What is the Embedded Computing Market Size?

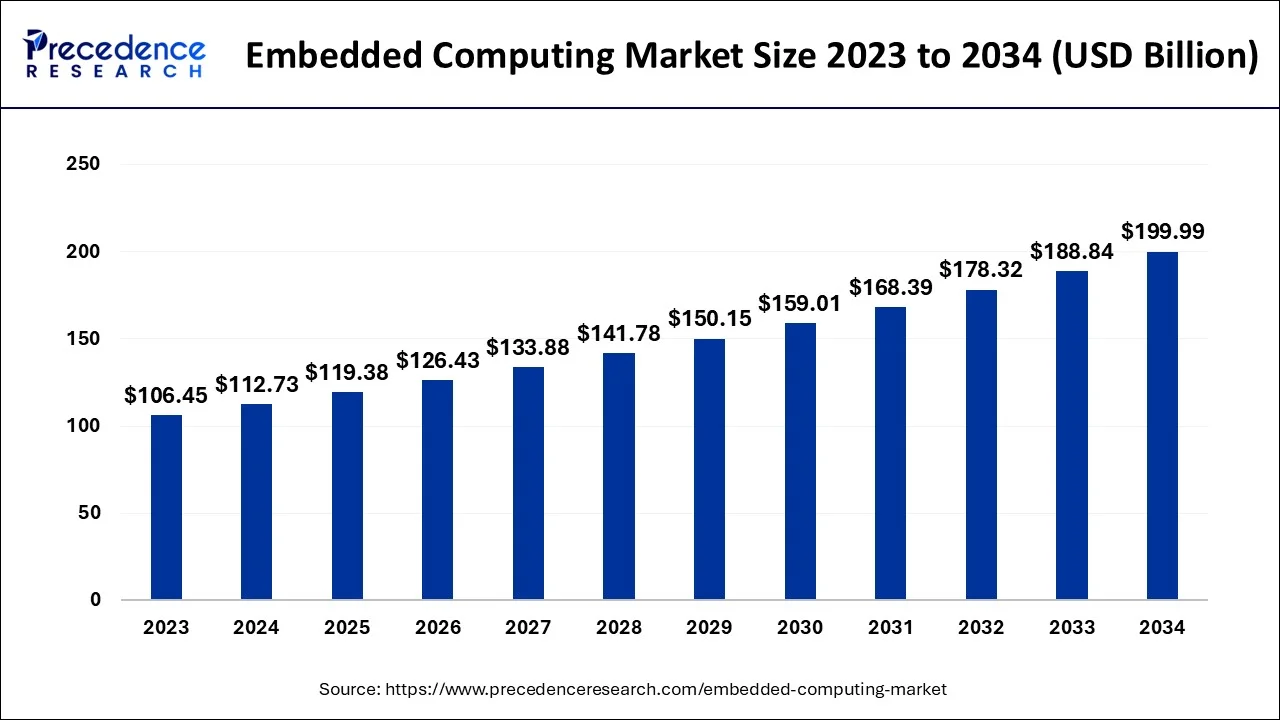

The global embedded computing market size is calculated at USD 119.38 billion in 2025 and is predicted to increase from USD 126.43 billion in 2026 to approximately USD 210.72 billion by 2035, expanding at a CAGR of 5.85% from 2026 to 2035.

Embedded Computing Market Key Takeaways

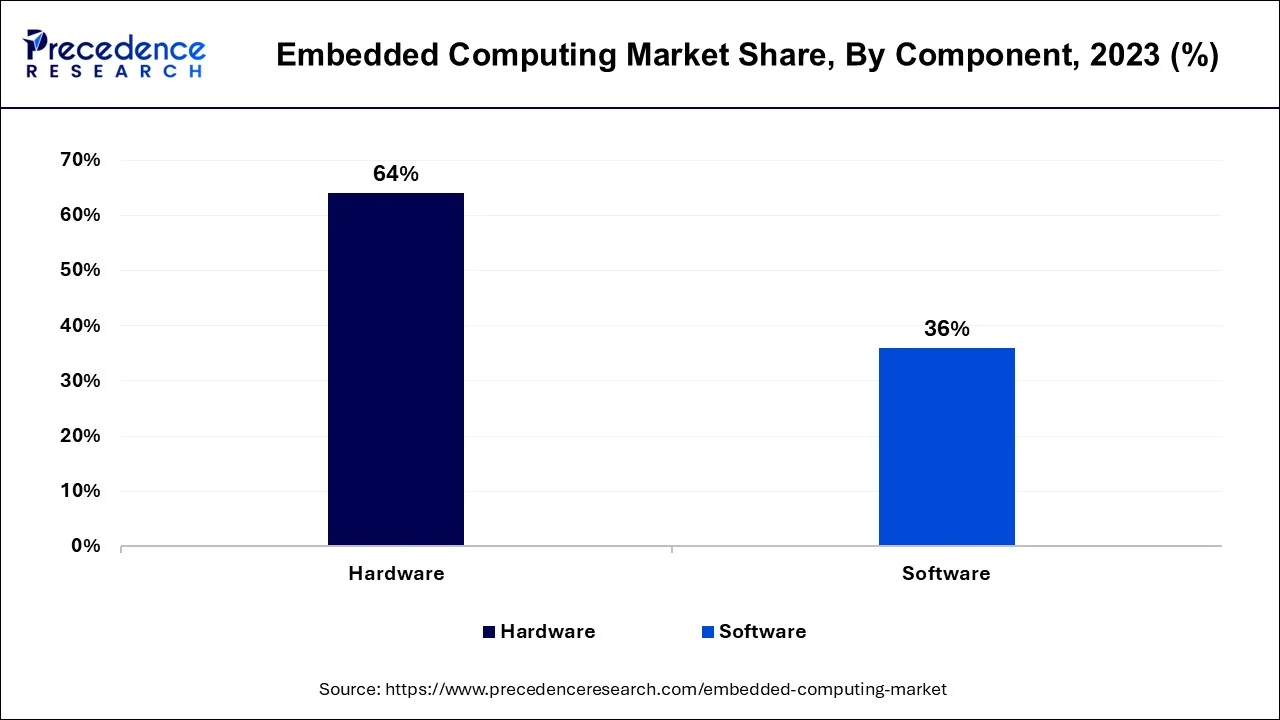

- Based on component, the hardware segment has had highest market share 64% in 2025. However, the software segment is anticipated to grow at a noteworthy CAGR from 2026 to 2035.

- Based on end user, the communication segment accounted largest share of around 30% in 2025. However, the automotive segment is forecast to grow at a notable CAGR between 2026 to 2035.

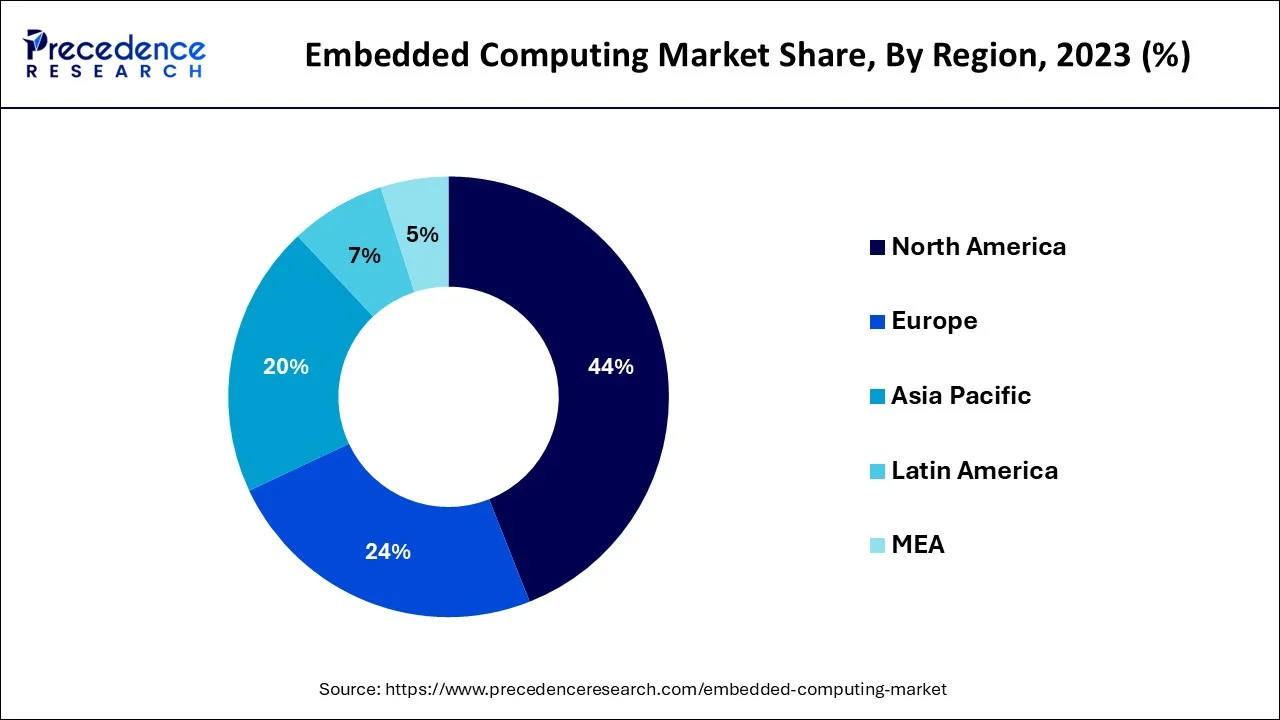

- North America region dominated the market with revenue share of around 44% in 2025. However, Asia-Pacific is anticipated to grow at a significant CAGR over the forecast period.

Strategic Overview of the Global Embedded Computing Industry

Embedded systems are task-specific, which means they are created to carry out a single task as opposed to a number of tasks. Although an embedded system's precise design is dependent on the task for which it is intended, most embedded systems have a CPU, a power source, memory, and communication ports. The use of embedded systems has numerous advantages. For instance, they are very adaptable and inexpensive, making it simple and affordable to customize them to precise functional and performance needs. Additionally, they use little power, which lowers the system's overall energy expenditures. It carries out tasks like processing data, reading sensor inputs, displaying necessary output, producing & delivering commands, and transforming data. The consumer electronics, personal care, healthcare, banking, telecommunications, automotive, security, office automation, home applications, and smart card industries are just a few of the industries where it is extensively used.

The surge in consumer electronics use and the increased use of artificial intelligence in a number of applications around the world have boosted the market for embedded computing. The development of technology in the healthcare and industrial sectors, as well as the rise in demand for automated processes in the automotive and smart home appliance industries, are other factors that influence the global embedded computing market.

Artificial Intelligence: The Next Growth Catalyst in Embedded Computing

AI is profoundly impacting the embedded computing market by enabling devices to move beyond pre-programmed instructions to become smarter, more autonomous, and capable of making real-time decisions. This shift, often referred to as ‘'Edge AI”, allows data processing to occur locally on the device, significantly reducing latency, conserving bandwidth, and enhancing data privacy and security compared to cloud-based systems.

Key applications driving this transformation include autonomous vehicles, industrial automation, and sophisticated healthcare monitoring devices that can analyze complex data like images, audio, and sensor inputs to proactively manage tasks like predictive maintenance or patient care.

Embedded Computing Market Growth Factors

In the automotive sector, embedded systems are essential. These systems are utilized by the ADAS technology found in hybrid and electric automobiles. The market for embedded computers has expanded as a result of the rise in demand for electric and hybrid vehicles brought on by public awareness of the environment's declining condition. This increases the need for the hardware and software utilized in embedded systems in EVs. The advancement of computer technologies has increased their integration into electronic systems. The embedded system provides a number of applications for electronics systems. A few examples of embedded system applications are cars, smart homes, office automation, and home appliances. Other businesses are now employing embedded systems, such as the military, the defense industry, and the healthcare sector. Rising R&D spending in areas including the automotive, medical, aerospace, and electronics is opening up opportunities for market participants. The global market is driven by product innovation and changing dynamics in developing countries.

The primary driver propelling the market's expansion is the increasing demand for and adaptation of electronic consumer goods and industrial gadgets. The use of embedded computing technology in the healthcare, automotive, artificial intelligence (AI), and many other industries is another driver fueling the growth of the market for performing research in medical science. In the healthcare sector, embedded computing is employed in surgery and treatment tools, patient monitoring systems, and diagnostic and imaging equipment. They are utilized in equipment and systems employed in the life sciences sector for bioinformatics, proteomics, and genome sequencing.

Market Outlook

- Market Growth Overview: The embedded computing market is expected to grow significantly between 2025 and 2034, driven by advancements in edge computing and AI, focused on security and connectivity, and Internet of Things proliferation.

- Sustainability Trends: Sustainability trends involve energy-efficient architectures, circular economy principles, integration with renewable energy systems, and edge computing and AI for efficiency.

- Major Investors: Major investors in the market include Intel Capital, Qualcomm Ventures, Robert Bosch Venture Capital, and ADM.

- Startup Economy:The startup economy is focused on Edge AI and machine learning, robust cybersecurity and safety, and open source hardware and software.

Key Trends of the Embedded Computing Market

- Embedded Architectures that are AI Native: In addition to their traditional use as parts of computer systems, embedded processors are also being designed with AI accelerators. As such, these types of systems can process an enormous amount of data in real time at the edge without relying heavily on cloud-based systems.

- Post Quantum Embedded Security: Device manufacturers are now incorporating the utilization of quantum-safe crypto into embedded devices, ensuring they will not be vulnerable to future advancements in cybersecurity techniques.

- Energy Efficiency Innovations at the Edge: Battery-operated devices now require ultra-low-power performance so that they may continue to sense and collect data without needing to be charged each day.

- Industrial ARM Ecosystem is Expanding Rapidly: The added flexibility, scalability, and improved performance per watt of the ARM architecture make it a superior choice for use in many industrial applications.

- Software-Enabled Innovations for Embedded Systems: Advanced Software Development Frameworks and Software Development Kits (SDKs) are simplifying the development process of deploying AI-based technologies, thereby enabling developers to build products faster and have more time to spend working on future innovations.

- Smart Infrastructure Using Embedded Systems: Traffic management systems, smart grids, and urban monitoring systems now require autonomous decision-making; therefore, there has been a surge in the implementation of embedded systems that support these applications.

Embedded Computing Market Trade analysis

Semiconductor supply chain localization efforts influence global trade in embedded computing.

As countries place greater emphasis on developing domestic production capabilities for embedded processors and modules, there is an increase in export demand for these types of products used in both automotive electronics and industrial automation applications.

As geopolitical trade dynamics shift, embedded chip products with high value are emerging as strategic assets for many countries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 119.38 Billion |

| Market Size in 2026 | USD 126.43 Billion |

| Market Size by 2035 | USD 210.72 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.85% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Application, Geography |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Segment Insights

Component Insights

Depending upon the component, the hardware segment hit largest revenue share in 2025. The growth is related to rising living standards, a greater public understanding of technology, and an increase in the country's disposable income. Additionally, as a result of their technological developments, increased understanding, and reasonably priced consumer electronics. People are inclined towards technology hence, the demand for embedded systems is increasing with time.

In addition, due to their advancements, increased awareness of technologies, and affordable consumer electronics, Asia-Pacific and LAMEA are anticipating a potential expansion in the hardware market throughout the projection period. These elements provide the hardware sector substantial growth potential.

Due to expanding industrial development activities, embedded computing is becoming more and more widespread worldwide, but especially in emerging nations. The significant reforms implemented by various governments in their individual countries are blamed for the growth of the embedded computer sector. The usage of embedded computers has also increased due to the expansion of industrial operations because they save time and aid in the automation of machines. In the near future, rising industrial development activities in emerging economies are expected to fuel the market.

Application Insights

During the projected period, the communication segment is anticipated to be the largest in the embedded computing market. The communication sector segment heavily relies on embedded computer systems as a result of population increase and the development of the Internet of Things (IoT). The rise in popularity of consumer electronics goods including mobile phones, laptops, tablets, personal computers, satellites, televisions, and radar as well as the drop in their prices contributed to the expansion of embedded computing in the communication business. Consumers are adopting new devices at high rate which encourages the sales of embedded computing devices in the market.

The section of the automotive industry is anticipated to grow at the fastest rate in the future years. This is a result of the fast rising deployment of sophisticated embedded systems. For various functions including audio systems, security, and ignition, automakers install embedded computing systems in their vehicles. The development of vehicles that are more network-savvy, safe, and energy-efficient is another area where major automakers are likely to engage in technology innovation, which is expected to create profitable growth prospects for the automotive industry.

During the projection period, the healthcare segment is expected to increase significantly. The market is expanding since embedded systems are increasingly being used in healthcare devices like imaging, CT, MRI, and vital sign monitors. A smaller operating system called an embedded system is made to carry out one or two particular functions. Data storage with embedded systems is common in the healthcare industry. It is typically required for OEMs to select industrial grade embedded systems since healthcare applications may be employed in harsh operating environments with temperature variations, exposure to shock and vibration, and more. Industrial-grade items are built to resist those difficult circumstances without losing any functionality. In addition, doctors can use telemedicine and other remote systems to diagnose patients, monitor their health remotely, and decide on a course of treatment helping to embedded systems used in biomedical applications. It is anticipated that there would be a rise in the need for industrial embedded computer systems, which will speed up market expansion. The availability of advanced patient monitoring solutions with improved embedded computing systems has also been made possible by a rise in awareness regarding the deployment of cutting-edge technology for better patient care.

Process control and industrial automation markets are significant end consumers of motherboards and other electronic components like microcontrollers, microprocessors, and graphics cards and have shown to be quite reliable in terms of embedded computer design and development. Industrial automation calls for robust designs that can withstand hostile conditions, high performance, maximum power efficiency, a wide range of I/O, and communication interfaces.

Regional Insights

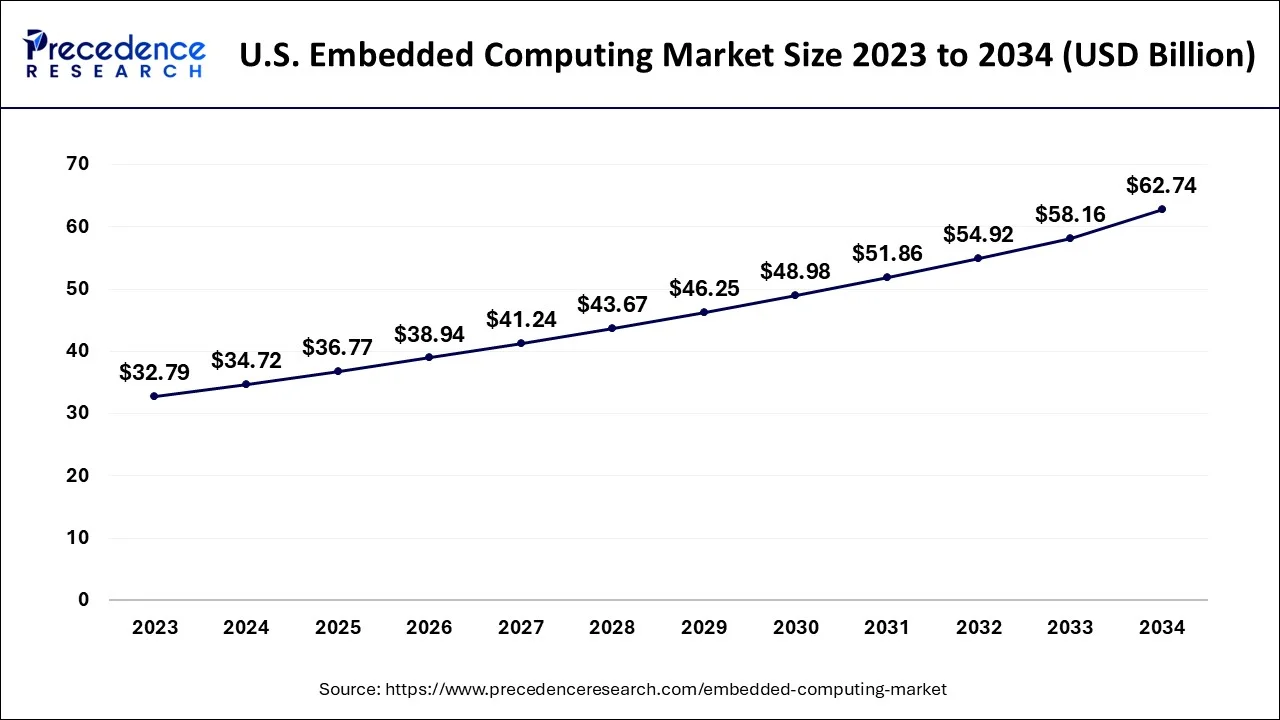

U.S. Embedded Computing Market Size and Growth 2026 to 2035

The U.S. embedded computing market size is evaluated at USD 36.77 billion in 2025 and is predicted to be worth around USD 66.43 billion by 2035, rising at a CAGR of 6.09% from 2026 to 2035.

The highest market share and dominant position in the embedded computing industry belong to North America. The strong rate of technological adoption and the existence of significant providers in North America are related. Demand for embedded computers is also rising as a result of the expanding IoT applications and robotics businesses in the area. Additionally, a robot-housed embedded system connects all of the different components. Robots would be reliant on external computing systems without an embedded system, raising the risk of communication glitches and delays between the robot and its external control system.

U.S. Embedded Computing Market Trends

The U.S.'s embedded computing market is experiencing significant growth, driven by the integration of AI and machine learning, innovation in government support and semiconductor, and emphasis on cybersecurity and energy efficiency. The deployment and expansion of 5G technology in the U.S. is boosting the demand for advanced embedded solutions that can manage high-speed data transfer and low-latency communication in connected infrastructure and devices, such as smart cities and autonomous vehicles

Asia-Pacific is considered as one of the leading regions in the embedded computing market. This region includes China, Japan, India, and rest of the world. During the forecast period, the market in Asia Pacific is anticipated to grow at a significant CAGR. Rising per capita income and continuous, extensive urbanization and industrialization are reasons that are driving Asia Pacific's embedded computer industry forward. Additionally, it is anticipated that the availability of inexpensive electronic goods in Asia and the Pacific will increase demand for microprocessors and microcontrollers in the region. High demand for embedded system hardware, such as microprocessors and controllers, is anticipated in Asia Pacific due to the growing use of autonomous robots and embedded vision systems in industrial applications. Throughout turn, this raises demand in Asia Pacific during the subsequent years.

China Embedded Computing Market Trends

China's technological localization and self-sufficiency, the integration of AI and edge computing, and the adoption of open-source architectures. Increased connectivity, ensuring robust cybersecurity trends.

How did the European Embedded Computing Market Experience Notable Growth?

The Industry 4.0 initiative, particularly strong in countries like Germany and France, has been a major catalyst for growth. This push for smart factories, automation, and data exchange has led to increased demand for robust, real-time embedded systems in industrial automation and manufacturing to improve operational efficiency and productivity.

Germany Embedded Computing Market Trends

Germany's embedded computing market is experiencing the rising importance of secure IoT connectivity, edge computing, and the integration of artificial intelligence for enhanced functionality. This expansion is further supported by collaborative government and industry initiatives aimed at fostering innovation and establishing security standards.

Value Chain Analysis of the Embedded Computing Market

- Hardware Component Design & Manufacturing: This foundational stage involves the research, design, and fabrication of the core physical components that form the embedded system, such as microprocessors (MPUs), microcontrollers (MCUs), and application-specific integrated circuits (ASICs).

Key Players: Intel Corporation, Renesas Electronics Corporation, NXP Semiconductors, Infineon Technologies AG, Texas Instruments Incorporated, STMicroelectronics, Microchip Technology Inc., Qualcomm Incorporated, AMD, and Samsung Electronics. - Software Development & Integration: This stage involves creating the operating systems (OS), middleware, and application-specific software that runs on the embedded hardware.

Key Players: Microsoft Corporation, IBM Corporation, Green Hills Software, Wind River Systems, and the hardware players - System Integration & Board Manufacturing: In this stage, the various hardware components (processors, memory, I/O ports, etc.) and software are integrated onto a single printed circuit board (PCB) or system-on-module (SoM) to create a functional, application-ready embedded computing solution.

Key Players: Advantech Co., Ltd., Kontron S&T AG, ADLINK Technology, and Eurotech SpA, - Distribution & Sales: Once the systems are manufactured and tested, they are moved through various channels, including direct sales, distributors, and value-added resellers, to reach the original equipment manufacturers (OEMs) or final end-users.

- Aftermarket Services & Support: This final stage involves post-deployment activities such as system maintenance, updates, technical support, and ongoing service agreements.

Top Companies in the Embedded Computing Market & Their Offerings

- Arm Holdings Plc.: Arm designs the underlying architecture used in the majority of microcontrollers and processors for embedded systems, licensing these efficient, low-power designs to other manufacturers.

- Fujitsu Limited: Fujitsu provides highly reliable embedded computing solutions, including boards, systems, and specialized components primarily targeted at industrial automation, medical, and public infrastructure applications.

- Intel Corporation: Intel provides powerful processors and comprehensive platforms often utilized in high-performance embedded computing applications such as industrial PCs, medical imaging, and networking equipment. They are key contributors in segments requiring significant processing power and broad software compatibility.

- IBM Corporation:IBM contributes to the embedded market through its high-performance computing solutions and a significant focus on integrating embedded systems with cloud services and enterprise data platforms.

- Microchip Technology, Inc.:Microchip is a leading provider of microcontrollers, analog, and mixed-signal semiconductors, which are fundamental components for countless embedded systems across consumer, automotive, and industrial sectors.

- Microsoft Corporation:Microsoft contributes through its embedded operating systems (like Windows IoT) and cloud services (Azure IoT) that connect and manage embedded devices, facilitating data processing and analysis.

- Qualcomm Incorporated:Qualcomm provides powerful, low-power system-on-a-chip (SoC) solutions, primarily targeting mobile, IoT, and automotive applications. Their focus on wireless connectivity and processing power is vital for connected embedded devices.

- Renesas Electronics Corporation: Renesas is a major supplier of microcontrollers, analog, power, and SoC products, with a dominant position in the automotive and industrial embedded computing markets. They provide comprehensive semiconductor solutions that power safety-critical systems in vehicles and factories.

- STMicroelectronics:STMicroelectronics specializes in a broad portfolio of semiconductors, including microcontrollers, sensors, and power management ICs, that are widely used in a variety of embedded applications, particularly consumer electronics, industrial automation, and automotive systems.

- Texas Instruments Incorporated: Texas Instruments is a leading designer and manufacturer of embedded processors and analog ICs, which are critical for signal processing, power management, and control functions in all types of embedded systems.

Recent Development

- In September 2025, Ambient Scientific introduced the GPX10 Pro AI-Native SoC, designed for battery-powered edge devices with advanced neural network inference capabilities. This silicon significantly enhances performance-per-watt and supports CNNs, RNNs, LSTMs, and GRUs locally on edge platforms, reflecting a move toward localized AI processing and lower latency.

(Source- embedded.com ) - After successfully completing its acquisition of Red Hat, IBM solidified its position as the leading hybrid cloud provider, advancing the company's high-value business model and reshaping the cloud market for its enterprise.

Segments covered in the report

By Component

- Hardware

- Microprocessor

- Microcontroller

- Digital Signal Processor

- Others

- Software

By Application

- Communications

- Industrial

- Consumer Electronics

- Automotive

- Healthcare

- Energy

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting