What is the Drilling Fluids Market Size?

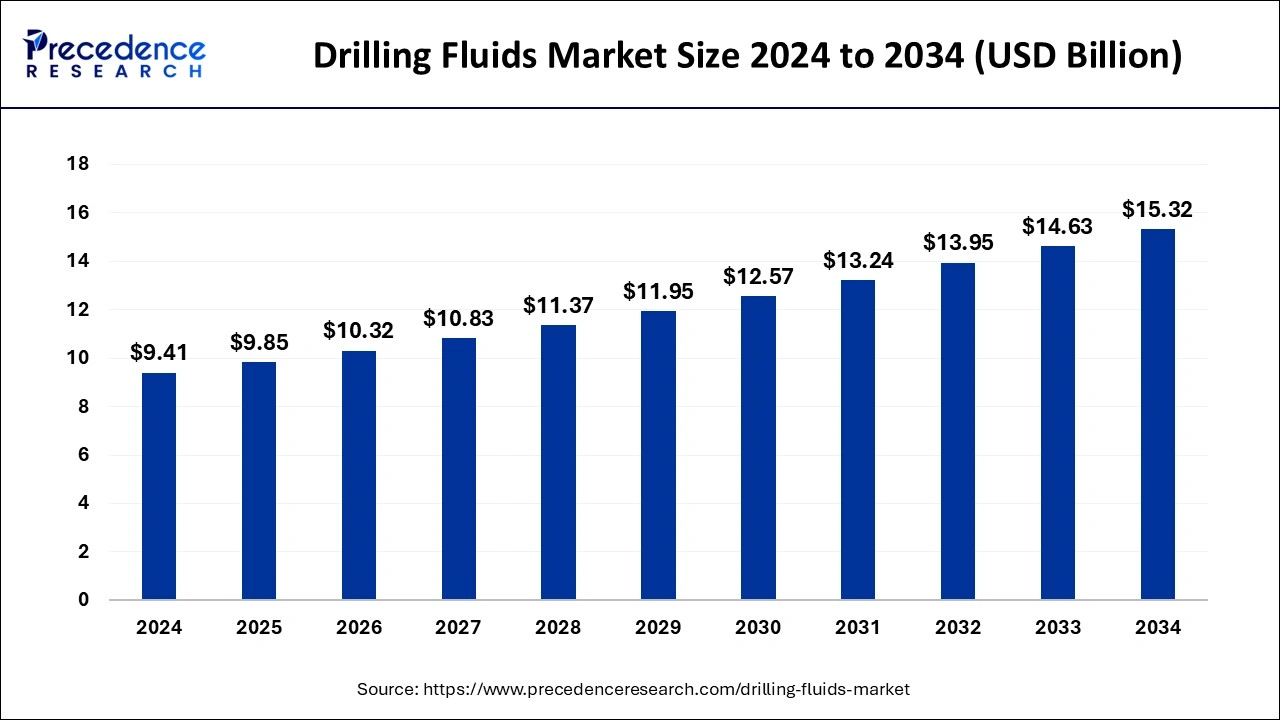

The global drilling fluids market size is valued at USD 9.85 billion in 2025 and is predicted to increase from USD 10.32 billion in 2026 to approximately USD 15.32 billion by 2034, expanding at a CAGR of 5% from 2025 to 2034.

Drilling Fluids Market Key Takeaways

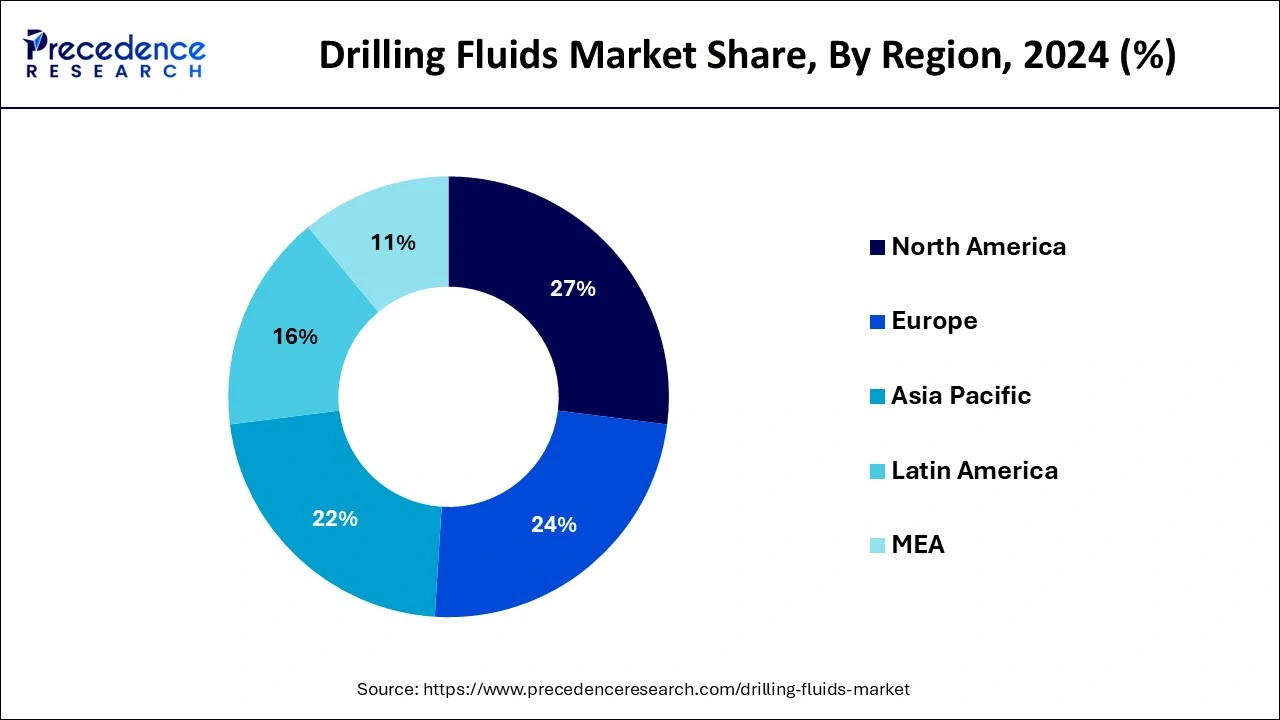

- North America led the market with the biggest market share of 27% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR during the forecast period.

- By Application, the onshore segment registered the maximum market share of 70% in 2024.

- By Product, the water-based fluids segment has held a major revenue share of 52.3% in 2024.

- By Product, the synthetic-based fluids segment is anticipated to grow at the fastest rate during the forecast period.

Advancements in Technologies That Will Change the Future of the Drilling Fluids Market

Drilling fluids, or drilling muds, are highly refined liquids that are specifically engineered to cool drill bits, stabilize the wellbore, control formation pressure, and carry cuttings to the surface. Market growth is driven by the need for drilling fluids that provide reliable performance in deeper and higher-pressure wells. Increased offshore exploration, fiscal pressures associated with more stringent environmental compliance requirements and increased movements towards low toxicity, water-based formulations are influencing providers of these products. Additionally, Digital Monitoring Tools and real-time data analytics are facilitating improved performance management of drilling fluids, creating a push towards more efficient drilling solutions that are driven by the chemistry used to develop the fluid

Impact of AI in Drilling Fluids Market

The applications of artificial intelligence (AI) in drilling fluids can be utilised for predictive modelling, in identifying best fluid formulation for specific well conditions, optimizing the design and performance of drilling fluids by evaluating large amounts of data, in wellbore stability analysis and improvement of drilling fluids by evaluating data from lab tests and field operations thereby enhancing drilling efficiency with reduced complications.

Artificial intelligence (AI) is making an impact on how muds and fluids are managed, which has been evident through numerous advancements made in the drilling fluid industry. In October 2025 Savant Fluid Management (FM) and NPTLabs established a partnership to release what they described as the first Predictive AI Fluid Management Platform in the industry.

(Source: businesswire.com)

The platform uses advanced X-ray fluorescence (XRF) technology to provide real-time data on both the chemical makeup and performance of drilling fluids through artificial intelligence (AI).

Drilling Fluids Market Growth Factors

- Upward spending through the value chain of the oil & gas sector is projected to propel the need for drilling fluids during forthcoming years. In recent times, Exxon Mobil Corporation declared spending of USD 20 billion by 2022 for extending its oil refining plant on the U.S. Gulf Coast that might fuel the requirement for drilling fluids in this region during years to come.

- Additionally, initiatives for expansion of the oil and gas sector in emerging nations are expected to motivate growth of the drilling fluids market in the Asia Pacific. For example, government of India has endorsed 100% Foreign Direct Investment in private and upstream sector refining projects. Moreover, rushing investments in oil & gas exploration activities in Mexico, drilling and production accomplishments are estimated to generate a huge demand for drilling during estimate period.

- The snowballing demand for crude oil has caused in an upsurge in drilling undertakings. North America contributes for maximum oil & gas production operations across the globe, shadowed by Europe. Rise in drilling undertakings directly influences the progress of drilling and completion fluids market.

- Multiple kinds of drilling fluids are essential dependent on the economic viabilities and geographic conditions for these operations. However, severe environmental and government guidelines regarding the utilization and disposal and usage of drilling fluids coupled with the geopolitical concerns in foremost oil manufacturing regions are estimated to confine the growth of market in the near future.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 9.85 Billion |

| Market Size in 2026 | USD 10.32 Billion |

| Market Size by 2034 | USD 15.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Application Insights

In 2024, onshore appeared as the prime application market segment and occupied around 70% revenue share of the total market. Cumulative amount of oil drilling operations to meet mounting energy requirements is projected to push the demand over for drilling fluids significantly. Furthermore, rising upstream expenditure to address oil production goals is anticipated to flourish the global oil and gas market, consequently motivating the need for drilling fluids.

Besides, upward demand for the harsh environments, mud in deep water, and remote sites is estimated to spur requirement for drilling fluids for offshore uses. Augmented environmental hazards related with offshore locations and maintenance expenses have insisted businesses to employ water-based or synthetic fluids for economical exploration and production undertakings.

Product Insights

Among different types of product segments involved in this market, water-based fluids segment appeared as major revenue contributor and garnered more than 52.3% of the market share in the year 2024. These fluids are expected to observe augmented proliferation and progress due to their cost-effectiveness and inferior environmental bearing caused by discharged mud and cuttings. The intensifying emphasis on refining the thermal and inhibitive performance of water-based systems to contend with non-aqueous fluids utilized for stimulating applications including onshore and offshore shelf activities is expected to flourish the requirement for water-based fluids during years to come.

Synthetic-based fluids segment is projected to grow significantly with fastest CAGR due to their outstanding thermal stability, lubricity, penetration rates, borehole control, which aid in plummeting the total costs.

Regional Insights

U.S. Drilling Fluids Market Size and Growth 2025 to 2034

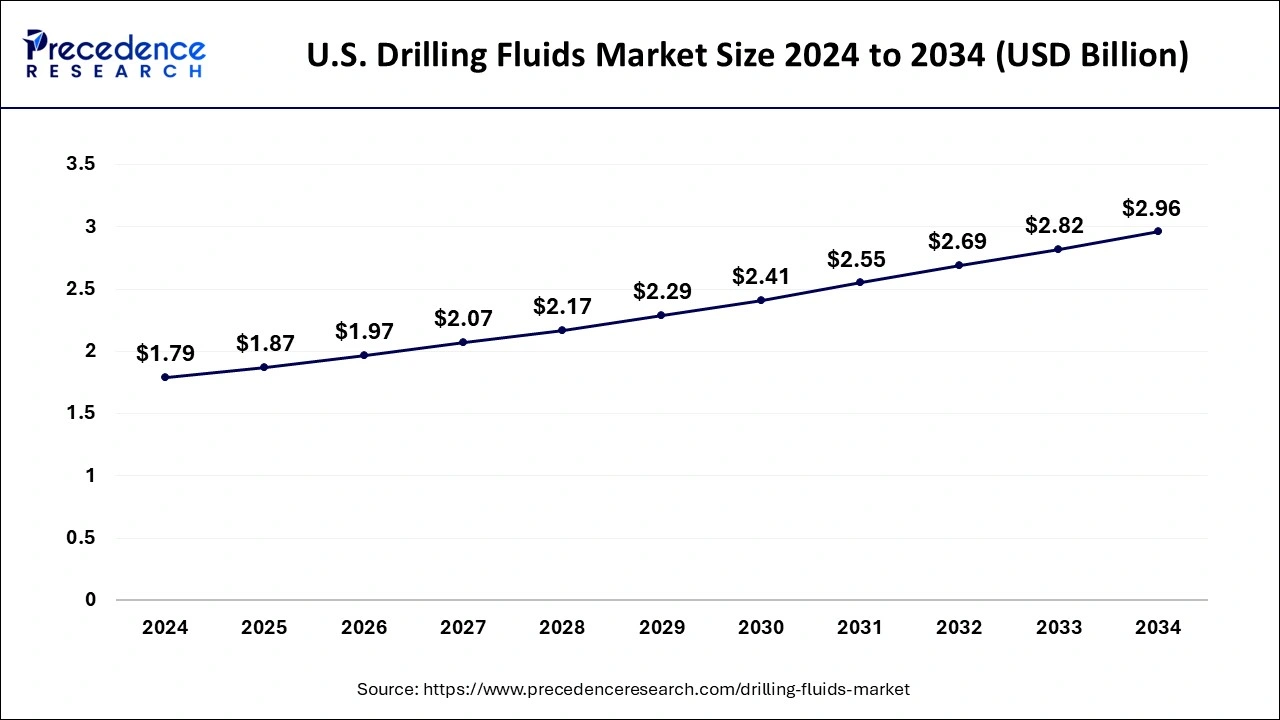

The U.S. drilling fluids market size is estimated at USD 1.87 billion in 2025 and is predicted to be worth around USD 2.96 billion by 2034, at a CAGR of 5.2% from 2025 to 2034.

North America has held 27% revenue share in 2024. Intensifying offshore drilling movements and shale boom is motivating the attention for drilling fluids in across such regions. The escalating onshore drilling practices in the North America Middle East and Asia Pacific are propelling the awareness for drilling fluids in inland saves. Besides, neighborhood of sprawling common assets in the "Golden Triangle" (Seaward Brazil Gulf of Mexico, and seaward West Africa) is instigation great attention in the locales, which is fore seen to spur the demand for drilling fluids during next few years.

U.S. Drilling Fluids Market Trends

The U.S. drilling fluid market is expected to grow significantly. The technological innovations in drilling, increased upstream transition of oil and gas activity, rise in offshore drilling activities, demand for various processes such as borewell drilling and mineral extraction are fuelling the market growth.

Asia Pacific region is also projected to record significant progress in the drilling fluid market. This growth is attributed to intensifying exploration of oil fields from untouched reserves. For illustration, Pakistan, Australia, Brunei, Malaysia and Papua New Guinea are some of the main nations which posses sun exploited offshore oil reserves. The ultra-deepwater and deepwater drilling operations are anticipated to upsurge in the impending future, motivated by novel findings in West Africa, Latin America, and the Asia Pacific. A mainstream offshore motion is attentive in deepwater regions, including U.S., Brazil, Angola, Nigeria, Norway and Malaysia among others. Moreover, recent detections completed in developing frontline regions, like the eastern Mediterranean Sea, the East Coast of Africa, and west coast of Australia, might suggestively lift the growth of offshore reserves.

China Drilling Fluids Market Trends

- China is expected to witness fastest growth for the drilling fluids market in the Asia Pacific region. The rising investments in oil and gas production industries, advancements in drilling technologies, extensive exploration of oil fields and increase in production activities driving the market expansion of China.

How Europe is Notably Growing in Drilling Fluids Market?

Europe's drilling fluids market continues to experience steady growth because oil and gas operators are modernizing their methods of exploration in offshore basins across the North Sea, Norwegian Sea, and Barents Sea. The stricter EU regulations on environmental matters have contributed to increasing the number of companies moving toward using low-toxicity biodegradable formulations of fluids. This has created new opportunities for innovation and new services within the market. Increased investment in geothermal energy drilling along with new well-stability technologies provides additional support for this increase in demand.

Norway Drilling Fluids Market Analysis

Norway's additional contributions come from being an established leader in offshore operations, as well as being an active participant in the exploration process on the Norwegian Continental Shelf (NCS). Furthermore, the Norwegian Government as well as many of the country's oil and gas operators continues to put emphasis on environmentally safe drilling methods, which has helped facilitate the rise in usage of water-based and synthetic-based fluids. Additionally, there is a strong regulatory framework surrounding the drilling industry, as well as an ongoing emphasis on improving operational efficiency, which drives continuous improvements in both fluid performance and monitoring.

Will the Growth of Energy Expansion Drive Market Growth in Middle East & Africa?

Newly emerging markets within the Middle East & Africa have seen explosive growth because of significant investment into exploration and development of both large conventional oil and gas reserves, as well as untapped reserves throughout onshore/offshore sites. This increased investment has produced a dramatic increase in the demand for high performance drilling fluids that meet the challenging requirements of the world's most extreme reservoirs. This area of the world is rapidly adopting digital tools for mud engineering and other activities related to drilling safety and the optimization of drilling fluids.

Saudi Arabia Drilling Fluids Market Analysis

Saudi Arabia continues to play an important role in the overall growth of the region through its ongoing drilling program to increase both the quantity and quality of oil and gas produced. The development of local service providers is being supported via the creation of technology partnerships and national energy projects that foster the growth of domestic service capabilities.

Value Chain Analysis for Drilling Fluids Market

Raw Materials Suppliers: Suppliers of Specialty Polymers and Additives; Provides Assurance of Quality via Cost Control and Compliance with Drilling Fluids Manufacturing and Performance Regulations

- Key Players: BASF, Solvay, Dow, Huntsman, and Clariant etc.

Research and Development: Develops Bespoke Fluid Chemistry including Laboratory Testing and Global Performance Improvement of Rheology, Temperature Stability, and Environmental Footprint to Suit Various Well Conditions

- Key Players: Schlumberger, Halliburton (Baroid), Baker Hughes, Newpark etc.

Manufacturing and Blending: This includes the blending of Base Fluids with Additives into Finished Mud Systems in Accordance with Safe Batching, Safety Procedures, and Scaling, both Offshore and Onshore.

- Key Players: Newpark Resources, Baker Hughes, and Weatherford etc.

Distribution/Logistics/Post-Sale Supply: This includes packaging, storing, transporting, and local stocking of Products for Drilling Operations at Competitive Costs in Terms of Manufacturing, Regulatory Documentation, and On-Site Inventory Management

- Key Players: Newpark, NOV, Baker Hughes, and Weatherford etc.

Drilling Fluids Market Companies

- National Oilwell Varco

- Schlumberger Limited

- Baker Hughes Incorporated

- Anchor Drilling Fluids USA, LLC

- Gumpro Drilling Fluids Pvt. Ltd.

Latest Announcements

- In October 2024, Magma Power LLC announced the approval of a new patent from the U.S. Patent and Trademark Office for a breakthrough geothermal system which utilizes novel float shoe technology thereby enhancing the safety and efficacy of heat extraction from underground magma reservoirs for sustainable heat production.

Recent Developments

- In June 2025, Newpark Fluids Systems, a major independent provider of drilling and completion fluids announced a restructure of its executive leadership team and board-level management to support what it described as “continued growth.” This suggests the company is preparing for expansion or diversification, likely to leverage rising demand for advanced drilling-fluid solutions.

- In June 2025,AES Drilling Fluids acquired Fossil Fluids LLC, a regional drilling-fluids provider based in Oklahoma. The acquisition aims to integrate Fossil Fluids' regional expertise and customer base into AES's portfolio indicating consolidation in the drilling fluids market, and strengthening AES's presence in key U.S. drilling regions.

- In October 2024, Azure Holding Group Corp. announced the completion of a strategic merger with CST Drilling Fluids which is a 4th-generation oilfield services company thereby engaging into extensive expertise and high quality solutions through the partnership.

- In August 2024, the Angarsk Petrochemical Company, a Rosneft refining and petrochemical complex enterprise began the production of Rosneft Drilltec B2Ih drilling fluids which are developed by using a low-viscosity hydrocarbon base and are eco-friendly in nature.

Segments Covered in the Report

By Product

- Water-based fluids (WBF)

- Oil-based fluids (OBF)

- Synthetic-based fluids (SBF)

- Others

By Application

- Offshore

- Onshore

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting