What is the Fish Pumps Market Size?

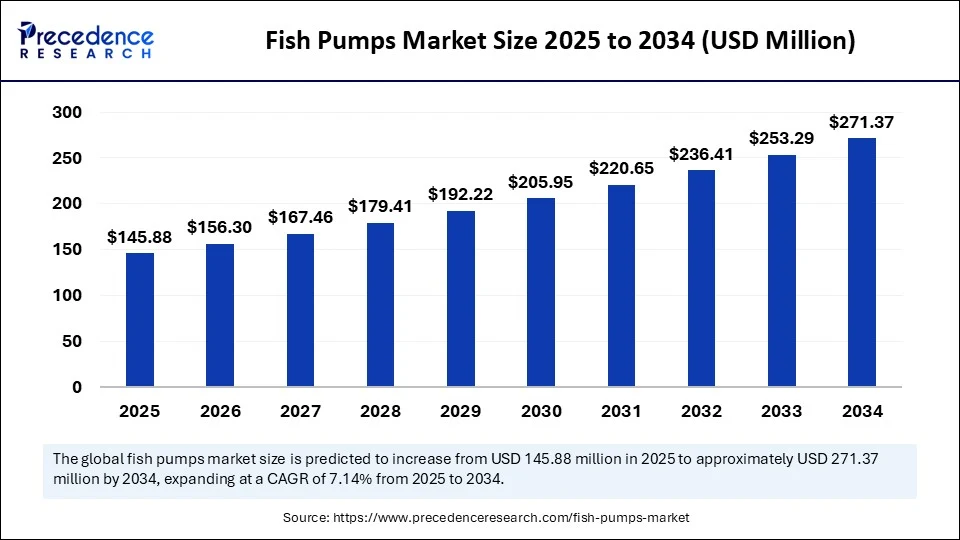

The global fish pumps market size is accounted at USD 145.88 billion in 2025 and predicted to increase from USD 156.30 billion in 2026 to approximately USD 271.37 billion by 2034, expanding at a CAGR of 7.14% from 2025 to 2034. The market is experiencing significant growth due to the rising demand for efficient seafood handling systems in the aquaculture and commercial fishing industries.

Fish Pumps Market Key Takeaways

- In terms of revenue, the global fish pumps market was valued at USD 136.16 million in 2024.

- It is projected to reach USD 271.37 million by 2034.

- The market is expected to grow at a CAGR of 7.14% from 2025 to 2034.

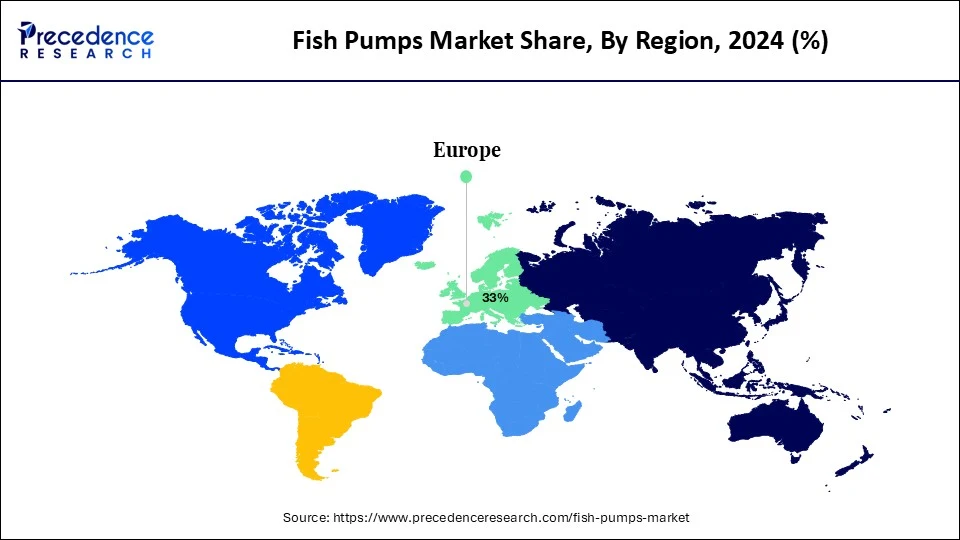

- Europe dominated the fish pumps market and dominated the fish pump market with the largest market share of 33% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the impeller pumps segment captured the biggest market share of 34% in 2024.

- By product type, the progressive cavity pumps segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By capacity, the 1,000–5,000 kg/hr segment contributed the highest market share of 39% in 2024.

- By capacity, the above 10,000 kg/hr segment is expected to grow at a significant CAGR between 2025 and 2034.

- By fish type, the medium fish segment generated the major market share of 45% in 2024.

- By fish type, the large fish segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By operation mode, the semi-automatic segment held the largest market share of 42% in 2024.

- By operation mode, the fully automatic segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the aquaculture segment led the market in 2024.

- By application, the processing plants segment is expected to grow at the highest CAGR between 2025 and 2034.

- By end use, the aquaculture operators segment accounted for significant market share of 38% in 2024.

- By end use, the seafood processors segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the direct sales/OEMs segment held the biggest market share of 46% in 2024.

- By distribution channel, the online retailers segment is expected to grow at a remarkable CAGR between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Fish Pumps

Artificial intelligence is revolutionizing the fish pumps market by enhancing precision and automation in aquatic logistics. AI-powered sensors and monitoring systems are being integrated with fish pumps to track water quality, fish health, and flow rates in real time. This technology enables smarter decision-making, minimizing losses and boosting yield. Predictive maintenance powered by machine learning also ensures minimal downtime and optimal pump performance. Overall, AI is driving both efficiency and sustainability across the fish transportation value chain.

Strategic Overview of the Global Fish Pumps Industry

Fish pumps are specialized pumping systems used for the transfer of live or harvested fish with minimal stress and injury. These pumps are widely used in aquaculture, commercial fisheries, and processing units. They ensure efficient handling of fish during processes such as grading, loading/unloading, sorting, harvesting, and transporting over long distances. Fish pumps are designed to support a wide range of fish species, sizes, and operational environments, from freshwater to marine settings.

The fish pumps market is expanding at a rapid pace, driven by growth in aquaculture, seafood consumption, and the adoption of sustainable fishing practices. These pumps play a crucial role in reducing fish stress and mortality during transport, making them indispensable for modern fisheries operations. Market players are focusing on innovation, offering customizable and energy-efficient pump solutions. Environmental regulations are further encouraging the adoption of systems that reduce fish handling stress. Overall, the market is poised for consistent growth over the next decade.

Key Market Trends

- Focus on fish welfare: There's a strong shift toward designing pumps that reduce stress, bruising, and mortality in fish, aligning with stricter animal welfare regulations.

- Growth of recirculating aquaculture systems (RAS): The rise of RAS facilities, especially in urban and land-based farming, is boosting demand for gentle, closed-loop pump systems.

- Sustainable and energy-efficient designs: Manufacturers are developing pumps that consume less energy and use environmentally safe materials, supporting green aquaculture practices.

- Expansion in emerging markets: Many countries across the world are investing in modern aquaculture infrastructure, driving demand for advanced fish pumping solutions.

Market Outlook

- Industry Growth Overview: The Fish Pumps market is expected to grow significantly between 2025 and 2034, driven by automation and technology integration, sustainability and eco-friendly solutions, and enhanced fish welfare.

- Sustainability Trends: Sustainability trends involve reducing environmental impact, primarily through enhanced energy efficiency, adopting eco-friendly materials, minimizing water consumption in systems, and improving fish welfare during handling.

- Major Investors: Major investors in the market include Cflow, Marel, Baader Group, Cuna del Mar, Hatch Blue, and Neptune NRCP.

- Startup Economy: The startup economy is focused on sustainability and energy efficiency, niche and specialized applications, and fish welfare-focused designs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 271.37 Million |

| Market Size in 2025 | USD 145.88 Million |

| Market Size in 2026 | USD 156.30 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.14% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Capacity, Fish Type, Operation Mode,Application, End Use, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Expansion of the Aquaculture Industry

The booming global aquaculture industry is the primary driver of the fish pumps market. With the world's appetite for seafood on the rise, fish farms are scaling up operations to meet demand efficiently. Fish pumps offer a fast, gentle, and cost-effective way to move large volumes of live fish with minimal handling stress. These systems are becoming essential for maintaining high survival rates and reducing labor costs. Governments and industry stakeholders are heavily investing in sustainable aquaculture practices, further fueling demand for advanced pumping solutions. As fish farming moves toward automation and precision, fish pumps are no longer optional; they are a necessity. Moreover, increasing fish farming to meet the global demand for seafood is expected to drive market growth.

Restraint

High Initial Investments

The fish pumps market faces significant barriers due to the high initial cost of advanced systems. Smaller aquaculture operators, especially in developing or low-income regions, often struggle to afford modern pump technology. Installation, maintenance, and the need for skilled labor can further raise operational expenses. Additionally, integrating smart technologies like AI and internet of things (IoT) can be complex and cost-prohibitive for small aquaculture. Regulatory compliance adds another layer of financial burden, especially in regions with strict environmental and animal welfare laws. These factors collectively slow down the widespread adoption of high-end fish pumping solutions.

Opportunity

Technological Innovations

Technological advancements are unlocking new growth opportunities for the fish pumps market. AI integration, IoT-enabled monitoring, and automated control systems are transforming how fish are handled and transported. Companies that innovate with smart pumps and energy-efficient models are poised to gain a competitive edge. Additionally, the surge in land-based and urban agriculture presents untapped potential for compact, customizable pump systems. There is also growing demand in emerging markets where modern aquaculture infrastructure is rapidly developing. This intersection of tech and aquaculture creates a fertile ground for market expansion.

Product Type Insights

Why Did the Impeller Pumps Segment Dominate the Market in 2024?

The impeller pumps segment dominated the fish pumps market with a major share of 34% in 2024 due to their high efficiency and adaptability in various fish handling operations. These pumps offer a reliable solution for transferring large volumes of fish while minimizing damage and stress. Their simple design, ease of maintenance, and cost-effectiveness make them a go-to choice, especially in large-scale aquaculture. Widely used in both sea and freshwater environments, they are suitable for different fish sizes and water conditions. Continuous improvements in impeller design are also boosting their energy efficiency. As a result, impeller pumps remain the most preferred product type across global operations.

The progressive cavity pumps segment is expected to grow at the fastest rate in the upcoming period due to their gentle and precise handling capabilities. They are especially valued for transporting sensitive or high-value fish species without injury. Their ability to handle varying fish sizes and fragile loads is winning favor among premium fish producers. These pumps also perform well in high-viscosity and mixed solids environments, adding to their versatility. While more expensive initially, their benefits is fish welfare and quality preservation justify the investment. As aquaculture moves toward high-value species, demand for these pumps is rising sharply.

Capacity Insights

How Does the 1,000–5,000 kg/hr Segment Dominate the Fish Pumps Market in 2024?

The fish pumps with a capacity range of 1,000-5,000 kg/hr segment dominated the market with largest market share of 39% in 2024 due to their suitability for medium- to large-scale aquaculture operations. This capacity range offers an ideal balance between speed and gentle fish handling. It is widely adopted by commercial fish farms and mid-sized seafood processors. The scalability of this range fits both batch and continuous operations without overwhelming infrastructure. Manufacturers are also standardizing designs around this capacity, making spare parts and servicing more accessible. This combination of flexibility and efficiency has solidified its leading market position.

Meanwhile, the pumps with a capacity of above 10,000 kg/hr segment is expected to grow at the fastest rate due to their high adoption in large-scale operations and export-driven seafood hubs. These high-capacity systems allow for rapid fish transfer, reducing loading times and improving logistical efficiency. They are in high demand at major processing plants and ports handling bulk fish movements. Automation and AI integration are making it easier to manage large volumes without sacrificing fish welfare. As the global seafood supply chain scales up, the need for high-throughput solutions is increasing. These heavy-duty systems are quickly becoming indispensable for industrial-grade aquaculture.

Fish Type Insights

What Made Medium Fish (e.g., Tilapia, Trout, Catfish) the Dominant Segment in the Fish Pumps Market?

The medium fish (e.g., tilapia, trout, catfish) segment dominated the market with the biggest share of 45% in 2024 due to their widespread availability. Species like tilapia, catfish, and trout are widely consumed across the globe. Fish pumps enable careful handling of these fish without bruising or injury. Their market dominance is driven by steady demand and the wide availability of processing infrastructure for medium-sized fish. Equipment manufacturers have tailored most pump designs to accommodate this category. As a result, medium-sized fish continue to set the operational standard for pumping systems.

On the other hand, the large fish (e.g., salmon, tuna, cod) segment is likely to grow at a rapid pace in the upcoming period. These species require specialized pumping systems that handle bulk and weight efficiently. As demand for premium fish rises globally, producers are investing in pumps with higher capacity and gentle transfer technology. Advanced materials and reinforced designs are supporting this trend. Larger pumps with customizable controls are now being adopted by major offshore and deep-sea operators. The segment is scaling up fast, driven by profitability and market demand.

Operation Mode Insights

Why Did the Semi-Automatic Segment Dominate the Market in 2024?

The semi-automatic segment dominated the fish pumps market with a major revenue share of 42% in 2024 due to their controlled balance and efficiency for most aquaculture operations. Semi-automatic fish pumps allow for manual oversight, which is crucial when handling delicate or varied fish loads. They are cost-effective, especially for small and mid-sized farms looking to modernize without fully automating. Operators favor the flexibility of adjusting settings without relying entirely on digital systems. Maintenance is simpler, with fewer training requirements for staff. For many, semi-automatic remains the practical and preferred option.

On the other hand, the fully automatic segment is expected to expand at the highest CAGR in the coming years due to the rising focus on automation to optimize fish handling. These systems can be integrated with AI, sensors, and remote controls to streamline every part of the fish-handling process. With rising labor costs and the push for scalable solutions, fully automating pumps are becoming more attractive. Large processing plants are seeking smart solutions to optimize workflows, boosting the adoption of fully automatic pumps. These pumps also support better hygiene and traceability, which are key concerns in modern seafood supply chains. As aquaculture modernizes, full automation is gaining unstoppable momentum.

Application Insights

How Does the Aquaculture Segment Dominate the Fish Pumps Market in 2024?

The aquaculture segment dominated the market, with the fish farms sub-segment maintaining a stronghold in 2024, as they rely heavily on efficient and humane fish transfer systems. With the global rise of farmed fish production, the demand for pumps that reduce mortality and handling time has skyrocketed. Fish pumps are integral to harvesting, grading, and transporting live fish in farming operations. The sector prioritizes solutions that maintain water quality and fish welfare during every phase. Continuous investment in infrastructure and technology further cements fish farms' central role. Their year-round operations ensure consistent and high-volume demand for pumping systems.

On the other hand, the processing plants segment is growing at the fastest rate over the forecast period as they are seeking solutions to increase throughput, reduce manual labor, and meet hygiene standards. Pumps streamline the flow of fish from unloading to gutting and cleaning areas, making operations more efficient. Large-scale plants require systems that can move tons of fish per hour while minimizing damage. The use of pumps also reduces contamination risk and meets global food safety protocols. As seafood exports grow, processing facilities are scaling operations and upgrading equipment. Pumps are now a standard fixture in any high-volume seafood processing line, contributing to segmental growth.

End Use Insights

What Made Aquaculture Operators the Dominant Segment in the Fish Pumps Market in 2024?

The aquaculture operators segment dominated the market with highest market share of 38% in 2024 due to their strong focus on streamlining fish handling to reduce injuries to fish. They demand reliable, low-stress systems that maximize fish survival and minimize handling time. These operators are investing in automation, sustainability, and data-driven tools to boost productivity. Pumps that support remote monitoring and AI-driven performance are becoming essential tools in their systems. As they aim for eco-certifications and efficiency, aquaculture operators are influencing the market's direction. Their needs are shaping the future of pump design and application.

Meanwhile, the seafood processors segment led the market in 2024 as they rely heavily on fish pumps to maintain fast, efficient, and hygienic workflows from catch to packaging. Pumps help reduce fish handling times and improve consistency across large-scale operations. As global seafood demand rises, processors are upgrading systems to boost volume and reduce costs. Gentle transfer systems also help maintain fish quality, which is critical for fresh and frozen markets. This segment is increasingly adopting fully automatic solutions for speed and traceability. Fish pumps have become indispensable in modern seafood processing environments.

Distribution Channel Insights

Why Did the Direct Sales/OEMs Segment Dominate the Fish Pumps Market in 2024?

The direct sales segment continues to dominate the market. Direct sales offer personalized service and end-to-end technical support, making it a dominant distribution channel. Manufacturers prefer this model to maintain close relationships with large clients like fish farms and processors. It ensures that buyers get custom-fit solutions and expert installation. Direct sales teams also provide training, maintenance, and after-sales services, adding value beyond the product itself. This channel is especially strong in regions with well-established aquaculture industries. Trust and technical reliability keep direct sales at the top.

Meanwhile, the online retailers segment is expected to grow at the fastest rate due to the convenience and broader access they offer. Smaller fish farms and startups are turning to digital platforms to compare products and find affordable solutions. The rise of e-commerce in B2B sectors is transforming how equipment is sourced and purchased. Online listings with detailed specs, videos, and reviews are helping buyers make informed decisions. Some retailers now offer virtual consultations and remote support, enhancing trust and usability. As digital adoption increases, online sales of fish pumps are surging.

Regional Insights

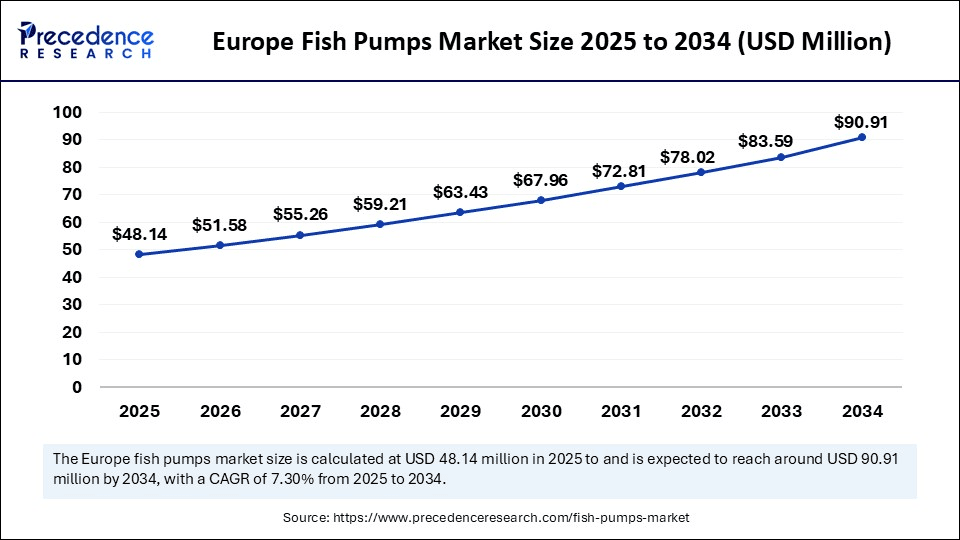

Europe Fish Pumps Market Size and Growth 2025 to 2034

The Europe fish pumps market size is exhibited at USD 48.14 million in 2025 and is projected to be worth around USD 90.91 million by 2034, growing at a CAGR of 7.30% from 2025 to 2034.

What Factors Contribute to Europe's Dominance in the Fish Pump Market?

Europe sustained dominance in the market by capturing the largest share of 33% in 2024. This is mainly due to its advanced aquaculture infrastructure and strict animal welfare regulations. Countries like Norway, Scotland, and Denmark have been heavily investing in sustainable fish handling technologies. The firms in the U.K. are also at the forefront of innovation, integrating AI, automation, and eco-friendly materials into pump designs. The country's commitment to reducing fish stress and improving transport efficiency is pushing demand for cutting-edge systems.

Europe: Germany Fish Pumps Market Trends

Germany's Fish Pumps market is strongly focused on sustainable and high-tech aquaculture practices, a shift towards land-based Recirculating Aquaculture Systems (RAS) and the integration of automated, digitally connected systems for optimised water management. Strong government support, often through EU funding, incentivises innovation and investment in sustainable aquaculture.

Government support, including guidelines for sustainable aquaculture and funding programs, to develop national aquaculture plans to facilitate the long-term growth of the market within the region. R&D funding and partnerships between the aquaculture industry's stakeholders and tech companies further solidify Europe's leadership. With a strong emphasis on quality and sustainability, there is a high demand for energy-efficient fish pumps in the region.

What are the Major Factors Boosting the Growth of the Fish Pumps Market?

Asia Pacific is expected to grow at the fastest CAGR over the forecast period, driven by rapid aquaculture expansion and rising seafood consumption. Countries like China, India, Vietnam, and Indonesia are scaling up fish production to meet local and global demands. As these nations are modernizing their fisheries, the need for efficient, high-volume fish pumping systems is rising sharply. Increasing government support, foreign investments, and rising awareness of fish welfare are accelerating adoption. Moreover, the expansion of fish farming and increasing fish production are likely to drive the growth of the market.

Asia Pacific: China Fish Pumps Market Trends

China's widespread adoption of recirculating aquaculture systems and the expansion of large-scale offshore fish farms are acquiring advanced pumping technology. Government initiatives strongly support modernisation and the integration of AI and automation for optimized water management. Domestic innovation in cost-effective, high-performance pumping solutions accelerates adoption among small and medium-sized enterprises.

On July 10, 2025, Chief Minister of Sikkim Prem Singh Tamang highlighted that the fisheries sector in Sikkim is thriving, where over 2,000 families are involved in pisciculture. During his message on National Fish Farmers' Day, he emphasized that the sector significantly contributes to self-employment, food security, and the local economy. He also noted that government efforts to promote sustainable fisheries have led to the adoption of modern aquaculture methods such as Recirculatory Aquaculture Systems and biofloc technology. Additionally, Sikkim's youth are increasingly interested in these advanced techniques, indicating a bright future for fisheries. The government's plan to introduce Organic Fish Farming aligns with the state's organic vision and will open new market opportunities for farmers.

(source: https://theprint.in)

Value Chain Analysis of the Fish Pumps Market

- Research & Development (R&D) and Design

This initial stage focuses on the innovation and engineering of fish pumps, emphasizing energy efficiency, gentleness on aquatic life, and durability in harsh marine environments.

Key Players: Pentair Aquatic Eco-Systems, PG Flow Solutions, Cflow, Zhejiang Daming, Innovasea. - Raw Material Sourcing & Component Manufacturing

This stage involves procuring specialized materials such as corrosion-resistant stainless steel, durable plastics, and electronic components for motors, sensors, and control systems. - Assembly, Integration & Testing

Components are assembled into the final fish pump products, which are then integrated with control systems and automation software.

Key Players: Pentair Aquatic Eco-Systems, PG Flow Solutions, Cflow, Qingdao Hishing Smart Equipment, Aquacare - Environment Ltd.

Distribution & Sales

This stage involves marketing, sales, and logistics to get the fish pumps to end-users such as aquaculture farms, research institutions, and large-scale offshore projects. Key Players: OEMs, integrators like Billund Aquaculture and AKVA Group. - Installation, Operation & Support

Post-sale activities include installing the pumps within complex aquaculture infrastructure, training operators, and providing ongoing maintenance, repairs, and software updates.

Key Players: CIMC Raffles

Top Companies in the Fish Pumps Market & Their Offerings:

- PG Flow Solutions: PG Flow Solutions is a Norwegian company specialising in advanced fluid handling and pumping systems for aquaculture, offshore, and marine industries.

- Hydrolox (Aqflow Inc.): Hydrolox offers various fish pump solutions designed to move fish gently and efficiently within aquaculture systems. They contribute to the market by focusing on minimizing stress and injury to aquatic life during transfer processes.

- Pentair Aquatic Eco-Systems: Pentair is a global provider of products and systems for water management in aquaculture, including a wide range of pumps designed for various applications from RAS to fish transport.

- IDS - Innovasjon & Design Sunnhordland AS: IDS is a Norwegian supplier of equipment and solutions for the aquaculture industry, including specialised pumps and handling systems. They contribute by providing innovative engineering solutions tailored to the unique needs of fish farming operations.

- AquaScan AS: AquaScan primarily develops technology for fish counting and size estimation, which often integrates with pumping and grading systems. They contribute to market efficiency by providing accurate monitoring tools that optimise the use and management of fish pumps and related equipment.

- FishFlow Innovations B.V.: This company specialises in developing fish-friendly pumping and transport systems designed with a unique, open impeller to minimise stress and injury. They contribute to the market by prioritising animal welfare in high-volume fish transfer operations.

- PumpAB: PumpAB is a Nordic company that likely provides various types of industrial pumps, some of which may be suitable for aquaculture applications. Their contribution to the fish pumps market involves supplying durable pumping solutions adaptable to different farming system requirements.

- Baader Group: Baader is a large, international company primarily known for food processing machinery, but its aquaculture division provides systems that may integrate pumping solutions.

- Marel hf.: Similar to Baader, Marel is a global provider of advanced food processing systems, with solutions applicable to fish processing and aquaculture logistics. They contribute to the market by offering integrated solutions that improve efficiency in high-volume fish handling operations.

- Faivre S.A.S: Faivre is a European manufacturer of equipment for aquaculture, including pumps, graders, and feeders. They contribute to the market with a wide range of reliable and practical solutions for traditional and modern fish farms.

- Aqua-Life Products: Aqua-Life specializes in the safe and gentle handling of live fish, providing a variety of products, including specialized fish pumps and related equipment. They contribute to the market by focusing on reducing fish stress and injury during transfer, improving overall stock health.

- Aqua Logistics LLC: Aqua Logistics provides a variety of aquaculture equipment and services, potentially including fish pumps suitable for different farming scales and systems. They contribute by supplying essential infrastructure and support for aquaculture operations.

- Rastech LLC: Rastech is involved in the engineering and supply of equipment for aquaculture systems, particularly RAS, which are highly reliant on effective water and fish pumps. They contribute by providing key components for advanced, land-based farming operations.

- Pentair Haffmans: Pentair Haffmans is part of the larger Pentair corporation, specializing in CO2 systems and gas control technologies, which are used in water quality management in aquaculture systems that use fish pumps. They contribute indirectly by supporting essential water parameter control within these systems.

- Innovasea Systems: Innovasea provides a wide range of aquaculture solutions, including fish pumps, integrated monitoring software, and farm management technologies.

- Asmak Industrial: Asmak is an aquaculture company primarily based in the Middle East, involved in farming operations that utilize fish pumps and associated equipment. Their contribution lies in being a key end-user and potentially a regional influencer in adopting specific technologies.

- Arenco AB: Arenco AB is involved in developing machinery for fish processing and potentially related handling equipment used in aquaculture systems. They contribute by providing specialised equipment that requires efficient fish transfer mechanisms.

- MasXTech AS: MasXTech specialises in technology solutions for the aquaculture industry, including potentially pumps and handling systems designed for efficiency and fish welfare. They contribute by engineering solutions that address modern farming challenges.

- VAKI Aquaculture Systems Ltd. (part of the MSD Animal Health group): VAKI is a leading provider of aquaculture equipment, including biomass counters, graders, and fish pumps. They contribute to the market by providing comprehensive systems for optimising fish handling and monitoring.

- Transportes Acuicolas de Chile S.A.: This company specializes in the transportation of live aquatic species, which relies heavily on sophisticated pumping and oxygenation systems to ensure the safe transit of fish. They are a significant end-user of specialised fish pumps within the logistics segment of the industry.

Fish Pumps Market Companies

- PG Flow Solutions

- Hydrolox (Aqflow Inc.)

- Pentair Aquatic Eco-Systems

- IDS - Innovasjon & Design Sunnhordland AS

- AquaScan AS

- FishFlow Innovations B.V.

- PumpAB

- Baader Group

- Marel hf.

- Faivre S.A.S

- Aqua-Life Products

- Aqua Logistics LLC

- Rastech LLC

- Pentair Haffmans

- Innovasea Systems

- Asmak Industrial

- Arenco AB

- MasXTech AS

- VAKI Aquaculture Systems Ltd.

- Transportes Acuicolas de Chile S.A.

Segments covered in the report

By Product Type

- Centrifugal Pumps

- Vacuum Pumps

- Water Jet Pumps

- Impeller Pumps

- Progressive Cavity Pumps

- Air Operated Diaphragm (AOD) Pumps

By Capacity

- Below 1,000 kg/hr

- 1,000–5,000 kg/hr

- 5,000–10,000 kg/hr

- Above 10,000 kg/hr

By Fish Type

- Small Fish (e.g., sardines, anchovies)

- Medium Fish (e.g., tilapia, trout, catfish)

- Large Fish (e.g., salmon, tuna, cod)

By Operation Mode

- Manual

- Semi-Automatic

- Fully Automatic

By Application

- Aquaculture

- Fish Farms

- Hatcheries

- Fishing Vessels

- Processing Plants

- Live Fish Transport Systems

By End Use

- Commercial Fisheries

- Aquaculture Operators

- Seafood Processors

- Research Institutes & Hatcheries

By Distribution Channel

- Direct Sales (OEMs)

- Distributors/Dealers

- Online Retailers

- System Integrators

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting