Endoscopy and Ambulatory Surgical Center Market Size and Forecast 2026 to 2035

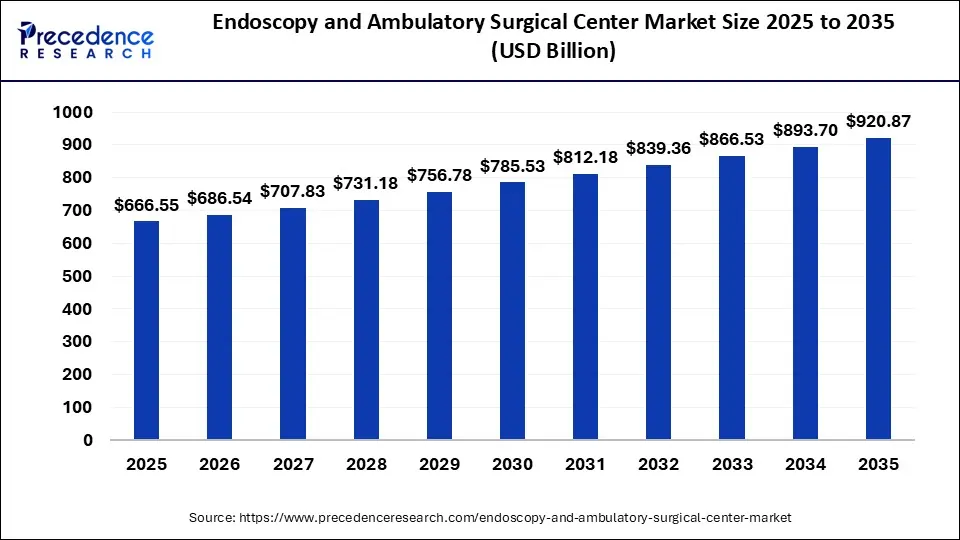

The global endoscopy and ambulatory surgical center market size was calculated at USD 666.55 billion in 2025 and is predicted to increase from USD 686.54 billion in 2026 to approximately USD 920.87 billion by 2035, expanding at a CAGR of 3.28% from 2026 to 2035. The growth of the market is attributed to the rising demand for minimally invasive procedures that offer faster recovery and reduce hospital stays.

Endoscopy and Ambulatory Surgical Center Market Key Takeaways

- In terms of revenue, the endoscopy and ambulatory surgical center market is valued at $666.55 billion in 2025.

- It is projected to reach $ 893.70 billion by 2034.

- The market is expected to grow at a CAGR of 3.32% from 2026 to 2035.

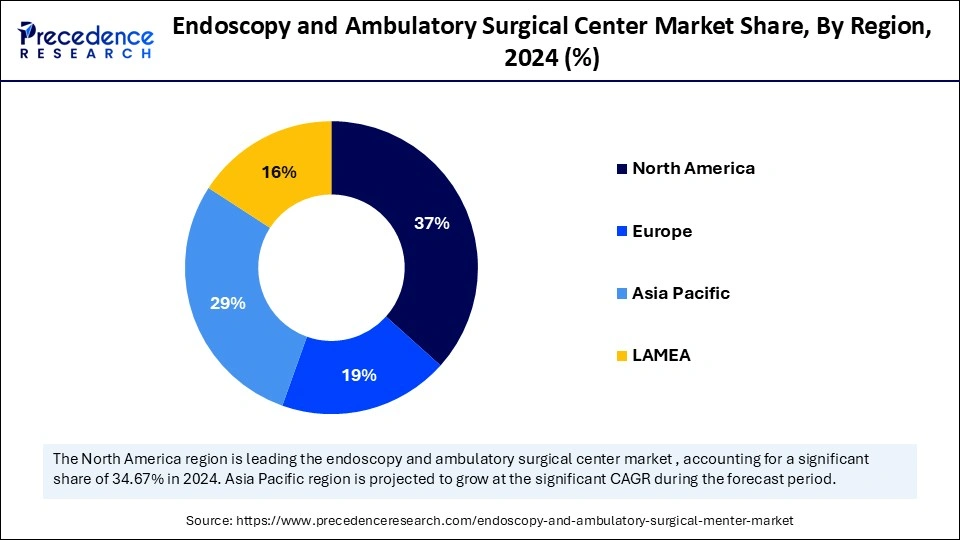

- North America dominated the market with the largest share of 37% in 2025.

- Asia Pacific is expected to expand at a CAGR of 3.70% during the forecast period.

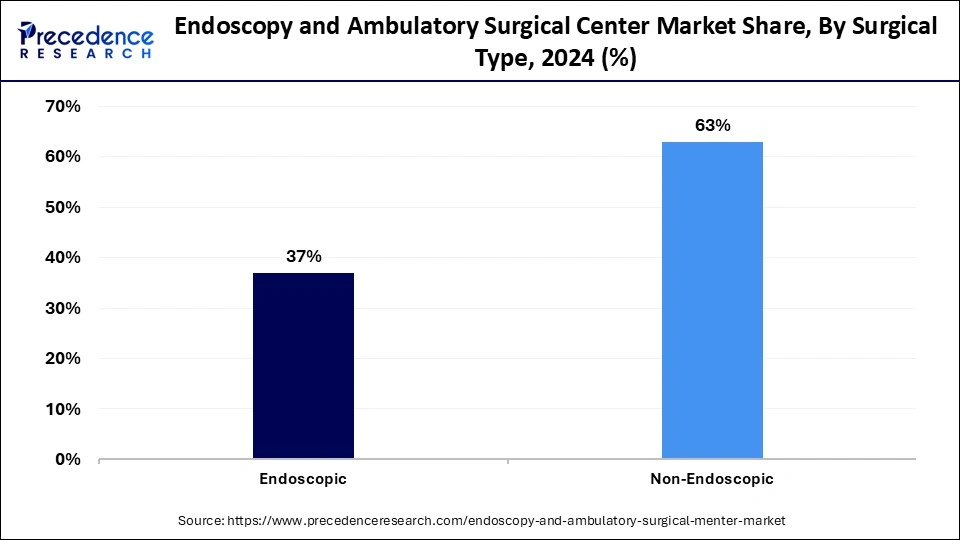

- By surgical type, the non-endoscopic segment held a significant share of 63% in 2025.

- By surgical type, the endoscopic segment is expected to grow at the fastest rate during the forecast period.

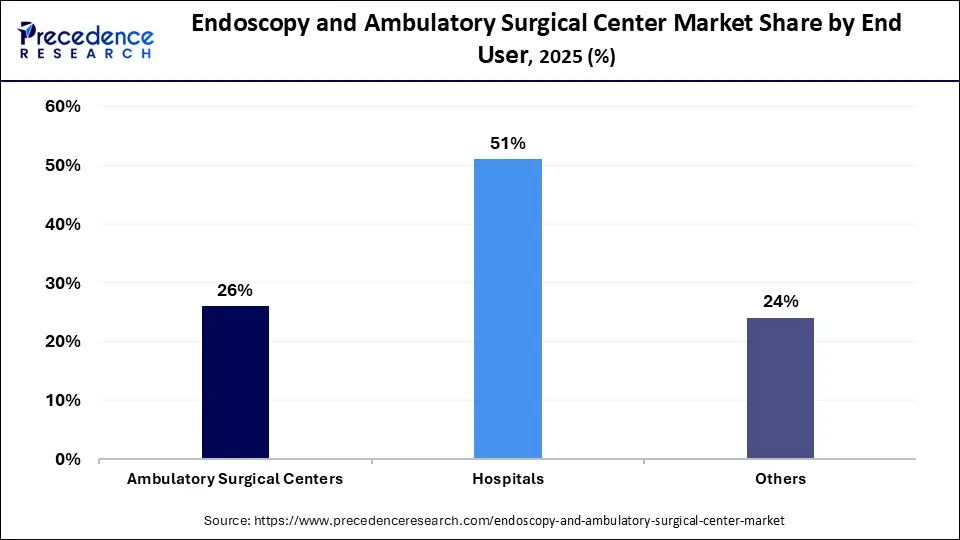

- By end user, the hospitals segment contributed the biggest market share of 51% in 2025.

- By end user, the ambulatory surgical centers segment is projected to grow at the fastest rate in the coming years.

Impact of AI on the Endoscopy and Ambulatory Surgical Center Market

Artificial intelligence (AI) is revolutionizing the market for Endoscopy and Ambulatory Surgical Center by improving patient outcomes, operational effectiveness, and clinical accuracy. AI-powered endoscopy instruments like Olympus's ENDO-AID CADe and Medtronic's GI Genius are enhancing lesion detection rates and providing real-time diagnostic support, greatly lowering human errors and assisting in the early detection of cancer. These systems promote minimally invasive care by automating documentation and enabling robotically assisted procedures. AI is being used concurrently by ASCs to optimize operations, including scheduling surgeries, controlling inventory, and expediting billing procedures. AI helps assess preoperative risks and monitor postoperative recovery remotely, improving patient satisfaction while reducing complications and costs. AI is becoming a vital enabler for scalable, effective, and intelligent medical services in value-based care models.

Market Overview

The Endoscopy and Ambulatory Surgical Center market is experiencing steady growth due to the increasing need to improve outpatient care and the growing need for minimally invasive procedures. ASCs are a practical substitute for conventional hospital-based surgeries, offering superior treatments with a lower risk of infection and quicker recovery periods. Endoscopy is increasingly being integrated into ASC services as a crucial part of minimally invasive diagnostics and treatments.

High-definition imaging and robotically assisted procedures are two examples of how technological developments in endoscopic instruments improve procedural efficiency and diagnostic accuracy. Furthermore, the number of procedures carried out in ASCs is increasing due to an aging population and the rising incidence of chronic diseases. The market is further fueled by healthcare reforms and advantageous reimbursement policies that support these centers' growth. Ongoing innovation and rising patient awareness about outpatient surgical alternatives are fueling the growth of the market. The rising healthcare cost is encouraging patients to shift towards ASCs, supporting market growth.

The Role of AI in Endoscopy & Ambulatory Surgery Center Operations

Artificial intelligence (AI) is transforming the endoscopy and ASC markets by improving clinical accuracy and enhancing operational performance. AI-enabled endoscopic systems provide real-time detection of polyps and lesions, allowing users to take quicker and more consistent actions and reduce the need for repeat procedures. The advantage for ASCs includes increased throughput, improved resource utilization, and increased profitability.

Recent innovations in the use of AI include medical device companies adding AI algorithms to imaging devices, as well as, multiple AI-assisted diagnostic tools that have received regulatory approval to be used in routine clinical practice. Ways that AI can be used include scheduling, inventory management, and predictive maintenance, to minimize downtime and costs. With the continuing growth of outpatient procedures, AI adoption is considered an important competitive advantage and a long term growth opportunity.

Endoscopy and Ambulatory Surgical Center Market Growth Factors

- Increasing Demand for Minimally Invasive Procedures: Patients prefer endoscopic and same-day surgical interventions due to less pain, minimal scarring, and quicker recovery.

- Rising Prevalence of Chronic Disease: Conditions like gastrointestinal disorders, cancer, and orthopedic issues require frequent diagnostic and surgical interventions. This encourages them to receive care from ASCs due to their cost-effectiveness compared to hospitals.

- Cost-effectiveness of ASCs: Ambulatory surgical centers offer high-quality care at lower costs compared to traditional hospitals, attracting both patients and insurers.

- Growing Aging Population: Older people are more prone to chronic diseases, boosting the need for diagnostics and therapeutic procedures offered by ASCs.

- Expanding Healthcare Infrastructure in Emerging Markets: Rising government initiatives to expand healthcare infrastructure, especially in emerging countries and rural areas, are projected to open up new avenues for market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 920.87 Billion |

| Market Size in 2026 | USD 686.54 Billion |

| Market Size in 2025 | USD 666.55 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.28% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Surgery Type, End User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Shit Toward Outpatient Care

The rapid shift toward outpatient settings due to their cost-effectiveness is a key factor driving the growth of the Endoscopy and Ambulatory Surgical Center market. Impatience with inpatient settings is encouraging patients to shift toward outpatient settings, especially for surgeries and routine checkups. Ambulatory surgical centers are becoming more and more popular because they offer patients more convenience, shorter hospital stays, and fewer risks associated with hospitals. To manage volumes of surgical procedures and lessen burdens on healthcare professionals, hospitals are also partnering with ASCs. ASCs are becoming a vital part of contemporary care delivery as healthcare systems prioritize cost-effectiveness.

High Patient Turnaround and Shorter Wait Times

In contrast to hospitals, ASCs provide faster check-in/check-out procedures and faster appointment scheduling. In addition to improving patient satisfaction, this efficiency enables facilities to handle increased patient volumes without sacrificing the standard of care. ASCs provide personalized care, attracting more patients. The rising reimbursement policies for ASCs, particularly in regions like North America and Europe, are driving the growth of the market.

Restraints

Shortage of Skilled Professionals

A shortage of skilled professionals is likely to hamper the growth of the Endoscopy and Ambulatory Surgical Center market. Advanced endoscopy procedures, such as endoscopic retrograde cholangiopancreatography (ERCP) and endoscopic submucosal dissection (ESD), require detailed knowledge and training, which limits their use. Certification courses and organized training programs are unavailable in many areas. ASCs are unable to provide complex endoscopic procedures without properly trained staff, which leads to delays in the procedures. Overworked professionals may also result in longer waiting times and lower quality care. The market is competitive, with hospitals and other healthcare providers also offering endoscopic services, limiting the growth of the market.

Infection Control Concerns

Endoscopes need to be cleaned and disinfected with extreme care because any neglect could lead to the spread of pathogens. Numerous outbreaks have drawn increased attention from both patients and regulators. Due to the labor-intensive and time-consuming nature of the reprocessing workflow, some centers skip cleaning steps when under pressure. Despite providing a vital solution, disposable endoscopes raise additional financial and environmental issues. Patients are also reluctant to choose these procedures because of the risk of infection. Safety and operational effectiveness need to be balanced in ASCs. Moreover, compliance with healthcare regulations and standards can be complex and costly, affecting the growth of the market.

Opportunities

Technological Advancements

Technological advancements create immense opportunities in the Endoscopy and Ambulatory Surgical Center market. Endoscopy procedure is revolutionizing because of technological innovations like artificial intelligence, robotics, and high-definition imaging. High-definition imaging solutions with improved accuracy, speed, and safety are being introduced by several companies. Olympus introduced the EVIS X1 system, which uses AI to improve the detection of cancers at an early stage. To improve precision, various companies are developing robotic endoscopic systems. These developments are rapidly gaining traction in ASCs, improving patient outcomes and lowering errors.

Increasing Prevalence of Chronic Conditions

The rising prevalence of chronic diseases opens up new avenues for the market's growth. Chronic diseases like respiratory illnesses, cancer, and gastrointestinal disorders require endoscopic procedures to manage conditions. Endoscopic procedures help in diagnosis, monitoring disease activity, and assessing complications. They also help with providing therapeutic interventions. The growing geriatric population is likely to maintain the long-term growth of the market, as older adults are more prone to chronic diseases. The increasing burden of chronic diseases worldwide significantly boosts the demand for routine endoscopic procedures.

Surgery Type Insights

The non-endoscopic segment dominated the Endoscopy and Ambulatory Surgical Center market with the largest share in 2025. This is mainly due to the increased demand for non-endoscopic procedures, owing to the perception of less invasiveness and quicker recovery. These procedures are more cost-effective than endoscopic procedures, attractive to both healthcare providers and patients. Non-endoscopic procedures are widely applicable in the fields of orthopedic and ophthalmology. The need for non-endoscopic procedures has increased in the last few years as a result of the rise in conditions like arthritis and age-related vision loss. An aging population, high reimbursement policies, and innovations in surgical technologies further bolstered the growth of the segment.

The endoscopic segment is expected to grow at the fastest rate in the coming years. The range of endoscopic procedures performed in ASCs is expanding, including urological endoscopy, gastroscopy, bronchoscopy, and colonoscopy. These procedures play a vital role in early detection and prevention. The rising demand for minimally invasive procedures is driving the growth of the market. With the increasing prevalence of cancer and gastrointestinal disorders, the need for endoscopic procedures is rising. Improved imaging and advanced scopes are improving the accuracy of these procedures, which significantly improves patient outcomes and safety. AI-driven endoscopy and disposable scopes are two examples of technological integration that are speeding up endoscopy adoption in ASCs.

End User Insights

The hospitals segment dominated the Endoscopy and Ambulatory Surgical Center market with the largest share in 2025 because of their ability to manage complicated, high-risk, and urgent procedures. They provide integrated services that include access to multidisciplinary specialists, advanced imaging, and intensive care units. Hospitals offer a wide range of medical services, including endoscopy, making them the preferred choice for patients with complex health needs. Hospitals are often equipped with advanced infrastructure and specialties with expertise in various endoscopic procedures, attracting patients seeking endoscopic procedures. Even though ASCs are becoming more popular, hospitals continue to play a vital role in performing endoscopic procedures.

The ambulatory surgical centers segment is projected to grow at the fastest rate during the forecast period because of their affordability and shorter procedure times. Many low-to-moderate-risk surgeries are switching to outpatient models, driven by regulatory support and technological advancements. Compared to inpatient hospitals, patients reap the benefits of outpatient settings, including shorter wait times and decreased infection risks. ASCs offer personalized care, reducing recovery time and enhancing patient outcomes. They offer endoscopic procedures at a lower cost than hospitals, making them attractive to patients seeking cost-effective care options.

U.S. Endoscopy and Ambulatory Surgical Center Market Size and Growth 2026 to 2035

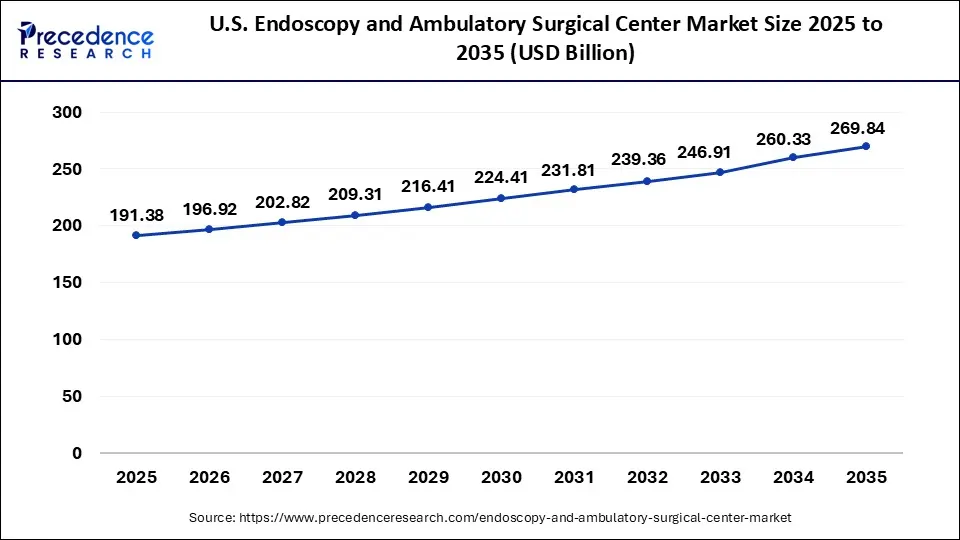

The U.S. endoscopy and ambulatory surgical center market size was exhibited at USD 191.38 billion in 2025 and is projected to be worth around USD 269.83 billion by 2035, growing at a CAGR of 3.5% from 2026 to 2035.

North America dominated the Endoscopy and Ambulatory Surgical Center market by capturing the largest share in 2025. This is mainly due to the increased shift toward outpatient care. The region has a well-established healthcare infrastructure, including advanced medical facilities, boosting the adoption of sophisticated endoscopes. The increased prevalence of gastrointestinal disorders has raised the volumes of endoscopic procedures. In addition, supportive reimbursement policies for endoscopic procedures bolstered the growth of the market in the region. The region is an early adopter of innovations like AI-driven endoscopy and robotic-assisted surgery, sustaining the long-term growth of the market. There is a high demand for minimally invasive surgeries, contributing to the regional market growth.

U.S.

The U.S. has an extensive number of endoscopy units and ambulatory surgical centers, with an extremely high number of outpatients receiving surgical procedures as well. There are very high volumes of procedures performed and also there has been an incredibly rapid adoption of new technologies. Because of a growing number of physicians owning ambulatory surgical centers and using value-based methods to deliver care, the U.S. is able to provide highly efficient delivery and patient satisfaction. There are continuous investments being made in the areas of clinical training of personnel, upgrades of devices, and infection-control standards which support the US as the leading market for outpatient-based surgery services.

Asia Pacific is expected to witness the fastest growth in the upcoming years. The increasing awareness among patients about the benefits of minimally invasive procedures and rising healthcare expenditures are key factors driving the growth of the market in the region. The rising demand for cost-effective healthcare services is encouraging patients to receive care from ASCs. The large patient population in the region is supporting regional market growth. Governments around the region are investing heavily in advancing existing healthcare infrastructure to improve access to quality healthcare services. In addition, the rising prevalence of chronic diseases is likely to contribute to the growth of the market.

China

China has emerged as the leading market within Asia Pacific due to the rapid development of its healthcare infrastructure. As a result of the increasing demand for diagnostic procedures and a greater emphasis on early disease detection and the use of minimally invasive options for treatment, China will continue to see a rapid increase in the need for endoscopic procedures. With the further expansion of private healthcare institutions and outpatient surgical facilities, the need for additional surgical facilities will increase. Further, with the continued investment into advanced medical technology, the expansion of health IT systems and the implementation of many of the new minimally invasive techniques will drive future growth of the market in Asia Pacific.

Europe is considered to be a significantly growing area. The growth of the Endoscopy and Ambulatory Surgical Center market can be attributed to the increasing preference for outpatient care models and minimally invasive procedures. There is a strong emphasis on lowering healthcare costs. The rising demand for patient-centric care models and the growing awareness among people about the early detection of diseases like gastrointestinal disorders and cancer are facilitating market expansion.

Germany

Germany has a highly functional healthcare system with a strong focus on outpatient services. There are enough specialized Endoscopy clinics and ambulatory surgical centers to provide the majority of outpatient endoscopy services to the German population and to provide coverage of their costs through statutory insurance. The advances in endoscopic technology and the skills of the endoscopists further contribute to high-quality endoscopy procedures performed in Germany. In addition, the continued investments into digital health, minimally invasive methods, and procedures will significantly enhance Germany's leadership role in outpatient endoscopy throughout Europe as a whole.

How Latin America Emerging Endoscopy and Ambulatory Surgical Center (ASC) Opportunities?

Emerging endoscopy and endoscopy and ambulatory surgical center opportunities exist in Latin America as gradual modernization of the health care environment and increased volumes of procedures drives demand for this type of facility. Greater awareness of the benefits of using minimally invasive methods to treat both chronic and preventive conditions creates an environment where patients will demand increased outpatient care. Many private healthcare providers continue to create new ASCs as a means to enhance productivity and reduce congestion in the hospitals where they provide services. Improvements in the availability of medical infrastructure and specialists contribute to this growth. There are still disparities in access to care throughout the region; however, the demand for endoscopic services continues to increase within urban areas due to changes in the pattern of diseases, and patients' preference for quicker recovery times has led to increased demand for outpatient surgical centers.

Brazil

Brazil is the leader in Latin America with its growing private health care sector, expanding outpatient surgical capacity, and creating new ASCs. Major cities offer ever-increasing numbers of ASCs, providing specialty diagnostic and outpatient surgery services through the use of endoscopy as a primary surgical tool. As private industry continues to invest in technology and training, the quality of procedures will continue to improve. Additionally, the demand for cost-effective and time-effective treatments will also drive endoscopy services provided by ASCs. The Brazilian government's commitment to increase access to healthcare through the implementation of programs designed to improve access to quality healthcare combined with a large patient population makes it a critical driver of growth for the entire Latin American region.

What Causes Rapid Growth of Endoscopy and Ambulatory Surgery Centers Market In the Middle East and Africa?

An ever-increasing amount of investment is being made by both public and private sectors into the endoscopy and ambulatory surgery centers market within the Middle East and Africa. With chronic disease rates on the rise, there is a considerable push to modernize medical facilities and expand outpatient surgical models throughout the region. More private companies are developing and operating endoscopy services, thus enhancing patient access. Ambulatory surgery centers can now be found within urban metropolitan centers, with the development of new technology leading to increased use of minimally invasive surgical procedures due to improved efficiency of hospitals and decreased costs.

Saudi Arabia

Saudi Arabia is one of the leading countries in the Middle East and Africa for surgical growth due to the investment and modernization measures taken. The development of more private hospitals and ambulatory surgery centers has allowed for more outpatient surgical procedures to take place. The adoption of new endoscopic technologies, as well as a growing number of physicians specializing in endoscopy, has improved the overall quality of service. The Saudi government has also initiated a number of health results, which will improve efficiency and patient satisfaction and help expand the number of ASCs in the country. The demand for preventative diagnostics and minimally invasive surgical procedures will drive significant growth throughout the Middle East and Africa in the middle of this expansion period.

Endoscopy and Ambulatory Surgical Center Market Companies

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

- CHSPSC, LLC.

- Edward-Elmhurst Health

- Eifelhöhen-Klinik AG

- Envision Healthcare Corporation

- Healthway Medical Group

- Nexus Day Surgery Centre

- Pediatrix Medical Group

- Prospect Medical Holdings, Inc.

- SurgCenter

- Surgery Partners

- TH Medical

- UNITEDHEALTH GROUP

Recent Developments

- In April 2025, FUJIFILM India officially launched its state-of-the-art ELUXEO 8000 Therapeutic Endoscopy Solution at the 22nd MUMBAI LIVE Endoscopy 2025, hosted by Sir HN Reliance Foundation Hospital. This marks the debut of the advanced system in India, following its successful rollout in Japan and Europe.

- In April 2024, Commons Clinic announced its USD 9.75 million investment in Marina Orthopedic & Spine Institute (MOSI), a trailblazing Los Angeles-metro independent surgery center that has set a national standard for minimally invasive spine and joint procedures. This initiative enables Commons Clinic to expand its network of ambulatory surgery centers (ASCs) while increasing its capabilities through its proprietary surgical care platform, Theater.

Segments Covered in the Report

By Surgery Type

- Endoscopic

- Gastrointestinal Endoscopy

- Obstetrics Endoscopy

- Urology Endoscopy

- Laparoscopy

- Bronchoscopy

- Laryngoscopy

- Arthroscopy

- Others

- Non-endoscopic

- Ophthalmology

- Obstetrics/Gynaecology

- Orthopedic

- Cardiovascular

- Otolaryngology

By End User

- Ambulatory Surgical Centers

- Hospitals

- Others

By Region

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting