What is the Electrophysiology Devices Market Size?

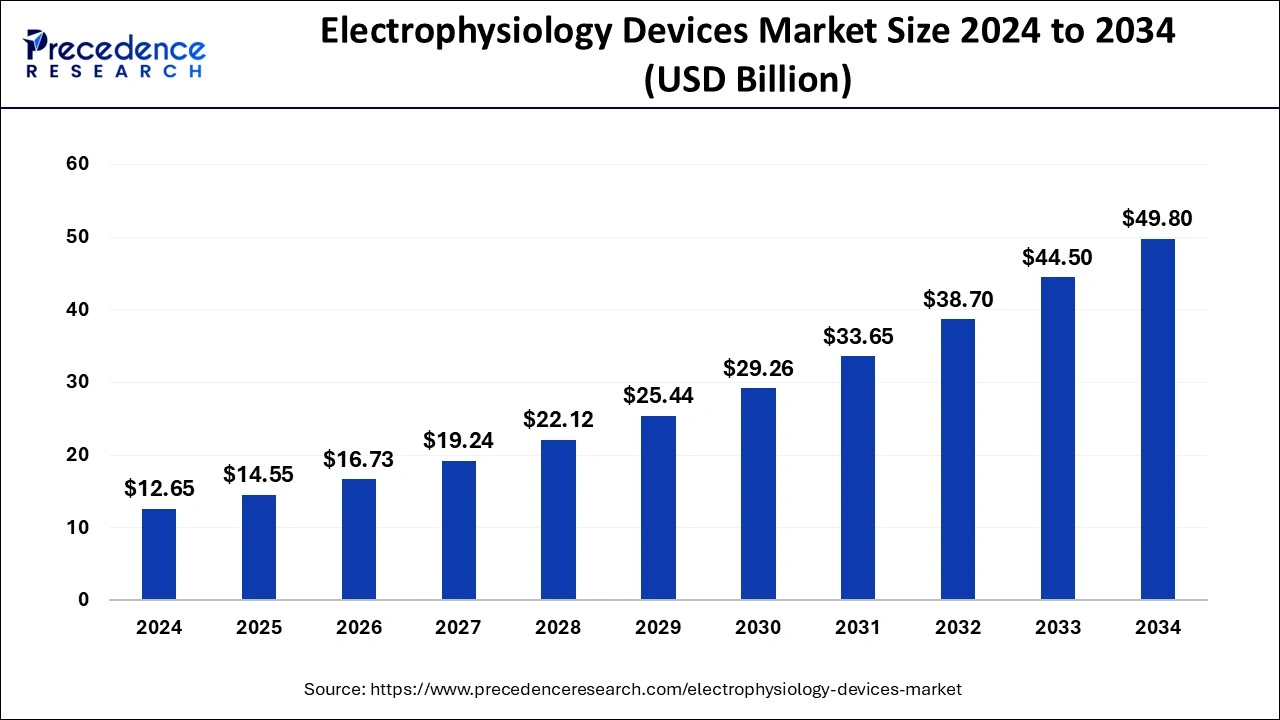

The global electrophysiology devices market size accounted for USD 14.55 billion in 2025 and is predicted to reach around USD 55.43billion by 2035 and is poised to grow at a CAGR of 14.31% from 2026 to 2035.

Electrophysiology Devices Market Key Takeaways

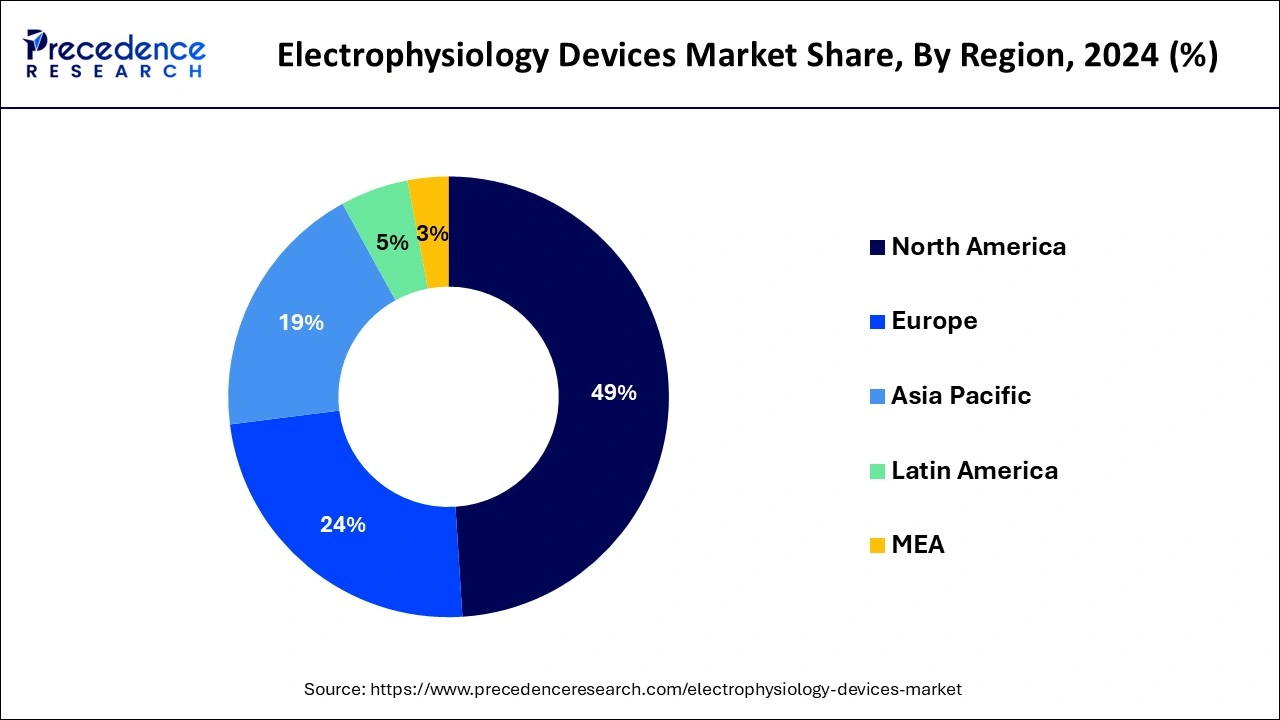

- North America led the market with the biggest market share of 49% in 2025.

- Asia Pacific is estimated to expand at the fastest CAGR during the forecast period.

- By Indication, the atrial fibrillation segment registered the maximum market share in 2025.

- By Application, the diagnostic devices segment has held a major revenue share in 2025.

How is AI contributing to the Electrophysiology Devices Industry?

AI enhances pacemaker implants by providing real-time electroanatomic mapping, automatic arrhythmia detection, outcome prediction, and signal-noise mitigation. It enhances the ablation accuracy, wearable diagnostics, simplifies implantable device monitoring, and improves the customized follow-up with highly advanced data interpretation.

Electrophysiology Devices Market Growth Factors

Increasing application of electrophysiology devices in the treatment and diagnosis of cardiovascular diseases that includes atrial fibrillation, rising demand for cardiac rhythm management devices used for continuous monitoring and increasing implementation of these devices in out-of-hospital settings are some of the high impact rendering growth drivers for the market.Growing prevalence of cardiac arrest and heart failure (HF) cases among the millennial owing to lifestyle habits such as excessive alcohol consumption and smoking is the other major factor that propels the market growth.

Introduction of new technologies that includes laser ablation, cryoablation, and ultrasound ablation as well as advanced mapping technologies are also anticipated to boost the demand of electrophysiology devices over the forecast period. Besides this, the presence of strict regulations related to the application of electrophysiology devices, high costs associated with these products, and the availability of alternative therapies are the key factors projected to impede the market growth.

Market Outlook

- Industry Growth Overview: The market is growing due to the presence of arrhythmia, aging, and the implementation of new sophisticated ablation technologies.

- Sustainability Trends: There are now shifts to catheter reprocessing, less plastics, eco-friendly designs, and the sustainability of the e-physiology lab.

- Major investors: Boston Scientific, Medtronic, Abbott, Johnson and Johnson, Siemens Healthineers, Philips Healthcare, and Biotronik are the investment drivers.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 55.43Billion |

| Market Size in 2026 | USD 16.73 Billion |

| Market Size in 2025 | USD 14.31 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.31% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Indication, Application, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Indication Insights

Atrial fibrillation leads the indication segment in the global electrophysiology devices market for the year 2025. It is a general type of arrhythmia related to high risk of blood clotting and stroke. In many cases, it remains undiagnosed in medical practices using conventional monitoring that result in inadequate treatment at the right time. Consequently, monitoring of atrial fibrillation involves enhanced technological devices for diagnosis that mitigates the limitations imposed by conventional technologies.

Application Insights

Electrophysiology diagnostic devices and treatment devices are two major application segments studied in this report. Diagnostic devices application segment accounted for the largest value share in 2025. Significant application of cardiac monitors as a standard monitoring and diagnostic tool for arrhythmias is one of the major factors attributing for the largest share of the market.

Subsequently, cardiac monitors dominated the electrophysiology diagnostic segment in 2025. The segment includes Electrocardiograph (ECG) monitors, holter monitoring devices, and Insertable Cardiac Monitors (ICM). Increasing application of these devices in interventional medical procedures for example catheter placement along with the introduction of digital and portable systems are some of the major factors expected to propel the growth of the segment during the forthcoming years.

On the other hand, the electrophysiology treatment devices segment offers lucrative growth opportunity in the coming years. Pacemakers emerged as the largest sub-segment in the year 2022. Increasing incidences of different forms of arrhythmia is one of the prime factors attributing for its rapid growth. Besides this, Automated External Defibrillators (AEDs) predicted to witness the highest growth rate over the analysis period. According to the CDC report, increase in the number of Sudden Cardiac Arrest (SCA) cases is a major threat to the population of the United States. Increased use of AEDs has proved useful in reducing the number of deaths among patients suffering from cardiac arrest outside hospitals.

Regional Insights

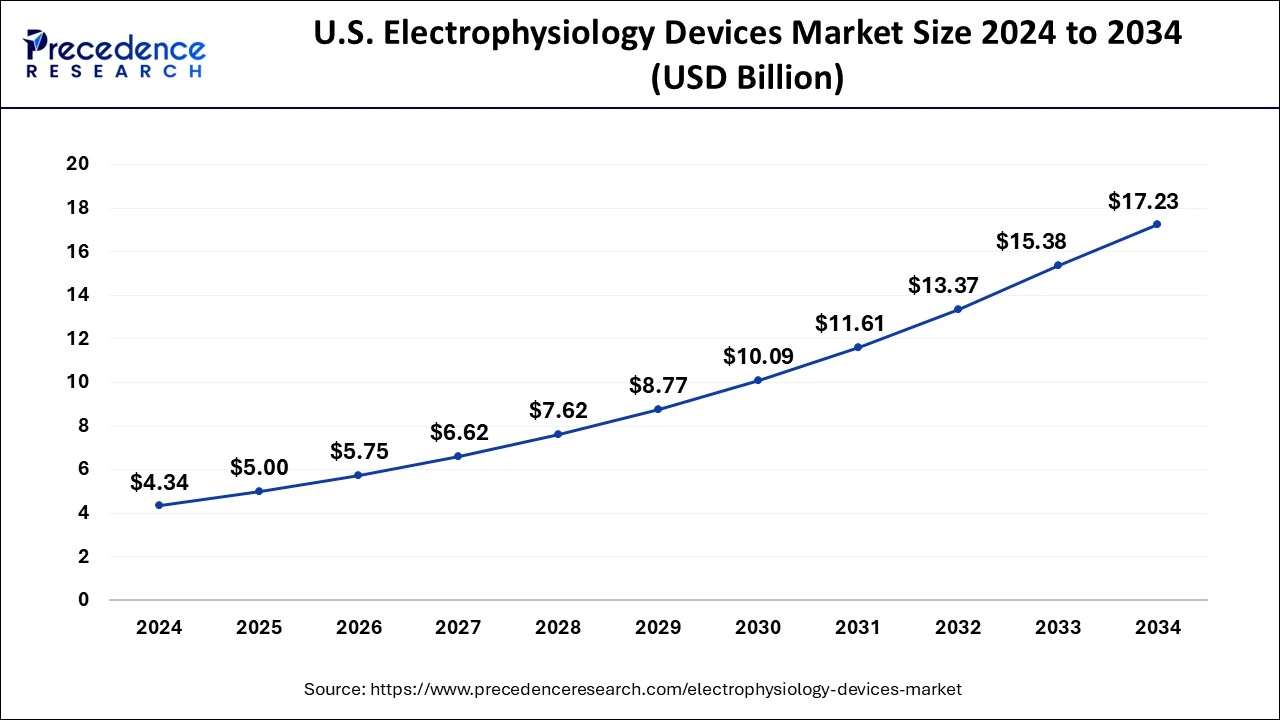

What is the U.S. Electrophysiology Devices Market Size?

The U.S. electrophysiology devices market size was valued at USD 5 billion in 2025 and is expected to be worth around USD 19.19 billion by 2035, at a CAGR of 14.40% from 2026 to 2035.

North America emerged as a global leader in the global electrophysiology devices market ad account for the largest value share of 49% in 2025. The growth of the region is primarily because of rising prevalence of cardiac arrest cases, Heart Failure (HF), and cardiac arrhythmia as a result of smoking, an unhealthy lifestyle, and alcohol consumption. The favorable reimbursement policies and presence of sophisticated healthcare infrastructure are anticipated to drive the growth of the region over the analysis period.

On the contrary, the Asia Pacific electrophysiology devices market has significant presence of untapped opportunities in reference to unmet medical requirements along with rapid growth in the incidence rates of target diseases. Furthermore, increasing patient awareness, improving healthcare infrastructure, and rising healthcare expenditure levels in the region are anticipated to assist manufacturers in grabbing maximum advantage on these available opportunities. Rapid developments in the healthcare infrastructure coupled with rise in disposable income in emerging economies such as China and India are likely to provide new opportunities and avenues for the market players to get maximum benefit over the forecast period.

What Are the Driving Factors of the Electrophysiology Devices Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe is highly adopting advanced technologies in electrophysiology that are backed by research funds. High-density mapping systems and next-generation catheters are more popular in the market. Such clinical centers focus on the accuracy of procedural applications, the use of innovation as a pathway of care, and the incorporation of AI tools into traditional cardiac treatment systems.

Germany Electrophysiology Devices Market Trends

Germany is the foremost country in Europe in terms of the application of modern technologies of the catheter and the developed cardiac facilities. Complex mapping systems are overwhelmed with high volumes of procedures. Intervention is still centered on the minimization of collateral tissue destruction, enhancing ablation accuracy and complex arrhythmias with expert electrophysiology skills.

Value Chain Analysis of the Electrophysiology Devices Market

- R&D: To find, filter, and invent electrophysiology devices with the help of thorough scientific research and testing.

Key Players: Biosense Webster (J&J), Abbott, Boston Scientific, Medtronic, Biotronik - Clinical Trials and Regulatory Approvals: Human study to prove safety, efficacy, and regulatory approval.

Key Players: FDA, CE (Europe), Medtronic, Boston Scientific, Abbott - Formulation and Final Dosage Preparation: This is the process of combining components into final device forms that are appropriate to clinical electrophysiology procedures.

Key Players: Osypka Medical, CathRx, MicroPort, CardioFocus - Packaging and Serialization: Defending devices and leaving them traceable and counterfeit-impossible with unique identification systems.

Key Players: West Pharmaceutical Services, CCL Industries, Steris, Amcor, Becton Dickinson - Distribution to Hospitals, Pharmacies of Electrophysiology Devices: Distributing completed devices to hospitals and clinical electrophysiology care facilities.

Key players: Medtronic, Abbott, Boston Scientific, J&J, Cardinal Health

Electrophysiology Devices Market Companies

- Medtronic Plc: Offers pulsed field ablation, cryoablation, and sophisticated mapping systems that comply with all-encompassing arrhythmia treatment packages.

- Abbot Laboratories: Provides cardiac mapping solutions and a variety of ablation catheter portfolios that allow quality electrophysiology intervention.

- Boston Scientific Corporation: FARAPULSE pulsed field ablation, left heart access, and advanced cardiac mapping technology.

Other Major Key Players

- Biotronik SE & CO. KG

- Biosense Webster, Inc.

- Nihon Kohden Corporation

- GE Healthcare

- Microport Scientific Corporation

- Siemens AG

- Koninklijke Philips N.V.

Key Companies & Market Share Insights

The global electrophysiology devices market seeks intense competition with companies observing to extensive R&D investments and new product development as sustainability strategies. Companies such as Abbot Laboratories, Medtronic Plc., Boston Scientific Corporation, and Biosense Webster, Inc. (Johnson & Johnson) hold significant brand recognition and strong product portfolios.

The market players are adopting inorganic growth strategies to strengthen their product portfolio along with cementing their foothold in the market. For instance, in January 2019, Medtronic Plc acquired EPIX Therapeutics, a private medical device company that designs and manufactures wide range of cardiac electrophysiology devices.

Recent Developments

- In September 2025, Johnson & Johnson and Boston Scientific dominate the US electrophysiology devices market. Johnson & Johnson has a longstanding majority share, while Boston Scientific's Farawave catheter leads in revenue. Future trends suggest Boston Scientific may challenge Johnson & Johnson's position, per GlobalData.

(Source: https://www.expresshealthcare.in ) - In July 2025, Philips Medisize's TheraVolt medical connectors simplify device integration, enhance equipment longevity, reduce customization time, and lower costs. This enables efficient solutions and flexibility for medical device firms working on PFA treatments for atrial fibrillation patients. (Source: https://www.mddionline.com )

Segments Covered in the Report

By Indication

- Atrial Fibrillation (AF)

- Atrioventricular Nodal Re-entry Tachycardia (AVNRT)

- Supraventricular Tachycardia

- Bradycardia

- Wolff-Parkinson-White Syndrome (WPW)

- Others

By Application

- Diagnostic Devices

- Diagnostic Electrophysiology Catheters

- Holter Monitoring Devices

- EP Mapping & Imaging Systems

- Electrocardiograph (ECG)

- Insertable Cardiac Monitors (ICM)

- Others

- Treatment Devices

- Automated external defibrillators (AEDs)

- Implantable Cardioverter Defibrillators (ICDs)

- CRT-D

- CRT-P

- Catheters

- Pacemakers

- Others

By End-User

- Ambulatory Surgical Centers

- Hospitals

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting