What is theGreen Facade Market Size?

The global green facade market size was calculated at USD 990 million in 2025 and is predicted to increase from USD 1,060 million in 2026 to approximately USD 1,830 million by 2034, expanding at a CAGR of 7.10% from 2025 to 2034. The market growth is driven by rising awareness of climate change mitigation initiatives, stringent environmental regulations promoting sustainable buildings, and the increasing urbanization that has led to greater demand for green facades.

Market Highlights

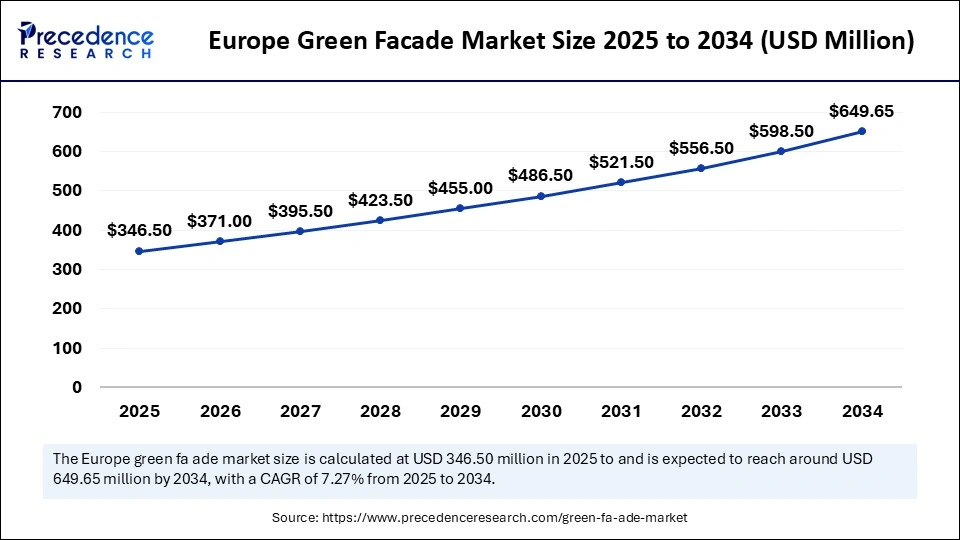

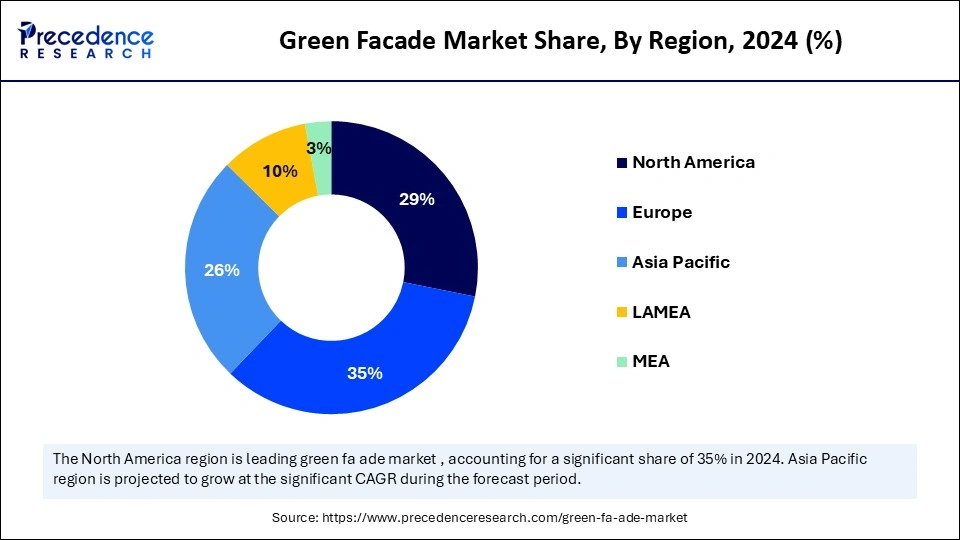

- By region, Europe dominated the green facade market by holding about 35% in 2024.

- By region, Asia Pacific is expected to grow at the fastest CAGR of 7.4% during the foreseeable period of 2025-2034.

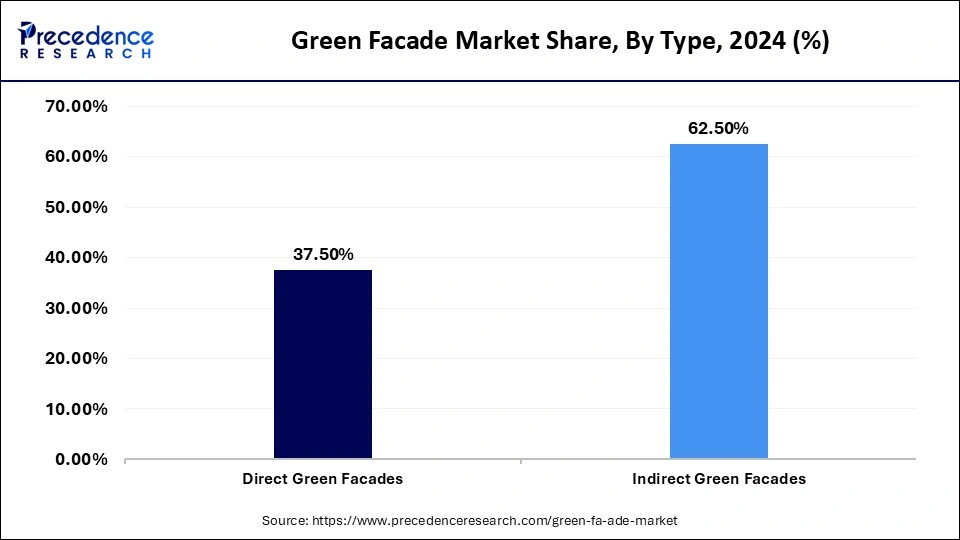

- By type, the indirect green facade segment dominated the market by holding nearly 62.5% share in 2024.

- By material, the steel segment dominated the market by holding nearly 42.5% share in 2024.

- By plant type, the evergreen plants segment dominated the market by holding nearly 34.8% share in 2024.

- By application, the commercial buildings segment held the largest market share of nearly 39.8% in 2024.

- By application, the residential buildings segment is expected to grow at a CAGR of 7% during the foreseeable period.

Market Size and Forecast

- Market Size in 2025: USD 990 Million

- Market Size in 2026: USD 1,060 Million

- Forecasted Market Size by 2034: USD 1,830 Million

- CAGR (2025-2034): 7.10%

- Largest Market in 2024: Europe

- Fastest Growing Market: Asia Pacific

What is Green Facade?

A green facade is a vertical greening system where climbing plants or vegetation grow on a building's exterior wall, either directly on the surface or supported by structures such as trellises, cables, or mesh frames. Plants may root in the ground or in containers attached to different building levels. Green façades enhance aesthetics, reduce energy consumption, improve air quality, and mitigate the urban heat island effect. They serve as natural insulation, filtering pollutants and providing biodiversity benefits. Commonly used in residential, commercial, and public buildings, green façades promote sustainability and contribute to healthier, cooler, and more visually appealing urban environments.

Key Technological Shifts in the Green Facade Market Driven By AI

Artificial Intelligence (AI) significantly enhances the design, planning, and plant selection processes in green facades. By leveraging AI models, architects can optimize the aesthetic and functional aspects of the facade based on the surrounding environment and existing infrastructure. AI can also analyze data from sensors to facilitate real-time optimization of plant growth, ensuring that the green facade remains healthy and sustainable. By considering local climate patterns, solar radiation, wind direction, and building orientation, AI is able to suggest ideal plant layouts and species that thrive in specific environments with minimal maintenance, reducing operational costs in the long term.

Green Facade Market Outlook

- Market Growth Overview: The global green facade market is poised for rapid growth between 2025 and 2034, primarily driven by the challenges of urbanization. As cities grow, space for traditional greenery becomes increasingly constrained, especially in densely populated areas. In response to these challenges and to combat climate change, the adoption of green facades has emerged as a sustainable solution. Green facades can also be integrated horizontally at ground level, addressing space limitations in compact urban environments.

- Sustainability Trends: The green facade market aligns closely with key sustainability trends in architecture and urban planning. These facades help mitigate the heat island effect by providing shade and cooling through evapotranspiration, reducing local temperatures. Additionally, green facades enhance biodiversity, improve energy efficiency, and contribute to air purification by absorbing CO2 and other pollutants, creating cleaner urban environments.

- Startup Ecosystem: The market is undergoing significant transformation, driven by innovative startups that focus on technology integration, modular design, and sustainability. These startups are developing modular facade kits that incorporate advanced irrigation and monitoring systems to optimize plant growth and environmental benefits. Some even aim to integrate green facades into comprehensive biophilic design strategies, blending nature with urban infrastructure.

- Government Support: Governments and municipalities are playing a crucial role in fostering the adoption of green facades by offering green building certification programs like LEED and BREEAM. These programs incentivize the construction of sustainable buildings and provide tax benefits, making green facades more budget-friendly and encouraging wider adoption across urban areas.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 |

USD 990 Million |

| Market Size in 2026 | USD 1,060 Million |

| Market Size by 2034 | USD 1,830 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Plant Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

Restraint

Complex Maintenance and Plant Selection

One of the primary challenges of green facades is the complexity involved in their maintenance. These structures require consistent watering, proper fertilization, and regular pruning, demanding specialized systems and expert care. This adds to the operational costs and maintenance complexity. Additionally, plant selection can be limited by local climate conditions and building orientation, making it difficult to choose species that require minimal maintenance. Another significant barrier is the lack of awareness and understanding among architects and property owners regarding the benefits of green facades, leading to a reluctance to incorporate them into buildings.

Opportunity

Demand for Biophilic Design

The green facade market presents significant growth opportunities, especially with the rising demand for biophilic design, which focuses on integrating natural elements into urban environments to enhance occupant well-being and productivity. This trend is particularly evident in commercial and institutional buildings, where green facades play a crucial role. Corporations pursuing Environmental, Social, and Governance (ESG) goals are increasingly adopting green facades to attract talent and improve employee satisfaction. Governments are also incorporating green facades in public projects such as bridges, transit stations, and parking areas, aligning with their sustainability and wellness objectives.

Segment Insights

Type Insights

What Made Indirect Green Facades the Dominant Segment in the Market in 2024?

The indirect green facades segment dominated the market by holding nearly 62.5% share in 2024 and is expected to register a CAGR of 6.8% during the forecast period. The segment continues to grow significantly due to its superior building protection and design flexibility compared to direct green facade systems.

Indirect green facades typically use separate support structures such as trellises or cable meshes, which guide plant growth and create an air gap between the vegetation and the building wall. This gap prevents structural damage caused by direct plant contact, simplifies building maintenance, and allows easier access to the vegetation layer, eliminating the need to dismantle the entire system for repairs or upkeep.

Material Insights

Why Did the Steel Segment Lead the Green Facade Market in 2024?

The steel segment led the market by holding nearly 42.5% share in 2024 and is expected to grow at the fastest CAGR of 6.9% during the foreseeable period. This is mainly due to steel's exceptional durability and longer lifespan compared to other materials, along with its fire-resistant properties, making it particularly suitable for large-scale, high-investment projects. Steel's high strength-to-weight ratio enables robust yet intricate designs, ideal for supporting complex façade structures. Additionally, its anti-corrosive nature and high resistance to humidity, extreme temperatures, and sudden climate shifts make it a preferred material in diverse environmental conditions, thereby driving its demand in the market.

Plant Type Insights

How Does the Evergreen Plants Segment Dominate the Green Facade Market?

The evergreen plants segment dominated the market by holding nearly 34.8% share in 2024 and is expected to grow at a 6.5% CAGR during the foreseeable period. The segment is expanding significantly while asserting its dominance over the market due to its ability to provide aesthetic appeal with constant thermal insulation. Evergreen facades can maintain their lush green colors for a longer period and prevent damage.

Evergreen plants provide a vibrant living landscape which enhances the buildings' beauty and overall impression. Also, the evapotranspiration process of evergreen plants makes the air cool around them, helping to reduce the urban heat island effect, which is crucial to achieve in cities.

Application Insights

Why Did the Commercial Buildings Segment Dominate the Green Facade Market?

The commercial buildings segment held the largest market share of nearly 39.8% in 2024. This dominance is driven by a combination of regulatory, financial, and branding incentives. Green facades are not only aesthetically appealing but also serve as strategic investments by commercial developers aiming to significantly reduce energy consumption. Studies indicate that such installations lead to 30–35% savings on utility bills related to cooling and heating.

The residential buildings segment is expected to grow at a CAGR of 7.4% during the foreseeable period. This growth is primarily due to the convergence of environmental concerns, financial incentives, and the urgency to mitigate carbon emissions in densely populated urban centers. The increasing popularity of biophilic design, demand for improved air quality, the need to combat urban heat islands, and the integration of smart technologies are collectively driving the adoption of green facades in residential buildings.

Regional Insights

Europe Green Facade Market Size and Growth 2025 to 2034

The Europe green facade market size was exhibited at USD 346.50 million in 2025 and is projected to be worth around USD 649.65 million by 2034, growing at a CAGR of 7.27% from 2025 to 2034.

What Made Europe the Dominant Region in the Green Facade Market?

Europe dominated the green facade market by holding the largest market share of nearly 35% in 2024. The region's dominance is attributed to a combination of stringent environmental regulations, progressive climate action policies, advanced urban planning, and growing sustainability awareness across both public and private sectors. The region's growth is further bolstered by ambitious EU-level initiatives such as the European Green Deal, which aims to significantly reduce carbon emissions and achieve a climate-neutral building stock by 2050. Green facades play a critical role in supporting these objectives, offering energy-efficient and eco-friendly solutions aligned with Europe's decarbonization goals.

How Are Germany & France Defining Leadership in the Europe Green Facade Market?

While several European countries are actively supporting the growth of the green facade sector, Germany and France stand out as key market leaders, driven by robust government support, substantial funding for carbon neutrality goals, and a strong cultural and regulatory emphasis on sustainability. Germany has emerged as a frontrunner in implementing architectural and technological innovations aimed at combating climate change and environmental degradation. High levels of public awareness, combined with a strong demand for energy-efficient and sustainable building solutions, are driving widespread adoption of green facades in major German cities.

Meanwhile, France is advancing through a policy-led approach, notably the French Energy Transition Law, which mandates energy-saving measures for newly constructed buildings. Cities like Paris are at the forefront of promoting sustainable urban development, with a clear focus on integrating greenery, such as green facades, into densely populated urban structures.

What Factors Make Asia Pacific the Fastest-Growing Region in the Green Facade Market?

Asia Pacific is expected to grow at the fastest CAGR of 7.4% during the foreseeable period of 2025-2034. The region's growth is primarily driven by rapid urbanization, increasing construction activity, and escalating climate-related challenges, which are pushing countries in the region to adopt sustainable building practices. Rising concerns over urban heat island effects, air pollution, and environmental degradation are accelerating the adoption of green facade systems as a mitigation strategy. Governments across the region are actively promoting green infrastructure through regulatory frameworks, certification programs, and incentives such as tax exemptions, fast-track approvals, and direct subsidies for green-certified projects. These initiatives are expected to fuel substantial market growth and position Asia Pacific as a key region in the global green facade landscape.

China Green Facade Market Trends

China has demonstrated its green building capabilities through several high-profile projects featuring integrated green facade systems. One notable example is the Shanghai Tower, which incorporates a double-glazed facade that significantly reduces heating and cooling loads. The building has earned LEED Platinum certification, underscoring its sustainability credentials.

In addition, China has introduced an ambitious national agenda for green construction. According to its action plan, the country aimed for 70% of all new urban buildings to meet green building standards by 2022. The government has also implemented stricter regulations on resource efficiency and energy consumption, further encouraging the adoption of sustainable technologies such as green facades in new developments.

Value Chain Analysis of the Green Facade Market

- Sourcing & Manufacturing

This is the initial stage, involving the procurement of core materials and components required for constructing green facades. These include climbing frames, wire meshes, plant systems, and water delivery infrastructure. Selection of plant species is based on local climate compatibility to ensure long-term viability.

Key Players: Jakob Rope Systems, Mobilane, LiveWall LLC, ELT India

- Design & Engineering

This stage focuses on the architectural and structural integration of green facades into building designs. It includes collaboration with architects and civil engineers to ensure the green facade aligns with the building's orientation, environmental impact, and aesthetic goals.

Key Players: Green Facade Solutions, San Greens, Luxury Vertical Gardens, Greenworks Ltd.

- Construction & Installation

This phase involves the on-site execution of the pre-approved green facade design. It includes the installation of structural supports, irrigation systems, and drainage infrastructure, followed by planting. Precise execution is critical to ensure stability, plant survival, and system durability.

Key Players: ELT India, ANS Global Ltd., Green Fortune

- Maintenance & Scheduled Services

Post-installation, this stage is essential for the long-term performance and aesthetics of the green facade. It includes scheduled maintenance such as pruning, fertilizing, and irrigation system upkeep. Increasingly, smart systems are being integrated to monitor plant health and environmental conditions in real-time.

Key Players: Safetech, ELT India, along with original installation companies that often provide ongoing maintenance contracts.

Top Companies Operating in the Green Facade Market

Tier I – Major Players

These companies dominate the global market with significant individual shares and collectively account for nearly half of the market revenue.

- Sempergreen: A global leader in sustainable building solutions, Sempergreen provides pre-grown vegetation mats and modular green facade systems that are widely adopted in large-scale commercial and public infrastructure projects across Europe, North America, and Asia.

- ELT India: As a major green infrastructure company in Asia, ELT India specializes in modular green facade systems with integrated irrigation technology and turnkey services from design to maintenance, making it a preferred partner for urban greening projects in India and the Middle East.

- Biotecture Ltd.: Based in the UK, Biotecture is known for its innovative hydroponic living wall systems used in high-profile commercial buildings and public installations, contributing significantly to the adoption of green facades in Europe through design-led, sustainable urban solutions.

Tier II – Mid-Level Contributors

These companies have a solid market presence with strong regional or segment focus. Together, they contribute roughly one-third of the market.

- GSky Plant Systems Inc.: Based in North America, GSky offers versatile living green wall systems for both indoor and outdoor applications, providing scalable facade solutions with automated irrigation and remote monitoring capabilities for commercial and institutional buildings.

- LiveWall, LLC: A U.S.-based innovator, LiveWall provides patented, soil-based green wall systems designed for sustainability, ease of maintenance, and aesthetic appeal, often used in retail, hospitality, and educational projects.

- Green Fortune: Originating from Sweden, Green Fortune specializes in vertical gardens and plant walls with automated irrigation systems, contributing to urban greening across Europe and Asia through customizable green facade designs.

- Green Over Grey: A Canadian company focused on artistic green wall installations, Green Over Grey integrates native and exotic plant species in creative facade designs for high-profile commercial and cultural buildings across North America.

Tier III – Niche and Regional Players

Smaller or regionally-focused companies with limited global scale. Their combined share represents about one-fifth of the total market.

- Lang + Fulton

- Naava

- Sagegreenlife

- ANS Group Global Ltd.

- Other local manufacturers and emerging firms

Recent Development

- In Type 2025, Tracer, the French green facade manufacturer, has adopted low-carbon XCarb recycled and renewably produced Magnelis steel for its ventilated facade substructures, offering a sustainable alternative to traditional galvanized steel, aluminum, and stainless steel.Source: https://europe.arcelormittal.com)

Exclusive Insights on the Green Facade Market

The market is witnessing a paradigm shift as environmental imperatives and urban densification converge to redefine modern architecture and sustainable development strategies. With the escalating demand for climate-resilient infrastructure and carbon neutrality frameworks, particularly within the context of ESG mandates and biophilic design integration, green facades are increasingly being leveraged as multifunctional ecological assets rather than mere aesthetic embellishments. This transformation is underpinned by regulatory momentum, including green building certifications (LEED, BREEAM) and government incentives that catalyze adoption across commercial, institutional, and high-density residential segments.

From an analyst's perspective, the market presents significant white-space opportunities across both mature and emerging economies, especially as technology integration (e.g., IoT-enabled irrigation systems and AI-powered plant selection algorithms) enhances operational efficiency and return on investment. Furthermore, the convergence of modular construction techniques and prefabricated green facade kits positions the sector for scalability in retrofitting applications, addressing aging infrastructure and decarbonization goals simultaneously.

The presence of a growing startup ecosystem, coupled with increased public-private investment in smart and sustainable city infrastructure, points to robust market expansion potential over the next decade. As sustainability transitions from optional to operational, green facades stand at the forefront of regenerative urban design, unlocking both ecological value and long-term economic viability.

Segments Covered in the Report

By Type

- Direct Green Facades

- Indirect Green Facades

By Material

- Steel

- Aluminum

- Plastic

- Wood

- Others

By Plant Type

- Evergreen Plants

- Deciduous Plants

- Climbing Plants

- Succulents

- Others

By Application

- Commercial Buildings

- Residential Buildings

- Public Infrastructure

- Industrial Buildings

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting