What is the Disaster Recovery as a Service Market Size?

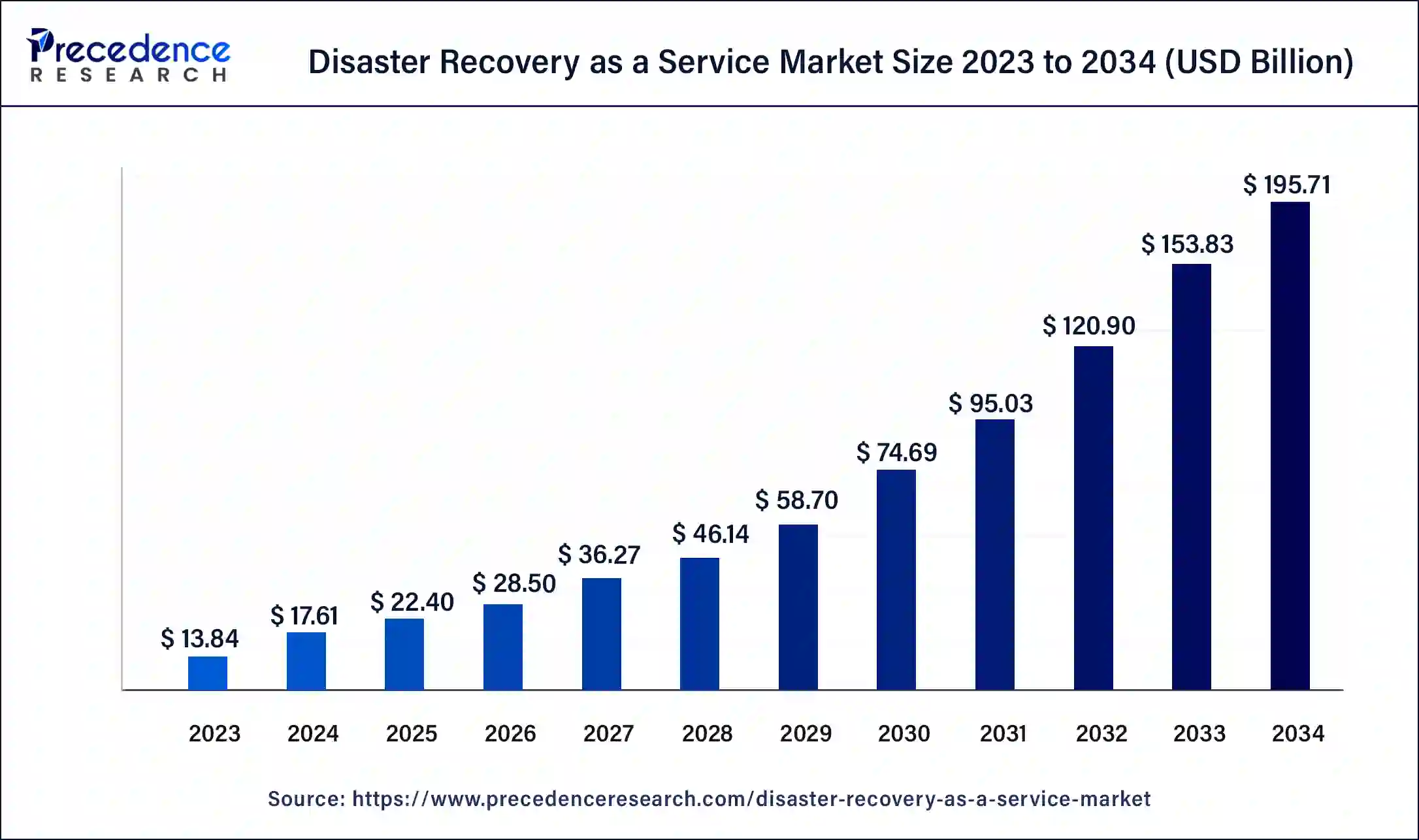

The global disaster recovery as a service market size is accounted at USD 22.40 billion in 2025 and predicted to increase from USD 28.50 billion in 2026 to approximately USD 195.71 billion by 2034, at a CAGR of 27.23% from 2025 to 2034. The benefits of disaster as a service include external IT experts, accessibility, platform agnosticism, data safety and security, frequent backup and quick recovery, etc. help the market's growth.

Disaster Recovery as a Service Market Key Takeaways

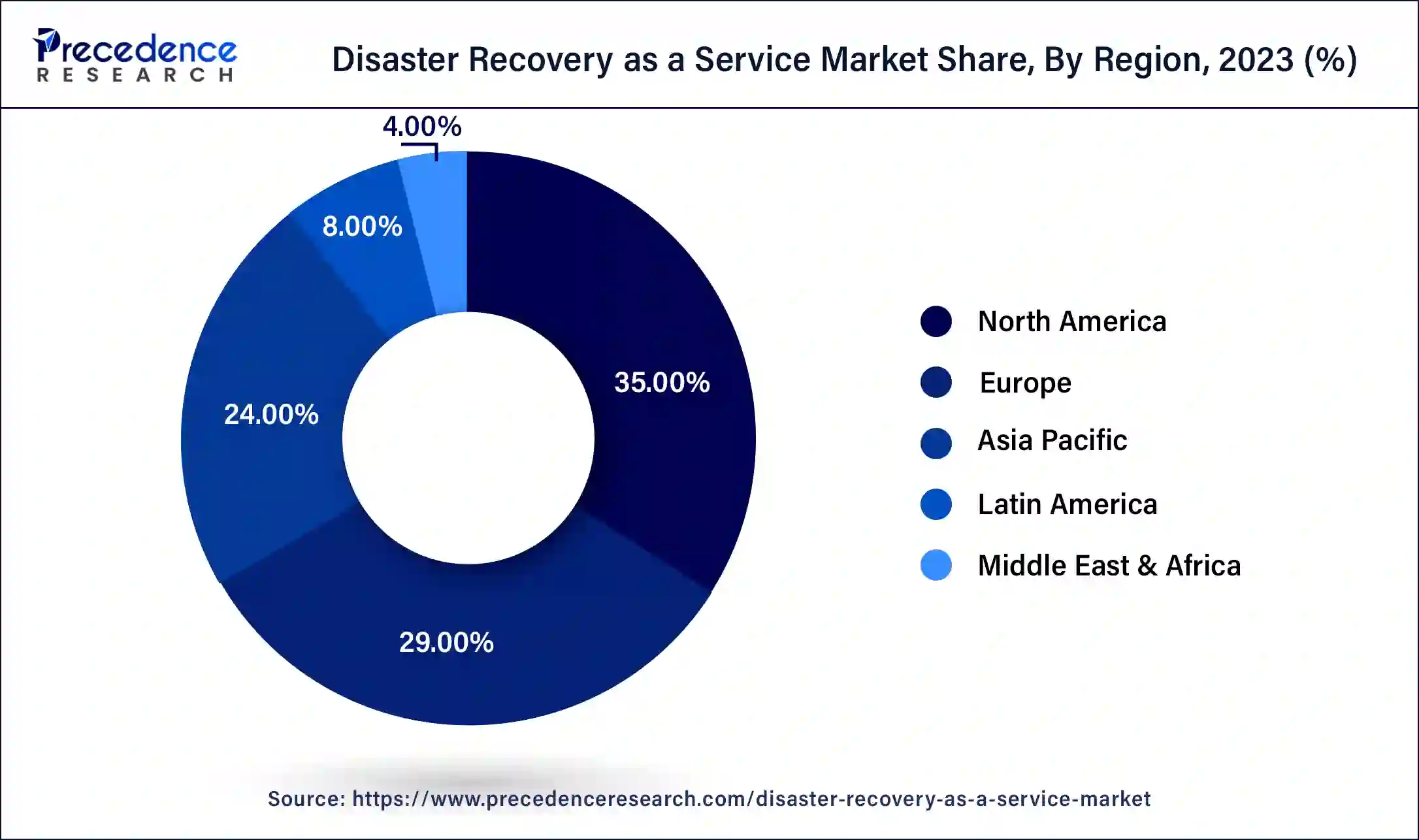

- North America dominated the disaster recovery as a service market with the largest market share of 35% in 2024.

- Asia Pacific is estimated to grow at a double digit CAGR of 30.02% during the forecast period of 2025-2034.

- By service type, the recovery & backup services segment has generated more than 46% of the market share in 2024.

- By service type, the real-time replication services segment is projected to grow at a notable CAGR of 29.05% during the forecast period.

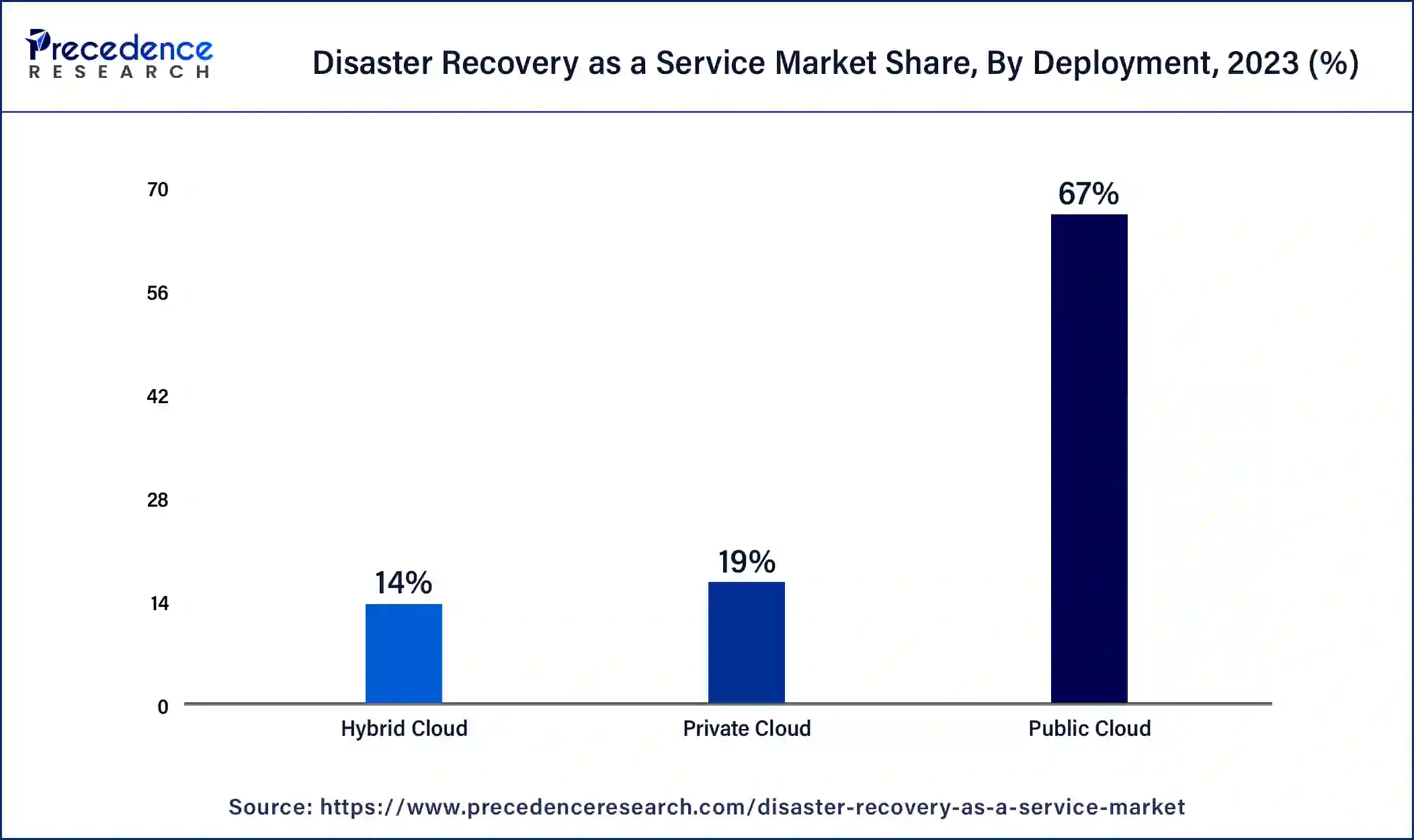

- By deployment, the public cloud segment accounted for the highest market share of 67% in 2024.

- By deployment, the hybrid cloud segment is growing at a solid CAGR of 32.03% during the forecast period.

- By end-use, the BFSI segment recorded the biggest market share of 24% in 2024.

- By end-use, the IT & telecommunication segment is poised to grow at a CAGR of 29.02% during the forecast period.

How is AI revolutionizing Disaster Recovery as a Service?

The use of AI in disaster recovery as a service benefit includes AI being more powerful, scale, speed, and near-time information processing. Advanced artificial intelligence (AI) tools that may help organizations handle an array of censorious tasks. These tasks include quarantining, identifying, and reducing potentially compromised data after security breaches and building an emergency notification system. AI is helpful in monitoring ongoing threats and potential status.

- For instance, in May 2024, IBM launched a power server for AI workloads, a core cloud edge named ‘IBM Power1012'. The IBM Power1012 was designed to provide customers the flexibility to run AI-based workloads in remote office and back office (ROBO) locations outside the mainstream data center facilities and in connection to cloud services like IBM Power Virtual Server for data recovery and backup.

What are the Robust Advantages of Disaster Recovery as a Service?

The disaster recovery as a service market (DRaaS) provides for the recovery of enterprise applications at another location in the event of a disaster. Disaster recovery as a service (DRaaS) is a third-party solution that delivers data recovery and data protection capabilities to enterprises on-demand over the Internet and on a pay-as-you-go basis. The benefits of disaster recovery as a service include faster implementation, expert guidance, and assistance in every step, better access to your system from anywhere, saving costs, freeing up valuable internal resources, instant recovery, no additional hardware required, no additional hardware required, accessibility, etc. contribute to the growth of the market.

Disaster Recovery as a Service Market Growth Factors

- The benefits of disaster recovery as a service include faster implementation, expert guidance, and assistance in each step, which frees up valuable internal resources, near-zero data loss, streamlined administration, and improved reliability.

- It also includes instant recovery, with no additional hardware required, accessibility, platform agnosticism, data safety, and security, which contribute to the growth of the disaster recovery as a service market.

- The benefits of DRaaS also include frequent recovery and quick backup, the minimum effort required on behalf of IT teams, an unparalleled level of reliability and security, a strong offense against cyber-attacks, fast failover, etc.

- Increasing Risks of Data Loss: Cyberattacks are on the rise, and natural disasters are constantly increasing demand for dependable disaster recovery solutions that are able to preserve critical company data and enable ongoing business operations.

- Adoption of Cloud Technology: As companies continue to switch to cloud-based technology infrastructures, Disaster Recovery as a Service (DRaaS) is going to be increasingly simple to implement and less expensive to deploy, as it's the most scalable.

- Need for Regulatory Compliance: Stricter data protection regulations can create challenges for companies, but it has also driven companies to adopt DRaaS in order to be compliant with regulations.

- Remote Workforce: DRaaS will be increasingly needed by companies that want to provide their workforce with the best security and consistent access to recovery solutions when maintaining remote working environments.

Cost Efficiency: Unlike other methods of recovery, which require expensive backup infrastructure and an off-site recovery location, DRaaS is low-cost.

Disaster Recovery as a Service Market Outlook:

- Global Expansion: Prominent drivers are the increasing threat of cyberattacks, the requirement for expanded business continuity, and the rising adoption of cloud-first plans are assisting the market development.

- Major Investors: Huge companies, like Microsoft, IBM, Amazon Web Services (AWS), and VMware, are escalating investment to offer robust cloud-based solutions.

- Startup Ecosystem: Bright Harbor, a startup founded in 2024, that offers a platform with tools for preparedness, real-time coordination, and simplified recovery processes.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 195.71 Billion |

| Market Size in 2025 | USD 22.40 Billion |

| Market Size in 2026 | USD 28.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.23% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Deployment, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising data security demand

There is an increased demand for data security as a service during disaster recovery. Best practices to protect sensitive data at the time of natural disasters include employee education and training, recovery and backup strategies for sensitive data, physical security measures implementation to prevent sensitive data, and the importance of disaster recovery planning and risk assessment planning contribute to the growth of the disaster recovery as a service market.

Restraint

Privacy and security concerns and other downsides

The privacy and security concerns in the existing infrastructure integration of DRaaS may be complex. DRaaS downsides also include businesses may trust service providers to implement their plan in the event of a disaster and meet the RPO (recovery point objective) and RTO (recovery time objective). AI makes it totally data-dependent. These factors can hamper disaster recovery as a service market growth.

Opportunity

Rising demand to reduce downtime

The rising demand for reducing downtime contributes to the growth of disaster recovery as a service market. The increased adoption of hybrid cloud disaster recovery as a service and the high use of disaster recovery as a service by mobile service providers are opportunities that contribute to the growth of the market. The use of cloud-based/native solutions, subscription-based models, real-time backup solutions, regulatory compliance, multi-cloud strategies, artificial intelligence (AI) and machine learning (ML), automation, and orchestration contribute to the growth of the market.

- In May 2024, the Oracle Cloud Infrastructure (OCI) was launched by the country's government-owned data storage and disaster recovery services provider, BDCCL (Bangladesh Data Center Company Limited).

Service Type Insights

The recovery & backup services segment dominated the disaster recovery as a service market in 2024. The benefits of recovery & backup services include IT resources being managed in a better way, service providers allowing employees to work efficiently and fast, security of your data, saving time and money, which helps to increase income with time, data versioning being done accurately, added security, technology may fail, protects the business reputation, raised reliability, quick access to data, etc. contribute to the growth of the market.

- In February 2024, COLUMBUS, Ohio, the #1 leader by market share in Data Protection and Ransomware, Veeam Software launched the Veeam Data Cloud, which provides disaster recovery as a service (DRaaS) or backup as a service (BaaS) for Microsoft Asure and Microsoft 365, allowing radical resilience and imposing powerful security technology and data protection in seamless and simple user experience.

Alliance Partners of Veeam Software Include

- VMware

- SUSE Rancher

- Red Hat

- Pure Storage

- Microsoft

- Lenovo

- Infinidat

- IBM

- HPE

- Dell EMC

- Cisco

- AWS

The real-time replication services segment is expected to be the fastest-growing during the forecast period. The benefits of real-time replication services include disaster recovery, such as cyber-attacks, floods, or fires, replicating data into analysis and reporting, security, and regulatory compliance, which helps the growth of disaster recovery as a service market. Organizations in utility, automotive, aerospace, healthcare, finance, and other highly regulated industries are required to perform regular data archival and backups. Performance and load balancing, data availability, and the single source of truth.

- In August 2024, the Customer Service App was launched by Thomas Cook and SOTC for streamlined travel management. The app provides real-time information on weather conditions, visa status, and other complex travel updates.

Deployment Insights

The public cloud segment dominated the disaster recovery as a service market in 2024. The basic benefits of the public cloud include freeing up IT talent, saving money, saving time, improved security with controlled access, regular penetration testing, security innovation, and more modern technology, as well as cyber security expertise. The benefits of the public cloud include it allows agility and DeOps success, location independence, no long-term contracts, cost-effectiveness, less expensive, faster, and easier setup as compared to on-site IT infrastructure, vast network of servers or high reliability, on-demand resources or near-unlimited scalability, no maintenance or service provider handles maintenance, lower costs or you pay only for the service you use, etc. contribute to the market's growth.

- In May 2024, an Arabic LLM (large language model) and Egypt's first public cloud service in Cairo as China ties grow was launched by Huawei Technologies.

The hybrid cloud segment is estimated to be the fastest-growing during the forecast period. The benefits of a hybrid cloud include improved risk management and security, business continuity, increased innovation and agility, improved control and scalability, reduced costs, better support for a remote workforce, multi-cloud options, access to new technologies, including AI, responsiveness to business needs, cost optimization, improved security and risk management, business continuity, regulatory compliance, data residency, increased computing workloads and control over data, etc. contribute to the growth of the disaster recovery as a service market.

- In September 2022, Perpetuuiti, in collaboration with SoftwareONE, launched a ‘Perpetuuiti Hybrid Disaster Recovery as a Service' (Hybrid DRaaS) in India for Microsoft Azure customers. The service helps customers achieve application and system recovery SLAs and meet the standards of the industry for security.

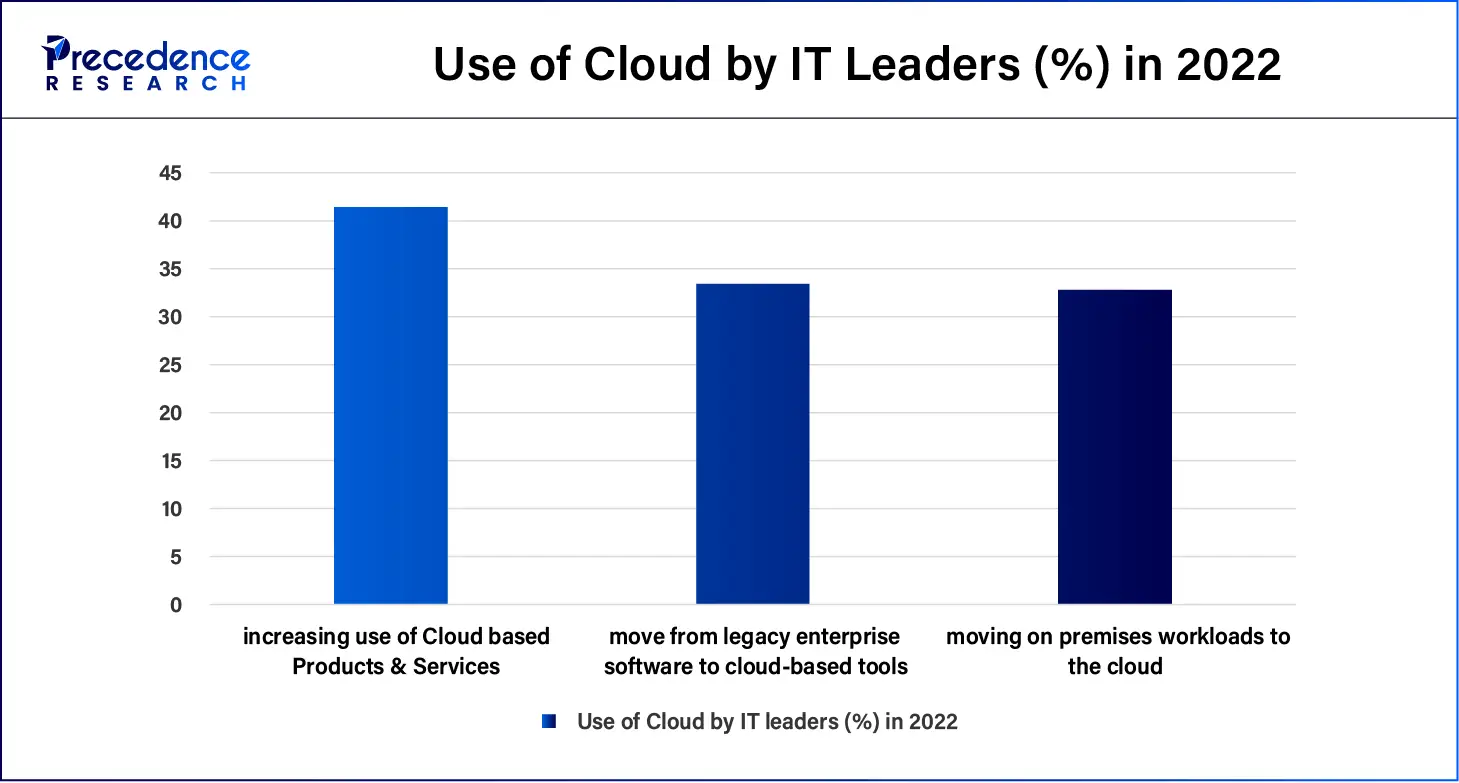

Because of the microeconomic climate, cloud readers are increasing their use of cloud-based products and services (41.4%), planning to move from legacy enterprise software to cloud-based tools (33.4%), and moving on-premises workloads to the cloud (32.8%).

End Use Insights

The BFSI segment dominated the disaster recovery as a service market in 2024. The benefits of the banking, financial services, and insurance (BFSI) sector include career opportunities like rapid career growth, high compensation packages, and a high range of work options, economic growth including managing risk, facilitating trade & investment, mobilizing savings, and diversification include spreading investments across many institutes and financial instruments lowers overall risks contribute to the growth of the market's growth.

- In May 2024, India's first LLM (large language model) application, ‘sesame,' was specially designed for the BFSI sector by Pine Labs-owned fintech company Setu.

The information technology & telecommunication segment is anticipated to be the fastest-growing during the forecast period. The benefits of IT & telecommunication are many and far-reaching, touching nearly every characteristic of our daily lives. With the help of telecommunication, it helps to improve global communication and connectivity. It helps a lot of people to make remote work accessible, which helps the growth of disaster recovery as a service market. Sectors like entertainment, education, and healthcare have completely changed with the influence of the Internet. A big change may be seen in e-commerce.

- In July 2024, the Nebula Telecom Large Model products, a new paradigm for highly autonomous networks, was launched by a leading global provider of integrated information and telecommunication technology solutions, ZTE Corporation.

Regional Insights

U.S. Disaster Recovery as a Service Market Size and Growth 2025 to 2034

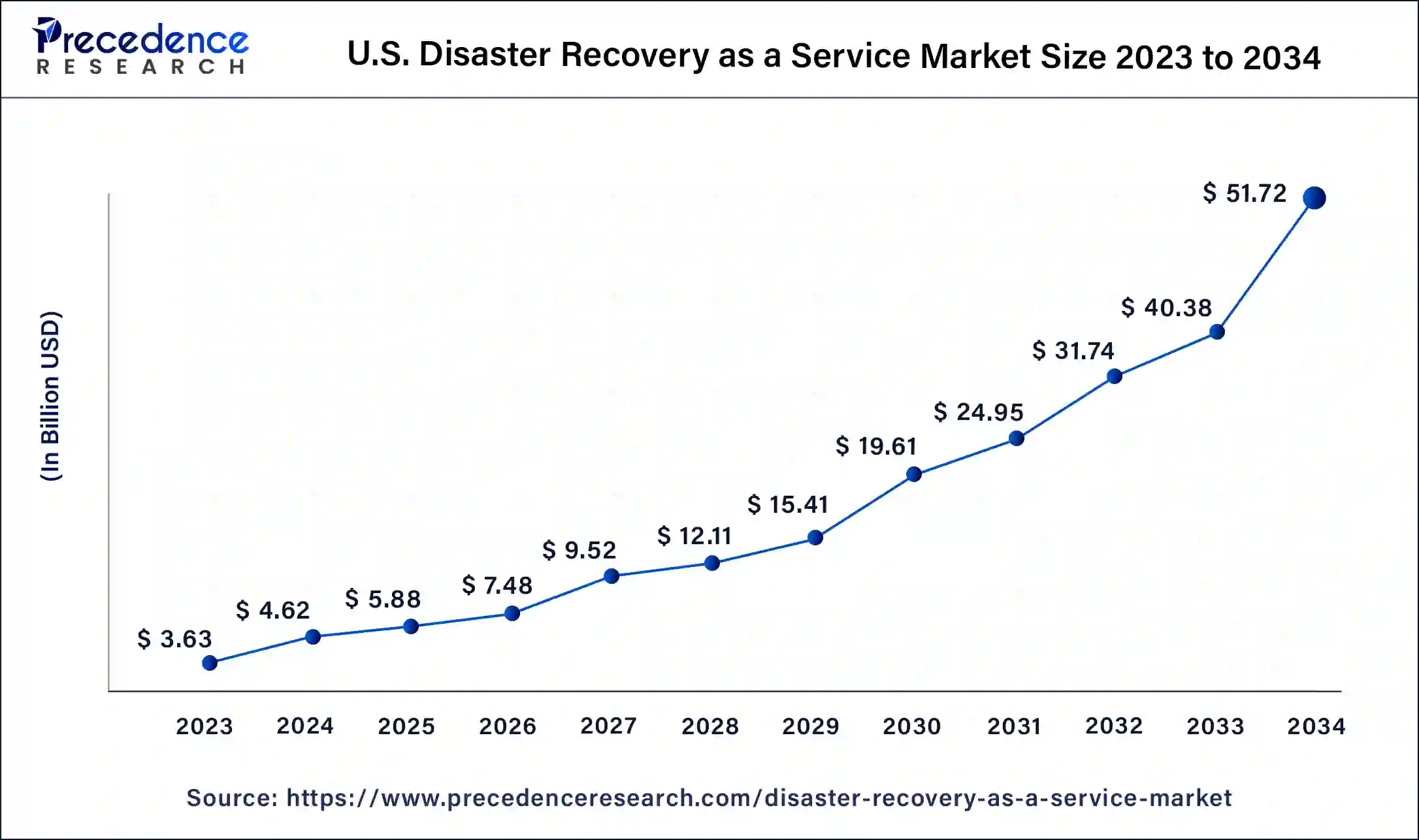

The U.S. disaster recovery as a service market size is exhibited at USD 5.88 billion in 2025and is projected to be worth around USD 51.72 billion by 2034, poised to grow at a CAGR of 27.32% from 2025 to 2034.

What Made North America Dominant in the Market in 2024?

North America dominated the disaster recovery as a service market in 2024. The increased advanced technologies and substantial investments in the disaster recovery industry, as well as the increasing imperative to safeguard critical data for many organizations in sectors like healthcare, government, BFSI, and others, led to increased demand for new products and the adoption of DRaaS, which helped the market grow.

- In January 2024, a series of disaster recovery financial services to help businesses and people by Jan. 9 storms in parts of South Carolina, Alabama, and Georgia, and in Northwest Florida was launched by Regions Bank's Pier Park branch in Panama City Beach, Fla.

Changing Data Privacy Regulations are Encouraging the Asia Pacific

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. A remarkable trend in the Asia Pacific region is increasing the focus on data compliance and sovereignty, which helps disaster recovery as a service market growth. With the transformation of data privacy regulations in different countries like India, organizations are tending towards DRaaS solutions that ensure the data stays within their country's borders and complies with local laws.

- In November 2022, a new data recovery service center was launched by a one-of-a-kind data recovery service, Access Data Recovery, at Trivandrum. With this evolution, the firm will gain a strong foothold and expand its customer reach.

Rise in Cloud-native Aim & AI Integration: U.S. Market Trend

The U.S. players are shifting towards cloud-native recovery offerings, and providers are focusing on multi-cloud reach to carry a variety of infrastructure requirements. Moreover, the U.S. market is developing integrated AI and machine learning for boosting capabilities, and numerous providers are raising automation and orchestration for quicker recovery.

Emerging Government Initiatives: Japan Market Trend

Nowadays, the Japanese government is promoting disaster management and resilient infrastructure through diverse initiatives, such as the World Bank conducted a thematic event in Tokyo in August 2025 to mark 10 years of collaboration on disaster risk management. As well as the Spectee Pro supports in analysing social media and big data to offer vital information to emergency responders, a significant component for any DRaaS strategy.

Exploration of Newer Offerings & Strategy is Impacting Europe

In this era, Europe is experiencing a lucrative expansion, due to the growing novel offerings, whereas XenTegra and US Signal presented particular solutions and compliance guides in early 2025, aiming at advanced failover orchestration, non-disruptive testing, and meeting industry-specific mandates, such as HIPAA and GDPR. Also, the EUCCS project has been considered in the new EU Security Strategy in reinforcing the Union's collective resilience against hybrid, natural, and intentional threats, underscoring a policy focus on disaster preparedness.

Escalating Cybersecurity Focus: France Market Trend

Day by day, French firms are facing advanced ransomware attacks, which greatly enable AI for strong DRaaS solutions. Specifically, these AI-enabled solutions are involved in accelerating security features, including ransomware detection and two-factor authentication.

Key Players Offerings:

- VMware, Inc.- A company introduced VMware Cloud Disaster Recovery & VMware Site Recovery.

- TierPoint, LLC- This usually provides tailored cloud-to-cloud recovery options with failover to private or multitenant clouds, automated failover, and both fully managed and self-service choices.

- Sungard Availability Services LP- A vital leader mainly facilitates a suite of DRaaS solutions, like the Cloud Recovery platform.

- Recovery Point Systems, LLC- A company that specialises in faster recovery of IBM Power and Z Mainframe, data loss avoidance through real-time replication and immutable storage, automated testing, and business continuity for both traditional and modern infrastructures.

- Microsoft Corporation- It unveiled Azure Site Recovery, which orchestrates replication, failover, and recovery for on-premises and Azure-based workloads.

Disaster Recovery as a Service Market Companies

- VMware, Inc.

- TierPoint, LLC

- Sungard Availability Services LP

- Recovery Point Systems, LLC

- Microsoft Corporation

- Infrascale, Inc.

- InterVision Systems, LLC

- IBM Corporation (U.S.)

- Amazon Web Services, Inc. (AWS)

- Acronis International GmbH

- NTT Communications Corporation

- Dell Technologies Inc.

- Cohesity, Inc. (U.S.)

- RackWare LLC (U.S.)

- Rubrik, Inc. (U.S.)

- Kaseya (U.S.)

- Cloudian

Recent Developments

- In February 2025, Pegasystems Inc., the Enterprise Transformation Company™, announced the launch of its new multi-region Pega Enhanced Disaster Recovery (EDR) service for Pega Cloud™. Enhanced Disaster Recovery service improves resilience and reliability across geographically dispersed regions during catastrophic events. Pega Enhanced Disaster Recovery is available as an additional purchase option for Pega Cloud clients in AWS Pega Cloud deployment regions. (Source: businesswire.com )

- In April 2025, Elastio, a leader in ransomware recovery assurance, announced a strategic partnership with JetSweep, a premier cloud-based Disaster Recovery as a Service (DRaaS) provider. This collaboration enhances business continuity solutions, ensuring organizations can quickly recover from cyber threats with minimal downtime. Najaf Husain, Co-founder and CEO of Elastio, stated, "JetSweep and Elastio's joint solutions ensure that AWS customers can recover quickly from a disaster, trusting that their data is clean and secure." (Source: businesswire.com )

- In June 2024, Converge ICT partnered with HPE Zerto to launch Disaster Recovery Service. The strategic partnership aims to bolster the Philippines' efforts towards data security, protecting businesses from disruptions borne from natural disasters and human error, and providing a robust shield against potential cyberattacks. With the launch of DRaaS, Converge ICT and HPE Zerto aim to bring world-class business continuity solutions to the Philippines, removing much of the complexity that is needed for them to secure their data. (Source: bworldonline.com )

- In December 2023, a new disaster recovery as a service solution for Azure named '11:11DRaaS for Azure' was launched by a managed infrastructure solutions provider, 11:11 Systems. It helps to eliminate complexity, enabling customers to free up time and ways to generate transformative business outcomes.

- In June 2024, disaster recovery as a service (DRaaS) was launched by Converge ICT in collaboration with a subsidiary of Hewlett Packard Enterprise (HPE), Zerto, to democratize continuity solutions in the Philippines. The strategic collaboration goals are to bolster the Philippines' struggle towards data security, provide a strong shield against potential cyberattacks, and prevent businesses from disruptions borne from human error and natural disasters.

Segments Covered in the Report

By Service Type

- Recovery & Backup Services

- Data Service Protection

- Real-time Replication Services

- Professional Services

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End-use

- BFSI

- IT & Telecommunication

- Retail & Consumer Goods

- Healthcare

- Government

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting