What is Enteral Feeding Devices Market Size?

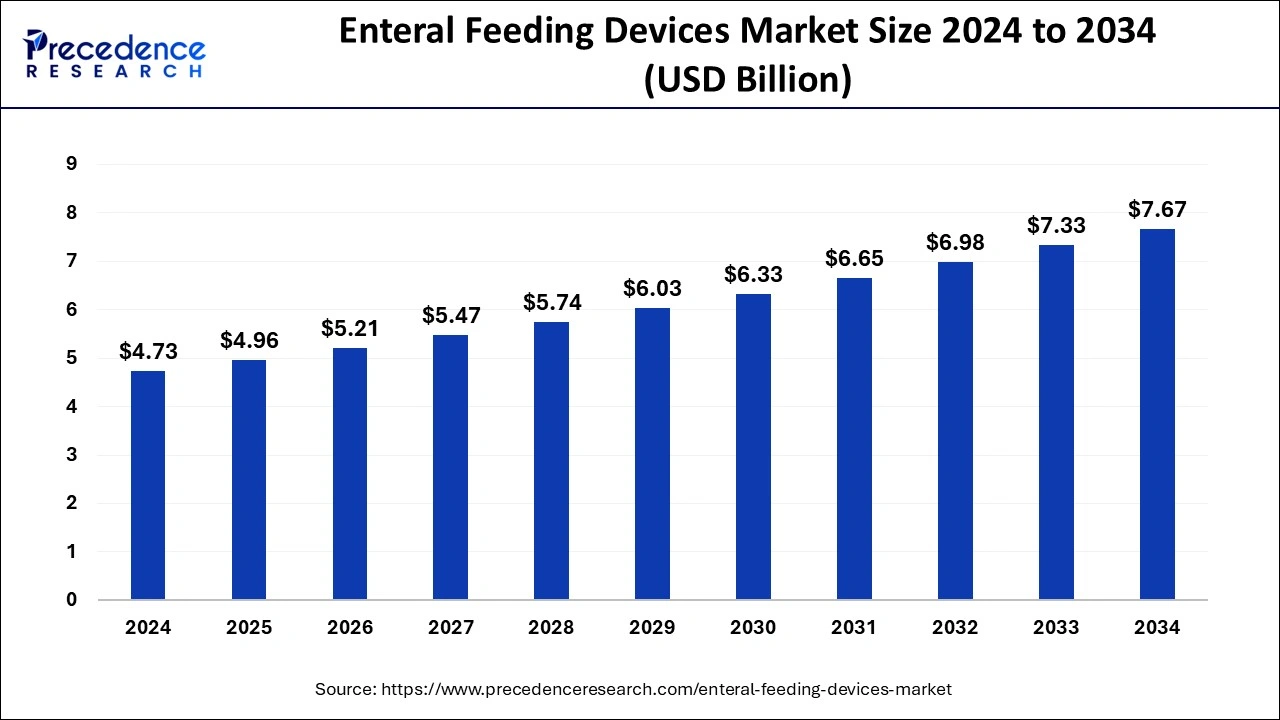

The global enteral feeding devices market size accounted for USD 4.96 billion in 2025 and is predicted to reach around USD 7.67 billion by 2034, growing at a CAGR of 4.95% from 2025 to 2034. The increasing number of hospitalizations, the rapidly expanding healthcare sector, and technological advancements drive the market.

Market Highlights

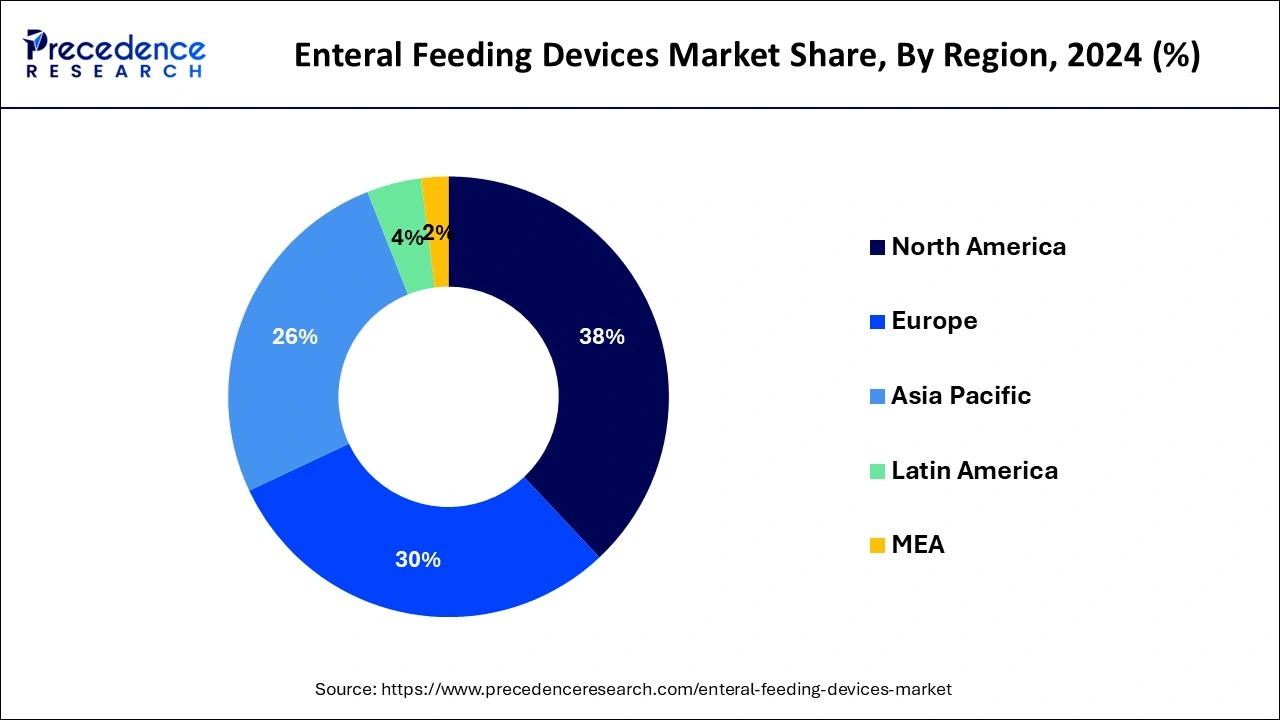

- North America led the global market with the highest market share in 2024.

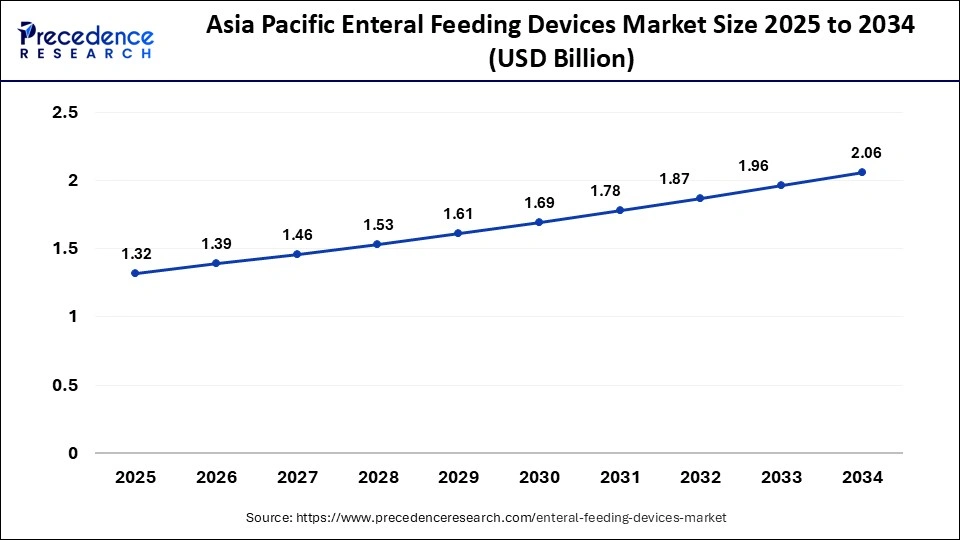

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By product type, the enteral feeding pump segment held a large share of the market in 2024.

- By product type, the enteral feeding tube segment is projected to grow rapidly during the forecast period.

- By age group, the adults segment held a major share of the market in 2024.

- By age group, the pediatrics segment is expected to register a significant growth rate in the coming years.

- By application, the cancer segment dominated the market in 2024.

- By end-user, the hospital segment registered a dominant presence in the market in 2024.

Market Size and Forecast

- Market Size in 2025: USD 4.96 Billion

- Market Size in 2026: USD 5.21 Billion

- Forecasted Market Size by 2034: USD 7.67 Billion

- CAGR (2025-2034): 4.95%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Delivering Nutrition with Care: Supporting Patients Through Advanced Feeding Solutions

Enteral feeding devices aremedical devicesused to deliver liquid nutrition directly to the stomach or intestines of those people who are unable to consume food orally due to some medical conditions or swallowing difficulties. Enteral feeding devices include feeding pumps, flexible tubes, and syringes. These devices help to administer liquid nutrition, medications, and supplements. These devices are placed through the nose or mouth or surgically implanted into the stomach. The global enteral feeding devices market has registered a significant growth over the years. There has been a significant increase in the demand for enteral feeding devices during the COVID-19 pandemic due to a large number of people requiring nutritional support, particularly those affected by COVID-19.

Enteral Feeding Devices Market Growth Factors

- Chronic disorders such as gastrointestinal diseases, cancer, cardiovascular disorders, etc. cause difficulty in swallowing, thereby driving the market.

- The rising incidences of chronic disorders lead to an increasing number of surgeries which potentiates market growth.

- The rapidly expanding healthcare sector contributes to market growth.

- Good health is of prime importance to the people. Hence, suitable measures are often taken to maintain good health.

- Several health insurance companies offer suitable insurance policies and reimbursement of their healthcare expenses.

- Advanced technologies drive the latest innovations in enteral feeding devices leading to market growth.

- Various government and private organizations provide funding for developing and manufacturing medical devices.

- Suitable policies are made by governments of various countries to regulate and distribute medical devices properly.

Market Outlook

- Industry Growth Overview- The global market is on a strong growth path, driven by a rising elderly population and increased chronic disease prevalence. Innovation in device technology and expansion of home healthcare services are further boosting adoption and market size.

- Global Expansion- The global market is expanding rapidly, driven by growing healthcare infrastructure in emerging regions, rising demand for home based nutritional support, and increasing incidents of chronic diseases and aging populations worldwide.

- Startup Ecosystem-The startup ecosystem in the enteral feeding devices market is vibrant innovative companies are developing compact, app connected pumps and advanced tube placement systems, attracting venture capital and accelerating commercialization

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 4.96 Billion |

| Market Size in 2026 | USD 5.21 Billion |

| Market Size by 2034 | USD 7.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.95% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Age Group, Product, Application, End User, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Major Drivers

Prevalence of Chronic Diseases and Rising Number of Surgeries

The growing prevalence of chronic diseases across the globe is expected to drive the market during the forecast period. Chronic diseases such as diabetes, cancer, chronic kidney disease (CKD), and Alzheimer's disease often cause serious problems, such as swallowing difficulty. However, proper nutrition is important in many chronic diseases, preventing complications and improving health outcomes. Thus, as the number of patients with these conditions increases, so does the need for nutritional support, which significantly boosts the market.

As per the National Library of Medicine, about one in three adults worldwide suffer from multiple chronic conditions (MCCs).

Furthermore, the rising number of surgical procedures is expected to drive the market. Surgical procedures often cause difficulties with oral intake after surgery due to pain or reduced appetite. However, enteral feeding devices play a vital role in delivering essential nutrition to patients recovering from surgical interventions, promoting faster recovery.

- According to the National Institute of Health (NIH), around 310 million major surgeries are performed worldwide every year.

Existing Restraints

Lack of awareness

The lack of awareness about the benefits and usage of enteral feeding devices among patients in underdeveloped regions hamper the market. If patients are unaware of the benefits of these devices in managing chronic conditions, their use becomes limited. Moreover, the lack of reimbursement policies for these devices deters some patients from adopting them.

Emerging Opportunities

Technological Advancements

The rising technological advancements in medical devices create lucrative opportunities in the market. Advancements in enteral feeding devices lead to user-friendly and portable devices, making them suitable for home care. Implementing real-time monitoring with these devices helps provide doctors with useful data about patient nutrition and feeding. Furthermore, the rising trend of self-medication and self-care propels the demand for these advanced devices.

Segment Insights

Product Type Insights

The enteral feeding pump segment held a large share of the market in 2024. The segment growth is mainly attributed to the rising concern about overfeeding. Enteral feeding pumps offer accurate control over nutrition given to patients, guaranteeing precise delivery of nutrients or medications. This precision helps to prevent overfeeding, which may lead to complications. However, this accuracy is crucial in cancer treatment, as inaccurate nutrition levels may lead to complications that impede treatment effectiveness. These pumps offer flexibility to combine methods such as continuous feeding overnight and bolus feeding during the day to make the feeding process more tailored to the patient's condition.

The enteral feeding tube segment is projected to grow rapidly during the forecast period. Enteral feeding tubes are available in a range of sizes. They are either inserted through the mouth or through the nose into the stomach. These tubes can be customized according to the patient's needs and can also be used to remove stomach contents.

Age Group Insights

The adults segment held a major share of the market in 2024 due to the growing prevalence of age-related diseases, such as diabetes, dementia, chronic obstructive pulmonary disease, and gastrointestinal disorders. Moreover, the increasing instances of dysphagia in adults contributed to the segmental growth. Enteral feeding devices are required to supply nutritional supplements to people suffering from these ailments. For instance,

According to the National Institute of Health (NIH), dysphagia is common in adults. About 1 in 6 adults experience difficulty in swallowing.

The pediatrics segment is expected to register a significant growth rate in the coming. There has been a significant growth in the occurrence of malnutrition among children. This, in turn, boosts the demand for enteral feeding devices that are designed for infants, such as nasojejunal tubes, G-tubes, and jejunostomy tubes. As per the World Health Organization (WHO), around half of deaths among children under 5 years of age are linked to undernutrition. Moreover, the increasing instances of premature birth are expected to boost the segment. For instance,

According to the National Library of Medicine, over 400,000 babies are born prematurely every year in the U.S.

Application Insights

The cancer segment dominated the market in 2024. The segment is anticipated to expand at the fastest CAGR during the forecast period due to the rising cancer cases worldwide. Cancer treatment, such as chemotherapy and radiation therapy, often creates mouth sores or swallowing difficulties. This boosts the need for reliable solutions for delivering medications and nutrients to patients with such conditions, thereby driving the demand for enteral feeding devices. For instance,

As per the World Health Organization (WHO), nearly 20 million new cancer cases and 9.7 million cancer deaths were recorded worldwide in 2022. About 1 in 5 people develop cancer in their lifetime, and about 1 in 12 women and 1 in 9 men die from cancer.

End-user Insights

The hospitals segment held a major share of the market in the enteral feeding devices market in 2024 due to the rising number of patients in hospitals requiring nutrition support. Moreover, factors such as easy accessibility to advanced medical devices, availability of skilled healthcare professionals, and the rising number of ICU admissions contributed to the market growth

Regional Insights

U.S. Enteral Feeding Devices Market Size and Growth 2024 To 2034

The U.S. enteral feeding devices market size is valued at USD 1.32 billion in 2025 and is expected to be worth around USD 2.06 billion by 2034, growing at a CAGR of 5.03% between 2025 and 2034.

North America held the largest share of the market in 2024 due to the increasing health awareness, rising geriatric population, and rising healthcare expenditure, which supports the adoption of advanced medical devices such as enteral feeding devices. Moreover, a significant growth in premature births in the U.S. contributed to the market growth. As premature birth increases, the demand for pediatric enteral feeding devices increases, which is vital in delivering essential nutrition to premature babies.

The U.S. is the major leader of the North American enteral feeding devices market, growth driven by high chronic disease prevalence and technological advancements. Well-established healthcare infrastructure of the country plays a vital role in market expansion. U.S. companies are investing heavily in technological advancements to enhance the efficiency and convenience of enteral feeding devices for an aging population, and increasing awareness of enteral nutrition benefits. High investments in electromagnetic technology for tube placement and the adoption of enteral feeding in long-term care facilities are taking place in the country. The largest enteral feeding pumps industry in the U.S. further contributes to the growth.

Empowering Care Responsible for Europe's Steady Growth

The Europe market is growing due to the increasing prevalence of chronic diseases, an aging population, and rising demand for advanced nutritional support. Strong healthcare infrastructure, government initiatives promoting home-based care, and technological advancements in feeding devices are boosting adoption. Additionally, growing awareness about enteral nutrition and improved reimbursement policies across European countries are further driving market expansion and enhancing patient access to modern enteral feeding solutions.

Strengthening Nutritional Care in UK

The UK market is expanding due to increasing cases of chronic and gastrointestinal diseases, a growing elderly population, and rising preference for home-based nutritional care. Government support for advanced medical nutrition, coupled with strong healthcare infrastructure and reimbursement systems, is driving adoption of enteral feeding devices. Additionally, continuous technological innovations and greater awareness among healthcare professionals and patients are further contributing to the steady growth of the market in the UK.

The "Feed Early Enteral Diet Adequately for Maximum Effect" (FEED ME) protocol, which has been adopted in some U.S. surgical trauma ICUs, enables subsidies on enteral feeding devices, further contributing to market expansion.

As per the Population Reference Bureau, the number of Americans ages 65 or above is anticipated to increase from 58 million in 2022 to 82 million by 2050, a 47% increase.

The favorable trade policies in China for the import and export of medical devices augment market growth. According to the Observatory of Economic Complexities, China's export of medical instruments increased by $183 million (24.2%), accounting for $938 million. While the import of medical instruments accounted for $862 million during the same period.

The Indian government announced the Rs. 500 crore scheme for the medical device sector to accelerate growth, reduce import reliance, and enhance India's position as a leading exporter of medical devices.

China is leading the regional market due to strong healthcare infrastructure, an aging population, and rising awareness of chronic disease in the country. China is focusing on the adoption of advanced medical technologies with improved efficiency and comfort. Government investments in the manufacturing sector are fostering market expansion.

Value Chain Analysis

R&D

- R&D focuses on enhancing safety, accuracy, and ease of use in enteral feeding devices.

- Innovations include smart pumps and improved placement systems.

- Efforts aim to reduce complications and improve patient comfort.

- Growth is driven by aging populations, chronic diseases, and technological progress.

Clinical Trials

- Clinical trials examine early feeding approaches in critical care and compare different feeding methods.

- Studies assess new device placement techniques and long-term tube management accessories.

- The main goal is to improve patient outcomes, enhance safety, and reduce complications in enteral feeding.

Patient Support and Services

- Patient support involves a multidisciplinary care team for effective device management.

- Provides thorough training and 24/7 technical and clinical assistance.

- Includes home care coordination to ensure safe and confident device use for patients and caregivers.

Key Players in Enteral Feeding Devices Market and their Offerings

- Cook Medical- Provides feeding access devices such as tubes and sets for direct enteral nutrition delivery via stomach or intestines.

- Abbott Laboratories- Supplies pumps, giving sets, and accessories designed for enteral feeding, enabling controlled nutritional delivery.

- Moog, Inc.- Manufactures mobile enteral feeding pumps and accompanying delivery sets for both hospital and home use.

- Vygon- Offers enteral feeding systems including tubes, pumps and sets compliant with safety connectors (e.g., ENFit) for ambulatory and clinical settings.

- Medtronic- Provides enteral nutrition device components such as feeding pumps, tubes and administration sets for healthcare facilities.

- Moog, Inc

- Nestle Health Science

- VYGON

- Danone

- Cardinal Health

- Braun

- Boston Scientific

- R. Bard

- Conmed Corporation

Latest Announcement by Industry Leaders

Tomás Thompson, Founder and CEO of Rockfield Medical Devices, commented that numerous medical devices have significantly changed over the last 40 years, but very little innovation has been made for enteral (tube) feeding. However, it is literally key to survival for people. The company launched a novel lightweight, discreet, and quiet enteral feeding pump that can be worn under clothing and used in a person's daily life.

Recent Developments

- In February 2025, the new Kangaroo OMNI™ Enteral Feeding Pump, Cardinal Health's innovative launch, is expected by the first half of 2025, in Europe, Australia, and New Zealand, followed by Asia later in the year. The innovation was previously launched in the United States and Canada in 2023 and will be introduced to Latin America in 2026.

- In February 2025, NanoVibronix acquired ENvue Medical Holdings to become a wholly-owned subsidiary of the Company. This Acquisition was approved by the Board of Directors of the Company and the Board of Directors and stockholders of ENvue.

- In October 2024, Avanos Medical expanded its comprehensive Enteral Feeding portfolio by launching a new nasogastric/nasointestinal tube retention system called CORGRIP SR, aiming to reduce accidental tube removal.

- In July 2024, Amsino Medical Group Company (Amsino), a leading provider of medical consumable devices, acquired Alcor Scientific's enteral feeding pump products. The acquisition allows Amsino to broaden its portfolio of enteral feeding devices with Alcor Scientific.

- In August 2023, Cardinal Health launched its next generation NTrainer System 2.0, a medical device designed to help premature and newborn infants develop the oral coordination skills to transition to independent feeding faster, thereby reducing their neonatal intensive care unit (NICU) stay. Through real-time assessment technology, the NTrainer System offers clinicians the objective data necessary to track the infant's progress in developing pre-feeding skills.

Segments Coverd in the Report

By Product Type

- Administration Sets

- Enteral Feeding Pump

- Enteral Syringe

- Enteral Feeding Tube

- Others

By Age Group

- Pediatrics

- Adult

By Application

- Gastrointestinal Disease

- Cancer

- Malnutrition

- Neurological Disorder

- Others

By End User

- Ambulatory Surgical Center (ASCs)

- Hospital

- Home Care

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting