What is the Green Steel Market Size?

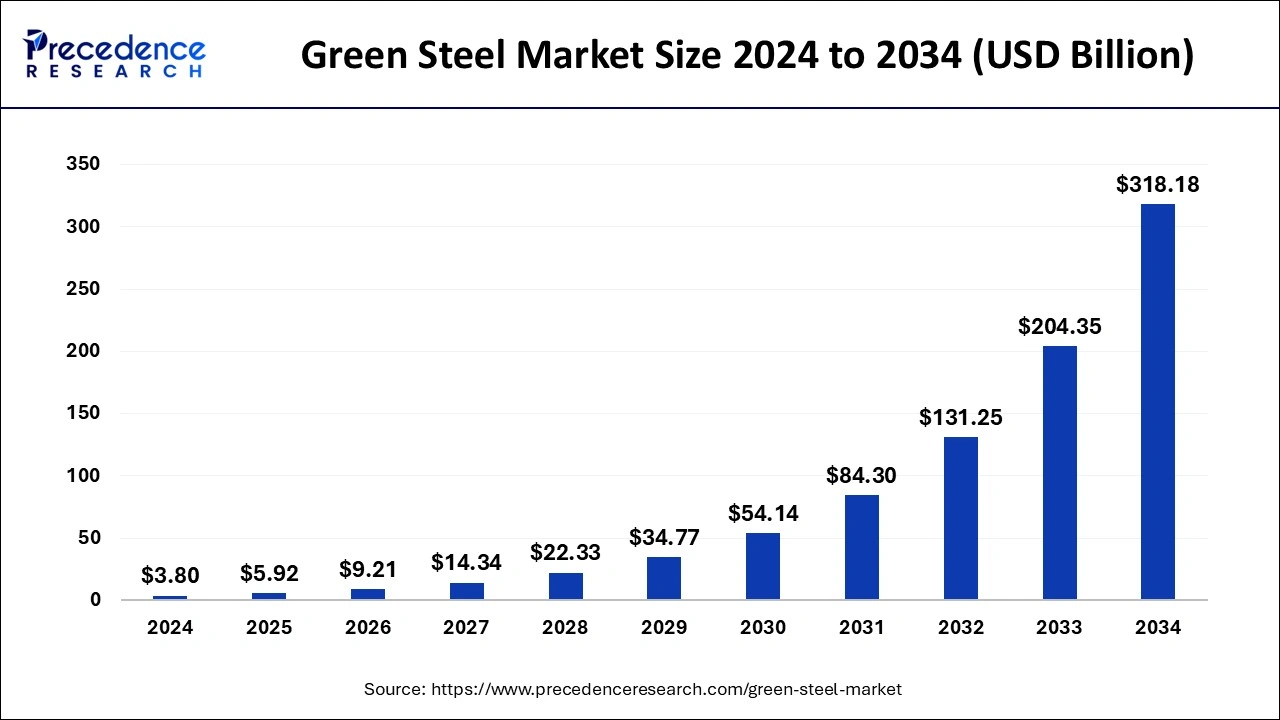

The global green steel market size was accounted for USD 5.92 billion in 2025 and is predicted to increase from USD 9.21 billion in 2026 to approximately USD 404.86 billion by 2035, growing at a CAGR of 52.58% from 2026 to 2035.

Green Steel Market Key Takeaways

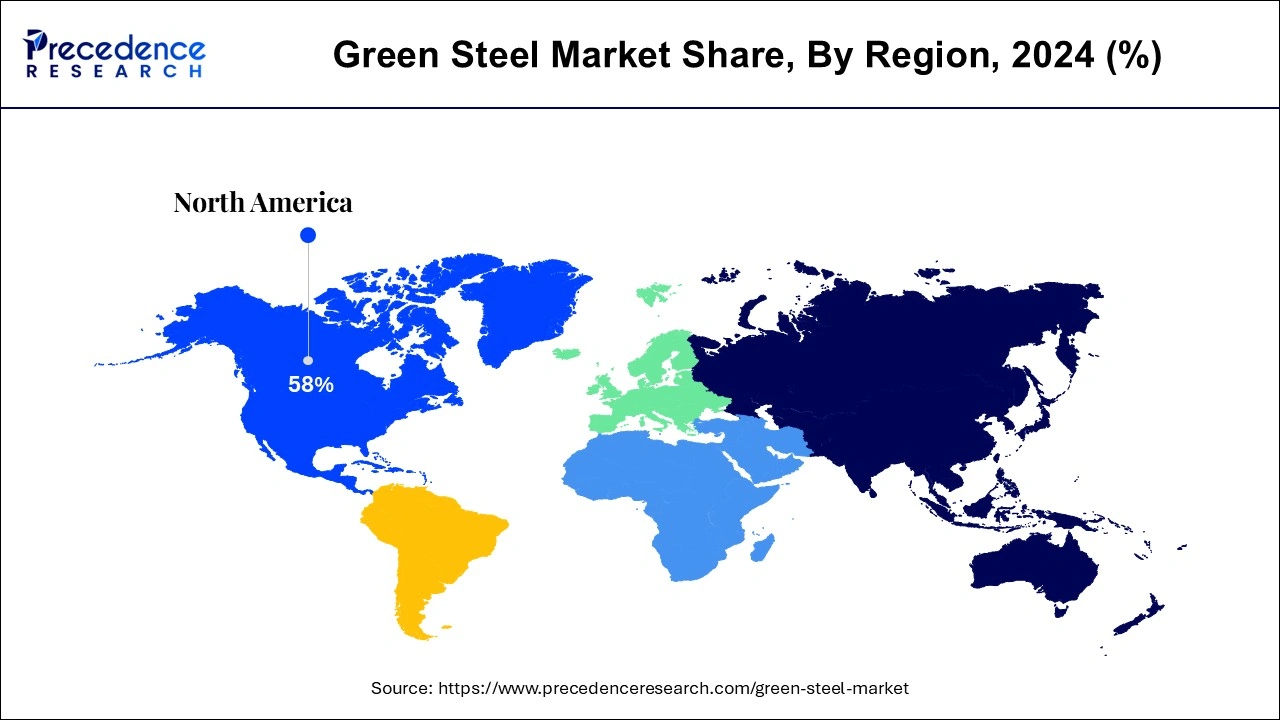

- North America dominated the global green steel market with the largest market share of 58% in 2025.

- By production technology, the electric arc furnaces segment is predicted to grow at the highest CAGR during the forecast period.

- By production technology, the molten oxide electrolysis segment is projected to grow at the fastest CAGR during the forecast period.

- By energy source, the solar energy segment is projected to grow the fastest CAGR during the forecast period.

- By end-user, the automotive and transportation segment is projected to grow at a notable CAGR over the forecast period.

Integration of AI in Steel Industry

Producers may reduce scrap and stabilize production to avoid rework by using AI/ML to make sure every heat meets quality criteria. This minimizes emissions and guarantees that the finished product is indeed green steel. AI and ML solutions might reduce at least 40 MT CO2e, which is equal to Portugal's fossil fuel use if they were implemented globally. The steel industry would gain from this as it would make their steel even more attractive to businesses like automakers that are attempting to draw in customers by using more ecologically friendly steel.

Market Overview

Green steel industry demand has increased in the last year due to innovative branded products introduced by steelmakers in Europe and the United States that offer consumers a carbon-efficient alternative while utilizing available capacities. Public and private steel buyers in the construction, automotive, and metal products sectors are signaling a commitment to purchase green steel. This includes the initiatives of the First Movers Coalition and CEM Industrial Deep Decarbonization.

As per the World Steel Association, approximately 1.85 tons of CO2 was introduced into the atmosphere due to the production of 1860 million tons of steel. There has been a boost in the manufacturing of green steel owing to the rising industrial emissions from various steel products, which further pushes organizations to introduce partnerships and strategies with private steelmakers.

Additionally, green steel is generated entirely from renewable sources like green hydrogen, the burgeoning R&D in Fuel Cell Electric Vehicles (FCEVs) and hydrogen-powered automobiles has a positive influence on technological advancement in green steel. Furthermore, some Asian countries, including China, South Korea, New Zealand, and others, currently use FCEVs manufactured by Toyota, Hyundai, and others. They also intend to use green hydrogen in their vehicles in the coming years, which will fuel the worldwide green steel growth.

Green Steel Market Growth Factors

- Rising concerns about the environment: Making the switch to green steel will significantly help mitigate climate change, as the steel sector is responsible for a large amount of world emissions. When green steel manufacturing is implemented, airborne pollutants are decreased, improving the quality of the air and the health of those who live close to steel operations.

- Sustainability: Nearly indefinitely recyclable, steel is a very sustainable product that is essential to the infrastructure required for emerging sectors like renewable energy and e-mobility.

- Conservation of resources: Green steel lessens the demand for virgin raw materials by prioritizing recycling and sustainable sourcing, protecting ecosystems and natural resources.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.92 Billion |

| Market Size by 2035 | USD 404.86Billion |

| Growth Rate from 2026 to 2035 | CAGR of 52.58% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Production Technology, By Energy Source and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising CO2 emission

Total carbon dioxide emissions from the steel and iron sector have increased over the last decade, owing primarily to rises in steel consumption and the energy required for production. Significant reductions in CO2 emissions are needed to achieve the Net Zero Scenario. Short-term Carbon dioxide emission reductions are possible primarily through improved energy efficiency and increased scrap collection, allowing for more scrap-based production.

Significant changes in emissions intensity will necessitate the use of new technologies like electricity-based production, hydrogen use, and CCUS. Green Steel initiatives are anticipated to reduce carbon dioxide emissions.

Various government initiatives

Green steel is predicted to play an important role in assisting nations around the world in achieving their sustainable advancement goals and reducing their carbon footprints. Green steel is critical to lowering countries' dependence on energy imports, protecting the environment, and meeting the world's growing energy needs. Furthermore, the production of steel produces a significant quantity of carbon dioxide. As a result, governments worldwide are expanding decarbonization strategies and promoting green steel, particularly in sectors like automotive and construction.

Restraints

The market will be hinder by complicated carbon accounting calculations

The primary challenge in the global green steel market has been a need for understanding carbon accounting calculations, as forecasting the levels of carbon tax during a manufacturing process is highly complex. This, in turn, is delaying the procedure of recognizing green steel, even though only a small percentage of companies in Northern Europe will be producing fossil-fuel-free steel in 2022.

Industries such as SMS groups and others have created a few digital tools. Nonetheless, companies have found it difficult to quantify the number of CO2 emissions from various processes of a complete manufacturing unit in recent years. As a result, when original equipment producers are not able to show emission-free products, market development is impeded.

High production expenses related to green steel

Since both direct hydrogen reduction and molten oxygen electrolysis use electricity as their primary energy input rather than coking coal, their cost structures are exposed to vastly different energy markets.

Segmant Insights

Production Technology Insights

The electric arc furnaces sector is anticipated to grow at the highest CAGR from 2026 to 2035. This is due to the fact that the electric arc furnace efficiently decreases the energy needed to manufacture green steel, planning to make it widely accepted as a method of manufacturing carbon-free steel.

Tata steel Europe announced plans in 2020 to produce green steel in the Netherlands using electric arc furnace (EAF) production technology. ArcelorMittal, along with tata steel, announced its strategy for producing fossil-free steel using EAF technology in Hamburg, Germany. As a result, EAF is expected to have a significant market share in the coming years, with a considerable growth rate.

Furthermore, the government's efforts to reduce carbon dioxide emissions in steel production within Europe result in an increase in the implementation of electric arc furnaces for the production of green steel.

The molten oxide electrolysis sector is expected to expand at the fastest CAGR. MOE uses roughly 3,500 units of energy to produce one ton of steel because it is an electricity-intensive process. This energy was derived from a carbon-free source (possibly renewable) and had an emission factor of 0.09 kg of Carbon dioxide per unit of energy produced. Total CO2 emissions were 0.315 tons CO2 per ton of steel, a fivefold reduction from the existing conventional steel-making procedure.

Since no carbon is introduced into the process in MOE, the steel generated will comprise non-carbon elements, possibly chromium. Aside from the alloy grade, there is no control over the steel composition produced by MOE, and the yield will depend on a specific steel grade. MOE has already been designated as one of the likely technologies to reduce CO2 emissions from the iron and steel industry by the American Iron and Steel Institute (AISI).

Energy Source Insights

Based on the source, wind energy is expected to play a significant role in the global production of green steel. Green hydrogen production plants use wind energy to generate hydrogen. Enhanced investment in renewable energy generation to decrease carbon emissions are projected to boost their market for the manufacturing of green steel in the near future.

Furthermore, the solar energy source is predicted to grow fastest. Solar energy is the most common of all energy resources and is available even in cloudy conditions. The rate at which the Earth intercepts solar energy is approximately 10,000 times more than the speed at which humans consume energy. Solar panel manufacturing costs have dropped significantly over the past decade, making them affordable as well as the cheapest form of energy. Solar panels have a durability of about 30 years and come in a variety of colors depending on the material used in their manufacture. For instance, EVRAZ North America announced that solar energy would be used to power its steel manufacturing operations in Pueblo, Colorado.

End-User Insights

During the projection period, the automotive & transportation segment is expected to capture a significant share of the worldwide green steel market. It is primarily due to automakers' growing awareness of their considerably greater carbon footprints recently, which has driven their preference for using sustainable materials, such as green steel, in the manufacture of automobiles and spare parts.

Several companies, including daimler AG, Mercedes-Benz AG, and Volvo AB, are showing an increased interest in green steel applications. Changes in raw material purchases for automotive manufacturers are anticipated to kickstart demand for green steel and help the market grow during the forecast period.

The building and construction sector is expanding in 2022. The green steel building is a prefabricated structure that preserves the environment, saves resources, as well as reduces pollution significantly over the course of the building's life cycle. This allows people to live in harmony with nature by making practical, efficient, and healthy use of space.

Renovation of areas, demolition of homes, road construction, growth of buildings, and other activities have resulted in an increase in construction waste year after year. Though steel structure buildings have a small share of the infrastructure industry, they are unable to be compared to concrete structures. According to the survey, China's annual construction waste output is approximately 3 billion tons, whereas the capacity for reuse is just 100 million tons.

Green steel construction has numerous advantages, including quick construction speed, high strength, good seismic performance, lightweight, high industrialization, and high housing yield. It is the simplest way to achieve standardization, modularization, factorization, mechanized, and assembly building production. Steel structure buildings are frequently used in public structures such as super high-rise office buildings, large-span spatial structures, industrial plants, airport terminals, etc.

Regional Insights

What is the U.S. Green Steel Market Size?

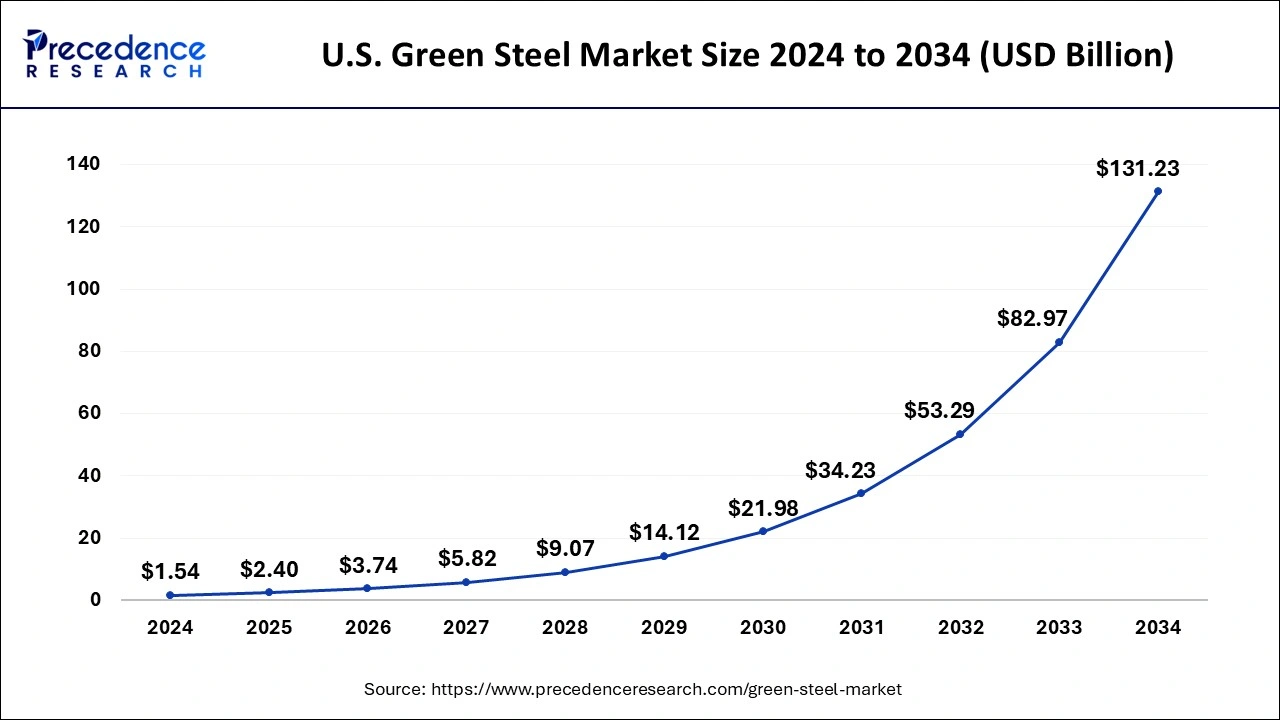

The U.S. green steel market size was evaluated at USD 2.40 billion in 2025 and is predicted to be worth around USD 167.10 billion by 2035, rising at a CAGR of 52.85% from 2026 to 2035.

How did North America dominate the Green Steel Market in 2025?

North America dominated the global green steel market with the largest market share of 58% in 2025. North America is also a hugely profitable market in the region for green steel. The green steel industry in the United Kingdom has grown in recent years as a result of rising investments and offtake partnerships among new companies to meet new business strategies.

Roughly 7% of world greenhouse gas (GHG) emissions and 11% of global carbon dioxide (CO2) emissions are attributable to the iron and steel sector. It is predicted that the demand for iron and steel will increase by up to 40% worldwide by 2050. This anticipated expansion emphasizes how critical it is to reduce emissions from this sector. As part of President Biden's Investing in America initiative, the U.S. Department of Energy (DOE) announced in April 2024 that it will provide $28 million in financing to 13 projects in 9 states to promote ultra-low life cycle emissions and zero-process-emission steelmaking.

U.S. Green Steel Market Analysis

The U.S. industry for green steel is experiencing remarkable growth, owing to strategic corporate investments, significant federal funding, policy support, and global leadership. In March 2024, the Biden Administration, the U.S., launched a new initiative of up to $1 billion for two revolutionary green steel projects.

How was the Noticeable Progress of Europe in the Green Steel Market?

In line with this, many steel manufacturers in countries such as Germany, Sweden, the United Kingdom, Norway, and others are implementing effective clean steel-making solutions to support carbon-neutral targets.

In the past six months in 2024, state funds for decarbonization initiatives in the European steel sector have grown by 4 billion, totaling 14.6 billion. A total of fifteen subsidy choices, with an average of around 1 billion in support per project, have been announced across European nations. With two significant projects in the UK and the Netherlands, Tata Steel has emerged as the chief beneficiary of governmental assistance for decarbonization.

Different types of help, such as direct grants, soft loans, OPEX compensations, etc., will be distributed by European countries. The European Commission anticipates that all assistance initiatives will help the EU Hydrogen Strategy be implemented, the European Green Deal goals be met, and the green transition will proceed more quickly in accordance with the REPowerEU Plan.

The UK Green Steel Market Analysis

The UK market is evolving as the country seeks to decarbonize its traditional steel industry in line with net-zero targets, with key players exploring alternatives such as hydrogen-based direct reduction and electric arc furnace production powered by renewable energy. Major initiatives include government-backed feasibility studies and partnerships, such as British Steel's collaboration on green hydrogen use, which aim to reduce COâ‚‚ intensity and support low-carbon steelmaking technologies.

What will be the Fastest Pace of the Asia Pacific in the Green Steel Market?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, due to decarbonization targets, government policies, and the rising industrial and urban demand for green steel. In February 2025, Australia launched a green iron fund of $636 million to support green steel work and boost its development.

India Green Steel Market Analysis

The major growth drivers of the Indian market are the national green hydrogen mission, green steel mission, and public procurement mandates. The Government of India planned to launch the national green steel mission by December 2024. In December 2025, India committed ₹455 crore to launch hydrogen-powered steel projects.

How is the Pivotal Growth of the Green Steel Market within South America?

South America is expected to experience significant growth during the forecast period, driven by abundant renewable energy, a hydrogen legal framework, strategic policy, and global events. Brazil is committed to strengthening its leadership in the clean industry with the launch of three new decarbonization projects selected by the industrial transition accelerator.

Brazil Green Steel Market Trends

Brazil's market is gaining momentum as sustainability goals and decarbonization efforts increasingly influence the country's steel industry, leading companies to invest in low-carbon production methods such as hydrogen-based reduction and electric arc furnaces powered by renewable energy. Domestic players like Aço Verde do Brasil have reported revenue growth and expanded production capacities, supported by strategic investments and the issuance of green bonds to fund environmentally focused projects.

How is the Middle East and Africa Gaining Momentum in the Green Steel Market?

MEA is expected to grow at a lucrative rate in the market in the coming years, driven by international trade, regulatory pressure, green hydrogen hubs, and strategic shifts in international trade policy. The Middle East and North Africa (MENA) region has potential opportunities to lead the green iron and steel transition.

Value Chain Analysis of the Green Steel Market

- Feedstock Procurement

This stage includes standardization, taxonomy, public procurement mandates, digital traceability, and monitoring systems.

Key Players: SSAB, H2 Green Steel, ArcelorMittal, Salzgitter AG, Nucor Corporation, Boston Metal. - Waste Management and Recycling

This stage is accelerated by advanced scrap recycling and sorting, by-product valorization, technological process integration, and policy and strategic targets.

Key Players: ArcelorMittal, Nucor Corporation, Tata Steel, and Sims Limited. - Regulatory Compliance and Safety Monitoring

This stage is transitioning through import, quality control, star rating system, hydrogen safety pilots, and incident management.

Key Players: Tata Steel, JSW Steel, H2 Green Steel, SSAB, ArcelorMittal.

Green Steel Market Companies

- Deutsche Edelstahlwerke

- SSAB

- Salzgitter AG

- JSW Steel

- ArcelorMittal

- H2GreenSteel

- Hesteel Group

- Liberty Steel Group

- Nucor

- Voestalpine

Recent Developments

- In September 2024, for a 1.25 billion green steel project in Port Talbot, Tata Steel, and the UK Government inked a 500 million grant funding agreement. The 1.25 billion initiative, the biggest investment in the UK steel sector in decades, will ensure steelmaking in Port Talbot, protect 5,000 jobs and protect the UK's steel sovereignty. This project, which will also get 500 million in UK Government Grant Funding, is the result of Tata Steel's substantial worldwide engineering and project expertise in addition to its projected 750 million investment.

- In January 2024, in addition to increasing the previously disclosed equity investment by 300 million, H2 Green Steel secured comprehensive debt financing agreements for 4.2 billion in project finance. Too far, 2.1 billion has been invested in stock. Additionally, the business received a grant of 250 million from the EU Innovation Fund. H2 Green Steel has already obtained over 6.5 billion in finance for the first large-scale green steel production in the world, which will be located in Northern Sweden.

Segments Covered in the Report

By Production Technology

- Molten Oxide Electrolysis

- Electric Arc Furnace

By Energy Source

- Wind Energy

- Solar Energy

By End-User

- Automotive & Transportation

- Building And Construction

- Electronic Industrial Equipment

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting