What is the Endoscopy Equipment Market Size?

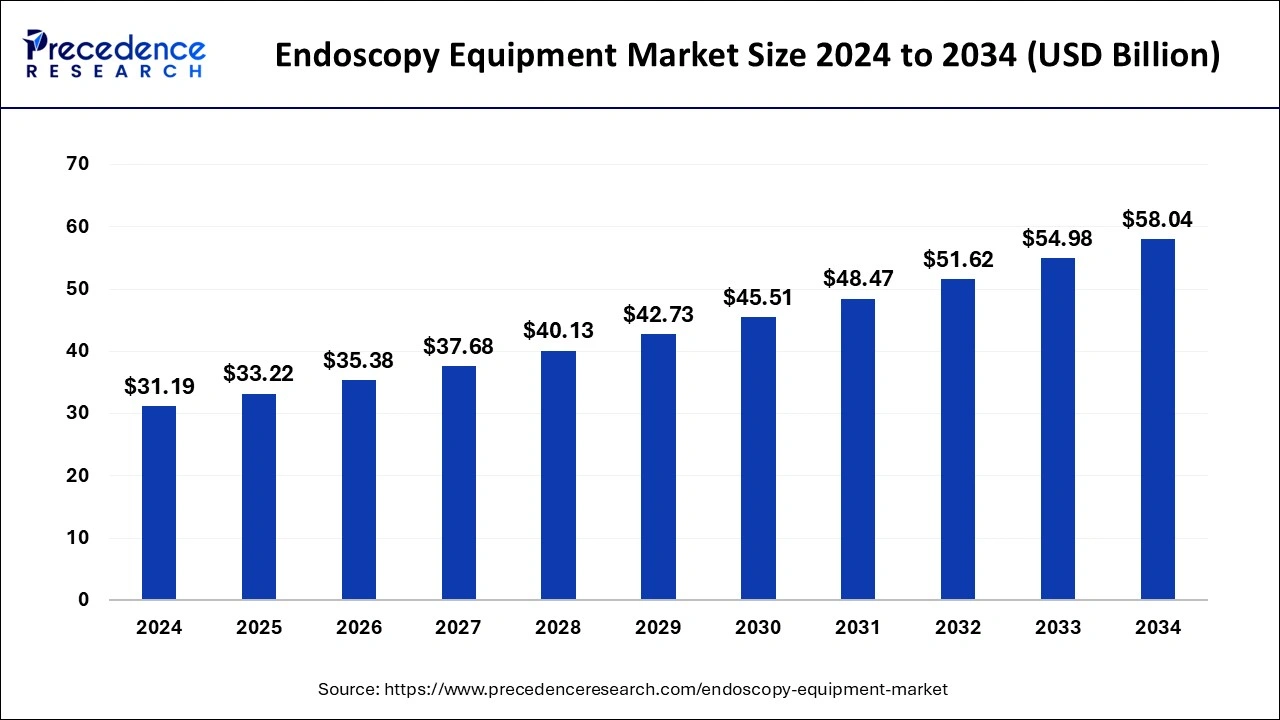

The global endoscopy equipment market size is projected to hit USD 33.22 billion in 2025 and is expected to reach over USD 61.30 billion by 2035 with a registered CAGR of 6.32% from 2026 to 2035

Market Highlights

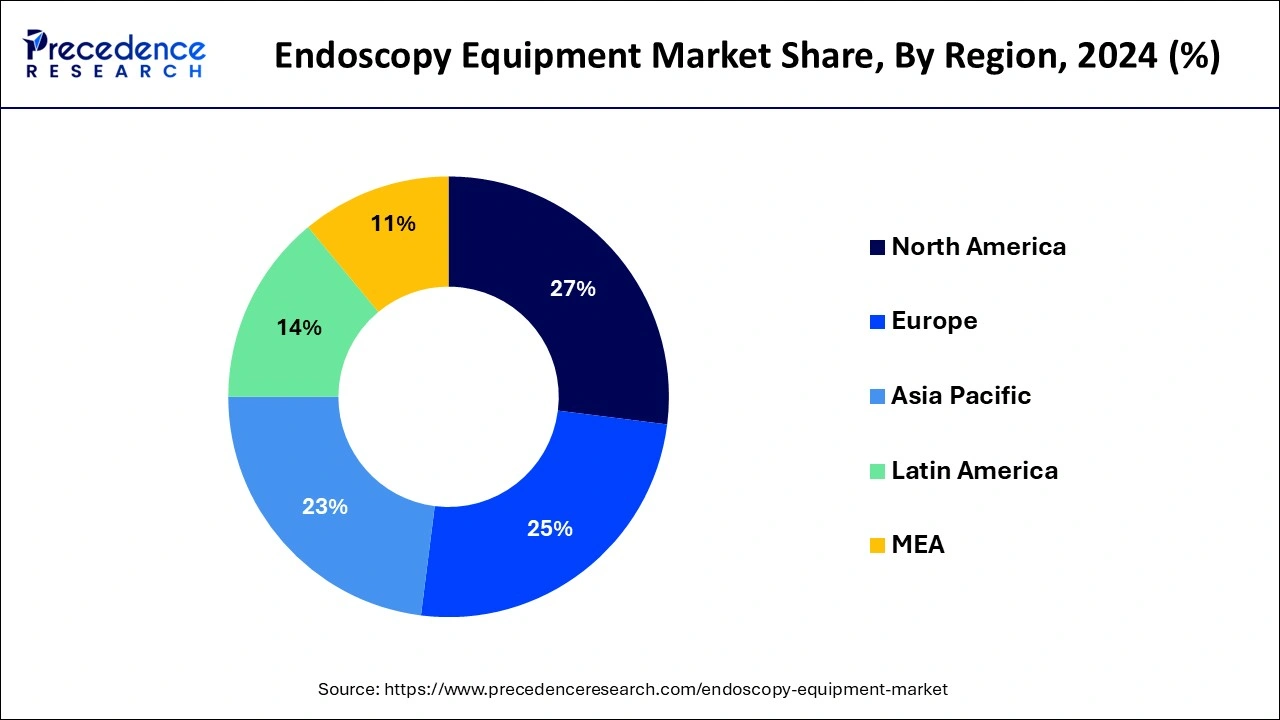

- North America led the global market with the highest market share of 27% in 2025.

- By product, the endoscopy visualization systems segment held the largest market share in 2025.

- By product, the endoscopes segment is expected to grow at a remarkable CAGR during the forecast period.

- By application, the gastrointestinal endoscopy segment captured the biggest revenue share in 2025.

- By application, the urology endoscopy segment is expected to expand at the fastest CAGR over the projected period.

- By end use, the hospitals segment registered the maximum market share in 2025.

Role of Artificial Intelligence in Endoscopy Equipment

Artificial intelligence is undoubtedly revolutionizing the realm of endoscopic equipment, making diagnostic equipment capable of exact results and timely treatments, thereby increasing efficiency and accessibility. Any help from the Computer-aided Detection (CAD) system, basically docking lesions with the brain of an artificial intelligence, decreases the chances of an abnormality being overlooked and cancer being, let us just say, clinically missed. CADx classifies polyps to select whether or not the polyp should be biopsied and how invasive the cancer should be treated.

With AI taking away the manual work of image recognition and analysis, quality assurance, and report generation, the burden on clinicians seems to be eased. The system is thus designed to help train Junior Endoscopist with continuous feedback in the evaluation of their own development. Altogether, these technologies could reduce the weight on healthcare by averting missed diagnoses and treatments unnecessary. The AI-enabled system also supports tele-diagnosis and telemedicine, thus for the further improvement of making expert endoscopic care accessible to the deprived.

Endoscopy Equipment Market Growth Factors

Endoscopy is a type of imaging that allows doctors to look within the body's organs and veins. This technique is useful not only for detecting damage, but also for surgical and therapeutic procedures. The endoscopy equipment market is being driven by factors such as an ageing population with an increase in the prevalence of cancer, gastrointestinal, and other chronic disorders, an increase in the number of hospitals, and technological advancements in endoscopy.

Endoscopes are one of the most commonly used medical imaging instruments. Endoscopes are introduced directly into the organ by a clinician or surgeon, as opposed to other imaging instruments. The endoscope has a camera and light on one end and the doctor may view the visual on a screen in real time. Instead of cameras, ultrasound endoscopes employ sound waves to produce detailed views of the intestinal wall and adjacent organs. This endoscopy equipment can be used for more than just imaging. They can also be used to place endoscopic implants.

During the projected period, the endoscopy equipment market is expected to rise due to an increase in the incidence of age-related disorders and an increase in the need for endoscopic equipment in diagnostic and therapeutic operations. The increased use of the endoscopy equipment for the diagnosis and treatment of a variety of illnesses is significant because it allows for less intervention and recovery time. As a result, the endoscopy equipment market expansion is expected. The rise in the senior population, who are more susceptible to a variety of medical disorders requiring endoscopic operations, such as gall stones and endometriosis, is fueling the endoscopy equipment market expansion.

On the other hand, the endoscopy equipment market is expected to be hampered by the high cost of endoscopic equipment and procedures, as well as inadequate compensation in developing countries. In the approaching years, factors such as product recalls and infections caused by endoscopes are projected to stifle the endoscopy equipment market growth. The healthcare industry in developing economies is expected to grow at a rapid pace, providing several chances for the endoscopy equipment market expansion.

Furthermore, biopsy instruments are frequently employed to obtain tissue samples for diagnostic testing. During the projected period, the endoscopy equipment market is expected to be driven by the rising adoption of low-cost disposable endoscopes. The endoscopy equipment market is expected to grow slowly in some locations due to a dearth of qualified endoscope operators.

Due to the growing need for endoscopy equipment for various therapeutic and diagnostic procedures, there is fierce competition among the existing manufacturers. Furthermore, prominent market players' technological developments in the field of endoscopy equipment are raising the stakes even higher during the forecast period.

- An increasing requirement for endoscopic procedures is posed by the increasing incidence of various chronic and age-related diseases, e.g., cancer, gastrointestinal disorders, gallstones, and endometriosis.

- Endoscopy became technologically advanced with high-resolution image recording, ultrasound, provides endoscopes, and minimally invasive instruments for diagnosis and treatment.

- The expansion of market growth also occurs due to a larger geriatric populace, prone to conditions that endoscopy treats.

- The opportunity to use disposable endoscopes is growing in regions where cost is paramount, as these endoscopes tend to reduce the infection risk.

- Putting in an impetus for further development are commitments to enhancing healthcare infrastructure and invigorating competitive marketing of modern endoscopy equipment internationally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 33.22 Billion |

| Market Size in 2026 | USD 35.38 Billion |

| Market Size by 2035 | USD 61.30 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.32% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Preference for Minimally Invasive Surgeries

Endoscopic procedures are kept as the specialization since they offer minimally invasive alternatives to open surgical procedures. The patient benefits from the procedure by way of decreased pain, quicker healing, and shorter hospital stays, while the healthcare side enjoys fewer complications and is more cost-effective. There is a growing patient preference for interventions that offer less trauma so that there can be an expeditious return to normal life. This trend is also strengthened by the technological advancements in the endoscopic field that allow for more conditions to be treated via minimally invasive techniques.

Restraint

Shortage of Skilled Professionals The other major challenge to the endoscopy equipment market is the global shortage of competent endoscopists and trained physicians. As the performance of high-quality endoscopic procedures demands a level of skill established through training-and such training is not widespread in many parts of the world-many remain unqualified. This shortage limits the capacity of healthcare systems, especially in areas where these systems are still not well developed, thereby impeding procedures that must be conducted to facilitate fast diagnosis and treatment. It has always been a hindrance to the market growth; on the other hand, it may deter established improvements needed for patient outcomes, thus making workforce enhancement an urgent imperative for continued growth.

Opportunity

Innovation and Technology

The technological innovations will provide great opportunities for the endoscopic equipment market. Advances in AI and distanced expert imaging bring higher quality to diagnosis, and 3D imaging provides better visualization. These days, with the growing trend in minimally invasive surgeries, there is a demand for these devices to be flexible and patient-friendly, thereby enhancing patient comfort and quick recovery. Inexpensive reusable endoscopes are now becoming popular in the markets where price consciousness prevails. Thus, these innovations lead to making endoscopy safer and more efficient and accessible to the masses, leading to widespread adoption, thereby presenting sound growth opportunities to manufacturers and healthcare professionals.

Segments Insights

Product Insights

The endoscopy visualization systems segment dominated the endoscopy equipment market in 2025. This is due to the advantages of high-definition visualization systems for the treatment and diagnosis of complex health conditions like gastrointestinal disorders, urinary disorders, cancer, and lung disorders, as well as the growing preference of healthcare professionals for using endoscopy visualization systems for better treatment and diagnosis.

The endoscopes segment is fastest growing segment of the endoscopy equipment market in 2025. This is attributed to an increase in endoscopic procedures and biopsies, as well as the availability of various types of endoscopes for improved diagnostics and treatment.

Application Insights

The gastrointestinal endoscopy segment dominated the endoscopy equipment market in 2025. Due to the increased incidence of gastrointestinal disorders and the growing elderly population, the gastrointestinal endoscopy segment had the biggest revenue share in 2025.

The urology endoscopy segment, on the other hand, is predicted to develop at a rapid rate over the projection period. The increased burden of urological diseases, as well as an increase in urology surgeries, is predicted to fuel demand for urology endoscopies.

End Use Insights

In 2025, the hospitals segment dominated the endoscopy equipment market. This is due hospitals having a much higher uptake and utilization of endoscopic devices than other healthcare systems, as well as advantageous payment rules. In addition, because hospitals are often the primary healthcare providers in many nations, the number of surgeries performed in hospitals is higher, indicating high adoption and demand.

The ambulatory surgery centers segment, on the other hand, is predicted to develop at the quickest rate in the future years. Some of the important aspects that are boosting the need for endoscopic interventions or procedures in ambulatory surgery centers include little discomfort due to microscopic surgeries, the shorter time required for endoscopy, and faster recovery time. As a result, endoscopy equipment market growth is influenced positively.

Regional Insights

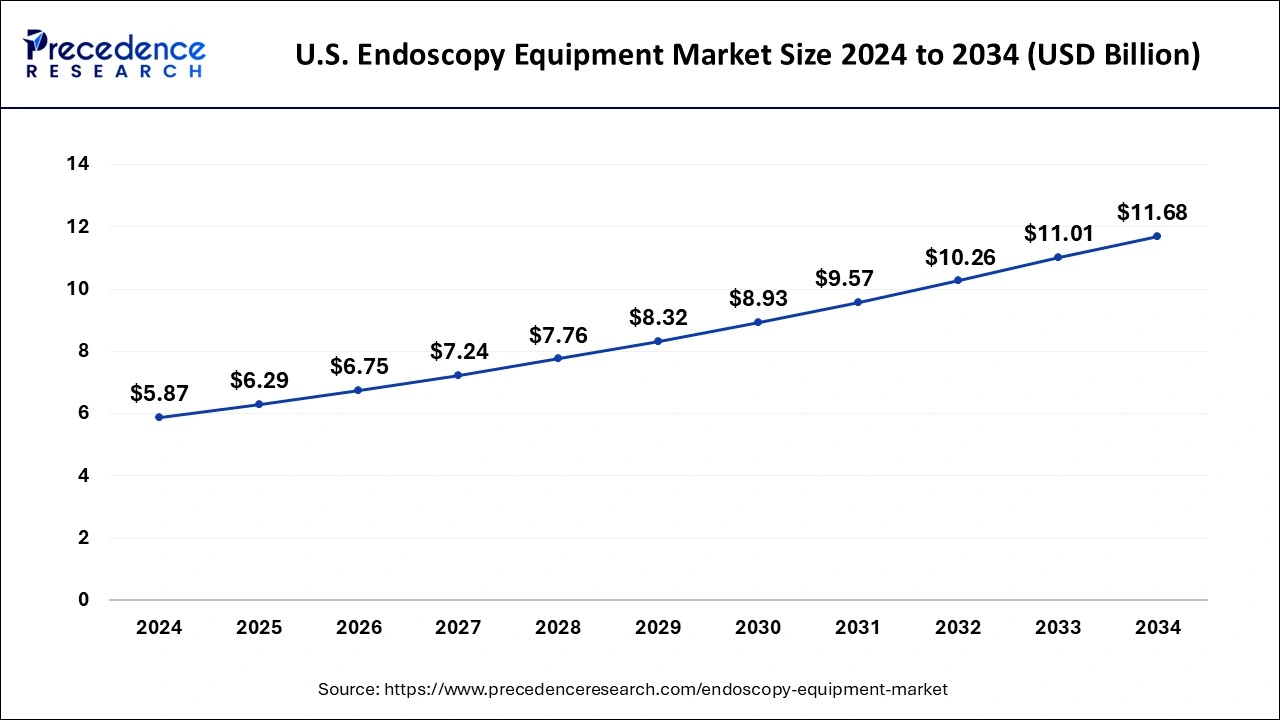

U.S. Endoscopy Equipment Market Size and Growth 2026 to 2035

The U.S. endoscopy equipment market size is estimated at USD 6.29 billion in 2025 and is predicted to be worth around USD 12.40 billion by 2035, at a CAGR of 7.02% from 2026 to 2035.

North America dominated the endoscopy equipment market with revenue share of 27% in 2025. Due to growing preference for minimally invasive surgeries, rising adoption of advanced technologies, and improved healthcare infrastructure, the North America dominated the global endoscopy equipment market.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. This is due to the region's increasing need for endoscopy-related technologies. Other factors include an ageing population and improved health infrastructure.

Endoscopy Equipment Market Companies

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Stryker Corporation

- Boston Scientific Corporation

- Johnson & Johnson

- Fujifilm Holdings Corporation

- Hoya Corporation

- Nipro Corporation

- Richard Wolf GmbH

- Cook Medical

Recent Developments

- In December 2024, Boston Scientific is set to launch Endoscopic Sleeve Gastroplasty (ESG) and Intragastric Balloon System (IBS) in India's expanding weight loss segment, powered by Apollo and Orbera365, respectively. (Source: https://health.economictimes.indiatimes.com)

- In July 2024, FUJIFILM India opened its Mumbai-based second-largest endoscopy equipment service center, aiming to reduce service turnaround times and improve delivery across India. (Source: https://www.healthcareradius.in)

- In July 2024, Mrs. Bamidele Abiodun, wife of Ogun State Governor, launched the first Endoscopy machine at OOUTH, marking a significant milestone in her commitment to improving healthcare services. (Source: https://guardian.ng)

Segments Covered in the Report

By Product

- Endoscopes

- Rigid Endoscopy Equipment

- Flexible Endoscopy Equipment

- Capsule Endoscopy Equipment

- Disposable Endoscopy Equipment

- Robot Assisted Endoscopy Equipment

- Endoscopy Visualization Systems

- Endoscopy Visualization Component

- Operative Equipment

By Application

- Gastrointestinal Endoscopy

- Laparoscopy

- Obstetrics Endoscopy

- Arthroscopy

- Urology Endoscopy

- Bronchoscopy

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

- Others

By End Use

- Hospitals

- Ambulatory Surgery Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting