Dry Eye Treatment Devices Market Size and Forecast 2025 to 2034

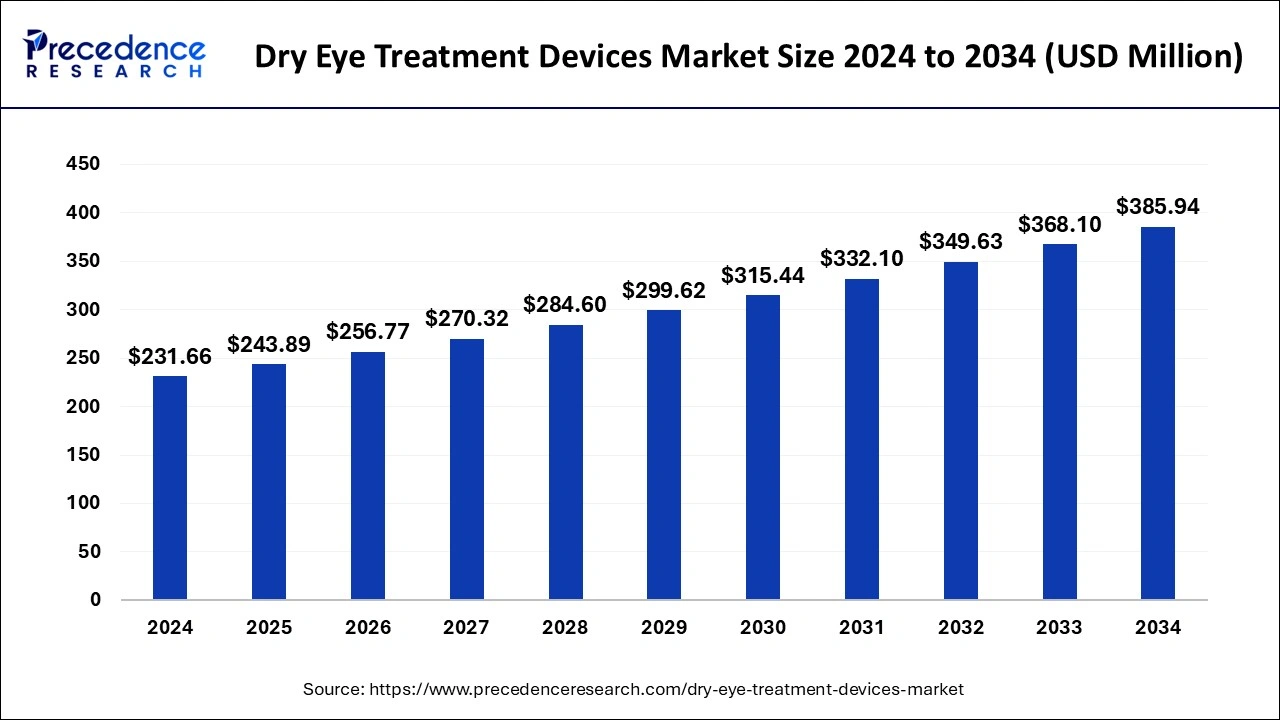

The global dry eye treatment devices market size accounted for USD 458.02 million in 2024, grew to USD 493.01 billion in 2025 and is projected to surpass around USD 948.56 million by 2034, representing a healthy CAGR of 7.55% between 2024 and 2034.

Dry Eye Treatment Devices Market Key Takeaways

- In terms of revenue, the global dry eye treatment devices market was valued at USD 458.02 million in 2024.

- It is projected to reach USD 948.56 million by 2034.

- The market is expected to grow at a CAGR of 7.55% from 2025 to 2034.

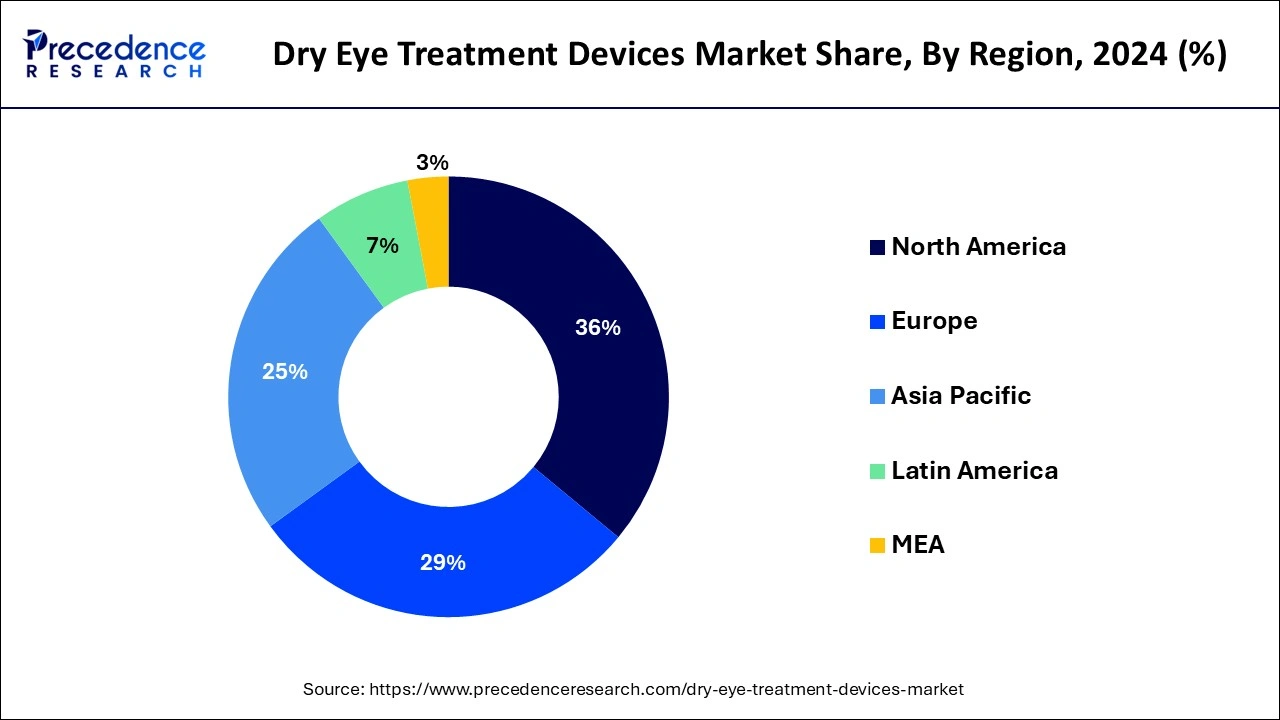

- North America led the market with the biggest market share of 36% in 2024.

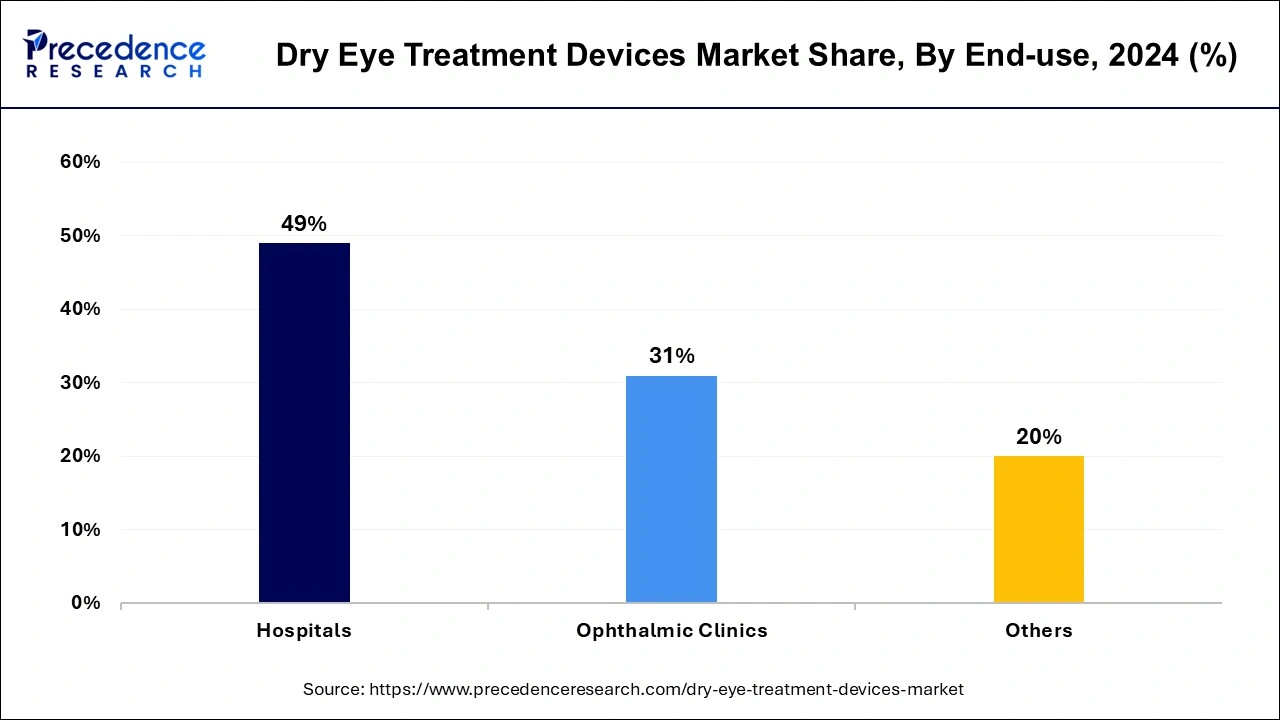

- By end use, the hospital segment registered the maximum market share of 49% share in 2024.

- By technology, the MGX segment generated the major market share of 43% in 2024.

- By technology, the Intense Pulsed Light segment is estimated to expand at the fastest CAGR of 7.53% over the projected period.

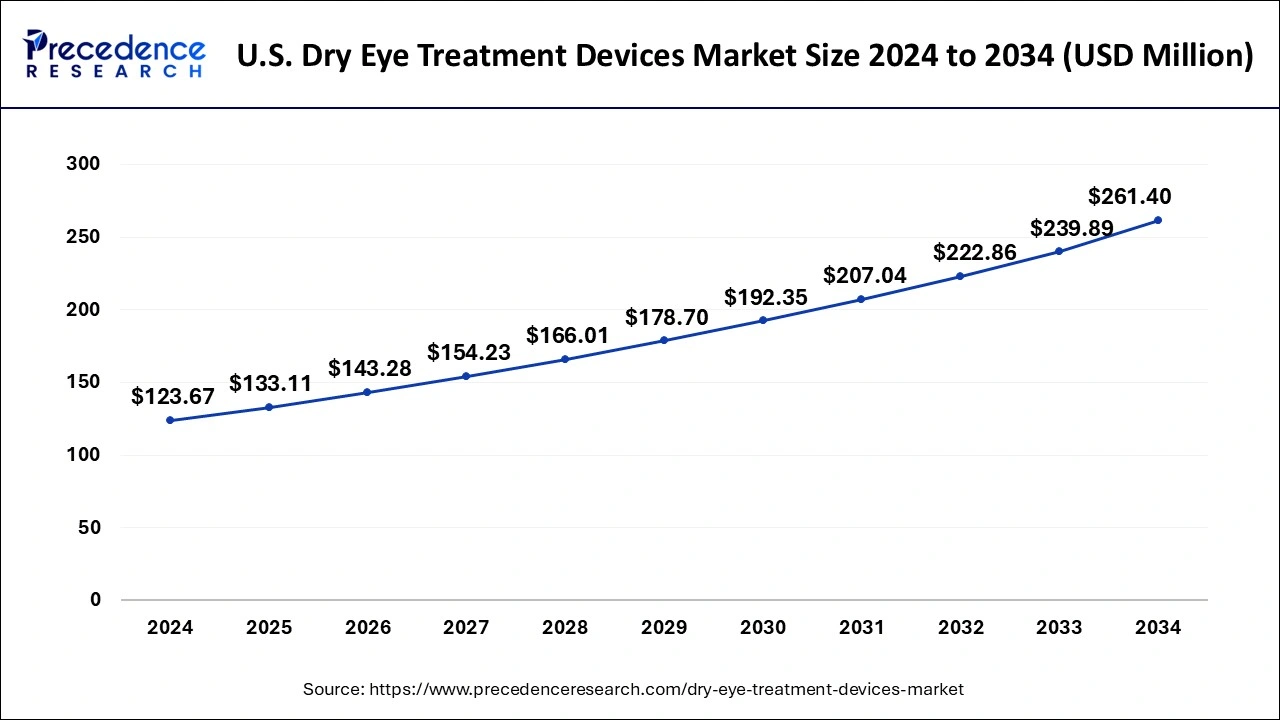

U.S. Dry Eye Treatment Devices Market Size and Growth 2025 to 2034

The U.S. dry eye treatment devices market size was valued at USD 123.67 million in 2024 and is anticipated to reach around USD 261.40 million by 2034, poised to grow at a CAGR of 7.77% from 2025 to 2034.

North America emerged as a dominant force in the global dry eye treatment devices market in 2024, driven by significant prevalence and increasing awareness of dry eye disease. In January 2022, the eyes on eyecare team conducted a survey involving 540 eyecare professionals across North America, including 450 practicing optometrists. With the introduction of newer, costlier therapies, a heightened societal and personal economic burden of DED is anticipated. Contributing factors include the ongoing global pandemic and an aging population. Over-the-counter topical treatments remain popular. Prescription-based treatments, such as topical steroids, have seen a particularly significant increase, highlighting the evolving landscape of DED management in North America.

DED remains underdiagnosed despite its significant public health impact, suggesting a considerable undiagnosed burden of the disease. The vast geographical expanse of the USA, characterized by diverse climates, underscores the influence of climatic factors on DED risk, necessitating careful consideration of prevalence and incidence estimations. The prevalence of DED is on the rise, with an estimated 35 million affected individuals in the USA alone. In the United States, a meta-analysis estimated a pooled prevalence of DED at 8.1%, with personal costs often elevated due to limited health insurance coverage for treatments like ocular lubricants and higher drug costs.

- In May 2023, Bausch + Lomb and Novaliq jointly announced the FDA approval of MIEBOTM (Perfluorohexyloctane Ophthalmic Solution) to address the signs and symptoms of dry eye disease.

- In January 2024, Harrow introduced Vevye, a dry eye drug, in the United States dry eye treatment devices market.

- In June 2023, Aldeyra Therapeutics reported the attainment of statistical significance for the primary and secondary endpoints in the Phase 3 INVIGORATE‑2 Trial of Reproxalap for allergic conjunctivitis.

- In January 2022, NovaBay Pharmaceuticals launched Avenova Lubricating Eye Drops to address dry eye symptoms.

Market Overview

The dry eye treatment devices market is experiencing significant growth driven by advancements in technology and increasing awareness about the condition. Dry eye disease (DED) affects a substantial portion of the population, with prevalence rates soaring as high as 95% among patients with blocked meibomian glands. This condition affects not only the elderly but also a considerable number of individuals across different age groups, with environmental factors such as low humidity, wind exposure, allergens, and smoke significantly exacerbating the symptoms.

Scientific evidence supports the efficacy of dry eye treatment devices in diagnosing the type and severity of the disease, particularly in evaporative dry eye disease cases. These devices offer a more comprehensive and long-term management solution compared to traditional treatments. In addition to addressing the symptoms of dry eye, these devices provide patients with comfortable vision, improving their overall quality of life. Notably, patients using topical antiglaucoma medications are particularly susceptible to dry eye, further driving the demand for innovative treatment options.

The market is witnessing a shift away from conventional eye drop formulations, which often contain preservatives like benzalkonium chloride that can induce ocular surface damage. The dry eye treatment devices market presents lucrative opportunities for manufacturers and investors alike, driven by the pressing need for effective, long-term solutions to this prevalent and often debilitating eye condition. Key players strive to dominate the market via collaborations, mergers, acquisitions, adoption of advanced technologies, and product launches.

- In January 2024, Nordic Group B.V. (Nordic Pharma) finalized its acquisition of Visant Medical, Inc. through its subsidiary Amring Pharmaceuticals, Inc.

- In December 2023, Reichert announced its plans to introduce four new dry eye devices in 2024.

- In May 2022, Alcon announced the acquisition of EYSUVIS, thereby expanding its portfolio of ophthalmic eye drops.

- In May 2023, DelveInsight conducted a comprehensive evaluation of the robust clinical trial pipeline for dry eye disease, with over 60 influential pharmaceutical companies entering the field.

- In May 2022, Brim Biotechnology and Ora partnered to expedite the development of BRM421, a regenerative peptide therapy for dry eye.

Dry Eye Treatment Devices Market Data and Statistics

- The American Academy of Ophthalmology reports that approximately 30% of patients seeking treatment exhibit symptoms consistent with DED, underscoring the substantial demand for the dry eye treatment devices market.

- In Canada, prevalence estimates from the Canada Dry Eye Epidemiology Study (CANDEES) indicate a symptom prevalence of 28.7%, reflecting a substantial DED burden in the country.

Dry Eye Treatment Devices MarketGrowth Factors

- The utilization of cutting-edge technology, such as rotating medical-grade sponges, enables the removal of excess bacteria, biofilm, and toxins from eyelids and outer meibomian glands. This innovative approach stimulates the growth of the dry eye treatment devices market by addressing the root causes of dryness more effectively.

- The increasing availability of device-based therapies that target the underlying causes of dry eye contributes significantly to the growth of the market. These therapies offer more targeted and efficient solutions compared to traditional methods, thus attracting a growing consumer base seeking effective treatments.

- High user satisfaction, with 91% of participants finding the devices easy and convenient to use, acts as a catalyst for the expansion of the dry eye treatment devices market. This positive user experience drives adoption rates and encourages further market penetration.

- Dry eye treatment devices equipped with adaptable handpieces allow for customized treatments tailored to individual needs. This flexibility appeals to a wider range of users, driving market growth through increased demand.

- Innovative device technology effectively reduces the level of pro-inflammatory mediators, thereby inhibiting inflammation associated with dry eye. This capability contributes to the growth of the dry eye treatment devices market by offering more comprehensive and long-lasting solutions.

- Devices with optimal energy control ensure the safe and hygienic delivery of treatments, enhancing their effectiveness. This feature instills confidence among users and healthcare professionals, further driving the expansion of the dry eye treatment devices market.

- Advanced device technology allows for the safe and comfortable treatment of wider areas affected by dry eye, effectively breaking the vicious cycle of inflammation. This expanded treatment coverage attracts more users seeking comprehensive solutions, fostering the growth of the dry eye treatment devices market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.55% |

| Global Market Size in 2025 | USD 493.01 Million |

| Global Market Size by 2034 | USD 948.56 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Technology and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dry Eye Treatment Devices Market Dynamics

Drivers

Addressing meibomian gland dysfunction and corneal damage through innovative solutions

The growth of the dry eye treatment devices market is primarily driven by the need to address discomfort stemming from blockages in the meibomian glands, which produce a protective oily layer for tears. These blockages lead to thickened meibum and clogged glands, exacerbating dry eye symptoms. Daily lubrication and warm compression at home, along with periodic deep cleaning of the glands, are essential for managing dry eye disease.

Dry eye treatment devices play a crucial role by massaging the meibomian glands and releasing clogged oils through heat application. Additionally, for patients with moderate-to-severe dry eye, lasting damage to the cornea may occur, necessitating the use of specialty contact lenses like scleral lenses to repair the corneal surface. These advancements in treatment options meet the increasing demand for comprehensive relief among individuals suffering from dry eye conditions.

Prevalence among high-risk populations

The rising prevalence of dry eye disease presents a significant driver for the growth of the dry eye treatment devices market, particularly among high-risk populations such as farmers and laborers. Individuals engaged in labor-intensive occupations are forced to endure prolonged exposure to adverse environmental conditions, including heat, sunlight, dust, wind, and chemical agents like fertilizers and insecticides. Despite facing heightened risk factors, this demographic often lacks access to protective equipment due to economic constraints and limited awareness.

- Approximately 20% of the population comprises individuals engaged in agricultural and labor-intensive occupations. There is a staggering 59.3% prevalence of dry eye within this population, with farmers and laborers exhibiting notably elevated risks of 32% and 28%, respectively, among dry eye patients.

The prevalence of dry eye among diabetic patients is alarmingly high, with a 67% prevalence rate. Among type 2 diabetic patients, 54.3% suffer from dry eye syndrome, further underscoring the pressing need for effective treatment solutions. This demographic represents a significant segment of the dry eye treatment devices market, highlighting the imperative for tailored interventions to address the unique needs of diabetic individuals and mitigate the impact of dry eye on their quality of life. Excessive environmental exposure contributes to this heightened risk, necessitating urgent awareness campaigns to promote the adoption of protective measures during work. While these initiatives may not entirely prevent dry eye incidence, they delay its onset and mitigate its severity.

- Dry eye disorder has a 67% prevalence rate in the diabetic population. Among type 2 diabetic patients, 54.3% suffer from dry eye syndrome, further underscoring the pressing need for effective treatment solutions.

Restraint

Limitations of the intranasal tear neurostimulator devices

Despite its potential benefits in treating dry eye, the adoption of the intranasal tear neurostimulator (ITN) device is hindered by several factors. The device is associated with common side effects, including nasal discomfort, burning, pain, nosebleeds, transient electrical discomfort, nasal congestion, facial pain, and headaches. Furthermore, its usage is contraindicated in patients with cardiac pacemakers, implanted or wearable defibrillators, or other implanted metallic or electronic devices in the head or neck, as well as those with hypersensitivity to the hydrogel coating the device probes or chronic nosebleeds.

The limitations associated with treatment options significantly narrow the eligible patient population for the device's use. The cost of the ITN device presents a significant barrier to widespread adoption. Priced at approximately $1000 with an additional monthly expense of approximately $50 for disposable tips, the device and its consumables are not covered by most insurance plans. This financial burden limits access to the device for many patients, thereby restraining the growth of the dry eye treatment devices market.

Regulatory hurdles

The medical devices are subjected to a series of regulatory tests and approvals prior to widespread human use. Authorities like the U.S. FDA and EMA thoroughly ensure the safety and efficacy of dry eye treatment devices before providing them with marketing approvals. The stringency maintained by pharma and biotechnological companies during the regulatory compliance procedure often creates additional financial and time-related issues. These may also contribute to the overall cost of the final product, significantly restraining the growth of the dry eye treatment devices market.

Opportunities

Tailored device options and personalization

In the dry eye treatment devices market landscape, a range of device options exist, each tailored to address specific indications. For instance, lacrimal intranasal neurostimulation proves beneficial for patients with aqueous tear deficiency, while scleral lenses offer advantages for those with irregular corneal surfaces, neurotrophic disease, or graft-versus-host disease. This individualized approach presents a significant opportunity in the market, particularly for patients unresponsive to conventional therapeutic options. By offering tailored device solutions, manufacturers can meet the diverse needs of patients and healthcare providers, thereby expanding their market presence and driving growth of the dry eye treatment devices market.

- In September 2023, Bausch + Lomb Corporation, a prominent global eye health company committed to enhancing people's vision and quality of life, completed the acquisition of XIIDRA, a non-steroidal eye drop specifically designed to alleviate the signs and symptoms of dry eye disease with a focus on inflammation linked to dry eye, along with other ophthalmology assets.

- In April 2023, Sun Pharmaceutical Industries Limited launched CEQUA in India, a novel ophthalmology treatment for DED with inflammation.

Advancements in technologies associated with intranasal tear neurostimulation devices

The emergence of the intranasal tear neurostimulator, recently FDA-approved for dry eye disease treatment, presents a notable opportunity in the dry eye treatment devices market. This innovative device is designed to stimulate mucosal nerves through minor electrical shocks, thereby increasing natural tear production via the nasolacrimal reflex pathway of the lacrimal function unit. This unit encompasses the lacrimal glands, ocular surface, and the sensory and motor nerves connecting these structures to maintain tear production and quality. This novel approach to DED treatment offers a promising opportunity for manufacturers and investors to tap into a growing market demand for effective, non-invasive solutions, thereby driving growth and innovation in the dry eye treatment sector.

- In December 2023, Amring Pharmaceuticals Inc. completed the acquisition of Visant Medical, Inc., a leading innovator in medical technology for dry eye disease.

- In November 2023, China Pharma Holdings, Inc. disclosed the completion of third-party testing for its dry eye disease therapeutic device.

Technology Insights

The meibomian gland expression (MGX) segment held the largest share of 43% of the dry eye treatment devices market in 2024. Combining technologies such as intense pulsed light (IPL) with MGX has demonstrated notable improvements in dry eye symptoms and meibomian gland function, particularly in patients with refractory dry eye. MGX is a well-established technology in dermatology, widely utilized for treating various skin conditions, including telangiectasia, erythema, pigmentation, and aging skin, owing to its proven therapeutic efficacy.

For the treatment of meibomian gland dysfunction (MGD)-related dry eyes, MGX offers a convenient, safe, and effective solution. In cases where meibomian glands are severely blocked, traditional methods like hot compresses and lid massage may prove ineffective. Manual MGX, preferred by many specialists, clears blockages efficiently and at a lower cost compared to other interventions. This cost-effectiveness enables more frequent treatment repetitions, contributing to the growth of the dry eye treatment devices market by providing accessible and efficient solutions for patients suffering from MGD-related dry eye conditions.

End-use Insights

The hospitals segment has held the largest revenue share of 49% in 2024, offering a diverse range of procedural therapies to tackle the condition comprehensively. These include punctual occlusion, low-level light therapy, meibomian gland thermal pulsation and expression, intense pulsed light therapy, and exfoliation. Recognition of long-term topical anti-inflammatory treatments like corticosteroids or cyclosporine for moderate to severe dry eye disease significantly evolved therapeutic approaches.

From traditional tear substitution to a more nuanced therapeutic algorithm, driven by advancements in pathophysiology understanding, diagnostic techniques, and novel therapies, the dry eye treatment devices market continues to expand. Ongoing research focusing on secretagogues, topical androgens, and new anti-inflammatory drugs promises further growth and innovation in dry eye treatment. The recent FDA approval of varenicline (Tyrvaya) administered via nasal spray adds to the treatment arsenal, highlighting a shift towards innovative delivery methods.

Dry Eye Treatment Devices Market Companies

- MiBo Medical Group

- Sight Sciences

- Lumenis

- ESW Vision

- Johnson & Johnson Vision Care

- Alcon, Inc.

Recent Developments

- In June 2023, Novartis entered into an agreement to divest its 'front of eye' ophthalmology assets in line with its focused strategy.

- In November 2022, Alcon finalized its acquisition of Aerie Pharmaceuticals, Inc., further strengthening its position in the ophthalmic pharmaceutical business.

- In January 2024, Harrow announced the availability of Vevye, a patented, non-preserved cyclosporine ophthalmic solution of 0.1%. Utilizing a "water-free" semifluorinated alkane eyedrop technology, Vevye is prescribed for twice-daily (BID) dosing in the United States.

Segments Covered in the Report

By Technology

- Broadband Light (BBL)

- Intense Pulsed Light (IPL)

- Meibomian Gland Expression (MGX)

- Combination (MGX+IPL)

By End-use

- Hospitals

- Ophthalmic Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting