What is the Endoscopic Spinal Surgery Equipment Market Size?

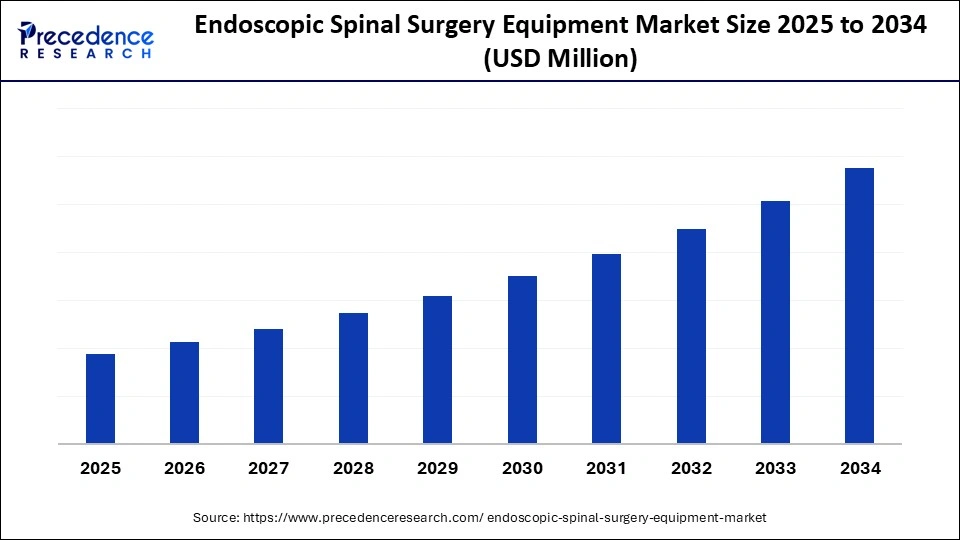

The global endoscopic spinal surgery equipment market is witnessing rapid growth as surgeons increasingly adopt minimally invasive techniques for spinal disorders, offering improved outcomes and shorter recovery times.The market growth is driven by rising demand for minimally invasive procedures, technological advancements, and the increasing prevalence of spinal disorders.

Market Highlights

- North America dominated the endoscopic spinal surgery equipment market with the largest market share of 40% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product type, the endoscopes segment led the market in 2024.

- By product type, the navigation and guidance systems segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By procedure type, the interlaminar endoscopic surgery segment captured the biggest market share of 40% in 2024.

- By procedure type, the transforaminal endoscopic surgery segment is expected to expand at a notable CAGR over the projected period.

- By application, the herniated disc repair segment contributed the highest market share of 45% in 2024.

- By application, the spinal stenosis treatment segment is expected to expand at a notable CAGR over the projected period.

- By end user, the hospitals segment generated the major market share of 50% in 2024.

- By end user, the ambulatory surgical centers (ASCs) segment is expected to expand at a notable CAGR over the projected period.

“Minimally Invasive Precision Boosts Endoscopic Spine Surgery Growth”

The endoscopic spinal surgery equipment market is driven by patient and surgeon preference for less invasive procedures with faster recovery times. Increased incidences of spinal disorders, an older population, and advancements in imaging and navigation technology are also increasing utilization. Hospitals and specialty surgery centers are purchasing more advanced endoscopic devices to improve precision and outcomes for patients. Furthermore, there is more awareness about decreased postoperative complications, leading to increased utilization. North America is the highest in utilization, while the Asia Pacific region shows strong growth in modernization in healthcare.

What are the Key Trends of the Endoscopic Spine Surgery Equipment Market?

- Increasing Prevalence of Spinal Disorders: The demand for advanced endoscopic technology, which allows for effective and minimally invasive surgical procedures, is due to the rise of degenerative spinal diseases, as well as age-related disorders like herniated discs.

- Improvement of Technology and Equipment: The advancement of imaging systems, navigation technology, and high-definition visualization tools will all contribute to improved accuracy of surgery, reduced risk, and global uptake of endoscopic spinal surgery equipment.

- Shift to Minimally Invasive Surgeries: Patients and surgeons are increasingly favoring minimally invasive surgery because of faster recovery time, fewer complications, and improved results. Demand for advanced endoscopic spinal surgery devices and systems is directly linked to these trends.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Procedure Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Innovation Transforming Endoscopic Spinal Surgery Amid Rising Global SCI Cases?

A key driver for the global endoscopic spinal surgery equipment market is the convergence of technological innovation and increased long-term spinal health needs. Over 15 million people are living with spinal cord injury (SCI) globally, and demand for safer and less invasive treatment options is strong. (Source: https://www.who.int)

Modern 4K endoscopic systems now provide surgeons with high-definition visibility of spinal structures, allowing complex surgeries to be performed using smaller incisions. Endoscopic discectomy volumes grew 8.58% between 2017 and 2021 according to Medicare data, while traditional microdiscectomy decreased 27.78%, showcasing the emergence of these expert-driven endoscopic spinal surgery techniques in practice throughout the world.(Source: https://www.jmisst.org)

Restraint

What is Constraining the Use of Endoscopic Spinal Surgery Devices Worldwide?

A primary constraint to the global market for endoscopic spinal surgery devices is a lack of trained surgeons and the skill development required to use these tools and techniques. While the procedure is benefit qualified as minimally invasive, becoming fluent in the endoscopic skills and techniques required may require both significant practice and training focused on endoscopic skills, which is relevant to many spinal surgeons, which is still limiting acceptance.

Opportunity

What Future Impact Can Robotics and Surgical Navigation Have on the Evolution of Endoscopic Spinal Surgery?

One key opportunity in the global endoscopic spinal surgery equipment market is the increased adoption of sophisticated navigation and robotics-assisted intra-operative guidance. Researchers have developed hybrid robot-aided, navigation-assisted systems with 1.02 mm accuracy associated with screw placement in spinal procedures; trials in cadaveric settings showed an 84-90% placement grade being A on the Gertzbein-Robbins scale. (Source: https://www.researchgate.net)

These advances present a tremendous opportunity to mitigate surgical risk, optimize patient outcomes, and enhance the complexity of cases to be performed via endoscopy - all generating a greater need for equipment that can deliver robotics, navigation, imaging, and enhanced visualization. Only time will tell how this field and future markets evolve.

Segment Insights

Product Type Insights

Which Product Type Dominated the Endoscopic Spinal Surgery Equipment Market in 2024?

The endoscopes segment led the market in 2024, with the rigid endoscopes sub-segment holding around 35% revenue share, because of their accuracy, durability, and compatibility with minimally invasive spine surgeries. Rigid endoscopes are still the most commonly used instruments in endoscopic spine surgery. Thorough imaging provided by rigid endoscopes (such as endoscopic views of complex pathology) has encouraged surgeons to select them over other imaging tools and has led to continued utilization in hospital settings internationally.

Navigation and guidance systems are rapidly being adopted due to the reduction in complications and increased accuracy of surgery associated with advanced imaging and real-time tracking. The increasing demand for safer surgery with improved results has pressured hospitals and ambulatory facilities to integrate guidance and navigation systems into their procedures and to support the growth of this category of products.

Procedure Type Insights

Which Is the Most Dominant Procedure Type in the Endoscopic Spinal Surgery Equipment Market?

The Interlaminar endoscopic surgery held a 40% share of the endoscopic spinal surgery equipment market in 2024, for its versatility in spinal procedures, as well as its familiarity among surgeons. Its minimally invasive technique permits effective treatment of lumbar spine conditions while producing less collateral tissue damage, less significant recovery times, and increased comfort to the patient and has therefore been widely adopted. Transforaminal endoscopic surgery is becoming increasingly popular as it provides access to challenging regions of the spine with minimal interruption. The increase in procedures performed on an outpatient basis and advancements in endoscopic technology are responsible for the increasing popularity of transforaminal endoscopic procedures, making it the fastest-growing procedure type in endoscopic spinal surgery.

Application Insights

Which Application Segment Dominates the Endoscopic Spinal Surgery Equipment Market in 2024?

The herniated disc repair dominated the endoscopic spinal surgery equipment market in 2024 with around 24% market share, due to its frequency in patients and the efficacy of minimally invasive treatments. Endoscopic cases allow for meticulous disc removal, less postoperative discomfort, and a quicker time to recovery, benefiting patients and surgeons alike. In the treatment of spinal stenosis, development is advancing quickly as the aging population requires minimally invasive treatment for nerve decompression. New endoscopic instruments and awareness of less invasive treatment are allowing more hospitals and surgery centers to offer these cases.

End User Insights

Which End User Has the Largest Endoscopic Spinal Surgery Equipment Market Share?

The hospitals dominated the endoscopic spinal surgery equipment market in 2024 with 50% of market share, because of their ability to perform complex cases with a specialized surgical team. Hospitals have the infrastructure to perform a large number of surgeries, which is why they are the largest driver of market demand. Ambulatory surgical centers (ASCs) are a growing end user because ASCs are focused on providing cost-effective, minimally invasive procedures. ASCs have benefited from more patients requesting outpatient care with shorter recovery times and a lower cost of operations; therefore, demand for endoscopic spinal surgery products is increasing quickly in ASCs.

Regional Insights

Why is North America Dominating the Endoscopic Spine Surgery Equipment Market?

North America maintains its leading position as a result of established hospital systems, high healthcare expenditure per capita, and concentrated surgical centers of excellence that experience rapid adoption of fully-endoscopic techniques and capital equipment. Large academic systems and private specialty hospitals, which have multi-disciplinary spine programs, facilitate piloting instrumentation that allows for faster clinical validation, reimbursement pathway work, and device modification.

The United States leads regional leadership via concentrated centers of innovation, solid regulatory pathways to get devices approved, and a large number of high-volume spine programs that publish clinical outcomes and train surgeons in endoscopic techniques. Hospital and specialty centers have reported favorable comparative outcomes and faster patient throughput for endoscopic procedures for select conditions; these clinical data are instrumental to hospital buying decisions and discussions with payers.

Why is Asia Pacific Projected to be the Fastest-Growing Region During the Forecast Period?

The = progress in Asia Pacific is evolving based on expanding healthcare capacity, an increasing need for minimally invasive procedures, and targeted investments in surgical training and simulation. Increased industry participation in education and partnerships with local distributors streamline technology transfer, while younger cohorts of surgeons are adopting endoscopic workflows in an effort to lead recovery times, a popularity that makes APAC the fasted adoption frontier for these devices.

China leads the APAC region owing to the rapid expansion of hospitals, large procedure/volume, and an active pipeline of domestic and international collaborations with a focus on minimally invasive spine solutions. Tertiary centers offer increasing structured training for the adoption of endoscopic techniques, along with multicenter outcome registries that further validate the indications for endoscopic utilization. These discussions regarding procurement are further swayed based on the documented reduction in perioperative morbidity and sooner patient turnover.

Is Europe Contributing to Growth Endoscopic Spinal Surgery Equipment?

The current expansion of utilization of endoscopic spinal surgery equipment in Europe is steady and ongoing, primarily due to the well-established healthcare ecosystem and focus on minimal intervention across the region. The increasing incidence of spinal pathology among the aged population, expansion of hospital construction, and faster recovery associated with endoscopic spinal systems are all factors that are stimulating the utilization of these endoscopic systems. In addition, medical educational programs and conferences in European countries can help improve the awareness of advanced spinal surgical techniques, accelerating penetration of technology through the several surgical facilities.

Germany Endoscopic Spinal Surgery Equipment Market Trend

Germany is well-positioned to lead the region in part because of its strong manufacturing base for medical technology, the well-equipped hospitals, and the competent neurosurgeons proficient with minimal intervention. German health care institutions are investing significantly in high-definition visualization systems, robotic-assisted devices, and navigation manual devices to enhance clinical efficiencies and surgical precision

Is Middle East & Africa Becoming an Emerging Region?

The Middle East & Africa (MEA) region is quickly becoming a potential growth region for endoscopic spinal surgery equipment due to healthcare infrastructure expansion, increasing patient awareness of treatment options, and government-funded surgical center investments. The increasing prevalence of spinal conditions related to lifestyle and greater access to specialty care is leading hospitals to invest in more advanced endoscopic platforms that are less invasive. In addition, in the Gulf nations, medical tourism is generating additional demand for advanced spinal surgery technologies.

South Africa Endoscopic Spinal Surgery Equipment Market Trend

South Africa is leading the way in the region due to its well-developed tertiary hospitals and skilled orthopedic and neurosurgical workforce. Private healthcare networks have begun to integrate minimally invasive spine technologies to improve recovery time and outcomes of surgical interventions. Furthermore, hospitals have partnered with global medical device manufacturers to aid in technical know-how for spine surgery, which has further established South Africa as a regional epicenter for the training and use of advanced spinal surgery technology.

Value Chain Analysis

- R&D: Research and development activities focus on improving visualization, precision tools, and integration with robotics, and various forms of equipment are designed to meet the increasing demand for minimally invasive spinal surgery procedures with safety outcomes for patients.

- Component Manufacturing: Often, optics, surgical tools, and navigation systems are manufactured through advanced engineering to provide quality assurance in terms of durability, accuracy, and seamless integration into an end-to-end complete endoscopic spinal surgery product line.

- Distribution and Supply Chain: Distribution channels incorporate the use of direct supply to hospitals, third-party distributors, and online platforms. While serving their role to get equipment to the field, they also ensure compliance with oversight organizations and ongoing product education.

- End User: Hospitals, ambulatory surgical centers, and specialty clinics purchase devices to perform minimally invasive procedures to reduce the time for recovery, improve surgical precision, and improve standards of patient care.

- After-Sale Maintenance: The manufacture always provides ongoing service, technical support, and equipment upgrades to maintain system reliability, extend the product lifecycle, and remain aligned with medical technology and surgical innovation trends.

Endoscopic Spinal Surgery Equipment Market Companies

- Agilyx

- Pyrowave

- Polystyvert

- GreenMantra Technologies

- Veolia

- SUEZ

- MBA Polymers

- Trinseo

- INEOS Styrolution

- BASF

- Brightmark

- Erema

- APK AG

- KBR

- Waste Management, Inc.

- CleanTech

- Plastic Recycling, Inc

- Avangard Innovative

- Ravago Group

- TotalEnergies

Recent Developments

- In October 2023, joimax launched iLESSYS Biportal Interlaminar Endoscopic Surgical System for the treatment of spinal conditions. A special Triangulation Tool to simplify the access triangulation of two ports, specific working with in-built irrigation outflow control for precise water management.(Source: https://www.biospace.com)

- In December 2024, Carlsmed, Inc. announced they have received FDA 510(k) clearance for the aprevo Cervical ACDF Interbody System. Mike Cordonnier, Chairman and CEO of Carlsmed Stated, “This 510(k) clearance is a major step forward in our mission to make personalized spine surgery the standard of care.”(Source: https://www.businesswire.com)

Segments Covered in the Report

By Product Type

- Endoscopes

- Rigid Endoscopes

- Flexible Endoscopes

- Visualization and Imaging Systems

- Surgical Instruments

- Forceps and Dissectors

- Retractors and Dilators

- Cannulas and Trocars

- Energy Devices

- Navigation and Guidance Systems

- Accessories and Consumables

By Procedure Type

- Interlaminar Endoscopic Surgery

- Transforaminal Endoscopic Surgery

- Thoracic Endoscopic Surgery

- Cervical Endoscopic Surgery

- Others

By Application

- Herniated Disc Repair

- Spinal Stenosis Treatment

- Degenerative Disc Disease

- Spinal Fusion Assistance

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Orthopedic and Spine Clinics

- Research and Academic Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting