Drilling Waste Management Market Size and Forecast 2025 to 2034

The global drilling waste management market size accounted for USD 6.69 billion in 2024 and is predicted to increase from USD 7.19 billion in 2025 to approximately USD 13.55 billion by 2034, expanding at a CAGR of 7.31% from 2025 to 2034.

Drilling Waste Management Market Key Takeaways

- The global drilling waste managementmarket was valued at USD 6.69 billion in 2024.

- It is projected to reach USD 13.55 billion by 2034.

- The drilling waste management market is expected to grow at a CAGR of 7.31% from 2025 to 2034.

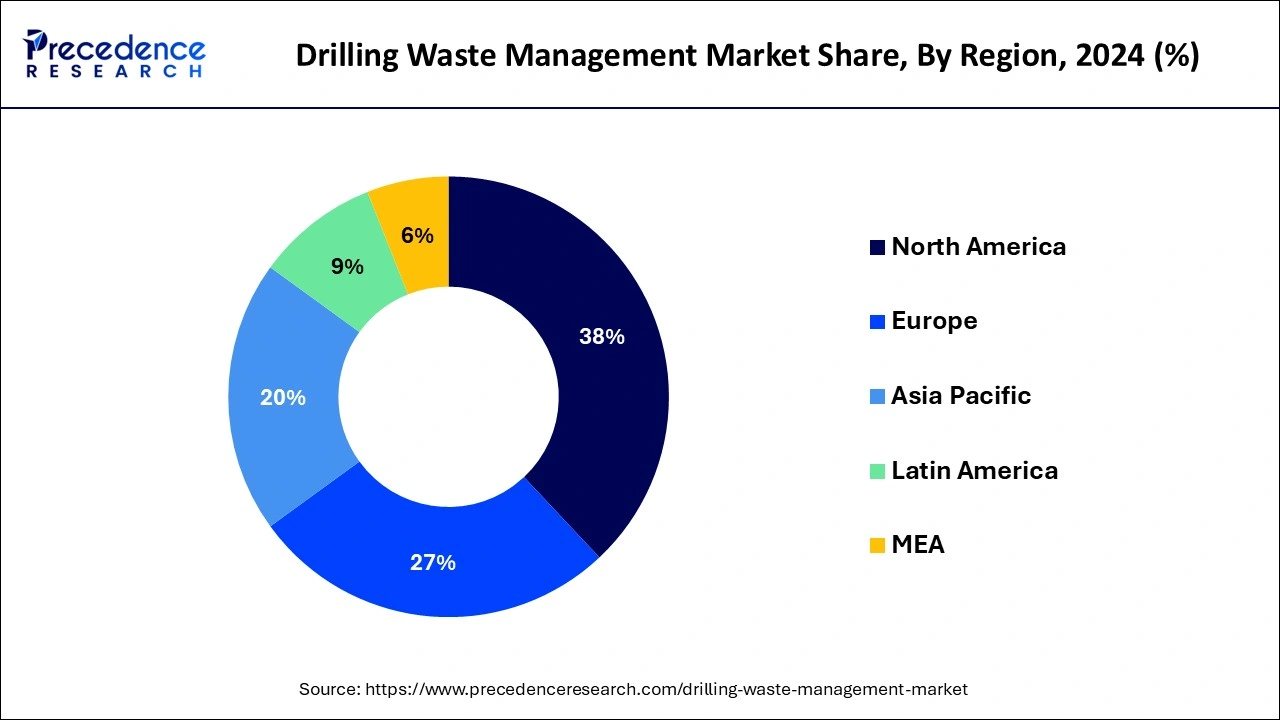

- North America contributed more than 38% of revenue share in 2024.

- The Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By service, the treatment & disposal segment has held the largest market share of 59% in 2024.

- By service, the containment & handling segment is anticipated to grow at a remarkable CAGR of 7.4% between 2025 and 2034.

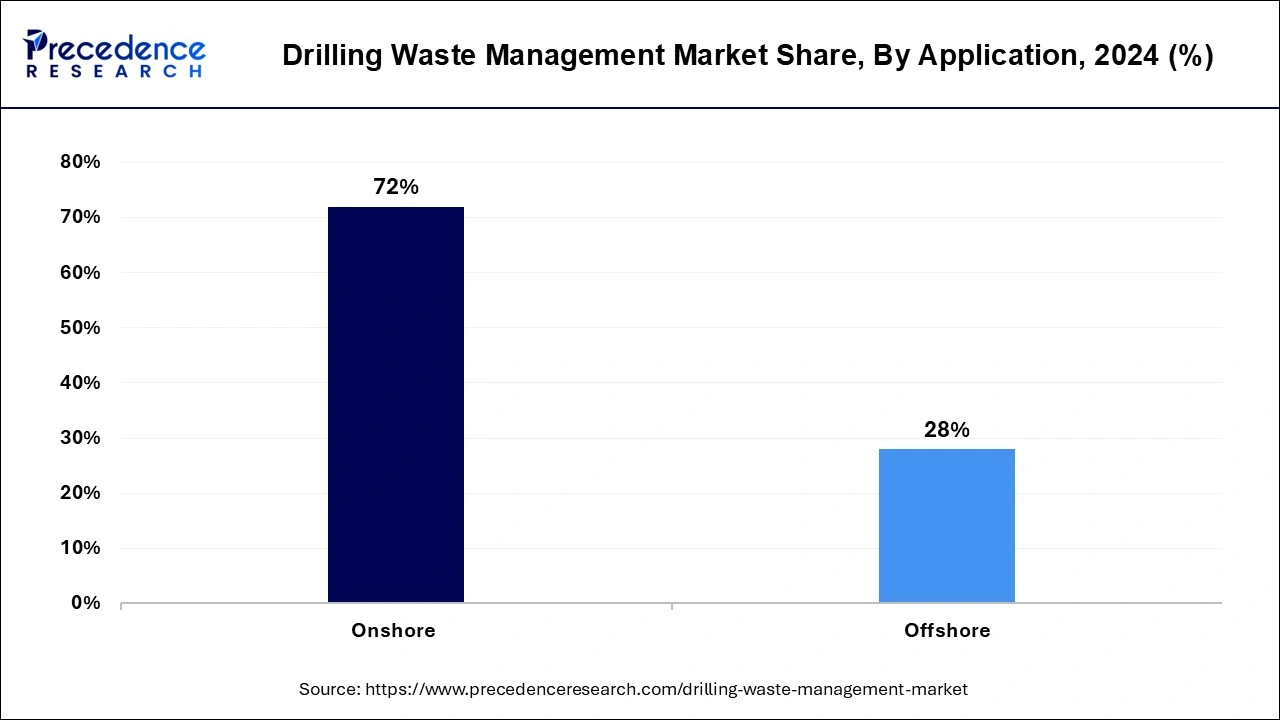

- By application, the onshore segment generated over 72% of revenue share in 2024.

- By application, the offshore segment is expected to expand at the fastest CAGR over the projected period.

- By waste type, the waste lubricants segment had the largest market share of 42% in 2024.

- By waste type, the contaminated water-based mud segment is expected to expand at the fastest CAGR over the projected period.

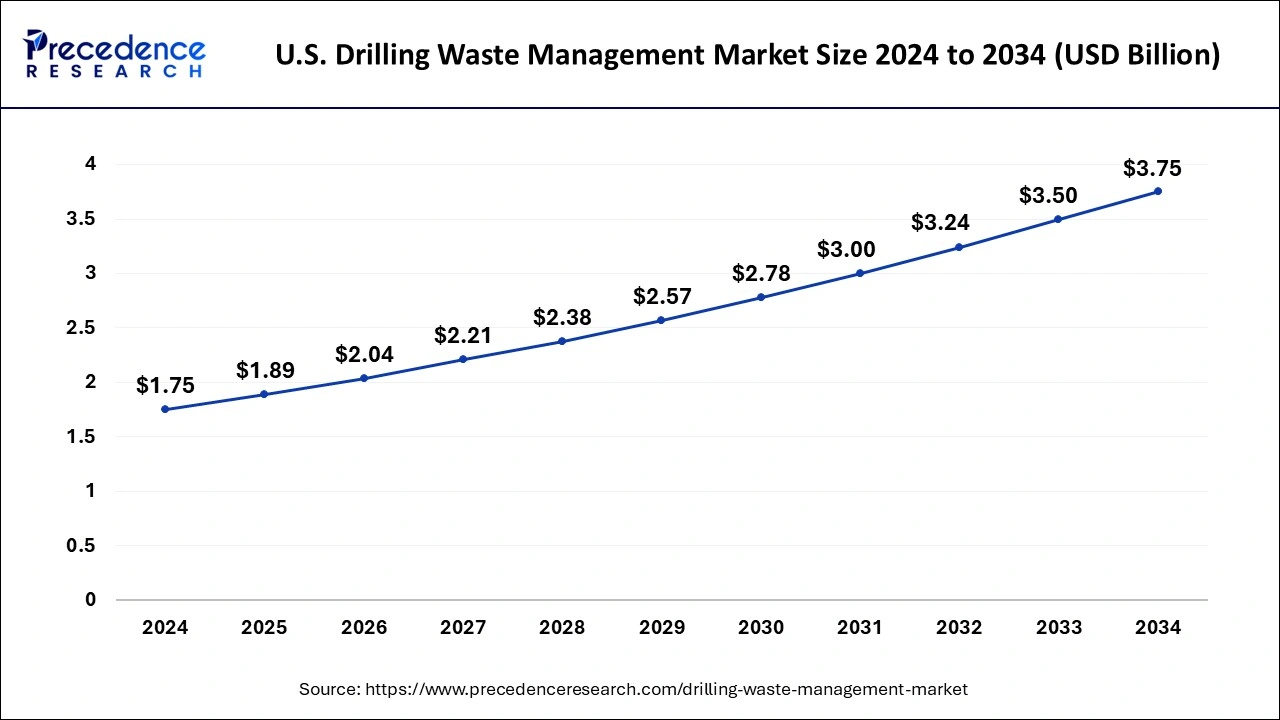

U.S. Drilling Waste Management Market Size and Growth 2025 to 2034

The U.S. drilling waste management market size was evaluated at USD 1.75 billion in 2024 and is projected to be worth around USD 3.75 billion by 2034, growing at a CAGR of 7.92% from 2025 to 2034.

North America has held the largest revenue share of 38% in 2024. In North America, the drilling waste management market is witnessing a surge in demand due to increased drilling activities, particularly in the shale gas sector. Stringent environmental regulations, such as those set by the Environmental Protection Agency (EPA), drive the adoption of advanced waste management technologies. The region's focus on sustainable practices and innovations in treatment technologies, coupled with a robust oil and gas industry, positions North America as a key market for drilling waste management solutions.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific experiences a growing demand for drilling waste management solutions fueled by expanding oil and gas exploration activities. Countries like China and Australia contribute significantly to the market, with increasing environmental awareness and regulations driving the adoption of efficient waste management practices. The rise in community awareness and stakeholder engagement further accelerates the implementation of sustainable drilling waste management strategies in Asia-Pacific.

In Europe, the drilling waste management market is characterized by a commitment to stringent environmental standards and sustainable practices in the oil and gas industry. The region's regulatory framework, including directives from the European Commission, emphasizes waste reduction and responsible waste disposal. With a focus on technological advancements and community engagement, European countries foster the adoption of innovative drilling waste management solutions, positioning the region as a hub for environmentally conscious practices in the industry.

Market Overview

The drilling waste management market involves processes and technologies to effectively handle and minimize waste generated during drilling operations in the oil and gas industry. It encompasses collecting, treating, and disposing of drilling cuttings, fluids, and other by-products. Key components include solids control systems, thermal treatment units, and waste disposal methods. Driven by environmental regulations, increasing drilling activities, and a focus on sustainable practices, the market aims to reduce the environmental impact of drilling operations, ensure regulatory compliance, and enhance the overall efficiency and safety of the drilling process.

The drilling waste management market is propelled by a growing emphasis on environmental stewardship, stringent regulations governing drilling waste, and the oil and gas industry's commitment to sustainable practices. Innovations in waste treatment technologies and the demand for efficient waste disposal solutions further contribute to market expansion.

Drilling Waste Management Market Growth Factors

- Regulatory Compliance Drive: Stringent environmental regulations worldwide drive the demand for effective drilling waste management solutions, ensuring compliance with industry standards.

- Increasing Drilling Activities: The rising global demand for energy leads to increased drilling operations, intensifying the need for advanced waste management practices in the oil and gas sector.

- Sustainable Practices Adoption: Growing industry commitment to sustainable practices propels the adoption of waste management technologies that reduce the environmental impact of drilling activities.

- Innovations in Treatment Technologies: Ongoing advancements in waste treatment technologies, including solids control systems and thermal treatment units, enhance the efficiency of drilling waste management.

- Efficient Disposal Solutions: The market offers solutions for the efficient disposal of drilling cuttings and fluids, addressing the industry's waste disposal challenges while promoting sustainability.

- Rising Environmental Concerns: Increasing awareness of environmental issues prompts the oil and gas industry to prioritize environmentally responsible drilling waste management strategies.

- Global Expansion Opportunities: The global nature of drilling activities presents opportunities for market expansion, with regions like North America, Europe, and Asia-Pacific witnessing significant growth.

- Health and Safety Prioritization: The focus on health and safety in the oil and gas sector accelerates the adoption of waste management practices that enhance worker safety during drilling operations.

- Technological Integration: The integration of advanced technologies, such as data analytics and automation, optimizes drilling waste management processes for improved efficiency and reduced operational costs.

- Market Consolidation Trends: The industry sees market consolidation trends as companies seek strategic partnerships and collaborations to enhance their capabilities in providing comprehensive drilling waste management solutions.

- Circular Economy Principles: Increasing alignment with circular economy principles promotes the development of innovative waste-to-resource strategies within the drilling waste management sector.

- Public-Private Collaboration: Collaborative efforts between public and private entities create opportunities for shared expertise and investment, fostering sustainable and effective drilling waste management practices.

- Community and Stakeholder Engagement: Proactive engagement with local communities and stakeholders becomes integral, ensuring transparency and addressing concerns related to the environmental impact of drilling waste.

- Resource Recovery Initiatives: Initiatives focused on recovering valuable resources from drilling waste underscore the industry's commitment to circularity and resource efficiency.

- Adoption of Best Practices: Companies embracing best practices in drilling waste management not only meet regulatory requirements but also enhance their corporate image and contribute to the overall sustainability of the industry.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.31% |

| Market Size in 2025 | USD 7.19 Billion |

| Market Size in 2024 | USD 6.69 Billion |

| Market Size by 2034 | USD 13.55 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | Service, Application, and Waste Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Commitment to sustainable practices and advancements in treatment technologies

The commitment to sustainable practices and advancements in treatment technologies significantly surges the market demand for the drilling waste management market. As the oil and gas industry increasingly aligns with environmental stewardship, there is a growing emphasis on adopting waste management solutions that minimize the ecological impact of drilling operations. Companies demonstrating a commitment to sustainability not only adhere to stringent environmental regulations but also appeal to a conscientious consumer base and enhance their corporate image.

Advancements in treatment technologies, including innovative solids control systems and thermal treatment units, play a pivotal role in meeting the industry's evolving needs. These technologies not only improve the efficiency of waste management processes but also contribute to resource recovery initiatives, transforming waste materials into valuable resources. The integration of these cutting-edge solutions not only ensures regulatory compliance but positions the industry as a responsible steward of the environment, fostering a positive market outlook and driving the adoption of advanced drilling waste management practices.

Restraint

Complex regulatory landscape and operational integration issues

The drilling waste management market faces constraints due to the complex regulatory landscape and operational integration issues. The stringent and evolving environmental regulations governing drilling activities create challenges for companies to navigate compliance, leading to increased costs and operational complexities. As regulatory requirements vary across regions, companies often encounter the need for tailored waste management solutions, adding a layer of complexity to their operations.

Operational integration issues arise from the diverse nature of drilling activities and the need for seamless waste management processes. Coordinating various stages of drilling, waste collection, treatment, and disposal becomes intricate, impacting the overall efficiency of the waste management system. Balancing compliance with regulations while optimizing operational processes presents a dual challenge for industry players, hindering the seamless integration of effective drilling waste management solutions and influencing the overall market demand.

Opportunity

Resource recovery initiatives, community and stakeholder engagement

Resource recovery initiatives and community stakeholder engagement play pivotal roles in surging the market demand for the drilling waste management market. Resource recovery, which involves extracting value from waste materials, aligns with circular economy principles, driving the adoption of innovative strategies for converting drilling waste into usable resources. Companies integrating resource recovery into their waste management practices not only reduce environmental impact but also contribute to a more sustainable and cost-effective approach, enhancing market demand.

Community and stakeholder engagement become crucial in addressing concerns related to the environmental impact of drilling waste. Proactive engagement fosters transparency, builds trust, and allows for the incorporation of local insights into waste management strategies. As communities increasingly prioritize sustainable practices, companies that actively involve and address the concerns of local stakeholders experience heightened acceptance and support, leading to increased market demand for drilling waste management solutions that prioritize both environmental responsibility and community well-being.

Service Insights

According to the service, the treatment & disposal segment has held 59% revenue share in 2023. Treatment & disposal services in the drilling waste management market encompass the efficient handling and processing of drilling waste materials. This involves the use of advanced technologies such as thermal treatment units and solids control systems to treat waste, ensuring compliance with environmental regulations. The trend in this service segment reflects a shift towards sustainable waste disposal methods, including resource recovery initiatives and the development of innovative technologies for environmentally responsible treatment processes.

The containment & handling segment is anticipated to expand at a significant CAGR of 7.4% during the projected period. Containment & handling services involve the safe and secure containment of drilling waste materials, minimizing environmental impact and ensuring worker safety. The trend in this service sector emphasizes the integration of automation and data analytics to optimize containment processes, reducing manual intervention and enhancing overall efficiency. Companies increasingly focus on developing advanced containment solutions that align with environmental sustainability goals, meeting the demand for comprehensive and secure handling practices in the drilling waste management landscape.

Application Insights

Based on application, the onshore segment held the largest market share of 72% in 2023. Onshore drilling waste management involves the efficient handling and disposal of waste generated during oil and gas drilling activities conducted on land. The trends in onshore drilling waste management include the adoption of advanced treatment technologies, such as thermal units and solids control systems, to ensure environmentally responsible disposal. The emphasis is on compliance with stringent regulations, resource recovery initiatives, and the integration of sustainable practices to minimize the ecological impact of onshore drilling operations.

On the other hand, the offshore segment is projected to grow at the fastest rate over the projected period. Offshore drilling waste management pertains to waste generated during oil and gas exploration conducted in marine environments. Trends in offshore drilling waste management focus on the development of specialized technologies and equipment for waste containment, treatment, and disposal at sea. Innovations include mobile treatment units, enhanced containment systems, and a growing emphasis on minimizing the environmental footprint of offshore drilling through advanced waste management strategies compliant with maritime regulations.

Waste Type Insights

In 2023, the waste lubricants segment had the highest market share of 42% on the basis of the end user. Waste lubricants in drilling waste management refer to used lubricating oils and fluids generated during drilling operations. The trend in managing waste lubricants involves the implementation of recycling and reprocessing technologies. Companies are increasingly adopting advanced treatment methods to recover valuable components from waste lubricants, contributing to sustainability and reducing the environmental impact of drilling operations.

The contaminated water-based muds segment is anticipated to expand at the fastest rate over the projected period. Contaminated water-based muds are drilling fluids that have been used and are now contaminated with various elements. In the drilling waste management market, the trend involves the development of efficient separation and treatment technologies to recover reusable components from contaminated water-based muds. Companies focus on minimizing waste and promoting the reuse of treated muds, aligning with environmental sustainability goals and regulatory requirements.

Drilling Waste Management Market Companies

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- National Oilwell Varco, Inc.

- Veolia Environnement S.A.

- SUEZ

- Secure Energy Services Inc.

- Newalta Corporation

- Tervita Corporation

- Imdex Limited

- Augean plc

- TWMA Group Limited

- Soiltech AS

- Step Oiltools AS

Recent Developments

- In 2020, TWMA has successfully secure a contract from North Sea operators for offshore processing of drilling waste, leveraging its innovative TCC RotoMill technology. This cutting-edge solution ensures the safe and effective on-site management of drill cuttings. The contract is estimated to have a substantial value, approximately £20 million.

Segments Covered in the Report

By Service

- Treatment & Disposal

- Containment & Handling

- Solids Control

- Others

By Application

- Onshore

- Offshore

By Waste Type

- Waste Lubricants

- Contaminated water-based muds

- Contaminated oil-based muds

- Spent Bulk Chemicals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting