What is the Facade Market Size?

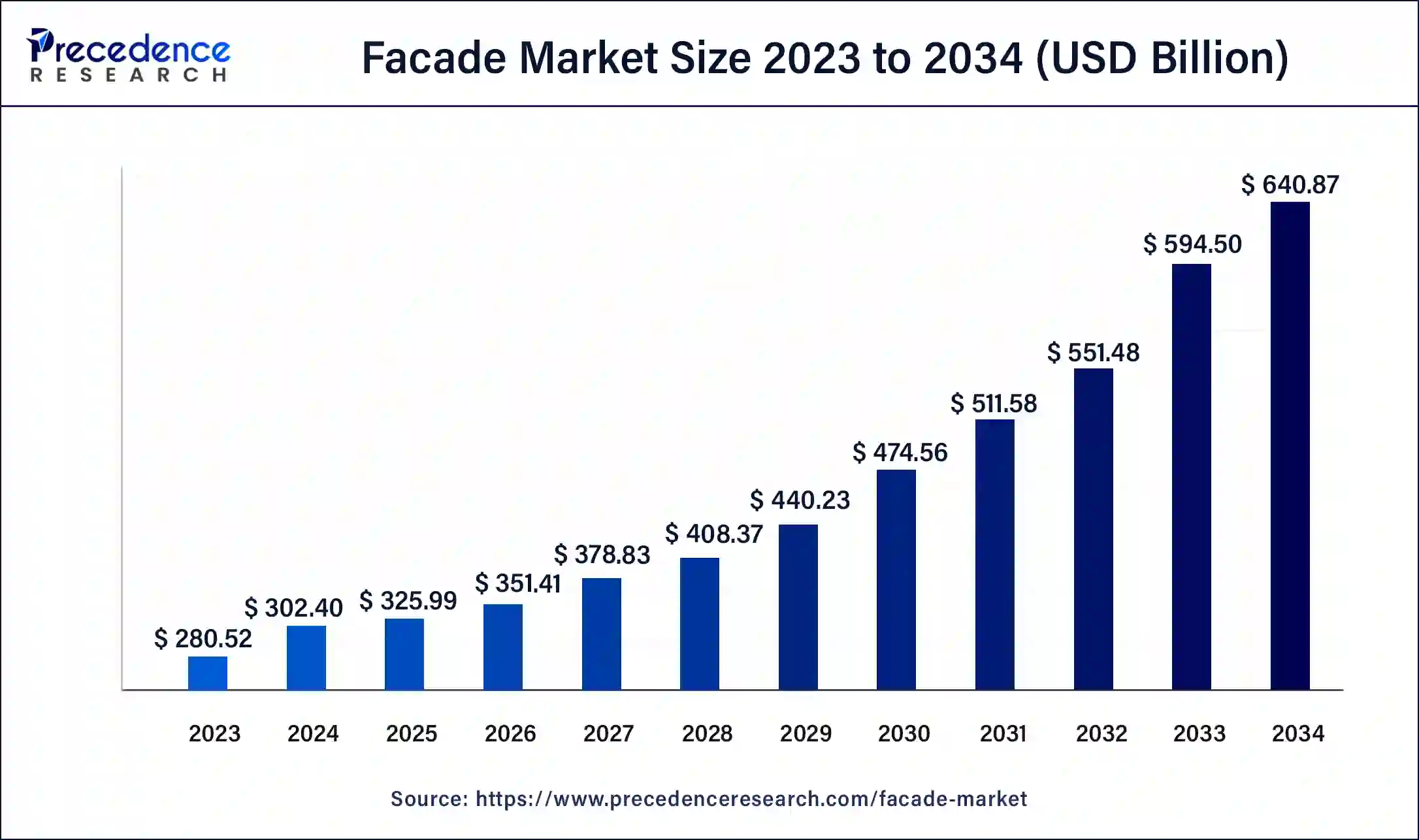

The global facade market size accounted for USD 325.99 billion in 2025, and is anticipated to hit around USD 351.41 billion by 2026, and is expected to reach around USD 685.01 billion by 2035, expanding at a CAGR of 7.71% from 2026 to 2035.

Facade Market Key Takeaways

- In terms of revenue, the market is valued at $325.99 billion in 2025.

- It is projected to reach $640.87 billion by 2035.

- The market is expected to grow at a CAGR of 7.80% from 2026 to 2035.

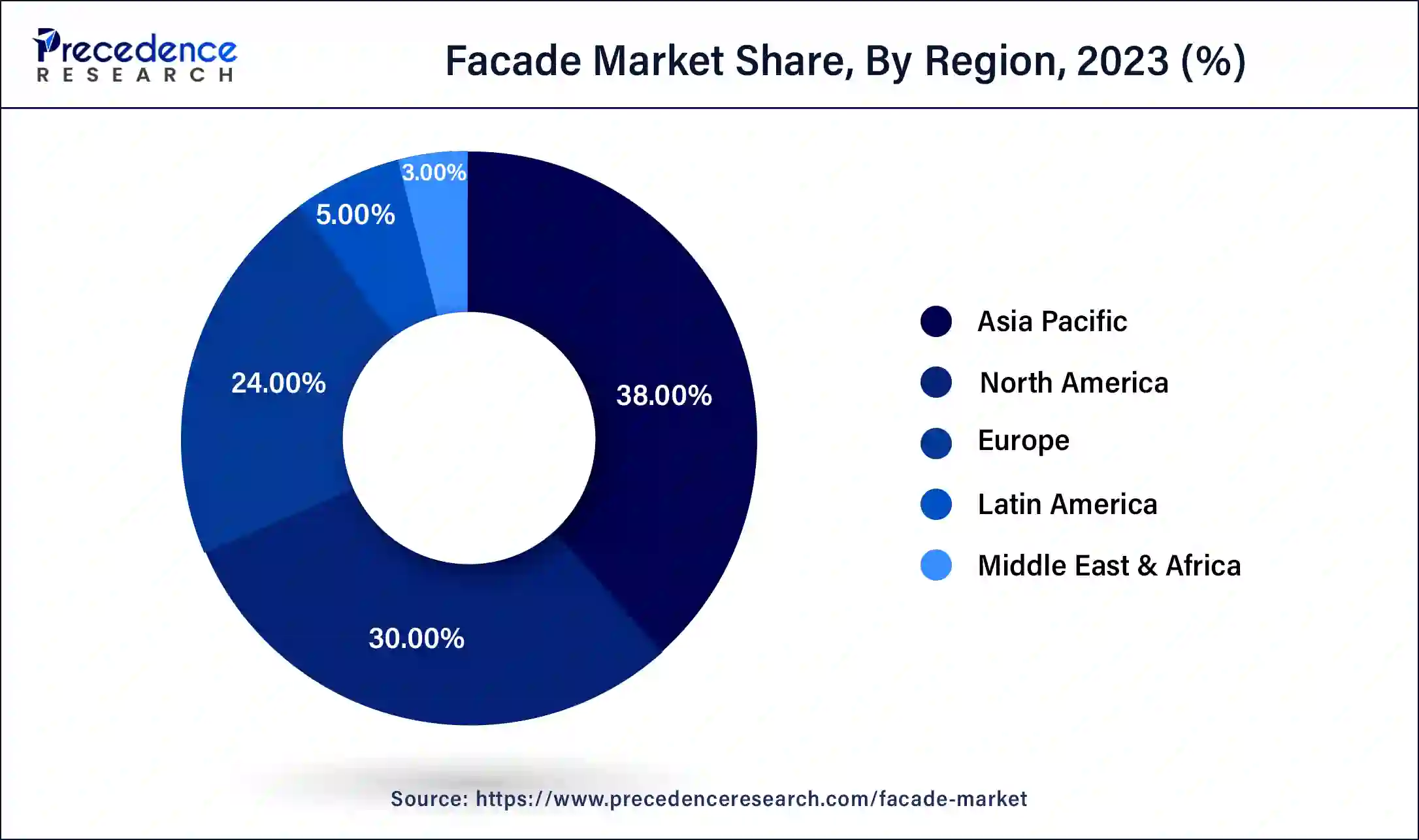

- By region, Asia Pacific dominated the market with the maximum market share of 38% in 2024, the region is expected to maintain its position during the forecast period.

- By product, the ventilated facades segment dominated the market in 2023, the segment is expected to grow at a significant share during the forecast period.

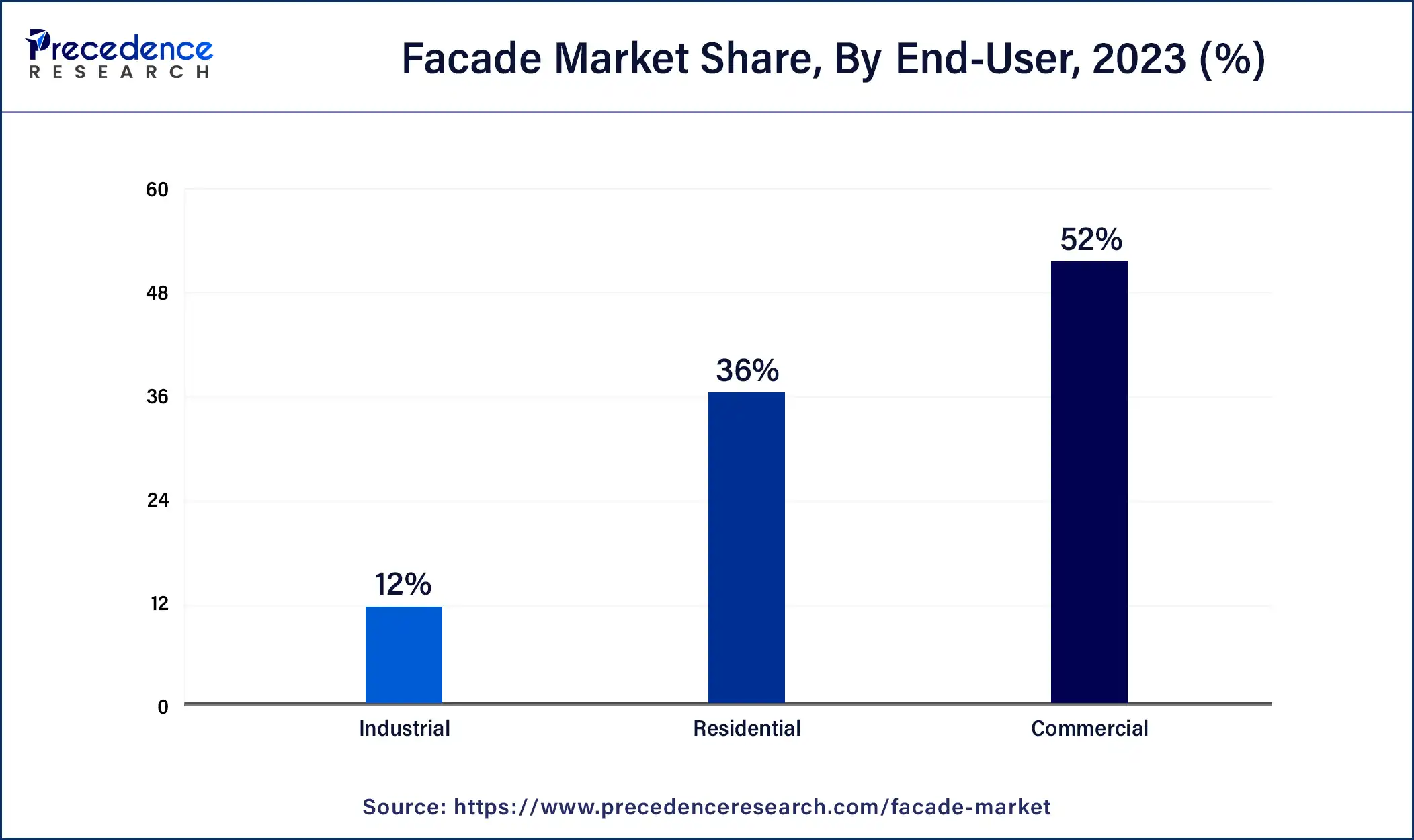

- By end-user, the commercial segment dominated the market with the largest market share of 52% in 2024. Additionally, the residential segment is expected to grow significantly during the forecast period.

Market Overview

The facade market usually deals with building facades while it covers the development and distribution of materials, designs and technologies associated with building facades. The façade market revolves around multiple elements including metal, glass, cladding systems and insulation. Facades are generally referred to as one part of the building, mostly the front side of the building's architecture.

In recent times it has become one of the most important parts of the building which offers an aesthetic look and unique character to the building construction. Facades can be installed in the new building or in the building which is under the renovation process. Rising construction activities across the globe are likely to contribute to the growth of the facades market. The increase in the market is attributed to the rising demand from the commercial and industrial sectors.

Artificial Intelligence: The Next Growth Catalyst in Façade

AI is transforming the facade industry by enabling significant advancements in design, efficiency, and maintenance. It uses generative design algorithms to explore thousands of high-performance design alternatives in minutes, balancing complex factors like structural integrity, aesthetics, and energy efficiency, a process that traditionally took weeks.

Furthermore, AI facilitates the development of "smart facades" equipped with embedded sensors that dynamically adapt to real-time environmental conditions, such as sunlight and temperature, to optimize occupant comfort and reduce energy consumption.

Technological Advancement

Technological advancements in the façade market feature smart façades, an automated shading system, dynamic glazing, digital technologies, glass processing, integrated solar panels, and modular facades. The dynamic glazing uses technologies such as electrochromic glass, also known as smart glass adjust the volume of shading. The smart facades use microprocessors, sensors, and actuators, which help with real-time control of the climate factors like humidity, light, and temperature. The modular facades are a prefabricated modular system that helps in reducing waste. The advancement in materials includes lightweight composite materials, which provide customization of designs.

The digital technologies consist of computer numerical control (CNC) machines and 3D printing. It helps in panel production and customization. Glass processing advancement gives access to the use of complex shapes and extra-large glass panes. Façade in solar panels is the integration of photovoltaic cells, which supports renewable energy and enables sustainability in the façade market.

Facade Market Growth Factors

Multiple commercial buildings including offices and malls try to maintain the aesthetics of buildings, facade plays a big role in the outer structure of the building through their detrimental effects. Such rising demand will act as a growth factor for the market. Facades are also beneficial for energy efficiency, apart from the aesthetic functionality facades play an important role in the consumption of energy by reducing energy bills, facades minimize the absorption of heat hence it reduces the cooling loads of the buildings which results in lower energy bills. One of the major valuable characteristics of the facades is the resistance to temperature and humidity.

In addition, solar facades are considered one of the most emerging types of facades. These advanced types of solar facades absorb solar energy and are used in several residential and commercial buildings as a secondary source of energy. The rising demand from regions like Asia Pacific, North America, and the Middle East is enhancing the growth of the facades market.

Market Outlook

- Market Growth Overview: The facade market is expected to grow significantly between 2025 and 2034, driven by the increasing urbanization and construction boom, strict energy efficiency and sustainability, and innovation in materials and systems.

- Sustainability Trends: Sustainability trends involve smart and adaptive facades, incorporating building-integrated photovoltaics, and biophilic design and green facades.

- Major Investors: Major investors in the market include Saint-Gobain Group, Kingspan Group, Permasteelisa S.p.A., and AGC Inc.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 685.01 Billion |

| Market Size in 2025 | USD 325.99 Billion |

| Market Size in 2026 | USD 351.41 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.71% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Higher energy performance

Energy efficiency is crucial when it comes to building construction, and environmental effect is a crucial aspect of any project. The best use of natural light and ventilation can be made possible by a well-structured facade. Glass facades allow for more natural light to enter buildings, reducing the need for artificial lighting. Such facades can now regulate and cool a building's interior thanks to new breakthroughs in glass materials. Overall, while offering high energy performances, the facades reduce the overall cost invested in cooling the infrastructure. Thus, the element is observed to fuel the market's growth.

Restraint

Lack of flexibility

The lack of flexibility in the facades market can restrain innovation and adaptability. It may lead to limited design options, making it harder to meet diverse aesthetic and functional requirements. Without flexibility, the industry might struggle to respond to changing environmental regulations and energy efficiency demands, hindering its overall growth and competitiveness of the market.

Opportunity

Development of kinetic facades

Kinetic facades are dynamic facades that change rather than static, as the name suggests. Its elements can be programmed to react to environmental elements, to increase energy efficiency, decrease solar heat, or for aesthetic purposes, such as an art piece. In addition to this, these kinetic facades offer some rain protection, they do not significantly improve thermal performance. By adjusting their position, kinetic facades can control the amount of natural light and heat entering the building, thus contributing to energy savings and reducing the need for artificial lighting and cooling. Thus, the rising requirement and development for kinetic facades present opportunities for the market to grow.

Segment Insights

Product Insights

The ventilated facades dominated the market with the largest market share in 2024, the segment will continue to grow at a significant rate during the forecast period. The growth of the segment is attributed to higher adoption of ventilated facades by the cold regions across the world. Ventilated facades are dry-installed exterior surface for building. The main objective of the ventilated facades is to maintain the exchange of air, light, and heat that goes between the interior and exterior of the building. It can be installed in the new building infrastructure or the building which is under renovation process. The ventilated facades are mainly made up of glass material that can transfer heat to provide a low temperature. There is rising demand from cold-weathered countries like countries in the European region for ventilated facades. Therefore, the segment is projected to witness significant growth during the forecast period.

On the other hand, the non-ventilated facades segment is expected to grow steadily during the forecast period. Non-ventilation facades are constructed with no ventilation or air cavity. such facades are made of a single-layer, non-ventilated structure. This structure is mostly constructed on slopped roofs for residential purposes. They offer a slim design due to its no ventilation structure, the installations of non-ventilated facades also reduce the time of installation during the building construction.

End-User Insights

The commercial segment dominated the market with the largest market growth in 2024, the segment is expected to generate a considerable and significant revenue during the forecast period. The growth of the segment is attributed to the rising use of facades for the protection of the interior and for giving a visually appealing look to the outer surface. The rising commercial and industrial construction across the world, especially in the developing countries, significantly promotes the segment's growth. Facades for commercial sector often have demand from retail shops, hotels, warehouses, malls and office buildings, to maintain the outer appearance of the building.

The residential segment is expected to witness a significant shift in its market share during the predicted time period. Facades installed for houses generally require low maintenance. The demand for facades from residential sector is observed to grow with the rising retrofitting activities for homes and residential buildings.

Regional Insights

What is the Asia Pacific Facade Market Size?

The Asia Pacific facade market size is estimated at USD 123.88 billion in 2025 and is predicted to be worth around USD 264.57 billion by 2035, at a CAGR of 7.88% from 2026 to 2035.

Asia Pacific is expected to sustain its position in the market during the forecast period. The growth of the region is attributed to the rising industrial, commercial and residential construction activities in the region. The rising population is one of the major factors for the developing commercial and residential sectors. Facades are sustainable, innovative designs in the facades, and safety is the major concern that is responsible for the growth of the facades market across the region.

Asia Pacific is dominating the façade market. The growth in infrastructure, construction activities, and a large number of urbanizations contribute half of the proportion to façade industries. Another factor influencing the growth of this region is the industrial sector. The increased foreign investment in industries boosts the demand for this market.

China Facade Market Trends

The U.S.'s rising need for data analytics, machine learning, and computer vision optimizes planning, irrigation, and harvesting, rising use of water, fertilizers, and pesticides reduces environmental impact, and rising use in precision farming, crop monitoring, and health fuel the market growth.

China is observed to be the largest contributor for the market's growth for the upcoming period. The advancements in façade installation techniques, availability of labors, cost-effective material and rising investments in the construction industry are a few factors to fuel the country's growth.

North America is expected to account for a notable share of the market during the forecast period. The growth of the market in the region is expected to be boosted due to the rising construction industry across the region. Increasing demand for solar facades from the countries like the United States and Canada will contribute to the growth of the market during the forecast period. Rising government initiatives for the development of the construction sector is expected to propel the growth of the façade market in North America.

U.S. Facade Market Trends

U.S. aggressive green building codes and an aging urban infrastructure necessitate large-scale renovation using high-performance glazing and advanced insulation. Stringent building codes and green building certifications, including LEED and ENERGY STAR, are encouraging developers to invest in high-performance facades that reduce energy consumption and carbon footprint.

The Middle East is expected to grow at a considerable pace during the anticipated period. Rising government support for the development of real-estate industry and developing economies in the region is fueling the growth of the market across the region. The gulf countries, such as Dubai, Qatar, Kuwait showing and tremendous growth in the real-estate industry and in the fancy world class buildings, these would result in the higher demand for the façades. These factors will contribute to the growth of the market in the Middle East.

How Did Europe Experience Notable Growth in the Facade Market?

Europe's shift toward adaptive systems, where smart facades featuring kinetic shading and modular components enable rapid, energy-efficient installation. The rise of rainscreen cladding as a preferred retrofit solution provides a critical thermal buffer for aging structures, while the integration of vertical gardens reflects a growing mandate for urban biophilic design.

Germany Facade Market Trends

Germany's superior thermal regulation and ability to meet strict carbon footprint mandates. The sector is defined by the commercial dominance of high-tech, "energy-positive" envelopes, where Building-Integrated Photovoltaics (BIPV) and smart glass are increasingly integrated into modular, Industry 4.0-manufactured systems.

Value Chain Analysis of the Facade Market

- Inbound Logistics (Raw Material Sourcing & Handling) This stage involves receiving, storing, and distributing raw materials like glass, metal, plastic, and stone for the production process.

Key Players: AGC Inc., Saint-Gobain Group, Rockwool International A/S, Kingspan Group, Knauf. - Operations (Manufacturing & Fabrication): This stage covers all activities that convert raw materials into finished facade components and systems, such as curtain walls or cladding panels.

Key Players: Permasteelisa S.p.A, Enclos Corp., Josef Gartner GmbH, Aluplex, HansenGroup. - Outbound Logistics (Distribution & Delivery): These activities ensure the finished facade products are delivered to construction sites efficiently and on time.

Key Players: AFS International, Lindner Group, THE BOUYGUES GROUP, and National Enclosure Company.

Facade Market Companies

- Fundermax manufactures high-pressure laminates (HPL) and other sustainable wood-based panels used extensively in creating durable, ventilated rainscreen facades.

- Gartner(Permasteelisa Group) is a leading specialist in the design and engineering of complex, custom curtain wall and facade systems for landmark architectural projects worldwide.

- HansenGroup designs, manufactures, and installs bespoke aluminum facade and curtain wall solutions, focusing on innovative and energy-efficient building envelopes.

- Hochtief, a major international construction company, contributes to the facade market as a general contractor, managing the integration of facade systems into large-scale infrastructure and building projects.

- National Enclosure Company, LLC., specializes in the design, engineering, and installation of diverse facade cladding systems, providing full-service enclosure solutions for the North American market.

- Schuco International supplies comprehensive, high-quality aluminum and steel systems for windows, doors, and facades, driving innovation in energy efficiency and building security.

Other Major Key Players

- Skanska

- Trimo d.o.o.

- Norsk Hydro ASA

- YKK AP Inc.

- Rockpanel Group (ROCKWOOL B.V.)

- Aluplex

- Bouygues

- Enclos

- EOS Framing Limited

- Saint-Gobain Group

- AFS International B.V.

- Kingspan Group

- Lindner Group

Recent Developments

- In June 2024, Royal Jaarbeurs announced a new biennial trade event in spring 2025 for the European Façade Industry. The launch of this new event is to strengthen the partnership with the European Façade Network (EFN), TU Darmstadt, and TU Delft.

- In May 2024, Dow announced a capacity extension in SAS Chemicals for the high-performance façade industry. Dow initiated the effort through the minority equity investment.

- In September 2024, Pura Facades launched an initiative to improve cladding knowledge. The half-day courses will be provided in person. The initiative is developed with the help of designers and architects for a better understanding.

- In Nov 2022, Saint Globen extended its partnership with the PV manufacturer Megasol for increasing its range of facades portfolio. The agreement reveals that the company Saint Globen occupies the minority stake in Megasol's unit which manufactures and develop BIPV solution in their Deitingen site in Switzerland.

- In April 2023, Solar Energy Systems ISE and the Fraunhofer Institute get a partnership with the industry partners for its TABSOLAR III research project for the development of new solar thermal facade panel as a part of it.

- In March 2023, “Vitro X™ Innovation Partnerships” the launch is proudly announced by the Vitro Architectural Glass, a new partnership program launch is announced for developing and identifying an innovator solution for the future challenges of the glass industry.

Segments Covered in the Report

By Product

- Ventilated Facades

- Non-ventilated Facades

By End-use

- Commercial

- Residential

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting