What is the Embolic Protection Devices Market Size?

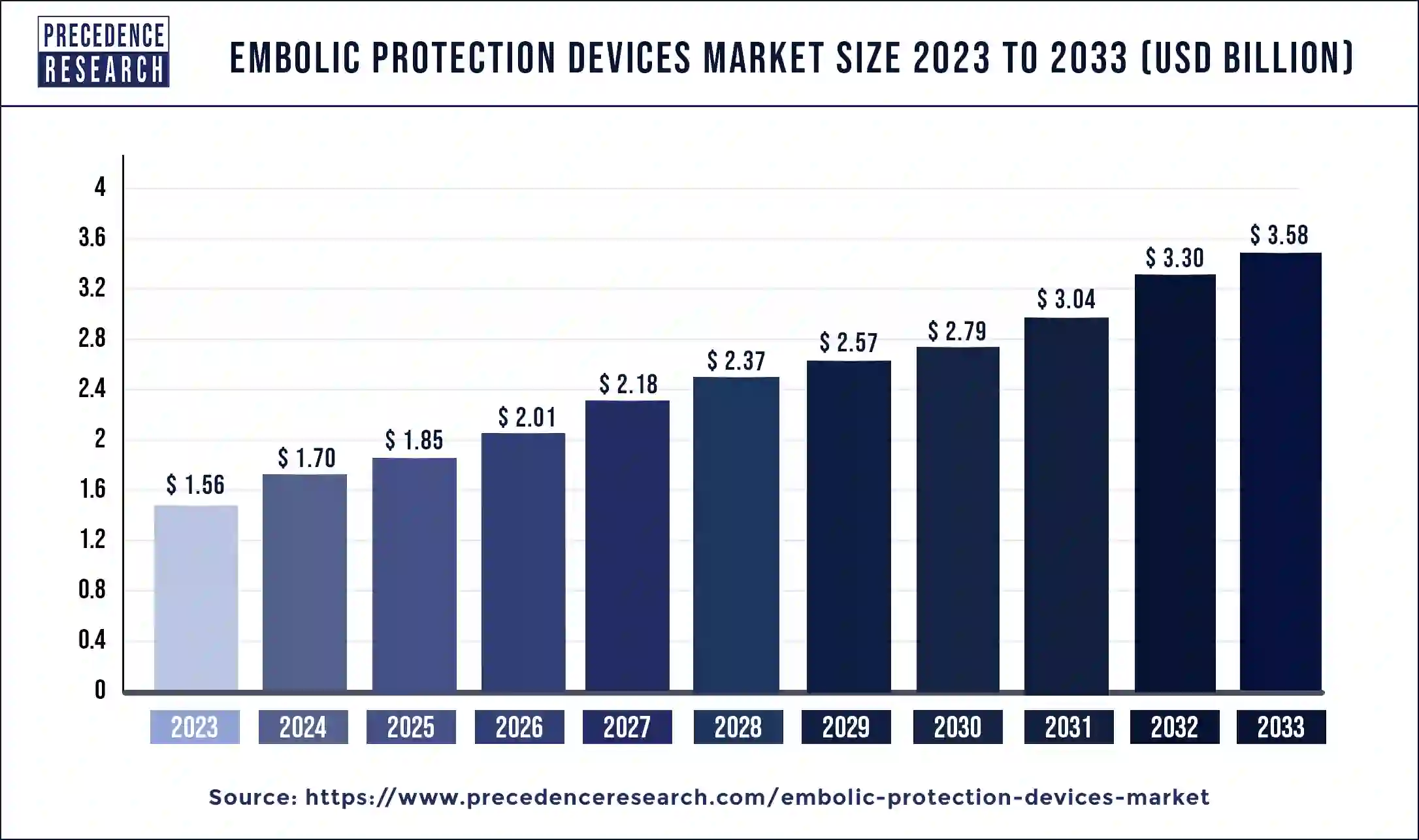

The global embolic protection devices market size is valued at USD 1.85 billion in 2025 and is predicted to increase from USD 2.01 billion in 2026 to approximately USD 3.86 billion by 2034, growing at a CAGR of 8.55% from 2025 to 2034 Rising cases of peripheral and neurovascular surgeries and heavy investments in the R&D of embolic devices are the prime factors that are propelling market growth of the embolic protection devices market.

Embolic Protection Devices Market Key Takeaways

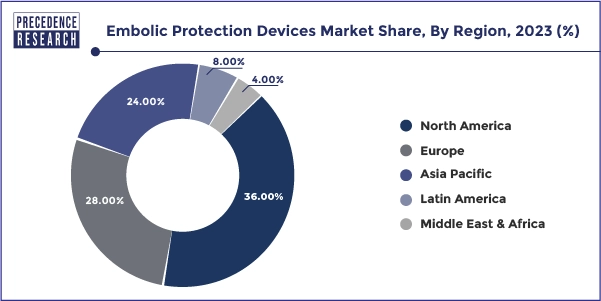

- North America has held a major revenue share of 36% in 2024.

- Asia Pacific is expected to show rapid growth in the global market during the forecast period.

- By product, the distal occlusion systems segment held a significant share of the market in 2024.

- By product, the proximal occlusion systems segment is expected to grow rapidly in the market over the projected period.

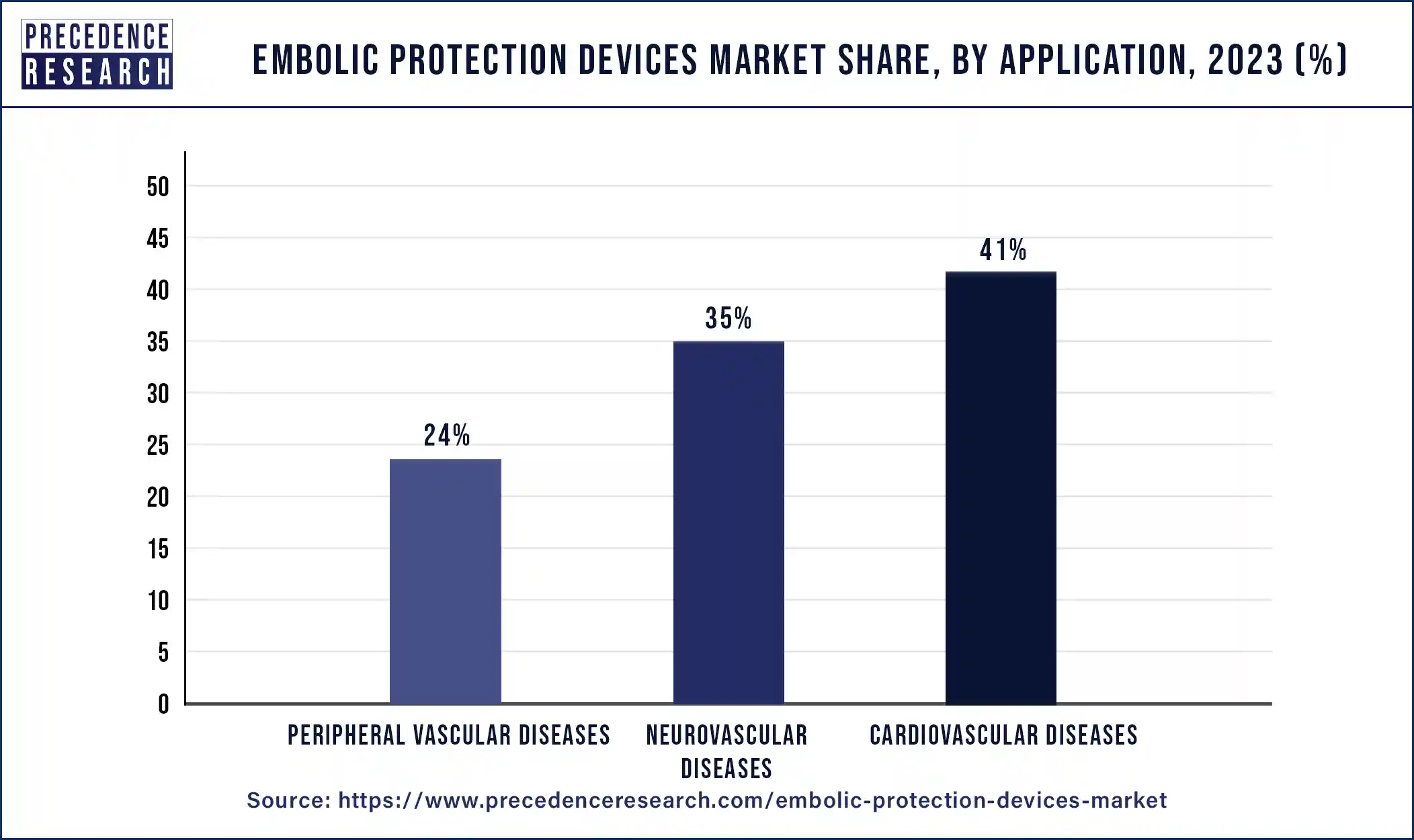

- By application, the cardiovascular diseases segment has contributed more than 41% of revenue share in 2024.

- By application, the peripheral vascular diseases segment is expected to witness the fastest growth in the market over the forecast period.

Market Overview

Embolic protection devices are specialized medical instruments designed to prevent debris, blood clots, or other harmful particles from migrating during minimally invasive procedures, particularly in cardiovascular interventions. These devices function as filters or barriers, capturing emboli that could otherwise travel through the bloodstream and cause complications such as stroke or organ damage. Embolic protection devices are widely used in healthcare, playing a crucial role in minimizing post-procedural complications and preserving patient well-being. The increasing focus on reducing post-procedural complications and hospital stays has accelerated the adoption of these devices globally.

Embolic Protection Devices Market Growth Factors

- Growing preference for minimally invasive therapy is expected to fuel the embolic protection devices market.

- Raising patient education and awareness will help further the embolic protection devices market expansion.

- Increasing healthcare spending and infrastructure development by the government, as well as from market players, can boost market growth shortly.

- Technological advancements, including filter designs and material innovation, are likely to propel the embolic protection devices market in the upcoming years.

- By protecting vital arteries and reducing the risk of embolization, the embolic protection devices market enhances the safety and success rates of procedures such as angioplasty, stent placement, and atherectomy.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.85 Billion |

| Market Size in 2026 | USD 2.01 Billion |

| Market Size by 2034 | USD 3.86 Billion |

| Embolic Protection Devices Market Growth Rate | CAGR of 8.55% from 2025 to 2034 |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

The growing incidence of cardiac diseases and the adoption of PCI

The embolic protection devices market is driven by the increasing prevalence of cardiovascular and neurovascular diseases, technological advancements, and the frequent introduction of new products by key market players in the diagnostic field. Additionally, the growing government initiatives in research and development for pre-diagnostics contribute to revenue growth.

EPDs capture blood and debris inside Saphenous vein grafts (SVGs), preventing distal embolization during stenting procedures. Using EPDs is the most effective method for reducing periprocedural myocardial infarction and major adverse cardiovascular events during SVG treatments. The American College of Cardiology recommends the use of EPDs whenever it is feasible.

- In September 2023, EnCompass Technologies received conditional investigational device exemption (IDE) approval from the US Food and Drug Administration to begin the US pilot study of its Fâ‚‚ cerebral embolic protection (CEP) system.

Restraint: Adverse events

In the embolic protection devices market, despite technological advancements, embolic protection devices carry risks of complications such as embolization, vascular injuries, and device malfunctions. Concerns about safety and effectiveness, particularly in high-risk situations, may discourage patients and healthcare professionals from using these devices. Furthermore, some patients and healthcare professionals may prefer alternative treatments, such as medical therapy or conventional surgery, over interventional procedures using embolic protection devices. Factors influencing this preference include patient comorbidities, clinical judgment, and perceived risks.

Opportunity: New possibilities in emerging economies

Emerging economies such as India, China, and South Africa are driving the growth of the global embolic protection devices market. Contributing factors include the increasing prevalence of chronic diseases, increasing private healthcare investments, rising income levels, growing healthcare awareness, and government initiatives to develop rural healthcare. Companies like Boston Scientific, Terumo, Stryker, and Medtronic are capitalizing on growth opportunities in these regions by increasing R&D investments and expanding their presence. They are also building and expanding manufacturing facilities in these countries due to the availability of low-cost labor and a large patient population.

- In January 2022, Cardiovascular Systems, Inc. initiated a recall of their WIRION Embolic Protection Device due to instances of filter breakage during retrieval.

Product Insights

The distal occlusion systems segment held a significant share of the embolic protection devices market in 2023. These devices are designed to be placed distally in the vessel to capture and prevent emboli from reaching critical organs during invasive cardiovascular procedures. Distal occlusion filters have become popular due to their effectiveness in reducing the risk of embolization and their compatibility with various interventional procedures. They offer benefits such as ease of use, improved patient safety, and clinical outcomes, which makes them the preferred choice for many healthcare professionals.

The proximal occlusion systems segment is expected to grow rapidly in the embolic protection devices market over the projected period. Proximal occlusion devices provide cerebral protection by reversing blood flow from the internal carotid artery into the arterial guide sheath, which serves as the conduit for deploying devices across the carotid bifurcation. The growing recognition of their effectiveness in preserving cerebral and peripheral circulation has led to increased adoption among healthcare professionals, driving demand for these devices.

- In October 2023, interventional treatment solutions provider Sirtex Medical commercially introduced the LAVA liquid embolic system. LAVA is claimed to be the first and only liquid embolic that has been approved to treat peripheral vascular hemorrhage. The system offers volume and viscosity options for optimizing the flexibility required for the treatment of patients with controlled target vessel occlusion.

Application Insights

The cardiovascular diseases segment dominated the embolic protection devices market in 2024. Cardiovascular diseases include conditions such as coronary artery disease, valvular heart disease, and peripheral artery disease. These often require invasive procedures like percutaneous coronary intervention (PCI) or transcatheter aortic valve replacement (TAVR), where embolic protection devices are essential in preventing complications. The global prevalence of cardiovascular diseases and the increasing use of minimally invasive procedures have driven the dominance of the cardiovascular segment in the market.

- According to the WHO, Cardiovascular diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives each year. Cardiovascular diseases kill 10,000 people in the WHO European Region every day, with men dying more frequently than women.

- In June 2023, Interventional cardiologists performed the world's first TAVR with a new embolic protection device. A new-look embolic protection device from Nevada-based EnCompass Technologies has been used for the very first time to help cardiologists complete transcatheter aortic valve replacement (TAVR) procedures.

The peripheral vascular diseases segment is expected to witness the fastest growth in the embolic protection devices market over the forecast period. Peripheral vascular disease (PVD) is a blood disorder that causes the arteries and veins outside of the brain and heart to narrow due to plaque formation after surgery. The peripheral diseases segment is expected to grow positively due to increased awareness of minimally invasive procedures and rising lifestyle disorders.

Regional Insights

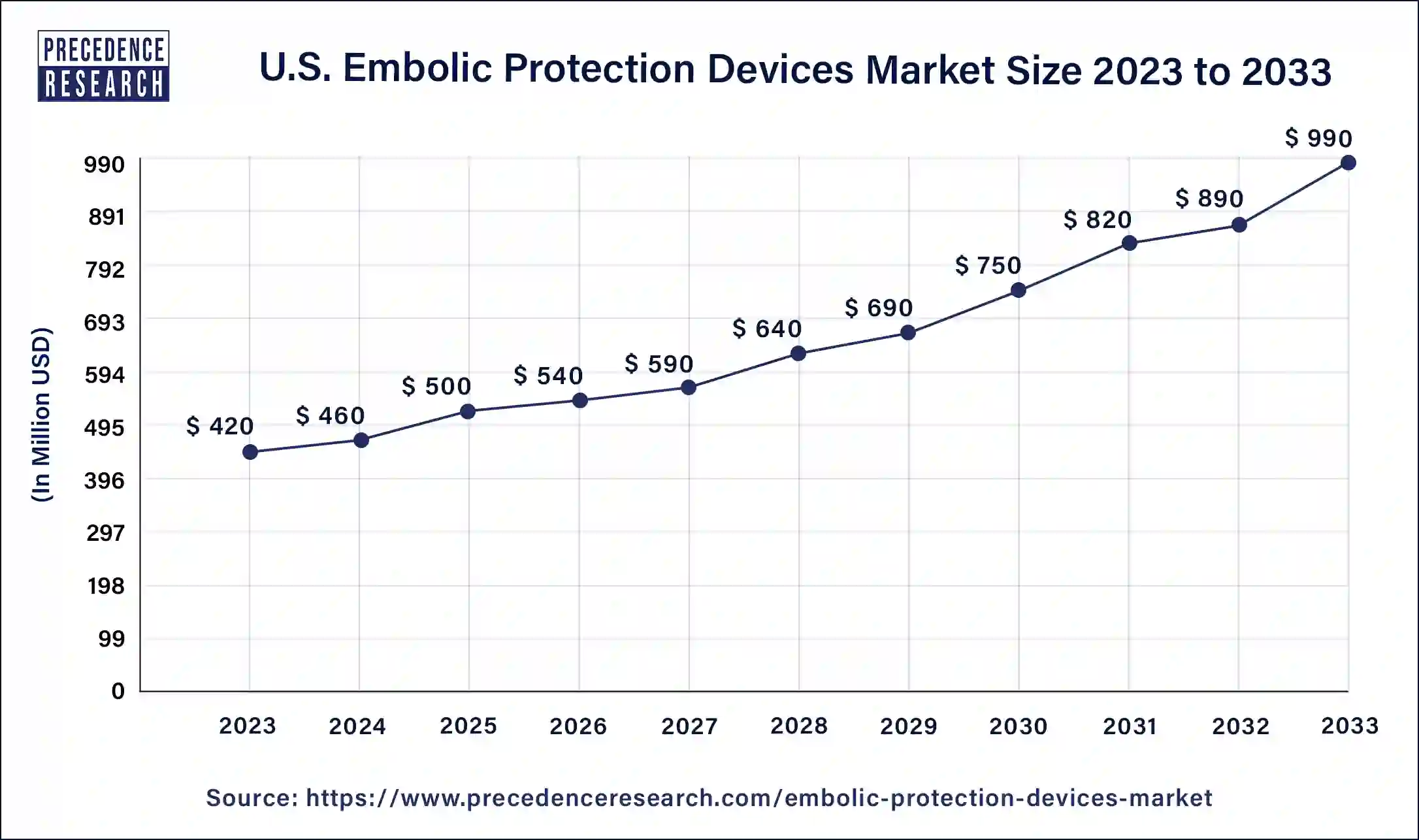

U.S. Embolic Protection Devices Market Size and Growth 2025 to 2034

The U.S. embolic protection devices market size was estimated at USD 500 million in 2025 and is predicted to be worth around USD 1,080 million by 2034 with a CAGR of 8.91% from 2025 to 2034.

North America's region dominated the global embolic protection devices market in 2024. The region's robust healthcare infrastructure, technological advancements, and high prevalence of cardiovascular diseases drive the demand for effective embolic protection strategies. Well-established healthcare facilities, a strong focus on patient safety and outcomes, favorable reimbursement policies, and a tendency to adopt innovative medical technologies can further promote the use of embolic protection devices in various cardiovascular interventions.

According to the Centers for Disease Control and Prevention, Heart disease is one of the leading causes of death in the United States, with one person dying every 33 seconds from cardiovascular disease. Nearly 695,000 people in the United States died from heart disease in 2021, which is 1 in every five deaths. It is estimated that 805,000 people suffer from heart attacks in the United States every year.

- In January 2023, Boston Scientific Corporation received FDA approval for its IN.PACT Admiral™ drug-coated balloon (DCB) for the treatment of patients with symptomatic peripheral artery disease (PAD).

Asia Pacific is expected to show rapid growth in the global embolic protection devices market during the forecast period. The region is experiencing rapid market growth due to several factors, including a growing elderly population, increasing incidence of cardiovascular diseases, improved access to healthcare services, and rising healthcare infrastructure investments.

Additionally, rising disposable incomes, an expanding medical tourism industry, and greater awareness of the benefits of minimally invasive procedures are driving the demand for embolic protection devices. Furthermore, supportive government initiatives and collaborations between regional and international market players are expected to further fuel market growth in Asia Pacific in the coming years.

- In September 2023, Penumbra and Asahi Intecc, a Japanese medical device manufacturer, announced that they would collaborate to introduce Penumbra's Indigo aspiration system into the Japanese market upon regulatory approval. Penumbra's Indigo aspiration system can be used to remove emboli and thrombi from vessels of the peripheral arterial and venous systems and for treatment of pulmonary embolism.

Embolic Protection Devices Market Companies

- Abbott Laboratories

- Allium Medical Solutions Ltd.

- Boston Scientific Corporation

- Cardinal Health Inc.

- Contego Medical LLC

- Innovative Cardiovascular Solutions LLC

- Edwards Lifesciences Corporation

- Medtronic Inc.

- Silk Road Medical Inc.

Recent Developments

- In November 2024, EmStop unveiled the completion of the ‘Controlled Arterial Protection to Ultimately Remove Embolic Material' (CAPTURE-1) early feasibility clinical study, which assessed the EmStop embolic protection system. The trial is expected to align with the company's goal of developing and commercialising the integrated embolic protection system intended for protected transcatheter aortic valve replacement (TAVR).

- In April 2024, Emboline, Inc., announced the acquisition of a significant portfolio of key intellectual property from SWAT Medical AB for aortic embolic protection during interventional cardiology procedures. This acquisition adds to Emboline's existing comprehensive portfolio of platform technologies that reduce the risk of stroke and ischemic damage to other organs resulting from embolic debris released into the bloodstream during minimally invasive procedures such as Transcatheter Aortic Valve Replacement (TAVR).

- In November 2023, Filterlex Medical Ltd., a cardiovascular medical device startup based in Israel, announced the publication of a first-in-human (FIH) study of the safety and feasibility of the company's next-generation Captis full-body embolic protection device during transcatheter aortic valve replacement (TAVR) procedures.

- In January 2023, Cardinal Health Inc., a distinguished leader in healthcare services and medical products, embarked on a strategic collaboration with Palantir, a renowned technology company specializing in data integration and analysis. This innovative partnership marks a significant step forward in the realm of healthcare supply chain management.

- In February 2023, Medtronic plc announced the launch of its EnVeo™ drug-eluting stent (DES) for the treatment of patients with PAD.

- In March 2023, Terumo Corporation received a CE mark for its Zilver PTX™ DCB for the treatment of patients with PAD.

- In July 2022, Edwards Lifesciences Corporation announced the FDA approval of its Amplatzer™ Vascular Plug II for the treatment of patients with pulmonary arteriovenous malformations (PAVMs).

- In June 2022, Cook Medical announced the FDA approval of its NirMesh™ Vascular Occlusion Device for the treatment of patients with varicose veins.

- In May 2022, Johnson & Johnson Services, Inc. announced the FDA approval of its Embozene™ Microspheres for the treatment of patients with symptomatic cerebral arteriovenous malformations (AVMs).

- In October 2023, German cardiovascular medical device company Protembis secured US Food and Drug Administration (FDA) approval for its PROTEMBO Pivotal IDE Trial. The ProtEmbo System from Protembis is an intra-aortic filter device offering protection for the brain from embolic material released during a transcatheter aortic valve replacement (TAVR) procedure.

Segments Covered in the Report

By Product

- Distal Occlusion Filters

- Proximal Occlusion Filters

- Distal Filters

By Application

- Neurovascular Diseases

- Cardiovascular Diseases

- Peripheral Vascular Diseases

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting