Dextrose Market Size and Forecast 2025 to 2034

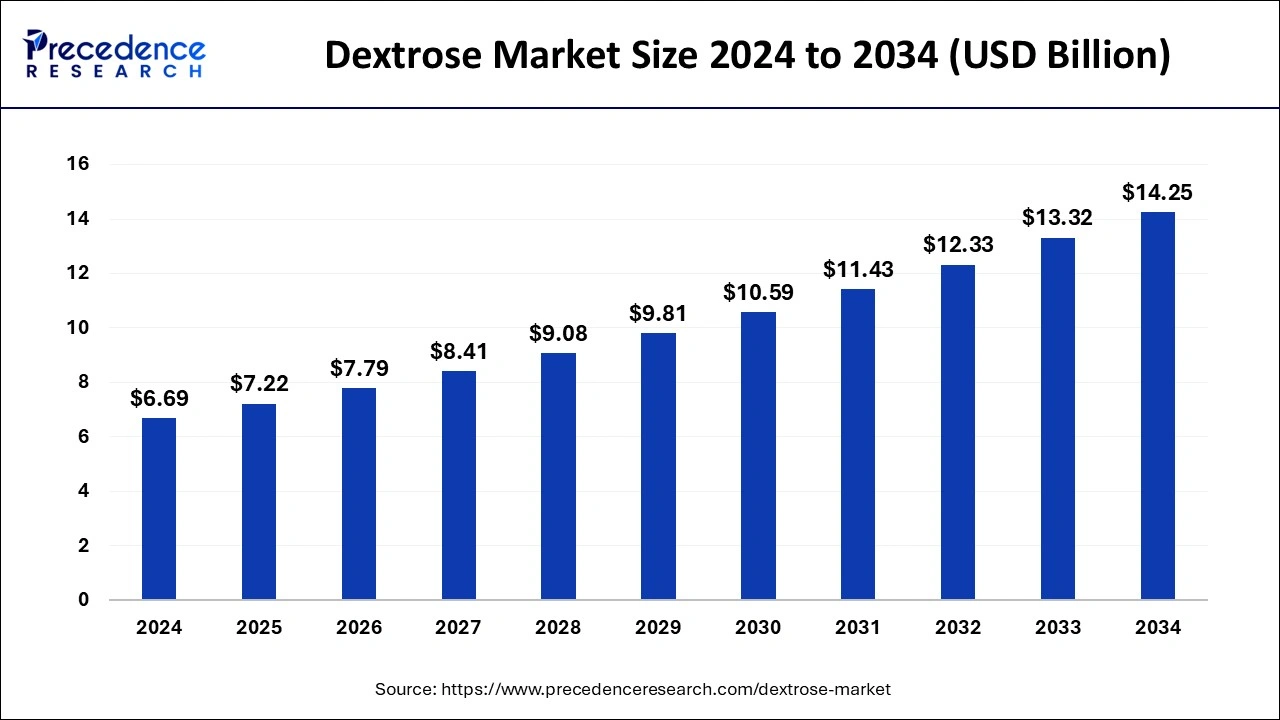

The global dextrose market size accounted at USD 6.69 billion in 2024 and is predicted to increase from USD 7.22 billion in 2025 to approximately USD 14.25 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034. The dextrose market is driven by the growing market for food items with fewer calories.

Dextrose Market Key Takeaways

- The global dextrose market was valued at USD 6.69 billion in 2024.

- It is projected to reach USD 14.25 billion by 2034.

- The dextrose market is expected to grow at a CAGR of 7.85% from 2025 to 2034.

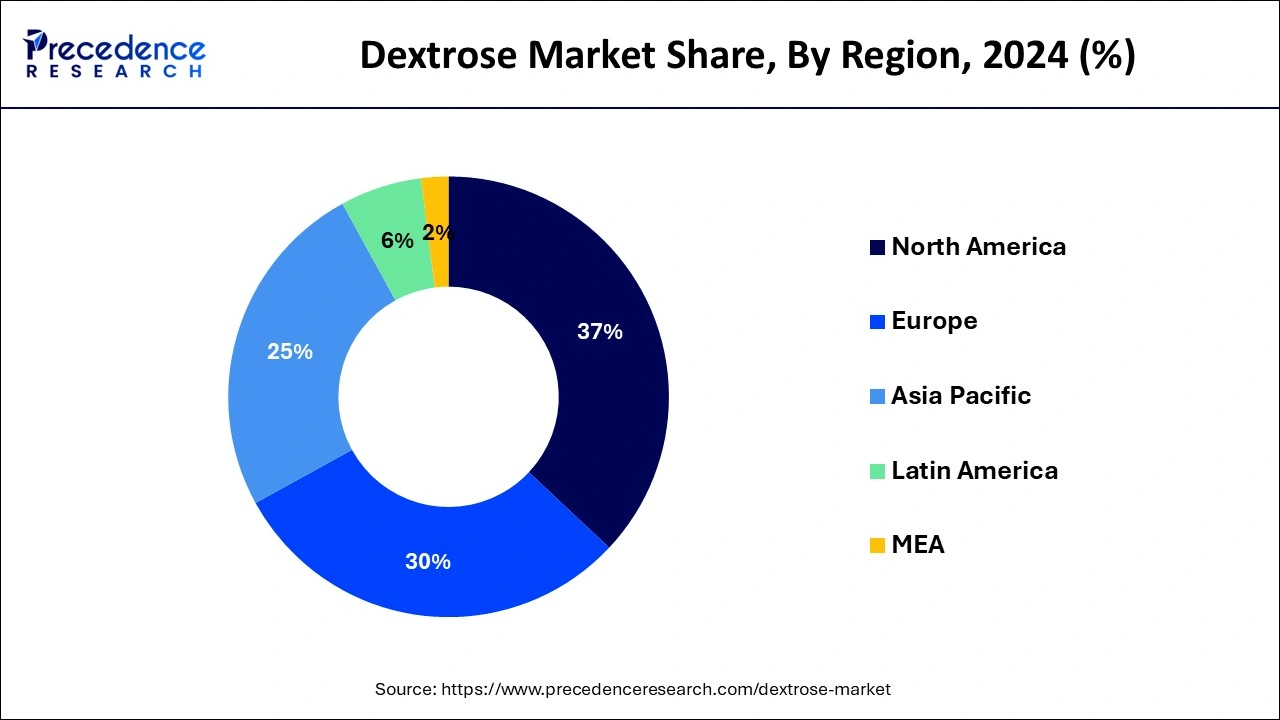

- The North America dextrose market size accounted for USD 2.29 billion in 2024 and is expected to grow around USD 4.93 billion by 2034.

- North America dominated the market with the largest market share of 37% in 2024.

- Asia Pacific is observed to be the fastest-growing region during the forecast period.

- By form, the dextrose monohydrate segment has contributed more than 37% of market share in 2024.

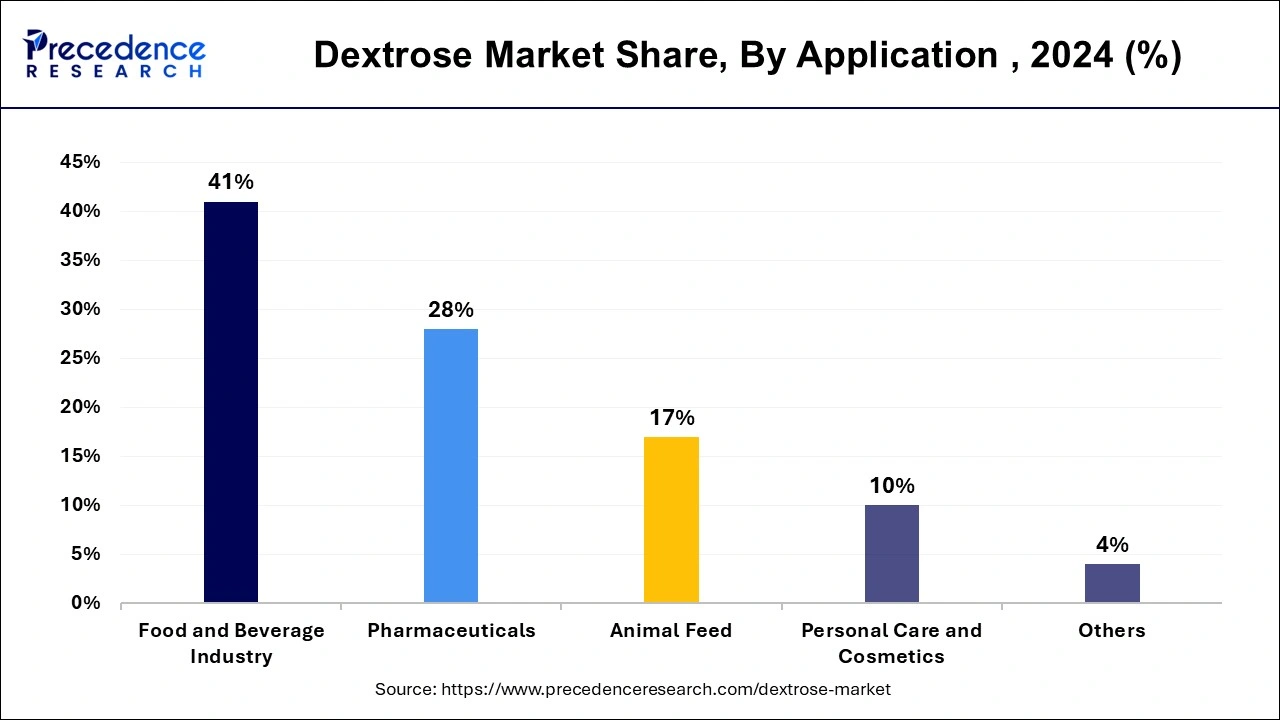

- By application, the food and beverage industry segment has held the biggest market share of 41% in 2024.

- By distribution channel, the online retail segment dominated the dextrose market in 2024.

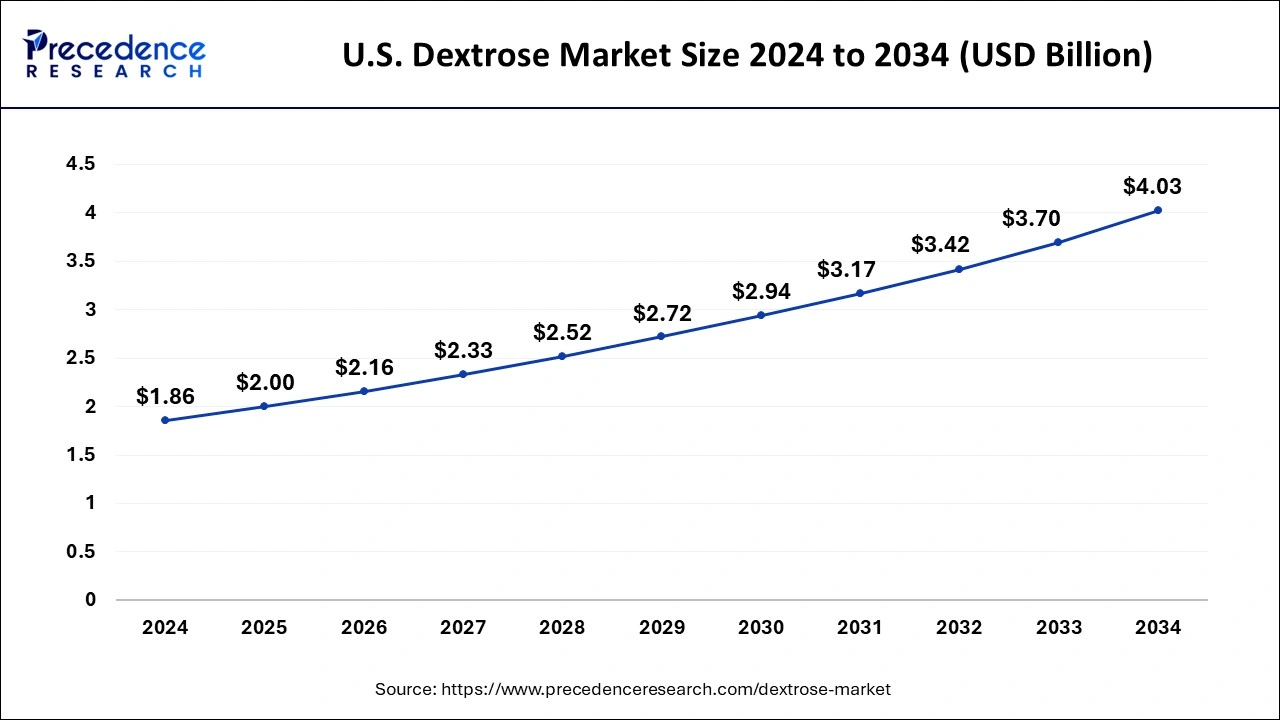

U.S.Dextrose Market Size and Growth 2025 to 2034

The U.S. dextrose market size was exhibited at USD 1.86 billion in 2024 and is projected to be worth around USD 4.03 billion by 2034, growing at a CAGR of 8.04% from 2025 to 2034.

North America held the largest share in the dextrose market and the region is observed to sustain the position throughout the predicted timeframe. To innovate and broaden their product lines, North American businesses consistently allocate resources to research and development projects. Their emphasis on product innovation allows them to efficiently target new market niches and adapt to changing consumer tastes. Furthermore, market expansion is facilitated by strategic alliances and cooperation with important players along the value chain.

Consumer preferences have become more health-conscious, increasing demand for healthier substitutes for conventional sweeteners like sucrose. This sustains the demand for dextrose in the area by going along with the growing trend towards cleaner labeling and natural ingredients in food and beverage goods.

- In April 2024, five injectable product launches occurred in the United States as part of Baxter International Inc.'s ongoing expansion of its pharmaceutical portfolio. Baxter is a global leader in anesthesia, medication compounding, and injectables.

Asia-Pacific is the fastest growing dextrose market during the forecast period. The Asia-Pacific region's food and beverage industries are expanding quickly thanks to urbanization, economic growth, and shifting consumer tastes. Dextrose is essential to numerous food and beverage items, including baked goods, dairy products, soft drinks, and candies, all in high demand. The Asia-Pacific area is witnessing an increase in the accessibility and affordability of dextrose due to technological developments in its production and processing, along with investments in research and development. This encourages the market's growth even more by incentivizing producers to use dextrose.

Market Overview

Made from corn or wheat, dextrose is a simple sugar with the same chemical makeup as blood sugar or glucose. It's frequently used as a sweetener for corn syrup, processed meals, and baked goods. Different concentrations of dextrose are used for different purposes. For example, if a patient has low blood sugar and is dehydrated, a doctor may administer dextrose as an IV solution. Several medications can also be mixed with dextrose IV solutions.

Researchers examined the effects of 100% orange juice versus an orange-flavored sucrose-sweetened beverage (SSB) on feelings, physical health, and sensory attributes in people of normal weight and the findings were published in the Journal Nutrients in January 2024.

Dextrose Market Data and Statistics

- According to estimates from the Centers for Disease Control and Prevention (CDC), over 37 million persons in the US, or around 11.3% of all adults, have diabetes. An additional 96 million persons have been observed to be prediabetic, which increases their chance of acquiring diabetes in the future.

- Diet and frequent consumption of soft drinks were found to raise salivary insulin levels in a recent study.

- More sugar and calories than the daily suggested limit can be found in two glasses of wine, more than in a cheeseburger.

Dextrose Market Growth Factors

- Natural sweeteners like dextrose can be found in candy, baked products, and beverages.

- Energy snacks and sports drinks include dextrose, a rapid energy source.

- Convenience and processed food consumption are rising.

- Increasing emphasis on physical activity and wellness promotes the market's expansion.

- There is rising demand for other medicinal medicines, such as antacid suspensions. This demand is observed to promote the growth of the dextrose market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.85% |

| Market Size in 2025 | USD 7.22 Billion |

| Market Size in 2024 | USD 6.69 Billion |

| Market Size by 2034 | USD 14.25 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Application, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamic

Drivers

Increasing consumer awareness regarding health and wellness

Consumers' snacking preferences have changed, with many choosing healthier options. Protein bars, granola bars, and energy balls are just a few snacks that use dextrose as a rapid energy source and natural sweetness. Dextrose-containing snacks have become more popular because consumers are looking for snacks that deliver prolonged energy without sacrificing flavor or nutrients. Such rising demand for healthy snacking with awareness of health and wellness is observed to act as a driver for the dextrose market.

Advances in production technologies and processes

Using cutting-edge production techniques makes it possible to produce dextrose of greater quality and purity levels. Advanced purification methods like chromatography and filtration enable producers to produce dextrose products that satisfy regulatory criteria and strict industry standards. Decrees with higher purity and quality are more favored for delicate uses, including medications and cosmetics. Within the dextrose sector, technological advancements in production also address sustainability and environmental problems.

The environmental impact of producing dextrose is lessened by employing sustainable manufacturing techniques, including maximizing water use, minimizing waste, and utilizing renewable energy sources. Further, advances in bioprocessing and biorefinery techniques make it possible to use biomass and agricultural waste as feedstock for dextrose production, supporting the concepts of circular economy and resource efficiency.

Restraint

Increased awareness about the health implications of high sugar consumption

Dextrose, being a rapidly absorbed form of glucose, can cause spikes in blood sugar levels. For individuals with diabetes or those at risk of developing the condition, managing blood sugar levels is crucial. High sugar consumption, including dextrose, can exacerbate glycemic control issues and contribute to long-term health complications associated with diabetes. This awareness prompts diabetic individuals and healthcare professionals to advise against or limit the consumption of dextrose-containing products.

Growing environmental consciousness

Growing environmental consciousness makes businesses and customers more aware of how different products and industries affect sustainability. Dextrose is a typical simple sugar used in the food and beverage, pharmaceutical, and other sectors. It is obtained from corn or other starches. However, the intense agricultural methods used in its production, such as the growing of maize, might negatively influence the environment. Deforestation, habitat destruction, soil erosion, and agrochemical-induced water contamination are some of these effects.

Opportunity

Continuous innovation in product formulations

Consumers are aware of their food choices, and well-being and health are becoming more of a priority. In some situations, dextrose, an essential sugar made from corn, is considered a healthier substitute for refined sugar. Manufacturers can create dextrose-based goods that appeal to health-conscious consumers by offering options that are low in calories or glycemic index due to ongoing innovation in product composition. Customers are looking for items with clear, uncluttered labeling that don't include any fake ingredients or additions.

Naturally occurring sugars like dextrose fit very nicely with the clean-label movement. By substituting dextrose or dextrose-based alternatives for artificial sweeteners or high-fructose corn syrup, manufacturers can create cleaner formulations and satisfy consumer desires for simpler and cleaner ingredient lists. This is made possible by ongoing innovation.

Form Insights

The dextrose monohydrate segment dominated the dextrose market in 2024. Dextrose monohydrate has several uses in many sectors and is very adaptable. It is essential to food and drink, animal feed, sports nutrition, and medications. Its adaptability has dramatically increased both its demand and market reach. As a rapid energy source, dextrose monohydrate is used in the sports and fitness business. It is frequently included in sports drinks, energy bars, and supplements to restock glycogen stores during and after physical activity. Because of its quick absorption rate, it's perfect for athletes and fitness enthusiasts looking for quick-acting energy sources.

The dextrose anhydrous segment is anticipated to grow in the dextrose market during the forecast period. The food and beverage industry uses a lot of dextrose anhydrous, a kind of glucose made from starches, as a bulking agent, texturizer, and sweetener. The demand for dextrose as a replacement for conventional sweeteners like sucrose and high-fructose corn syrup is rising due to customer preferences for natural and healthier food options.

In addition to being a sweetener, dextrose anhydrous can regulate crystallization, retain moisture, and improve browning in food products. Food makers are using it more widely because of its functional benefits, particularly in items where shelf-life, texture, and flavor are important considerations. The market is driven by an expanding consumer base for processed foods and beverages due to the growing population in emerging economies.

Application Insights

The food and beverage industry segment dominated the dextrose market in 2024. Due to its versatility, dextrose can be used in a variety of food and beverage applications. It is used in meal replacements, sports nutrition, and functional beverages, in addition to more conventional products like soft drinks, candy, and baked goods. The food and beverage industry's consistent need for dextrose is guaranteed by its wide range of applications.

The pharmaceuticals segment is the fastest growing in the dextrose market during the forecast period. Global population growth inevitably leads to a rise in healthcare needs. Furthermore, there is a greater demand for pharmaceutical items due to rising health consciousness and a growing desire for preventative healthcare practices. In this setting, there is an increase in demand for dextrose, an essential ingredient in many medicinal therapies. The production and supply of pharmaceutical-grade dextrose are rising due to investments in growing pharmaceutical manufacturing facilities, especially in emerging markets. Modern production facilities with cutting-edge technology increase productivity and guarantee a consistent supply of premium dextrose to satisfy the expanding market demand.

Distribution Channel Insights

The online retail segment dominated the dextrose market in 2024. Geographical restrictions are removed via online retail, giving customers access to dextrose items anywhere in the world. Manufacturers and merchants may reach a broader range of consumers and market segments thanks to this global accessibility, which broadens their market reach. The environment of Internet retail encourages vendor competitiveness and price transparency. Customers may quickly find the finest offers and discounts by comparing prices across several online retailers. Additionally, internet retailers frequently offer comparable prices because they have a more negligible overhead than conventional locations.

Recent Developments

- In March 2024, CandyRific announced tp release three new character candy novelties in collaboration with Universal Products & Experiences. The novelties are based on the Minions, an animated series by Illumination that has become a global hit. Character fans, Fanimation fans, and little backpacks are among the things that will be offered starting in May 2024.

- In July 2023, During the "One Week One Lab" (OWOL) program, the CSIR-Central Food Technological Research Institute (CFTRI) unveiled two new technologies: a glucose-laced amla (gooseberry) beverage and superfood, nutrient-dense quinoa germ.

Dextrose Market Companies

- Archer Daniels Midland Company (ADM)

- Cargill

- Incorporated

- Tereos

- Tate & Lyle PLC

- Fooding Group Limited

- Provitamine GmbH

- Singsino Group Ltd

- Ingredion Incorporated

- Global Sweeteners Holdings Limited

Segments Covered in the Report

By Form

- Dextrose Monohydrate

- Dextrose Anhydrous

- Liquid Dextrose

By Application

- Food and Beverage Industry

- Pharmaceuticals

- Animal Feed

- Personal Care and Cosmetics

- Other

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Retail

- Wholesale Distribution

- Foodservice Distribution

- Industrial Supply

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting