What is the Domain Name System Tools Market Size?

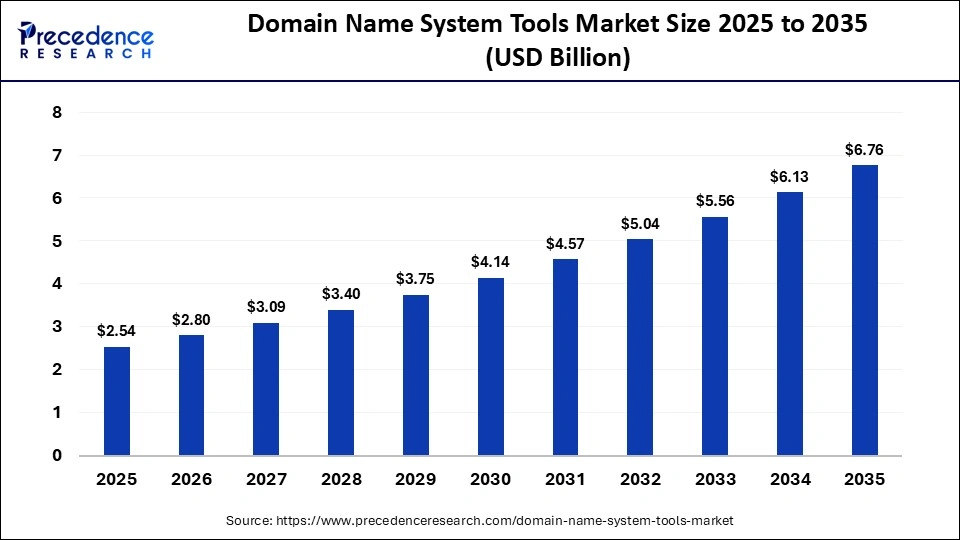

The global domain name system tools market size was calculated at USD 2.54 billion in 2025 and is predicted to increase from USD 2.80 billion in 2026 to approximately USD 6.76 billion by 2035, expanding at a CAGR of 10.30% from 2026 to 2035.The market is witnessing substantial growth due to the accelerating demand for robust, AI-powered security solutions and enhanced infrastructure performance to combat escalating cyberthreats.

Market Highlights

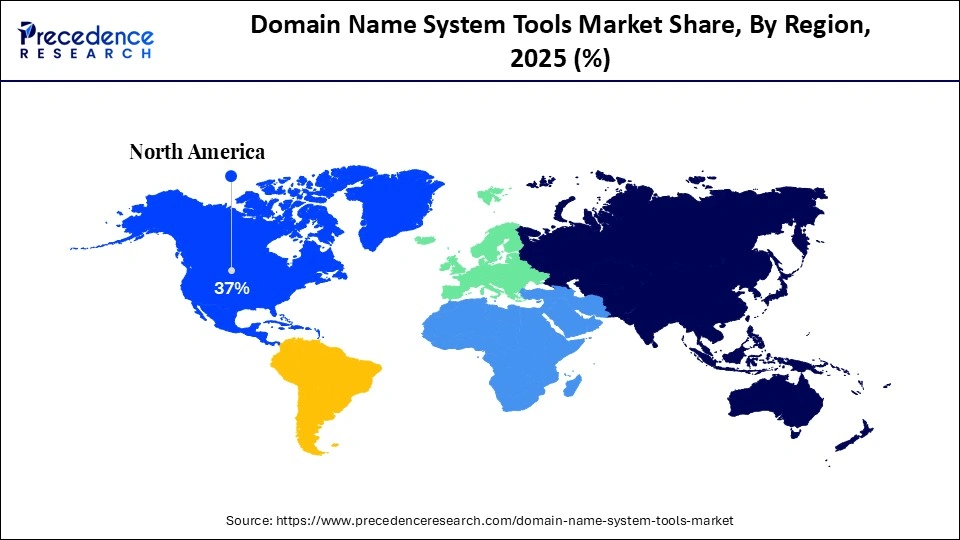

- North America dominated the market with a major market share of 37% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

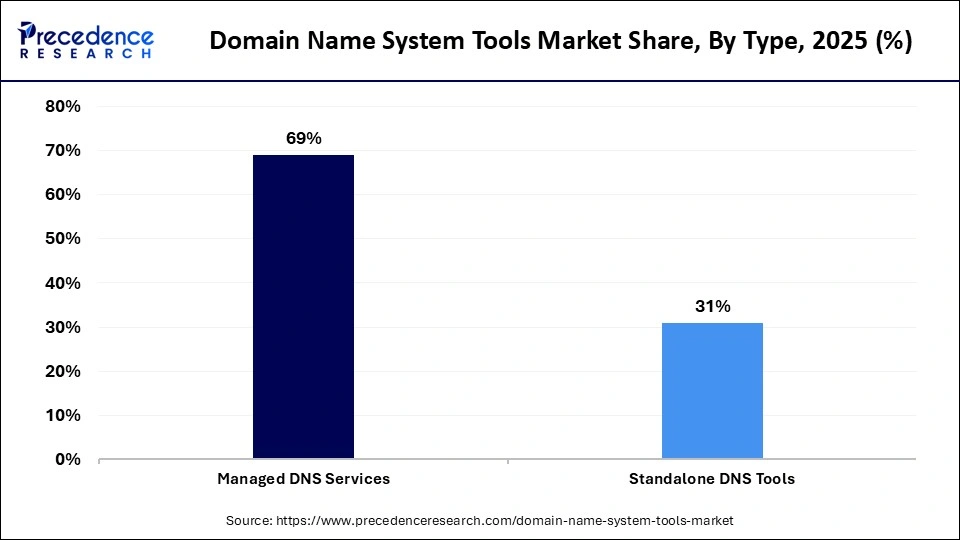

- By type, the managed DNS services segment generated the biggest market share of 69% in 2025.

- By type, the standalone DNS tools segment is expected to expand at the fastest CAGR between 2026 and 2035.

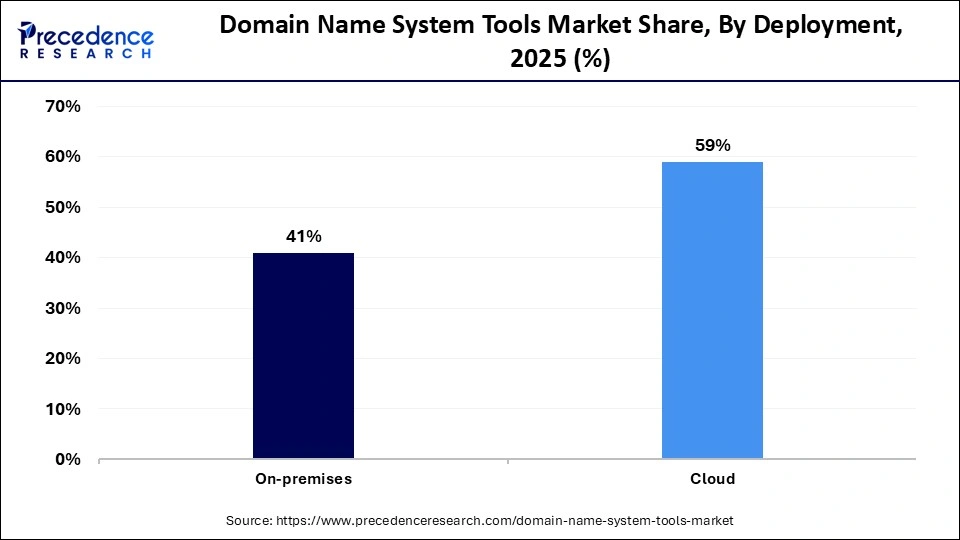

- By deployment, the cloud deployment segment contributed the highest market share of 59%in 2025.

- By deployment, the on-premises segment is expected to grow at a strong CAGR between 2026 and 2035.

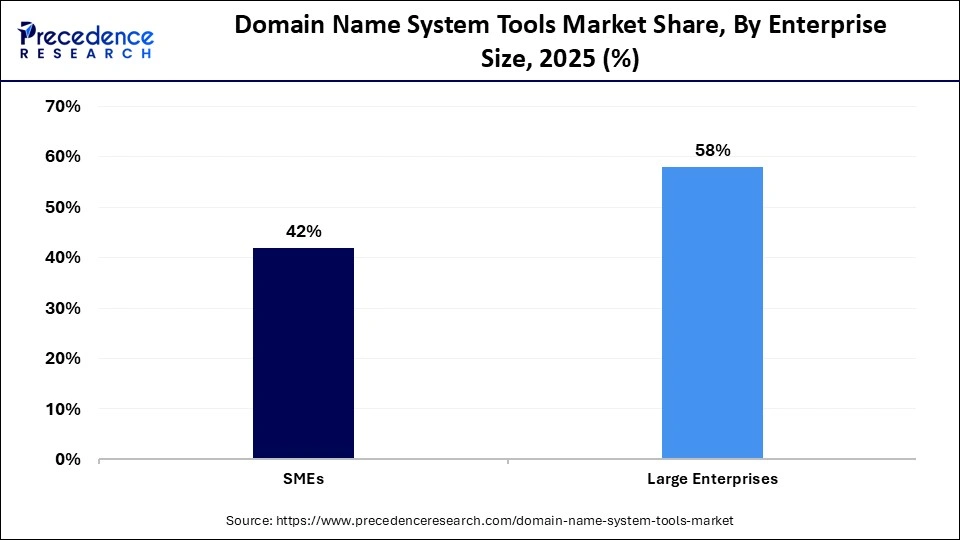

- By enterprise size, the large enterprises segment held a major market share of 59% in 2025.

- By enterprise size, the SMEs segment is expected to expand at a significant CAGR from 2026 to 2035.

- By end use, the IT & telecom segment accounted for the largest market share in 2025.

- By end use, the government segment is expected to grow at a solid CAGR between 2026 and 2035.

What are Domain Name System Tools?

Domain name system tools encompass solutions that allow users to query, manage, and monitor domain name system (DNS) records, including DNS lookup, propagation checkers, and DNSSEC management, to ensure reliable internet connectivity and a secure web presence. These solutions include both on-premise and managed services, as well as cloud-based options. The market is driven by increasing DDoS attacks and DNS vulnerabilities, which are driving adoption of secure, managed DNS services. The increased use of hybrid and multi-cloud environments requires sophisticated traffic routing. E-commerce growth necessitates robust, high-performance web traffic management.

How is AI Transforming the Domain Name System Tools Market?

Artificial intelligence (AI) is significantly transforming the domain name system tools market by improving domain search, valuation, and security. AI algorithms analyze user behavior, search trends, and semantics to suggest relevant and high-value domain names, moving beyond simple keyword matching. AI tools analyze market data to forecast domain value, aiding investors in identifying, purchasing, and managing domain portfolios to maximize ROI. AI detects malicious, typo-squatted domains to prevent phishing attacks and monitors traffic patterns for anomalies indicating DNS hijacking or DDoS attacks.

Major Trends in the Domain Name System Tools Market

- Immersive AI-Driven Security and Automation: Modern DNS tools are incorporating AI and machine learning to proactively detect and mitigate threats like DDoS attacks and DNS hijacking in real time, reducing false positives.

- Shift Toward Managed DNS Services: Organizations are increasingly adopting on-premises infrastructure for managed DNS services to achieve higher uptime, lower latency, and better scalability, particularly for e-commerce and web-heavy businesses.

- Adoption of Cloud and Hybrid Architectures: The surge in cloud-native applications, 5G, and IoT has increased demand for cloud-based and distributed DNS systems, ensuring seamless connectivity and performance.

- Intense Focus on Security Protocols: Due to rising cyber threats, there is a strong trend toward adopting DNS Security Extensions to ensure data integrity and prevent traffic redirection.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.54Billion |

| Market Size in 2026 | USD 2.80 Billion |

| Market Size by 2035 | USD 6.76Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Enterprise Size, End Use, and Region |

| End UseRegions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

What Made Managed DNS Services the Dominant Segment in the Market?

The managed DNS services segment dominated the domain name system tools market while holding the largest share in 2025. This dominance is primarily due to its superior performance, high availability, and robust security features, including DDoS protection and fast query resolution. Enterprises are increasingly shifting to managing DNS services to mitigate risks associated with DNS hijacking and DDoS attacks, which are essential for maintaining an online presence. Additionally, managed DNS service providers leverage Anycast networks and global infrastructure to ensure low latency and fast website loading times, which are critical for retail, e-commerce, and IT services, thereby driving demand for managed service providers.

The standalone DNS tools segment is expected to experience the fastest growth during the forecast period. This growth is mainly driven by the rising demand for specialized security, granular control over infrastructure, and increasing cybersecurity threats. Organizations in regulated industries prefer standalone, on-premises tools to maintain strict control over their data, ensuring it remains within their internal network for security and compliance. These tools offer greater flexibility, allowing organizations to configure and customize their DNS environments to meet specific operational requirements.

Deployment Insights

How Did the Cloud Deployment Segment Lead the Domain Name System Tools Market?

The cloud deployment segment led the global market in 2025, mainly due to its ideal scalability, flexibility, and cost-efficiency compared to resource-heavy on-premises systems. This segment's leadership is also driven by the rapid shift to cloud-native, distributed IT architectures that require high availability, low latency, and automated security to support global operations. Cloud DNS tools enable businesses to scale resources up or down based on real-time demand, which is essential for dynamic web-based and multi-cloud environments and provides better performance for international users through faster resolution times.

The on-premises segment is expected to grow at the fastest rate during the forecast period. This is primarily due to the heightened demands for data security, strict regulatory compliance in industries such as BFSI and healthcare, and the need for total control over network infrastructure. On-premise solutions ensure sensitive data remains within internal networks, thus reducing the risk of breaches while supporting legacy system integration. This deployment allows for lower latency and faster, real-time processing compared to some cloud alternatives to integrate new tools with existing systems.

Enterprise Size Insights

Why Did the Large Enterprises Segment Dominate the Domain Name System Tools Market?

The large enterprises segment dominated the market in 2025, driven by the high demand for security, scalability, and performance needed to manage complex and expansive infrastructures. Their dominance is further supported by the strong demand for advanced features like automated failover, traffic management, and compliance across large, hybrid, and multi-cloud environments. The shift of large enterprises toward IoT, serverless architectures, and containerization necessitates advanced DNS automation. To ensure business continuity and prevent revenue loss during downtime, large enterprises rely on sophisticated tools that offer geo-routing and robust traffic management.

The SMEs segment is expected to experience the fastest growth during the forecast period. This growth is primarily driven by the rapid adoption of e-commerce, cloud-based services, and the need for affordable, high-performance security. As SMEs transition to online retail and cloud-based models, they require scalable and reliable DNS infrastructure to handle increased traffic and maintain uptime. Small businesses are increasingly targeted by cyber threats, making managed DNS tools essential for providing critical, user-friendly security features like DNSSEC and DDoS mitigation, which are vital for maintaining customer trust.

End Use Insights

What Made IT & Telecom the Leading Segment in the Domain Name System Tools Market?

The IT & telecom segment led the market in 2025 due to the industry's high demand for secure, scalable, and high-performance network infrastructure. Telecom operators and ISPs require fast, authoritative DNS to maintain, manage, and secure backbone services and customer connectivity. The rapid shift to hybrid cloud and virtualized environments necessitates advanced DNS management tools capable of dynamic IP addressing and ensuring high availability. Additionally, the rollout of 5G networks and the need for high-speed, automated, AI-powered DNS traffic management are essential to handle increasing traffic volumes.

The government segment is expected to experience the fastest growth in the foreseeable future. This growth is primarily driven by massive investments in digital infrastructure, critical cybersecurity needs, and modernization requirements for citizen services. An increased focus on enhancing online services, developing smart cities, and improving public sector efficiency necessitates reliable and high-performance DNS management. Consequently, government agencies are transitioning to cloud-based, scalable DDI solutions to support modern IT environments by adopting digital government strategies.

Regional Insights

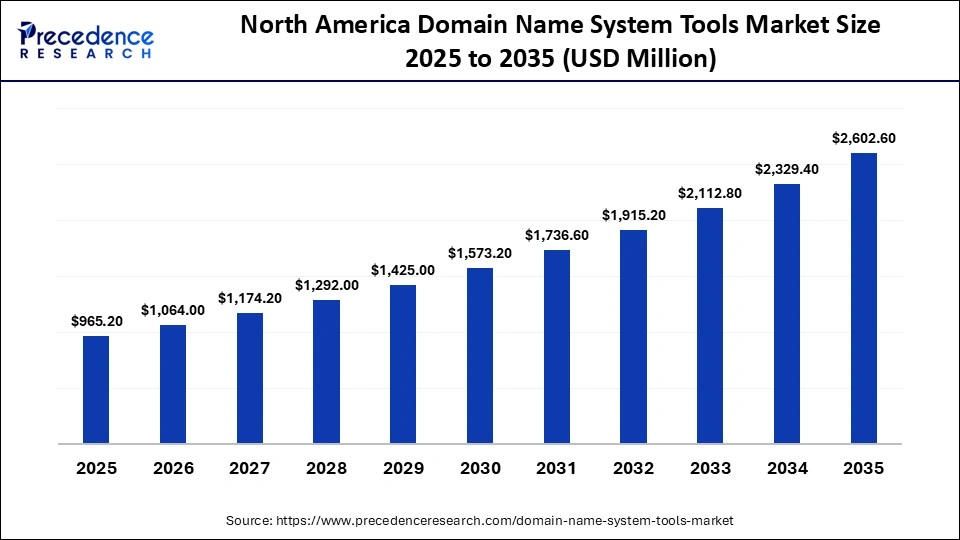

How Big is the North America Domain Name System Tools Market Size?

The North America domain name system tools market size is estimated at USD 965.50 million in 2025 and is projected to reach approximately USD 2.602.60 million by 2035, with a 10.43% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Domain Name System Tools Market?

North America dominated the domain name system tools market by capturing the largest share in 2025. The region's leadership in the market is attributed to its advanced IT infrastructure, a high concentration of large enterprises, and early adoption of cloud-based services. The region has a highly developed digital infrastructure and a high concentration of large enterprises, which support advanced DNS management solutions. The increased frequency of sophisticated DDoS attacks targeting financial, e-commerce, and SaaS platforms necessitates advanced, secure DNS tools. Moreover, the presence of leading vendors, including Akamai Technologies, Cloudflare, AWS, Microsoft, and F5, leads to innovation in the market, ensuring the long-term dominance of the region.

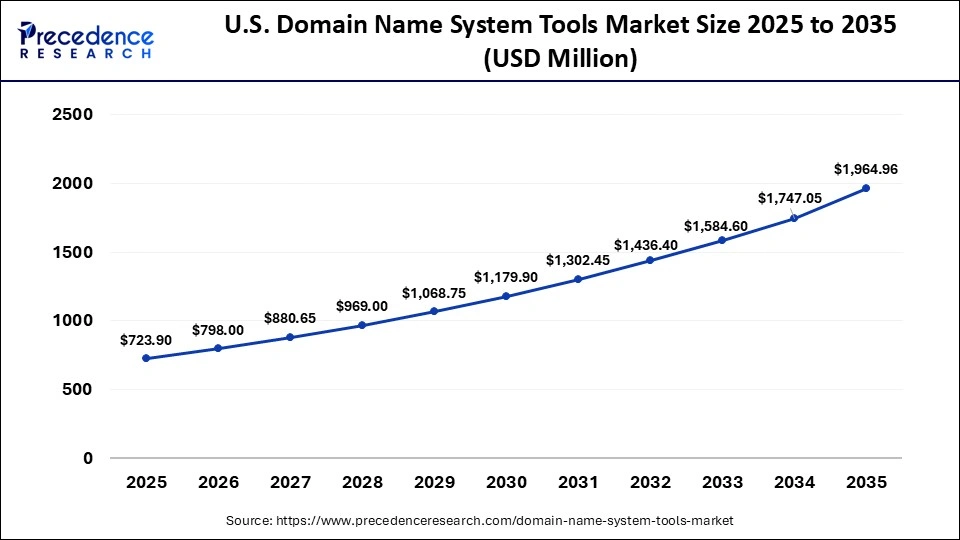

What is the Size of the U.S. Domain Name System Tools Market?

The U.S. domain name system tools market size is calculated at USD 2723.90 million in 2025 and is expected to reach nearly USD 1,964.96 million in 2035, accelerating at a strong CAGR of 6.22% between 2026 and 2035.

U.S. Domain Name System Tools Market Trends

The U.S. is the major contributor to the market within North America, driven by high adoption of DNS tools and ongoing technological advancements. The country is home to leading market players like Akamai Technologies, Cloudflare, F5, and Microsoft. The U.S. is a critical hub for DNS infrastructure, including the management of top-level domains like .com and .us. U.S. companies are leaders in implementing advanced security, such as DNS firewalls and anti-DDoS solutions, to address the high, evolving security threats, supporting market growth.

Why is Asia Pacific Considered the Fastest-Growing Region in the Domain Name System Tools Market?

Asia Pacific is expected to grow at the fastest rate during the forecast period, driven by intense digitalization and higher demand for robust security. Countries like China and India are seeing massive expansions in their digital economies, leading to a surge in internet users, connected devices, and the need for reliable DNS infrastructure to manage this traffic. Organizations are increasingly migrating to cloud infrastructures, increasing the demand for managed DNS services that offer scalability, flexibility, and reduced latency. The proliferation of IoT devices and 5G network rollouts in the region necessitate advanced, scalable DNS tools.

India Domain Name System Tools Market Trends

The market in India is expanding as a result of the increasing demand for managed DNS services. The rapid increase in internet users and digital businesses in India, along with the adoption of .in domains, has heightened the need for security, making DDoS protection and GeoDNS popular, high-growth services. The .in domain has grown significantly, managed by NIXI, highlighting a strong local digital infrastructure.

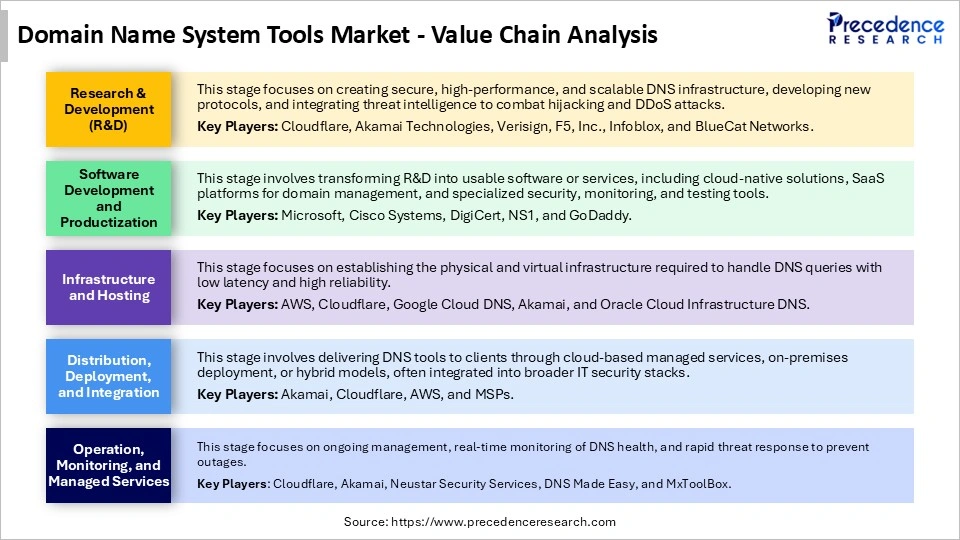

Domain Name System Tools Market Value Chain Analysis

Who are the Major Players in the Global Domain Name System Tools Market?

The major players in the domain name system tools market include Cloudflare, Inc., Amazon Web Services., Akamai Technologies, Inc., Google LLC., Microsoft Corporation, Oracle Corporation, IBM Corporation, GoDaddy Operating Company, LLC, Neustar Security Services, Infoblox Inc. , DigiCert, Inc., F5, Inc., EasyDNS Technologies Inc,. DNSFilter, BlueCat Networks

Recent Developments

- In June 2025, Akamai Technologies unveiled Akamai DNS Posture Management, a solution for unified, multicloud visibility over DNS assets. This agentless system enhances security by quickly detecting DNS-based attacks and vulnerabilities, which are crucial as organizations manage multiple DNS configurations. The agentless solution provides real-time monitoring and guided remediation across all major DNS providers.(Source: https://www.prnewswire.com)

- In October 2025, DNS analytics allow for evaluating data about DNS queries to your zone. You can use the dashboard to get insights quickly based on a predefined set of dimensions, or use the API to access all fields available in the GraphQL DNS analytics schemas. When using GraphQL, you also have the option to retrieve data for DNS queries across all zones within a given Cloudflare account.(Source: https://developers.cloudflare.com)

- In April 2025, DigiCert integrated UltraDNS into its DigiCert ONE™ platform, automating management between Public Key Infrastructure (PKI) and DNS. This integration addresses the challenges of shorter certificate lifespans and improves digital trust, allowing teams to predict and resolve issues efficiently. Managing certificates and DNS records and automating domain validation through one platform is quickly becoming a necessity, remarked Deepika Chauhan, Chief Product Officer at DigiCert.(Source: https://www.digicert.com)

Segments Covered in the Report

By Type

- Managed DNS Services

- Standalone DNS Tools

- By Deployment

- On-premises

- Cloud

By Enterprise Size

- SMEs

- Large Enterprises

By End Use

- BFSI

- IT & Telecom

- Media and Entertainment

- Retail and E-commerce

- Healthcare

- Government

- Education

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting