Data Protection and Recovery Solutions Market Size and Forecast 2025 to 2034

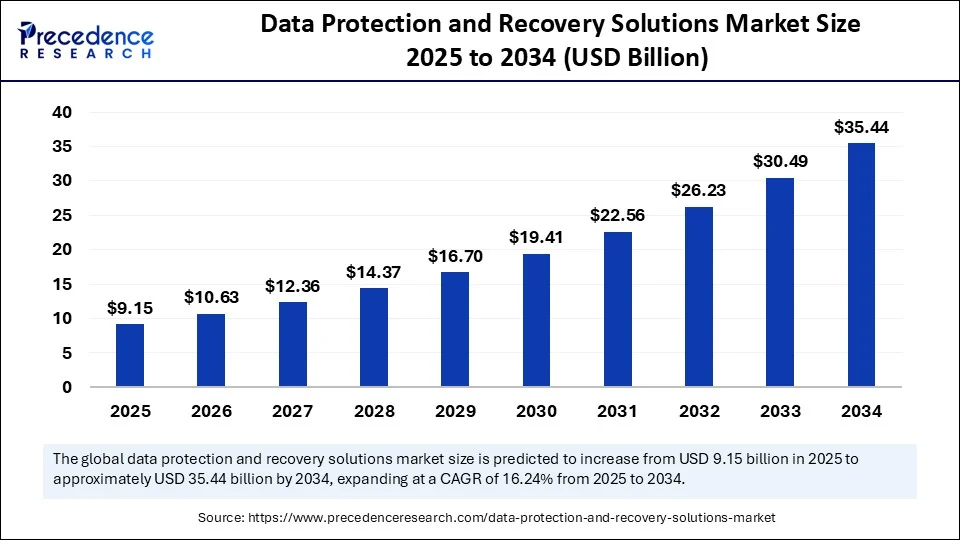

The global data protection and recovery solutions market size was estimated at USD 7.87 billion in 2024 and is predicted to increase from USD 9.15 billion in 2025 to approximately USD 35.44 billion by 2034, expanding at a CAGR of 16.24% from 2025 to 2034. The increasing digitization and rising incidence of cyber threats are driving the growth of this market.

Data Protection and Recovery Solutions Market Key Takeaways

- In terms of revenue, the global data protection and recovery solutions market was valued at USD 7.87 billion in 2024.

- It is projected to reach USD 35.44 billion by 2034.

- The market is expected to grow at a CAGR of 16.24% from 2025 to 2034.

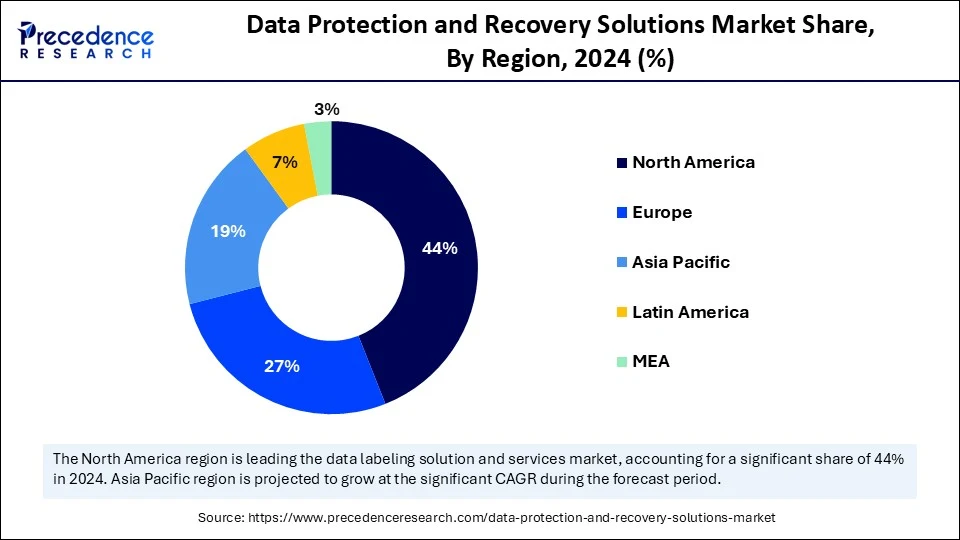

- North America dominated the data protection and recovery solutions market with a 44% share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By solution type, the backup and recovery software segment captured the biggest market share of 38% in 2024.

- By solution type, the cloud data protection segment is expected to expand at the fastest CAGR during the forecast period.

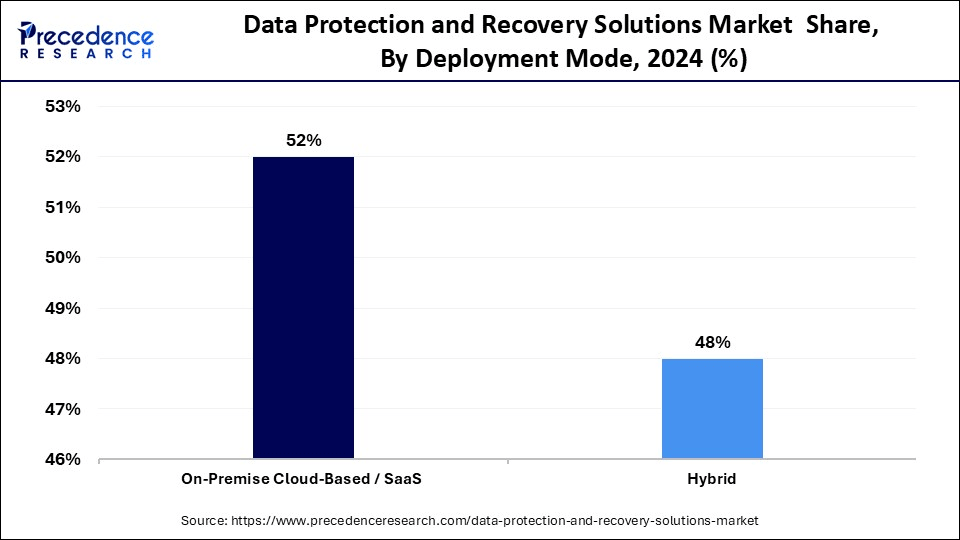

- By deployment mode, the on-premises segment contributed the biggest market share of 52% in 2024.

- By deployment mode, the cloud-based/Saas segment is expected to grow at the fastest CAGR in the upcoming period.

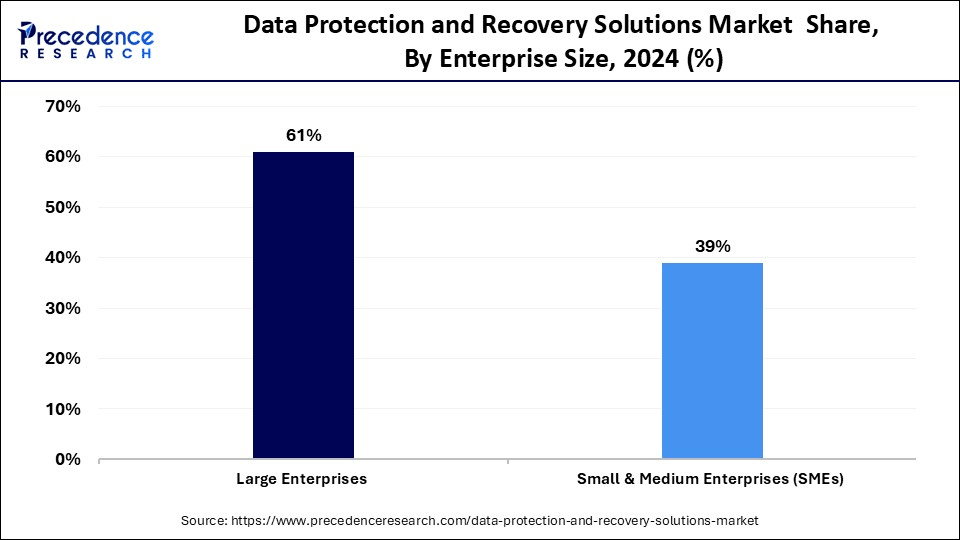

- By enterprise size, the large enterprises segment held the highest market share of 61% in 2024.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to expand at the fastest CAGR during the forecast period.

- By industry vertical, the BFSI segment held a 24% share of the market in 2024.

- By industry vertical, the IT and telecom segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By functionality, the data backup and restore segment generated the major market share of 33% in 2024.

- By functionality, the ransomware/malware resilience segment is expected to expand at the fastest CAGR during the forecast period.

AI Impact on the Data Protection and Recovery Solutions Market

Artificial Intelligence (AI) is significantly impacting the data protection and recovery solutions market, transforming how organizations safeguard their data and ensure business continuity. AI-powered solutions offer advanced capabilities that enhance efficiency, accuracy, and overall effectiveness. AI algorithms can analyze vast amounts of data to identify anomalies, patterns, and potential threats in real-time. This enables proactive detection of malware, ransomware, and other cyber threats, allowing organizations to take immediate action to prevent data breaches.

AI-driven solutions provide robust system protection and recovery, identifying unusual activity and analyzing massive transaction and activity logs in any system around the clock, a task beyond human security experts, and automatically responding to cyber security incidents. AI algorithms automate recovery processes, privatizing critical system applications, ensuring instant restoration, and minimizing downtime in critical business applications. Critical data classification and handling are optimized using powerful tools, enabling faster data segmentation. AI integration reduces overall costs and boosts efficiency. The challenges of finding and deploying highly expert technicians are addressed by this system, which bridges the gap with efficient solutions and reduced costs.

U.S. Data Protection and Recovery Solutions Market Size and Growth 2025 to 2034

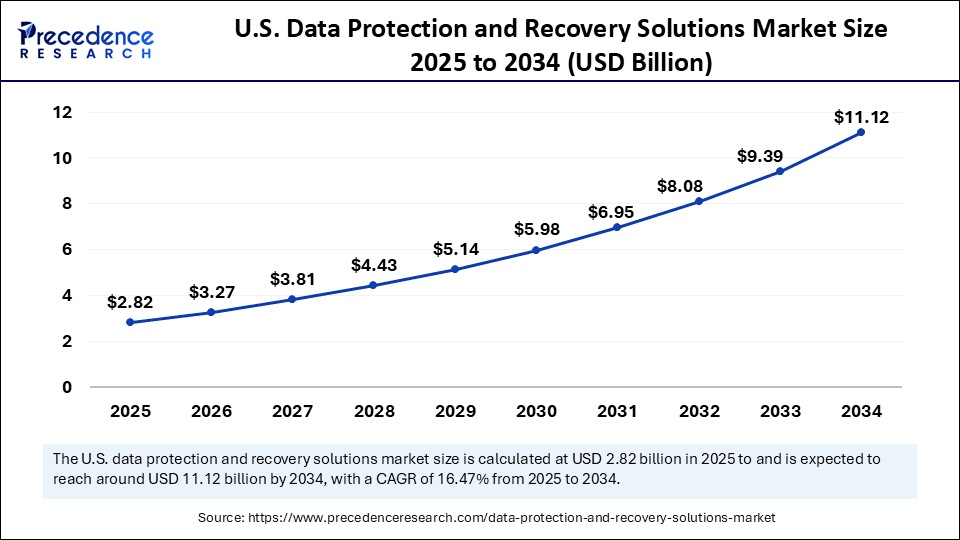

The U.S. Data Protection and Recovery Solutions market size was exhibited at USD 2.42 billion in 2024 and is projected to be worth around USD 11.12 billion by 2034, growing at a CAGR of 16.47% from 2025 to 2034.

What Made North America the Dominant Region in the Data Protection and Recovery Solutions Market in 2024?

North America dominated the market with the largest share in 2024. This is mainly due to the presence of robust IT infrastructure in the region and stringent regulations regarding data privacy and safety. The increased frequency of cyberattacks further created the need for data protection solutions. The presence of a large number of key market players in this region further bolstered the growth of the market. The widespread adoption of cloud technologies also supports market growth.

Many major tech companies in North America rely heavily on robust IT infrastructure, driving the demand for data safety in this region. Governments and the public have recognized the importance of data protection, leading to stringent regulations and ongoing efforts to raise awareness of basic safety standards within organizations.

European Data Protection and Recovery Solutions Market Trends?

Europe is expected to grow at a notable rate in the upcoming period. European governments have introduced numerous data privacy regulations, strongly emphasizing data protection and security. The widespread use of cloud services and data centers in the European business ecosystem has increased cyber threats, prompting significant investments in robust data protection solutions for rapid data recovery. Organizations are developing their infrastructure to counter these threats, with government organizations, healthcare, and technology companies being primary targets for data theft. Healthcare institutions, in particular, are increasingly adopting data protection and recovery solutions due to service disruptions.

Asia Pacific Data Protection and Recovery Solutions Market Trends

Asia Pacific is expected to experience the fastest growth during the forecast period due to an increase in cyberattacks. This region is witnessing a shift toward automated data protection and recovery tools, including those utilizing machine learning. Rising e-commerce and digital transactions generate vast amounts of sensitive data daily, while healthcare services increasingly use digital platforms, creating the potential for data breaches. Moreover, the explosion of data from various sources, including cloud computing, IoT devices, and mobile applications, necessitates robust data protection and recovery solutions. The increasing emphasis on data privacy creates opportunities for solutions that offer robust data privacy features.

Market Overview

The data protection and recovery solutions market encompasses software and hardware platforms designed to safeguard enterprise data from loss, corruption, theft, or disasters and ensure rapid recovery of data to maintain business continuity. These solutions include backup and restore, disaster recovery, archiving, replication, cloud data protection, and ransomware protection. They are used across sectors such as BFSI, healthcare, IT, retail, and manufacturing, helping organizations comply with data privacy regulations and maintain uptime. The market is witnessing rapid growth, driven by the rising demand for cloud-based data storage solutions. With more ransomware attacks, robust protection and recovery are essential, particularly in BFSI, healthcare, and manufacturing.

Data Protection and Recovery Solutions Market Growth Factors

- The increasing incidence of cyberattacks and data breaches drives the demand for efficient data protection and recovery solutions.

- Organizations are dealing with a massive amount of data, making data recovery and protection strategies essential, which significantly boosts the market growth.

- Cloud computing's scalability, flexibility, and cost-efficiency drive its adoption, increasing the need for data protection and recovery solutions.

- The shift to digital platforms by companies, organizations, and governments makes ensuring proper resilience and security against cyber threats essential, driving market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.44 Billion |

| Market Size in 2025 | USD 9.15 Billion |

| Market Size in 2024 | USD 7.87 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution Type, Deployment Mode, Enterprise Size, Industry Vertical, Functionality, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Cyber Threats and Increasing Data Volume

The rise in ransomware attacks, data breaches, and other cyber threats has made data protection a top priority for organizations. In recent times, cyberattacks have become more sophisticated, leading to increased frequency. Trends and data breaches highlight a growing need for data protection and recovery solutions. The rise of digitization has massively increased data volumes, making robust data protection and recovery essential for seamless business operations, given the reliance on data. The increased adoption of cloud solutions, due to their scalability, flexibility, and cost-effectiveness, makes organizations more susceptible to data breaches and cybersecurity threats compared to other solutions. This necessitates the deployment of robust data protection and recovery systems in the cloud environment to ensure security and compliance.

Restraint

High Deployment and Maintenance Cost

Significant deployment costs are a major barrier to the growth of the data protection and recovery solutions market. These costs stem from software, hardware, and licensing, which collectively increase the overall expenditure. Furthermore, continuous maintenance and the need for skilled IT professionals necessitate substantial financial investment, representing a considerable expense for the system's smooth operation. Complex systems often create maintenance and integrity challenges. Not every organization can afford highly experienced professionals to manage these intricate issues, potentially leading to system failures and increased security breaches. Moreover, integrating data protection solutions with existing IT infrastructure can pose challenges, restraining the growth of the market.

Opportunity

Cloud Adoption and Digitalization

The shift toward cloud-based services and hybrid IT environments creates significant opportunities in the market, as these environments require solutions that can protect data across different platforms. Moreover, digital transformation is generating significant opportunities in this market, driven by the growing use of digital services and the surge in data generation. Businesses increasingly rely on digital platforms for their daily operations. Governments have also embraced digital platforms to provide services to the public. However, this shift has also increased the potential for cyber threats and data breaches, necessitating careful management to safeguard crucial government information. This underscores the importance of robust data backup and recovery solutions.

Solution Type Insights

The backup & recovery software segment dominated the market in 2024. This is mainly due to the increased need for backup solutions for minimizing data loss and maintaining business operations in the cases of cyberattacks. These software solutions are used to recover lost data from an organization's hard drives and servers that have been affected by a cyber-attack, leading to system failure. Backup tools create various batches of backups at frequent intervals. These complete system backups are then reloaded onto the operational industrial server, allowing the system to resume normal operations.

The cloud data protection segment is expected to grow at the fastest rate during the forecast period. Cloud solutions are widely adopted for their flexibility and cost-effectiveness, but they are comparatively less secure and more vulnerable to cyber threats than on-premises solutions. This necessitates robust security measures in cloud data protection, which is why this segment is experiencing rapid growth.

Deployment Mode Insights

The on-premises segment held the largest share of the data protection and recovery solutions market in 2024. This is mainly due to the increased demand for highly secure solutions among businesses. The higher security standards of on-premises solutions make them highly secure compared to cloud solutions. On-premises solutions provide complete control over IT infrastructure, hardware, and software, allowing organizations to implement customized security standards and tools based on their specific needs, resulting in enhanced security and protection.

The cloud-based/SaaS segment is expected to grow at the fastest rate in the upcoming. The growth of the segment is attributed to the rapid shift toward cloud and hybrid environments. Enterprises are increasingly using cloud and SaaS applications, making them the prime targets for cybercriminals. Businesses are deploying these systems due to their cost-effectiveness and flexibility. However, the increased cybersecurity challenges are driving a strong need for data protection and recovery solutions. If a cybersecurity failure occurs and the entire system collapses, it can take a significant amount of time to resume business operations and prevent substantial financial losses. This highlights the critical role of data recovery solutions in this specific domain.

Enterprise Size Insights

The large enterprises segment dominated the market with a major share in 2024. The substantial data volume handled by large enterprises necessitates robust cybersecurity measures and data backup solutions. Large enterprises manage a complex array of data across various locations. A live industrial server may crash due to internal issues or a cybersecurity incident. Robust data protection and recovery solutions ensure system recovery from such incidents and facilitate seamless operations.

The small & medium enterprises (SMEs) segment is expected to grow at the fastest rate in the coming years. Small and medium enterprises (SMEs) are also heavily utilizing digital solutions, leading to the generation of massive amounts of data. This creates the demand for data protection and recovery solutions. The increasing cyber threats like ransomware are further fueling segmental growth.

Industry Vertical Insights

The BFSI segment held the biggest market share in 2024. This is mainly due to increased digitalization and the volume of digital transactions. Crucial data related to financial transactions and banking, financial, and insurance (BFSI) data necessitates robust security solutions, as these are highly vulnerable to cyberattacks. This is driving the demand for robust data protection and recovery solutions.

The IT & telecom segment is expected to grow at the fastest CAGR during the forecast period. The telecom sector's extensive use of cloud services and internet of things (IoT) solutions is generating a demand for substantial data protection and recovery solutions. The rapid expansion of IT infrastructure and growing concerns over network security are likely to drive segmental growth.

Functionality Insights

The data backup and restore segment held the largest share of the data protection and recovery solutions market in 2024. The data backup and restore segment is crucial for the recovery and seamless operation of IT infrastructure in many organizations, especially in the event of system failures or security incidents. Established organizations frequently face cyber threats, and the restoration of critical business data within a specific timeframe is essential to prevent significant financial losses.

The ransomware/malware resilience segment is expected to grow at the fastest rate during the forecast period. Ransomware and malware have become highly prevalent recently, creating a substantial need to stop and build a strong defense against these attacks, as they can lead to complete system shutdowns and require significant time and resources for recovery.

Data Protection and Recovery Solutions Market Companies

- Veeam Software

- Dell Technologies (Dell EMC)

- Veritas Technologies

- IBM Corporation

- Commvault Systems Inc.

- Acronis International GmbH

- Rubrik Inc.

- Cohesity Inc.

- Microsoft Corporation (Azure Backup)

- Amazon Web Services (AWS Backup)

- Google Cloud (Actifio)

- Unitrends (part of Kaseya)

- Barracuda Networks Inc.

- Zerto (a Hewlett-Packard Enterprise company)

- Datto, Inc.

- Arcserve LLC

- Druva Inc.

- Wasabi Technologies

- OpenText (Carbonite)

- Hitachi Vantara

Recent Developments

- In July 2025, HCLSoftware launched HCL Domino 14.5 on July 7 as a major upgrade, specifically targeting governments and organisations operating in regulated sectors that are concerned about data privacy and digital independence. This new tool gives organisations full control over their AI models and data, helping them comply with regulations such as the European AI Act.

(Source: https://analyticsindiamag.com) - In April 2025, rueNAS entered into a partnership with Storj to launch TrueCloud Backup. Together, TrueCloud Backup revolutionizes data protection, providing unmatched security, scalability, and performance for organizations navigating today's evolving data challenges.

(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Solution Type

- Backup & Recovery Software

- Disaster Recovery & Business Continuity

- Archiving Solutions

- Data Replication & Deduplication

- Cloud Data Protection

- Ransomware Protection

- Continuous Data Protection (CDP)

By Deployment Mode

- On-Premise Cloud-Based / SaaS

- Hybrid

- By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry Vertical

- BFSI

- Healthcare

- IT & Telecom

- Retail & E-commerce

- Manufacturing

- Government

- Education

- Others (Media, Legal, etc.)

By Functionality

- Data Backup & Restore

- Disaster Recovery (DRaaS, cold/warm/hot sites)

- Archiving & Compliance

- Ransomware/Malware Resilience

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting