What is Heat-Shrink Tubing Market Size?

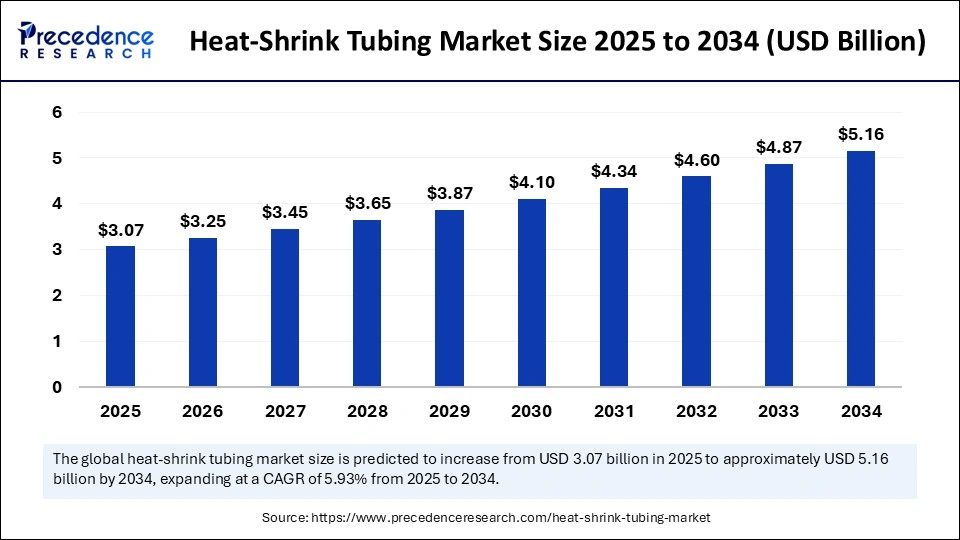

The global heat-shrink tubing market size accounted for USD 3.07 billion in 2025 and is predicted to increase from USD 3.25 billion in 2026 to approximately USD 5.16 billion by 2034, expanding at a CAGR of 5.93% from 2025 to 2034. The heat shrink tubing market is expanding due to its exceptional capabilities to protect delicate wirings and offer sustainability. The growing sector like electronics, automotive, aerospace and Défense are increasingly adopting heat shrink tubing for highest protection against environmental fluctuations further escalating the market.

Market Highlights

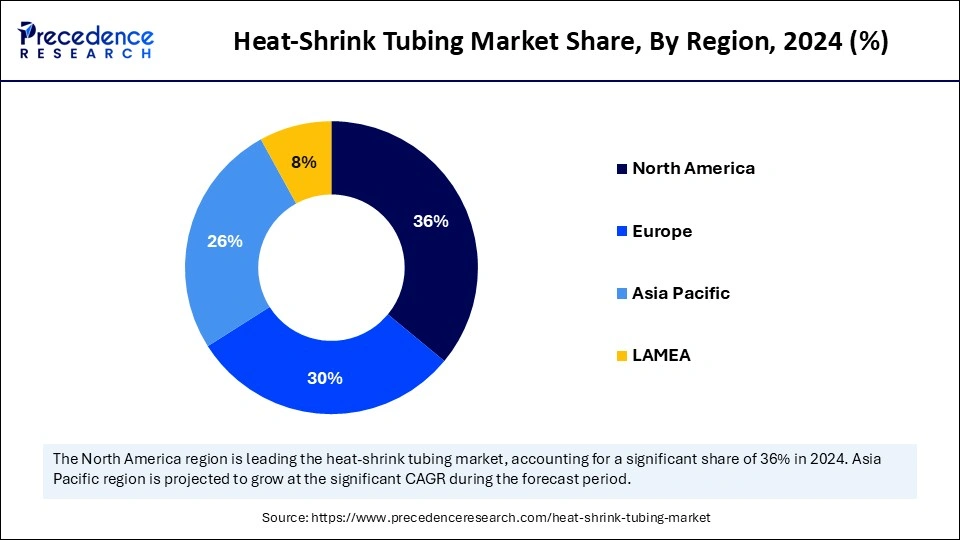

- North America held the largest revenue share of 36% in 2024.

- Asia Pacific is expected to fuel at the fastest growing CAGR from 2025 to 2034.

- By application the automotive segment led the global market with highest revenue share in 2024.

- By application the electrical and electronics segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By material the polyolefin segment contributed the biggest revenue share in 2024.

- By material the polyvinyl chloride segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By wall thickness the thin wall segment held the major revenue share in 2024.

- By wall thickness the medium wall segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By Ratio the 2:1 segment dominated the global heat shrink tubing market with largest share in 2024.

- By Ratio the 3:1 segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By certification the UL segment generated the biggest revenue share in 2024.

- By certification the ISO segment is expected to grow at the fastest CAGR from 2025 to 2034.

Market Overview

The global heat shrink market is significantly expanding due to its widespread applications in various industries such as electronics, aerospace, automotive and telecommunications. The tubing is majorly used for environmental safety, and strain relief for connectors, wires and other components as they require proper insulation from environmental factors like moisture in air, chemicals and rusting due to reactive molecules like free radicals in the air. Heat shrink tubing is basically a plastic-based and cylindrical in shape tubing material tend to shrink in dimeter when exposed to environmental actors like heat. It is made up of PVC, polylefine and thermoplastics to offer insulation and strain relief for cables and wires.

One of the key trends driving the heat shrink tubing market is, increasing shift towards eco-friendly and halogen-free heat shrinking tubing to provide sustainability. Heat shrink tubing provide compact and protective insulation that supports wire durability and performance at the same time, particularly in stressful, heat assistant environments. Thus, manufacturers of electric vehicles are increasingly adopting heat shrink tubing for flame resistance and lowering toxic emissions in the worst-case scenario like fire to ensure safety and sustainability. In the advent of EVs and advanced electronic gadgets, systems and other technical applications, the demand for heat shrink tubing is witnessing a significant surge across the globe.

Role of Artificial Intelligence in Heat-shrink Tubing Market

The integration of artificial intelligence (AI) with heat shrink tubing manufacturing is significantly impacting the market's growth while offering exceptional efficiency and safety as well during the process. Automation has given a precise direction to produce heat shrink tubing by providing customize temperature control, optimization in shrink ratios and standardize application across various tubing sizes. It also helps in enhanced production cycles, lowered operational costs while preserving consistent wire quality.

Manufacturers are significantly embracing AI –powered machinery to streamline production process and reduce human errors, leading towards efficient heat shrink tubing production and increased demand causes faster market growth. Moreover, in custom heat shrink tubing sub sector, AI is offering excellent solutions and supports product development by suggesting various formulations for material and design accuracy which is crucial for performance and longevity of the tubes. The technology of AI cand further aid to testing and quality check for products, escalating innovation and customization in response to industry-centric needs.

Heat-Shrink Tubing MarketGrowth Factors

- The substantial increase in global power generation capacity is a key driver for the heat shrink tubing market.

- Growing demand for advanced electronics systems and electric vehicles is directly influencing the demand for heat-shrink tubing on a large scale.

- Heat shrink tubing offers exceptional safety and sustainability along with eco-friendly material is a prime advantage.

- Growing industrialization around the world highly impacting the production of heat shrink tubing which help market's expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.07 Billion |

| Market Size in 2026 | USD 3.25 Billion |

| Market Size by 2034 | USD 5.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Material, Wall Thickness, Ratio, Certification,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is government backing heat shrink tubing market, leading to its expansion?

One of the major driving factors for the heat shrink tubing market expansion includes increasing support by government for expansion of transmission and distribution system owing to the growing demand for electricity in residential, commercial areas across the globe. Aging infrastructure of electricity generating system stresses the importance of strong and robust infrastructure leading towards search for sustainable yet eco-friendly options, where heat shrink tubes fits in. To reduce the increased risk of blackout due to aging infrastructure, cost effective and reliable electricity delivery becomes crucial aspect in today's era where, electricity is basic need to operate even a small home appliance to largest industrial settings.

Government across the globe have set standards like T&D system of electricity delivery and material usage in electric power generation plants and other systems to ensure longevity and safety. The heat shrinks tubing market is indirectly get impacted by renewable energy projects and growing telecommunication sector with infrastructure expansion along with emergence of 5G technology.Heat-shrink tubing use to protect delicate wirings and connectors in telecommunication networks. On the other hand, renewable energy sources infrastructure is crucially dependant on high temperature resistance materials with unique properties further propelling the demand for heat shrink tubing.

Restraint

Stringent regulations for toxic emission

A notable restraining factor that impending the heat shrink tubing market growth is stringent governments regulations set for lowering the toxic gas emission. The rapid industrialization has severely affected the health of air, land and water resources due to release of toxic materials and wastes in industries without nullifying their toxicity by proper method. This has seriously damaged human health and environment's balance. As industrial revolution gain fast pace in recent years, the cumulative efforts have been taken by authorities to reduce pollution and toxicity caused by industrial wastes and it becomes paradigm shift to control toxic gas emission form wherever they emerge. This shift eventually hits various markets including heat shrink tubing that impedes market growth.

Opportunity

Rising requirement from the electronics and telecommunication sector

The increasing expansion of telecommunication infrastructure due to advent of cutting-edge technologies such as 5G is creating lucrative opportunity for the market to scale faster globally. As heat shrink tubing offer robust insulation and protection against rusting components their demand is escalating in the electronics and telecommunication industry.

For example, a single 5G base system may involves complex wiring and connecter structure that will be delicate and need to protect exclusively with robust material like heat shrink tubing to achieve longevity and system reliability. Another factor includes, increasing surge for compact electronics gadgets is encouraging manufacturers to heavily invest in reliable solutions that can withstand environmental fluctuations while keeping performance safe.

Segment Insights

Application Insights

The automotive segment held the largest market share in 2024. The segment is expanding due to growing demand for reliable sealing and insulation of complex wiring system needed in automotive parts of modern time. Surge in electric vehicle is another reason the segment is growing further. As it has ADAS system which is delicate and essential to protect from environmental friction the thermal and electrical protection system have seen increased demand, fuelling the market on a global scale.

The electrical and electronics segment is expected to grow at the fastest CAGR in the upcoming period. The segment growth is attributed to the global expansion of data centers, consumer electronics like smartphones, compact gadgets, other electronic machines and renewable energy plants. Due to the increasing compact electronics machines, high density circuit requires efficient cable management for proper insulation from heat generation. Also growing heavy investments in rising sectors like 5G, smart grids, industrial automation are in search for enhanced electrical protection system.

Material type Insights

The polyolefin segment held the largest market share in 2024. The segment is expanding due to the material presents exceptional flexibility, performance and cost effectiveness as well. The material holds properties to work against high temperature, rusting/abrasion, chemicals, moisture which made it suitable for various crucial applications in developed and emerging industries. Thus, increasing demand from OEMs and manufacturers for polyolefin material is further expanding the segments growth.

The polyvinyl chloride segment is expected to grow at the fastest CAGR in the upcoming period. The PVC material seen significant surge due its competency for low voltage applications, low cost, easy manufacturing and widespread availability making it attractive choice for many industries including domestic wiring and consumer electronics. Also, advancement in coloured and flexible PVC patterns offer customization and branding requirements.

Wall thickness Insights

The thin wall segment held the largest market share in 2024. The thin wall segment is dominating globally due to its growing need in various industries like electronics, automotive, aerospace where, lightweight and compact insulation is needed which is offer by thin wall tubing. Its cost efficiency and quick shrink times again supports its growth on a large scale. Trends like miniaturization and high-density circuitry is supported by thin wall tubing fuelling the segment's growth.

The medium wall segment is expected to grow at the fastest CAGR in the upcoming period. The medium wall tubing provides highly backed mechanical protection and proper insulation in adverse conditions. Due to this characteristic, this tubing is majorly used in renewable energy plants, power distribution system and industrial applications where exceptional durability is required. Medium wall tubing is ideal choice for higher voltage levels and resistance to abrasion and environmental impacts. Henec its largely used in utilities and outdoor installations systems.

Ratio Insights

The 2:1 segment held the largest market share in 2024. The ratio is found ideal option for leading industries like automotive, electronics and general industrial use. As it provides balance between high performance and affordability.it has higher compatibility for off-the-shelf components further expand mass adoption. This tubing ratio is cost effective and sustainable for broad spectrum of standard applications propelling the segment's growth in the global market.

The 3:1 segment is expected to grow at the fastest CAGR in the upcoming period. The segment is expanding due to its ability to adjust with large connectors, irregular shapes and significant sized components. It offers excellent fitting for more secure protection system in challenging environments. Thus, it is largely used for industrial applications, marine and aerospace sector which are crucial in terms of safety.it also offers greater flexibility along with tight coverage which leads to proper sealing against harsh environmental factors that may affect adversely to the delicate wiring systems,

Certification Insights

The UL segment held the largest market share in 2024. The UL-certification stands for underwriters laboratories certification which is well known for its reputation in safety terms, quality and compliance with worldwide electrical standards. UL certification offers reliability for manufactured products which is essential in critical sectors like automotive, aerospace and electronics. To reduce liability risk and comply with regulatory safety standards, several manufacturers and OEMs seek UL certification that further supports product approvals in international market.

The ISO segment is expected to grow at the fastest CAGR in the upcoming period. The segment is growing significantly due to leading companies are prioritizing standard quality management with environmental compliance. ISO certification indicates proper manufacturing process, increased reliability of products and compliance of international practises. To ensure supplier credibility and mitigate any risk, manufacturers opt for ISO certification to trade in international market as well.

Regional Insights

U.S. Heat-Shrink Tubing Market Size and Growth 2025 to 2034

The U.S. heat-shrink tubing market size is exhibited at USD 830 million in 2025 and is projected to be worth around USD 1,420 million by 2034, growing at a CAGR of 6.17% from 2025 to 2034.

Which Region Dominated the Heat-shrink Tubing Market in 2024?

North America dominated the global market by holding the largest revenue share of 36% in 2024.The reason behind this dominance lies in the role of government backed expansion of transmission and distribution systems across the region. It plays crucial role between power generation stations and consumers. Major reason that supports market growth include aging electrical infrastructure which may lead to widespread blackout if not taken care properly. Moreover, increasing adoption of het shrink tube for various industries including aerospace, defense, industrial and commercial applications, automotive telecommunication further expanding the market reach.

Why is Asia Pacific Considered the Fastest-Growing Market for Heat-Shrink Tubing?

Asia pacific is expected to grow at a significant CAGR during foreseeable period. The region is expanding due to various factors like expansion of electronics manufacturing, renewable energy sector, growing automotive industry and rapid development in the medical device sector along with favourable government initiatives for strengthening of all these sectors in the Asia pacific.

Heat shrink tubing is playing crucial role in electronics, as it is used for insulation and wire bundling for many devices. Renewable sector highly depends on robust infrastructure to generate power for various applications from plants like wind turbine plants, solar plants where insulation for different wires is essential to keep it running continuously, further expanding the demand for heat shrink tubing market. Based on country level analysis, China is a leading as a major hub for polyolefin-based heat shrink tubing and its export while, south-east Asia is witnessing rapid expansion in heat shrink tubing production and its demand at a local place. Japan, south Korea leading as an innovator and introduction of high-performance heat shrink tubes based on PTFE and fluoropolymer.

U.S. Heat-Shrink Tubing Market Trends

The U.S. heat-shrink tubing market is witnessing significant growth driven by the increasing demand for advanced electrical insulation in sectors such as automotive, aerospace, and telecommunications. Additionally, the trend toward environmentally friendly materials and the growing adoption of automation and electric vehicles are propelling the need for more durable, high-performance heat-shrink tubing solutions. The U.S. Department of Transportation highlighted the rising use of heat-shrink protection in transportation wiring systems, emphasizing its significance to mobility infrastructure. The increased research and development efforts focus on creating specialized materials like bio-based/recyclable polymers and high-performance fluoropolymers.

India Heat-Shrink Tubing Market Trends

In India, the market is growing due to the expanding automotive and electronics sectors, which require reliable insulation solutions for wiring and cable protection. Government initiatives like the Production-Linked Incentive (PLI) scheme and the "Make in India" campaign mainly support the electronics manufacturing sector in India.

How is the Opportunistic Rise of Europe in the Heat-Shrink Tubing Market?

Europe is experiencing a strategic rise in the market, driven by strict environmental regulations like the European Union's Green Deal. These regulations encourage the adoption of halogen-free and sustainable heat-shrink cable accessories. There is an increasing demand for heat-shrink tubing from the automotive/electric vehicle and energy/utility sectors in Europe.

France is leading the market. The French government initiatives provide funding for large-scale sustainable heating projects. France aims to build a network with partners and reduce its carbon footprint. There is a notable shift towards the use of environmentally friendly and halogen-free materials, driven by stricter regulations and a growing focus on sustainability and energy efficiency in industrial applications.

What Potentiates the Growth of the Latin America Heat-Shrink Tubing Market?

The market in Latin America is driven by the growing telecommunications sector and regulatory initiatives that promote electrical safety standards in countries like Brazil and Argentina. Industrial expansion and government efforts related to electrical safety, telecommunications, and infrastructure are fueling the increased use of heat-shrink tubing in the region. In June 2025, Brazil and the UN Environment Program (UNEP) announced the launch of a new initiative to combat extreme heat through sustainable cooling. The various government programs and initiatives in Brazil are aimed at climate change mitigation, which significantly contribute to the market.

What Opportunities Exist in the Middle East and Africa for the Heat-Shrink Tubing Market?

The Middle East and Africa (MEA) offer significant opportunities in the market, driven by increased demand for heat-shrink tubing in medical devices, electronics, and automotive industries. Regional companies have launched new types of heat-shrink tubing for specific applications in medical devices and electric vehicles. Saudi Arabia leads the regional market. The goal of Saudi Vision 2030 is to reduce reliance on imports and to encourage local manufacturing for major projects and infrastructure development, thereby supporting market growth. There is also an increasing demand for heat-shrink tubing in the oil and gas, telecommunications, and electrical sectors.

Recent developments

- On 15th oct 2024, a leading material specialist and founder of peelable heat shrink tubing –PHST technology known as Junkosha, introduced a six more sizes of 1:8:1 shrink ratio translucent PHST solutions with intent to offer widest array of both large and small sizes tubes for consumers in medical industry.

(Source: https://www.medicaldesignandoutsourcing.com)

- On 23 January 2023, a leading manufacturer and provider of fluoropolymer tubing like PTFE, PFA, FEP and other polymer materials with high performance capacity announce that they acquired assets of Rhem plastics, based in Plainfield to broaden their portfolio and offer fabricated tubing products like retractable coils and shaped tubing needed for fluid handling applications etc.

(Source: https://www.fluorotherm.com)

Heat-Shrink Tubing Market Companies

- Panduit

- Alpha Wire

- Sumitomo Electric Industries

- ElectriFlex Company

- Caplugs

- TE Connectivity Ltd.

- DENSIT

- Mundial

- Antronix

- AutomationDirect

- Hellermann Tyton

- nVent Electric

- Garland Industries

- Canusa

- 3M

- Iljin Electric

Segments covered in the report

By Application

- Automotive

- Electrical and Electronics

- Telecommunications

- Military and Aerospace

- Medical and Healthcare

By Material

- Polyolefin

- Polyvinyl Chloride (PVC)

- Fluoropolymer

- Silicone

- Elastomer

By Wall Thickness

- Thin Wall

- Medium Wall

- Thick Wall

By Ratio

- 5:1

- 2:1

- 3:1

- 4:1

- 5:1

By Certification

- UL

- CSA

- RoHS

- REACH

- ISO

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting