What is the Digital Textile Printing Market Size?

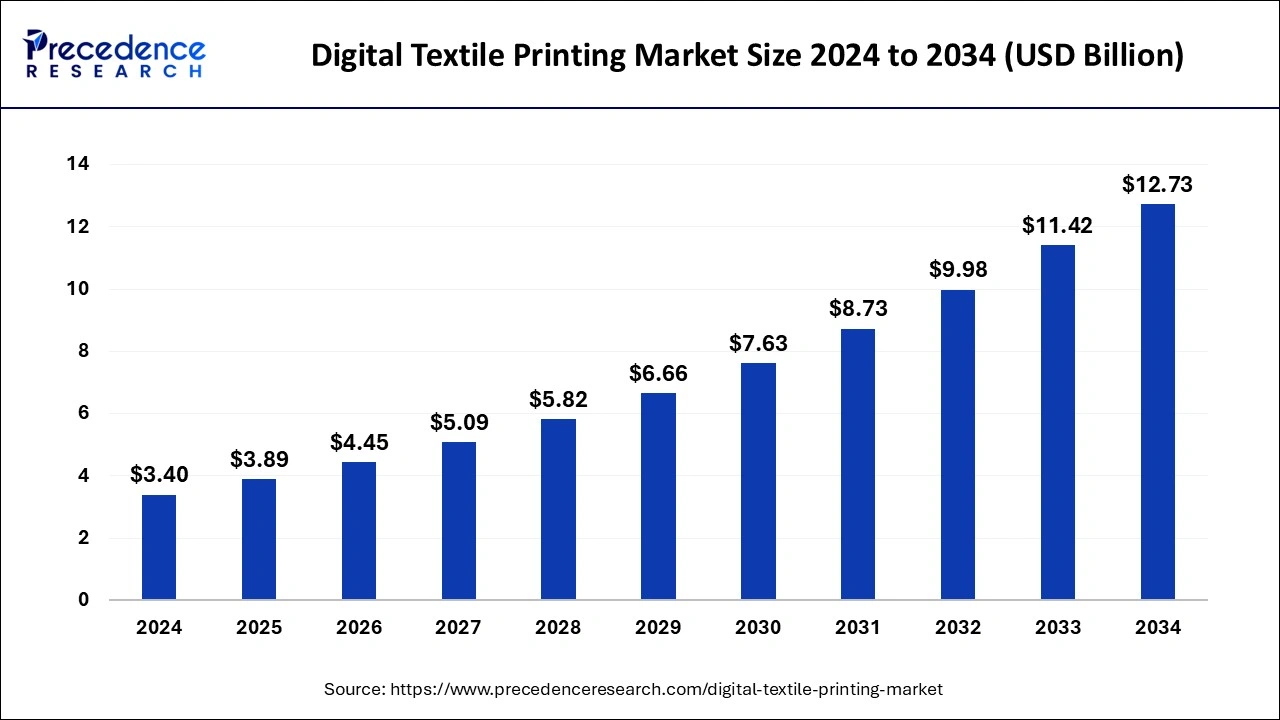

The global digital textile printing market size is calculated at USD 3.89 billion in 2025 and is predicted to increase from USD 4.45 billion in 2026 to approximately USD 14.13 billion by 2035, expanding at a CAGR of 13.77% from 2026 to 2035.

Digital Textile Printing Market Key Takeaways

- The global digital textile printing market was valued at USD 3.40 billion in 2024.

- It is projected to reach USD 12.73 billion by 2034.

- The market is expected to grow at a CAGR of 14.11% from 2025 to 2034.

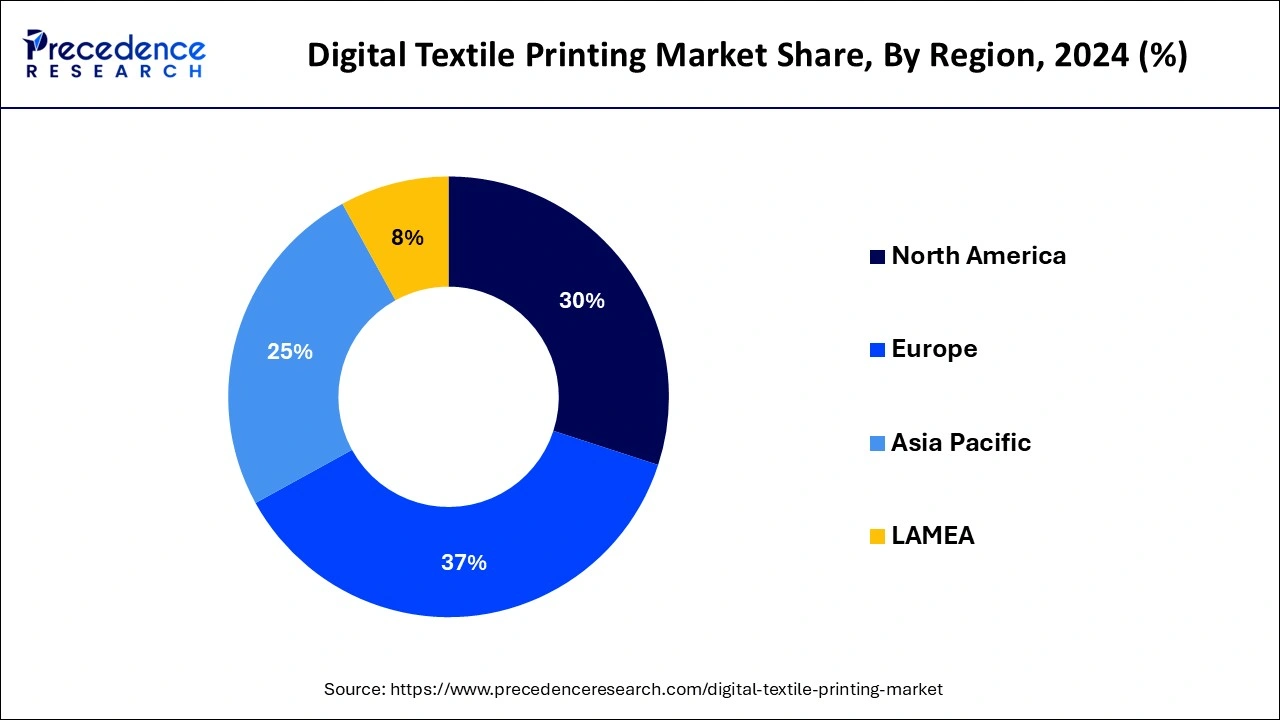

- Europe led the global market with the largest market share of 37% in 2024.

- By printing process, the direct-to-fabric (DTF) segment has held the major market share of 68% in 2024.

- By printing process, the direct-to-garment segment is expected to be the fastest-growing segment over the forecast period.

- By textile material, the cotton segment has contributed more than 53% of the market share.

- By textile material, the polyester segment is anticipated to grow at the fastest CAGR of 15.21% in the upcoming years.

- By operation, the multi-pass operation segment accounted for the biggest market share of 63% in 2024.

- By operation, the single-pass operation segment is anticipated to be the fastest growing during the projected period.

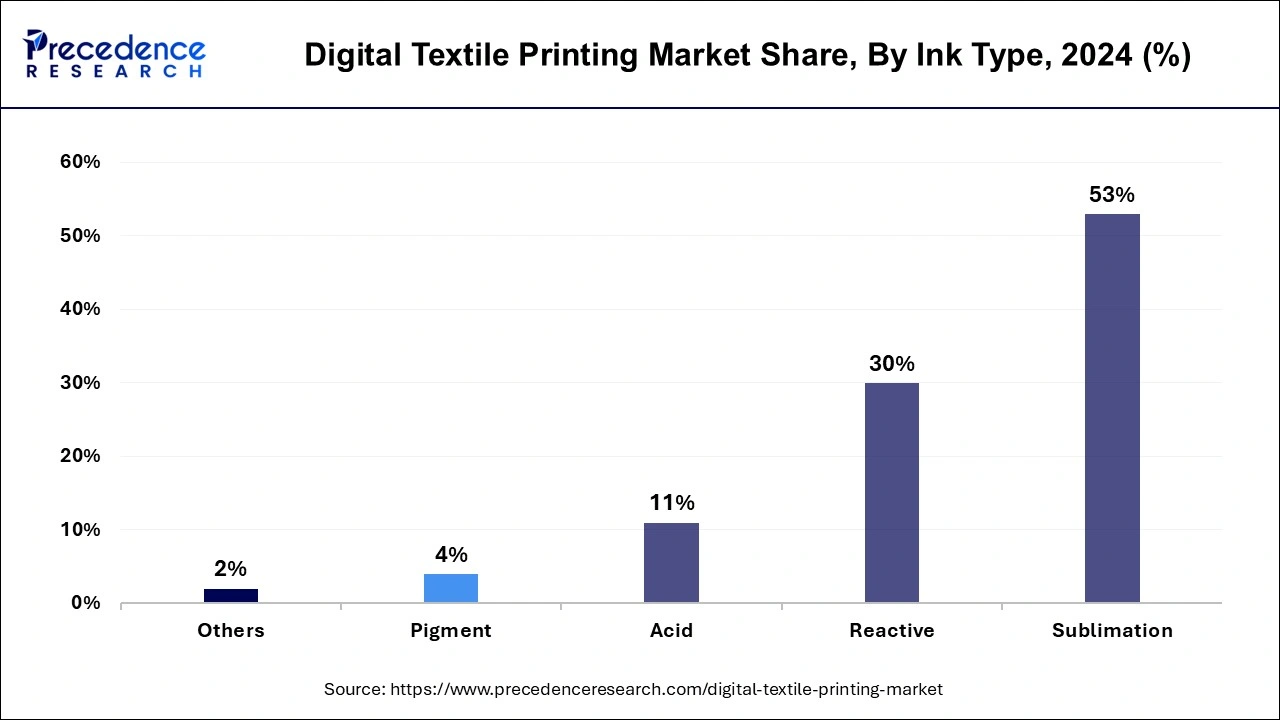

- By ink type, the sublimation segment has contributed more than 63% of the market share in 2024.

- By application, the clothing/apparel segment has recorded more than 54% of market share in 2024.

- By application, the home decor segment is projected to grow at a solid CAGR of 14.62% over the forecast period.

Market Overview

Digital textile printing is a cutting-edge method that utilizes inkjet technology to seamlessly transfer various designs onto fabric. This versatile technique can be applied to a wide range of fabric types, including cotton, silk, and polyester, by offering manufacturers unprecedented flexibility in design creation. The process involves feeding the fabric through a printing device, where ink is precisely deposited onto the surface in tiny droplets.

Subsequently, the fabric undergoes finishing treatments, which may include steam or heat application, washing, and drying to enhance durability and appearance. With the evolution of technology, digital printing has emerged as a preferred choice over traditional dyeing methods among manufacturers. This shift is driven by continuous advancements in digital printing technology, which have led to remarkable improvements in quality, speed, and versatility. Innovations such as high-resolution printers, sophisticated color management systems, and eco-friendly ink formulations have revolutionized the digital printing landscape, which makes it an increasingly attractive option for textile manufacturers.

Digital Textile Printing Market Growth Factors

- Growing changes in fashion trends are one of the key contributors to the growth of the digital textile printing market.

- A rise in demand for printed textiles globally is anticipated to drive market growth shortly.

- Growing per capita income in emerging economies, along with rapid fashion changes, can fuel market growth.

- The increasing use of textile printing in automotive interiors and vehicle wrapping can propel the digital textile printing market growth during the forecast period.

- New product launches and collaboration between key market players are also boosting the growth of the digital textile printing market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 13.77% |

| Market Size in 2025 | USD 3.89 Billion |

| Market Size in 2026 | USD 4.45 Billion |

| Market Size by 2035 | USD 14.13 Billion |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Printing Process, Operation, Textile Material, Ink Type, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Surge in demand for fashion products

In the digital textile printing market, the utilization of a wide spectrum of colors is virtually limitless, which gives unparalleled design possibilities. Unlike rotary screen printing, digital printers are not constrained by a maximum number of screens, thus optimizing space utilization. Moreover, digital printing consumes less ink and power, and it eliminates the need for water in the sublimation process. These advantages contribute to cost savings, which are pivotal in driving market growth. The surge in demand for "fast fashion" products, fueled by shifting consumer behavior, rapid urbanization, and increased disposable income, coupled with shorter fashion design cycles, is expected to further boost the adoption of digital textile printing solutions in the apparel and garment industry.

- In February 2024, DuPont celebrates the 35th anniversary of DuPont™ Artistri Digital Inks. In 1989, DuPont introduced Cromalin, the first pigment dispersions that were sampled to desktop printers. Since then, the Artistri Digital Inks portfolio has evolved significantly, offering solutions to multiple printing segments: home & office, textile, commercial, and packaging.

Restraint

The rise of internet and television advertising

Transitioning from traditional print media to digital platforms presents a considerable hurdle for the digital textile printing market in the upcoming future. The rise of Internet and television advertising poses a key challenge to print media as more businesses and consumers embrace digital channels for marketing and brand promotion. The widespread use of smartphones and the Internet of Things (IoT) has reshaped the landscape of advertising, prompting a shift from print to digital mediums. The expansion of mobile telephony further propels this shift, the growing number of connected consumers, and the rapid adoption of mobile broadband, all contributing to the swift digital transformation.

Opportunity

The growing importance of UV-cured inks

The market for digital textile printing is growing and there is an increasing demand for UV-cured inks. This popularity can be attributed to the fact that UV-cured ink dries quickly and has a lower level of volatile organic compounds (VOC). Moreover, it is versatile and can be used on different surfaces including glass, vinyl, metals, and wood. UV-cured ink offers several benefits such as scratch and abrasion resistance, zero emissions, excellent bonding capabilities, improved chemical and solvent resistance, long-lasting outdoor durability, and increased gloss levels. These advantages have widened the range of applications for UV-cured ink, and furniture manufacturers are increasingly using them to improve production processes and increase production output.

- In June 2025, Arrow Digital added the Canon UVgel Wallpaper Factory, a fully modular print and cut workflow solution consisting of a Colorado M5W large-format roll-to-roll printer and a Fotoba XLD170WP high-speed digital cutter to automatically cut flexible media into custom sizes and length to its printing arsenal.

Segment Insights

Printing Process Insights

The direct-to-fabric (DTF) segment dominated the digital textile printing market in 2023. In direct-to-fabric (DTF) printing, designs and patterns are directly printed onto a large roll of fabric. Once the printing process is complete, the fabric is cut and sewn into various apparel and home decor items like curtains and wallpaper. DTF printing utilizes a variety of inks, including pigment inks, reactive dyes, dye-sublimation inks, and acid dyes. Companies offer both types of printers to cater to the growing demand for each method.

The digital textile printing market is expanding, thanks to the growing importance of UV-cured inks. This surge in demand for ultraviolet-cured ink is due to its fast-drying time and reduced volatile organic compound content. UV-cured ink is versatile and can be used to print on various surfaces like glass, vinyl, metals, and wood. It offers several beneficial properties, including scratch and abrasion resistance, zero emissions, superior bonding capabilities, improved chemical and solvent resistance, extended outdoor durability, and increased gloss levels. These advantages have widened the scope of UV-cured ink applications. Furniture manufacturers are increasingly adopting them to streamline production processes and enhance production output.

- In March 2025, Pigment.Inc. hosted its distribution partner training event at its showroom in Uitgeest, Netherlands. The training event focused on the company's latest Q Series direct-to-garment (DTG) and direct-to-film (DTF) industrial-grade printing platforms.

Textile Material Insights

The cotton segment dominated the global digital textile printing market in 2023. Cotton, being a natural fiber, is extensively employed in digital textile printing for fashion and sportswear due to its excellent moisture management and long-lasting durability. The segment experiences growth primarily because of the high wash fastness associated with reactive ink, which is predominantly utilized for cotton fabric substrates.

The polyester segment is anticipated to grow at the fastest rate in the digital textile printing market. Polyester fabric seamlessly integrates with sublimation printing, a widely adopted and efficient method in digital textile printing. Sublimation ink forms a strong bond with polyester fibers, resulting in vivid, enduring, and high-caliber prints.

This capability to achieve exceptional outcomes through sublimation printing on polyester has positioned digital polyester printing as the preferred choice for numerous businesses and industries. Polyester, being a cost-effective material compared to natural fibers such as silk or linen, offers widespread availability and affordability by rendering it an appealing option for businesses aiming for cost-efficiency in their printing operations.

Operation Insights

The multi-pass operation segment was the dominant technology used in the digital textile printing market in 2024. In multi-pass printing, the printer heads move across the fiber width to print the designs multiple times. This method is cost-effective because it requires fewer print heads. One advantage of multi-pass digital textile printing is that any errors that occur during the initial runs of the print heads are compensated for by subsequent passes. Multi-pass printers are also known as scanning printers.

The single-pass operation segment is anticipated to be the fastest growing segment in the digital textile printing market during the projected period. Single-pass digital printing is an advanced technique that enables rapid, efficient, and accurate printing using specialized equipment, which requires just a single pass to apply ink or images onto diverse surfaces.

Ink Type Insights

The sublimation segment dominated the digital textile printing market in 2024. Sublimation inks produce vibrant and saturated colors, resulting in high-quality prints with excellent color reproduction. This makes them particularly appealing for applications where vivid and eye-catching designs are desired, such as fashion apparel, sportswear, and soft signage. Sublimation prints are highly durable and resistant to fading, washing, and abrasion.

The dye sublimation process bonds the ink directly into the fibers of the textile, creating long-lasting prints that maintain their quality even after repeated washings or exposure to harsh environmental conditions.

Application Insights

The clothing/apparel segment dominated the digital textile printing market in 2024. The surge in fast fashion and evolving consumer tastes has increased the need for rapid turnaround times within the apparel sector. Digital textile printing offers swifter production cycles compared to conventional methods, eliminating lengthy setup procedures such as screen printing. This results in shorter lead times and accelerated time-to-market. The agility and adaptability to evolving fashion trends make digital textile printing a preferred option for clothing manufacturers and brands by navigating the dynamic landscape of the fashion industry.

- In March 2024, Kyocera Corporation released its new sustainable inkjet textile printer, "FOR EARTH" *1, which reduces the water usage for textile printing to virtually zero to solve environmental issues, such as water pollution, in the textile and apparel industry.

The home decor segment is expected to experience significant growth in the digital textile printing market over the forecast period. Digital textile printing is widely used in the soft signage industry for various purposes, such asexhibition stands, indoor and outdoor advertising banners, flags, sound-absorbing panels, fabric roll-ups, event frames, displays, backgrounds, and wall coverings, among other applications.

Regional Insights

Europe Digital Textile Printing Market Size and Growth 2026 to 2035

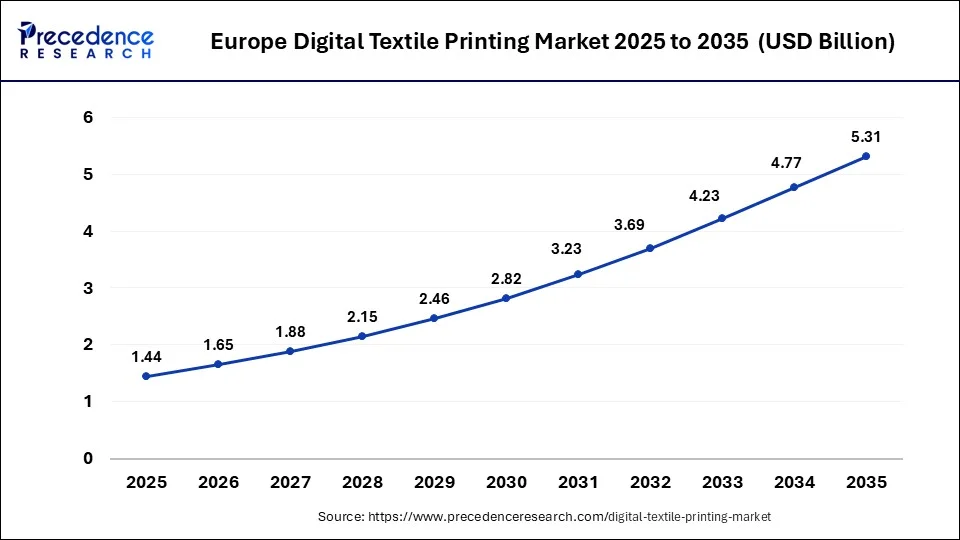

The Europe digital textile printing market size was exhibited at USD 1.26 billion in 2025 and is projected to be worth around USD 4.77 billion by 2035, growing at a CAGR of 14.24% from 2026 to 2035.

Europe held the largest share in 2025. Italy leads the regional market due to the burgeoning requirements of the fashion sector within the country. Moreover, the concentration of various fashion enterprises and prominent brands in cities like Milan, Rome, Venice, and Palermo further fuels the demand for sophisticated digital textile printing solutions by offering an extensive array of color schemes and fashion patterns. Germany and France also stand out as key markets in Europe, making substantial contributions to market expansion.

- In March 2025, Mimaki Europe, one of the leading manufacturers of digital printing and cutting technologies, is set to bring the very latest in UV print technology, including brand-new products, to the FESPA Global Print Expo.

Asia Pacific is observed to grow at a significant rate in the global digital textile printing market during the forecast period. The surge in demand for ready-to-use home textile products like sofas, cushion covers, curtains, and bed sheets is propelling market growth. As consumers increasingly prefer these products, there's a rising need for efficient and adaptable production methods, such as digital textile printing, to satisfy the demand for personalized and distinct designs.

- In March 2025, KingT launched its new label digital printing equipment, L-Press 510/330s, equipped with a Fuji Samba nozzle and capable of running at 80m/min. Li Zhiming, general manager of KingT, said, ‘We have specialized in inkjet printing for many years, and this is our first inkjet digital printing equipment in the label industry. KingT is currently the first Chinese label digital press supplier to use a Samba nozzle.

In India, a significant portion of the demand for home textiles is met by the unorganized and MSME sectors. Digital textile printing offers many advantages to these sectors, such as lower setup costs, faster production turnaround times, and the ability to handle smaller order quantities. Additionally, the cost-effectiveness and flexibility of digital textile printing make it an attractive solution for the unorganized and MSME sectors to increase their production capacities and meet the growing demand.

Digital Textile Printing Market Companies

- Seiko Epson

- Mimaki Engineering

- Kornit Digital

- D.Gen

- RolandDG Corporation

- Dover Corporation

- Konica Minolta

- Brother Industries

- Colorjet

Recent Developments

- In June 2023, Roland DG, a prominent global manufacturer of wide-format inkjet printers and printer/cutters, introduced the Roland DG Connect subscription service. This cloud-based connected service aims to enhance value and facilitate business growth for users.

- In June 2023, Mimaki Engineering, known for its expertise in industrial inkjet printers, cutting plotters, and 3D printers, is set to unveil the innovative "Neo-Chromato Process." This technology focuses on the sustainable reuse of colored polyester textiles by removing the dye-sublimation ink.

Segments Covered in the Report

By Printing Process

- Direct-to-fabric

- Direct to Garment

By Operation

- Single-pass

- Multi-pass

By Textile Material

- Cotton

- Silk

- Polyester

- Others

By Ink Type

- Sublimation

- Pigment

- Reactive

- Acid

- Others

By Application

- Clothing/Apparel

- Home Décor

- Soft Signage

- Industrial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting