What is the Agricultural Pumps Market Size?

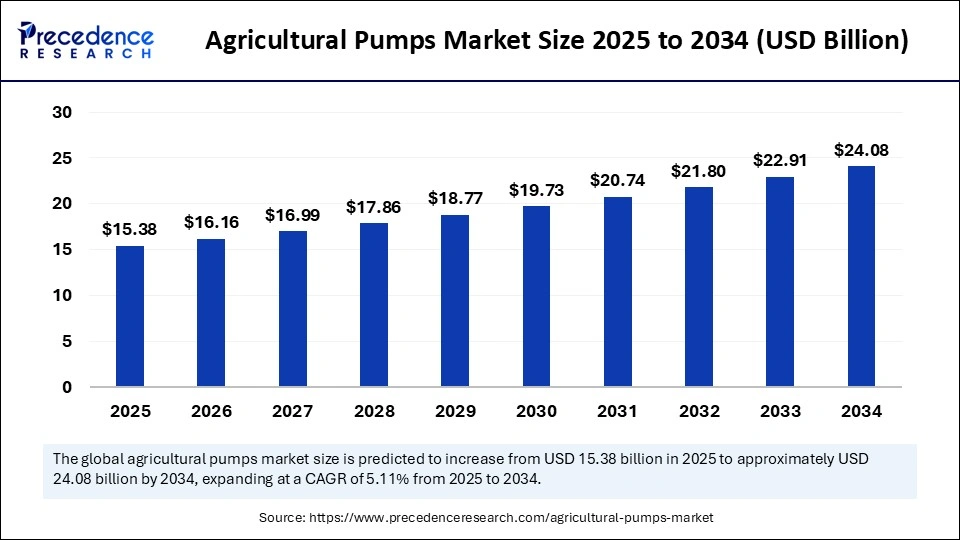

The global agricultural pumps market size accounted for USD 15.38 billion in 2025 and is predicted to increase from USD 16.16 billion in 2026 to approximately USD 25.21 billion by 2035, expanding at a CAGR of 5.07% from 2026 to 2035. Growing due to increasing demand for efficient integration systems driven by water scarcity and the need to boost crop productivity.

Agricultural Pumps Market Key Takeaways

- In terms of revenue, the agricultural pumps market is valued at $15.38billion in 2025.

- It is projected to reach $25.21 billion by 2035.

- The market is expected to grow at a CAGR of 5.07% from 2026 to 2035.

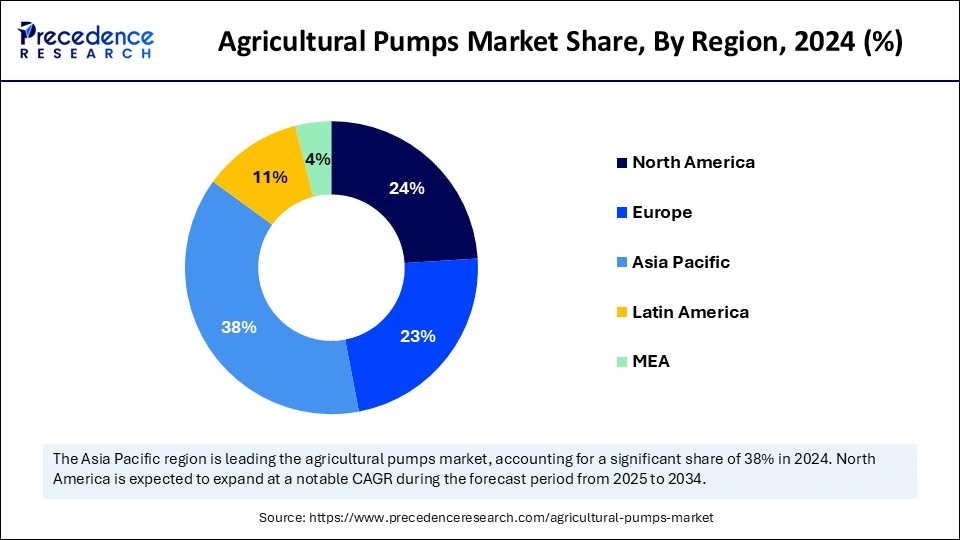

- Asia Pacific dominated the market with the largest market share of 38% in 2025.

- North America is expected to expand at the fastest CAGR during the forecast period.

- Europe is expected to grow at a considerable growth rate in the upcoming period.

- By product type, the centrifugal pump segment dominated the agricultural pumps market with the highest market share in 2025.

- By product type, the positive displacement pump segment is expected to witness significant growth in its market share during the predicted timeframe.

- By application, the water & wastewater treatment segment dominated the market.

- By application, the chemical segment is expected to grow at the fastest rate in the market during the forecast period.

Market Overview

The agricultural pumps market is witnessing significant growth globally, driven by the growing need for efficient agricultural water management that is efficient. Farmers are increasingly using motorized and solar-powered pumps to maximize water use as a result of growing concerns about water scarcity and the need for sustainable irrigation. Market expansion is also being fueled by government subsidies, particularly in emerging economies and increased farming mechanization. The need for highly efficient pumping systems is growing across all sizes of businesses, from small farms to major commercial enterprises.

How is AI changing the Agricultural Pumps Market?

By increasing farming productivity and water efficiency, artificial intelligence is transforming the market for agricultural pumps. Pumps equipped with AI can automatically modify water flow in response to crop requirements, weather, and soil moisture levels. This benefits farmers by lowering energy consumption, conserving water, and enhancing crop health. AI-driven solutions can also plan maintenance, minimize downtime, and anticipate pump failures. This extends the equipment's lifespan in addition to lowering costs. To update their irrigation systems and improve overall farm performance, more farmers are selecting smart pumps.

What's Causing the Rise in Demand for Smart Irrigation Systems?

Water conservation, cost reduction, and increased crop yields are the main drivers of the growing demand for smart irrigation systems. To help farmers and gardeners better manage resources and adjust to changing weather conditions, these systems use technology to water plants efficiently. Smart irrigation is becoming more and more popular as a result of growing water scarcity and an emphasis on sustainable farming.Convenience is another benefit of smart irrigation systems, which enable remote computer or smartphone monitoring and control. By doing this, the user can prevent overwatering and underwatering, which can damage plants. Even home gardeners and small-scale farmers are implementing these systems to increase productivity and safeguard the environment as technology becomes more widely available and reasonably priced.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 25.21 Billion |

| Market Size in 2025 | USD 15.38 Billion |

| Market Size in 2026 | USD 16.16 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.07% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Shift towards solar-powered and hybrid pumping systems

The transition to renewable energy sources has spotlighted solar-powered pumps as sustainable alternatives to traditional diesel or electric pumps. Particularly in isolated or off-grid locations, these systems provide economical and environmentally responsible solutions. E.g., India has been encouraging the installation of solar pumps under the PM KUSUM scheme, offering farmers subsidies to encourage adoption.

- In May 2025, Haryana Renewable Energy Development Agency reported the installation of over 154,000 solar-powered water pumps, contributing significantly to the state's solar energy capacity and reducing farmers' dependency on non-renewable energy.

(Source-https://timesofindia.indiatimes.com)

Rising Agricultural demand and irrigation needs

The increasing global population necessitates enhanced agricultural productivity. Efficient irrigation systems are vital to meet this demand, leading to a surge in the adoption of agricultural pumps. Modern pumps ensure optimal water distribution, enhancing crop yields and supporting food security goals. In regions like Asia Pacific, where agriculture is a primary livelihood, the demand for reliable irrigation solutions is particularly high.

Restraints

Inadequate and unreliable power supply

In many rural areas, inconsistent electricity access or low voltage affects the efficiency and reliability of electric pumps. This leads to crop damage and deters investment in pump infrastructure. Farmers often depend on grid electricity that's available for only a few hours a day. Voltage fluctuations can damage pump motors, leading to hair repair costs. Some farmers revert to diesel pumps, increasing operational expenses and pollution.

- In February 2024, Ember noted Bihar had achieved only 420MW of renewable power versus a 63433MW target, pointing to rural energy defects.

(Source- https://ember-energy.org)

Maintenance and technical know-how barriers

Modern pumps need specific maintenance and technical know-how, particularly those that are connected to the Internet of Things or solar technology. Access to technicians and training is limited for many farmers. System failures result from a lack of post-installation assistance and the availability of spare parts. Farmers are left with useless equipment because many small vendors do not provide servicing. Mobile tech support centers and awareness campaigns are still not widely available.

- In November 2023 – NABARD reported weak technical support in Tier-3 towns affecting pump usability.

(Source- https://www.nabard.org)

Opportunities

Rising demand for micro irrigation systems

As more farmers use precision farming techniques, there is a growing trend toward micro-irrigation or drip and sprinkler systems. The need for pumps that enable intelligent irrigation is fueled by these systems' requirement for constant water pressure. In addition to pump kits, governments and banks are providing bundled loans for micro-irrigation. Additionally, contract farming initiatives are used by food processing companies to promote such systems. Additionally, farmers save 30–60% on water, which is crucial in areas that are prone to drought.

- January 2024 – Jain Irrigation saw a rise in drip-compatible pump sales due to a surge in horticulture farming across western India.

(Source- https://www.jains.com)

Growth in Solar Pump Adoption

Solar pumps are being used more and more frequently as a result of falling solar panel costs and unstable grid power. They are perfect for isolated off-grid agricultural areas and have minimal maintenance and no fuel costs. Nowadays, a lot of solar pumps have dual-mode systems that enable solar or grid charging. Solar pump deployment in Asia and Africa is supported by international organizations such as the World Bank and IRENA. Additionally, Make in India and other regional initiatives have boosted domestic manufacturing.

- In April 2024 – Over 500,000 solar pumps were installed under PM-KUSUM; startups like Khethworks introduced portable solar pumps for small farms.

(Source- https://www.pib.gov.in)

Segment Insights

Product Type Insights

Centrifugal pump segment dominated the agricultural pumps market with the largest share in 2025 because of their affordability, ease of use, and capacity to manage high water volumes. They are perfect for the cultivation of staple crops in Asia and Latin America because they are especially well-suited for open-well and flood irrigation applications. Because of their great scalability, centrifugal pumps can be deployed in a variety of ways on farms of all sizes, from tiny 1 HP units to massive multi-stage systems. They are popular in many different regions due to their broad availability and suitability for diesel electric and solar power. Leading manufacturers also keep improving their designs for increased durability and energy efficiency.

Positive displacement pump segment is expected to grow at the fastest rate in the market increased demand for precision farming and micro-irrigation systems. Even with variable loads, these pumps provide steady flow and pressure, which makes them ideal for sprinkler and drip systems. For high-value crops where accurate water delivery is essential, such as grapes, tomatoes, and floriculture, farmers are increasingly choosing positive displacement pumps. These pumps are perfect for solar and battery-powered systems because they use less energy at low discharge levels. Gear screw and peristaltic pump technological developments are extending their applications outside of conventional zones.

Application Insights

Water & wastewater treatment segment dominated the agricultural pumps market with the largest share in 2025, because of the increasing demand for effective irrigation water management and agricultural runoff recycling. Agro-industrial facilities and farms are spending more money on water treatment and water-reuse pumps as water scarcity becomes a serious problem, promoting sustainable farming methods. The need for sophisticated pumping solutions that can handle corrosive and abrasive wastewater is being further driven by stringent environmental regulations and sustainability goals. In the agricultural industry, these pumps are crucial for filtration, effluent management, and sludge handling processes due to advancements in pump materials and designs that increase longevity and efficiency.

Chemical segment is expected to grow at the fastest rate in the market, driven by the growing use of liquid nutrients, chemical fertilizers, and pesticides in contemporary farming. Precision agriculture, especially for fertigation and crop protection applications, is increasingly dependent on specialized pumps that can safely handle hazardous and corrosive fluids. Particularly in automated systems for greenhouses and vertical farms, the use of chemical dosing pumps is growing due to advancements in corrosion-resistant materials and precise flow control. Rapid growth and innovation in this market segment are being driven by the trend toward automation and increased input efficiency in global markets.

Regional Insights

What is the Asia Pacific Agricultural Pumps Market Size?

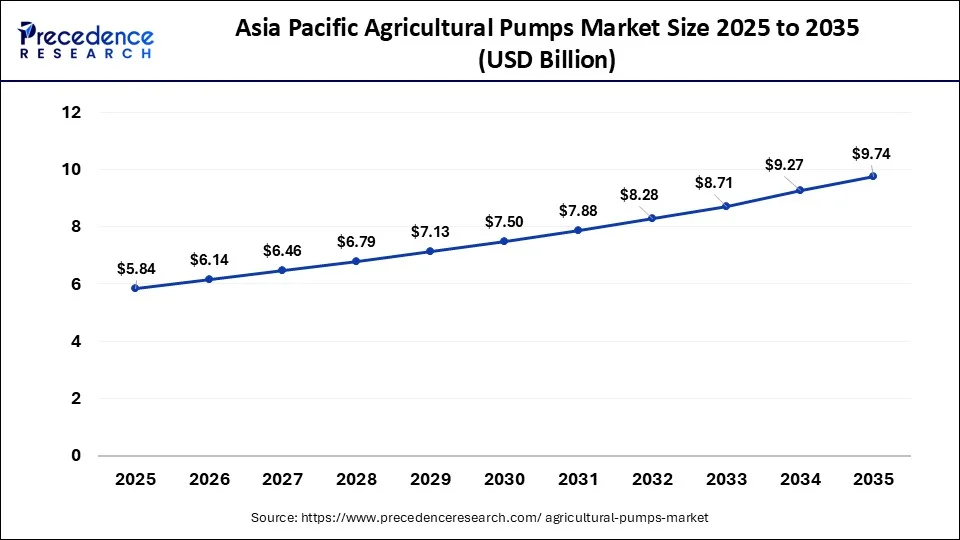

Asia pacific agricultural pumps market size was exhibited at USD 5.84 billion in 2025 and is projected to be worth around USD 9.74 billion by 2035, growing at a CAGR of 5.25% from 2026 to 2035.

Asia Pacific accounted for the major market share of 38% in 2025. This is mainly due to the increased need for contemporary irrigation methods and government programs that encourage rural electrification. The adoption of pumps is being accelerated by the rapidly growing agricultural sector and the move toward precision farming. Furthermore, there is heightened demand for energy-efficient pumps due to the rapid shift toward sustainable farming practices. The growing awareness of water conservation further sustains the region's position in the market.

North America is expected to witness rapid growth in the coming years, driven by substantial investments in agricultural infrastructure and sophisticated farming techniques. Long-standing supply chains, cutting-edge technology, and widespread use of intelligent and energy-efficient pumping systems help the region retain its dominant market position. Furthermore, the use of creative pump solutions is encouraged by strict environmental regulations and government support for sustainable farming. North America's dominance of the market is further reinforced by the existence of important manufacturers and continuous R&D efforts.

How is Europe Growing in the Agricultural Pumps Market?

Europe is expected to grow at a considerable rate in the upcoming period because of its strict water management regulations and emphasis on sustainable agriculture. Environmental regulations and the implementation of sophisticated irrigation systems promote the use of high-performance pumps that are built to last. Europe's market is growing steadily thanks to government incentives to reduce water waste and innovations in smart pump technologies. To create ecologically friendly pumping solutions, the area also acts as a center for research partnerships.

Germany Agricultural Pumps Market Trends: Regulatory initiatives set by the European Union, particularly related to energy efficiency and environmental sustainability, are significantly influencing the country's market landscape, further driven by its advanced industrial base and emphasis on high-efficiency pump systems. Demand for advanced irrigation, drainage, and livestock watering pumps is rising as climate variability and resource conservation become priorities.

What are the Advancements in the Agricultural Pumps Industry in Latin America?

Latin America is expected to have substantial growth in the market, driven by increasing mechanization, rising demand for efficient water management, and government initiatives that are supporting modern farming practices. Increasing government subsidies, technological advancements, and rising farm sizes further contribute to market expansion. Countries such as Brazil, Mexico, and Argentina are leading players.

Brazil Agricultural Pumps Market Trends: The country's market landscape is characterized by a mix of global players, regional manufacturers, and innovative startups. Solar-powered pumps are also gaining popularity in the region, especially in off-grid regions, as they help in reducing operational costs and environmental impact.

MEA's Growing Agricultural Pumps Industry

The Middle East and Africa are expected to witness steady growth in the market and are expected to maintain this growth in the upcoming years. This growth is due to rising water stress across arid climates. Governments in the region are seen expanding desalination and water transfer infrastructure.

Urban population growth further increases demand for reliable agricultural pumping systems. Smart pumping systems with automation and IoT integration are gaining traction, fostering innovation and driving adoption. Countries like Saudi Arabia and the UAE are leading players.

UAE Agricultural Pumps Market Trends: The country has recently deployed its SCADA-based remote monitoring across its water pump networks, which helps in enabling faster fault detection, centralized control, and reduced reliance on manual field intervention. Government policies promoting sustainable agriculture and treated water reuse are driving investment in specialized irrigation pumps.

Agricultural Pumps Market Companies

- Grundfos Holding A/S

- Ingersoll-Rand

- Flowserve Corporation

- Sulzer Ltd.

- Pentair

- ITT, INC.

- Schlumberger Limited

- EBARA International Corporation

- The Weir Group PLC

Latest Announcements

- On 15 April 2025, Grundfos announced the launch of its new solar-powered positive displacement pump designed for precision agriculture. The CEO of Grundfos stated, “This innovation will empower farmers to maximize water efficiency while reducing energy costs in remote locations.”(Source - https://www.grundfos.com)

- On 5 January 2025, Netafim announced the rollout of an IoT-enabled smart irrigation pump system across several regions. The CEO of Netafim stated that, “Integrating AI with pumping solutions revolutionizes farm water management, boosting productivity and conserving resources.” (Source- https://www.xylem.com)

Recent Developments

- On 11 March 2025, Kirloskar Brothers Limited announced the launch of two advanced borewell submersible pumps, KU7P and LEHR, designed for the agricultural and domestic sectors. These pumps aim to enhance energy efficiency and reliability in water supply applications.(Source- https://www.kirloskarpumps.com)

- On 26 March 2025, CRI Pumps reported a significant increase in demand for their energy efficiency and solar-powered pumps, contributing to a 34% growth in total operating income for FY24. The company continues to focus on innovative solutions to meet the evolving needs of the agricultural sector.(Source- https://www.careratings.com)

- February 2025 – Grundfos introduced the LC232 Controller, a new groundwater pump controller tailored for smart agriculture in the Asia Pacific region. This controller facilitates remote monitoring and intelligent control of submersible borehole pumps, enhancing water management efficiency.(Source- https://www.wwdmag.com)

Segments Covered in the Report

By Product Type

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating

- Rotary

- Others

By Application

- Oil & Gas

- Chemicals

- Construction

- Power Generation

- Water & Wastewater Treatment

- Others

By Regions

- North America

- Europe

- Asia-Pacific,

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting