What is the Enteral Feeding Formulas Market Size?

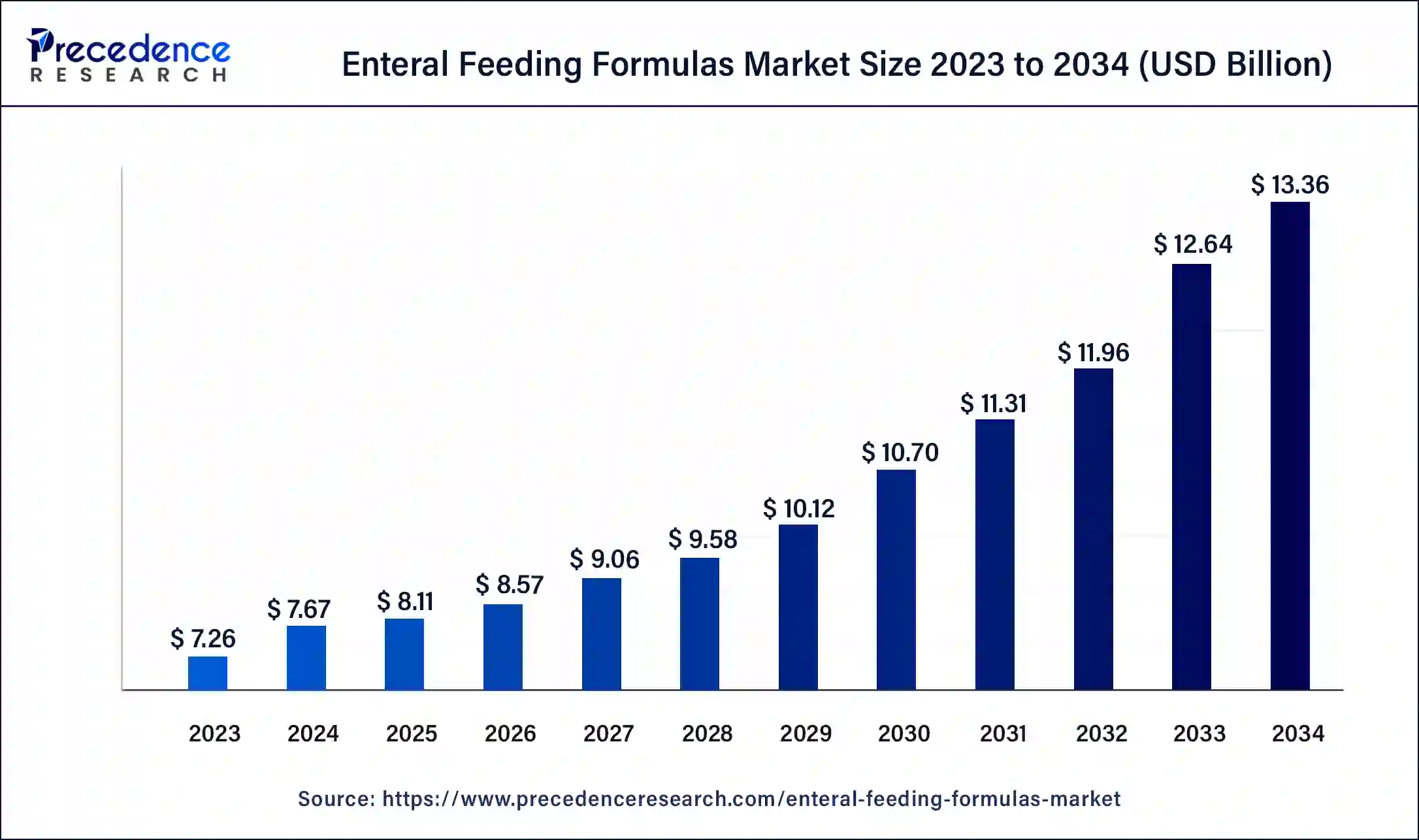

The global enteral feeding formulas market size was valued at USD 8.11 billion in 2025, accounted for USD 8.57 billion in 2026, and is expected to reach around USD 14.05 billion by 2035, expanding at a CAGR of 5.65% from 2026 to 2035. The North America enteral feeding formulas market size reached USD 2.32 billion in 2025. The rise in the aging population and the incidence of chronic diseases, which put individuals at a higher risk of life-threatening disorders are the key factors expected to drive the acceptance of enteral feeding formulas and boost market growth in upcoming years.

Enteral Feeding Formulas Market key Takeaways

- In terms of revenue, the enteral feeding formulas market is valued at USD 8.11 billion in 2025.

- It is projected to reach USD 14.05 billion by 2035.

- The enteral feeding formulas market is expected to grow at a CAGR of 5.65% from 2026 to 2035.

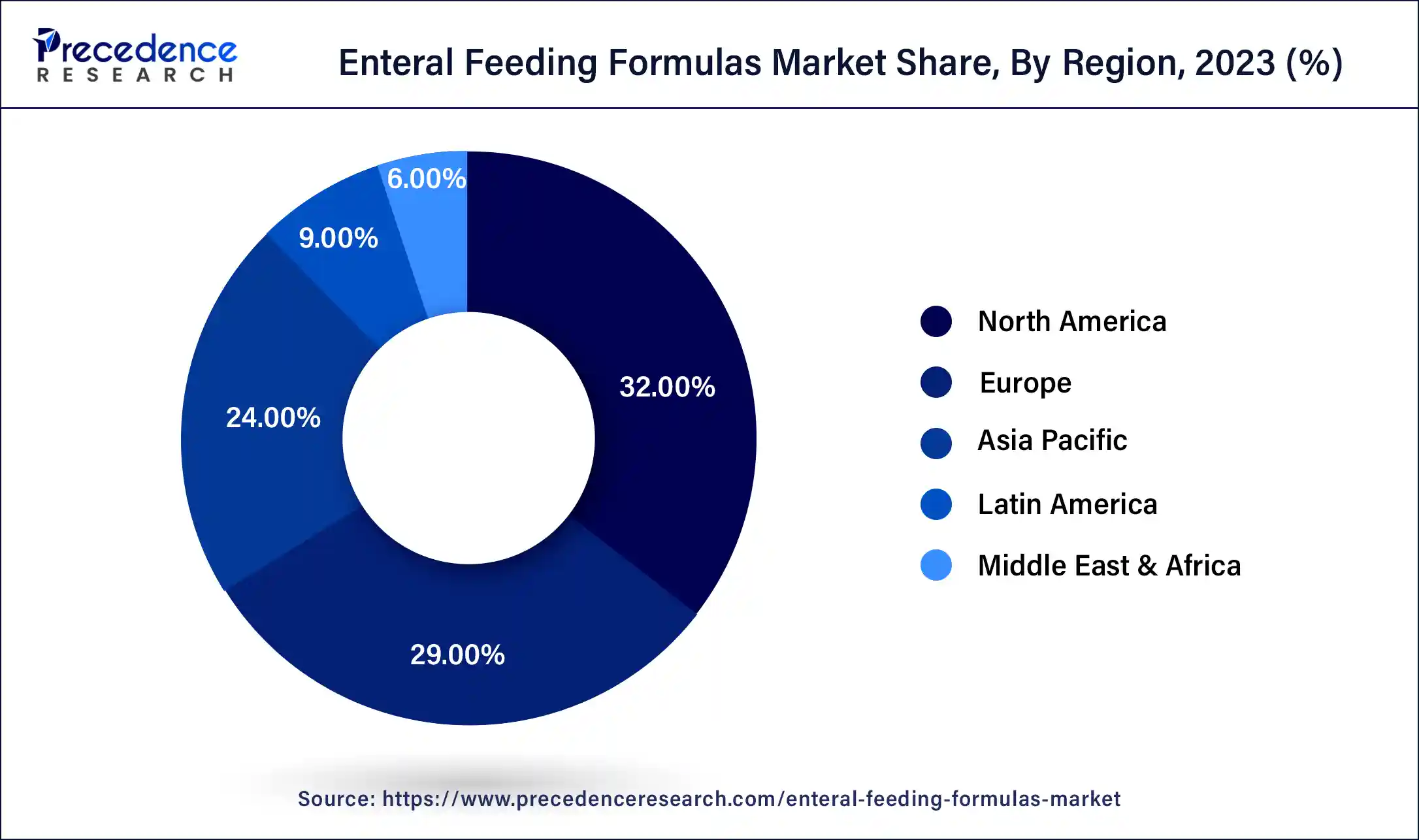

- North America held the largest market share of 32% in 2025.

- By product, the standard formula segment dominated the market with the largest market share of 58% in 2025.

- By flow type, intermittent feeding flow segment has captured the largest market share of 90% in 2025.

- By stage, the adult segment has accounted for the largest share of 91% in 2025.

- By indication, the cancer care segment held a significant share of the market in 2025.

- By sales channel, the institutional segments dominated the market with the highest market share of 52% in 2025.

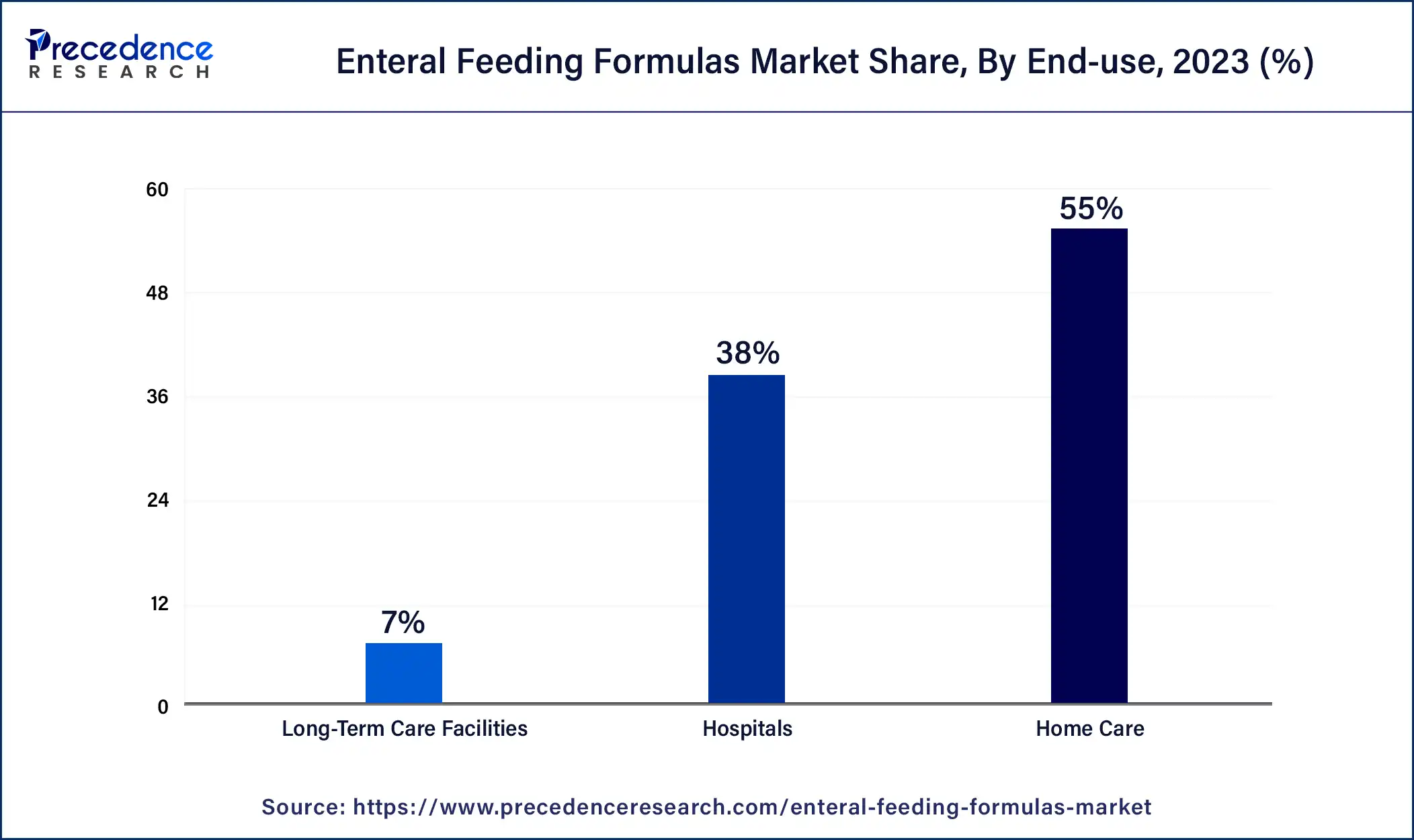

- By end use, the home care segment is expected to grow at the fastest CAGR of 5.92% over the forecast period.

What is the Enteral Feeding Formula?

Enteral feeding involves providing nutrition through the gastrointestinal (GI) tract, which includes the mouth, intestines, stomach, and esophagus. It is used when individuals cannot eat for various reasons like illness, stroke, injury, or cancer. Enteral feeding can be administered orally or through a tube inserted directly into the stomach or small intestine. In medical settings, it typically refers to tube feeding.

The global enteral feeding formulas market offers solutions in the form of formulas, primarily derive energy from carbohydrates, with standard formulas containing 30-60% of energy from carbohydrates. These formulas vary in caloric density from 1.0 to 2.0 kcal/mL and contain a combination of fats, carbohydrates, proteins, and micronutrients. Enteral feeding can be used as a supplement or as the sole source of nutrition. Enteral feeding devices are widely used in critical care units (CCU), operating theaters (OT), intensive care units (ICU), and for home care of severely ill patients.

How is AI contributing to the Enteral Feeding Formulas Industry?

Artificial intelligence creates a patient-focused approach to enteral nutrition through its complete transformation into a medical treatment. The system uses clinical data to create personalized formulas that determine patient tolerance and deliver automatic feeding adjustments while implementing safety measures to protect patients, facilitating better nutritional support, improving pump performance, and advancing research on scientific enteral nutrition products.

Market Trends

The increasing popularity of the specialized formulas is heavily contributing to the growth of the market in the current period. Every patient has a different medical history, which leads to leading need for specialized and customized formulas for patients in the current period. Also, several brands are developing specific products to meet this in recent years, which is expected to lead to market growth in the coming years.

The increasing elderly population suffering from sarcopenia and the incidence of preterm deliveries are spearheading the industry growth in the current period. ?Enteral feeding, which is a type of nutrition support that requires skilled medical intervention, has led to the growth observed in the elderly population.

A significant value of older adults is affected by sarcopenia, which is linked to malnutrition. Moreover, ultrasound has identified a growing global concern for adolescents and young adults, which, along with weak muscular modifying nutritional factors in infants, identifies a pressing enteral nutrition support need.

The increase in preterm births needs specialized nutritional solutions, such as sip feeds, to ensure that newborns receive adequate nutrition during critical developmental stages is driving industry growth in the current period. Furthermore, growing concerns of under nutrition exacerbated by pregnancy, coupled with lack of supportive policies for working mothers, increasing the demand for enteral feeding formulas in recent years.

Enteral Feeding Formulas Market Growth Factors

- Diseases like sarcopenia, which decreases muscle strength and function in an aging population require enteral food.

- Rise in the elderly population and increase in the incidence of chronic diseases are anticipated to contribute to market growth.

- Rise in preterm births is one of the major factors fueling the market growth.

- Growing awareness of the advantages of primary enteral feeding which improves clinical products for critically injured patients is expected to drive market growth.

- In the forecast period, technological developments and product innovations are anticipated to drive the growth of the enteral feeding formulas market.

Market Outlook

- Industry Growth Overview: Aging and chronic diseases increase the clinical transition of parenteral nutrition to enteral nutrition.

- Sustainability Trends: Clean-label formulas and eco-friendly packaging, such as plant-based ones, become significant in any enteral manufacturing.

- Key Investors: Nestle S.A., Abbott Laboratories, Danone S.A., Fresenius Kabi AG, and B. Braun SE are the major investors.

Market Scope

| Report Coverage | Details |

| Global Market Size by 2035 | USD 14.05 Billion |

| Global Market Size in 2025 | USD 8.11 Billion |

| Global Market Size in 2026 | USD 8.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.65% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Flow Type, Stage, Indication, End-use, Sales Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The growing prevalence of diabetes

The incidence of diabetes is on the rise globally. due to unhealthy lifestyles, including poor dietary regimes in the risk of microvascular and macrovascular diseases in an elderly population with type 2 diabetes Dietetic patient who have a healthy GI system, but insufficient oral intake needs enteral nutrition formulas to maintain their blood sugar levels. The rise in the prevalence of diabetes in the geriatric population helps the enteral feeding formulas market to grow.

- for instance, as per CDC's 2022 National Diabetes Statistics Report, more than 130 million adults are living with diabetes or prediabetes in the United States. Also, Type 2 Diabetes incidence has been rising throughout several regions, especially in North America.

Restraint

Constant risk of clogging

Clogging often occurs when large meals, bulking agents, and medications are delivered through relatively small PEG tubes. There are two main types of tube occlusion: internal lumen occlusion and mechanical tube failure. Feeding tube clogging can happen in up to 25% of cases, particularly when thick meals and medications are delivered through narrow feeding lines. The acidic pH of stomach juice can lead to protein coagulation, making repeated gastric aspiration undesirable. Tube obstructions have been associated with poor nutrition and clinical outcomes, risking inadequate nutritional intake for patients. Tube replacement is costly, both financially and in terms of resources. Radiographic confirmation is a commonly used method for verifying enteral feeding tube placement, but it comes with time, financial, and patient exposure costs. Thereby, the enteral feeding formulas market is observed to get impacted by the risk of clogging of tubes.

Opportunities

Increase in government investments

The development of cost-effective and efficient diabetes therapy and growing government investments in healthcare propel the growth of the enteral feeding formulas market growth. The rise in healthcare expenditures with effective health interventions increases labor supply and productivity. which then increases GDP which helps to stimulate market growth. The increase in the use of diagnostic labs and healthcare units in emerging markets is helping the market to grow during the forecast period. Moreover, a rise in awareness among hospital workers about hospital-linked malnutrition and the growth in several neonatal intensive care units along with the rise in demand for personalized medicine are anticipated to boost the market growth.

- for instance, in August 2024, Cardinal Health announced the launch of its next-generation NTrainer™ System 2.0, a medical device designed to help premature and newborn infants develop the oral coordination skills important for the transition to independent feeding faster, helping to reduce their neonatal intensive care unit (NICU) length of stay.

The increasing demand for feeding equipment

The market is experiencing growth due to factors such as the aging population and the rise in age-related disorders. There's an increased demand for enteral nutrition formulas among elderly patients receiving care at home, driven by greater awareness of balanced diets worldwide. This has led to a rise in the number of manufacturers in the market. Additionally, there's a growing recognition of deficiencies in both macro and micronutrients among hospitalized patients during the pre- and post-surgery periods, further boosting market growth. Moreover, the use of enteral feeding formulas to meet the nutritional needs of newborns is increasing due to the rising prevalence of preterm births, contributing to market expansion.

Segment Insights

Product Insights

The standard formula segment dominated the market this growth is linked to their widespread use in patients, specifically chronically tube-fed patients. The broad utilization of standard formulas among all category patients with cost-effectiveness is also boosting the segment's growth. Moreover, high preference and recommendations by doctors to consume this formula for G-tube patients to improve child nutrition is helping segment growth.

Disease-specific formula segment is expected to grow at the fastest rate with a rise in the incidence of several chronic disorders like cancer and diabetes these formulas also provide nutritional support to people suffering from diseases that are characterized by organ dysfunction. These formulas also help patients who are suffering from pulmonary and hepatic diseases. The launch of different nutritional products by manufacturers as per patients' needs is fueling segment growth.

Flow Type Insights

The intermittent feeding flow segment has dominated the enteral feeding formulas market with a substantial market share in 2024. This tube is useful for patients who need nutrition intake at intervals.it is also referred to in cases where a nasogastric feeding tube is used.in older people, dysphagia and malnutrition are common and can lead to nutritional deficiency. thus creates the need for enteral feeding to provide nutrients.

The continuous feeding flow segment is projected to grow at a significant rate during the forecast period. This is due to the rise in the adoption of continuous feeding flow types for severely ill patients. suffering from cancer, severe burns, and heart condition.

- For instance, according to an article published in MDPI in January 2022, in a controlled trial, the continuous enteral feeding group achieved more than 80% of the target nutrition requirement more frequently than the intermittent enteral feeding group.

Stage Insights

The adult segment accounted for the largest share of the enteral feeding formulas market. This growth is driven by the wide availability of tube feeds or products for adults on a commercial scale., the rising use of enteral tube feeding in individuals with various illnesses, including chronic liver disease, diabetes and pulmonary disease (COPD), is contributing to the segment's market expansion.

The pediatric segment is observed to be the fastest growing segment during the forecast period in the enteral feeding formulas market due to the increasing prevalence of malnutrition among hospitalized children. Furthermore, pediatric patients with gastrointestinal disorders, such as severe gastroesophageal reflux, allergies, food refusal behavior, and metabolic disorders, are also candidates for tube feeding.

Indication Insights

The cancer care segment led the enteral feeding formulas market with the largest market share in 2024. Cancer patients have unique nutritional requirements that may not be adequately met by regular food alone. Enteral feeding formulas are specially formulated to provide balanced nutrition tailored to the specific needs of cancer patients, including increased protein, vitamins, and minerals to support immune function and aid in recovery.

Enteral feeding formulas are designed to be easily digestible and well-tolerated by patients undergoing cancer treatment. They are often lactose-free, gluten-free, and low in residue, reducing the risk of gastrointestinal complications and promoting optimal nutrient absorption even in patients with compromised digestive function.

Sales Channel Insights

The institutional segment dominated the enteral feeding formulas market in 2024. Institutions, including hospitals, long-term care centers, and disability facilities, accounted for most enteral nutrition product purchases in 2024. Doctors play a significant role in influencing the decision to purchase these formulas. The segment is experiencing growth due to the increasing number of healthcare institutions, both private and public, and the rising population of patients with chronic diseases worldwide.

The online sales channel segment is expected to grow at the fastest CAGR over the estimated period. There is a shift toward direct selling to consumers via different e-commerce platforms which can contribute to segment growth. The availability of online pharmacies, especially in urban areas, acts as a major driver for the segment's expansion.

End-use Insights

The home care segment is expected to show the fastest growth over the forecast period. It includes different subtypes such as home health agencies, nursing homes, hospices, adult day care, etc. The rising popularity of home healthcare systems, especially after the COVID-19 pandemic is observed to promote the segment's expansion in the upcoming period.

Post-surgery patients, especially those who are under home-care systems require formulas to meet nutritional values in order to recover from the ongoing health issues.

Regional Insights

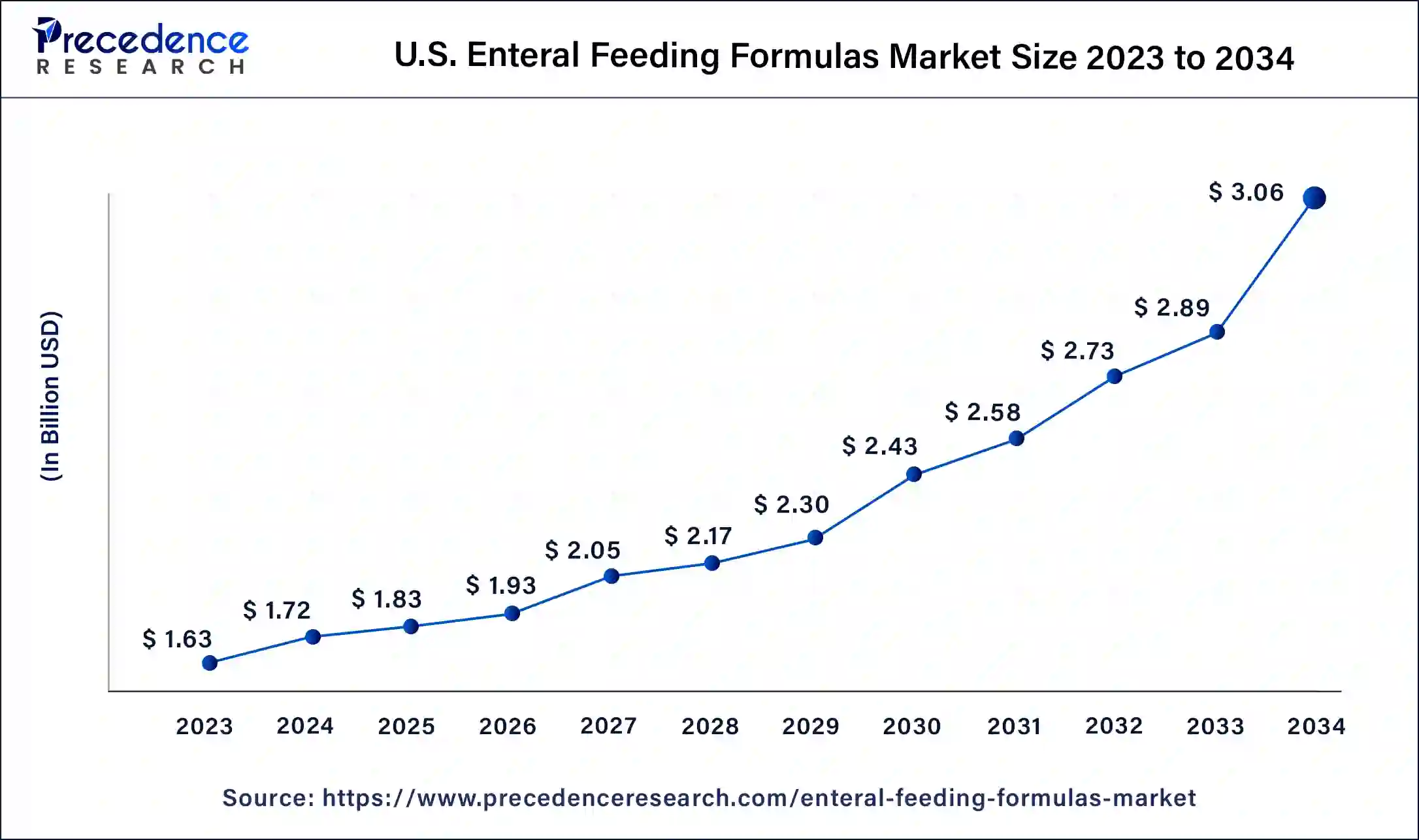

What is the U.S. Enteral Feeding Formulas Market Size?

The U.S. enteral feeding formulas market size was estimated at USD 1.83 billion in 2025 and is predicted to be worth around USD 3.22 billion by 2035, at a CAGR of 5.65% from 2026 to 2035.

North America held the largest market share in the enteral feeding formulas market in 2025. North America has a high prevalence of chronic diseases such as cancer, gastrointestinal disorders, neurological conditions, and metabolic disorders. These conditions often require long-term enteral nutrition support, driving the demand for enteral feeding formulas in the region. The aging population in North America is increasing, leading to a higher prevalence of age-related conditions such as malnutrition, dysphagia, and neurodegenerative diseases. Enteral feeding formulas play a crucial role in meeting the nutritional needs of elderly individuals, contributing to the market dominance in the region.

- According to the American Cancer Society, in 2022, the estimated number of new cancer cases diagnosed is 1.9 million. Such a high incidence of cancer cases in the United States is anticipated to propel the market growth in this region due to the increase in the adoption of enteral feeding formulas in these patients.

Asia Pacific is expected to register the fastest growth rate over the coming years. The region is witnessing advancements in enteral feeding formulas, including the development of specialized formulas for specific medical conditions and patient populations. These innovations cater to the diverse healthcare needs of the Asia Pacific population and contribute to market dominance. Enteral feeding formulas are becoming more culturally accepted in Asia Pacific countries, with a shift towards embracing modern healthcare practices and dietary preferences. This cultural acceptance encourages healthcare professionals and patients to consider enteral nutrition as a viable treatment option.

What Are the Driving Factors of the Enteral Feeding Formulas Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe is a developed enteral nutrition market due to its strict clinical guidelines and an aging population. Hospitals focus on formulas and standardized nutrition protocols that are disease-specific. The reasons behind growth include reimbursement support, an increase in chronic conditions, and the growing use of home-enteral nutrition in healthcare systems.

Germany the Enteral Feeding Formulas Market Trends

Germany focuses on clinical accuracy and patient security. Oncology and neurology disease-specific tube-matched formulas are applied in hospitals. Home nutrition is monitored by using smart pumps. The geriatric blends that can help counter muscle loss are gaining momentum with the help of evidence-based clinical decision-making and well-developed healthcare infrastructure.

Value Chain Analysis of the Enteral Feeding Formulas Market

- R&D: Research and preliminary testing of new nutritional formula with scientific soundness and therapeutic significance.

Key Players: Abbott Nutrition, Nestlé Health Science, Danone Nutricia, Fresenius Kabi - Clinical Trials and Regulatory Approvals: Safety, dosage, and effectiveness are proven in human trials, and then regulatory approval is offered.

Key players: Abbott, Nutricia (Danone), Fresenius Kabi, Baxter International - Formulation and Final Dosage Preparation: An accurate mixture of ingredients leads to stable liquid or powder enteral-ready products.

Key Players: Abbott Nutrition, Nestlé Health Science, Danone Nutricia, B. Braun - Packaging and Serialization: Unique serial identification and authentication traceability. Packaging ensures supply chain authentication and uniqueness with serial identification.

Key players: Cardinal Health, Avanos Medical, Fresenius Kabi, Vygon - Distribution to Hospitals and Pharmacies of Enteral Feeding Formulas: Logistics: The logistics would make sure that the product is delivered to hospitals and pharmacies that can help sustain patient care.

Key Players: Cardinal Health, Medline Industries, McKesson

Enteral Feeding Formulas Market Companies

- Nestle S.A.: Offers standard, peptide-based, and real-food formulas, with industry leadership in clinical innovation, global distribution strength, and leadership in nutritional science.

- Abbott Laboratories: Offers clinically advanced enteral nutrition products such as Ensure and Pedialyte with a focus on full nutrition, tolerance, and medical reliability.

- Mead Johnson Nutrition Company: Focuses on standard and specialty infant nutritional products in the treatment of allergy and metabolic sensitivity using customized nutritional interventions.

Other Major Key Players

- Fresenius Kabi AG

- Danone S.A.

- Victus Inc.

- Hormel Foods, LLC

- B. Braun Melsungen AG

- Global Health Product Inc.

- Aveanna Healthcare

- Meiji Holdings Co., Ltd.

- Nutricia

Recent Developments

- In 2025, Cardinal Health introduced its latest product line of enteral feeding pumps in the international market. The feeding pump is called OMNITM. Also, this pump will be available in countries such as Australia, Europe, and New Zealand as per the information provided by the company recently. (Source- https://pharmafile.com)

- In 2024, Vygon launched its enteral feeding system recently called Nutrisafe2. Also, the main motive of the launch of this system is to ensure feeding safety and precision for the neonates, as per the report published by the company. Also, the company is going to address the challenges with their latest innovation, such as tubing misconnections, and prevalent risk in neonatal care. (Source - https://health.economictimes.indiatimes.com)

- In September 2023,Abbott announced the plan to boost the manufacturing of various adult enteral formulas for the retail market to counteract low supply in the institutional sector.

- In February 2023,Nestlé and EraCal Therapeutics initiated a research collaboration to identify novel nutraceuticals for controlling food intake.

- In September 2022,Kate Farms introduced Adult Standard 1.4, a high-calorie medical formula now offered in chocolate. This product is designed to assist in weight gain, weight maintenance, and improved tolerance while providing a delicious taste.

- In September 2022,Kate Farms raised $75 million in a Series C funding round led by life-science investor Novo Holdings. With this, Kate Farms will be able to increase its efforts in developing plant-based clinical nutrition research, product innovation, and development into more channels.

Segments Covered in the Report

By Product

- Standard Formula

- Disease-specific Formulas

- Alzheimer's

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By Flow Type

- Intermittent Feeding Flow

- Continuous Feeding Flow

By Stage

- Adults

- Pediatrics

By Indication

- Alzheimer's

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

By End-use

- Hospitals

- Cardiology

- Neurology

- Critical Care (ICU)

- Oncology

- Others

- Home Care

- Long-Term Care Facilities

By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting