What is the Green Coatings Market Size?

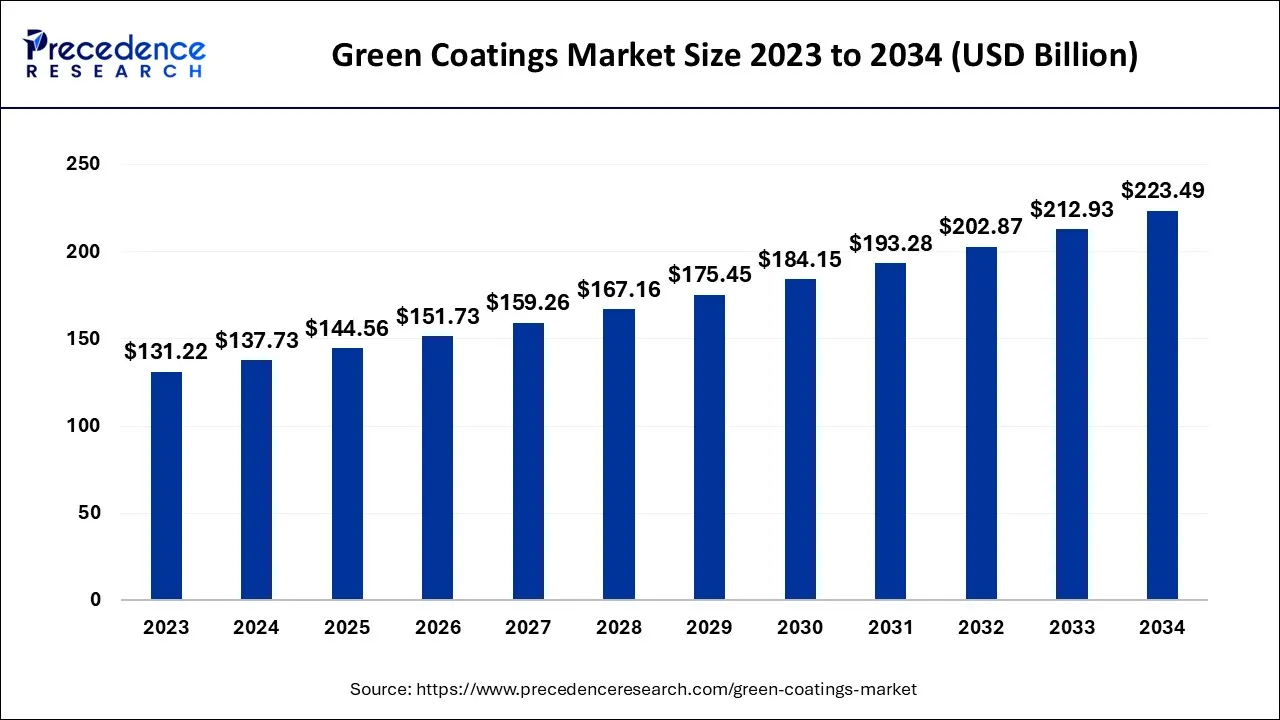

The global green coatings market size was calculated at USD 144.56 billion in 2025, and is anticipated to hit around USD 151.73 billion by 2026, and is projected to surpass around USD 234.05 billion by 2035, growing at a CAGR of 4.48% from 2026 to 2035.

Green Coatings Market Key Takeaways

- In terms of revenue, the market is valued at $144.56 billion in 2025.

- It is projected to reach $234.05 billion by 2035.

- The market is expected to grow at a CAGR of 4.48% from 2026 to 2035.

- By type, the waterborne coatings segment has generated revenue share of around 74% in 2025.

- By application, the architectural segment has captured revenue share of 39% in 2025.

- Asia-Pacific is poised to grow at a CAGR of 5.1% over the forecast period 2026 to 2035.

What is the Green Coating?

Environmentally friendly coatings, or "green coatings," release almost no volatile organic compounds (VOCs) during manufacture. Some of the most popular choices for green coatings include radiation-hardened coatings, powder coatings, high-solid paints, and water-based paints. These coatings are made with all-natural components like clay, milk, castor oil, soybean, and vegetable oil. They improve the overall efficiency of the equipment while also assisting in reducing the negative impacts of infrared and ultraviolet (UV) radiations. They are thus used in a variety of industries, including maritime, aerospace, aviation, mining, oil & gas, automotive, and construction.

The construction industry has seen tremendous growth worldwide, which is one of the main factors supporting the market's optimistic outlook. Green coatings are painted on interior extrusions, roofs, door frames, windows, panels, and walls as protective and decorative paints. They are also utilized on a variety of consumer goods, including oven parts, electronic boxes, rooftop heating, HVAC (heating, ventilation, and air conditioning) units, furniture, fixtures, and furniture.

Also, the general public's growing environmental consciousness and the surge in demand for aqueous and powder-based coatings are driving the industry ahead. These versions are safer for human health than conventional solvent-borne coatings because they are block-resistant and VOC-free. Other elements that promote expansion include a variety of product developments, such as the creation of radiation-curable coatings. They are created from plant-based materials and processed utilizing low-energy electron beams (EB) or ultraviolet (UV) rays.

Additional reasons, such as quick industrialization and the adoption of supportive government policies to encourage sustainability, are projected to fuel the growth of the green coatings market.

How is AI contributing to the Green Coatings Industry?

The creation of eco-friendly coatings is motivated by AI because it can detect coatings that are eco-friendly, streamline the manufacturing process, and forecast the functionality of the coating, hence resulting in the emergence of intelligent adaptive coating. All things that deal with trying out new coatings are done efficiently, and wastes are minimized through the use of AI. AI is also involved in making energy efficiency, compliance, and more rapid and sustainable outcome simulations.

Green Coatings Market Growth Factors

There are the following factors which are expected to boost the green coatings market growth:-

- Presence of zero volatile organic compounds

- Increasing attention to sustainability and health

- Increased environmental regulations: Mandatory government policies aimed at cutting VOC emissions and other toxic materials mean that industries will have to embrace green coatings sourced from green chemistry to find alternatives in various sectors such as automotive, construction, and packaging.

- Increased public consciousness: The increased public demand for health and sustainability is encouraging the use of non-toxic, biodegradable, and low-odor coatings, pushing product and coatings manufacturers to make financial commitments to green technologies that resonate more with their customers' preferences.

- Increased green building development: The increase in sustainable development and the constructing of green buildings worldwide is driving demand for environmentally benign coatings to meet energy efficiency targets, as well as indoor air quality and overall sustainability improvements in buildings.

- New developments in coating technologies: Improvements in coating technology, such as waterborne, powder-based, and bio-based coatings, are improving performance and ease of application, making products that are greener, able to compete more readily with traditional coatings, and expanding their market appeal.

- Corporate sustainability: More and more companies are starting to adopt sustainable practices in accordance with their ESG (Environmental, Social, Governance) strategies, and because of this, there is a growing interest in the demand for sustainable green coatings for industrial or commercial use.

Market Outlook

- Industry Growth Overview: The market grows because of the sustainable architecture necessities due to regulations and the popularity of the eco-friendly concepts all over the world.

- Sustainability Trends: The application of water-based powder bio-based coatings promotes the practice of the circular economy in the industrial consumer sphere on the global consumer level.

- Global Expansion: Europe is the first to adopt, with North America and Asia Pacific driving up the demand for green coating globally.

- Major Investors: BASF, Nippon Paint, Sherwin-Williams are the major investors that drive strategic investments across the globe.

- Startup Ecosystem: Startup innovates bio-polymers, AI tools formulation of biodegradable materials that enable sustainable coatings development and commercialization.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 234.05 Billion |

| Market Size in 2025 | USD 144.56 Billion |

| Market Size in 2026 | USD 151.73 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.48% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Presence of zero volatile organic compounds

The demand for green coatings has grown over the past ten years due to the availability of ultra-low or zero volatile organic compounds (VOCs). In addition, there is an increasing tendency towards the need to reduce VOCs in paints, and both regionally and globally, government rules are becoming stricter on VOC laws. Also, being an environmentally friendly product, the green coating has piqued customers' interest in the market, which is growing steadily as consumers become more aware of the health risks associated with VOC exposure, which is boosting the demand for green coatings in the marketplace. Thus, fuelling the expansion of the global market for green coatings.

Due to consumer demand for a low-odour interior finish and improved indoor air quality, businesses like PPG Industries, Inc. are implementing green manufacturing practices for the fabrication of their products by adhering to legal requirements in line with Leadership in Energy & Environmental Design (LEED) criteria.

Increasing attention to sustainability and health

There has been a gradual shift in demand from solvent-borne coatings to environmentally friendly products, such as UV-curable coatings, high solids, powder coatings, and waterborne, since these products contain fewer solvents that evaporate during the curing phase, as a result of growing awareness of the negative effects of VOC emissions and rising global warming, supported by the aforementioned regulations. Given that it doesn't contain any solvents and only seldom emits VOCs into the atmosphere, powder coating has become increasingly popular.

Because of the creation of novel products and formulations as well as improvements in application procedures, this industry is expanding quickly. Asia Pacific is anticipated to have the largest and fastest-growing market for green coatings during the forecast period. This can be attributable to the area's expanding construction and automobile sectors.

Key Market Challenges

There are the following factors which can restrain the market from growing

- The cost and accessibility of specialty raw ingredients required for green coatings

- Environmental concerns

The cost and accessibility of specialty raw ingredients required for green coatings - The market for green coatings with low or no solvent content is increasing as people become more aware of issues like global warming, climate change, and personal health. However, this industry still has several challenges to overcome before it can compete with coatings made from fossil fuels. There are several things to consider. When compared to petrochemical products, the cost of renewable materials is significantly higher. Green coatings go through a difficult procedure to become environmentally friendly, which raises their price when they are finished. When there are cheaper options accessible, users are reluctant to pay the higher price.

To create synthetic technologies that are less or not damaging to the environment and human health - Green chemistry can be used to create synthetic treatments that are environmentally friendly and eco-friendly coatings. Several industrial processes have used industrial reactions and green solvents to significantly reduce toxicity, which is a very difficult task. Every synthetic reaction leaves some by-products behind, and these by-products can be detrimental to both the environment and people's health.

Key Market Opportunities

The green coatings market presents several opportunities for growth and expansion in the coming years. Here are some of the key opportunities:

- Rising need for raw commodities that are renewable

- Rising environmental concern

Rising need for raw commodities that are renewable: In order to comply with regulations and profit from government subsidies for the use of renewable resources, many firms are striving to lower their carbon footprint. Also, green resources are always available and their prices are not as volatile as those of oil and its derivatives. Alkyds, acrylics, and other resins made from bio sources are offered by various resins producers to improve the performance of green coatings in comparison to conventional coating technologies.

Rising environmental concern - The key element driving the market expansion is the population's growing environmental concerns in developing regions, which are manifested in higher spending on infrastructure. In growing nations like Japan and China, the need for aqueous and powder coatings to replace solvent-borne coatings is also rising, particularly in the industrial and automotive sectors. The market for green coatings is being driven by a number of factors, including rising demand for plant-based wood coatings and radiation cure coatings, increased awareness of VOC emissions, increased use of ultraviolet curing coatings and plant-based sources for producing wood coatings, and rising usage of ultraviolet curing coatings and radiation cure coatings. In addition, the market for green coatings will see new opportunities as coatings technology advances, the use of radiation cure coatings increases, research and development efforts increase, and end-user industry demand for the product rises.

Technology Insights

Due to the early acceptance of the technology, particularly in architectural applications across Europe and North America, waterborne coatings have dominated the business. Due to rising product demand in automotive and industrial applications in growing nations like India and Brazil, the technology is anticipated to rise at a high rate. With over 80% of the total demand for waterborne coatings in 2016, the architecture industry accounted for the largest application category. Over the next eight years, the expansion of the green coating market is anticipated to be driven by increased infrastructure spending as well as expanding economies in Asia Pacific and the Middle East.

Increased demand for household items including microwaves, washing machines, and freezer cabinets is anticipated to boost the expansion of the powder coating sector. Due to the shift in OEM preference from liquid coatings to powder coatings, the demand for technology for the manufacturing of consumer goods is anticipated to increase at a significant rate during the forecast period.

Application Insights

The manufacture of automobiles depends heavily on automotive OEM coatings. These are quite durable and of high quality. They have superior mechanical qualities that shield cars from scuffs, climate, and chemical exposure. Interior automotive coatings increase an automobile's surface area. The manufacturing of cars and trucks is rising, which is boosting the demand for coatings.

The OICA estimates that 80.1 million passenger automobiles were produced worldwide in 2021. Because EVs are becoming more and more popular, these figures are also anticipated to rise over the projected period. The advent of IoT and the employment of robots in the manufacturing cycle have led to higher efficiency, a decrease in labour, and shorter cycle times, for example, which have all benefited the automobile sector.

Due to innovation, numerous producers have recognized the growing client needs and are now utilizing green coatings to address their health-related worries. It also fits with the green attitude used by producers of electric vehicles.

Regional Insights

Due to the expanding population and burgeoning economies of Italy, Spain, and U.K, Europe is predicted to increase. In the UK National Infrastructure Delivery Plan 2016–2021, a number of infrastructure projects, including seaports and airports, have been planned. These projects are expected to drive market demand during the following eight years. The main market for green coatings is anticipated to be India, which is anticipated to increase rapidly between 2021 and 2025. Over the anticipated time, it is anticipated that the country's manufacturing sector will expand quickly due to the Make in India initiative adopted by the Indian government.

The building industry in the area is anticipated to benefit from rising consumer disposable income and changing consumer lifestyles in Brazil, which will also favourably affect the market for green coatings. Growth is anticipated to be fueled by government initiatives to address the nation's housing shortage, cheap interest rates, and an escalating middle-class population. Because of the region's quickening industrialization and urbanisation, the Middle East and Africa are predicted to experience tremendous growth. Over the next eight years, market trends are anticipated to be positively impacted by the expansion of the leading coating manufacturers in this region and the growth of the application sectors.

What Are the Driving Factors of the Green Coatings Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. The European market is also going forward primarily because of strict environmental regulation, the interest in the circular economy, and the high culture of sustainability. Three of the aspects that resulted in the gradual implementation of green coatings are renovation of the building stock, industrial modernization, and automotive transformation.

Germany Green Coatings Market Trends:

Germany is highly geared towards sustainability, adherence to rules and regulations, and the use of modern manufacturing technologies. The drivers of the acceptance of green coatings are the automotive industry, energy-saving constructions, and bio-based technologies. Circular economy principles are also shaping the market, with greater focus on recyclable packaging, reduced raw material use, and lifecycle transparency.

Value Chain Analysis of the Green Coatings Market

- Feedstock Procurement: Purchase of bio-based raw materials, putting price, sustainability, availability, and quality as counter-measures.

Key Players: ExxonMobil Chemical, DuPont, Mitsubishi Chemical Corporation - Chemical Synthesis and Processing: Change of raw materials to coating intermediates using chemical reaction technologies.

Key Players: BASF SE, Dow, Inc., DuPont - Compound Formulation and Blending: It involves the combination of various resin types, fillers, and colorants to achieve desirable green performance properties.

Key players: BASF SE, Dow, Inc., DuPont - Packaging and Labelling of Green Coatings: Green Coatings protect the environment by placing the coatings in eco-friendly containers, labeling and storing, transportation, and distribution.

Key players: BASF SE. Nippon Paints

Top Green Coatings Market Companies and their Offerings

- The Sherwin-Williams Company: The Sherwin-Williams Company produces powder and waterborne paints that have low emission profiles, which are of use in industrial, architectural, and consumer applications.

- Nippon Paint Holdings Co. Ltd.: Nippon Paint Holdings Co. Ltd. promotes and develops extremely high-performance coating that enhances the durability, beauty, and ultimately environmental protection of the diverse sectors.

- Koninklijke DSM N.V.: Koninklijke DSM N.V. offers bio-based components that are sustainable and therefore enable the development of environmentally-friendly coatings to be innovative.

Green Coatings Market Companies

- The Sherwin-Williams Company

- Nippon Paint Holdings Co. Ltd.

- Koninklijke DSM N.V.

- Kansai Paint Co. Ltd.

- Jotun

- Hempel A/S

- BASF SE

- Axalta Coating Systems Ltd.

- Asian Paints Limited

- Akzo Nobel N.V.

Recent Developments

- In March 2025, Anochrome Group introduced a PFAS-free coating solution for the wind energy industry, which helps companies in the sector meet stringent environmental specifications. In collaboration with NOF Metal Coatings Europe, Anochrome Group now offers Geomet 321 + PLUS VLh 2 Silver. This coating system is completely free of PFAS but still produces impressive protection performance.

- In February 2024, Arkema, a world leader in specialty materials, highlighted new technologies and advancements aimed at increasing circularity, energy efficiency, decarbonization, and living comfort through more sustainable paint and coating solutions at Paint India. Arkema leads in developing waterborne technologies with bio-based raw materials and low-carbon feedstock.

- August 2021-The product was introduced by AkzoNobel N.V. in the Indian market. It is the first green paint to receive a USDA certification in India.

- October 2020 -This product was introduced in the Indian market by AkzoNobel N.V. The item is the country's first green paint with USDA certification.

- In March 2025, PPG launched a digital lesson with Centrum JongerenCommunicatie Chemie, introducing chemistry to youth. The “Green paint factory” lesson enables students to design a factory, considering sustainability and costs across six areas: energy, packaging, binders, pigments, transport, and waste, suitable for a third-grade chemistry curriculum. (https://www.indianchemicalnews.com)

- In March 2024, Berger Paints is focusing on sustainability by establishing a technology transfer agreement for producing paint stabilisers with green ammonia. Collaborating with Ramakrishna Mission Vidyamandira, the company aims to replace conventional stabilisers with eco-friendly alternatives through green hydrogen-free production and electrocatalytic techniques. (https://www.manufacturingtodayindia.com)

Segments Covered in the Report

By Technology

- Radiation-Cure

- High-Solids

- Powder

- Waterborne

By Application

- Product finishes

- Packaging

- Wood

- High-Performance

- Industrial

- Automotive

- Architectural

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting