What is the Enhanced Oil Recovery Market Size?

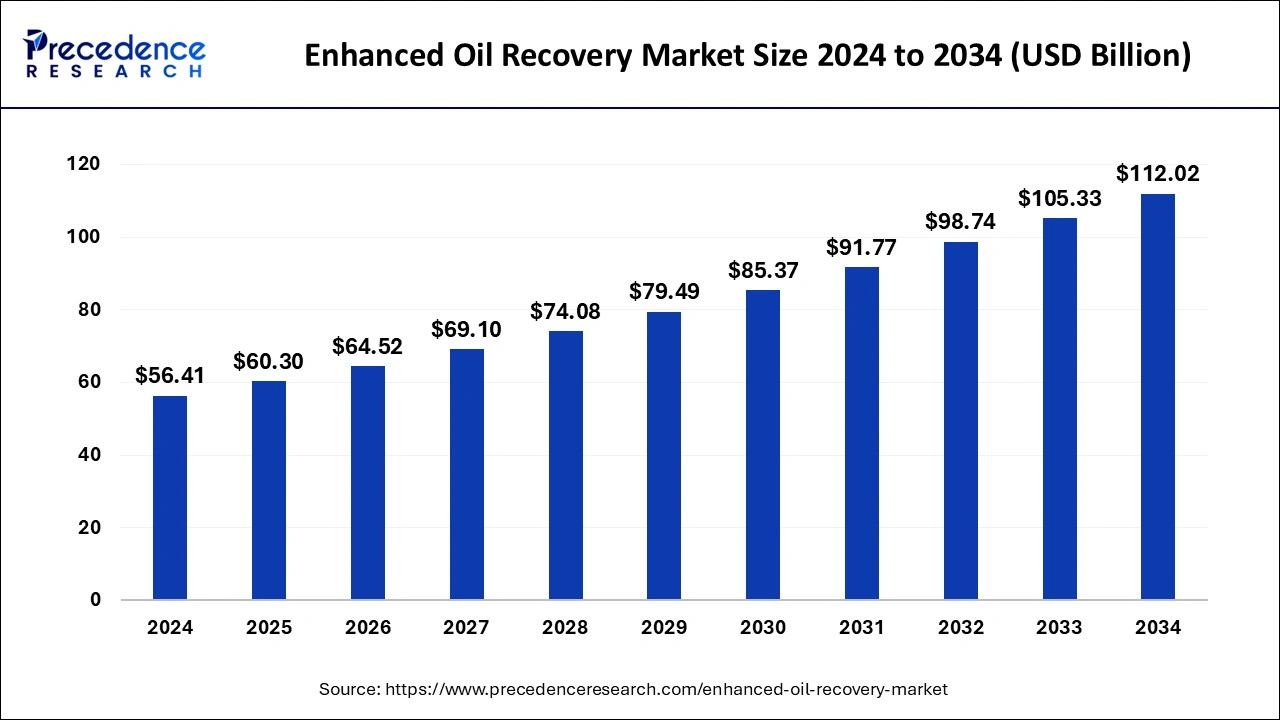

The global enhanced oil recovery market size is calculated at USD 60.30 billion in 2025 and is predicted to increase from USD 64.52 billion in 2026 to approximately USD 118.64 billion by 2035, expanding at a CAGR of 7% from 2026 to 2035.

Enhanced Oil Recovery Market Key Takeways

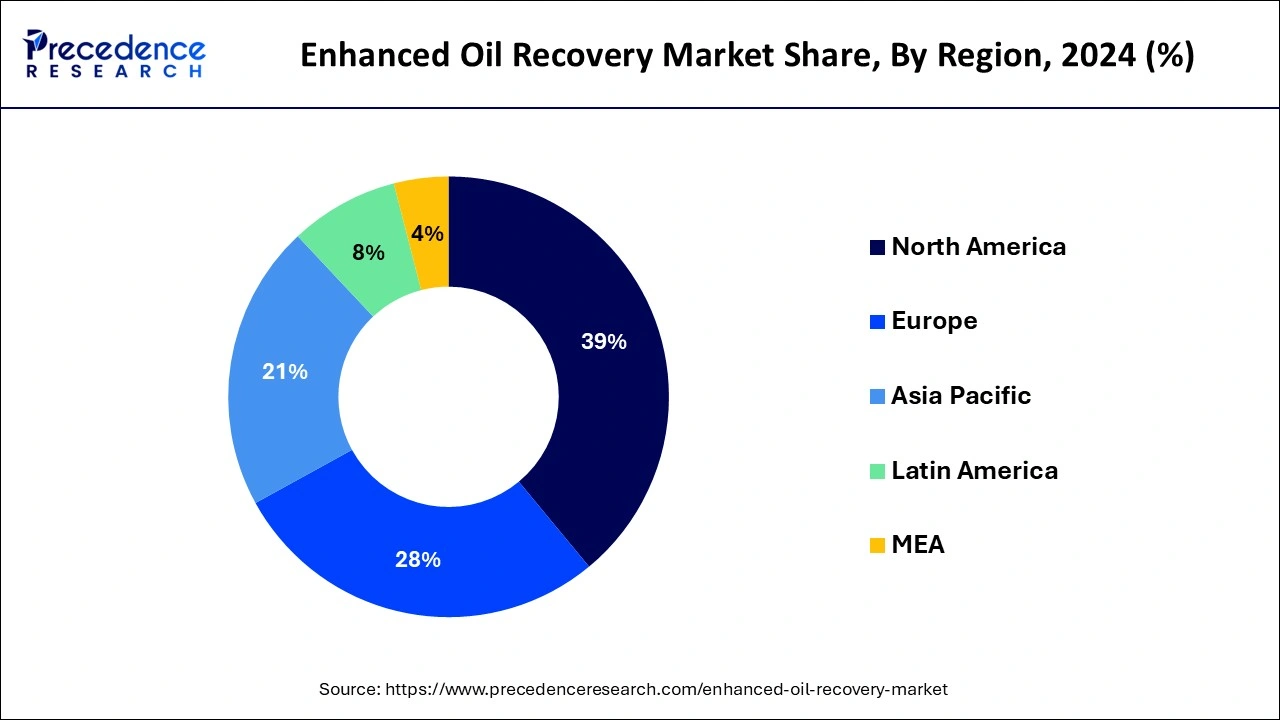

- North America dominated the global market with the largest market share of 39% in 2025.

- Asia Pacific is projected to expand at the notable CAGR during the forecast period.

- By technology, the thermal technology segment has held the largest market share in 2025.

- By application, the onshore segment captured the biggest market share in 2025.

How AI is Changing the Enhanced Oil Recovery Market?

Artificial intelligence is revolutionizing various industries, and the enhanced oil recovery industry is no exception. By enabling more efficient, cost-effective, and precise operations, the integration of AI technologies has introduced a new dimension to enhanced oil recovery. AI, with its capabilities for data-driven decision-making, predictive analysis, and machine learning, can transform how oil fields are managed, particularly in terms of reducing operational uncertainties and optimizing recovery rates. Operators can analyze and process huge amounts of data from m reservoirs in real-time, minimize the risks associated with traditional EOR methods, and adjust recovery strategies dynamically, through the use of AI. In addition, the integration of AI improves the accuracy of forecasts, enhances recovery, allows for better resource allocation, and reduces downtime, owing to significant cost savings. These advanced trends are expected to revolutionize the growth of the enhanced oil recovery market in the coming years.

Enhanced Oil Recovery MarketMarket Trends

- As secondary and primary oil recovery techniques may leave oil in the reservoir up to 70%, various oil extracting companies have further started relying more on tertiary oil recovery or enhanced oil recovery techniques, further driving the market growth.

- Gas injection, thermal recovery, and chemical injection are the most commonly utilized enhanced oil recovery techniques all around the world and the majority of the enhanced oil recovery technologies are currently utilized offshore, as oil companies are developing methods to enlarge onshore enhanced oil recovery methods.

- The growing demand for oil has also added to the rising demand for enhanced oil recovery around the globe and several governments worldwide are taking initiatives to use technologies that are advanced in nature for the extraction of oil in order to achieve more and more profits from the existing fields of oil & gas.

- The increasing number of key market players around the globe are deploying innovative technologies for the development of the enhanced oil recovery industry is further expected to drive the growth of the enhanced oil recovery market.

Market Outlook

- Start-up Ecosystem:The start-up growth of the EOR is witnessing heavy growth due to EOR's transformation for sustainability demand and a better tomorrow. Most of the start-ups are unifying solar-influenced energy systems along with carbon to avoid an energy penalty.

- Industry Growth Overview:The EOR industry is witnessing a noteworthy growth due to the massive production length from the historic/old oil fields. The technological advancement is the reason for this increased production volume, as it stands as a huge support and confidence to bring profit into the EOR businesses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 60.3 Billion |

| Market Size in 2026 | USD 64.52 Billion |

| Market Size by 2035 | USD 118.64Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Over few decades, the depletion of fossil fuels energies has contributed to the adding operation of enhanced oil recovery technologies in the oil and gas industry. The growing demand for oil has also been added to the rising enhanced oil recovery worldwide demand. Furthermore, several governmental bodies around the globe are taking enterprise to exercise oil extraction advanced technologies in order to achieve high profits from the existing fields of oil and gas. In addition, countries like India and China are offering fiscal impulses to attract transnational companies in order to invest more towards the market of enhanced oil recovery. In line with this, the different companies each over the world are engaging in research and development conditioning to ameliorate oil recovery. For case, British Petroleum has developed advanced ways that can prize oil using thermally actuated bitsy patches which expand deep into the force.

The ongoing COVID-19 epidemic has impacted the oil & gas industry encyclopedically. Owing to the scenario of COVID-19, various oil& gas companies across various regions closed or paused their manufacturing services and installations as various countries started practicing partial or full lockdown strategy in order to deal with the epidemic. Furthermore, the key players across the region further delayed or suspended the main oil & gas systems. Likewise, the epidemic has further impacted the prices of crude oil, well drilling and product conditioning, and the force chain of oil and gas. Owing to the dropdown in the product conditioning has also majorly impacted short/ medium term enhanced oil recovery market. In addition, the key market players around the globe are deploying innovative technologies for the development of enhanced oil recovery market.

Segment Insights

Technology Insights

By technology, the thermal technology segment is likely to hold the 40% market share in 2020. In addition, among thermal enhanced oil recovery, the steam is injected in order to improvise the mobility of oil through various reservoir and lower the viscosity. It is mainly utilized in reservoirs with heavy oil in order to recover billions of barrels comprising of heavy crude oil. In addition, the thermal enhanced oil recovery is also categorized further on the basis of type as combustion of steam, in-situ, and others. The steam segment is poised to grow at a fastest growth rate during the forecast period. Due to the growth of the mature oilfields and growth of discoveries of shale gas in the Gulf of Mexico are estimated to drive the enhanced oil recovery market.

Application Insights

By application, the onshore segment accounted revenue share of 90% in 2022 and is expected to grow at the fastest CAGR during the forecast period. This is attributed to the growing number of oil fields in the developed and developing regions such as Africa and North America. The oil fields in these regions help in the depletion of oil.

In addition, constant initiatives are taken by government and market players for the growth and development of the segment during the forecast period. Moreover, the key market players are investing in the onshore enhanced oil recovery segment. The onshore enhanced oil recovery helps in the cost savings as compared to offshore enhanced oil recovery.

Regional Insights

What is the U.S. Enhanced Oil Recovery Market Size?

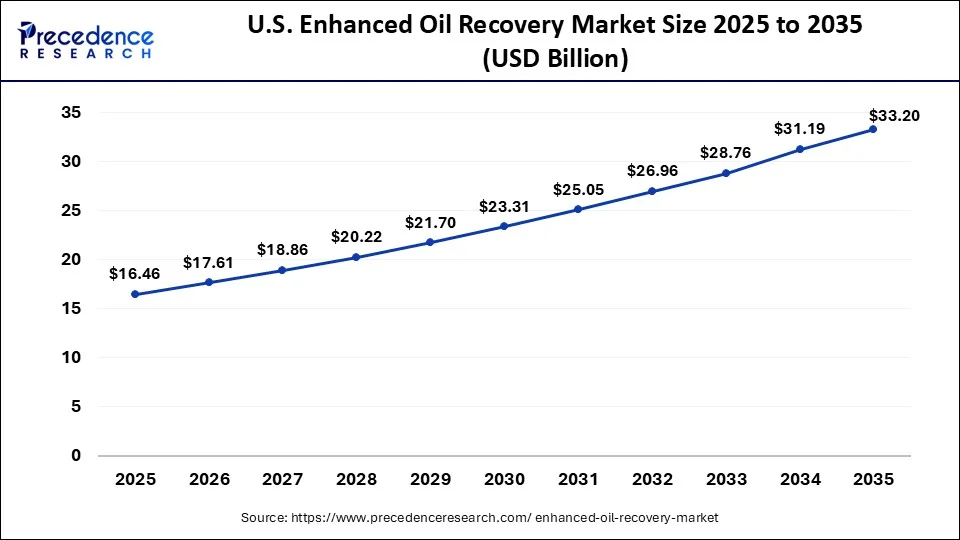

The U.S. enhanced oil recovery market size was exhibited at USD 16.46 billion in 2025 and is projected to be worth around USD 33.20 billion by 2035, growing at a CAGR of 7.27% from 2026 to 2035.

North America dominated the enhanced oil recovery market in 2025. The market growth in the region is attributed to the increasing advanced extraction technologies and the extensive oil reserves available in the region. In addition, the increasing presence of various unconventional matured fields and oil and gas resources in the U.S. are expected to drive the market growth. EOR technologies such as chemical flooding, gas injection and thermal recovery are rapidly equipped to extend the life of aging reservoirs and enhance production efficiency, as conventional oil reserves decline in the U.S.

The United States is the clear leader in the enhanced oil recovery (EOR) space in North America. The large quantity of mature oil reservoirs, as well as the government's commitment to research and development creates competitive opportunities in EOR. The U.S. is employing thermal, gas injection, and chemical EOR approaches. CO? injection in Texas and along the Gulf Coast is particularly popular. Other state and federal government economic policies and supportive frameworks to promote carbon capture, usage, and storage (CCUS) are expected to foster additional development and usage of EOR. The major oil companies still have significant positions of influence in relation to the EOR market however they are aided by working with technology providers.

Asia Pacific is anticipated to witness the highest CAGR during the forecast period, with China occupying the largest market share across the region. Rising oil and gas demand from the major economies including China and India along with the surged deployment of enhanced oil recovery in aged wells in order to meet the product targets are likely to boost the market growth in the Asia Pacific. However, Europe, North America, Asia-Pacific and LAMEA are the key regions included in the study of the enhanced oil recovery market.

China is the leader in the enhanced oil recovery market in the Asia Pacific region given its substantial incentive to increase production from decline oil fields and facilitate its overreliance on crude imports. There are numerous EOR projects that China is initiating as part of their respective fields using polymer flooding, chemical injection, and CO?-EOR, particularly in the Daqing, Shengli, and Xinjiang fields. With state owned enterprises funding major social initiatives with substantial government financing, China is developing EOR technologies to assist in stabilizing domestic production. These initiatives are part of China's long-term goal to develop all aspects of modern energy security while optimizing oil recovery.

Europe's Advancements' Impact on Enhanced Oil Recovery

Europe's advancements in enhanced oil recovery have a great impact on the transformation of traditional oil extraction. The new tool for energy security and carbon management is the first step to advancement. The transition towards carbon capture, utilisation and storage (CCUS) is seen presentable for offering permanent carbon storage and also to elevate the production scale.

The modern EOR techniques installation is particularly identifying the gap in production, mainly in the North Sea. This advanced method has potential for the spaces of mature fields and recovers 5-15% more of the natural oil. The technological innovation is a huge support to the regional advancements.

Latin America's Contribution to the Enhanced Oil Recovery Industry

Latin America's contribution to this industry has grown rapidly and is initially determined by its infinite hydrocarbon reserves. Within the region, Brazil is known for its offshore EOR, and Mexico earns recognition with its Nitrogen injection programs, which manage neglected reservoir stress. Colombia's unique EOR techniques, such as cyclic steam injection and other fields like Cupiagua and Cusiana.

Colombia's new EOR techniques promote thermal EOR and a solution to pressure displacement and maintenance. Venezuela's concentration on technologies is also a major contribution to the EOR sector.

Enhanced Oil Recovery Market-Value Chain Analysis

- Resource Extraction: The resource extraction in EOR includes gases, heat, or injecting fluids that later convert into oil reservoirs to trim a few major properties, enhance mobility, and mitigate oil viscosity. The techniques and fundamental mechanisms harness the resource extraction analysis.

Key Players – Chevron Corporation (US), Royal Dutch Shell Plc (Netherlands), Petrobras (Brazil), and - ExxonMobil Corporation (US).: Distribution Network Management

The distribution network management in EOR is all about serving injectants to wells and refining recovery volume by analysing and maintaining the logistics, quality and businesses through modern chains like AI and ML.

Key Players – BP Plc, China National Petroleum Corporation (CNPC) & Sinopec. - Regulatory Compliance and Energy Trading: This analysis of legal walls in EOR is essential for this emerging, crucial landscape, which elevated due to the demand for more mature field production without compromising the environment's safety and further obeying the carbon management regulations.

Key Players – Environmental Protection Agencies (US EPA) and State Oil & Gas Commission

Enhanced Oil Recovery Market Companies

- Halliburton Energy Services, Inc

- Royal Dutch Shell plc

- Schlumberger Limited

- Chevron Phillips Chemical Company LLC

- TechnipFMC plc

- National Aluminium Company Limited

- Baker Hughes Company

- Total SA

- China National Petroleum Corporation

- Titan Oil Recovery

Recent Developments

- In May 2025, SLB announced the launch of Electris™ a portfolio of digitally enabled electric well completions technologies that boost production and recovery while reducing the total cost of ownership of an asset. Electris completions digitalize control of the entire productive area of the wellbore, providing real-time production intelligence across the reservoir.

(Source: https://www.worldoil.com) - In October 2024, ICM has signed an EPC agreement to provide Absolute Energy, LLC, with its patented FOT Oil Recovery™ technology, which enhances oil production while reducing natural gas consumption and improving the facility's overall energy efficiency. This innovative technology stands apart by offering ethanol producers a more sustainable solution.

(Source: https://www.businesswire.com) - In October 2024, Japan Petroleum Exploration Co. launched an inter-well CO2 injection test in collaboration with national energy company PT Pertamina in Indonesia. The aim behind this launch was to conduct CO2 injection across multiple wells to improve the effectiveness of CO2 sequestration and CO2-EOR (Enhanced Oil Recovery).

- In June 2024, India's leading private oil and gas producers, Vedanta Group and Cairn Oil & Gas announced the commencement of the largest commercial ASP flooding in Rajasthan. This ASP technique is designed to enhance oil recovery in mature fields and boost output potential significantly.

Segments Covered in the Report

By Technology

- Thermal EOR

- Steam

- In-situ Combustion

- Others(Hot water and Solar)

- Chemical EOR

- Polymer

- Surfactant

- Alkaline Chemical

- Polymer

- Foamers

- Others

- Gas EOR

- CO2

- Other Gas(Nitrogen and Natural gas)

- Others (microbial, seismic, simultaneous water alternating gas, and water alternating gas)

By Application

- Onshore

- Offshore

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting