What is the Endoscopy Devices Market Size?

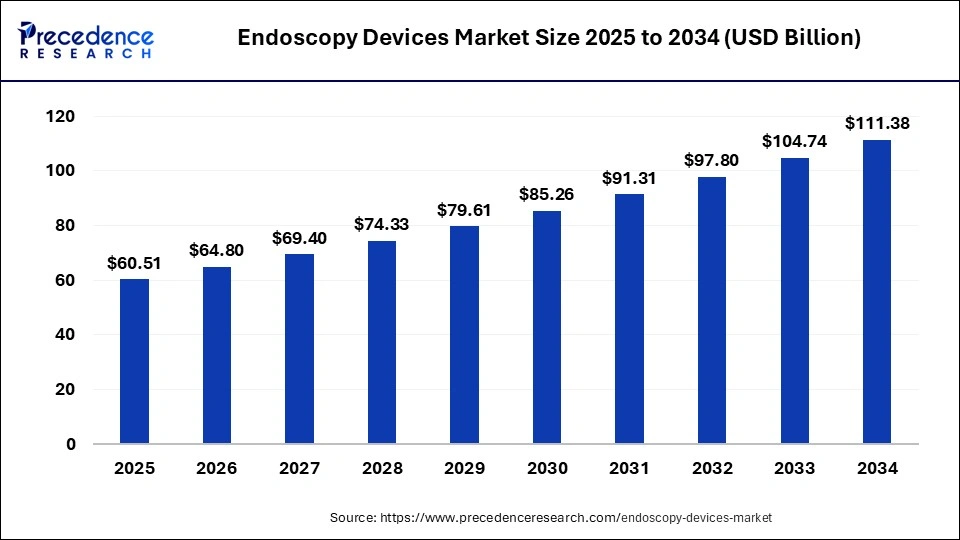

The global endoscopy devices market size is calculated at USD 60.51 billion in 2025 and is predicted to increase from USD 64.80 billion in 2026 to approximately USD 111.38 billion by 2034, growing at a CAGR of 7.10% from 2025 to 2034.

Endoscopy Devices Market Key Takeaways

- By product, the endoscopy visualization systems segment has held a 37% revenue share in 2024.

- By end user, the hospitals segment has accounted 48% revenue share in 2024.

- By application, the gastrointestinal (GI) endoscopy segment has captured a revenue share of around 55.2% in 2024.

- The urology endoscopy application segment is growing at a strong rate.

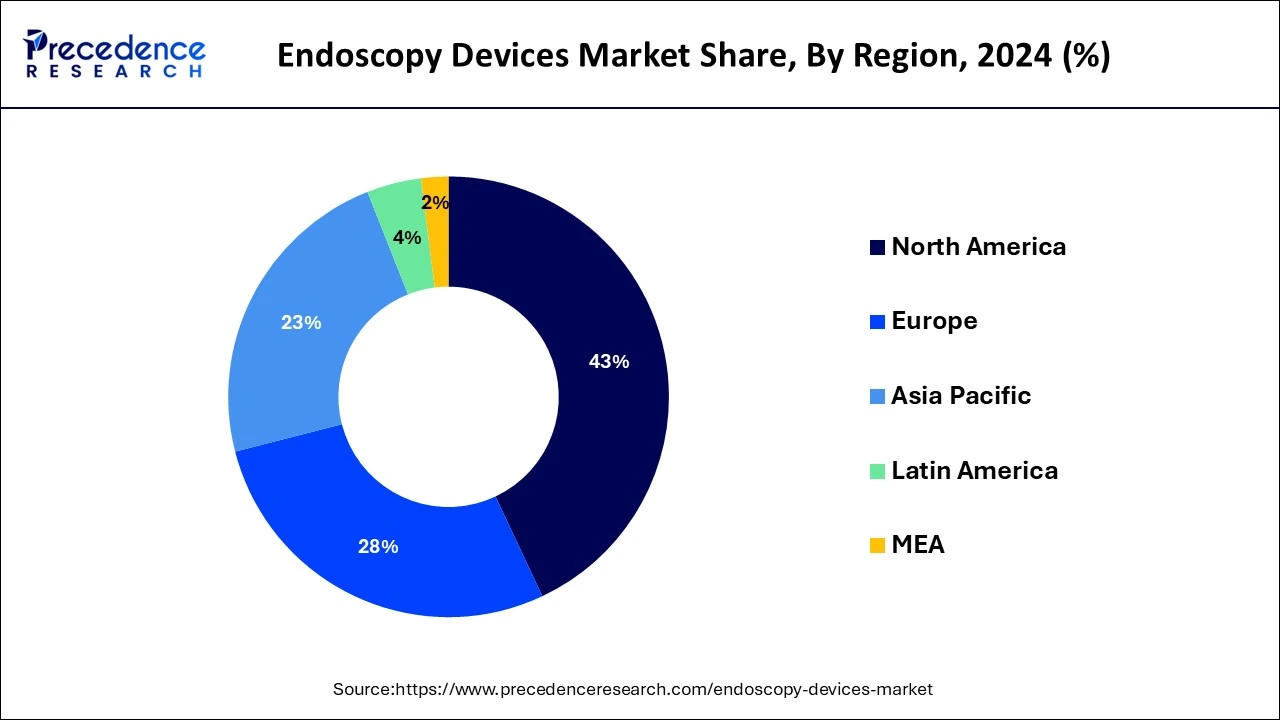

- The North America region has generated a revenue share of around 43% in 2024.

- The Asia Pacific region is poised to grow at a CAGR of 6.9% between 2025 to 2034.

Endoscopy Devices Market Growth Factors

Rise in preference for minimally invasive endoscopic procedures along with an increase global geriatric population are the key factors boosting the demand for endoscopy devices. The market for endoscopes is also being driven by a surge in the prevalence of urological, gastrointestinal, respiratory, and gynecological disorders that requires endoscopic procedures for proper treatment &diagnosis. An increase in the adoption of endoscopes as well as visualization systems in healthcare industry coupled with the technological advancements in the similar field further aids to the growth of the market.

In addition, proliferation in the prevalence of age-related problems together with increase in demand for endoscopy devices in therapeutic & diagnostic procedures is the other important factor that propels the market growth. Implementation of such devices in treatment and diagnosis of health problems is necessary as it allows minimal intervention that further results in shorter recovery time.

Geriatric population is the most common group prone to medical problems that require endoscopic procedures such as gall stones, intestinal perforation, endometriosis, pelvic abscess, and liver abscess. According to a research conducted by Population Reference Bureau, in 2018, there were nearly 52 Million people with age 65 years or above in the United States and projected to cross the number of 95 Million by 2060. The aforementioned factor anticipated to boost the need for endoscopic procedures, thereby escalating the demand for endoscopy devices during the forecast period.

Market Scope

| ReportCoverage | Details |

| Market Size in 2025 | USD 60.51 Billion |

| Market Size by 2034 | USD 111.38 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Hygiene, End User, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

Endoscopy visualization systems captured the highest value share 37% in the year 2024. This is attributed to the rising preference for high definition (HD) visualization system by medical professionals, as it helps in treatment &diagnosis of complex diseases that include GI disorders, cancer, urinary disorders, and lung disorders during minimally invasive surgical procedures. Presently, manufacturers offer HD visualization systems that are capable of switching images from 3D to 2D and vice versa also impact positively on the market growth of segment.

The endoscopes segment projected to exhibits lucrative growth rate of nearly 9.5% over the analysis period. Flexible endoscopes dominated the segment with the highest value share in 2024 due to rising preference of safety, better ergonomics, and efficacy over rigid endoscopes. However, endoscopy visualization components register notable growth over the forecast period, wherein HD monitors accounted for the largest value in 2024.

End-use Insights

Hospitals segment encountered to be the largest end-user in the year 2024, as it is the primary health center in majority of countries. Further, the total number of endoscopic surgeries takes place at hospitals is comparatively higher than other healthcare systems, such as specialty clinics or ambulatory surgical centers (ASCs). Consequently, the demand of endoscopy devices at hospitals is higher compared to other end-use segments. Furthermore, the segment expected to maintain its dominance in the forthcoming years owing to rising investment from governments of various regions for the development of hospitals. This subsequently predicted to boost the demand for endoscopy devices in the coming years.

Key Companies & Market Share Insights

The global endoscopy devices market seeks intense competition among the market players. This is mainly because of adoption of various inorganic growth strategies by the industry participants such as merger & acquisition, regional expansion, new product launch & approval.

Light in the Dark: Endoscopy Devices are sunshine in the park

Market Outlook

- Industry Overview: The industry is composed of device OEMs, large diversified medtech firms and niche endoscopy specialists, component suppliers, optics, CMOS/CCD sensors, fiber bundles, flexible insertion tubes, contract manufacturers, sterilization/reprocessing equipment providers, distributors, and hospital procurement teams. Key industry dynamics include consolidation as large players expand portfolios through acquisition, competitive pressure from lower-cost suppliers, and the rise of single-use endoscope entrants challenging traditional reusable device economics.

- Sustainability Trend: Sustainability in endoscopy balances infection control and patient safety against environmental impact. Single-use endoscopes and disposables reduce cross-contamination risk and reprocessing resource use water, energy, and chemicals, but create medical waste challenges. The sustainability trend, therefore, focuses on lifecycle assessments, recyclable or medical-grade degradable materials for disposables, and greener reprocessing technologies that decrease energy and chemical consumption for reusable endoscopes.

- Manufacturers are exploring circular models, remanufacturing, validated reconditioning programs, and take-back schemes for high-value components to reduce embodied carbon. Hospitals increasingly evaluate total environmental impact alongside clinical performance, prompting device makers to report on recyclability, packaging reduction, and carbon intensity of manufacturing.

- Major Investment Themes: Investors and corporates are targeting diagnostic accuracy, infection control, and cost-efficiency. Investment themes include single-use endoscopy platforms to address infection risk and reprocessing costs, advanced imaging modules and optics with higher resolution, fluorescence, spectral imaging, AI/ML solutions for automated polyp and lesion detection and reporting, integrated therapeutic endoscopy tools, endoscopic submucosal dissection accessories, endoscopic suturing, and disposable consumables with improved material profiles.

- Sustainable Ecosystems and Startups: A healthy ecosystem combines OEMs, hospital systems, regulatory expertise, and startups that focus on narrow but high-impact problems: low-cost single-use scopes for resource-constrained settings, AI lesion-detection algorithms, compact video processors for point-of-care, and eco-friendly disposable materials. Incubators linked to clinical centers accelerate validation and pilot programs, while partnerships with sterilization specialists ensure operational compatibility.

- Startups that succeed typically secure early clinical champions, demonstrate clear workflow or safety advantages, and design for regulatory pathways. Collaborative pilots that evaluate both clinical outcomes and environmental metrics are becoming a differentiator for investment and procurement decisions.

Regional Insights

U.S. Endoscopy Devices Market Size and Growth 2025 to 2034

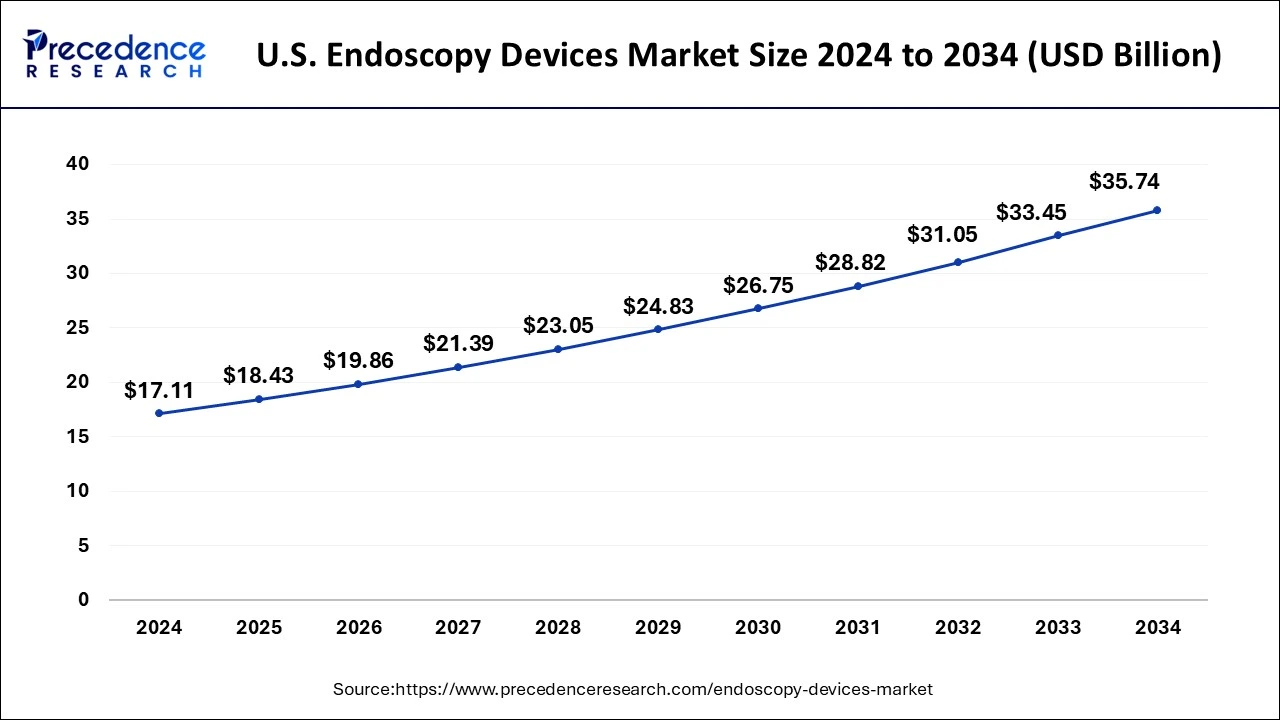

The U.S. endoscopy devices market size was exhibited at USD 18.43 billion in 2025 and is projected to be worth around USD 35.74 billion by 2034, growing at a CAGR of 7.64% from 2025 to 2034.

In 2024, North America accounted for the largest revenue share 43% owing to increase in preference for minimally invasive surgeries, rise in the prevalence of diseases such as colon & bladder cancers, and increase in geriatric population. Additionally, rising adoption of robot-assisted endoscopes used for surgical and diagnostic procedures is further positively influencing the market growth in the region. However, the Asia Pacific anticipated as the most opportunistic region during the forecast period. Increasing economies of China and India estimated to be the significant contributors for the market growth in this region.

The Asia Pacific region is projected to witness strong growth over the forecast period 2025 to 2034.

Can Latin America Expand Access to Endoscopy While Controlling Costs?

Latin America's endoscopy landscape is mixed: larger markets such as Brazil and Mexico have well-developed hospital infrastructures and a base of specialists, enabling uptake of mid- to high-end endoscopy systems, while many smaller or rural markets have constrained access and rely on periodic outreach or mobile clinics. Cost sensitivity favors reusable flexible endoscopes in tertiary centers but creates opportunities for low-cost single-use devices in remote settings where reprocessing infrastructure is limited.

Local distributors and regional manufacturers often play a key role in procurement and service; training and maintenance services are critical to ensure device uptime. Investment in workforce training, mobile endoscopy units, and pragmatic single-use solutions that lower infection risk without imposing high per-procedure costs could markedly expand screening and diagnostic coverage.

Brazil Endoscopy Devices Market Trends

Brazil's scale supports localized service networks and the potential for pilot programs in single-use technology and reprocessing best practices; Mexico's integration with North American supply chains encourages adoption of technologies aligned with regional standards. Smaller economies may benefit from cost-effective fiber scopes and tele-endoscopy models where experts support local operators remotely, improving diagnostic reach without full capital investments.

Will Middle East & Africa Leapfrog Infrastructure Gaps with Portable Endoscopy Solutions?

In the Middle East and Africa, endoscopy adoption reflects a spectrum from advanced tertiary centers in wealthy urban centers to underserved rural or peri-urban areas. Wealthier Gulf countries and some North African centers procure advanced imaging systems, therapeutic endoscopy platforms, and single-use devices to meet infection-control standards. In Sub-Saharan Africa and less-resourced regions, infrastructure constraints limited sterilization facilities, and scarce trained endoscopists limit procedure volumes, creating an opportunity for portable, ruggedized endoscopy systems, battery-operated processors, and low-cost single-use scopes that mitigate reprocessing needs.

Telemedicine and training partnerships with international centers can expand local capability. Procurement strategies in these regions often prioritize total cost of ownership and serviceability, and successful deployments hinge on supply-chain reliability and durable after-sales support.

Country-level

Gulf states can act as regional hubs for advanced endoscopic care and training, while countries with constrained budgets may adopt pragmatic models mobile outreach clinics with single-use scopes or regionalised.

| Company | Country | Revenue |

| Boston scientific corp | U.S. | US $ 16.47 billion |

| Karlz stores SE | Germany | Euro 2.18 billion |

| Ambu A/S | Denmark | DKK 4013 million |

| CONMED corporation | U.S. | Specific endoscopy revenue not listed |

| Olympus Corporation | Japan | Had a large portfolio |

Market Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing focuses on high-precision optics and imaging sensors, CMOS/CCD chips, biocompatible polymers for insertion tubes and distal tips, high-performance LEDs or laser light sources, small-form electronics PCBs, connectors, and materials for disposable components that meet sterility and biocompatibility standards. Procurement strategies emphasize supplier qualification, traceability, and long-term contracts for critical optical and electronic components to avoid production disruptions.

- Technological Advancements: Technological advances transforming endoscopy include high-definition and ultra-high-definition imaging, digital enhancements, narrow band imaging, fluorescence, autofluorescence, miniaturized CMOS sensors enabling smaller scopes, single-use endoscope manufacturing techniques, and AI algorithms for real-time polyp detection and characterization. Robotics and articulated endoscopic platforms extend therapeutic capabilities, enabling complex intraluminal procedures with finer control.

Endoscopy Devices Market Companies

- Karl Storz GmbH & Co. KG (A global leader in endoscopes, medical instruments, and visualization equipment.)

Richard Wolf GmbH (A major provider of products for endoscopy and extracorporeal shock wave treatment.) - PENTAX Medical (A leading global provider of endoscopic imaging solutions, particularly in the gastrointestinal (GI) and pulmonology fields)

- Medtronic Plc (Covidien) (While Medtronic is a massive global medical technology company with a diverse portfolio, its acquisition of Covidien significantly expanded its presence in surgical instruments and technologies.)

- Machida Endoscope Co., Ltd. (Historically, Machida was a significant Japanese manufacturer of flexible and rigid endoscopes.)

Segments Covered in the Report

By Product

- Endoscopes

- Flexible Endoscopes

- Colonoscopes

- Upper Gastrointestinal Endoscopes

- Sigmoidoscopes

- Bronchoscopes

- Pharyngoscopes

- Laryngoscopes

- Nasopharyngoscopes

- Duodenoscopes

- Rhinoscopes

- Other Flexible Endoscopes

- Rigid Endoscopes

- Arthroscopes

- Laparoscopes

- Cystoscopes

- Urology Endoscopes

- Neuroendoscopes

- Gynecology Endoscopes

- Other Rigid Endoscopes

- Disposable Endos copes

- Capsule Endoscopes

- Robot Assisted Endoscope

- Flexible Endoscopes

- Endoscopy Visualization Systems

- High Definition (HD) Visualization Systems

- 3D Systems

- 2D Systems

- Standard Definition (SD) Visualization Systems

- 3D Systems

- 2D Systems

- Ultrasound Devices

- High Definition (HD) Visualization Systems

- Endoscopy Visualization Components

- Insufflators

- Camera Heads

- High-definition Monitors

- Light Sources

- Video Processors

- Suction Pumps

- Operative Devices

- Access Devices

- Energy Systems

- Hand Instruments

- Suction & Irrigation Systems

- Snares

- Wound Retractors

By Application

- Urology Endoscopy

- Gastrointestinal (GI) Endoscopy

- Obstetrics Endoscopy

- Laryngoscopy

- Laparoscopy

- Bronchoscopy

- Arthroscopy

- Otoscopy

- Mediastinoscopy

- Other Applications

By Hygiene

- Single-Use

- Reprocessing

- Sterilization

By End-Use

- Ambulatory Surgical Centers

- Hospitals

- Other End-uses

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting