What is the Diagnostic Dermatology Equipment Market Size?

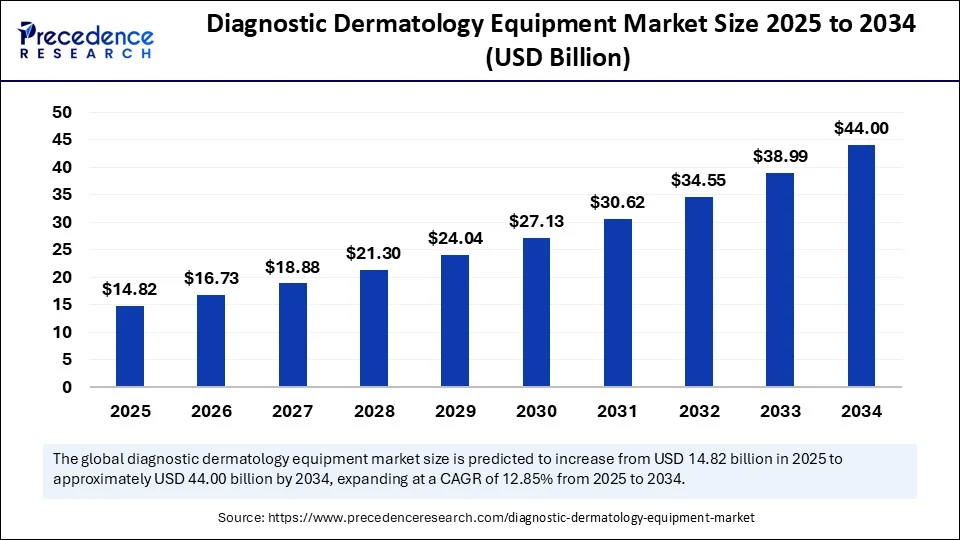

The global diagnostic dermatology equipment market size is calculated at USD 14.82 billion in 2025 and is predicted to increase from USD 16.73 billion in 2026 to approximately USD 44.00 billion by 2034, expanding at a CAGR of 12.85% from 2025 to 2034. The growth of the diagnostic dermatology equipment market is driven by the rising cases of skin cancer, increasing awareness of early diagnostics, and advancements in imaging technologies.

Diagnostic Dermatology Equipment MarketKey Takeaways

- In terms of revenue, the global diagnostic dermatology equipment market was valued at USD 13.14 billion in 2024.

- It is projected to reach USD 44 billion by 2034.

- The market is expected to grow at a CAGR of 12.85% from 2025 to 2034.

- North America led the diagnostic dermatology equipment market in 2024.

- Asia Pacific is expected to expand the fastest CAGR in the market between 2025 and 2034.

- By device type, the dermatoscopes segment held the largest market share in 2024.

- By device type, the microscopes & trichoscopes segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the dermatitis segment captured the biggest market share in 2024.

- By application, the skin cancer segment is expected to expand at a notable CAGR over the projected period.

- By end-user, the dermatology clinics segment contributed the major market share in 2024.

- By end-user, the hospitals segment is expected to expand at a notable CAGR over the projected period.

Artificial Intelligence: The Next Growth Catalyst in Diagnostic Dermatology Equipment

Artificial intelligenceis rapidly changing the landscape of diagnostic dermatology by improving the accuracy and speed of skin disease detection. AI improves the accuracy of skin lesion analysis. It also helps in early detection of skin cancer. These technological developments also respond to the global demand for early, rapid, and accurate diagnosis of melanoma and the growing burden of chronic skin diseases, particularly in spite of primary-care type settings and among underserved populations. The recent surge in regulatory approvals for AI-based products has increased the adoption of AI-powered dermatoscopes and imaging modalities.

- In January 2024, DermaSensor Inc. received FDA clearance for its AI-powered medical device to detect all three common skin cancers (melanoma, basal cell carcinoma, and squamous cell carcinoma). For the first time, the 300,000 primary care physicians in the U.S. can now be equipped to provide quantitative, point-of-care testing for all types of skin cancer.

(Source: https://www.businesswire.com)

Strategic Overview of the Global Diagnostic Dermatology Equipment Industry

Diagnostic dermatology equipment identifies, monitors, and evaluates various skin diseases, including melanoma, psoriasis, acne, and other skin ailments. Diagnostic dermatology devices include dermatoscopes, imaging devices, and biopsy tools, which allow for earlier diagnosis and improve the outcomes of clinical interventions. The diagnostic dermatology equipment market is witnessing significant growth due to the increasing incidences of skin cancers, greater interest in aesthetic dermatology, and increased access to modern imaging technology.

Technological advancements such as AI-aided skin assessments and digital dermoscopy are changing the future diagnostic landscape through advanced accuracy and increased utilization of devices. The increasing numbers of dermatology consultations each year, especially among urban and elderly patient populations, are also contributing to diagnostic dermatology device acceptances. Increased healthcare expenditures and the increased utilization of tele-dermatology is allowing diagnostic dermatology devices to play a bigger role in both clinical and cosmetic dermatology practices.

What are the Major Growth Factors of the Diagnostic Dermatology Equipment Market?

- Increasing Cases of Skin Conditions: With the worldwide rise in melanoma, eczema, psoriasis, and acne, the need for early diagnosis and ongoing vigilance are rising and the demand for diagnostic equipment is continuing to grow.

- Advancements in Imaging Technology: With AI, 3D imaging, and high-resolution dermatoscopy, imaging technologies have advanced diagnostic accuracy, and a greater uptake of technologically advanced equipment is taking place in the clinical realm.

- Rise of Aesthetic/Cosmetic Dermatology: The increased desire for skin aesthetics and procedures, including skin rejuvenation and assessment of moles, leads to clinics investing in newer diagnostic equipment for clinical and aesthetic purposes.

- Increased Tele-dermatology Services: The rise of virtual skin consultations, which took place after the COVID-19 pandemic, has increased the availability of portable diagnostic devices and smart tools.

- Supportive Health Care Infrastructure and Prevalence: The initial access to dermatology services is improving in emerging markets, and prevalence campaigns for skin cancer screening are driving penetration in all areas.

Market Outlook

- Market Growth Overview: The Diagnostic Dermatology Equipment market is expected to grow significantly between 2025 and 2034, driven by the rising incidence of skin conditions, innovation in non-invasive diagnostic technologies, such as advanced imaging systems, digital dreamscape, and AI-enabled diagnostics. Integration of AI and machine learning, and growing awareness and demand for early diagnosis.

- Sustainability Trends: Sustainability trends involve circular economy, eco-conscious manufacturing, and energy efficiency.

- Major Investors: Major investors in the market include Roche Diagnostics, Johnson & Johnson MedTech, Siemens Healthineers, and Philips Healthcare.

- Startup Economy: The startup economy is focused on AI and digital health monitoring startups, teleconsultation and consumer device startups, and advanced imaging and pathology startups.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 44 Billion |

| Market Size in 2025 | USD 14.82 Billion |

| Market Size in 2026 | USD 16.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase in Skin Cancer Incidents Driving the Demand for Diagnostic Dermatology Equipment

A major driver of the diagnostic dermatology equipment market is the rapid increase in skin cancer rates. According to the skin cancer foundation, around 90% of nonmelanoma skin cancer cases are linked to UV light. In the U.S., more than 9,500 people are diagnosed with skin cancer every day, and more than two patients die every hour from skin cancer. Basal cell carcinoma (BCC) has the highest incidence rate of all skin cancers, with respected estimates indicating 3.6 million cases in the U.S. alone.

In contrast, around 5,400 people die of nonmelanoma skin cancer monthly worldwide. Furthermore, melanoma deaths are projected to reach 8,430 by 2025, and men are likely to be impacted to a higher degree.

(Source: https://www.skincancer.org)

This alarming number has increased awareness campaigns, screening programs, and government entities supporting initiatives for early detection. The increasing incidence of skin cancer cases is boosting the demand for new diagnostic technologies, including dermatoscopes, artificial intelligence systems, imaging technologies, and portable skin scanners to facilitate early and accurate diagnosis.

Restraint

Shortage of Skilled Professionals Worldwide Limits Utilization of Diagnostic Dermatology Equipment

A key factor limiting the growth of the diagnostic dermatology equipment market is the shortage of qualified individuals with the ability to operate advanced instruments. The limited availability of qualified dermatologists in low- and medium-income countries restricts access to qualified dermatologist professionals. As of 2023, the World Health Organization reports that many people worldwide, particularly in rural and underserved areas, have limited or no access to specialized dermatological care.

In sub-Saharan Africa, there is fewer than one dermatologist per million people. In Africa, < 1 dermatologist is available per million population, with the majority practicing in urban areas. Instruments such as a dermatoscope or confocal microscope, even if advanced, cannot be used unless someone with a correct knowledge of the pathology can safely operate it. The inequality in the availability of trained personnel to operate the equipment affects the use of the technology, and therefore, the shortage of workforce capacity is a significant barrier to the diagnostic dermatology equipment market worldwide.

(Source: https://pmc.ncbi.nlm.nih.gov)

Opportunity

Increasing Demand for Teledermatology Solutions

A major opportunity for the diagnostic dermatology equipment market lies in the rising demand for teledermatology, which is especially important for underprivileged and remote locations. Digital healthcare as a whole is gaining interest globally, and teledermatology platforms, in particular, are integrating with diagnostic applications (such as digital dermatoscopes and smartphone attachable imaging devices). The American Academy of Dermatology reported that teledermatology consultations surged post-2020 due to loosened regulations and patients' general preference for remote care.

Countries like Australia and Canada are investing heavily in telemedicine solutions to extend their dermatological capacity in rural areas. As a result, device manufacturers are encouraged to develop more portable and cloud-connected diagnostic systems that can transmit and store high-resolution images. As medical institutions continue to transition to digital services, the demand for mobile health digital platforms combined with dermatology-specific diagnostic equipment continues to rise.

- In April 2023, MedX Health and PharmaChoice announced the launch of MedX Teledermatology screening platform across Canada. This platform allows patients to quickly access qualified dermatologists.

(Source: https://www.businesswire.com)

Why are Dermatoscopes is Dominating Device in Diagnostic Dermatology Equipment Market?

Dermatoscopes sub segment dominates the market in 2024. Dermatoscopes are the most widely used device type, as they are crucial for non-invasive visual assessment of skin lesions, especially when it comes to making the diagnosis of melanoma and other pigmented skin diseases. They are much loved by dermatology practices because they help clinicians make accurate and timely diagnoses. Digital and artificial intelligence-enhanced dermatoscopes have solidified their position in dermatology by enabling improved image storage, comparison and teledermatology.

The use of microscopes and trichoscopes is steadily increasing due to the rising incidence of hair disorders and scalp diseases. Trichoscopy has been recognized as the most important diagnostic examination for alopecia, androgenetic hair loss, and scalp infection, thus driving a demand for trich microscopes in specialty dermatology practices, as well as aesthetic clinics and outpatient surgery centers focusing on hair restoration and scalp.

Which Application Segment Dominated the Diagnostic Dermatology Equipment Market in 2024?

Dermatitis is most dominating application segment in diagnostic dermatology equipment market. Dermatitis which includes atopic, seborrheic, and contact dermatitis, is one of the most common skin diseases diagnosed globally, and therefore, it is the most common application area for diagnostic devices. The chronic and recurrent conditions of dermatitis require continuous monitoring and imaging, establishing a routine for dermatoscopes and diagnostic devices that are a part of the clinical workflow.

Skin cancer is becoming the fastest growing application because of an increase in UV exposure, an aging population, and general awareness about detecting cancer at an early stage. High-resolution imaging and artificial intelligence-based diagnostic tools will continue to evolve to assist in the identification of suspicious lesions, accelerating the trend for more diagnostic devices in dermatoscopes and oncology based dermatology.

What Makes Dermatology Clinics the Dominating Treatment Type?

Dermatology clinics Dominates the market in the end-user segment, as they are the clinical environment that performs the majority of skin examinations, aesthetic procedures, and management of long-term skin conditions. Patients with chronic or cosmetic skin concerns, driving the demand for diagnostics like dermatoscopes and imaging devices.

While dermatology clinics hold the market, hospitals represent the end-user segment now exhibiting the highest growth rate. This can be attributed to a growing trend of dermatology services being integrated into multispecialty administration, along with increased inpatient visitations for skin disease and a growing need for comprehensive cancer diagnostics, which is now stimulating hospitals to invest in diagnostic dermatology devices, especially at tertiary care and academic medical centers.

Regional Insights

Which Region Dominated the Diagnostic Dermatology Equipment Market in 2024?

The of North America is dominating region in diagnostic dermatology equipment market a with factors such as elevated skin cancer prevalence, continual expansions to coverage, immediate integrations of AI technology to dermatology diagnostic technology, and the capability to receive FDA clearance on advanced imaging devices, coupled with ample trained dermatologists, high clinic volumetric infrastructure, etc., have kept North America to be the center point for early diagnostics and detection in dermatology technology. In addition, national campaigns for skin cancer awareness [better resourcing] and patient criticism for non-invasive technology that could provide more accurate diagnostic options for dermatology, have helped spur nationally.

With high incidence of melanoma, a higher level of regular screenings and costs covered by insurance in the U.S. continues to push demand on FDA cleared tools. Clinics adopt standard digital dermatoscopes and AI-based imaging technology at unprecedented rates, along with major health systems investing in mobile diagnostic platforms (selenase - with dermatoscopes) that allow platform associativities on delays in triaging and better patient outcomes in urban and rural settings.

Canada Diagnostic Dermatology Equipment Trends

In Canada the growing presence of universal health care and teledermatology continues to provide governments with ways to allocate funding to delivery of diagnostic services to rural and impoverished communities, respectively, since now both governments and organizations can provide diagnostic imagery for skin cancers. This national funding to not only develop beyond dermatological tools in hospitals - an essential feature for later testing, but also competence to develop AI-enabled tools in smaller clinics and provincial hospitals, through formal letters of intent towards interdisciplinary research initiatives to be advanced for collaboration towards improved technological systems put in place.

What Makes Europe the Emerging Marketplace in Diagnostic Dermatology Equipment Market?

Europe's growth is driven by the rising incidence of melanoma, more supportive medical regulations about skin cancer, and EU-funded digital health initiatives. Countries are providing imaging devices and digital dermatoscopes for both dermatology and ophthalmology through primary care and community care channels. This growth is especially prominent in countries with strong, established healthcare systems and the proactive detection of skin diseases and cancers.New and different collaborations between public and private sectors in the deployment of AI solutions in dermatology is causing rapid increases in uptake and implementation in more countries in Western Europe and Central Europe.

Germany's hospitals and private clinics, particularly, are leading the adoption of imaging devices in dermatology, buoyed by both insurance reimbursement and a a long-standing med-tech manufacturing base. A dermatologist is encouraged in Germany via insurance reimbursement through national health insurance. There is the direct involvement of research institutions in AI research development, innovation, and deployment in skin imaging, and dermatological diagnostics.

UK Diagnostic Dermatology Equipment Market Trends

The UK is rapidly expanding teledermatology schemes through NHS programs in primary practice, and is using desktop and mobile digital devices and tools to reduce delays in diagnoses; expand the number of dermatologists across the country via remote and digital technologies for dermatologists to see patients. Regional trusts are investing in mobile diagnostic units to serve their local community, as well as AI-driven real time triage, to assist in improving workflows, services, and patient outcomes across their populations.

How Rapid Healthcare Transformation Accelerating Dermatology Diagnostics in Asia Pacific?

The Asia Pacific market is growing at fastest CAGR because of investment in healthcare infrastructure, the expansion of access to dermatology services, and increasing occurrences of skin-related diseases. Programs for health screening backed by government agencies and initiatives to support the use of digital health technology are contributing to the adoption of portable, AI-enabled dermatology diagnostic devices along with overall awareness for early diagnosis programs in both developed and developing nations. The increasing role of teledermatology and collborations with global technology companies are also supporting adoption in key countries.

China Diagnostic Dermatology Equipment Market Trends

China has witnessed the increased adoption of AI-enabled diagnostic technologies and digital dermoscopy for skin disease because of government-led cancer screening and innovation in technology at major hospitals within large cities such as Beijing and Shanghai. Local med-tech companies are collaborating with hospitals to pilot real-time imaging systems. Furthermore, regulatory encouragement to facilitate the use of AI for diagnosis and growing public awareness for the effects of UV radiation on skin health are also supportive for continued growth.

India's demand for improved health services in rural capacities and upgrades to public hospitals will facilitate further use of handheld dermatoscopes and imaging systems, via government health missions, and will support continued adoption of quality skin disease programs. Programs such as Ayushman Bharat are broader intent in coverage transition, along with scope for awareness campaigns for skin disease, and certificate courses aimed at medical professionals. Urban diagnostic centres are also increasingly using AI-enabled technologies to support practice enhancement by improving accuracy and speed in diagnostic detection.

Diagnostic Dermatology Equipment Market Value Chain Analysis

- Research & Development (R&D) and Product Design

This initial stage involves innovating and designing new diagnostic technologies, such as advanced imaging systems, AI-powered diagnostic algorithms, and non-invasive testing methods.

Key Players: DermoScan GmbH, FotoFinder Systems GmbH, and Canfield Scientific, Inc. - Manufacturing & Assembly

This stage involves the production, assembly, quality control, and testing of diagnostic dermatology equipment, including handheld dermoscopes, imaging systems, and related software.

Key Players: Heine Optotechnik GmbH & Co. KG, 3Gen LLC., and Mindray Medical International Limited - Distribution & Sales

This stage focuses on marketing, sales, and logistics to get the equipment into the hands of dermatologists, clinics, and hospitals worldwide.

Key Players: Henry Schein, McKesson Corporation, FotoFinder and DermoScan.

Top Companies in the Diagnostic Dermatology Equipment Market & Their Offerings:

- Bausch Health: Bausch Health contributes to the market through its subsidiary, Ortho Dermatologics, which provides a wide range of prescription dermatology products and aesthetic devices.

- Alma Lasers Ltd.: Alma Lasers is a global innovator in laser, light-based, and ultrasound solutions for both the aesthetic and surgical markets.

- Cutera, Inc.: Cutera specializes in manufacturing energy-based devices that integrate dermatology and aesthetics, offering products for skin treatment like acne, skin revitalization, and hair removal.

- Lumenis Be Ltd. (acquired by Boston Scientific's surgical business): Lumenis develops and manufactures advanced energy-based medical devices, primarily lasers and intense pulsed light (IPL) systems.

- Cynosure Inc. (a Hologic company): Cynosure provides advanced aesthetic systems for hair removal, body contouring, and skin revitalization. Their innovative laser and light-based technologies serve both cosmetic and medical dermatology needs, supporting diagnosis-driven treatment plans.

- Dino-Lite Europe (IDCP B.V.): IDCP B.V., the company behind Dino-Lite Europe, contributes by providing digital microscopes and dermoscopes. These portable, handheld devices allow dermatologists to capture high-resolution, magnified images of skin lesions for detailed analysis and diagnosis.

- IDCP B.V.: This company (the parent of Dino-Lite Europe) develops and markets digital imaging solutions, including specialized dermoscopes, that are used as diagnostic aids by dermatologists.

- Genentech, Inc. (a member of the Roche Group): Genentech is a leading biotechnology company focused on developing pharmaceuticals for serious diseases like cancer, but is not a direct manufacturer of diagnostic dermatology equipment.

- Michelson Diagnostics Ltd.: Michelson Diagnostics contributes advanced imaging technology, specifically Optical Coherence Tomography (OCT), which allows dermatologists to see beneath the skin's surface non-invasively.

- Galderma S.A.: Galderma is a pure-play dermatology company focused on drugs and aesthetic solutions, not diagnostic equipment manufacturing. Their products treat various skin conditions, driving the overall dermatology market and related diagnostic needs.

- Casio Computer Co., Ltd.: Casio contributes to the diagnostic dermatology market through its development of specialized digital cameras and handheld dermoscopes. These devices incorporate high-resolution optics and imaging technology for skin documentation and lesion analysis.

- Nikon Corporation: Nikon is a global leader in optics and imaging technology, supplying high-quality optical components and digital cameras that are integrated into various diagnostic dermatology imaging systems.

Diagnostic Dermatology Equipment Market Companies

- Bausch Health

- Alma Lasers Ltd.

- Cutera, Inc.

- Lumenis Be Ltd.

- Cynosure Inc.

- Dino-Lite Europe

- IDCP B.V.

- Genentech, Inc.

- Michelson Diagnostics Ltd.

- Galderma S.A.

- Casio Computer Co., Ltd.

- Nikon Corporation

- Others

Recent Developments in Diagnostic Dermatology Equipment Market

- In March 2025, Damae Medical, announced its deepLive™ medical device has received 510(k) clearance1 from the U.S. Food & Drug Administration (FDA). deepLive™ is a non-invasive imaging tool that provides real-time, three-dimensional visualization of the skin. This cutting-edge technology empowers dermatologists to perform accurate clinical assessments and evaluate tissue health with increased precision.

(Source:https://octnews.org)

- In January 2024, DermaSensor Inc. announces FDA clearance for its First AI-Powered Medical Device to Detect All Three Common Skin Cancers (Melanoma, Basal Cell Carcinoma and Squamous Cell Carcinoma).

(Source:https://www.cancernetwork.com)

- In May 2024, SciBase Holding AB ("SciBase"), a leading developer of artificial intelligence (AI)-based solutions for skin disorders is announced the launch of the eBarrier Score for Nevisense, the first-ever AI skin barrier assessment tool built for use in research and cosmetic testing. Nevisense and the eBarrier Score utilize AI-generated algorithms that researchers can use to directly quantitate the severity of skin barrier dysfunction related to common skin disorders.

(Source: https://investors.scibase.se)

Segments Covered in the Report

By Device Type

- Dermatoscopes

- Contact Oil Immersion

- Cross-Polarized Dermatoscopes

- Hybrid Dermatoscopes

- Microscopes & Trichoscopes

- Multispectral Photoacoustic Microscopy (PAM)

- Reflectance Confocal Microscopy (RCM)

- Others (Raman Spectroscopy, etc.)

- Imaging Equipment

- X-Ray

- Magnetic Resonance Imaging (MRI)

- Ultrasound

- Others (Optical Coherence Tomography, etc.)

By Application

- Dermatitis

- Psoriasis

- Skin Cancer

- Others (Cellulitis, etc.)

By End-User

- Hospitals

- Dermatology Clinics

- Others (Research Institutes, etc.)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting