What is the Digital Oilfield Market Size?

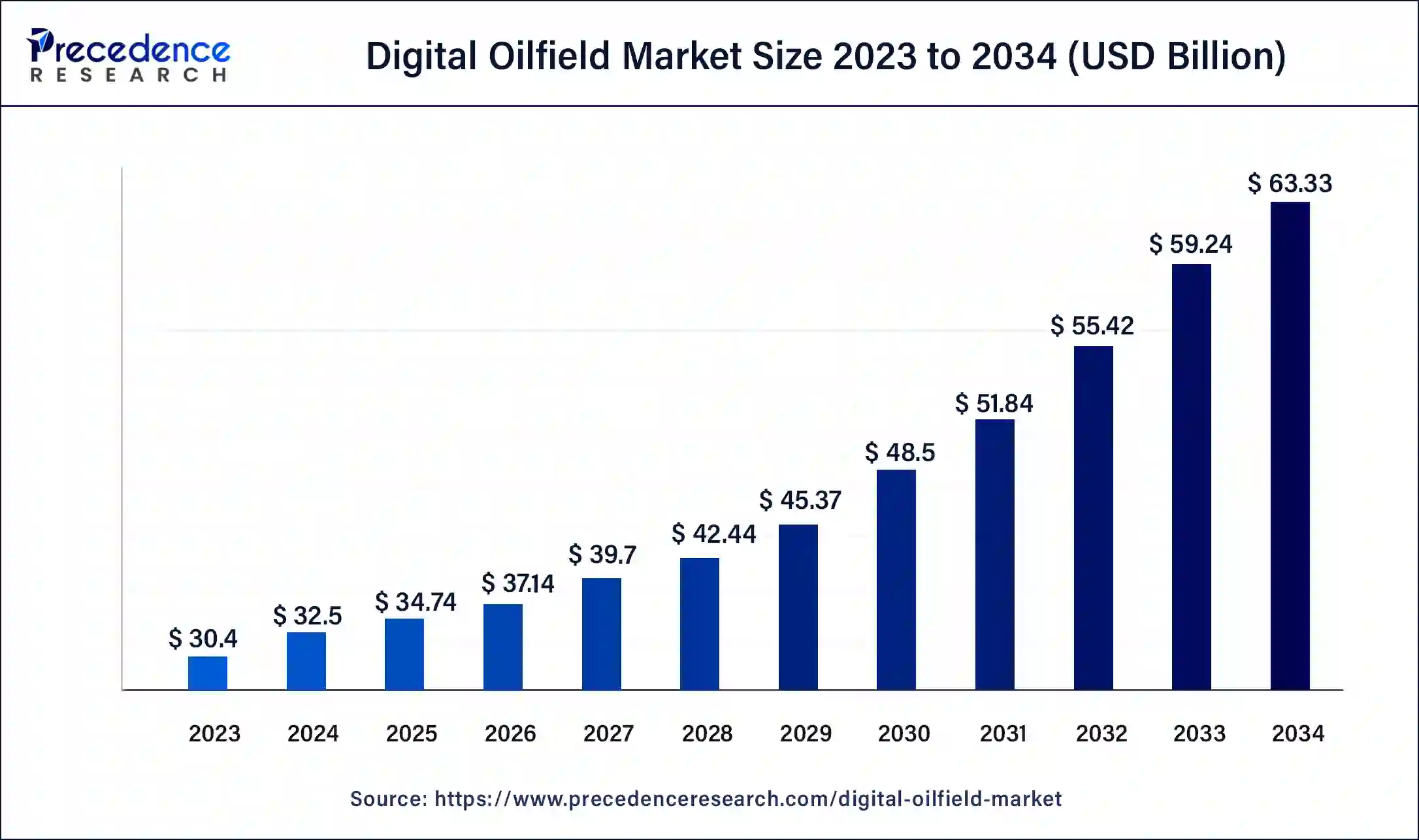

The global digital oilfield market size is calculated at USD 34.74 billion in 2025 and is predicted to increase from USD 37.14 billion in 2026 to approximately USD 67.24 billion by 2035, expanding at a CAGR of 6.83% from 2026 to 2035.

Market Highlights

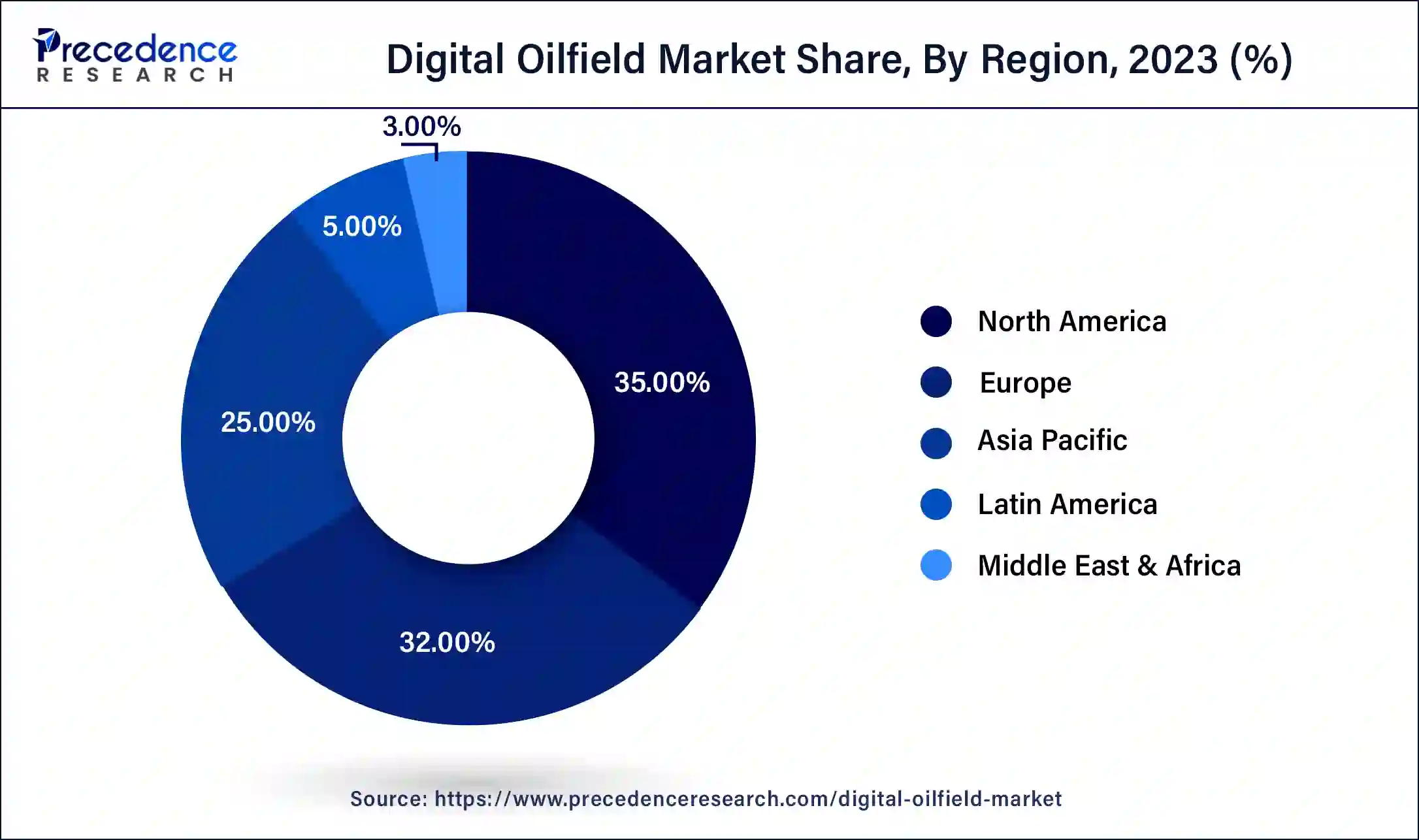

- North America led the global market with the highest market share of 35% in 2025.

- By process, the reservoir production segment is expected to have the largest market share over the projected period.

- By solution, the hardware solution segment is expected to have the highest market share during the forecast period.

Growth Factors

The usage of digital intelligence in this industry is able to make intelligent decisions in order to make effective measurements and analysis of the field. The use of digital intelligence has made decision making easy in this industry. In order to meet the demands of the products an efficient production with cost effective measures is needed. The operational risk is reduced to a great extent due to this platform. It ensures better safety of the workers. The use of technology in the oilfield market helps in improving the decision making process and improves the operational performance of industry. In order to save the costs on all the operations in oil and gas industry the industries are celebrating their investment in digital technology. Digital oilfield technology will provide success for the field operators as well as the engineers in the long run. The setup for the project should be robust. The producers of oil and gas are looking for opportunities into deep water. The problem solving has become faster with teamwork and collaboration through digital oilfield market.

The digital oilfield techniques are serving as an integral part of planning, production and exploration of this industry, which is helping in substantially increasing the output through analytical and statistical tools. The industry is working on upgrading the existing tools to make it more efficient. Advanced tools of software and hardware shall shape the market. In order to access the complex or normal reservoirs of oil with higher accuracy the technology, called reservoir optimization technique is used and it shall grow in the future. The onshore oil fields shall dominate the market size as it is more accessible with larger capacity of reservoirs of conventional and unconventional resource. The digital oilfield technology shall boom on the offshore markets as there are complex procedures to be followed that involve a lot of risks for the production and completion of the project. The performance and management of the gas and oil platforms has advanced due to the wireless technology, collection platforms and data analysis mobility. Just like the offshore wind market, growing investments on the offshore oil market will pace the technology demand. Due to cloud computing. The industry has seen the usage of sensors and big data analytics analytics, which helps in the Oilfield procedures. And market players of the digital oilfield market include Accenture, General Electric, Intel, Emerson, Honeywell, Cisco repro, Redline and Infosys etc.

Market Outlook

- Industry Growth Overview: The digital oilfield market is growing, as development in technologies such as IoT, Artificial Intelligence, anddata analytics is increasing. This growth is driven by the requirement to improve efficiency, ensure important safety, meet environmental guidelines, and enhance operations through real-time monitoring.

- Global Expansion:The digital oilfield market is experiencing global expansion, as major organizations are accepting digital services to optimize exploration, manufacturing, and drilling by allowing real-time monitoring, enhancing decision-making, and mechanizing processes. North America is dominated in the market by a massive presence of oil and gas organizations and early adoption of technologies such as IoT, AI, and digital twins.

- Major investors:Major investors in the digital oilfield industry are primarily large, established oilfield service companies, multinational technology corporations, and major national and international oil and gas producers. It includes SLB, Halliburton, Baker Hughes, Weatherford International, and many other companies

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 34.47 Billion |

| Market Size by 2026 | USD 37.14 Billion |

| Market Size by 2035 | USD 67.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.83% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Process, Solution, Application, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Process Insights

The reservoir production segment is estimated to grow faster and is expected to have large market shares in the forecast period because there is an increasing demand for oil and gas. It involves modeling measurement and analysts and various functions of reservoir productivity. The technique helps in understanding what is the maximum amount of fluid flow that can be extracted from a reservoir.

That helps in identifying the hydrocarbon resources and monitoring daily feud pressure metrics. There are many other factors and activities. That caused a large impact on the oil and gas production segment. Softwares are designed in order to understand the data generated during the activities related to Oil extraction, which could be exploration, drilling, the production cycles and also to understand the opportunities for product optimization. The engineers are able to understand what the amount of oil that can be extracted is. They can also understand. The appropriate preparation locations for all the processes based in reservoir production requires softwares that are designed for that function. The engineers are able to gain a clearer picture of all the factors that affect the production, depend on the evolving geospatial data and changing reservoir conditions. The 3D visualizing technique helps in understanding the subsurface geology of a particular area.

Solution Insights

The hardware solution is expected to show the fastest growth and has the largest market share during the forecast. The hardware solution includes the wireless sensors, supervisory control and data acquisition, distributed control system as smart wells. These are all the important components. Of the new technology, digital oilfield, which are used widely across the globe. The hardware technology also involves safety systems and programmable logic controller. In order to reduce the non productive time the market for the hardware solutions is increasing day by day. Europe shall have the largest market share of the digital oil market. After the European countries, North America is going to dominate the market size due to growing need for reducing the human intervention, and also since there is a demand for big data management. In order to use distributed control systems, the automated solutions are also increasing in the segment. Besides all these, the various gas and oil companies are working on unique products to automate the entire process without harming the environment. The innovations in the digital oilfield market are likely to propel the growth in this segment in the years to come.

By Process

The drilling optimisation segment is expected to grow at the fastest CAGR in the market during the forecast period. This segment is gaining traction in the market with its robust predictive analytics, use of AI, digital twins, and real-time monitoring. To adjust the volume of weight, rate of penetration, additional mud weight, and torque can be executed via real-time monitoring to prevent disturbance and operate hassle-free throughout the process.

By Solution

The software segment is expected to grow at the fastest CAGR in the market during the forecast period. The software solution to the digital oilfield is grounded to its core applications, such as reservoir optimisation, drilling, production refining, etc. This solution meets the needs of AI-fuelled decision-making and automation. The popular Landmark software is used in drilling automation and end-to-end asset refining.

By Application

The offshore segment held the largest share in the market. The offshore application stimulates modern technologies, as this sharpness to the technologies will fix the extreme, expensive, and crucial impact of platform flow, deepwater, and subsea. The offshore platforms make space for genuine onshore monitoring with the help of digital twins, AI-sponsored tools, and SCADA systems.

This offshore tech support is indirectly beneficial to the onshore operation. The mechanism flows in favor only if the offshore meets precision in the digital oilfield. The modern tools play an essential role for the sake of safety, specifically in the monitoring area.

The onshore segment is expected to grow at the fastest CAGR in the market during the forecast period. The onshore application makes the physical resource access seamless and accelerates the density volume of the well. It revolves around the automation of manual data gathering, which gives an actual and researched level of analysis to tailor safety and mitigate operational costs measurably.

The remote control system, involving a segregation system and controlling injection pumps, mitigates the need for on-site staff. The manual data entry adds potent value to the onshores' precision operations.

Regional Insights

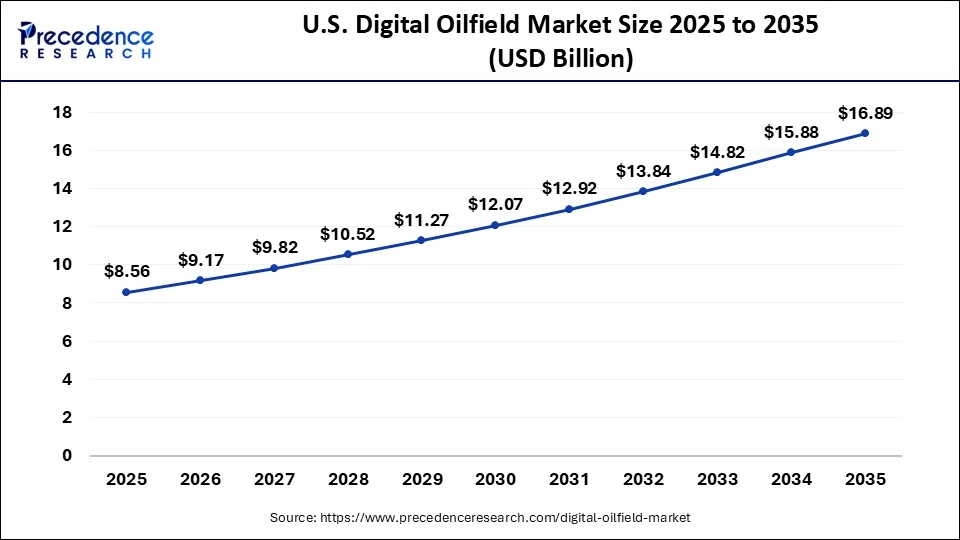

What is the U.S. Digital Oilfield Market Size?

The U.S. digital oilfield market size is estimated at USD 8.56 billion in 2025 and is predicted to be worth around USD 16.89 billion by 2035, at a CAGR of 7.03% from 2026 to 2035.

A food tech company beyond oilwhich is based in Israel, launched its new blockchain in the year 2024, which is named as solar Oil project, which is going to help in recycling the abandoned wells for extracting the oil and eliminating the ecological hazard. One of the largest national oil companies in China, China National Offshore Oil Corp, Started the functioning of Qinhuangdao 32 -6 smart oilfield. The technology used is Big data, artificial intelligence, cloud computing and IoT. The European nations are set to hold the largest market share in the digital oilfield segment, followed by North America. In order to reduce the human intervention, these countries are rapidly creating innovations in order to improve the efficiency. In order to better serve the oil and gas industries, various nations across the world are focusing on innovations and developments in this field.

Further development and transportation of oil and gas, various softwares and hardwares are developed. Osprey data, which is headquartered in US, is oil and natural gas Company, which introduced state of the art platform that can be used on mobile devices, Ease of access to various technicians working in this field. In order to develop a virtual representation of a deep water gas field, the Ormane Lange a digital twin solution was developed by a British multinational oil and gas company, Norske Shell.

U.S. Accelerates Smart Wells

In the United States, the digital oilfield market is seeing accelerated growth, driven by the widespread adoption of smart wells and real-time production optimization platforms. Operators are using advanced technology to maximize recovery from mature fields and streamline unconventional resource extraction processes.

North America's Connected Energy Boom

The North American digital oilfield market is expanding rapidly as oil and gas companies heavily invest in automation, big data analytics, and Internet of Things (IoT) technologies. This digital transformation focuses on enhancing operational efficiency, improving safety standards, and significantly reducing environmental impact across the region.

Asia Pacific: Government initiatives and support

Asia Pacific is the fastest growing region in the market due to rapid development and economic growth in countries such as China and India have created an increasing energy demand, pushing oil and gas companies to surge domestic manufacturing. Governments in the region, specifically in China and India, are powerfully backing the digitalization of the energy field through supportive policies, funding, and mandates for automation.

China: Technological advancement and adoption

China is a leader in adopting advanced technologies, such as IoT, AI, and big data analytics, to improve exploration, production, and drilling. These technologies allow for real-time monitoring, predictive maintenance, and enhanced decision-making, resulting in significant expense reductions and efficiency gains.

Europe: High operational costs and safety standards

Europe is experiencing substantial growth in the market due to the wide oil and gas sectors in this region that need sophisticated digital services to exploit recovery and extend their operational life. The trend toward unmanned and remotely operated platforms is gaining momentum in the region. High-speed connectivity, such as 5G and satellite links, helps real-time monitoring and control from onshore centers.

UK: Industry Collaboration and R&D

The UK has stringent government guidelines and a focus on transitioning to sustainable energy. The requirement to lower carbon emissions and ensure environmental protection has pushed the manufacturing to adopt digital services for precision monitoring of drive consumption, emissions, and energy usage, which drives the growth of the market.

What are the Advancements for Digital Oilfields in Latin America?

Latin America is set to experience significant growth in the upcoming years. This is due to the region's rich oil reserves and ongoing investments in digitalization processes. Countries such as Brazil, Mexico, and Argentina are leading players in the region as they are rapidly adopting digital oilfield solutions in order to enhance exploration and production efficiency.

Moreover, the region is also witnessing increasing advancements in IoT, AI, and cloud computing, which are thus enabling oilfield operators to make data-driven decisions, improve asset performance, and reduce downtime. The shift towards sustainable energy practices and the rise of smart oilfields are also contributing to the market's expansion.

Brazil Digital Oilfield Market Trends

The country is witnessing a steady transition from traditional methods to digital technologies. This growth and development are driven by growing investments in automation and real-time monitoring systems. Cloud-based platforms and remote sensing technologies are also gaining traction, enabling data-driven decision-making and agile responses to dynamic field conditions, thus boosting market potential.

What are the Advancements for Digital Oilfields in the Middle East and Africa?

The Middle East and Africa are growing at a steady pace and are expected to keep growing in the upcoming years. This growth is due to the growing demand for operational efficiency and cost reduction amid fluctuating oil prices. Digital oilfield technologies, including real-time data analytics, automation, and predictive maintenance, are advancing, helping streamline processes, optimize production, and reduce operational downtime and costs.

The region also has a number of mature oilfields, which facilitates the need for advanced digital solutions to help sustain production levels and extend field life.

Saudi Arabia Digital Oilfield Market Trends

The country's vast oil reserves and the government's focus on modernizing the oil industry are creating a favorable environment for market growth and development. Additionally, the country is also witnessing a rise in exploration and production activities, which leads to the need to optimize existing oilfield infrastructure. The ongoing digital transformation in the oil and gas sector is further enhancing market adoption even more.

Value Chain Analysis

- Input and Technology Sourcing: Digital oilfields rely on components such as industrial sensors, IoT devices, control systems, and data acquisition hardware. This technology must be able to withstand harsh field environments such as extreme temperatures and pressure. Suppliers focus on accuracy, ruggedness, and secure data transmission.

Key Players: Siemens, Honeywell, Emerson - Manufacturing Process: In this stage, providers integrate hardware and software into end-to-end oilfield solutions. Systems provide real-time production monitoring, predictive maintenance, and reservoir management. AI and digital twins are increasingly being used in order to optimize operations.

Key Players: Baker Hughes, ABB, Rockwell - Distribution Process: In this stage, digital oilfield solutions are delivered directly to oil and gas operators as well as national oil companies. Long-term service contracts and subscription models prove to be beneficial here. Adoption is driven by cost reduction, safety improvements, and production efficiency.

Key Players: Shell, BP, Chevron

Digital Oilfield Market Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Houston, Texas |

Technological innovation and digital leadership |

In November 2025, SLB launched a new AI product as it focuses on digital sales growth. |

|

|

United States |

Financial Health and Liquidity |

In August 2025, Halliburton Company unveils an evolution in oilfield intelligence: the next-generation Summit Knowledge digital ecosystem. |

|

|

Weatherford International |

United States |

Comprehensive service offerings |

Weatherford sees the next industry-defining leap in the fusion of physical operations with data foundations and cross-disciplinary execution. |

|

ABB |

Switzerland |

Strong financial position and cash flow |

In November 2025, ABB expands its power technology partnership with Applied Digital for AI-ready data centers. |

|

Emerson |

United States |

Technology and innovation |

TotalEnergies and Emerson's Aspen Technology business have announced a strategic collaboration to deploy advanced digital technologies for the continuous, real-time collection of data from TotalEnergies' industrial sites. |

Other Major Key Players

- CGG

- Siemens

- Rockwell Automation

- Kongsberg

Recent Developments

- In March 2025, Schneider Electric unveiled the One Digital Grid Platform, an AI-powered platform designed to enhance grid resiliency and efficiency. This platform is set to be available later in 2025. The company announced a $700 million investment plan in the U.S. to enhance energy infrastructure and AI capabilities.

(Source: prnewswire.com ) - In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil's cross-country pipeline network, enhancing efficiency and safety through real-time monitoring and robust cybersecurity. Spanning over 20,000 kilometers across multiple states in India, the network is vital to supporting the country's energy needs, transporting 125 million metric tons of oil and 49 million metric standard cubic meters of gas annually. (Source:abb.com )

- Weatherford International PLC. Announced on December 2021 that it was awarded a three year digital oilfield contract from the Kuwait Oil Company. Petrofac has announced they have that they have received extension in their contract with Neo Energy on January 2022. It will be operational for 27 wells across the various regions in the United Kingdom.

Segments Covered In the Report

By Process

- Drilling Optimization

- Reservoir Production

- Production Optimization

- Safety Management

- Others

By Solution

- Hardware

- Software

- Data Storage

- Others

By Application

- Onshore

- Offshore

By Technology

- IoT

- Advance Analytics

- Robotics

- Cloud Computing

- Mobility

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content