What is the Spinal Access Systems Market Size?

The global spinal access systems market size is calculated at USD 6.30 billion in 2025 and is predicted to increase from USD 6.71 billion in 2026 to approximately USD 11.05 billion by 2034, expanding at a CAGR of 6.44% from 2025 to 2034. The market is experiencing robust growth, driven by the rising prevalence of spinal disorders, an aging global population, and significant investments in advancing healthcare infrastructure.

Market Highlights

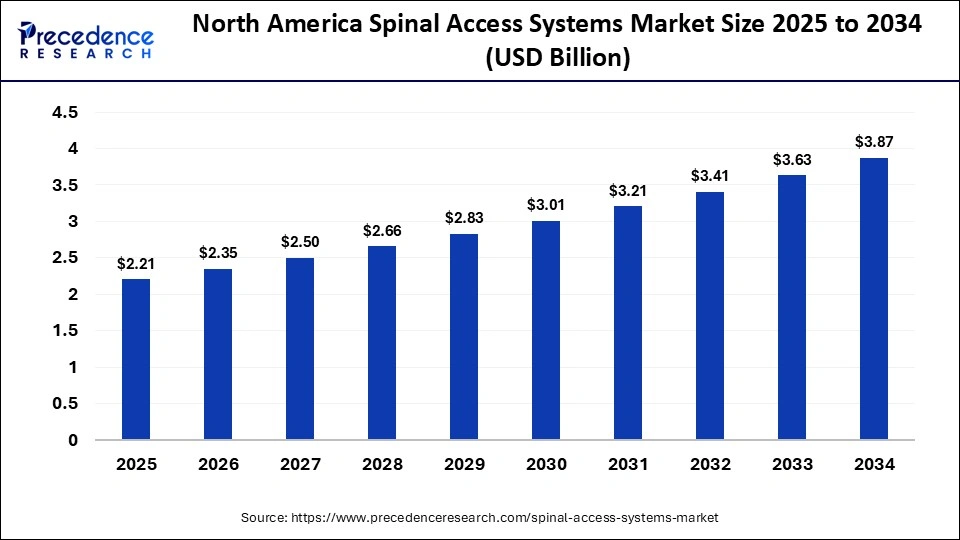

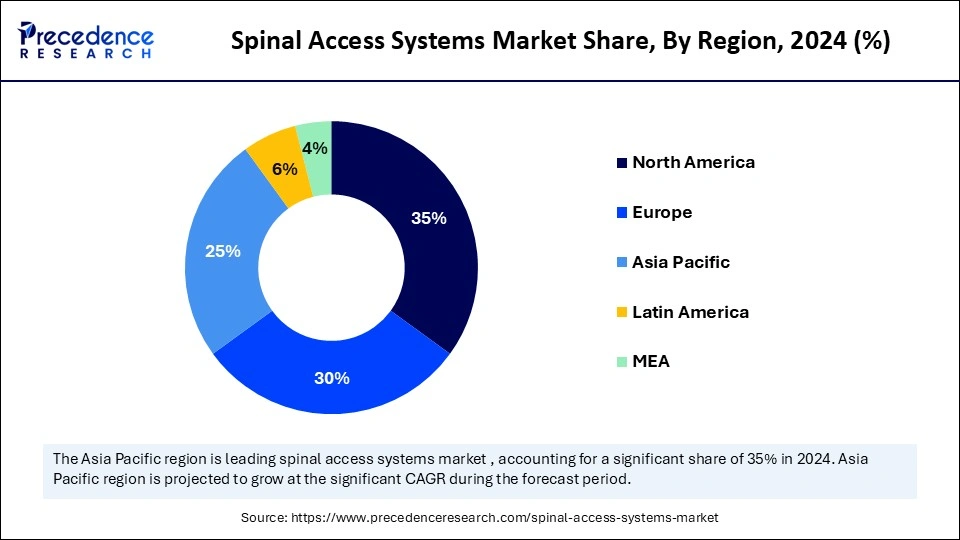

- North America accounted for the largest market share of 35% in 2024.

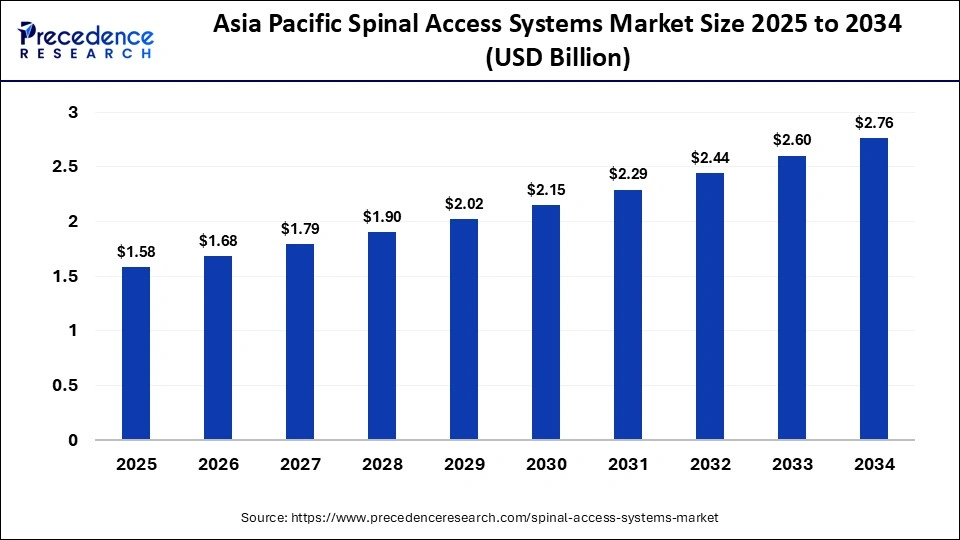

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By product type, the pedicle screw systems segment held the major market share of 55% in 2024.

- By product type, the interbody fusion devices segment is expected to witness a significant share from 2025 to 2034.

- By material type, the titanium segment contributed the highest market share of 45% in 2024.

- By material type, the PEEK segment accounted for considerable growth in the global spinal access systems market 2025 to 2034.

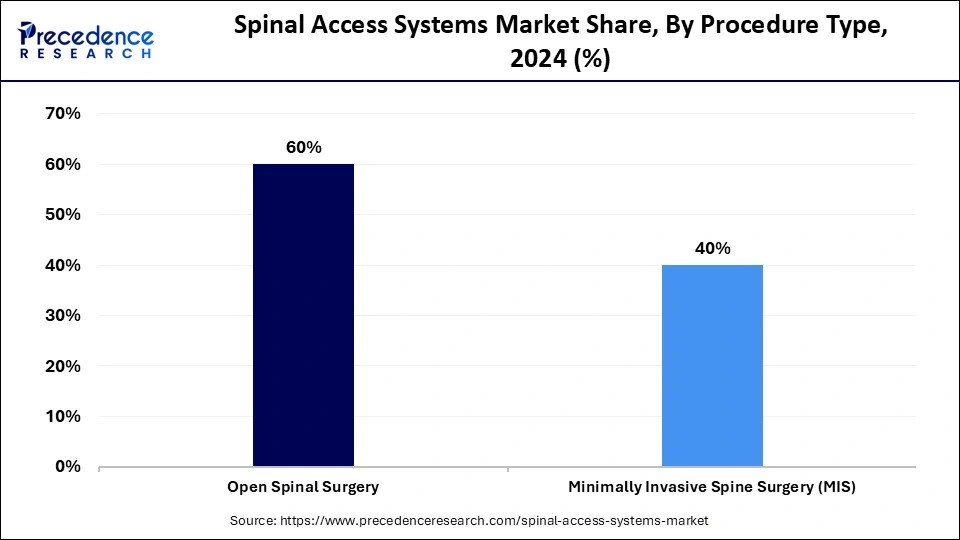

- By procedure type, the open spinal surgery segment dominated the market, accounting for 60% in 2024.

- By procedure type, the minimally invasive spine surgery (MIS) segment is expected to grow significantly 2025 to 2034.

- By application, the degenerative spine disorders segment accounted for the highest market share of 40% in 2024.

- By application, the trauma & fracture segment is expected to grow at a remarkable CAGR 2025 to 2034.

- By end-user, the hospitals segment generated the highest market share of 65% in 2024.

- By end-user, the specialty clinics segment is projected to grow at a CAGR between 2025 and 2034.

What are spinal access systems?

An increase in conditions such as degenerative disc disease, spinal stenosis, and vertebral fractures is anticipated to drive the growth of the spinal access systems during the forecast period. The spinal access systems market comprises surgical instruments, retractors, tubular and minimally invasive access platforms, navigation-compatible access tools, expandable and rigid working channels, and ancillary disposables used to gain, maintain, and optimize access to the spinal column during diagnostic, decompression, and fusion procedures.

This market covers products for open, minimally invasive (MIS), and percutaneous spinal approaches across cervical, thoracic, and lumbar indications. It includes both reusable instrument systems and single-use access devices designed to reduce tissue trauma, shorten operative time, and enable integration with imaging, navigation, and implant systems.

Key Technology Shifts in the Spinal Access Systems Market

In the rapidly evolving technological landscape, Artificial Intelligence (AI) and machine learning (ML) emerge as a transformative force for the growth and significant innovation in the spinal access systems market by offering innovative solutions to longstanding challenges in spine care. Artificial intelligence (AI) integration is reshaping the management of spine care by enhancing surgical systems for improved patient access, planning, and execution. The application of AI on spinal access systems allows for better surgical adjustments based on instant and real-time imaging feedback. AI can predict potential complications and personalize the approach based on an individual's unique anatomy and risk factors, improving overall patient outcomes.

Major Trends in the Spinal Access Systems Industry

- Shift toward Minimally Invasive Surgical (MIS) Techniques: Minimally invasive spine surgery is rapidly expanding, driving demand for smaller, modular access systems that integrate with imaging and robotics to improve precision, reduce recovery time, and enhance OR efficiency.In August 2025, Wenzel Spine, Inc., a medical device company pioneering minimally invasive surgical and analytic solutions for spinal disorders, today announced completion of first cases and the U.S. limited commercial launch of its novel panaSIa Expandable SI Fusion System. panaSIa is the first expandable sacroiliac (SI) fusion implant cleared by the FDA and represents a breakthrough in addressing sacroiliac joint dysfunction with enhanced biomechanical stability and procedural efficiency.

- Technology Convergence: Navigation, Robotics, Digital & Smart Systems: Access systems are evolving into digitally integrated platforms with navigation, robotics, and smart features (AI, AR, data feedback), transforming them from mechanical tools into connected, intelligent surgical solutions.In April 2025, Alphatec Holdings commercially launched its Prone TransPsoas (PTP) corpectomy system, expanding the type of spine surgeries using PTP. The latest system launch, announced, includes deformity and corpectomy procedures for complex pathologies of the thoracolumbar spine.PTP Corpectomy represents a significant step forward in Atec's commitment to improving patient outcomes in the most complex spine surgeries.

- Increasing Focus on Cost-Effectiveness & Value-Based Healthcare: Hospitals seek faster recovery and lower complication rates, pushing suppliers to offer clinically proven, cost-effective access systems and develop affordable versions for emerging markets.In October 2024, Life Spine, Inc., a leading medical device company specializing in the design, development, manufacturing, and marketing of products for the surgical treatment of spinal disorders, announced the ongoing adoption of its ProLift Micro Endoscopic Expandable Spacer System. This system utilizes the same Micro Invasive tube for access, disc preparation, and interbody delivery, further advancing the company's approach to Micro Invasive fusions.

- Material Innovations & Product Evolution: New materials and modular designs are making spinal access systems lighter, radiolucent, and disposable, while hybrid and patient-specific solutions enhance usability and reduce infection risk. In April 2023, Spine and orthopedics company Orthofix Medical (Orthofix) launched two access retractor systems for minimally invasive spine (MIS) procedures. The commercial launch of the Lattus lateral access system and the Fathom pedicle-based retractor system bolsters the company's access solutions portfolio. The Lattus system is easy to use and provides versatility. The blade retraction strength, along with the ‘down-and-out' splay feature, allows surgeons to access challenging anatomy.

Spinal Access Systems Market Outlook

Between 2025 and 2030, the industry is expected to experience accelerated growth, driven by rising demand for spinal surgeries, an aging population, and the adoption of minimally invasive surgical techniques. Moreover, continuous technological innovation is propelling the growth of the segment. Enhanced imaging systems, navigation technologies, and ergonomic instrument designs improve surgical precision and safety.

Leading players are expanding their geographical presence due to high demand in both developed and emerging economies. For instance, in July 2025, VB Spine LLC, a global, family-led spine company dedicated to advancing patient outcomes, announced the completion of the sale of Stryker's spinal implants business in Australia and New Zealand. This milestone builds upon the formation of VB Spine on April 1, 2025, following the acquisition of Stryker's U.S. spinal implants business by Viscogliosi Brothers, LLC. It also marks VB Spine's first market entry outside the United States and establishes a direct presence in two fast-growing markets.

Several strategic investors are actively engaged in the market, accelerating growth during the forecast period. For instance, in October 2025, In Hospital for Special Surgery (HSS), the nation's top-ranked orthopedic hospital, is joining General Atlantic, a leading global investor, in its launch of a new, independently operated national platform of ambulatory surgery centers (“ASCs”) dedicated to delivering advanced, patient-centered orthopedic and spine outpatient care.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.30 Billion |

| Market Size in 2026 | USD 6.71 Billion |

| Market Size by 2034 | USD 11.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.44% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material Type, Procedure Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Major Breakthroughs in the Spinal Access Systems Market

| Date | Breakthrough Particular |

| In March 2025 | Tenon Medical, Inc., a company transforming care for patients suffering from certain Sacroiliac Joint (SIJ) disorders, announced that the U.S. Food and Drug Administration (FDA) has provided clearance of an expanded indication for the Catamaran SI Joint Fusion System for use in augmenting thoracolumbar fusion. With this approval, the Catamaran is indicated to treat the SI joint as either a stand-alone treatment or to augment a spinal fusion. |

| In August 2025 | Interventional Systems and HICREN announced the approval for their joint venture's surgical robot platform in China. The two companies collaborated as a joint venture, Sino-European MicroRobotics (SEMR), to develop a spinal surgical navigation and positioning system. |

| In April 2025 | LEM Surgical, a developer of.4 advanced robotic technologies for hard tissue surgery, announced that the U.S. Food and Drug Administration (FDA) had granted 510(k) clearance for its Dynamis Robotic Surgical System, marking a significant milestone in the evolution of robotic-assisted hard tissue surgery. |

| In June 2024 | Providence Medical Technology, Inc., an innovator in solutions for spinal surgery, announced that the U.S. Food and Drug Administration (FDA) cleared the use of the CORUS Navigation Access System for use with the CORUS Spinal System during spinal surgery. The CORUS Navigation Access System is specifically designed for use with Medtronic's StealthStation System for posterior spinal fusion procedures. This FDA clearance strengthens Providence Medical Technology's portfolio and underscores its commitment to advancing spinal surgery for high-risk spinal fusion patients. |

Spinal Access Systems MarketSegmental Insights

Product Type Insights

The pedicle screw systems segment dominated the global spinal access systems market with a 55% share in 2024, driven by the rising incidence of spinal disorders, including degeneration and trauma. Pedicle screw systems are a crucial component of spinal fusion procedures. Moreover, a growing number of accidents and rapid technological advancements are likely to drive segment growth.

On the other hand, the interbody fusion devices segment is expected to grow rapidly during the forecast period. The surge in the aging population and sedentary lifestyles is significantly contributing to an increasing incidence of spinal issues requiring fusion procedures. Innovations such as 3D printing, robotic-assisted surgery, and new materials, such as porous PEEK, along with the rise of minimally invasive surgical techniques, are likely to drive the segment's growth during the forecast period.

Material Type Insights

The titanium segment held a dominant 45% share of the spinal access systems market in 2024, as it is a crucial component of spinal access systems, particularly for the instrumentation and implants used in spinal fusion procedures. Titanium is widely used for spinal fusion implants, such as pedicle screws, cages, rods, and others. The material's superior properties include strength, biocompatibility, and corrosion resistance.

On the other hand, the PEEK segment is expected to grow at a notable rate. Polyether ether ketone (PEEK) is a high-performance thermoplastic polymer with several properties well-suited for spinal applications. This material is biocompatible and non-toxic. PEEK is highly resistant to chemicals, wear, and high temperatures, which ensures its long-term stability within the body.

Procedure Type Insights

The open spinal surgery segment held the majority, 60% share of the market for spinal access systems in 2024, owing to the increasing prevalence of spinal disorders in an aging population, like degenerative disc disease and scoliosis. and an aging population. Open surgery is crucial for complex cases requiring extensive intervention, which includes conditions like spinal deformities, severe degenerative diseases, and multi-level pathologies.

On the other hand, the minimally invasive spine surgery (MIS) segment is projected to grow at a CAGR between 2025 and 2034. Minimally invasive (MIS) procedures are gaining significant benefits, owing to the various benefits such as smaller incisions, reduced hospital stays, and faster recovery times.

Application Insights

The degenerative spine disorders segment held a 40% share in the spinal access systems market because of the increasing prevalence of degenerative spine disorders, such as degenerative disc disease, spinal stenosis, and herniated discs, which creates an increasing demand for surgical intervention and devices. The global aging population is more susceptible to degenerative spinal conditions and increasing demand for minimally invasive surgeries is expected to accelerate the growth of the segment.

On the other hand, the trauma & fracture segment is anticipated to grow notably during the forecast period. The surge in the number of road accidents, sports injuries, and falls among an aging population is expected to spur the demand for spinal trauma and fracture treatment. Spinal access systems facilitate minimally invasive procedures for trauma and fracture, leading to less post-operative pain, reduced tissue damage, and faster recovery times.

End User Insights

The hospitals segment held a 65% share of the market for spinal access systems in 2024, as hospitals are the dominant and primary end-users for these systems due to high demand and economies of scale. Hospitals handle the majority of spinal procedures, which has led to an increasing investment in advanced spinal technology like robotic-assisted platforms and navigation systems, to improve precision and overall treatment outcomes.

On the other hand, the specialty clinics are anticipated to grow at a significant CAGR because specialty clinics are mainly dedicated to spine surgery, and they perform a wide range of procedures, from complex open surgeries to minimally invasive techniques. Specialty clinics are at the forefront of adopting new and advanced spinal access technologies.

Spinal Access Systems MarketRegional Insights

The North America spinal access systems market size is estimated at USD $2.21 billion in 2025 and is projected to reach approximately USD $3.87 billion by 2034, with a 6.46% CAGR from 2025 to 2034.

Why is North America Dominating the Spinal Access Systems Sector?

North America dominates the spinal access systems sector primarily due to its advanced healthcare infrastructure, high adoption of minimally invasive and robotic-assisted spine surgeries, and strong presence of leading medical device manufacturers. The region benefits from significant R&D investment, favorable reimbursement policies, and a high prevalence of spinal disorders among an aging population. Moreover, well-trained surgeons, access to cutting-edge technology, and a robust regulatory framework that supports innovation further strengthen its market leadership. Continuous product advancements and early adoption of digital and navigation-integrated systems keep North America at the forefront of global growth.

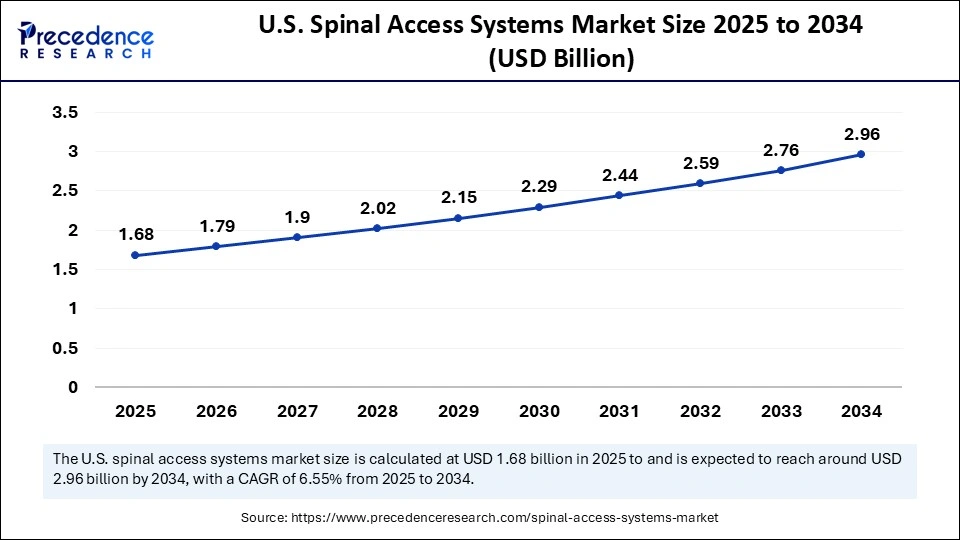

The U.S. spinal access systems market size is expected to be worth USD 2.96 billion by 2034, increasing from USD 1.68 billion by 2025, growing at a CAGR of 6.55% from 2025 to 2034.

U.S. Spinal Access Systems Market Insights

The U.S. spinal access systems industry is expanding due to the high incidence of degenerative spine conditions and increasing demand for advanced surgical solutions. Growing adoption of minimally invasive and robotic-assisted procedures continues to enhance surgical precision and patient outcomes. Strong healthcare infrastructure and the presence of leading medical device companies drive consistent innovation in access and navigation technologies. Favorable reimbursement frameworks and high healthcare spending further support the widespread use of advanced spinal access systems. An aging population and rising awareness of spinal health continue to boost procedural volumes and sustain long-term market growth.

The Asia Pacific spinal access systems market size is expected to exceed USD $2.76 billion by 2034, up from USD $1.58 billion by 2025, growing at a CAGR of 6.43% from 2025 to 2034.

Why is Asia the Fastest Growing in the Spinal Access Systems Industry?

Asia is the fastest-growing region in the spinal access systems industry due to a rapidly aging population, rising incidence of spinal disorders, and expanding access to advanced healthcare infrastructure. Increasing adoption of minimally invasive and robotic-assisted spine surgeries across countries like China, India, and Japan is driving strong procedural growth. Governments and private hospitals are investing heavily in modern surgical technologies, improving affordability and availability. Growing medical tourism and awareness of spine health are further fueling demand. Combined with cost advantages and a large patient base, these factors make Asia the most dynamic growth region in this market.

Japan Spinal Access Systems Sector Insights

Japan's spinal access systems sector is expanding steadily, driven by a large aging population and an increasing prevalence of degenerative spinal disorders. In 2022, approximately 136,000 spinal surgeries were performed, with spinal fusion procedures accounting for the majority. Growth is supported by the country's advanced healthcare infrastructure, strong reimbursement systems, and rapid adoption of minimally invasive and robotic-assisted surgical techniques. The presence of leading global manufacturers such as Medtronic, Stryker, and Globus Medical continues to enhance innovation, product quality, and accessibility across Japan's spine care sector.

Latin America has seen notable growth in the spinal access systems industry driven by expanding healthcare infrastructure, rising investment in modern surgical facilities, and increasing awareness of advanced spinal treatment options. A growing middle-class population and greater access to private healthcare are driving demand for minimally invasive and image-guided spinal procedures. Countries such as Brazil and Mexico are leading adoption, supported by improvements in surgeon training and hospital capabilities. Additionally, partnerships with global medtech companies are accelerating technology transfer and making advanced access systems more widely available across the region.

Brazil Spinal Access Systems Market Insights

Brazil's spinal access systems market is experiencing steady growth driven by the rising incidence of degenerative spinal disorders and the aging population. The country's adoption of minimally invasive surgical techniques and increasing demand for advanced access devices are key growth factors. Healthcare infrastructure improvements, along with both public and private hospital expansions, support wider penetration of modern spinal access systems. Major global device manufacturers, as well as local players offering lower-cost solutions, are active in Brazil's market landscape. Growth is especially seen in segments such as spinal fusion devices and minimally invasive implants.

Spinal Access Systems MarketValue Chain

The value chain begins with sourcing medical-grade titanium, stainless steel, and biocompatible polymers (PEEK, UHMWPE) used to manufacture access systems, retractors, and guide instruments. Suppliers must meet ISO 13485 and FDA material compliance standards ensuring sterilizability and biocompatibility. Precision machining, corrosion resistance, and lightweight properties are critical for surgical usability. Upstream value is captured by suppliers of precision-engineered components and specialty medical materials, especially those offering validated supply traceability and cleanroom-ready parts.

This is the core value-creation stage, involving CAD-based product design, ergonomic engineering, and integration of visualization systems for minimally invasive spinal access. Manufacturers emphasize modular retractor systems, reduced tissue disruption, and compatibility with navigation or robotic platforms. Processes such as CNC machining, surface finishing, sterilization, and rigorous quality testing ensure safety and consistency. Value capture lies with OEMs and specialized medtech firms that combine strong IP portfolios, clinical evidence, and surgeon co-development programs, such as Medtronic, Stryker, and Globus Medical.

Finished spinal access systems are distributed via direct sales teams, surgical distributors, and hospital procurement networks. Training and intraoperative support for surgeons are critical, driving demand for clinical education programs and technical service teams. Compliance with regional regulatory approvals (FDA, CE Mark) and sterilization logistics adds downstream complexity. Value capture at this stage is highest among companies with robust surgeon relationships, hospital partnerships, and after-sales service ecosystems, enabling brand loyalty and procedural preference.

Spinal Access Systems Market Companies

Medtronic is the global leader in spinal and orthopedic solutions, offering a comprehensive portfolio of implants, biologics, and navigation-assisted technologies. Its spinal division provides innovative systems for fusion, minimally invasive surgery, and motion preservation. Medtronic’s focus on robotics and AI-enhanced spine surgery platforms reinforces its leadership in advanced spinal care.

DePuy Synthes, a subsidiary of Johnson & Johnson, is a key player in the spine and orthopedic implants market. The company’s broad product line includes spinal fusion systems, disc replacement technologies, and deformity correction solutions. Its integration of digital surgery and 3D printing strengthens its innovation leadership in personalized spine care.

Stryker offers a wide range of spinal implants, surgical instruments, and navigation technologies, including its Mako robotic platform for precision spine procedures. The company’s acquisition of K2M expanded its portfolio in complex spine and minimally invasive systems. Stryker continues to lead through its focus on advanced materials and patient-specific surgical planning.

Zimmer Biomet develops innovative spine and orthopedic products, including motion preservation and fusion devices. Its ROSA robotic system enhances surgical precision and workflow efficiency. The company’s focus on digital integration and smart implants underscores its commitment to improving clinical outcomes and surgeon experience.

NuVasive specializes in minimally invasive spine surgery solutions, including its XLIF lateral access system and advanced neuromonitoring technologies. The company’s focus on procedural integration and outcomes-based innovation positions it as a leader in next-generation spine surgery solutions.

Globus Medical provides a full range of spine and musculoskeletal solutions, from implants to surgical robotics. Its ExcelsiusGPS robotic platform combines navigation and imaging for high-precision spine surgery. The company emphasizes innovation in patient safety and surgical efficiency.

Alphatec Spine focuses on advanced spine surgery solutions that prioritize patient alignment and long-term outcomes. Its product range includes fixation systems, biologics, and access technologies designed for minimally invasive procedures.

K2M, now part of Stryker, was known for its 3D-printed titanium spinal implants and solutions for complex spine deformities. Its integration into Stryker expanded the company’s offerings in advanced and minimally invasive spinal technologies.

Orthofix develops spine and orthopedic products including fixation systems, bone growth stimulators, and biologics. The company focuses on regenerative therapies and minimally invasive spinal solutions for improved healing and patient recovery.

SeaSpine designs and manufactures spinal fusion and orthobiologic products used in complex spine and minimally invasive surgeries. Its innovative graft materials and modular implant systems support improved surgical flexibility and patient outcomes.

Aesculap, part of B. Braun, offers spinal implants, surgical tools, and navigation systems designed for precision and efficiency. The company’s emphasis on surgical safety and ergonomic innovation strengthens its role in spine and neurosurgical solutions.

Spineology focuses on developing anatomically optimized spinal implants and minimally invasive solutions. Its proprietary mesh technology reduces tissue disruption and improves fusion outcomes in spinal repair.

Paradigm Spine specializes in motion-preserving spinal technologies, notably the Coflex interlaminar stabilization device. The company’s focus on alternative treatments to spinal fusion supports long-term mobility and patient comfort.

RTI Surgical provides biologic implants and spine surgery solutions for tissue regeneration and spinal reconstruction. Its portfolio emphasizes safety, innovation, and biocompatibility.

SpineGuard develops smart drilling and navigation technologies that use real-time sensing to enhance safety during spine surgery. Its DSG (Dynamic Surgical Guidance) technology minimizes risks of pedicle breaches and nerve injury.

Recent Developments

- In April 2023, Orthofix Medical Inc., a leading global spine and orthopedics company, announced the commercial launch of two access retractor systems to aid surgeons during minimally invasive spine (MIS) procedures.(Source: https://www.businesswire.com)

- In October 2025, Pompano Beach Chiropractic Clinic announced the expansion of its services to include Spinal Decompression Therapy, featuring the advanced KDT (Kennedy Decompression Technique) system. This innovative treatment reinforces the clinic's ongoing commitment to providing non-surgical, evidence-based solutions for patients suffering from back pain and spinal disorders.(Source: https://www.tallahassee.com)

Spinal Access Systems MarketSegments Covered in the Report

By Product Type

- Pedicle Screw Systems

- Monoaxial Screws

- Polyaxial Screws

- Cannulated Screws

- Rod & Plate Systems

- Titanium Rods

- Stainless Steel Rods

- Plates & Connectors

- Interbody Fusion Devices

- PEEK Cages

- Titanium Cages

- 3D-Printed Cages

- Navigation & Ancillary Instruments

- Surgical Guides

- Retractors & Clamps

By Material Type

- Titanium

- Pure Titanium

- Titanium Alloy

- Stainless Steel

- 316L Stainless Steel

- 304 Stainless Steel

- PEEK / Polyether Ether Ketone

- Radiolucent PEEK

- PEEK with Carbon Fiber

- Cobalt-Chrome

- CoCr Alloy Rods

By Procedure Type

- Open Spinal Surgery

- Posterior Approach

- Anterior Approach

- Minimally Invasive Spine Surgery (MIS)

- Percutaneous Pedicle Screw Fixation

- Endoscopic Spine Procedures

By Application

- Degenerative Spine Disorders

- Spondylolisthesis

- Disc Herniation

- Spinal Stenosis

- Trauma & Fracture

- Vertebral Fractures

- Spinal Injuries

- Deformity Correction

- Scoliosis

- Kyphosis

- Tumor / Oncology

- Spinal Tumors

- Metastasis

By End User

- Hospitals

- Multi-Specialty Hospitals

- Spine Surgery Centers

- Specialty Clinics

-

- Orthopedic Clinics

- Neurology/Neurosurgery Clinics

- Ambulatory Surgery Centers (ASCs)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting