What is Green Chemicals Market Size?

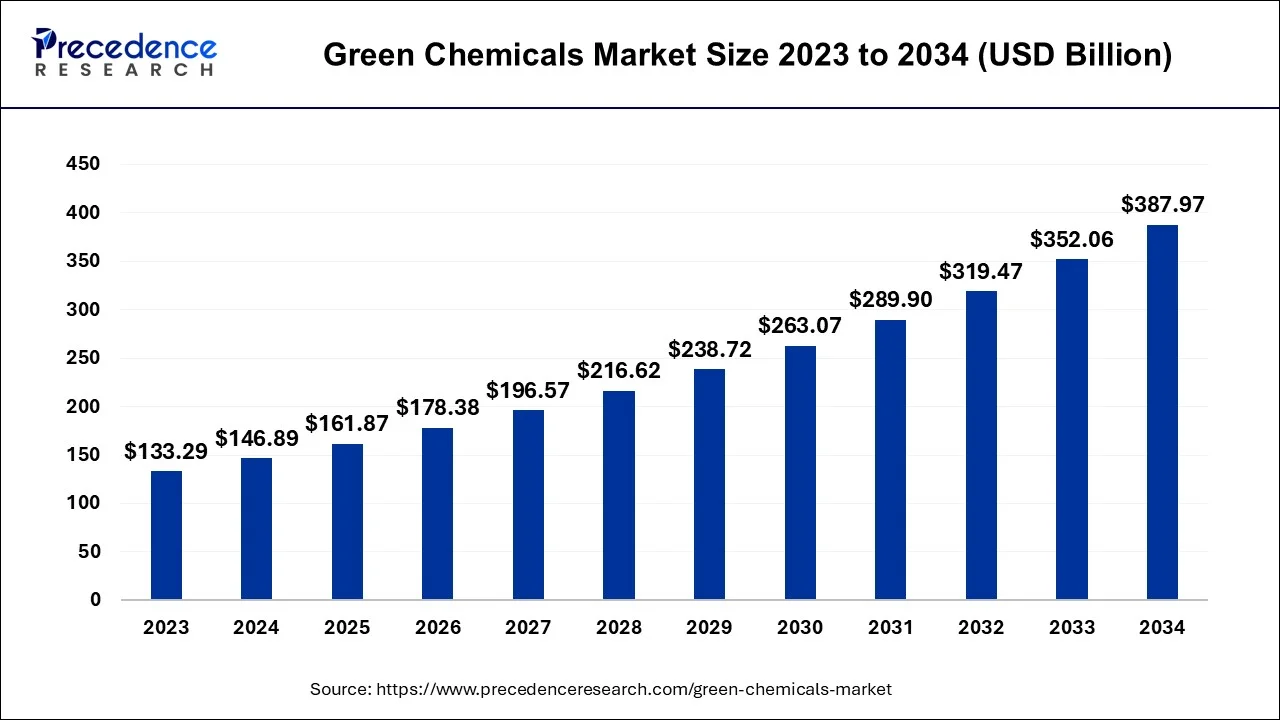

The global green chemicals market size accounted for USD 161.87 billion in 2025 and is anticipated to reach around USD 421.66 billion by 2035, expanding at a CAGR of 10.05% between 2026 to 2035.

Market Highlights

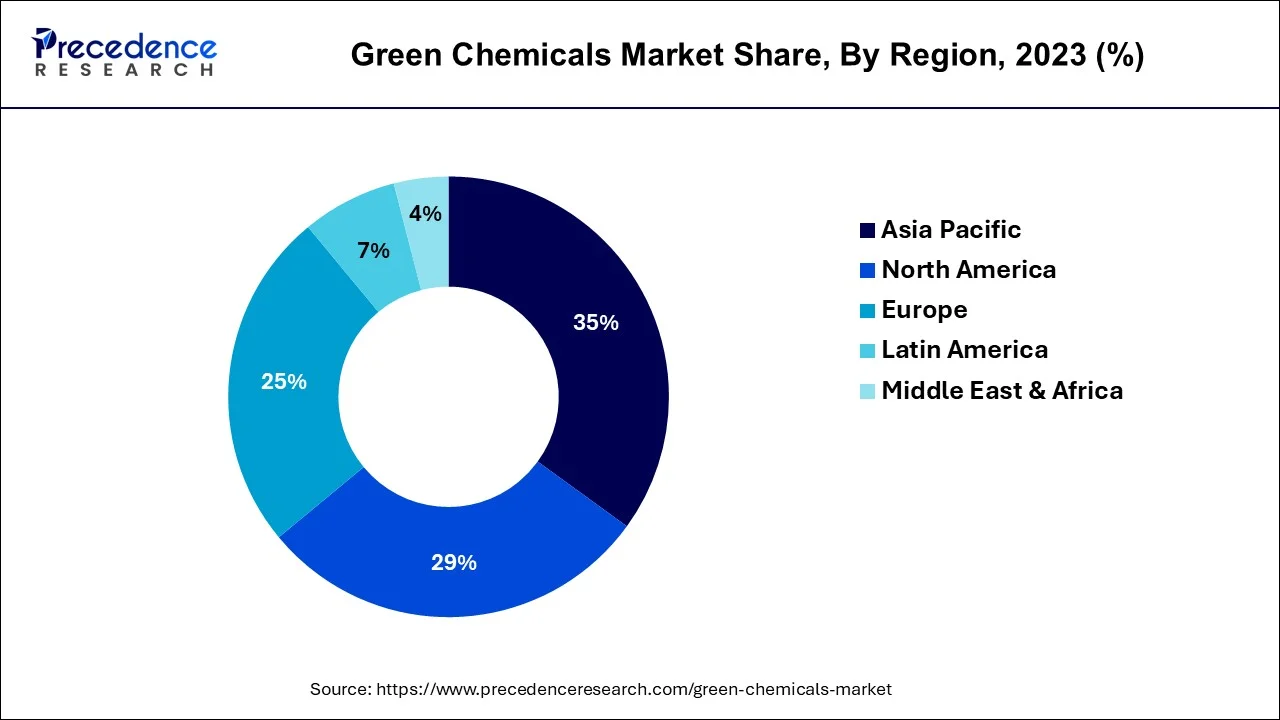

- Asia-Pacific contributed more than 35% of revenue share in 2025.

- Europe is estimated to expand the fastest CAGR between 2026 to 2035

- By Type, the bio-alcohols segment has held the largest market share of 48% in 2025.

- By Type, the bio-ketones segment is anticipated to grow at a remarkable CAGR of 10.1% between 2026 to 2035

- By Application, the industrial & chemical segment generated over 62% of revenue share in 2025

- By Application, the packaging segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The green chemicals market encompasses environmentally friendly chemical products and processes designed to minimize the environmental impact of chemical manufacturing. It includes bio-based chemicals, renewable feedstock, and sustainable production methods that reduce greenhouse gas emissions, energy consumption, and waste. Green chemicals aim to replace or enhance traditional chemical products that may pose environmental or health risks. They play a crucial role in various industries, including agriculture, manufacturing, and consumer goods, by promoting cleaner and more sustainable practices, thereby contributing to a greener and more environmentally responsible future.

The market is driven by the growing awareness of environmental concerns, regulations promoting sustainability, and increasing consumer demand for eco-friendly products. Green chemicals are used in various industries, including agriculture, packaging, automotive, and cosmetics, and are a pivotal component of the global shift towards more sustainable and responsible chemical manufacturing practices.

How is AI Influencing the Green Chemicals Industry?

AI models forecast environmental impacts and determine non-toxic, biodegradable, and sustainable solvents for chemical reactions, decreasing reliance on harmful traditional chemicals. AI models determine real-time data from sensors, e.g., in distillation, mixing to adjust parameters such as temperature and pressure, improving resource utilization, and minimizing waste. AI aids in forecasting the toxicity along with bioaccumulation of new compounds, permitting chemists to choose safer and even less-hazardous options early in the development process.

Green Chemicals Market Growth Factors

- Increasing awareness of environmental issues and climate change is driving the demand for green chemicals. Consumers and industries are seeking more sustainable and eco-friendly alternatives to traditional chemicals.

- Governments worldwide are implementing stricter regulations and incentives to promote the use of green chemicals. This regulatory support encourages companies to adopt more sustainable practices.

- Changing consumer preferences, especially among younger generations, favor products and processes that are environmentally responsible. Green chemicals align with these evolving consumer values.

- Advancements in green chemical technologies are making them more cost-competitive with traditional chemicals, reducing the cost barrier to adoption.

- Green chemicals often emphasize resource efficiency, which can lead to cost savings and reduced waste generation, benefiting both the environment and a company's bottom line.

- Research and development in green chemistry are leading to innovative solutions that meet or exceed the performance of traditional chemicals. Additionally, investments in R&D to develop innovative green chemical solutions promote the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 161.87 Billion |

| Market Size in 2026 | USD 178.38 Billion |

| Market Size by 2035 | USD 421.66 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.05% |

| Largest Market | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Sustainability initiatives and growing consumer awareness

Government sustainability initiatives, as well as efforts from corporations and industries, have led to more stringent requirements for eco-friendly practices. These mandates promote the utilization of green chemicals to reduce pollution, conserve resources, and decrease greenhouse gas emissions. Consequently, the market is witnessing an upsurge in innovative approaches to developing and applying green chemicals, particularly in sectors like agriculture, manufacturing, and consumer goods. These green chemical solutions play a pivotal role in addressing environmental concerns and aligning industries with the growing global commitment to sustainability.

Moreover, consumer awareness and preferences are shifting towards environmentally responsible products. With greater access to information and heightened concern for environmental issues, consumers are actively choosing products that incorporate green chemicals. This consumer-driven demand not only encourages companies to adopt sustainable practices but also fosters the development of new and improved green chemical solutions that align with both environmental goals and customer expectations. The synergy between sustainability initiatives and informed consumers creates a dynamic environment in which green chemicals play a pivotal role in shaping a more eco-conscious and sustainable future.

Restraint

Regulatory hurdles and higher production costs

Regulatory hurdles and higher production costs pose significant challenges to the green chemicals market. While regulations promote the adoption of eco-friendly chemical solutions, they also impose stringent compliance requirements and certification processes, increasing the complexity of manufacturing and distribution. Meeting these regulations often demands substantial investments in research, testing, and documentation, which can deter some companies from transitioning to green alternatives.

Moreover, green chemicals often come with higher production costs, primarily due to the need for advanced technologies, sustainable sourcing of raw materials, and eco-friendly production processes. These elevated costs can make green chemicals less attractive to businesses seeking to maximize profitability in the short term. However, the initial investments and ongoing operational costs often prove daunting, particularly for smaller businesses with limited financial resources. To address these challenges, the green chemicals sector must foster collaborative relationships with regulatory authorities, explore inventive, cost-effective production techniques, and undertake extensive educational efforts to underscore the enduring benefits of adopting eco-friendly chemical solutions.

Opportunity

Renewable energy chemicals and bio-based polymers

The green chemicals market is experiencing a surge in demand due to the integral role that renewable energy chemicals play in the transition toward a sustainable future. Green chemicals are essential in energy storage and conversion processes, like batteries and solar panels, as the world transitions to renewable energy sources. This surges demand for chemicals that improve the sustainability and efficiency of these technologies. For instance, advanced electrolyte materials in batteries, a green chemical innovation, are crucial for storing energy from renewable sources and powering electric vehicles. This drives both the development and adoption of green chemicals.

Another significant driver is the rise of bio-based polymers. These environmentally friendly alternatives to traditional plastics are derived from renewable resources like plant-based feedstock, reducing the reliance on fossil fuels. As consumers and industries increasingly seek sustainable packaging solutions, bio-based polymers are in high demand, transforming the plastics market. The use of these polymers results in reduced carbon emissions and decreased environmental impact. Together, renewable energy chemicals and bio-based polymers fuel the growth of the green chemicals market, providing essential building blocks for a more sustainable and eco-friendly future.

Segment Insights

Type Insights

According to the type, the bio-alcohols segment has held a 48% revenue share in 2025. Bio-alcohols, which include ethanol, methanol, and butanol produced from bio-based feedstock, have gained traction in the green chemicals market. Their eco-friendly nature and applicability in a range of industries, from fuel production to cosmetics, make them sought-after alternatives. The trend in bio-alcohols involves continuous research to enhance production efficiency and expand applications, particularly in the automotive sector for biofuels and in sanitizing products due to their disinfectant properties.

The bio-ketones segment is anticipated to expand at a significant CAGR of 10.1% during the projected period. Bio-ketones, like acetone and butanone, are ketones derived from bio-based sources. They are gaining importance in green chemistry due to their applications in sustainable solvents, resin production, and pharmaceuticals. The market trend is focused on developing greener routes for ketone production and exploring new applications, such as in the growing cosmetics and personal care industry. As sustainability becomes a focal point, these bio-based ketones are expected to witness increasing demand across various sectors.

Application Insights

Based on the application, the industrial & chemicals segment is anticipated to hold the largest market share of 62% in 2025. In the industrial & chemicals sector, green chemicals find extensive applications as raw materials, solvents, and catalysts. The trend here is an increasing transition toward sustainable manufacturing processes. Manufacturers are embracing eco-friendly chemicals to reduce their environmental footprint and comply with stringent regulations. This shift towards green practices is driven by the growing awareness of the environmental impact of chemical processes.

On the other hand, the packaging segment is projected to grow at the fastest rate over the projected period. In the packaging segment, there is a rising demand for green chemicals to create environmentally friendly packaging materials. From biodegradable polymers to sustainable inks and coatings, the focus is on reducing waste and pollution associated with packaging. Consumers' increased eco-consciousness and stringent environmental regulations are pushing companies to adopt green chemicals in their packaging solutions, making it an evolving and promising market.

Regional Insights

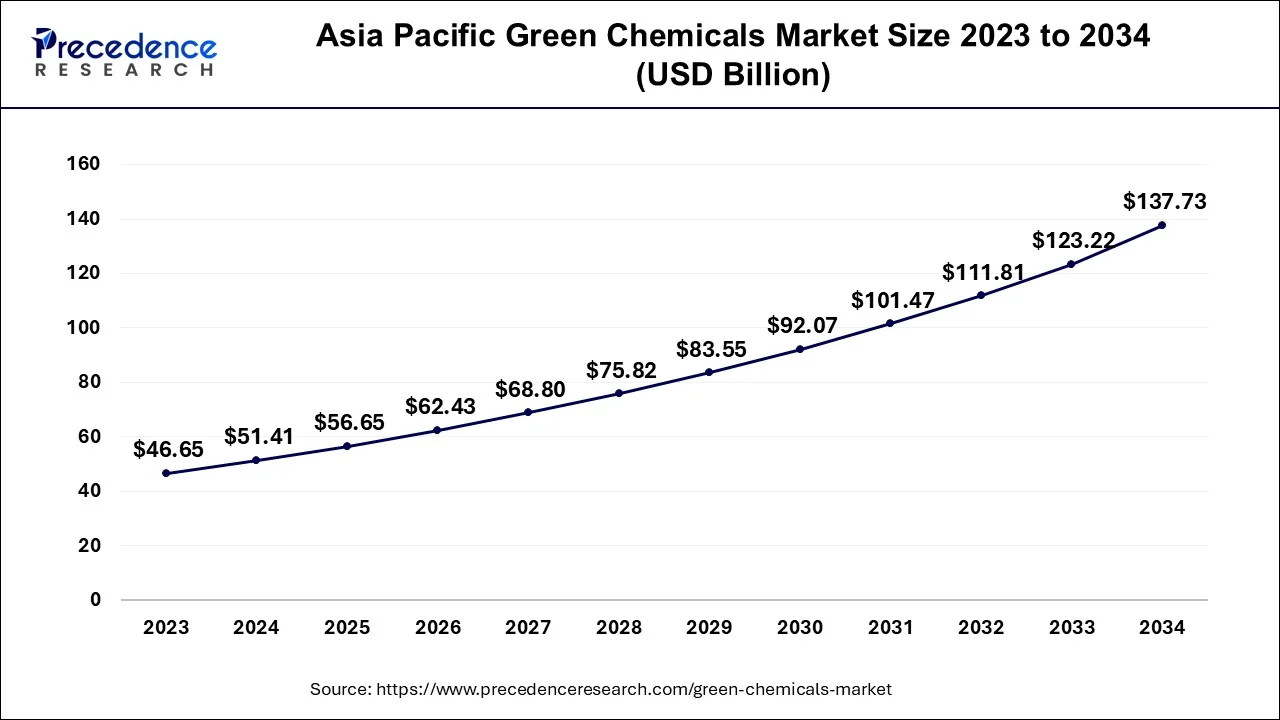

What is the Asia Pacific Green Chemicals Market Size?

The Asia Pacific green chemicals market size is estimated at USD 56.65 billion in 2025 and is expected to be worth around USD 150.17 billion by 2035, growing at a CAGR of 10.24% between 2026 to 2035.

Asia Pacific has held the largest revenue share 35% in 2025. Asia Pacific is experiencing robust growth in the green chemicals market, driven by increasing awareness of environmental sustainability and government initiatives to promote cleaner alternatives. Key trends include a rising emphasis on bio-based and renewable feedstock, which aligns with the region's commitment to reduce carbon emissions. Additionally, the burgeoning middle-class population is showing a preference for eco-friendly products, further propelling the demand for green chemicals in various industries, from manufacturing to agriculture.

Why is Europe Considered the Fastest-Growing Market for Green Chemicals?

Europe is estimated to observe the fastest expansion. Europe has been at the forefront of green chemical adoption, with stringent regulations promoting sustainability. The region is witnessing a transition towards circular economy models, focusing on recycling and reducing waste. Bio-basedpolymers, eco-friendly packaging materials, and sustainable solvents are gaining traction. Furthermore, European consumers and businesses are increasingly mindful of their carbon footprint, pushing for greener chemical solutions in the automotive, construction, and healthcare sectors. As Europe continues to champion eco-consciousness, the green chemicals market here is expected to thrive.

What Drives the Market in North America?

In North America, the green chemicals market is flourishing due to a growing emphasis on environmental stewardship. The region is witnessing a surge in bio-based chemicals, renewable feedstock, and sustainable manufacturing practices. With a focus on reducing carbon emissions and transitioning to greener alternatives, North American industries are driving innovation in sustainable chemicals, catering to the demands of eco-conscious consumers and regulations favoring cleaner solutions.

India Green Chemicals Market Analysis

India's market is growing due to rising environmental awareness, government initiatives promoting sustainable manufacturing, and increasing adoption of bio-based and renewable feedstock. Expanding industrial sectors such as pharmaceuticals, agriculture, and packaging are driving demand for eco-friendly chemicals. Additionally, consumer preference for sustainable products and stricter regulations on chemical emissions further fuel market growth.

UK Green Chemicals Market Analysis

The market in the UK is expanding, as industries are adopting low-carbon and energy-efficient production methods. Innovation in biodegradable polymers, sustainable solvents, and eco-friendly coatings is rising. Government policies, green funding initiatives, and increasing collaboration between research institutions and manufacturers are accelerating development. Growing corporate commitments to sustainability and consumer preference for environmentally responsible products further propel market growth.

U.S. Green Chemicals Market Analysis

The U.S. market is growing as companies seek to reduce hazardous waste, lower greenhouse gas emissions, and meet sustainability goals. Rising investment in research for bio-based chemicals, green solvents, and renewable materials, along with increasing awareness of environmental impact among manufacturers and consumers, is driving demand across sectors like agriculture, healthcare, and industrial manufacturing.

Sustainable Chemistry Driving the Global Green Chemicals Market in Latin America

Latin America's market shows notable growth during the forecast period. Latin American countries are accepting stricter environmental policies, pushing for decreased carbon footprints, and funding the commercialization of green technologies via regulations. There is increasing pressure from both users and industries for sustainable options in the food packaging, automotive, and personal care sectors.

Brazil Green Chemicals Market Trends

Brazil is actively decreasing its dependency on conventional Western markets by fostering stronger ties with Arab nations to mitigate risks from worldwide trade wars and geopolitical shifts. Brazil's "corridor-first" strategy seeks to use the Middle East as a hub to access wider markets in Africa and South Asia, decreasing exposure to US-China trade tensions.

Role of Green Chemicals in the Circular Economy in MEA

MEA's market shows fast growth during the forecast period. By leveraging renewable feedstocks and even designing non-toxic processes, green chemistry assists MEA countries, mainly the UAE and Saudi Arabia, in decreasing reliance on fossil fuels, handling waste in booming industrial sectors, and working with global net-zero goals.

Growing renewable feedstock availability in some African countries, supportive policies in GCC nations, and rising adoption of biodegradable and eco-friendly chemical alternatives are promoting this shift, while technological advances and investments in bio-based production help reduce costs and enhance scalability.

UAE Green Chemicals Market Trends

The UAE is positioning itself as a regional centre for bio-based chemicals via investment in R&D, biotechnology, along with infrastructure in specialized, eco-friendly industrial zones. Because of strict government regulations on waste and also consumer demand for eco-friendly options, bio-based polymers such as PLA or PHA are in high demand for packaging.

Value Chain Analysis

- Feedstock Procurement: Green chemicals feedstock sourcing focuses on renewable and circular materials like biomass, waste, and captured COâ‚‚ to reduce environmental impact.

Key Players: BASF, Dow, DuPont, SABIC. - Quality Testing and Certification: Green chemicals undergo quality testing and certification to ensure compliance with environmental and health standards throughout their lifecycle.

Key Players: UL Solutions, Eurofins, DNV, NSF International. - Packaging and Labelling: Green chemical packaging uses sustainable materials, eco-friendly inks, and clear labeling with certifications, ensuring safety, recyclability, and environmental compliance.

Key Players: Amcor, Berry Global, Mondi Group, Huhtamaki.

Top Companies in the Market & Their Offerings

- Solvay S.A.: Produces sustainable specialty chemicals and bio-based solutions that reduce environmental impact and support green industrial applications.

- INEOS Group Holdings S.A.: Offers eco-innovative chemical products with a focus on energy efficiency and reduced carbon footprint across industries.

- Archer Daniels Midland Company: Supplies renewable feedstocks and bio-based intermediates essential for green chemical production and sustainable materials.

- Cargill, Incorporated: Develops bio-based chemicals and sustainable ingredients from renewable resources for use in plastics, coatings, and more.

- Novozymes A/S: Provides industrial enzymes and biotechnologies that enable greener chemical processes and lower environmental impact.

- Corbion N.V.: Produces bio-based lactic acid and sustainable polymer building blocks for eco-friendly packaging and green chemical applications.

Other Green Chemicals Market Companies

- BASF SE

- DuPont de Nemours, Inc.

- Koninklijke DSM N.V.

- Huntsman Corporation

- AkzoNobel N.V.

- Clariant AG

- Stepan Company

- Croda International PLC

- Evonik Industries AG

Recent Developments

- In June 2025, Syensqo introduced Miracare Biopacify, a biodegradable, microplastic-free opacifier for liquid detergents. With over 90% renewable carbon content, it meets upcoming EU regulations while delivering strong performance, reinforcing Syensqo's green chemicals portfolio for sustainable home care solutions.(Source: https://www.syensqo.com)

- In April 2024, Merck launched Cyrene, a bio-based solvent derived from renewable cellulose, designed to replace restricted solvents like DMF and NMP. Aligned with green chemistry principles, Cyrene offers safer handling, reduced environmental impact, strong performance in advanced chemical applications, and is now globally available.(Source:https://www.indianchemicalnews.com)

- In 2022, SABIC has finalized the acquisition of Clariant's stake in Scientific Design, thereby securing full ownership of the catalyst leader. This acquisition reinforces SABIC's presence in the Specialties market, aligning with their strategic shift to establish a standalone Specialties division to pursue diverse growth opportunities.

- In 2021, BASF and CATL have formed a strategic partnership focusing on battery materials, including cathode active materials (CAM) and battery recycling, to advance global carbon neutrality goals, as per a framework agreement signed by the two companies.

- In 2019, INEOS has successfully acquired the Ashland Composites Business, now rebranded as INEOS Composites. The company, a global frontrunner in unsaturated polyester resins, vinyl ester resins, and gelcoats, is set to further strengthen its position in these key product segments.

Segments Covered in the Report

By Type

- Bio-alcohols

- Bio-Polymers

- Bio-organic acids

- Bio-ketones

- Others

By Application

- Industrial & Chemical

- Food & Beverages

- Pharmaceuticals

- Packaging

- Construction

- Automotive

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting