecast period, driven by the development of microservices-based, container-based, and Kubernetes-based software. DevSecOps is used to provide continuous testing and monitoring of security in dynamic cloud environments. Dominance of this environment is supported through the need to have scalable and automated security solutions.

Use Case Insights

Which Use-Case Segment Held the Major Market Share in 2025?

The secure CI/CD pipeline automation segment dominated the DevSecOps market by holding the largest share of approximately 28% in the year 2025, because companies integrate security checks into all software delivery processes. Risk mitigation is performed through automated testing, vulnerability scanning, and compliance enforcement without impacting development. This application is still the focus of DevSecOps value propositions.

The supply chain security segment is projected to be the fastest-growing in the DevSecOps market during 2026-2035, because there is an increase in attacks on open-source dependencies and third-party components. DevSecOps tools assist organisations in detecting vulnerabilities, testing software integrity, and imposing secure sourcing behavior. The increasing regulatory pressure and big profile breaches are driving the move towards supply chain-oriented security solutions.

Regional Insight

How Big is the North America DevSecOps Market Size?

The North America DevSecOps market size is estimated at USD 4.33 billion in 2025 and is projected to reach approximately USD 15.86 billion by 2035, with a 13.86% CAGR from 2026 to 2035.

Why North America Dominated the DevSecOps Market?

North America dominated the market by holding a share of approximately 42% in the year 2025, because of the early adoption of cloud computing, well-developed cybersecurity efforts, and the presence of the leading DevSecOps solution providers. Companies in the region are now focusing on secure software development to counter the rising security threats in the network and regulatory demands. There are also high investments in DevOps automation and digital transformation that encourage the prevalence of DevSecOps. The region is also enjoying a well-established ecosystem of technology vendors, startups, and research institutions.

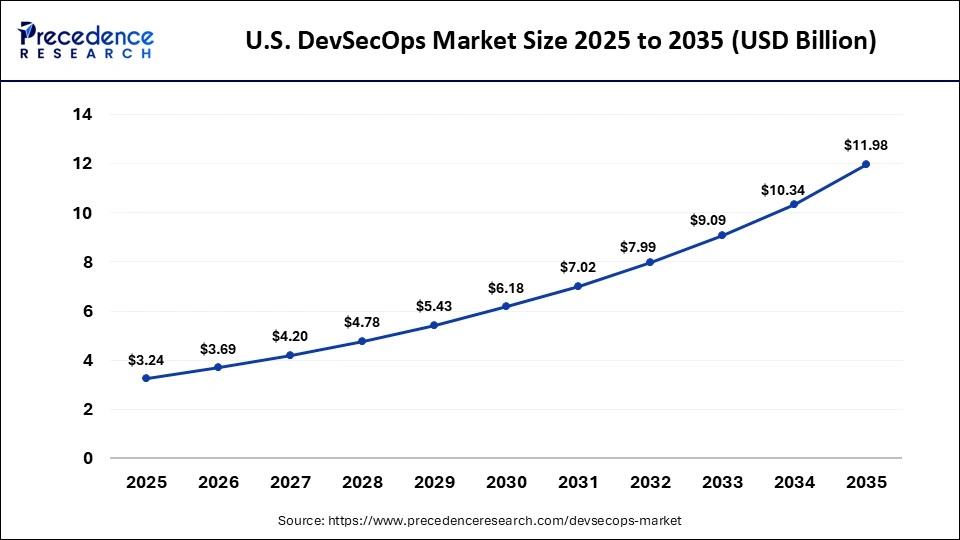

What is the Size of the U.S. DevSecOps Market?

The U.S. DevSecOps market size is calculated at USD 3.24 billion in 2025 and is expected to reach nearly USD 11.98 billion in 2035, accelerating at a strong CAGR of 13.97% between 2026 and 2035.

U.S. Country Level Analysis

The U.S. is the DevSecOps market leader due to the high volume of enterprise adoption, a high level of CI/CD maturity, and high compliance requirements in the IT, finance, and healthcare sectors. Significant technology centres and federal programs on cybersecurity promote innovation and deployment. Canada is making consistent contributions with the increased use of clouds and governmentally funded digital security initiatives. Close cooperation between companies and cybersecurity amateurs maintains regional hegemony.

How is Asia Pacific the Leading Prodigy in the DevSecOps Market?

Asia Pacific is the fastest-growing region in the market between 2026 and 2035, owing to the rapid digitalization, the growth of cloud-based infrastructure, and the growth of exposure to cyberattacks. There has been a tendency towards modernization of legacy IT systems and an agile model of development within organizations all over the region. The increasing application security and compliance awareness are hastening the process of implementing DevSecOps. The high number of developers in the region also contributes to a high growth momentum.

Country Level Analysis

In the country front, China is moving toward growth by implementing large-scale cloud adoption and an augmented enterprise focus on software security. India is developing fast because of the explosive IT services, startups, and the use of cloud-native development. Japan has a boost in the form of regulated industries that need secure automation. A joint venture of these nations makes Asia Pacific the largest footprint of the global DevSecOps market.

DevSecOps Market Value Chain Analysis

- Product Conceptualization and Design

Product conceptualization and design focus on embedding security controls directly into DevOps workflows, ensuring seamless integration with CI/CD pipelines, cloud platforms, and developer tools. Vendors prioritize user-centric design, automation, and scalability to reduce friction between development and security teams.

Key players: Palo Alto Networks, Snyk, GitLab, Synopsys, Checkmarx

- Raw Material Procurement

In the DevSecOps context, raw materials primarily include cloud infrastructure, open-source security frameworks, APIs, and threat intelligence feeds. Reliable access to cloud services, container registries, and vulnerability databases is critical for building robust security automation platforms.

key players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud, Red Hat, Aqua Security.

- Marketing and Promotions

Marketing and promotional activities emphasize value propositions such as “shift-left security,” faster release cycles, and regulatory compliance. Vendors rely on digital campaigns, developer communities, industry events, and strategic partnerships to build credibility and accelerate adoption.

key players: GitHub, HashiCorp, CrowdStrike, Rapid7, Fortinet.

- Customer Support and Feedback

Customer support and feedback loops play a vital role in refining DevSecOps platforms, as continuous updates are required to address emerging threats and developer needs. Vendors use real-time feedback, user analytics, and enterprise support models to enhance product performance and customer retention.

Key players: Atlassian, Splunk, IBM, ServiceNow, Qualys.

- Research and Development (R&D)

R&D is central to innovation in DevSecOps, focusing on AI-driven threat detection, automation, cloud-native security, and compliance-as-code. Continuous investment in R&D enables vendors to stay ahead of evolving cyber risks and rapidly changing development environments.

Key players: Microsoft, Google, Palo Alto Networks, Synopsys, Trend Micro.

Recent Developments

- In January 2026, India and the European Union held discussions to explore opportunities for integrating their defence supply chains as part of efforts to strengthen strategic cooperation. The dialogue focused on enhancing industrial collaboration, improving supply chain resilience, and enabling greater technology sharing between both sides. By aligning defence manufacturing and procurement ecosystems, India and the EU aim to build trusted partnerships and develop future-ready defence capabilities while deepening broader security and diplomatic ties.(Source: https://www.business-standard.com)

- In January 2026, A CNCF survey conducted by Linux Foundation Research reveals that Kubernetes has achieved broad enterprise adoption, with the majority of organizations running production clusters. The findings highlight widespread use of cloud-native technologies and growing deployment of AI workloads on Kubernetes platforms. Despite strong adoption, organizations continue to face challenges related to security, skills gaps, and organizational readiness, underscoring the need for continued investment in training and cloud-native governance.(Source: https://cloudnativenow.com)

Who are the Major Players in the Global DevSecOps Market?

The major players in the DevSecOps market include Amazon Web Services (AWS), Inc., Atlassian Corporation Plc., Broadcom, Inc., Check Point Software Technologies Ltd., Entersoft Security, and Gitlab, Inc.

Segments Covered in the Report

By Component

- Software/Platforms

- AppSec toolchains

- CI/CD security orchestration

- Policy & compliance automation

- Services

- Consulting & implementation

- Managed DevSecOps services

- Training & support

By Deployment Mode

- Cloud-based

- On-premise

- Hybrid

By Security Type

- Application Security (AppSec)

- Cloud Security (CSPM/CWPP integrations)

- Infrastructure & IaC Securit

- Container & Kubernetes Security

- Identity, Secrets & Access Security

By Tool Type

- SAST (Static Application Security Testing)

- DAST (Dynamic Application Security Testing)

- SCA (Software Composition Analysis)

- Secrets Management Tools

- Container Image Scanning & Runtime Protection

- CI/CD Security & Policy-as-Code Tools

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-Use Industry

- IT & Telecom

- BFSI

- Healthcare & Life Sciences

- Retail & E-commerce

- Government & Defense

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Other Industries

By Development Environment

- Cloud-native Applications (microservices/Kubernetes)

- Hybrid Applications

- On-premise/Legacy Applications

By Use Case

- Secure CI/CD Pipeline Automation

- Vulnerability Management & Remediation

- Compliance & Audit Automation

- Threat Detection & Runtime Security

- Supply Chain Security (SBOM, dependency risk)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting