Fusion Energy Market Size and Forecast 2025 to 2034

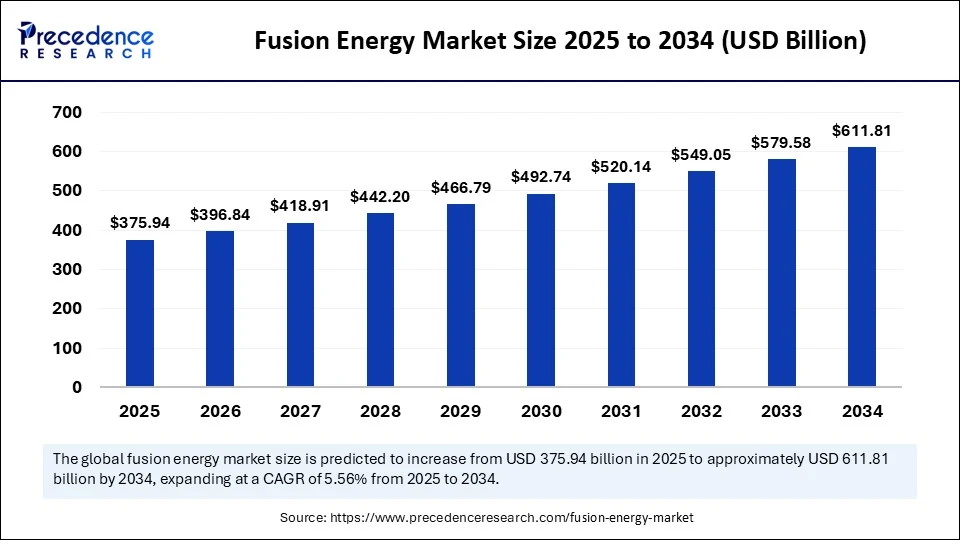

The global fusion energy market size accounted for USD 356.14 billion in 2024 and is predicted to increase from USD 375.94 billion in 2025 to approximately USD 611.81 billion by 2034, expanding at a CAGR of 5.56% from 2025 to 2034. The market growth is attributed to rising technological advancements, strategic public-private investments, and increasing global momentum toward clean, secure, and scalable energy alternatives.

Fusion Energy MarketKey Takeaways

- In terms of revenue, the global fusion energy market was valued at USD 356.14 billion in 2024.

- It is projected to reach USD 611.81 billion by 2034.

- The market is expected to grow at a CAGR of 5.56% from 2025 to 2034.

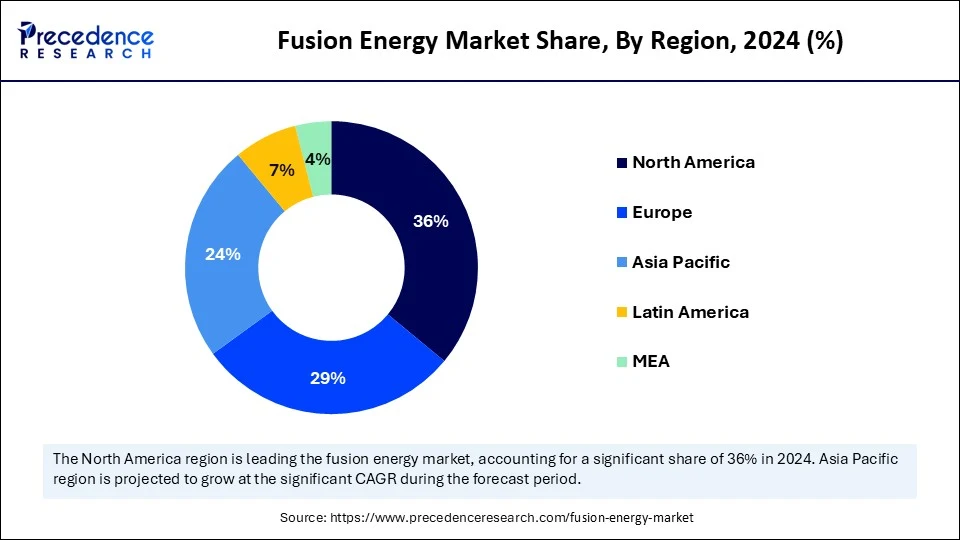

- North America dominated the fusion energy market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By technology, the magnetic confinement fusion segment held a major market share in 2024.

- By technology, the inertial confinement fusion segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By application, the power generation segment contributed the biggest market share in 2024.

- By application, the space propulsion segment is expanding at a significant CAGR between 2025 and 2034.

- By fuel type, the deuterium-tritium segment held the significant share in 2024.

- By fuel type, the deuterium-deuterium segment is expected to grow at a significant CAGR over the projected period.

- By investment type, the public sector investments segment accounted for highest market share in 2024.

- By system type, pilot plants segment generated the major market share in 2024.

- By system type, commercial reactors segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Fusion Energy Market

Artificial intelligence (AI) is transforming the fusion energy market by boosting the performance of reactors, accelerating research, and cutting development costs. Scientists can use AI to accurately predict plasma behavior, enabling real-time adjustments that stabilize fusion reactions and prevent energy loss. AI assists in designing more efficient and stable reactor configurations by simulating and optimizing complex systems. AI also minimizes downtime by predicting equipment failures and suggesting design improvements, leading to the development of next-generation reactors.

U.S. Fusion Energy Market Size and Growth 2025 to 2034

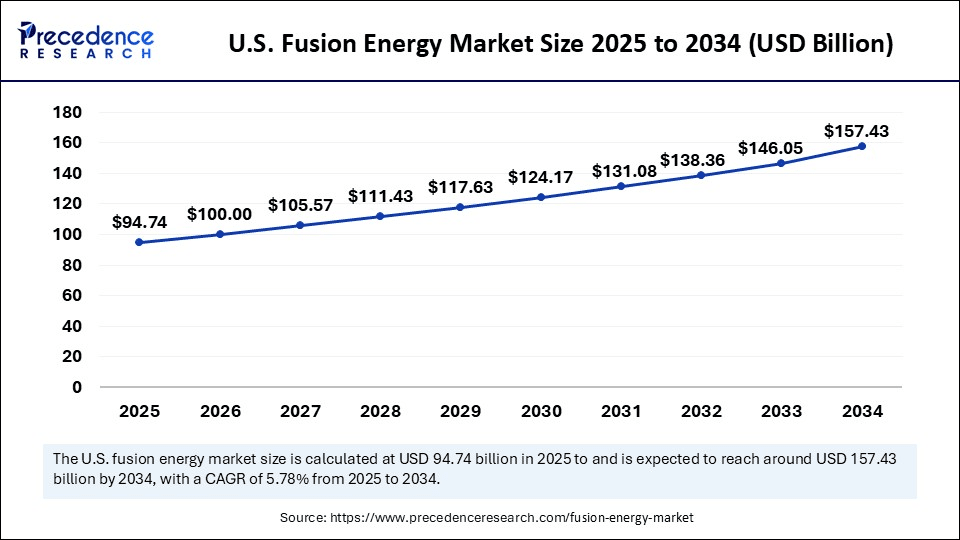

The U.S. fusion energy market size was exhibited at USD 89.75 billion in 2024 and is projected to be worth around USD 157.43 billion by 2034, growing at a CAGR of 5.78% from 2025 to 2034.

What Made North America the Dominant Region in thr Fusion Energy Market in 2024?

North America registered dominance in the market by capturing the largest revenue share in 2024 due to a combination of public-private partnerships, innovative science, and a well-developed high-tech energy innovation ecosystem. The Fusion Energy Sciences (FES) program within the U.S. Department of Energy (DOE) sustained significant investments in reactor design research, fuel cycle research, and plasma control technologies. Developments at national laboratories such as the Lawrence Livermore National Laboratory (LLNL) and the Princeton Plasma Physics Laboratory (PPPL) in magnetic and inertial confinement systems were particularly important.

In late 2023 and continuing on into 2024, a U.S. technical breakthrough event was the achievement of scientific energy breakeven at the LLNL National Ignition Facility (NIF), a world-first, reaffirming North America's technical leadership in inertial confinement fusion. Furthermore, the region is a long-term leader in commercial fusion deployment, particularly through the incorporation of commercially viable AI control systems, further driving market growth in this region.

(Source:https://lasers.llnl.gov)

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by substantial government funding, rapid technological advancements, and a strong focus on energy independence. In 2024, China advanced its EAST project, achieving sustained plasma pulses exceeding 100 million degrees Celsius for 403 seconds, reinforcing its national goal to develop a commercial fusion reactor by 2045.

Japan's National Institute of Fusion Science (NIFS) expanded its work with stellarator-based systems, while South Korea's KSTAR reactor set new confinement duration records. The IAEA estimated in 2024 that Asia was responsible for over 40% of new experimental fusion infrastructure development globally. The China Institute of Plasma Physics, Chinese Academy of Sciences (ASIPP), became a leading contributor to ITER components, and South Korea's National Fusion Research Institute (NFRI) planned the construction of the K-DEMO reactor in the 2030s. Furthermore, strong policy support aimed at achieving long-term energy independence and low-carbon economic development is expected to fuel market growth in the coming years.

(Source: https://currentaffairs.chinmayaias.com)

(Source: https://world-nuclear.org)

European Fusion Energy Market Trends

Europe is expected to grow at a notable rate during the forecast period, supported by a strong institutional network, pan-European collaboration, and leadership in innovative research. The ITER Organization in Saint-Paul-lès-Durance, France, remains the largest and most advanced fusion energy collaboration globally, uniting technical efforts in plasma physics, superconducting magnet systems, and tritium breeding technologies. Other countries, including Germany, the UK, and France, are advancing through organizations like the Max Planck Institute for Plasma Physics (IPP), CCFE, and CEA, which are focused on next-generation confinement systems such as tokamaks and stellarators. Additionally, European partnerships with Asian and North American counterparts have fostered robust scientific collaboration.

Market Overview

The fusion energy market is experiencing rapid growth, driven by the increasing global demand for carbon-free and sustainable energy solutions. This technology simulates the sun's process, fusing hydrogen isotopes like deuterium and tritium under high pressure and temperature to release substantial amounts of green energy. In 2024, the International Atomic Energy Agency (IAEA) noted that over 50 countries were actively engaged in fusion research or deployment efforts, reflecting rising international interest. The U.S. Department of Energy (DOE) announced increased funding for its Fusion Energy Sciences (FES) program, aiming to expedite developments in pilot plants within the public and private sectors, with the goal of integrating them into the grid by the 2030s. Furthermore, ongoing investments and resource scaling by governments and scientific agencies, is anticipated to further drive market growth in the coming years.

(Source: https://www.iaea.org)

(Source: https://www.asme.org)

Fusion Energy MarketGrowth Factors

- Growing Advancements in Plasma Diagnostics: Improved real-time monitoring tools are boosting reactor control accuracy and overall system efficiency.

- Boost in Supercomputing and AI Integration: Next-gen AI models and exascale computing are driving advanced fusion simulations and predictive plasma behavior analysis.

- Propelling Role of Academic-Industry Collaborations: Joint ventures between universities and private firms are accelerating fusion prototype development and technology transfer.

- Expanding National Fusion Strategies: Countries are driving growth through formal fusion roadmaps, funding commitments, and regulatory readiness initiatives.

- Surging Focus on Non-Electric Applications: Fusion's potential beyond electricity, such as hydrogen production and desalination is fuelling diversified R&D pipelines.

- Growing Momentum in Compact Reactor Designs: Innovation in small-scale fusion reactors is boosting commercial viability for decentralized and mobile energy applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 611.81 Billion |

| Market Size in 2025 | USD 375.94 Billion |

| Market Size in 2024 | USD 356.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Outlook, Application Outlook, Fuel Type Outlook, System Type Outlook, Investment Type Outlook and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Rising Global Demand for Clean Energy Driving Growth in the Fusion Energy Market?

Increasing global demand for clean and sustainable energy is projected to drive the market growth in the coming years. The anticipated increase in global demand for clean and sustainable energy is expected to drive the development of fusion technology. Countries are seeking alternatives to fossil fuels that offer minimal environmental pollution, durability, and stable production. Nuclear fusion, which mimics the sun's power on Earth, provides carbon-free emissions and abundant fuel sources like deuterium and tritium isotopes. This demand has prompted governments and stakeholders to invest in pilot plants, reactor prototypes, and supporting infrastructure.

The push to achieve the net-zero goals of the Paris Agreement is accelerating the adoption of new technologies and investment strategies. The International Energy Agency (IEA) reported that over 130 nations have committed to net-zero emissions by 2050, creating immediate pressure to expand fusion research. In 2024, the ITER Organization achieved a major construction milestone, completing nearly 80% of its Tokamak complex, demonstrating the global effort to commercialize fusion energy. Moreover, the strong interest in energy independence and national security is expected to increase government involvement in domestic fusion programs.

(Source: https://www.iea.org)

Restraint

Limited Availability of Specialized Materials Impedes Fusion Reactor Development

Limited availability of specialized materials is anticipated to hinder the growth of the market. Reactor development faces bottlenecks due to limited access to specialized materials. Key materials like tritium breeding materials, neutron-resistant alloys, and high-temperature superconductors are scarce, making large-scale production challenging. The handling of tritium, a radioactive isotope crucial for most fusion designs, presents regulatory and technical hurdles. These restrictions delay prototype testing and sustained operation of pilot fusion reactors, affecting market growth.

Opportunity

Why is Growing Public and Private Investment Accelerating the Fusion Energy Market's Commercialization?

Growing public and private investment in fusion research is anticipated to create immense opportunities for players competing in the market. Startup and partnerships involving fusion technology have been funded heavily in the last ten years by venture capital firms, major oil players, and state funds. Governments of the U.S., the UK, China, and the EU have initiated billion-dollar programs by backing institutions such as ITER, PPPL, and General Fusion. Such investments aid in the development of new reactor concepts and designs, advanced plasma control systems powered by artificial intelligence, and resistant materials. Direct federal-industry collaboration led to the U.S. Department of Energy (DOE) later broadening its Milestone-Based Fusion Development Program through the 2024 selection of eight privately owned companies to develop fusion pilot plants by the early 2030s. Furthermore, as nations are seeking to de-risk scale-up of fusion through collation of funding and resources, the market is set to grow in the coming years.

(Source: https://www.ans.org)

Technology Insights

Why Did the Magnetic Confinement Fusion Segment Dominate the Fusion Energy Market in 2024?

The magnetic confinement fusion segment dominated the market with a major share in 2024. This is mainly due to a broad and well-established technological foundation across various countries supported the development and implementation of MCF systems. The use of Tokamaks, a specific type of MCF device, particularly in projects like ITER, which benefited from substantial government funding and international scientific collaboration, helped in the advancement of this technology. The use of powerful, superconducting magnets and sophisticated plasma shaping techniques had enhanced energy retention. Consequently, MCF became the primary focus of fusion efforts, both public and private. Moreover, the proliferation of magnetic confinement technology in major current fusion experiments worldwide further supports this segment's growth.

The inertial confinement fusion segment is expected to grow at the fastest rate in the coming years, driven by advancements in laser systems, target design, and energy deposition techniques. In late 2023, the National Ignition Facility (NIF) at LLNL in the U.S. achieved scientific energy gain, which was further being transferred experimentally in 2024 to achieve the results. This breakthrough has renewed interest in ICF as a viable path to commercial fusion energy, particularly for defense and high-density energy applications.

In 2024, the U.S. Department of Energy (DOE) expanded laser fusion programs, integrating ICF goals into its long-term energy innovation strategy. Increased investor interest in laser-based systems globally led to new partnerships among research agencies in the U.S., UK, and Japan. Additionally, Chinese scientists at the Institute of Plasma Physics (ASIPP) began exploring hybrid ICF-MCF strategies, combining magnetic fields with high-power lasers for compression and extended confinement.

(Source: https://lasers.llnl.gov)

(Source: https://www.focused-energy.co)

Application Insights

What Made Power Generation the Dominant Application of Fusion Energy in 2024?

The power generation segment dominated the fusion energy market with the largest revenue share in 2024. This is mainly due to the long-term investment in reactor-scale demonstration ventures and interventions in electricity system decarbonization internationally. Funding programs and government-backed projects, such as the ITER project in France, the STEP program in the UK, and the Fusion Energy Sciences (FES) program in the United States, are focusing substantial resources on constructing fusion reactors designed to produce grid-scale power. Furthermore, the increasing demand for dependable baseload sources of energy that do not produce carbon emissions or long-lived radioactive wastes is further enhancing the dominance of this segment in the market.

The space propulsion segment is expected to grow at a significant CAGR in the upcoming period, driven by technological developments and the growing interest in the exploration of the deep space. Space agencies and private aerospace firms are exploring fusion-based propulsion systems, which offer abnormally high thrust-to-weight ratios and significantly reduce travel times between planets. These systems are poised to revolutionize mission programming. In 2024, NASA's Innovative Advanced Concepts (NIAC) program funded preliminary research on compact fusion engines, aiming to power human missions to Mars and beyond.

Other research centers, including MIT's Plasma Science and Fusion Center (PSFC) and Japan's National Institute for Fusion Science (NIFS), are investigating fusion-propelled systems, such as direct fusion drives and inertial fusion thrusters. In 2024, the IAEA reported a surge of strategic interest in fusion technology for space propulsion, spanning both civilian space programs and national defense institutions. Moreover, the superior efficiency of fusion propulsion systems, often exceeding that of chemical rockets on long-duration missions, is further driving demand for fusion energy solutions.

(Source: https://www.nasa.gov/directorates)

(Source: https://www.iaea.org)

Fuel Type Insights

How Does the Deuterium-Tritium Fuel Segment Secure its Position in the Fusion Energy Market in 2024?

The deuterium-tritium (D-T) segment dominated the market in 2024, owing to its lower ignition temperature and higher energy yield during reactions. This fuel configuration is favored by research institutions and demonstration facilities because it requires less complex conditions to initiate and sustain fusion reactions compared to other combinations. Additionally, strong international collaboration on tritium handling, storage, and recycling technologies is expected to ensure long-term growth of this segment.

The deuterium-deuterium (D-D) fuel segment is expected to grow at the highest CAGR during the forecast period. The growth of the segment is driven by its readily available supply and reduced reliance on radioactive isotopes. Deuterium, naturally abundant in seawater, offers a secure, long-term fuel source without the regulatory complexities associated with tritium. This makes it attractive for broader deployment, aligning with national preferences. Furthermore, ongoing advancements are positioning D-D as a strong secondary option, particularly for future fusion concepts focused on sustainability and abundant fuel sources.

Investment Type Insights

Why Did Public Sector Investments Take the Lead in the Fusion Energy Market in 2024?

The public sector investments segment dominated the market with the biggest share in 2024. Governments worldwide have recognized the potential of fusion energy, leading to substantial, long-term investments in the field. Major projects like the ITER project in France, supported by the EU, U.S., China, Japan, India, Russia, and South Korea, have consumed a significant portion of global public funding to advance scalable fusion power.

In 2024, the International Atomic Energy Agency (IAEA) estimated that over 65% of fusion investment came from public sources, reflecting strong policy support for decarbonization and energy security. The U.S. Department of Energy (DOE) through its Fusion Energy Sciences (FES) program, the UK Atomic Energy Authority (UKAEA), and Euratom have incorporated integrated multi-year budget plans for fusion pilot plants and tritium breeding research. Moreover, the implementation of long-term national energy policies by countries worldwide is anticipated to drive further growth in this segment.

(Source:https://www.iaea.org)

The private sector investments segment is expected to grow at a significant rate in the coming years, fueled by rising interest in fusion viability, technological advancements, and increased venture capital involvement. In 2024, prominent startups such as Commonwealth Fusion Systems (CFS), TAE Technologies, and Helion Energy announced major breakthroughs in both magnetic and inertial confinement, attracting substantial investments. The International Energy Agency (IEA) reported record levels of private sector investment in fusion in 2024, driven by improvements in high-temperature superconductors, AI-driven plasma control, and compact reactor designs. The growing number of new private sector investments focused on fusion energy technology is also contributing to market expansion.Commonwealth Fusion Systems (CFS) initiated testing of its SPARC reactor, announcing in December 2024 that it had set a world record for magnetic field strength in a compact tokamak.

(Source: https://www.iea.org)

(Source: https://cfs.energy)

System Type Insights

Why Did the Pilot Plants Segment Dominate the Fusion Energy Market in 2024?

The pilot plants segment dominated the fusion energy market in 2024, driven by increased emphasis on prototype testing, systems validation, and data collection to support scaling toward commercialization. New national initiatives from the U.S. Department of Energy and the EUROfusion alliance in Europe acknowledged pilot-scale plants as crucial steps toward commercialization. Additionally, facilities such as PPPL, LLNL, and IPP provided pilot-scale environments for testing advanced diagnostics and materials in intense neutron environments, thereby further boosting the segment.

(Source: https://www.iaea.org)

The commercial reactors segment is expected to grow at a significant CAGR in the future years, owing to the focus on scalable, grid-connected fusion systems that produce baseload energy. Government agencies, including the U.S. DOE and IEA, noted that international regulatory and financing frameworks are evolving to accelerate the fusion pilot-to-commercial rollout. The IEA Fusion Review 2024 highlighted that over 20 commercial-scale concepts were actively under development globally, with several aiming to be operational by the early 2030s. The Euratom program for developing a European demonstration fusion power reactor (DEMO) advanced toward engineering design review. The growing business interest in constructing next-generation systems, along with collaborations with local manufacturers, is expected to drive segmental growth in the coming years.

(Source: https://www.iaea.org)

Fusion Energy Market Companies

- Commonwealth Fusion Systems

- European Organization for Nuclear Research

- First Light Fusion

- General Fusion

- Helion Energy

- ITER Organization

- Korea Superconducting Tokamak Advanced Research

- Lawrence Livermore National Laboratory

- MAX IV Laboratory

- National Renewable Energy Laboratory

- Princeton Plasma Physics Laboratory

- Russian Federal Nuclear Center

- Tokamak Energy

- United States Department of Energy

Recent Developments

- In February 2025, Helion Energy began building the world's first commercial fusion power plant, aiming to deliver zero-emission energy by replicating the sun's hydrogen fusion process—backed by major private-sector momentum.

(Source: https://energy-oil-gas.com)

- In November 2024, Japan launched the FAST (Fusion by Advanced Superconducting Tokamak) project to achieve fusion-based power by the 2030s, with international partners from the UK, USA, and Canada supporting D-T plasma and tokamak development.

(Source: https://www.world-nuclear-news.org)

- In April 2025, The UK government committed £20 million to launch Starmaker One, a private fusion fund targeting £100–150 million to help fusion startups scale, managed by East X Ventures.

(Source: https://www.world-nuclear-news.org)

Latest Announcement by Industry Leader

- In June 2025, Proxima Fusion, recognized as Europe's fastest-growing fusion energy company, has announced the successful closure of its €130 million (\$150 million) Series A financing round — marking the largest private fusion investment ever recorded in Europe. Francesco Sciortino, CEO and Co-founder of Proxima Fusion, stated: "Fusion has become a real, strategic opportunity to shift global energy dependence from natural resources to technological leadership. Proxima is perfectly positioned to harness that momentum by uniting a spectacular engineering and manufacturing team with world-leading research institutions, accelerating the path toward bringing the first European fusion power plant online in the next decade."

(Source: https://www.proximafusion.com)

Segments Covered in the Report

By Technology Outlook

- Inertial Confinement Fusion

- Magnetic Confinement Fusion

- Spheromaks

- Stellarators

By Application Outlook

- Industrial Applications

- Power Generation

- Research and Development

- Space Propulsion

By Fuel Type Outlook

- Proton-Boron

- Deuterium-Tritium

- Deuterium-Deuterium

By System Type Outlook

- Pilot Plants

- Experimental Reactors

- Commercial Reactors

By Investment Type Outlook

- International Collaborations

- Private Sector Investments

- Public Sector Investments

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting