What is the Digital Advertising Market Size?

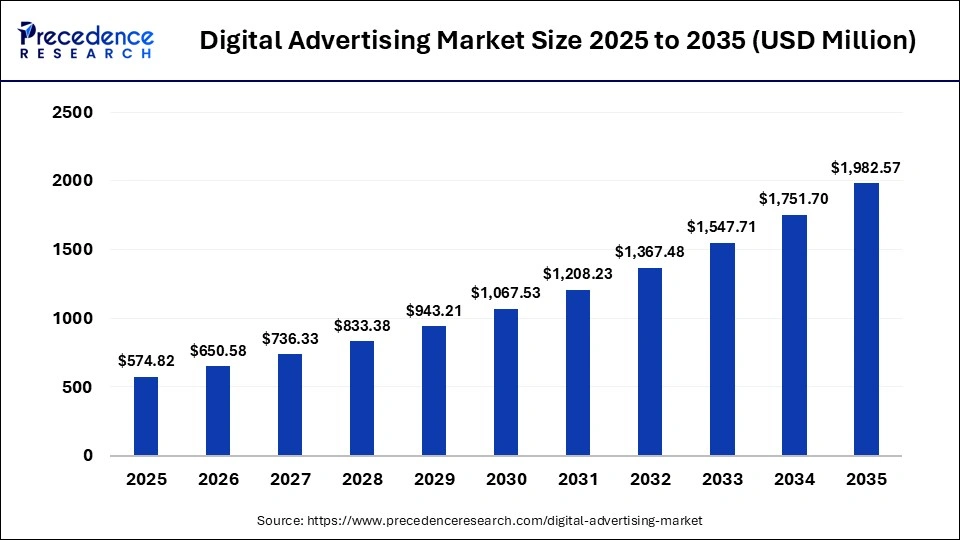

The global digital advertising market size was calculated at USD 574.82 million in 2025 and is predicted to increase from USD 650.58 million in 2026 to approximately USD 1,982.57 million by 2035, expanding at a CAGR of 13.18% from 2026 to 2035. The digital advertising market is boosted by the increasing popularity of smartphone advertising, as well as the rapid investment by manufacturing companies to run digital ads. Moreover, the growing focus of ed-tech companies on adopting social media advertising for gaining maximum consumer attention, along with the surging adoption of digital advertising solutions by the entertainment industry, is playing a prominent role in shaping the industrial landscape.

Market Highlights

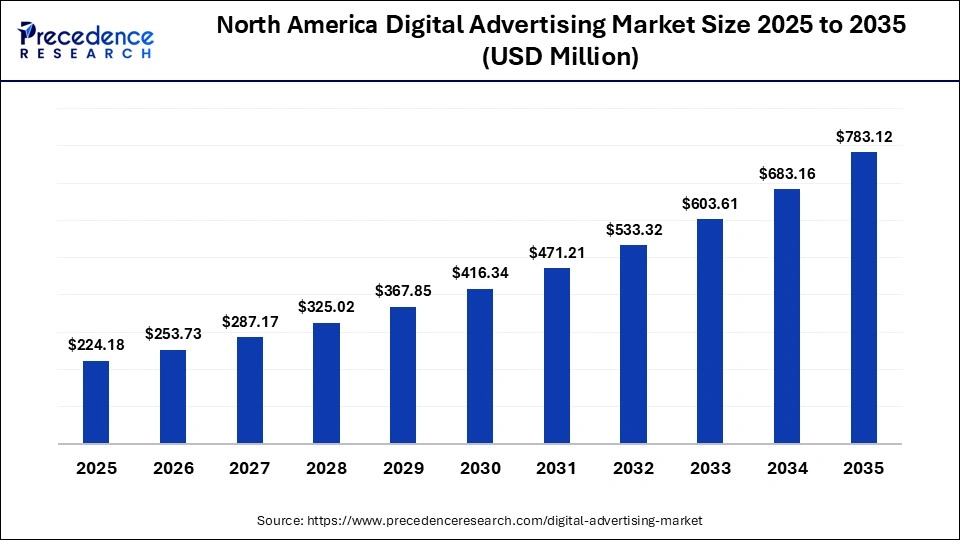

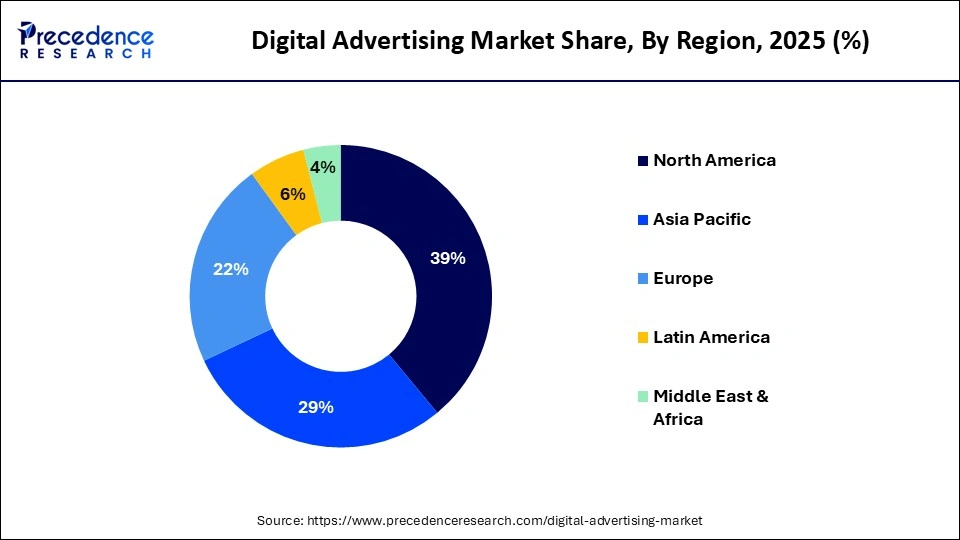

- North America dominated the digital advertising market, holding a share of around 39% in 2025.

- Asia Pacific is expected to expand with the highest CAGR of 13.5% from 2026 to 2035.

- By platform type, the mobile ads segment held the largest market share, accounting for 56% in 2025.

- By platform type, the digital TV segment is expected to grow at a remarkable CAGR of 12.4% between 2026 and 2035.

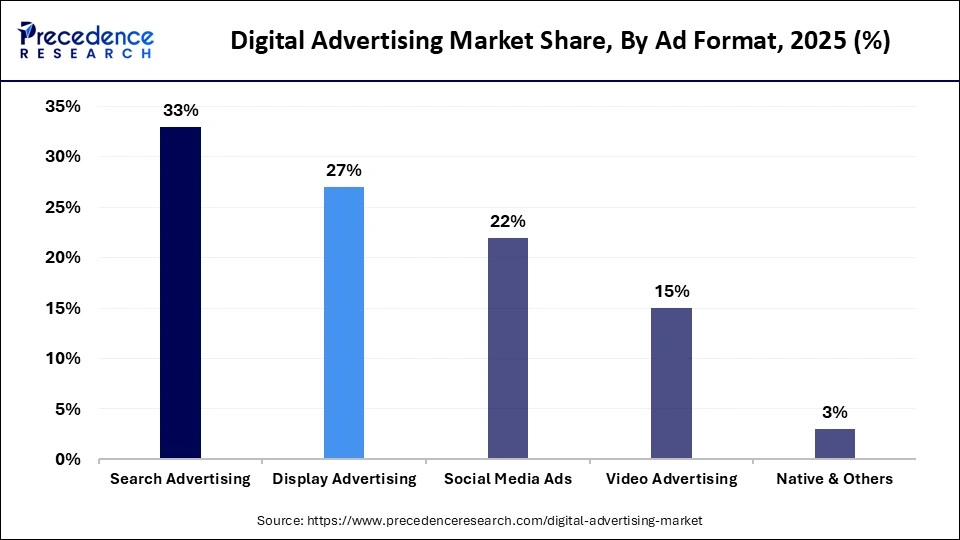

- By ad format, the search advertising segment held the largest market share of 33% in 2025.

- By ad format, the video advertising segment is growing at the highest CAGR of 12.8% between 2026 and 2035.

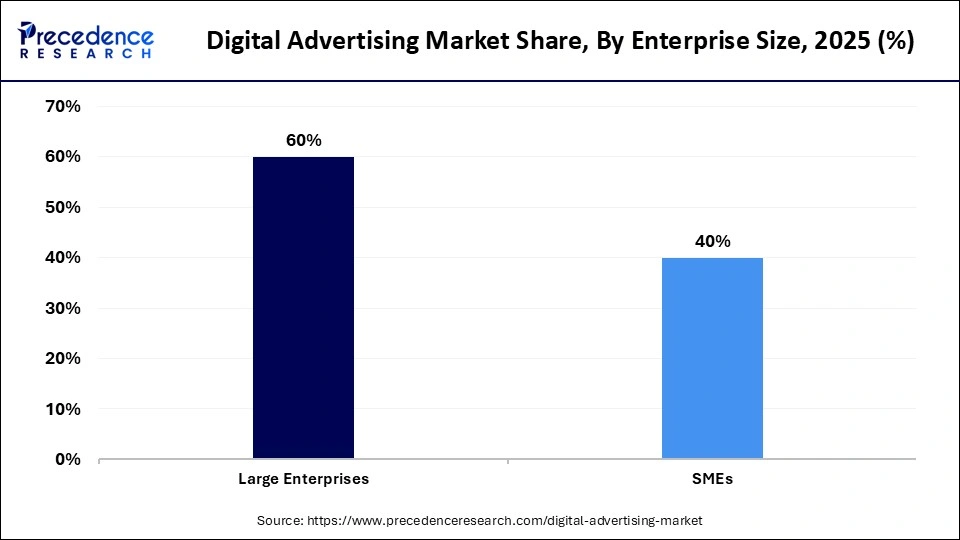

- By enterprise size, the large enterprises segment held the largest share of 60% in the industry.

- By enterprise size, the SMEs segment is poised to grow at the fastest CAGR of 12.5% between 2026 and 2035.

- By industry vertical, the retail & e-commerce segment led the market with a share of 23% in 2025.

- By industry vertical, the BFSI segment is expected to rise with the highest CAGR of 12.6% during the forecast period.

What is the Demography of the Digital Advertising Market?

The digital advertising market is an integral branch of the ICT industry. This industry deals in delivering digital advertising solutions across the world. There are several types of advertising systems provided by this sector, including search advertising, banner advertising, video advertising, social media advertising, native advertising, and interstitial advertising. These advertising solutions are designed for various platforms, such as computers, smartphones, tablets, and others. It finds application in numerous sectors, comprising BFSI, automotive, IT & telecommunication, healthcare, consumer electronics, retail, media & entertainment, education, and some others. This market is expected to expand significantly with the global rise of the retail sector.

What is the Role of AI in the Digital Advertising Market?

AI has reshaped the advertising landscape globally. In recent times, digital advertising companies have started using AI in their platforms to optimize campaign performance, automate tasks, content generation, and personalization. Additionally, AI enhances audience targeting & segmentation and promotes advertisements. Thus, AI has played a vital role in impacting the digital advertising market in a positive manner.

- In January 2026, Magic Hour launched the AI UGC Ad Generator. The AI UGC Ad Generator is an advanced platform designed for generating video ads.

Digital Advertising Market Trends

- Collaborations: Numerous digital advertising companies are collaborating with automotive brands to run digital ads. For instance, in January 2026, Park Garage Group collaborated with Wildstone. This collaboration is aimed at installing digital ad boards across Europe.

- Popularity of Social Media Advertising: The popularity of social media advertising has increased rapidly in developed countries to enhance brand building and increase user engagement. For instance, in January 2026, Ortho Marketing launched a social media marketing platform. This platform is designed for engaging patients with dentists globally.

- Surging Demand for Mobile-Based Advertising Platforms: The demand for mobile advertising platforms has increased rapidly from the retail sector to gain maximum consumer attraction. For instance, in July 2025, InMobi Advertising launched InMobi Buyer Hub. InMobi Buyer Hub is a newly designed advertising platform that enables retailers to launch their ads for smartphone users.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 574.82 Million |

| Market Size in 2026 | USD 650.58 Million |

| Market Size by 2035 | USD 1,982.57 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Platform Type, Ad Format, Enterprise Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Platform Type Insights

Why did the Mobile Ads Segment Dominate the Digital Advertising Market?

The mobile ads segment dominated the digital advertising market with a share of 56% in 2025. The increasing adoption of mobile ads by the BFSI and telecom sectors to deliver essential information about products and services has boosted the market expansion. Additionally, the rising sales of smartphones in various countries, such as China, India, and the U.S. has increased the demand for mobile ads, thereby shaping the industry in a positive direction. Moreover, numerous advantages of mobile ads, such as advanced targeting, personalization, and wide reach, are expected to boost the growth of the digital advertising market.

The digital TV segment is expected to rise at a remarkable CAGR of 12.4% between 2026 and 2035. The rise in the number of TV service subscribers across several nations, including Canada, India, and Germany, has driven the market growth. Moreover, the surging emphasis of educational companies to launch their services through digital TV ads is expected to drive the growth of the digital advertising market.

Ad Format Insights

What Made the Search Advertising Segment Lead the Digital Advertising Market?

The search advertising segment leads the digital advertising market with a share of 33% in 2025. The growing use of search advertising to connect users with businesses by boosting visibility has boosted the market expansion. Moreover, numerous advantages of search advertising, including cost-effectiveness, targeting the proper audience, and performance tracking capability, are expected to foster the growth of the digital advertising industry.

The video advertising segment is expected to rise at the highest CAGR of 12.8% between 2026 and 2035. The rising adoption of video advertising solutions by the travel and finance companies for gathering maximum customer attention has driven the market growth. Additionally, several benefits of video advertising solutions, such as enhanced brand engagement, building trust, and easy sharing capabilities, are expected to boost the growth of the digital advertising market.

Enterprise Size Insights

Why did the Large Enterprises Segment hold the largest share of the Digital Advertising Market?

The large enterprises segment held the largest share of 60% in the digital advertising market, as the rise in the number of large manufacturing companies across various nations, including China, the U.S., and Germany, has boosted the market expansion. Additionally, the surging emphasis of large enterprises to present their products through social media ads is contributing positively to the industry. Moreover, the rapid investment by large healthcare brands to adopt video advertising services for attracting a wide range of TV users is expected to accelerate the growth of the digital advertising market.

The SMEs segment is expected to expand at the fastest CAGR of 12.5% between 2026 and 2035. The rise in the number of government initiatives aimed at developing the SME sector across various nations, such as India, France, and Saudi Arabia, has boosted the market expansion. Also, the increasing focus of medium enterprises on showcasing their products and services through social media ads due to their cost-effectiveness is contributing positively to the industry. Moreover, the surging investment by SMEs to gather maximum customers through digital advertising platforms is expected to drive the growth of the digital advertising market.

Industry Vertical Insights

What made the Retail & E-Commerce Segment lead the Digital Advertising Market?

The retail & e-commerce segment leads the digital advertising market with a share of 23% in 2025. The rapid expansion of the e-commerce industry in several nations, including China, the U.S., Canada, and the UK, has boosted the market expansion. Additionally, the rapid investment by retail companies in adopting video advertisement, as well as technological advancements in the online retail platforms, is playing a prominent role in shaping the industrial landscape. Moreover, partnerships between e-commerce brands and advertising companies to launch ads through social media are expected to propel the growth of the digital advertising sector.

The BFSI segment is expected to expand with the highest CAGR of 12.6% during the forecast period. The technological advancements in the BFSI sector across numerous countries, such as Germany, the UAE, and South Africa, have driven the market growth. Also, the increasing focus of BFSI brands on running their ads through mobile phones is positively contributing to the industry. Moreover, collaborations among BFSI companies and video advertisement service providers for launching video ads to attract genuine consumers are expected to boost the growth of the digital advertising market.

Regional Insights

How Big is the North America Digital Advertising Market Size?

The North America digital advertising market size is estimated at USD 224.18 million in 2025 and is projected to reach approximately USD 783.12 million by 2035, with a 13.33% CAGR from 2026 to 2035.

Why did North America dominate the Digital Advertising Market in 2025?

North America dominated the digital advertising market with a share of 38-40% in 2025. The rising popularity of video advertising across the U.S., Mexico, and Canada has boosted the market expansion. Also, the rapid investment by the government for deploying digital advertising boards in the urban areas, coupled with the surging adoption of social media advertisements by the BFSI sector, is playing a vital role in shaping the industrial landscape. Moreover, the presence of various digital advertising companies, such as Microsoft Corporation, Amazon, Meta, and Disruptive Advertising, is expected to propel the growth of the digital advertising market in this region.

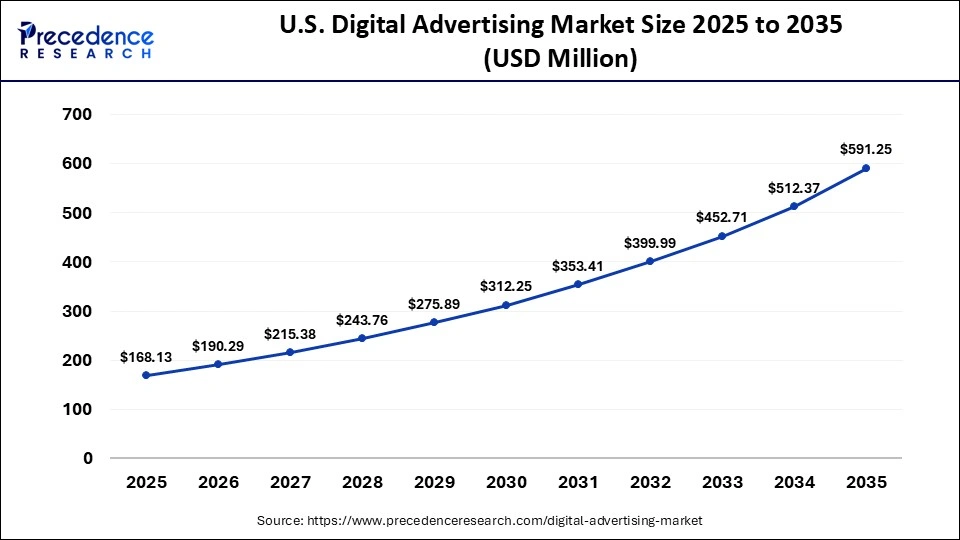

What is the Size of the U.S. Digital Advertising Market?

The U.S. digital advertising market size is calculated at USD 168.13 million in 2025 and is expected to reach nearly USD 591.25 million in 2035, accelerating at a strong CAGR of 13.4% between 2026 and 2035.

U.S. Digital Advertising Market Analysis

The surging emphasis of manufacturing brands to run their ads through smartphones to attract a wide range of consumers, coupled with the rapid digitalization of the educational sector, has driven the industrial expansion. Additionally, the technological advancements in the telecom sector are playing a crucial role in shaping the industrial landscape.

Rising adoption of data-driven advertising platforms is enabling precise audience targeting, real-time performance tracking, and measurable return on ad spend. Expansion of high-speed mobile networks is supporting richer ad formats such as video, interactive, and location-based advertising. In parallel, increased use of AI-powered analytics and programmatic buying is improving campaign optimization and cost efficiency across digital channels.

Why Asia Pacific is Growing with the Highest CAGR in the Digital Advertising Market?

Asia Pacific is expected to rise with the highest CAGR of 13.5% during the forecast period. The rising emphasis of e-commerce brands on adopting search advertising for gathering high traffic on their websites has boosted the market expansion. Also, the rapid investment by the healthcare companies for advertising their products through TV in various countries, including China, Japan, India, South Korea, and Thailand, is positively contributing to the industry. Moreover, the presence of several market players such as Baidu, Alibaba, Tencent, and TikTok is expected to drive the growth of the digital advertising market in this region.

- In August 2025, Alibaba launched Accio Agent. Accio Agent is an AI-based platform that is designed to enhance online sourcing for merchants.

China Digital Advertising Market Trends

The increasing focus of electronics brands on showcasing their products through mobile ads and desktop ads has boosted the market expansion. Additionally, the rapid expansion of the retail sector, coupled with a rise in the number of SMEs, is playing a crucial role in shaping the industry in a positive direction.

Growing adoption of e-commerce and social commerce platforms is increasing demand for performance-based and conversion-focused digital advertising formats. Advances in data analytics and AI-driven ad targeting are enabling advertisers to optimize campaigns across multiple digital touchpoints. In parallel, expansion of mobile internet access and digital payment ecosystems is reinforcing sustained growth of digital advertising adoption across China.

Who are the Major Players in the Global Digital Advertising Market?

The major players in the digital advertising market include Adobe, Amazon.com Inc., AOL (Yahoo), Baidu, ByteDance, Dentsu Inc., Disruptive Advertising, Microsoft Corporation, Tencent Holdings Ltd., Verizon, WebFX, X Corp., Globo, IAC, Meta.

Recent Developments

- In January 2026, Digital ShoutOuts launched Chat-Prompt.ai. Chat-Prompt.ai is an AI-based conversational marketing platform that helps brands to launch digital campaigns autonomously.(Source: https://www.campaignindia.in)

- In December 2025, Bobo Digital launched an AI-enabled advertising platform. This AI-based platform is designed for businesses to optimize customer acquisition and retention(Source: https://www.newsfilecorp.com)

- In October 2025, American Express launched Amex Ads. Amex Ads is a digital advertising platform designed for the consumers of the U.S. region.(Source: https://www.exchange4media.com)

Segments Covered in the Report

By Platform Type

- Mobile Ads

- Desktop Ads

- Digital TV

- Other Platforms

By Ad Format

- Search Advertising

- Display Advertising

- Social Media Ads

- Video Advertising

- Native & Others

By Enterprise Size

- Large Enterprises

- SMEs

By Industry Vertical

- Retail & e-Commerce

- BFSI

- IT & Telecom

- Healthcare

- Media & Entertainment

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting