What is the Fluid Sensors Market Size?

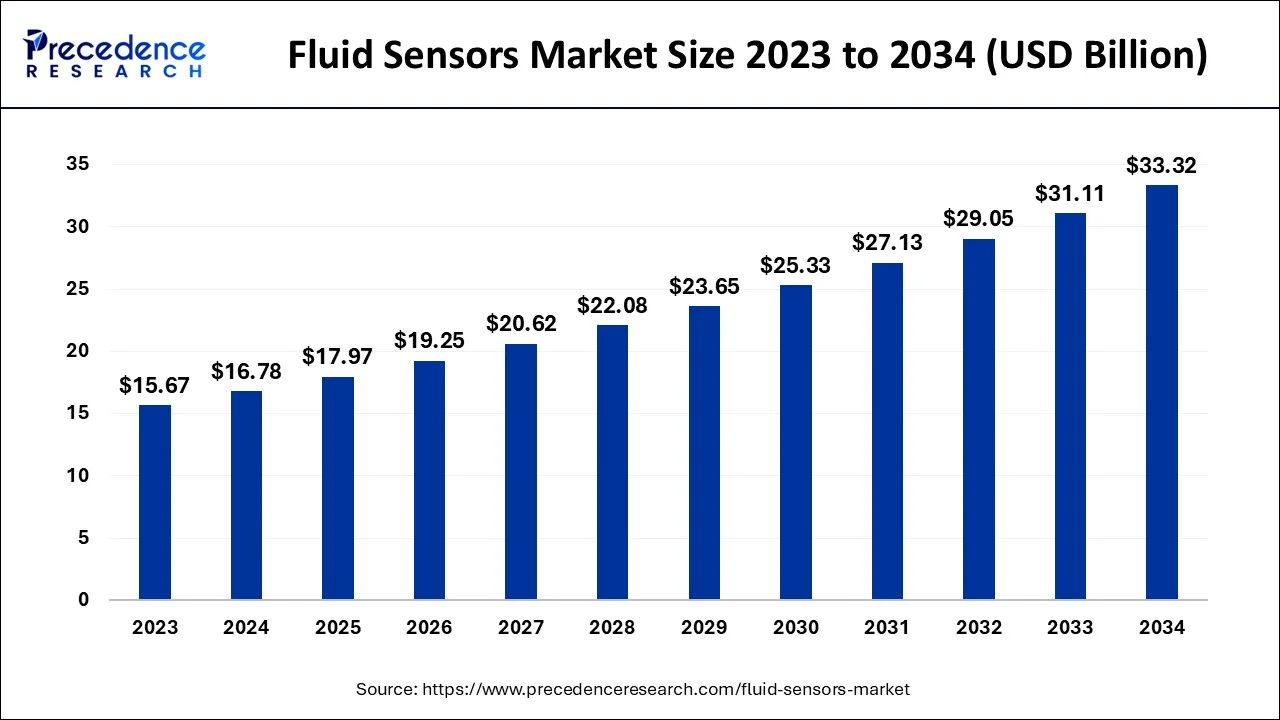

The global fluid sensors market size is calculated at USD 17.97 billion in 2025 and is predicted to increase from USD 19.25 billion in 2026 to approximately USD 35.43 billion by 2035, expanding at a CAGR of 7.02% from 2026 to 2035.

Fluid Sensors Market Key Takeaways

- By basis type, the flow sensor segment is projected to have the largest market share from 2026 to 2035.

- In 2023, By end user, the power & utility segment is expected to have the largest market share.

- In 2023, The Asia-Pacific has accounted highest revenue share.

Market Overview

Fluid sensors are electrical devices used in the oil and gas, petroleum, and automotive sectors to continually measure the flow rate of fluid into and out of pipelines. The need for fluid sensors is anticipated to expand significantly throughout the anticipated period of time due to rising demand in the oil and gas industry for a variety of applications, including tank level monitoring and oil quality testing. The demand for crude oil and natural gas has expanded as a result of greater mobility and industrialization. Due to the extreme and harsh conditions, there is a growing need for trustworthy and high-quality sensors in the oil and gas business. The industry is using pressure and temperature sensors more and more to control ambient conditions and oil composition. The rise of the fluid sensors market share will also be aided by the need for multi-level sensors for oil separation in oil drilling operations.

The market for fluid sensors has been negatively impacted by Covid-19. Automobile, oil and gas, chemical, food and beverage, power and utilities, and other companies and sectors that use fluid sensors in equipment saw a dip in growth during the pandemic period due to a drop in consumer demand. These elements are anticipated to have a detrimental effect on the market for fluid sensors. However, during the epidemic phase, businesses everywhere are feeling the necessity to manage their operations digitally. Implementing technologies like the industrial internet of things (IIOT) will allow for virtual production control and real-time monitoring of the manufacturing process for fluid sensor devices. These elements are anticipated to positively affect market expansion as well as the size of the fluid sensors market during the pandemic.

Fluid Sensors Market Growth Factors

Rapid industrialization and urbanization have made it more important than ever to use cutting-edge methods for fluid detection and analysis. These sensors make sure that all liquid-related activities and procedures take place without the need for human intervention.

- The growing end-user demand.

- Increasing demand for detection of liquid leakages.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.97 Billion |

| Market Size in 2026 | USD 19.25 Billion |

| Market Size by 2035 | USD 35.43 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.02% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

- The market for fluid sensors is anticipated to grow at a faster rate due to the increased focus on industrial automation - The growing importance of industrial automation is anticipated to support the expansion of the global market for fluid sensors. In fields like automotive, manufacturing, chemical, medical, oil & gas, and power generation, manual measurements of fluid parameters like temperature, fluid pressure, and humidity as well as fluid acceleration are no longer necessary due to advancements in measurement technologies like optical sensing, vibrating or tuning fork, ultrasonic sensors, capacitance sensing, and others. Moreover, the demand for high-performance automated solutions to ensure comfort and safety has increased as a result of the expansion of the automobile sector and the development in disposable incomes. Leading car companies like Audi and BMW are progressively putting sensors inside their vehicles. To prevent possible risks, sensors are utilized for temperature monitoring, water cooling, and fluid measuring in the braking system. Magnetic floats and liquid sensors with built-in cable connectors can be utilized to monitor low liquid levels or numerous fluid locations.

- Rising demand from oil & gas industry - The demand from the oil and gas sector for applications like tank level monitoring and oil quality evaluation will cause a rapid rise in the fluid sensors market. Demand for crude oil and natural gas has increased as a result of increased industrialization and mobility. There is a growing need for dependable and superior sensors because of the intense and challenging working conditions in the oil and gas sector. In order to manage the oil composition and environmental conditions, pressure and temperature sensors are being used more and more in the industry. They are used to keep an eye on pressure and vibration fluctuations that might harm machinery and pipes.

Key Market Challenges

- High cost - The high costs involved in the study, creation, and use of fluid sensor technology for the measurement of a variety of parameters, such as fluid pressure, temperature, level control, volume, and others, may provide a barrier to the market's growth.

Key Market Opportunities

- Increasing adoption - The industrial internet of things refers to connected devices. Devices like motors, sensors, wastewater transportation systems, and other gear may all work together owning to IoT software for industrial applications. One market development for fluid sensors is the industrial internet of things, which is expected to offer benefits including remote access to the device and fluid sensor control by experts from a distance. The system can foresee the need for sensor maintenance when there is a strong chance that the equipment will break down. These attributes are anticipated to improve operational effectiveness, mass customization, remote diagnostics, and other sectors. These components, it is predicted, would broaden the market's potential uses for fluid sensors.

- Technological developments in the fluid sensors market will facilitate the deployment of fluid sensors across several business verticals. With advancements in wireless transmission technologies, it is now possible to communicate more effectively across various devices and manage every aspect of the system at the granular level. Due to their ability to detect semi-solid objects and fluids without coming into contact with them, field effect sensors are special. Constant advancements in the semiconductor and electronics sectors have made it easier to create robust sensors that can withstand adverse conditions. The development of intelligent sensors that can adapt to their environment and deliver incredibly accurate readings will assist in the market expansion for fluid sensors.

Segment Insights

Type Insights

On the basis type, the flow sensor segment is expected to have the largest market share in the coming years period. Due to the increased emphasis on industrial automation, it is predicted that the flow sensor sub-segment would grow throughout the forecast period. As measurement technology has improved in industries including oil and gas, manufacturing, automotive, chemical, medical, and power generation, fewer people are using manual measuring techniques for fluid parameters like temperature, fluid pressure, humidity, and fluid acceleration. These factors are predicted to lead the flow sensor sub-segment to grow fastest.

End User Insights

On the basis of end-user, the power & utility segment is expected to have the largest market share in 2023. A rise in the number of powers producing facilities and a huge demand for energy in businesses due to the world's growing population have both contributed to the need for more electricity and are supporting the expansion of the power and utility sub-segment.

The use of fluid sensors in power production units like thermal and hydropower plants provides benefits like ensuring the lowest number of emissions is ensured by the flow sensor. For instance, sophisticated flow meters and varied installation options for flow measurement equipment assist monitor the rate of ammonia (NH3) gas coming from the chimneys. These elements are anticipated to support the sub-growth segments within the anticipated time frame.

Regional Insights

U.S. Fluid Sensors Market Size and Growth 2026 to 2035

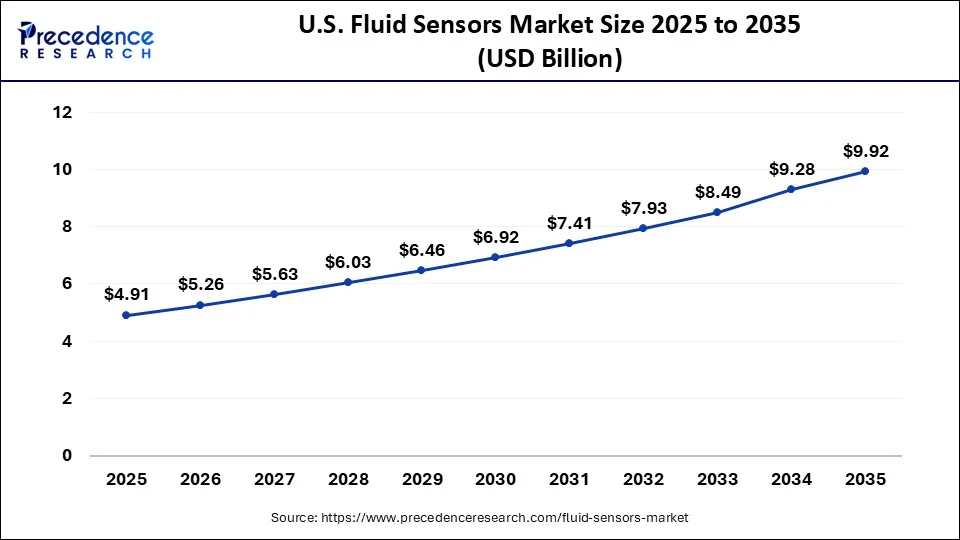

The U.S. fluid sensors market size is estimated at USD 4.91 billion in 2025 and is expected to be worth around USD 9.28 billion by 2035, rising at a CAGR of 7.29% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Fluid Sensors Market?

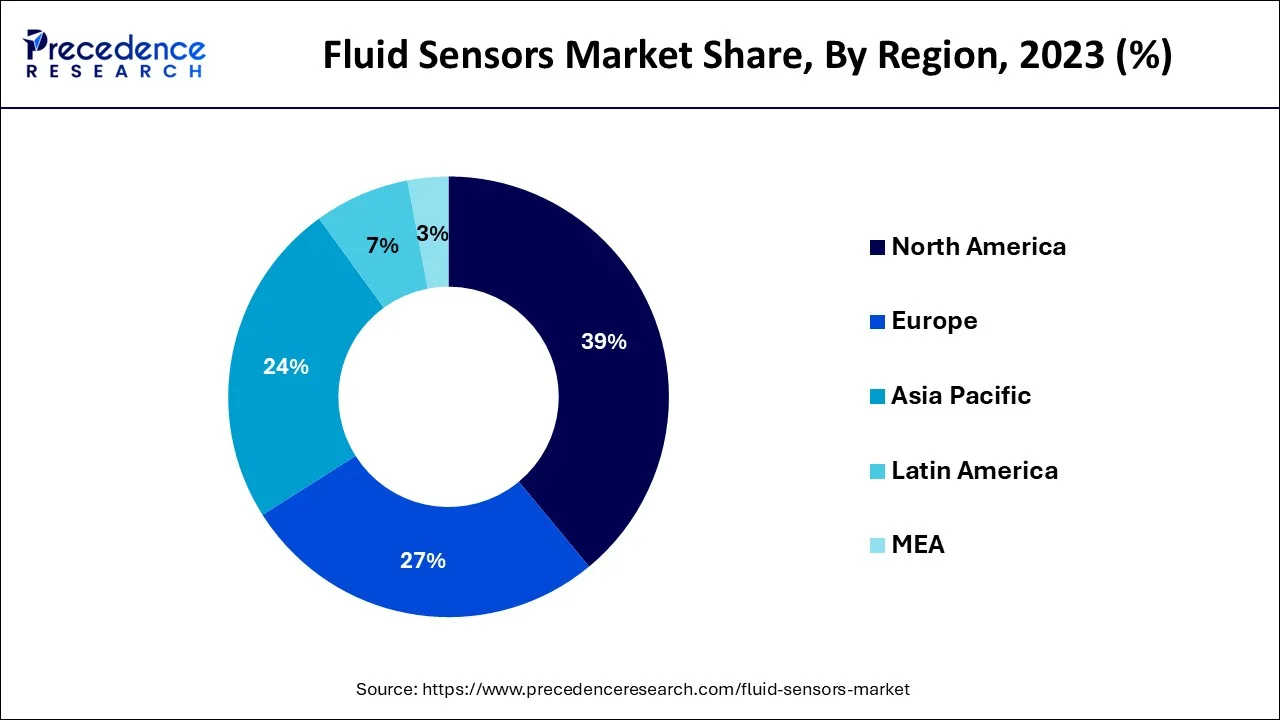

On the basis of geography, Asia-Pacific accounted highest revenue share in 2025. Since China, India, Japan, and South Korea are the primary production centers for industrial fluid sensors, the market is growing in the region as a result of the rising rate of industrial output in these developing and growing countries. A further factor contributing to the Asia-Pacific region's quick economic development is the high usage of fluid sensors in the oil and gas, water and wastewater, chemical, food and beverage, automotive, and other sectors. This high usage is what is fueling the fluid sensors market's expansion. The expansion of the fluid sensors market is anticipated to be fueled by the rising use of artificial intelligence in APAC nations. Government initiatives like the National Mission for Clean Ganga (NMCG) also place demands on the level and flow detection sensors, which is good for the market's expansion.

China is a major contributor to the Asia Pacific fluid sensors market due to its large-scale industrial and manufacturing base, which drives high demand for fluid monitoring and automation solutions. The country's strong focus on industrial automation, smart manufacturing, and technological innovation has accelerated the adoption of advanced sensor technologies across sectors such as automotive, chemical, and energy.

What Makes North America a Significant Region in the Market?

North America represents a technologically mature and well-developed market for fluid sensors. The regional market growth is driven by strong adoption across industrial automation, oil & gas, water and wastewater treatment, and healthcare equipment. The region benefits from early integration of Industry 4.0 technologies and IIoT-enabled sensing technologies, as well as stringent safety and environmental regulations. Demand is further supported by advanced manufacturing ecosystems, high levels of R&D investment, and widespread deployment of smart infrastructure and process-monitoring systems.

The U.S. leads the North American fluid sensors market because of its large industrial base, advanced oil and gas industry, and widespread automation in manufacturing and utilities. High demand comes from applications like flow measurement, pressure sensing, and level monitoring in energy, pharmaceuticals, and water management. Federal infrastructure upgrades, shale gas activities, and smart factory initiatives keep pushing sensor adoption forward.

What Makes Europe a Notably Growing Area in the Fluid Sensors Market?

Europe is expected to grow at a notable rate in the coming years, supported by strict environmental regulations, energy-efficiency mandates, and strong adoption of industrial automation. The region emphasizes precision sensing in chemical processing, automotive manufacturing, water treatment, and renewable energy systems. EU policies promoting sustainable manufacturing and digitalization, combined with the presence of leading sensor manufacturers, are driving steady demand for advanced, high-accuracy fluid sensing solutions.

Germany is a major player in the European fluid sensors market, underpinned by its advanced engineering capabilities and leadership in industrial automation. Fluid sensors are widely used across automotive production, chemical processing, and factory automation. The country's strong focus on Industry 4.0, smart factories, and process optimization supports demand for intelligent, connected fluid sensors with high precision and reliability.

Fluid Sensors Market - Value Chain Analysis

- Sensor Design & Manufacturing

Fluid sensors are developed through processes including sensing element fabrication, MEMS manufacturing, electronic circuit integration, calibration, enclosure assembly, and signal-processing optimization. These sensors include flow, level, pressure, and quality sensors used for liquids and gases.

Key Players: Siemens AG, Emerson Electric Co., Honeywell International Inc., ABB Ltd. - Quality Testing & Certification

Fluid sensors require certifications for measurement accuracy, durability, electrical safety, electromagnetic compatibility, and industry-specific compliance. Key certifications include ISO quality standards, IEC safety certifications, ATEX for hazardous environments, and UL product safety approvals.

Key Players: ISO (International Organization for Standardization), IEC (International Electrotechnical Commission), - UL Solutions, TUV SUD.

Distribution to End-Use Industries

Fluid sensors are distributed to industries such as oil & gas, water and wastewater treatment, chemical processing, pharmaceuticals, food & beverage, HVAC, and industrial automation.

Key Players: Endress+Hauser, Yokogawa Electric Corporation, Schneider Electric.

Fluid Sensors Market Companies

- Schneider Electric

- Robert Bosch GmbH

- Emersion Electric Company

- Texas Instruments

- ABB

- SICK AG

- NXP Semiconductors

- Siemens

- Rockwell Automation

- Honeywell

Recent Developments

- In September 2022 –Digi-Key and Schneider Electric sign a distribution agreement. The new relationship will expand Digi-(Thief Key's River Falls, Minnesota) present range of electronic components and automation products by allowing it to sell a variety of Schneider Electric's power, automation, control, and sensor solutions.

Segments Covered in the Report

By Type

- Flow Sensor

- Level Sensor

By Technology

- Non-contact Sensor

- Contact Sensor

By End User

- Automotive

- Water & Wastewater

- Oil & Gas

- Chemical

- Food & Beverage

- Power & Utilities

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting