What is the Oilfield Chemicals Market Size?

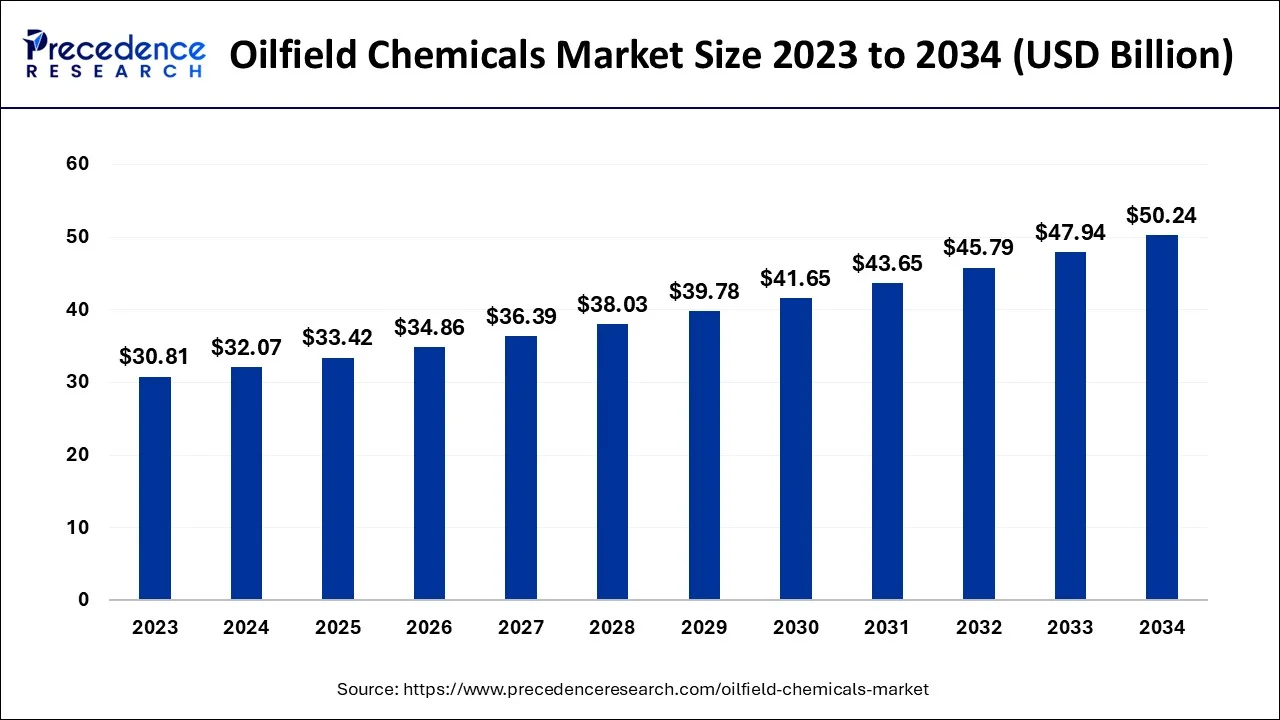

The global oilfield chemicals market size is estimated at USD33.42 billion in 2025 and is predicted to increase from USD 34.86 billion in 2026 to approximately USD 52.44 billion by 2035, expanding at a CAGR of 4.61% from 2026 to 2035

Market Highlights

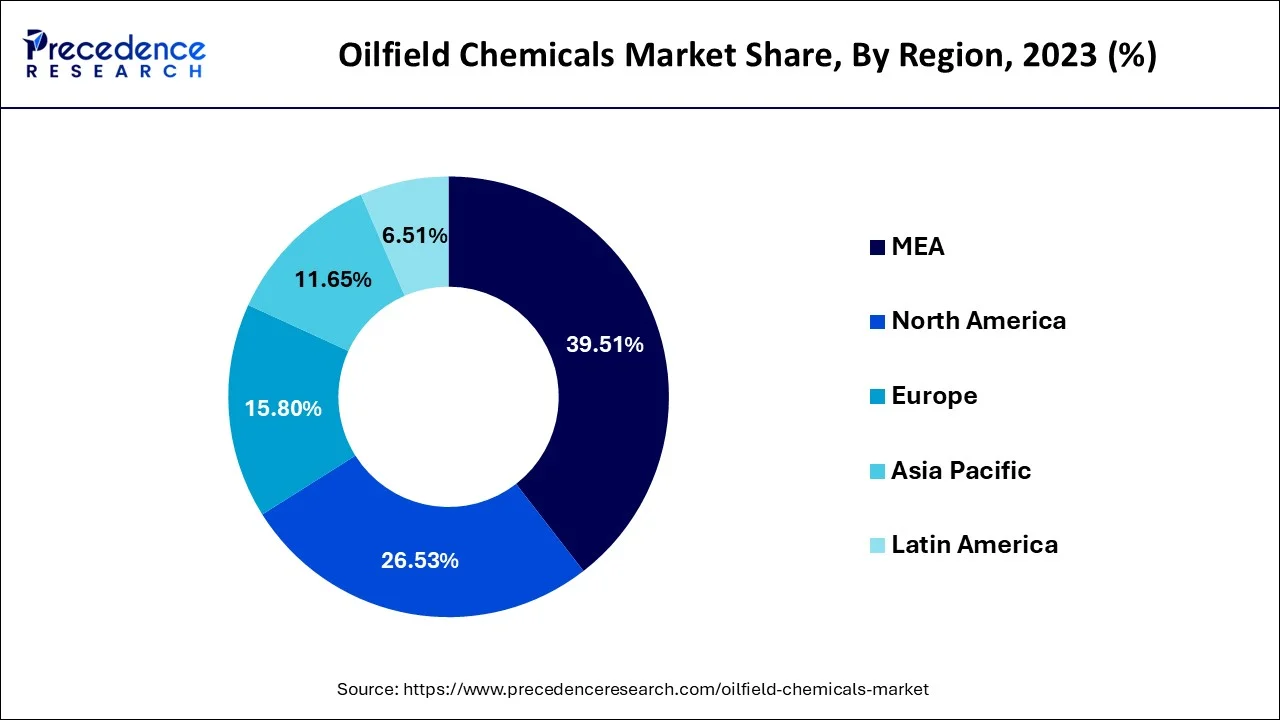

- Middle East and Africa dominated the global market with the largest market share of 39.54% in 2025.

- North America generated more than 26.48% of revenue share in 2025.

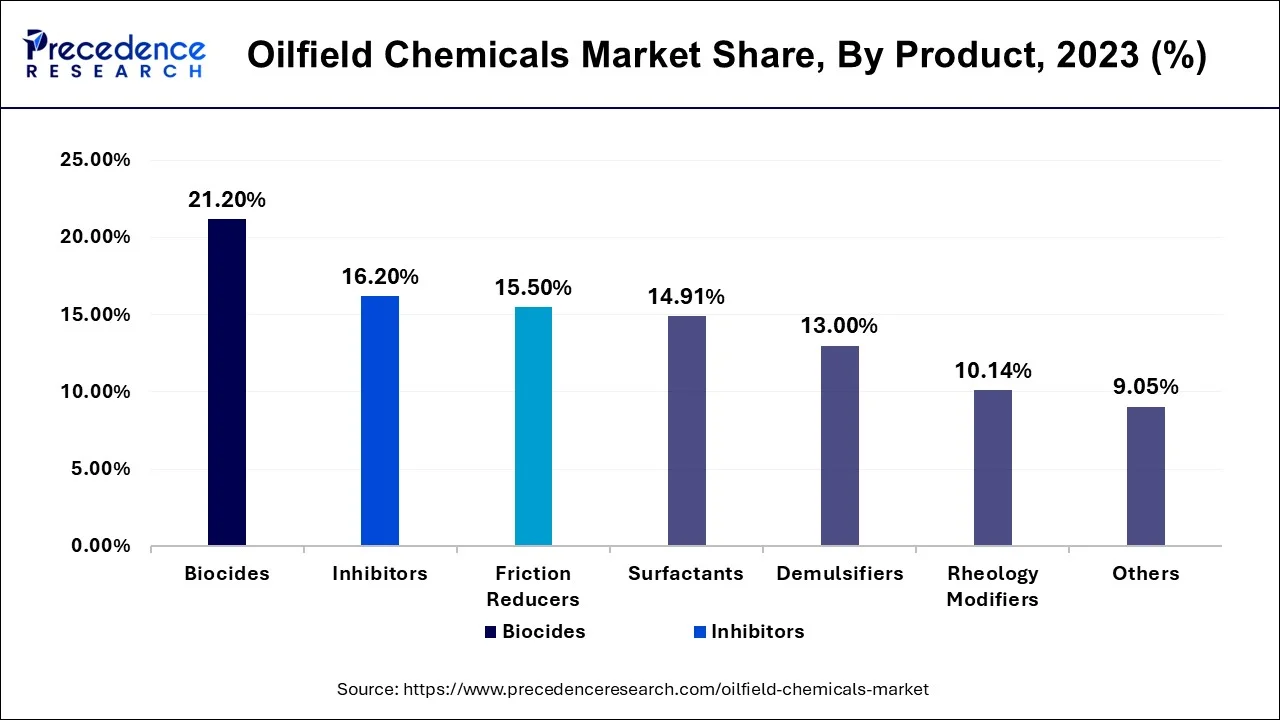

- By product, the biocides modifiers segment captured the biggest market share of 21.45% in 2025.

- By application, the workover & completion modifiers segment contributed the highest market share of 50.20% in 2025

- By application, the production chemicals segment is expected to grow at a remarkable CAGR of 5% during the forecast period.

- By location, the onshore segment generated the major market share of 70.15% in 2025.

- By product, the corrosion inhibitors segment is projected to experience the highest growth rate in the market between 2026 to 2035

Market Overview

Oilfield chemicals refer to a broad range of chemical substances used in the exploration, production, and refining of crude oil and natural gas. These chemicals play various roles in different stages of the oil and gas industry, including drilling, well stimulation, production, enhancement, corrosion prevention, and refining processes.Oilfield chemicals can be categorized into several groups based on specific functions and applications, which include drilling fluid additives, production chemicals, and well stimulation. These chemicals are used in drilling muds to improve the efficiency of drilling operations. They may consist of viscosities, shale inhibitors, fluid loss control agents, and weighing agents to enhance the stability and lubricity of the drilling fluids.

The oilfield chemicals are also utilized during the production phase to optimize the flow of hydrocarbons from the reservoir to the surface. These chemicals are used in well-stimulation techniques like hydraulic fracturing to enhance the productivity of oil & gas reservoirs.The oilfield chemicals market is expected to witness continued growth in the coming years. Key trends include the development of advanced chemicals with improved performance characteristics, adopting digital technologies for efficient chemical management and monitoring, and increasing investments in research and development activities to address evolving industry requirements.

- According to Reuters, after the Russia-Ukraine war, Russia is back on track in 2023 for the production of crude oil. Russia's output in the industry is 9.6 million barrels per day.

- As per Enerdata, the US produced 1.3% more crude oil in 2021 (which accounts for 17% of world output). Russia overtook Saudi Arabia as the second-largest crude oil producer in the world, with a production increase of almost 1.5%. The Middle East (+1.6%), led by Iran (+17.6%) despite sanctions, North America (+2.5%), including +5.9% in Canada, the CIS (+1.8%), and Asia (+3.3%) all saw increases in oil output.

- In November 2022, the oil output of Canada reached an all-time high of 4794.00 BBL/D/1K.

Oilfield chemicals are a specialized suite of formulations and additives drilling fluids, completion and stimulation chemicals, production and corrosion inhibitors, biocides, scale and paraffin control agents, demulsifiers, and specialty solvents designed to keep upstream and midstream operations safe, productive and cost-effective. They are applied across the well lifecycle: drilling, cementing, completion, stimulation, production and enhanced oil recovery (EOR). The market is inherently tied to hydrocarbon activity, oilfield service cycles, and capex in upstream projects, yet it has matured into a technology-led sector where formulation science, regulatory compliance and supply reliability are as important as price.

Oilfield Chemicals Market Growth Factors

- The rising global demand for oil and natural gas is one of the key factors driving the growth of the oilfield chemicals market.

- Growing deepwater activities and complexity in operation seeking oilfield chemicals.

- Technological advancements in oilfield chemical technologies are driving the adoption rate in offshore locations.

- Growing production of shale gas and crude oil drives the market.

- The need for drilling fluid, corrosion, and scale inhibitors to reduce environmental impact and improve well production is contributing to market growth.

- The rising usage of oilfields in water treatments is likely to fuel the market growth.

- Rising focus on reducing carbon emissions and adopting sustainable solutions is expected to drive market expansion.

Market Outlook

- Industry Outlook: The industry is consolidating into a mix of global majors and nimble specialists. Large suppliers offer global logistics, multi-product portfolios and integrated field-services, while smaller innovators focus on niche, high-performance chemistries or geography-specific problems. Competitive advantage increasingly depends on technical service depth field trials, customized formulations, regulatory compliance expertise, and resilience of supply chains. As operators demand lower total cost-of-ownership, vendors are moving from just-supplying chemicals to offering packaged chemistry, analytics and service solutions that reduce downtime and improve recovery. Partnerships between oilfield service companies and chemical specialists are expanding to deliver bundled offerings for complex wells.

- Sustainability Trend: Sustainability is reshaping product design and procurement. Operators and regulators demand reduced-toxicity formulations, biodegradable surfactants, lower-VOC solvents, and minimized freshwater use in hydraulic fracturing and well interventions. There is growing emphasis on life-cycle impacts manufacturing emissions, transport footprint, and disposal of chemically contaminated wastes. Producers increasingly request chemicals that enable reduced flaring, lower corrosion-related leaks, and more efficient water recycling. The sector is also exploring circular strategies for produced-water treatment chemicals, reclaiming certain chemistries or replacing single-use products with recyclable or enzymatic alternatives.

- Major Investment: Capital is flowing into several areas: R&D for greener, higher-performance formulations; scale-up capacity for specialty polymers and surfactants; localized blending and storage terminals to secure on-time supply; and digital platforms that link chemical dosing to realtime well analytics. Investors are also targeting facilities for safe handling and recycling of chemically laden waste streams and equipment for laboratory automation to accelerate formulation screening. Strategic alliances and bolt-on acquisitions bolster service capabilities particularly where operators seek one-stop vendors for chemistry, technical supervision and data-driven optimization.

- Startups: Startups are active across disruptive niches: biodegradable fracturing additives; enzyme- or microbe-based scale and souring control; direct-replacement surfactants from renewable feedstocks; nanoscale corrosion inhibitors; and smart chemicals that respond to downhole sensors triggered release, pH-activated seals. Other young firms commercialize digital-chemistry offerings lab-to-field AI models that predict compatibility, scaling risk or optimal dosing or low-capex water-treatment chemistries designed for decentralized reuse. Many are partnering with incumbent service providers for piloting and scale validation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 33.42 Billion |

| Market Size in 2026 | USD 34.86 Billion |

| Market Size by 2035 | USD 50.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.61% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Application, and By Location, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising production of oil & gas

The increase in oil and gas production worldwide is expected to boost the growth of the oilfield chemicals market. Oilfield chemicals protect equipment and pipes against corrosion. Scale inhibitors, biocides, surfactants, corrosion inhibitors, and friction inhibitors are widely used chemicals in oil production. They help to enhance productivity and recovery rates. They also prevent the formation of emulsions during the oil drilling process and help in the separation of oil and water. Moreover, the rising number of oil and gas exploration sites propels the market.

- For instance, in August 2024, Iraq's oil ministry finalized 13 new contracts for oil field development and exploration, as announced in an August 14 ceremony in Baghdad.

Restraints

Changing regulations for the chemical industry

The key reason limiting the need for oilfield chemicals from growing is the evolution of chemical regulations. The criteria for enforcing chemical rules indicate that they are intricate and dynamic. Since many countries have their own set of rules and regulations, it is hard for international enterprises to adhere to them. Currently, nations like China, Japan, and Indonesia are striving to update their existing chemical regulations. As a result, the sector's growth is being constrained by evolving regulations and legislation.

Opportunities

Rising Exploration towards Offshore and Deep Water:

As oil and gas industry increasingly shifts focus toward offshore and deep water exploration, there is growing demand specialized oilfield chemical capable of with pressure, temperature, and corrosive environments. Companies are investing in developing and deploying advanced chemical solutions tailored for these challenging offshore environments. For instance, Jacam Catalyst had expended its services to include production chemicals and solutions for offshore markets, marking a significant milestone after integrating ProFlow, which it acquired in 2022. Located in Gardendale, the company has how developed products specifically for challenging offshore environments, which constitute 14% to 15% of the U.S. oil gas production. This expansion into offshore markets resents a significant growth opportunity for oilfield chemical providers.

The integration of digital technologies and automation in oilfield operations is creating opportunities for the development of intelligent chemical management systems. These systems utilize real time data analytics, artificial intelligence, and machine learning to optimize chemical usage, monitor equipment performance, and predict maintenance needs. By implementing such technologies, operators can enhance efficiency, reduces costs, and minimize environmental impact. The adoption of digital solutions in chemical management is expected to grow, driven by the industry's push towards digitalization and operational optimization.

Segment Insights

Product Insights

The biocides segment generated over 21.45% of revenue share in 2024, and it is expected to grow at the highest CAGR over the forecast period. The demand for biocides in the oilfield chemicals market is expected to continue growing as microbial control becomes increasingly important in the industry. There is a growing focus on developing environmentally friendly and biodegradable biocide formulations to meet regulatory requirements and address environmental concerns. Additionally, the development of advanced monitoring and control technologies to detect and manage microbiological issues is expected to influence the demand for biocides in the future.

The production chemicals segment is projected to expand at the fastest pace over 2025-2034, led by higher intensity production operations and the need to maintain flow assurance and asset integrity as fields age. This bucket covering demulsifies, corrosion inhibitors, scale inhibitors and biocides benefits from sustained water cut management, sour service exposure, HP/HT conditions, more complex artificial lift systems that increase chemical consumption per barrel. Operators are also tightening uptime targets and emissions baselines, pushing continuous injection and real time dosing programs that raise spend on specialty blends with better thermal stability and lower toxicity. As offshore tiebacks and brownfield life extenuation projects multiply (alongside unconventional refraces), production chemicals see outsized volume growth versus one off drilling/ Cement stages, cementing their status as the fastest riser in the stack.

Application Insights

The workover and completion segment held the largest share of 50.20% in 2024. Workover and completion operations involve various well intervention activities aimed at enhancing the productivity of oil and gas wells. These activities include cleaning, perforating, stimulating, and repairing wells to optimize production and extend their operational lifespan. Oilfield chemicals play a crucial role in facilitating these operations by addressing challenges such as scale formation, corrosion, and formation damage. The dominance of the workover and completion segment in the oilfield chemicals market is driven by the critical role these operations play in optimizing oil and gas production, maximizing resource recovery, and ensuring the integrity and reliability of oilfield assets.

The production chemicals segmentis expected to grow at the highest CAGR over the forecast period. The increasing oil & gas production across the globe is one of the significant factors that propel the segment growth during the study timeframe. For instance, the OECD estimated that global crude oil output will be around 102.84 million barrels per day in 2023.

Global Oilfield Chemicals Market Revenue, By Application, 2022-2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Drilling Fluid | 5,574.9 | 5,761.5 | 5,965.6 |

| Production Chemicals | 5,990.0 | 6,254.4 | 6,542.9 |

| Cementing | 3,232.2 | 3,342.9 | 3,463.9 |

| Workover & Completion | 14,856.4 | 15,451.2 | 16,100.8 |

Location Insights

The onshore segment is expected to hold the largest market share during the forecast period. Onshore oil and gas projects frequently use oilfield chemicals like demulsifiers, corrosion inhibitors, and others because they quickly separate water from crude oil, lowering the expense of later water treatment stages. The need for oil field chemicals is rising as there are more onshore oil and gas projects underway across the world.

For instance, the Alaska LNG project in the United States and Sriracha Refinery Expansion & Upgrade in Thailand are expected to offer a plethora of opportunities for the oilfield chemicals sector by 2025 and 2024 respectively.

Global Oilfield Chemicals Market Revenue, By Location, 2022-2024 (USD Million)

| By Location | 2022 | 2023 | 2024 |

| Onshore | 20,787.1 | 21,613.2 | 22,515.4 |

| Offshore | 8,866.4 | 9,196.8 | 9,557.8 |

Regional Insights

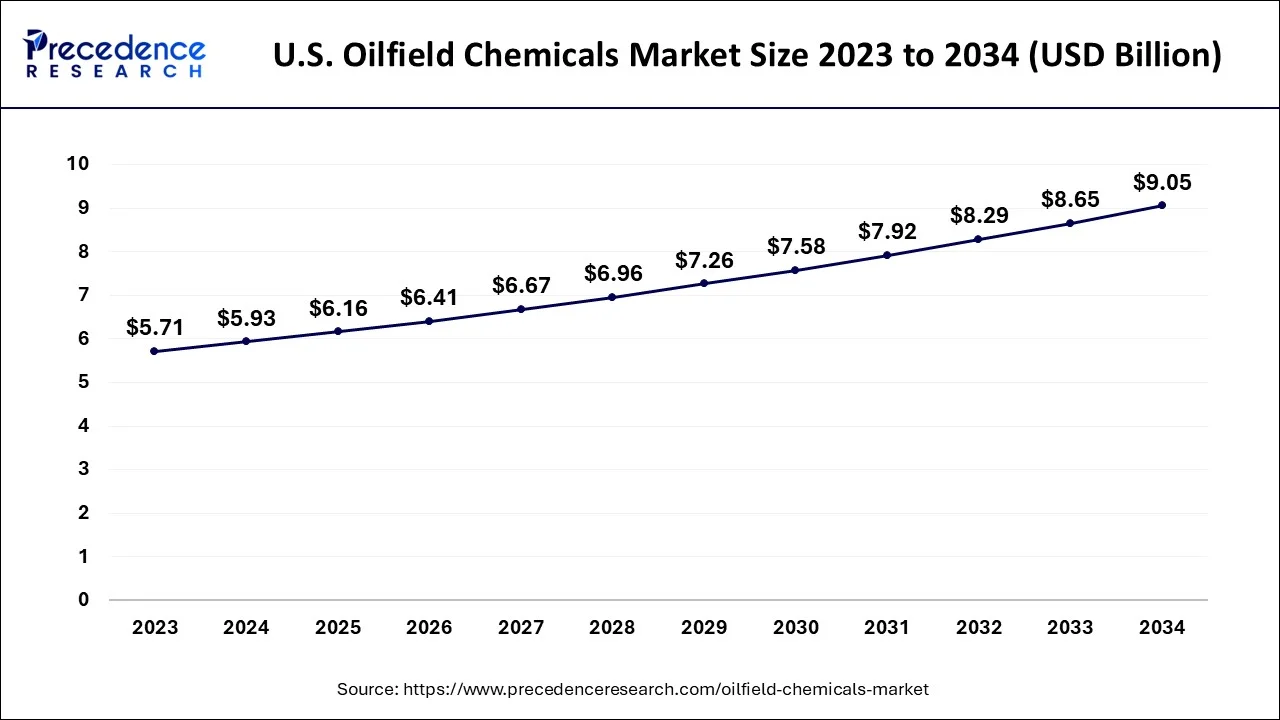

U.S. Oilfield Chemicals Market Size and Forecast 2026 to 2035

The U.S. oilfield chemicals market size accounted for USD 6.16 billion in 2025 and is expected to be worth around USD 9.42 billion by 2035, growing at a CAGR of 4.34% from 2026 to 2035

Middle East and Africa dominated the market with the largest share of 39.54% in 2024. Many countries in the Middle East, such as Saudi Arabia and Iraq, are among the world's top oil producers. The high production levels necessitate significant usage of oilfield chemicals to optimize production, maintain well integrity, and mitigate operational challenges such as corrosion, scaling, and wax deposition. Governments and national oil companies (NOCs) in the Middle East and Africa have made substantial investments in oil and gas exploration and production activities. These investments drive demand for oilfield chemicals to support drilling operations, well completion, and reservoir management efforts.

North America contributed 26.48% of revenue share in 2024. The regional growth is attributed to the growing oil & gas production. For instance, according to the Energy Information Administration (EIA), the average amount of U.S. crude oil produced daily in 2022 was 11.9 million barrels; the EIA predicts this year, in 2023, the crude oil production will set a new record with an average of 12.4 million barrels per day, only marginally more than last year.

Moreover, the expansion of the oilfield chemicals market is accelerated by an increase in onshore and offshore oil and gas development projects in the North American area. For instance, Driftwood LNG (Calcasieu Parish LNG Liquefaction Plant USA), an onshore natural gas project, will start operating in 2023. Additionally, Pemex, the state-owned oil and gas corporation of Mexico, said in March 2021 that it had found 1.2 billion barrels of oil and natural gas in an onshore complex in the state of Tabasco, near where the business wants to construct a new refinery. Oil and gas output will rise as a result, which is expected to enhance demand for oilfield chemicals.

The Asia Pacific region is witnessing significant growth in the oilfield chemicals market, driven by the region's high energy consumption and the need for efficient oil and gas operations. The growing population, rapid urbanization, and industrial development in countries like China, India, and Southeast Asian nations contribute to the increasing demand for oilfield chemicals. The region is home to several prominent oil and gas-producing countries, including China, India, Indonesia, Malaysia, and Australia. These countries have been actively exploring and developing their hydrocarbon resources, both onshore and offshore, leading to a higher demand for oilfield chemicals to support drilling, completion, and production operations. For instance, China's National Energy Agency established a domestic crude oil production target of around 1.5 billion barrels for 2022 after the government stressed the importance of crude oil exploration and production in May 2022. This goal is an increase of 2% from the plan for 2021.

Oilfield Chemicals MarketValue Chain Analysis

- Raw Material Sourcing: Raw materials come from the broader chemical industry: petrochemical-derived surfactants and solvents, specialty monomers for polymers, inorganic salts for corrosion inhibitor systems, and agricultural/biobased feedstocks for emerging green chemistries.

- Technological Advancements: Technological progress spans both formulation science and digital enablement. On the chemistry side, advances include engineered polymers for high-temperature EOR, low-toxicity biocide alternatives, scale inhibitors with extended lifetime at reservoir conditions, and nano-enabled corrosion protection.

Oilfield Chemicals MarketCompanies

- Merck & Co., Inc.: An American multinational pharmaceutical company that does business as MSD outside the U.S. and Canada. It is one of the largest biomedical companies by revenue.

- Amgen, Inc.: A U.S.-based biotechnology company.

- F. Hoffmann-La Roche Ltd.: A Swiss multinational pharmaceutical and diagnostics company.

- Pfizer Inc.: An American multinational pharmaceutical and biotechnology corporation. It was the biggest pharmaceutical company by sales in 2024.

- Teva Pharmaceutical Industries Ltd.: A multinational pharmaceutical company headquartered in Israel.

- Sun Pharmaceutical Industries Ltd.: A multinational pharmaceutical company based in India. It is a major player in the Indian market, with a large market capitalization

Other Oilfield Chemicals Market Companies

- SMC Global

- BASF SE

- Solvay

- BERRYMAN CHEMICAL

- Thermax Limited

- Oilfield Chemicals

- SVS Chemical Corporation LLP

- SEATEX LLC

- Kemira

- Hawkins

- Chemiphase

- SicagenChem

- SAHARA Middle East Petroleum Services, Ltd.

Recent Developments

- In July 2025, SLB's $8 billion acquisition of ChampionX received approval from the UK's Competition and Markets Authority. This strategic move aims to enhances SLB's production systems unit and expand its capabilities in chemicals and automation technologies used in oil extraction.

(Source: https://mnacritique.mergersindia.com) - In August 2025, Cathedral Holdings opened a new 5,000 square foot technical lab and office space in The Woodlands, Texas. This facility chemical solutions for oil and gas operations, particularly in the Permian Basin and Midland area.

Segments Covered in the Report:

By Product

- Demulsifiers

- Inhibitors

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

By Application

- Drilling Fluid

- Production Chemicals

- Cementing

- Workover & Completion

By Location

- Onshore

- Offshore

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting