What is the Fault Current Limiter Market Size?

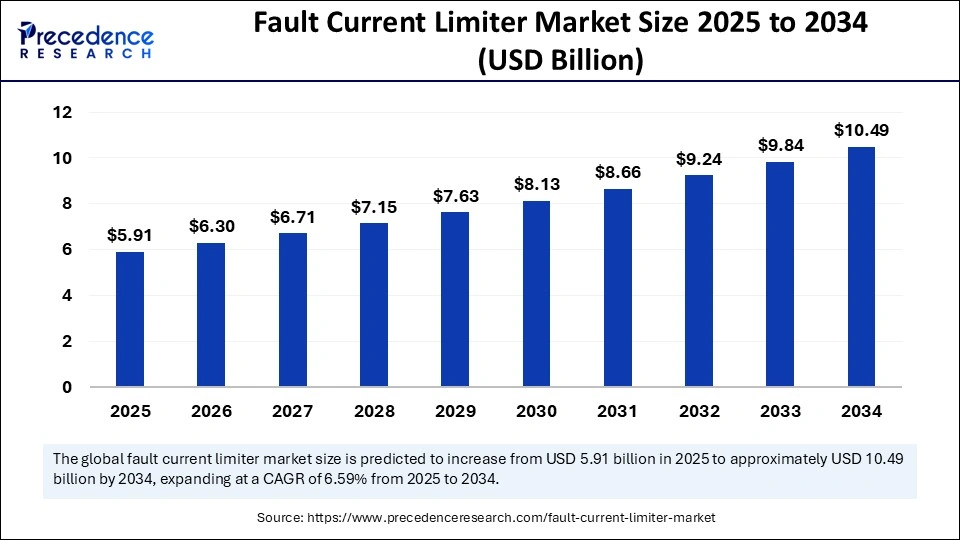

The global fault current limiter market size is accounted at USD 5.91 billion in 2025 and predicted to increase from USD 6.30 billion in 2026 to approximately USD 10.49 billion by 2034, expanding at a CAGR of 6.59% from 2025 to 2034. Increasing the use of superconducting fault current limiters (SFCLs) is the key factor driving the growth of the market. Also, technological advancements in superconducting materials, coupled with the growing focus on grid modernization, can fuel market growth further.

Fault Current Limiter Market Key Takeaways

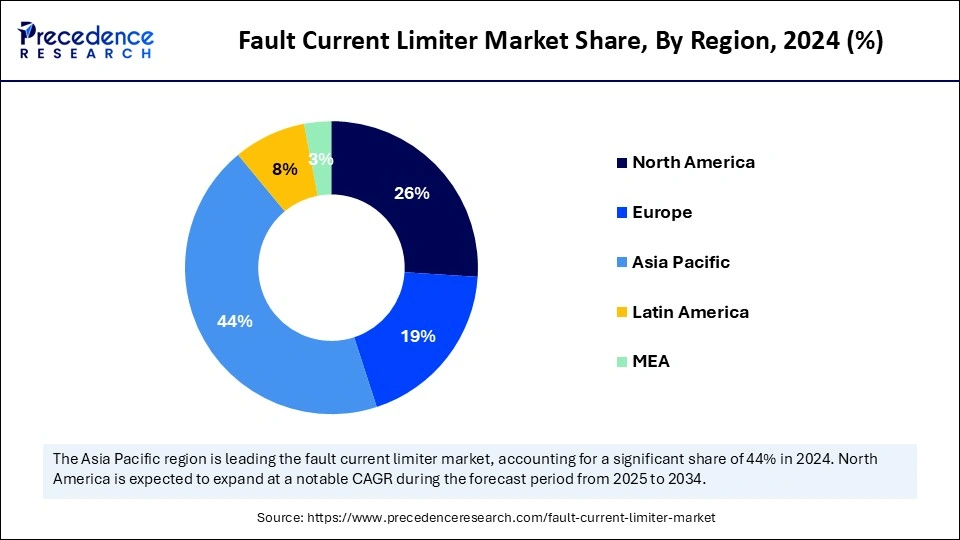

- Asia Pacific dominated the largest market share of 44% in 2024.

- North America is expected to grow at the fastest CAGR during the period.

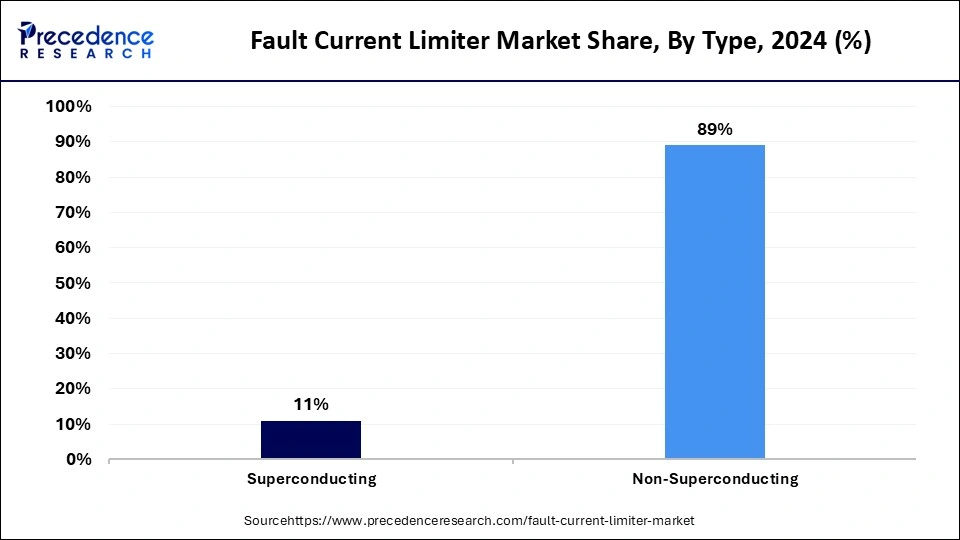

- By type, the superconducting segment contributed the biggest market share of 89% in 2024.

- By type, the non-superconducting segment is anticipated to grow at the fastest CAGR over the forecast period.

- By voltage range, the high voltage segment held the largest market share of 56% in 2024.

- By voltage range, the medium voltage segment is anticipated to grow at the fastest CAGR over the forecast period.

- By end use, the power stations segment captured the highest share of 37% in 2024.

- By end use, the oil and gas segment is projected to grow rapidly during the forecast period.

Role of Artificial Intelligence (AI) in Enhancing Applications of the Fault Current Limiter Market

Artificial Intelligence plays a crucial role in the market by enhancing the reliability, efficiency, and adaptability of the fault current limiter market. Driven techniques such as expert systems, fuzzy logic, and optimization algorithms are utilized to improve overall FCL performance and forecast potential issues. Furthermore, AI optimizes the coordination of FCLs, reduces outage areas, and improves system reliability. Predictive analysts predict potential failures, enabling proactive maintenance.

- In July 2024, LS Cable and System (LS C&S) and LS Electric launched superconducting projects for internet data centers (IDCs) in the AI Era. They plan to actively expand into both domestic and international markets, including Vietnam. The superconducting solution can transmit high-capacity power equivalent to 154kV at a lower voltage of 22.9kV.

Market Overview

The market refers to the sector involved in the development, manufacturing, and sale of devices that restrict the quantity of current passing through a system during some electrical issues, like short circuits. Also, these devices safeguard equipment from potential damage and help monitor the proper stability of grids.FCLs have different applications, such as in distribution networks, power transmission, renewable energy projects, and industrial facilities.

Fault Current Limiter Market Growth Factors

- Growing demand for reliable and efficient power is expected to boost the fault current limiter market growth shortly.

- Innovations in grid modernization and the rising adoption of electric vehicles can propel market growth soon.

- Government initiatives to upgrade and expand transmission and distribution networks will likely contribute to the market expansion further.

Fault Current Limiter Market Outlook

- Industry Growth Overview: The fault current limiter market is set for strong growth from 2025 to 2034. This expansion is driven by the need for grid resilience, rising renewable energy integration, and grid modernization. The increasing demand for superconducting FCLs for high-voltage and non-superconducting FCLs for lower-voltage applications also contributes to market growth.

- Global Expansion: The market is growing worldwide as demand for reliable and resilient electrical grids increases, driven by the need to prevent damage from electrical surges and improve grid stability in both urban and industrial areas. Emerging regions, particularly in Asia-Pacific, Latin America, and Africa, offer significant opportunities due to rapid infrastructure development, rising investments in smart grid technology, and the increasing adoption of renewable energy sources, which require advanced solutions to maintain grid reliability and manage fault currents effectively.

- Major Investors: Large automation and power companies like ABB, Siemens, and Schneider Electric are key players, investing heavily in R&D and acquisitions. Investment is also supported by government initiatives to develop smart grids.

- Startup Ecosystem: Startups are focused on innovation in superconducting materials, solid-state designs, and AI-enabled grid protection. Emerging players are focusing on developing solutions that offer faster response times, reliability, and modular designs for easier grid integration.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10.49 Billion |

| Market Size in 2025 | USD 5.91 Billion |

| Market Size in 2026 | USD 6.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.59% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Voltage Range, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Increasing demand for enhanced power grid infrastructure

The major factor driving the market's growth is the growing demand for improved and sophisticated power grid infrastructure and the rising shift towards the adoption of renewable energy applications. In addition, different visitors, glass, diodes, copper, solenoids, and metal wings are also involved in fault current limiters. The latest fault limiter shows a raised reliance on industrial lines of the future.

- In July 2024, a Global provider of solar solutions, Huawei FusionSolar, launched its largest commercial and industrial (C&I) inverter available to the market to date, the 150K high-power C&I inverter series. The former is powered by solar PV only, while the latter requires an optimizer.

Restraint

Low affordability and high cost

Deploying fault current limits can cause substantial costs, such as installation costs, all equipment costs, and some power shifts to current systems. Hence, the willingness and affordability of stakeholders to invest in this sector can pose a substantial challenge, particularly in small-budget items. However, some FCL technologies lack well-established track records, which can lead to hesitation among companies and consumers to adopt this option.

Opportunity

Grid modernization

Ongoing efforts to modernize power grids, such as the integration of distributed energy resources and renewable energy sources, often include the use of FCLs, which will likely create significant market opportunities in upcoming years. Furthermore, superconducting FCLs offer benefits in terms of weight, size, and performance as compared to conventional FCLs, which makes them convenient for an extensive range of applications.

- In March 2025, Damodar Valley Corporation (DVC) launched a Rs 1,500 crore project to modernize power supply in its command area to ensure round-the-clock quality power and to reduce aggregate technical and commercial (AT&C) losses. DVC's entire distribution network primarily serves industries, with negligible supply to retail consumers.

Type Insights

The superconducting segment dominated the fault current limiter market in 2024. The dominance of the segment can be attributed to the lower costs, reliability, and extensive applicability of this segment across different power systems. Additionally, the superconducting FCLs are more cost-effective as compared to other types. The materials used in non-excessive FCLs are more viable, which makes them useful for power system operators and companies.

- In September 2024, UK fusion pioneer Tokamak Energy launched TE Magnetics, a new business division focused on the industrial deployment of high-temperature superconducting (HTS) magnet technology. Designed to confine extremely hot plasma in a tokamak fusion reactor, HTS magnets can enable magnetic fields for applications likely to drive scientific discoveries.

The non-superconducting segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be credited to its crucial role in tackling the challenges related to fault currents in power systems. Also, this segment encompasses an extensive range of materials where superconductivity is not required, such as many traditional materials and conductors used in different electronic devices and infrastructure.

Voltage Range Insights

The high voltage segment held the largest fault current limiter market share in 2024. The dominance of the segment can be linked to the growing demand for innovative protection solutions in high-voltage power grids. This segment mainly emphasizes FCLs designed for high-voltage transmission lines, which are important for safeguarding grid infrastructure from fault currents to ensure reliability. Countries are also heavily investing in expanding and modernizing power grids, which can positively impact segment growth.

The medium voltage segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the ongoing expansion of medium-voltage power grids, combining renewable energy sources into current networks. In addition, the medium voltage current limiter devices can be utilized to safeguard electrical systems by restraining the amount of fault currents. These types of FCL are essential for preventing equipment damage.

End Use Insights

In 2023, the power stations segment dominated the fault current limiter market by holding the largest share. The dominance of the segment is owing to the important role of fault current limiters in improving the overall reliability and safety of power stations, which are crucial to electricity generation. Moreover, the surge in outdoor recreational activities and technological innovations in battery technology and portability is impacting positive segment growth soon.

The oil and gas segment is projected to grow rapidly during the forecast period. The growth of the segment is due to the increasing use of FCLs in different oil and gas facilities, such as refineries, pipelines, power plants, and offshore platforms. Furthermore, FCLs are important for safeguarding electrical systems in these settings from the damaging effects of fault currents. Both non-superconducting and superconducting FCLs are utilized in oil and gas applications.

Regional Insights

Asia Pacific Fault Current Limiter Market Size and Growth 2025 to 2034

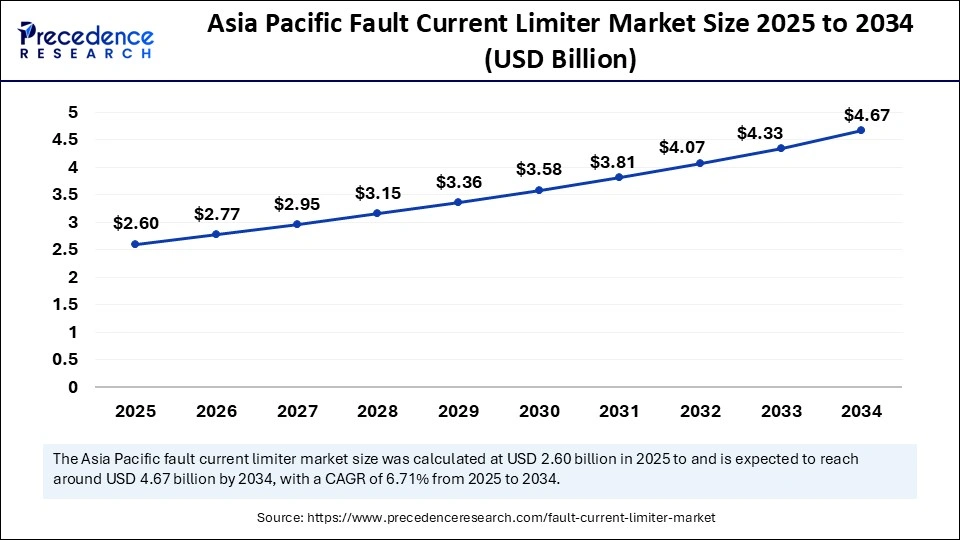

The Asia Pacific fault current limiter market size is exhibited at USD 2.60 billion in 2025 and is projected to be worth around USD 4.67 billion by 2034, growing at a CAGR of 6,71% from 2025 to 2034.

Asia Pacific held the largest fault current limiter market share in 2024. The dominance of the region can be attributed to the ongoing urbanization and industrialization occurring across many industries, such as China, India, and Japan. The increasingly growing transmission and distribution (T&D) infrastructure in this country is escalating the market reach in the region during the forecast period. Moreover, operators in the power generation field are rapidly investing in advanced power generation facilities to fulfill the increasing demand for power.

In Asia Pacific, China led the market owing to the country's robust plans for renewable energy integration and grid modernization. Also, the government in the country, emphasizing building resilient and strong power infrastructure, along with significant investments in power generation projects, is fueling the demand for innovative fault current limiters.

What Makes North America the Fastest-Growing Region?

The North American fault current limiter market is expected to grow at the fastest rate over the period studied. The growth of the region can be credited to the low maintenance cost and high energy efficiency of these limits. The expansion of distributed generation and the integration of renewable energy sources will soon impact positive regional growth. Furthermore, technological innovations in FCL design, like the development of solid-state and superconducting limiters, are anticipated to contribute to market growth during the forecast period.

In North America, the U.S. dominated the fault current limiter market. The dominance of the region can be credited to the significant investment in innovative grid technologies, such as fault current limiters, to safeguard its extensive electrical infrastructure from the growing risks of fault currents and short circuits.

- In March 2023, the Establishment of a multi-billion-dollar R&D platform using materials used in Silicon Valley to accelerate new semiconductor development. It is the world's largest and most sophisticated joint research and development facility in semiconductor manufacturing.

How is Europe Contributing to the Fault Current Limiter Market?

Europe is an emerging player in the fault current limiter market, with a strong focus on sustainability, operational efficiency, and advanced technology. Strict EU regulations on grid safety and the ongoing shift to renewable energy sources are accelerating the adoption of FCLs to handle the variability and complexity of power flows. The market is driven by the need to upgrade aging power infrastructure and incorporate new energy sources, with major manufacturers like Siemens and ABB investing heavily in R&D for advanced solutions, including superconducting and solid-state FCLs.

Germany leads the market within Europe. The market benefits from strong investments in industrial modernization and a well-established infrastructure that prioritizes the highest safety and environmental standards. There is a high demand for efficient, high-quality FCLs to support the country's manufacturing, construction, and transport sectors. The German government's focus on sustainable agriculture and precision application technologies is expected to shape future market applications.

How is the Opportunistic Rise of Latin America in the Fault Current Limiter Market?

Latin America is experiencing a strategic rise in the market, driven by the need for improved grid stability and the integration of a high share of renewable energy sources, especially hydro power, solar, and wind. The region is expanding its transmission and distribution networks, which heightens the risk of high fault currents, thereby increasing the demand for protective devices. Key countries like Brazil and Chile are leading the adoption of FCL technologies in power plants and industrial settings to ensure reliable power supply and prevent equipment damage.

Brazil leads the fault current limiter market in Latin America, supported by its extensive power grid serving over 50 million customers and ongoing modernization of its electrical infrastructure. The main focus is on protecting large power plants and expanding transmission and distribution networks. While non-superconducting FCLs currently dominate the market because of their cost-effectiveness, there is increasing interest in advanced superconducting technologies for their faster response times and higher efficiency.

What Potentiates the Growth of the Market in the Middle East and Africa?

The market in the Middle East and Africa is expanding due to major investments in infrastructure, the oil and gas industry, and large renewable energy projects. The region faces difficulties in managing high power demand, especially for industrial processes and district cooling systems, requiring strong power generation and safety equipment. As countries diversify beyond oil and gas, they are updating their power grids to maintain stability for new industries and smart city initiatives, boosting demand for FCLs.

The UAE is a key player in the market in the Middle East and Africa, driven by ambitious government initiatives that promote technological innovation and economic diversification. Major investments in large-scale infrastructure and smart city projects, along with rapid digitalization and the expansion of 5G networks and renewable energy infrastructure, are fueling strong demand for FCLs. These devices are vital to ensuring the stability and safety of critical infrastructure and an increasing number of data centers.

Value Chain Analysis

- Research and Development (R&D)

Focuses on innovating various FCL technologies and materials science, especially for superconducting FCLs.

Key Players: AMSC, GridON, ABB, Siemens, and Schneider Electric. - Component & Raw Material Sourcing

Procuring specialized raw materials and components like fuses, circuit breakers, and cryogenic systems for SFCLs.

Key Players: Stirling Cryogenics, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., and ABB Ltd. - Manufacturing and Production

Physical production and assembly of FCL devices, involving engineering, quality control, and testing.

Key Players: ABB, Siemens, Schneider Electric, Eaton, GE, Toshiba, and Nexans. - Distribution and Supply Chain Management

Ensures efficient delivery of large, high-voltage equipment to installation sites via distribution networks, dealers, and direct sales.

Key Players: ABB, Siemens, and Schneider Electric. - Installation, System Integration, and Service Delivery

Professional installation and commissioning of FCLs into the customer's existing electrical infrastructure.

Key Players: Duke Energy Corp, NextEra Energy Inc., and Larsen & Toubro (L&T) Limited. - Aftermarket Support and Maintenance

Focuses on maximizing operational lifespan through monitoring, predictive maintenance, repairs, and spare parts supply.

Key Players: General Electric (GE), American Superconductor Corporation (AMSC), and Nexans.

Top Companies in the Fault Current Limiter Market and Their Offerings

- ABB Ltd.: Conventional and high-voltage superconducting FCLs for grid stability.

- Siemens AG: FCL solutions and smart charging networks for complex power systems.

- American Superconductor Corporation (AMSC): HTS wire and systems, specializing in SFCLs for utilities and defense.

- Nexans: Advanced superconducting FCLs for rail and power sectors.

- Rongxin Power Electronic Co., Ltd.: Solutions for improving power quality and energy efficiency in power systems.

Other Key Players

- Applied Materials

- Also

- Zenergy Power Electric Co.

- Superconductor Technologies Inc.

- Applied Materials

- Alstom

- Zenergy Power Electric Co.

Fault Current Limiter Market Companies

- Rongxin Power Electronic Co. Ltd.

- Applied Materials

- American Superconductor Corporation

- Also

- Zenergy Power Electric Co.

- Nexans

- Superconductor Technologies Inc.

- ABB Ltd.

- Applied Materials

- Alstom

- Zenergy Power Electric Co.

- Siemens AG

Latest Announcement

- In March 2025, German tech firm Siemens AG announced that it plans to invest more than USD 10 billion into American manufacturing jobs, software, and AI infrastructure, according to the company's statement. Siemens is preparing to make its largest-ever investment in industrial software and artificial intelligence with the acquisition of Altair Engineering.

Recent Developments

- In July 2024, Nexperia launched new high-current electronic fuses, NPS3102A and NPS3102B, in its power device portfolio. These newly launched eFuses are low-ohmic, high-current, and resettable electronic fuses used to protect downstream loads from excessive voltages.

- In March 2023, the Establishment of a multi-billion-dollar R&D platform using materials used in Silicon Valley to accelerate new semiconductor development. It is the world's largest and most sophisticated joint research and development facility in semiconductor manufacturing.

- In September 2023, Thermometrics Corporation unveiled its new SX Series NTC thermistors. These thermistors are specifically made for LED lighting. The business is currently putting more of an emphasis on growing its client design for specialized markets.

Segments Covered in the Report

By Type

- Superconducting

- Non-Superconducting

By Voltage Range

- High

- Medium

- Low

By End Use

- Power Stations

- Oil and Gas

- Automotive

- Paper Mills

- Chemicals

- Steel and Aluminum

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting