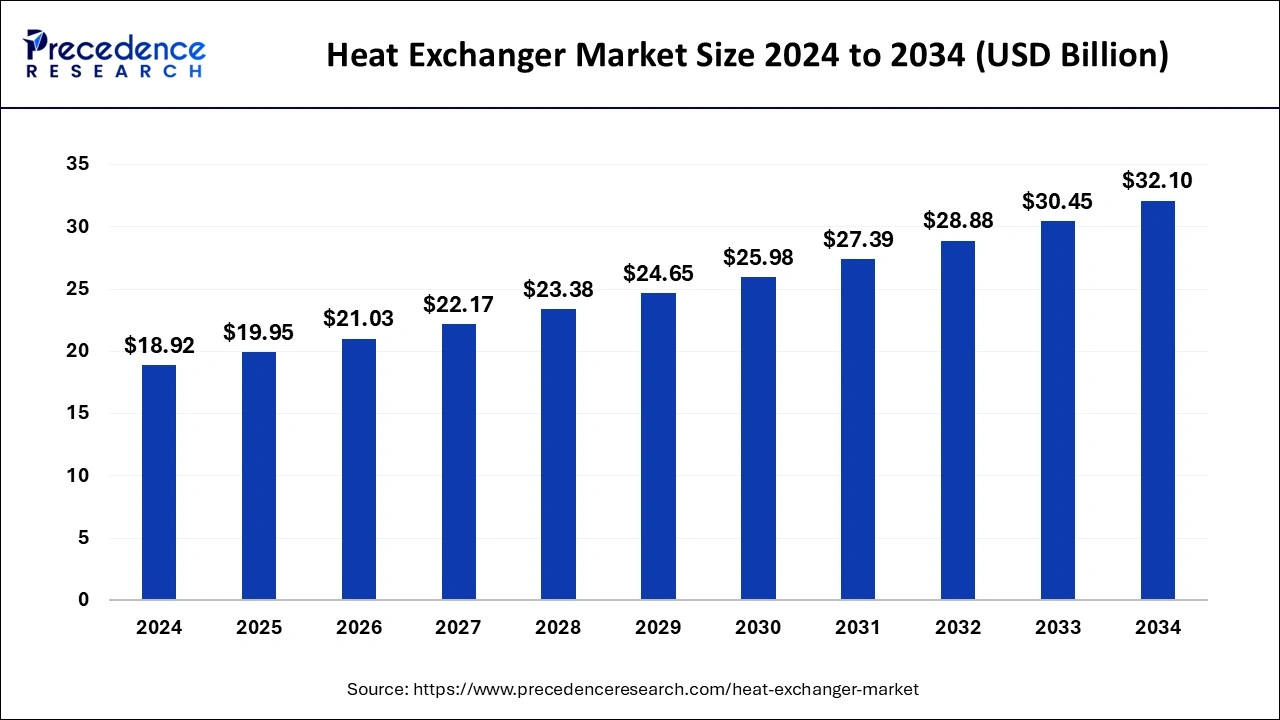

Heat Exchanger Market Size and Forecast 2025 to 2034

The global heat exchanger market size was estimated at USD 18.92 billion in 2024 and is anticipated to reach around USD 32.10 billion by 2034, expanding at a CAGR of 5.43% from 2025 to 2034.

Heat Exchanger Market Key Takeaways

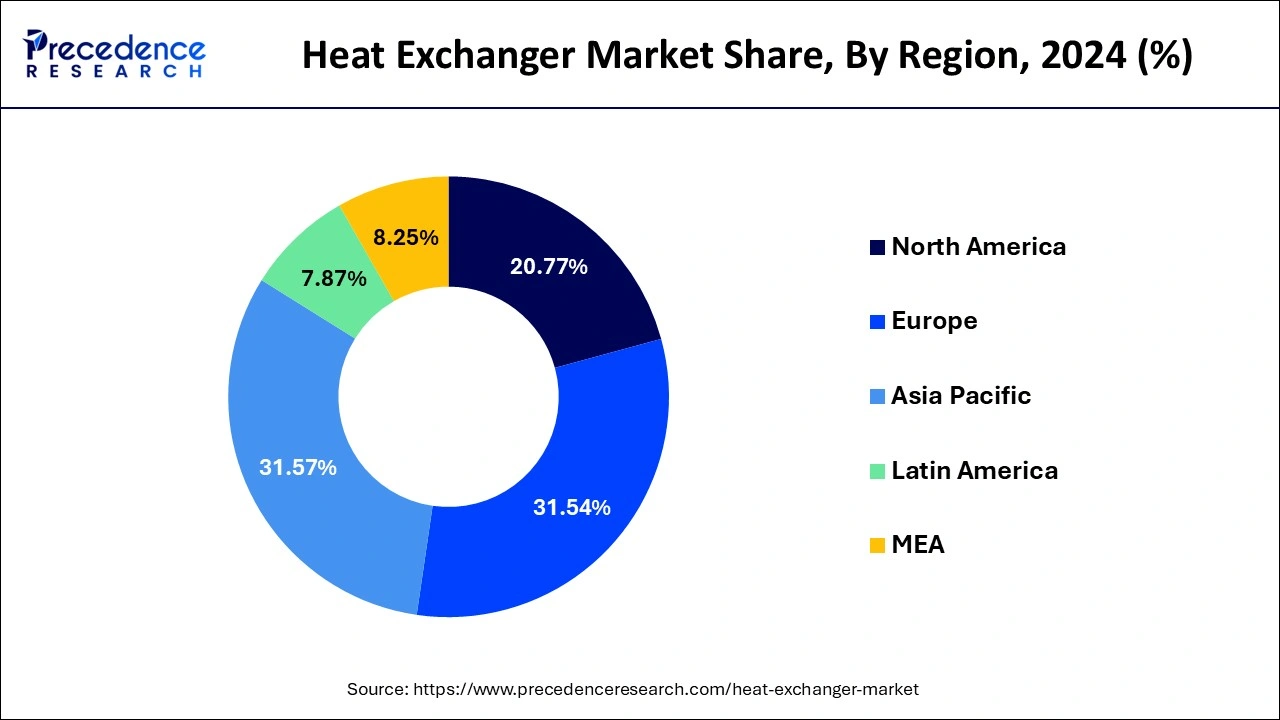

- Asia Pacific dominated the global heat exchanger market with the largest market share of 31.57% in 2024.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By Products, the shell & tube segment contributed the highest market share in 2024.

- By end user, the Chemical and petrochemical segment captured the biggest market share in 2024.

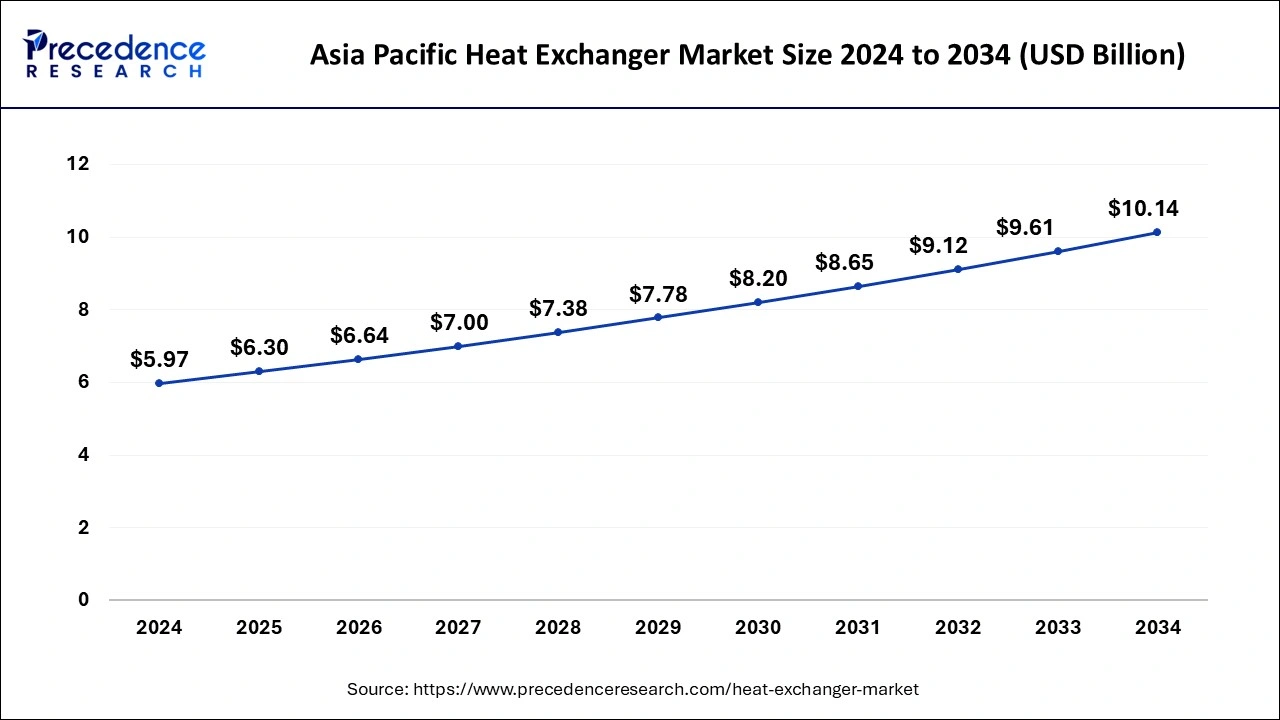

Asia Pacific Heat Exchanger Market Size and Growth 2025 to 2034

The Asia Pacific heat exchanger market size was evaluated at USD 5.97 billion in 2024 and is predicted to be worth around USD 10.14 billion by 2034, rising at a CAGR of 5.44% from 2025 to 2034.

Asia Pacific dominated the global heat exchanger market with the largest market share of 31.57% in 2024. This can be attributed to the quick urbanization and industrialization of nations like China, Japan, and India. In 2020, Asia-Pacific had a GDP of 5.67 billion USD.

Europe's market for advanced heat exchangers is anticipated to increase significantly between 2025 and 2034, supported by the presence of strict environmental rules that place a premium on reducing carbon emissions.

In the future years, North America is anticipated to see exponential expansion. This may be attributed to elements like the existence of well-established players in a variety of industry sectors including aircraft, HVAC, aerospace, and automobiles.

What Factors Are Driving the Heat Exchanger Market in North America?

North America held a significant share of the global heat exchanger market in 2024. It is driven by its superior industrial base and developments in industries such as power generation and chemical processing. The focus of the region on energy efficiency and sustainability has led to the investment in the latest technology of heat exchangers, which allows minimizing the use of energy and the emission of carbon dioxide. Tightening green policies, especially in the U.S and Canada countries are forcing the industries to use cleaner and efficient equipment, and this is also leading to the growth of the market.

In North America, the United States controls the heat exchanger market because of its vast industrial base and intelligent production capacities. The investments in research and development are constant, which contributes to the innovations in the form of the creation of high-performance products of heat exchangers with energy-saving characteristics.

Why Is the Heat Exchanger Market Growing Fast in the Middle East & Africa?

The Middle East and Africa heat exchanger market is experiencing robust growth, catalyzed by industries such as oil & gas, petrochemical, and power generation, which are in the region. Extensive projects to build infrastructure to expand the energy sector are creating demand for high-tech heat exchanger technologies, which can enhance energy efficiency and reliability of operations. The market force is also affected by the strategic significance of the Middle East as a global energy hub and by the investments in highly competent thermal management facilities.

Market Overview

Heat exchanger demand was lower than expected in all regions compared to levels prior to the global COVID-19 epidemic, which has been unprecedented and catastrophic. Our research shows that the global market will have a loss of -5.5% in 2020 compared to 2019.

The increase in HVAC installation and other industrial operations are contributing to the expansion of the global market. Increased use of heat exchangers in a variety of applications and increasing use of renewable energy sources will promote growth.

The working temperature of a system is controlled by a heat exchanger, which also recovers the heat from the wastewater. The machinery operates with two fluids or gas and fluid mixtures at various heat levels and temperatures. The primary methods of transferring heat between fluids or air are often tubes or pipes. One passes over the pipes, while the other passes through them. These are utilized in a number of different processes, including chillers, vaporizers, reboilers, evaporators, and condensation. These are crucial components for applications like air conditioning, refrigeration, chemical processing, power production, and automobiles.

This industry was threatened by the COVID-19 epidemic. The extraordinary measures required to stop the virus' spread have made working conditions difficult in several industries. As a result of the industry shutdowns caused by the illness epidemic, product demand has changed. Due to constraints from the government, the production facilities for these exchangers were shut down in various places. Even when some of the requirements were relaxed, output has been hampered by the lack of personnel. The market is anticipated to respond favorably to the pandemic with a greater desire for total district energy and renewable energy objectives as well as the requirement to meet HVAC demand. For instance, the United Kingdom's government has said that by 2030, district heating networks would be able to meet 17% of the country's heating demands.

Heat Exchanger Market Growth Factors

The heat exchanger is mostly utilized as cooling technology across several sectors. These exchangers can efficiently control a system's operating temperature, which is what is driving the market's expansion. The minimum temperature range for water-cooled, steam-heated, and air-cooled heat exchangers, respectively, should be about 15 degrees Fahrenheit, 20 degrees Fahrenheit, and 25 degrees Fahrenheit, according to a research study.

To avoid mixing, the medium may be in close proximity to one another or isolated from one another by a complete wall. Thermal management is becoming more and more in demand across a variety of industries, including HVAC, power generation, chemicals, and petrochemicals.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.95 Billion |

| Market Size by 2034 | USD 32.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.43% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product , End-Use, Material of Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Extensive economic growth and technological advancements would drive the market

- The industry outlook will see new possibilities as a result of the rising integration of the present product line with cutting-edge and next-generation network-based solutions for better fault detection and seamless operations. The advancements in technology provide several productivity advantages as well as real-time monitoring and issue diagnosis. The Industrial Internet of Things (IIoT), among other cutting-edge technologies, is being researched and developed by a number of the industry's major companies. This addition can significantly aid in lowering system downtime, energy use, wear and tear, and efficient machine optimization.

- In the last few decades, the world economy has expanded to unprecedented levels as a result of the population boom, growing incomes, and the power of the consumer. The economy's rapid expansion causes global trade to expand, which is followed by a rise in commercialization. The rising need for comfortable cooling and heating is a result of increased trade and commerce, which is helping the industry develop.

Emerging economies' industrial sectors are expanding quickly to support market expansion

- Heat exchangers are essential parts of many different industries. For instance, the equipment is placed for pasteurization in the food and beverage business, and it is utilized to recover heat in the oil and gas, and power industries. In addition to their former use, they are mostly utilized as cooling equipment in the industrial sector. To control the operational temperature of the whole system, coolants flow via these exchangers. Due to increased power demand and energy requirements, the product's rising oil & gas application scope is developing together with the expansion of all the aforementioned industries. The aforementioned elements will cause an increase in the worldwide market throughout the forecast period.

- For instance, China's industrial production increased by 7.5% in January 2022 as the market recovered from the COVID-19 epidemic. The Chinese government's Made in China 2025 strategy intends to turn China from a low-end manufacturing nation to a high-end manufacturing nation. Consequently, increasing industrialization will encourage the use of this technology.

Key Market Challenges

Installation, operational, and maintenance costs will limit market expansion

- Heat exchangers can be used in large industrial settings, hospitals, schools, and other places. Because economies of scale are hard to overcome, these systems cannot be used for lower capacities, particularly residential ones. Market obstacles to a larger deployment still exist, including a lack of knowledge about technological uses, numerous advantages, and cost reductions, particularly in Africa and Latin America. One of the biggest market limitations is the high initial expenditure needed for installation. However, as technology develops, the cost of making these things will go down.

- Pressed plates, which are less costly than the welded plates used in earlier generations, are utilized in plate heat exchangers nowadays. Additionally, pressed plates are more resistant to chemical reactions and corrosion, which degrade the product and necessitate regular replacement. Pressure dips and system leaks are two possible drawbacks of the product category. It can be challenging to detect and fix leaks in the heat transfer process. To remedy a leak, several exchangers must be completely disassembled. Similar pressure decrease throughout a plate heat exchanger necessitates inspection of every plate for flaws. These procedures have substantial operating and upkeep expenses, which are expected to impede market expansion.

Key Market Opportunities

In order to support growth, renewable energy sources for power generation should be expanded and more applications should use them

- The most important source of energy for the generation of electricity is generally regarded as fossil fuels. According to the Energy Information Administration (EIA), coal is the third-largest fuel, providing over 19% of the U.S. energy output, while natural gas was used to generate about 40% of the country's electricity in 2020. These fossil fuels emit GHGs into the atmosphere. One of the key aspects that will ultimately help the acceptance of a product is the increasing use of renewable resources for power generation, such as wind and solar.

- The installation of devices will be prompted by the increase in energy consumption that would result from the requirement to lower greenhouse gas emissions. In wind turbines, heat exchangers are essential because they convert solar energy from solar collectors to the liquid or air that heats water or a place. In order to further stimulate the market, the government is also focusing on renewable energy installation. For instance, Germany declared its intention to reach 20 GW of offshore wind energy production by 2030.

- Additionally, practically all industrial applications employ these goods to maintain output under restricted pressure and temperature conditions and to balance temperature. The market will benefit from the developing industrial phases, which include refineries, manufacturing facilities for various goods, power-generating products, and district heating and cooling systems.

Product Insights

In 2024, the industry's top-performing segment, shell & tube held the highest revenue share. Products made of shells and tubes are composed of a collection of tubes arranged in a cylindrical shell with the tube axis parallel to the shell's axis.

Applications requiring a wide temperature and pressure range, as well as transfer between two liquids, between liquids & gases, or between two gases, employ shell & tube products. These simple heat exchangers are excellent for transferring heat from steam to water. But because they take up a lot of room, it's expected that throughout the projected period, segment growth would be constrained.

Plate-type construction consists of either smooth or corrugated plates. Depending on the level of leak tightness required, these items are categorized as brazed, welded, or gasketed. At low to medium pressures, plate & frame products are commonly utilized for liquid-liquid exchange.

Products that use air cooling, commonly referred to as air coolers, include a tube bundle, an air pumping mechanism like a blower or an axial flow fan, and a support structure. Petrochemical plants, refineries, compressor stations, gas treatment plants, power plants, and other facilities utilize these items. Products that use air cooling can be mounted either vertically, horizontally, or at an angled slope.

End-Use Insights

Chemical and petrochemical products dominated the market in 2024, making for 23.4% of total revenue demand. The petrochemical industry's expansion is projected to be aided by the increasing demand for textiles, plastics, digital gadgets, packaging, and medicinal and agricultural products.

The demand for heat exchangers in the oil and gas end-use industry will increase at a CAGR of 4.9%. The need for heat exchangers is anticipated to rise as shale gas is used more often in the manufacturing and energy sectors and as shale gas exploration operations increase as a result of technical developments in exploration.

HVAC systems would not function without heat exchangers. The need for heat exchangers in the HVAC sector is anticipated to increase as people become more conscious of the need to conserve energy and lower their energy costs. In the heat recovery procedure, which uses steam, water, air, and refrigerants, the products are employed. The market for the product is expected to increase due to the growing demand for effective heat recovery systems with excellent corrosion resistance.

Heat Exchanger Market Companies

- Alfa Laval (Sweden)

- Kelvion Holding Gmbh (Germany)

- GEA Group (Germany)

- Danfoss (Denmark)

- SWEP International AB (Sweden)

- Thermax Limited (India)

- API Heat Transfer (U.S.)

- Tranter, Inc. (U.S.)

- Mersen (France)

- Linde Engineering (U.K.)

- Air Products (U.S.)

- HISAKA WORKS, LTD. (Thailand)

Recent Developments

- In March 2025, Alfa Laval, partnered with SSAB and Outokumpu, installed heat exchangers at Laakso Joint Hospital in Helsinki, Finland, with a carbon footprint 60% lower. This remarkable achievement is part of Alfa Laval's Concept Zero program, aimed at heat exchangers with no fossil carbon emissions to be produced by 2033.

(Source: https://www.outokumpu.com/en/news/2025/outokumpu,-alfa-laval-and-ssab-in-collaboration-to-reduce-emissions-at-laakso-joint-hospital-in-helsinki-3567334 - In October 2023, Conflux Technology initiated production on a metal 3D-printed heat exchanger. The new launch builds on the successful launch of the considerable success of the new heat exchanger in the M 4K system. AMCM plans to apply the same principle to enhance their recently announced M8 K system, with a build volume of 800 x 800 x 1200 mm.

(Source: https://www.kelvion.com) - In August 2023, Kelvion supplied its ConBraze GK108H brazed plate heat exchanger to the Fraunhofer Institute for Solar Energy Systems (ISE) for the LC150 research project, focusing on developing propane-based heat pumps for 150 grams and below refrigerants, and conformance to EU safety standards for indoor use. The GK108H was designed to achieve the lowest fill volume possible with high thermal efficiency, and it played a part in this project.

(Source: https://www.confluxtechnology.com) - March 2022:Alfa Laval, a pioneer in vital heat transfer, separation, and fluid handling technologies, introduced a gasket plate heat exchanger that is expected to have an influence on several applications. The TS45 is the most advanced exchanger in the world, offering performance and adaptability.

Segment Covered in the Report

By Product

- Plate & Frame

- Brazed Plate & Frame

- Welded Plate & Frame

- Gasketed Plate & Frame

- Others

- Shell & Tube

- Air-Cooled

- Microchannel

- Others

By End-Use

- Chemical & Petrochemical

- HVAC & Refrigeration

- Oil & Gas

- Food & Beverage

- Power Generation

- Pulp & Paper

- Others

By Material of Construction

- Carbon Steel

- Stainless Steel

- Nickel

- Others (Titanium, Nickel Alloy, Copper, Molybdenum)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting