What is the GaN-powered Chargers Market Size?

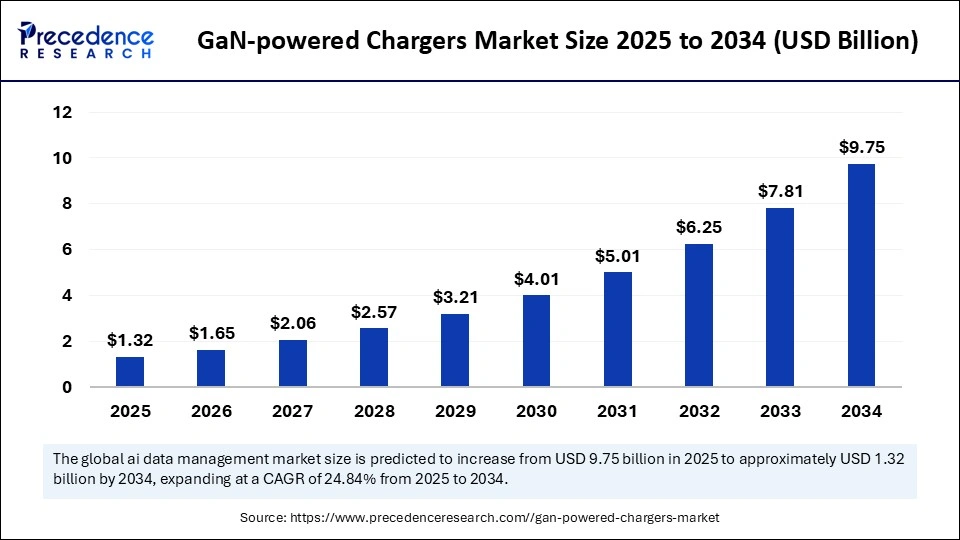

The global GaN-powered chargers market size was calculated at USD 1.06 billion in 2024 and is predicted to increase from USD 1.32 billion in 2025 to approximately USD 9.75 billion by 2034, expanding at a CAGR of 24.84% from 2025 to 2034. The market is growing due to rising demand for compact energy-efficient charging solutions across consumer electronics and electric vehicles.

Market Highlights

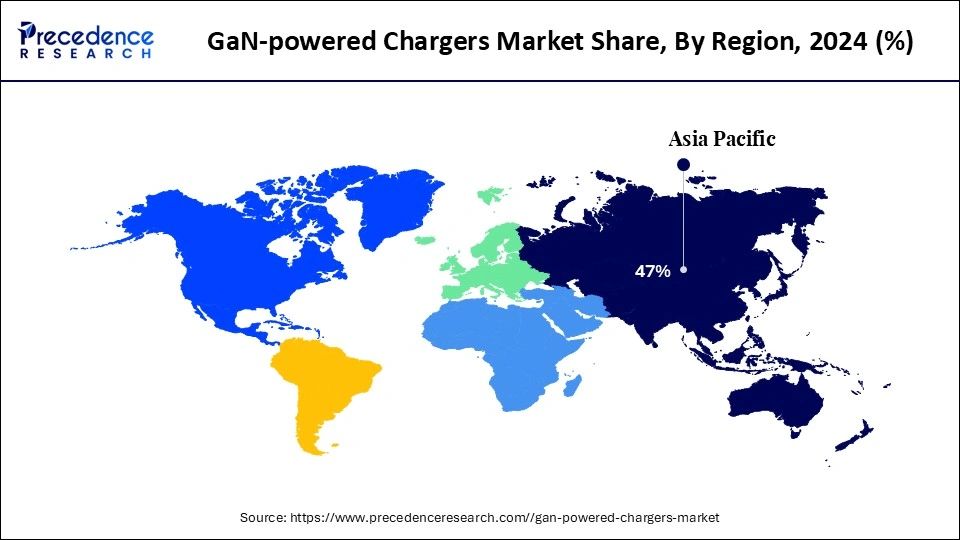

- Asia Pacific dominated the GaN-powered chargers market with the largest market share of 47% in 2024.

- North America is expected to grow at a notable CAGR during the forecast period.

- By power output, the 30W-65W chargers segment held the biggest market share of 43% in 2024.

- By power output, the 65W-100W segment is expected to grow at the fastest CAGR during the forecast period.

- By product type, the wall chargers segment captured the highest market share of 47% in 2024.

- By product type, the multi-port chargers segment is expected to grow at the fastest CAGR during the forecast period.

- By device compatibility, the smartphones segment is expected to grow at the fastest CAGR during the forecast period.

- By device compatibility, the tablets & laptops segment contributed the highest market share in 2024.

- By distribution channel, the online segment accounted for the significant market share 58% in 2024.

- By distribution channel, the offline segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the residential/consumer segment generated the major market share of 70% in 2024.

- By end user, the commercial segment is expected to grow at the fastest rate during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 1.06 Billion

- Market Size in 2025: USD 1.32 Billion

- Forecasted Market Size by 2034: USD 9.75 Billion

- CAGR (2025-2034): 24.84%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

What Encompasses the GaN-powered Chargers Market?

The GaN-powered chargers market is experiencing rapid growth as businesses and consumers shift toward faster, more compact, and energy-efficient charging options. In addition to lowering heat loss, gallium nitride (GaN) technology allows chargers to deliver higher power in smaller designs, which makes them perfect for wearable technology, laptops, tablets, smartphones, and even electric cars. Demand is being driven by the growing use of AI-enabled devices, the need for more sustainable products, and the growing power requirements of consumer electronics. GaN devices are becoming commonplace in both personal devices and industrial applications, which bodes well for the market.

- In February 2025, Navitas Semiconductor announced its GaNFast and GeneSiC technologies are powering Dell's latest family of notebook adapters ranging from 60W to 360W, delivering faster charging in a more compact and eco-friendly form.(Source: https://www.globenewswire..com)

What Is the Impact of AI-Driven Device Adoption on the GaN-Powered Chargers Market?

AI-driven device adoption is significantly enhancing demand in the GaN-powered chargers market because gadgets are becoming more power-hungry and always on (like AI notebooks, edge devices, or smart equipment with continuous learning/interference). Consumers and manufacturers are seeking chargers that offer high wattage, fast charging, compact size, and high efficiency, all of which are advantages of GaN technology. GaN makes it possible for smaller, lighter adapters with reduced heat loss, which is ideal for AI-enabled laptops, notebooks, and other devices that need to be portable and perform well.

- In September 2024, DeperAI launched India's first UFCS-compatible fast chargers using GaN III technology (20W, 25W, 65W Pro), targeting both iOS and Android device users with efficient fast charging adapters.(Source: https://www.gizmochina.com)

GaN-powered Chargers MarketGrowth Factors

- Rising consumer electronics demand: With smartphones, laptops, and wearables needing faster charging, GaN chargers are preferred for their compact and efficient design.

- Shift to USB-C and Power Delivery: Standardization around USB-C/PD is boosting demand for universal, high-wattage GaN chargers.

- Faster charging needs: Users expect quick charging without overheating, and GaN handles higher power with less heat loss.

- Compact size & portability: GaN enables smaller, lighter chargers, ideal for travel and multi-device charging.

- Energy efficiency & sustainability: GaN chargers reduce energy waste and heat, aligning with eco-friendly regulations and consumer awareness.

- Multi-device support: Growing need for multi-port chargers to power phones, tablets, and laptops together drives adoption.

- Expansion into Electric vehicle & industrial use: Beyond personal devices, GaN is gaining traction in EV charging and industrial power systems.

- Technological improvements: Advances in GaN chip design and cost reductions are making them more affordable and mainstream.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.06 Billion |

| Market Size in 2025 | USD 1.32 Billion |

| Market Size by 2034 | USD 9.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.84% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Power Output, Product Type, Device Compatibility, Distribution Channel, End-User, Material Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Fast-Charging Consumer Electronics

GaN-based chargers are becoming more popular than silicon-based ones due to the increasing use of wearable laptops, tablets, smartphones, and other devices that need fast and high-power charging. Premium consumer electronics are perfect for GaN chargers because they can handle higher voltages and provide faster charging speeds in a much smaller package. GaN has emerged as the go-to technology since customers demand portable devices with small footprints and high performance without compromising.

- In July 2025, Xiaomi announced its next-generation 90W ultra-compact GaN charger using Navitas GaNSense Control ICs, designed to provide ultra-fast charging for AI-powered and high-performance devices.(Source: https://www.globenewswire.com)

Consumers of today favor chargers that are small, light, and convenient to carry in pockets or purses. Higher power density and smaller form factors are made possible by GaN-based chargers, which satisfy this requirement. Businesses can attract professionals and tourists who value portability thanks to innovations like foldable plugs and incredibly thin designs.

- In July 2025, URBAN Smart Wearables introduced “Lumen,” India's slimmest 67W GaN charger, credit card-sized for portability, offering efficiency and fast charging at Rs 1,799.(Source: https://timesofindia.indiatimes.com)

Restraints

High Manufacturing Costs

GaN-based chargers are more expensive than conventional silicon chargers because they require sophisticated materials and specialized semiconductor processes to produce, which presents obstacles to growth in the GaN-powered chargers market. Large-scale adoption is restricted by this increased production cost, particularly in areas where prices are crucial. For new players entering the market, the additional R&D expenses raise the bar even more. Furthermore, smaller producers frequently find it difficult to compete with bigger names that have well-established supply chains. Due to this disparity in cost, market democratization is slowed down, and GaN adoption remains niche rather than widespread.

Limited Consumer Awareness

Despite their benefits, such as faster charging, compact size, and improved efficiency, GaN charge are still unfamiliar to many consumers, especially in emerging economies. Limited awareness slows down adoption, and educating consumers requires costly marketing efforts from manufacturers. This creates a gap between innovation and mainstream use. Consumers also tend to stick to bundled OEM hargers, reducing the incentive to explore advanced alternatives. Without aggressive branding and partnerships, GaN chargers may remain a niche product for tech-savvy buyers only.

- In February 2024, Bull launched a 65W GaN charger in China with UFCS support, but adoption outside tech-savvy buyers remains limited, highlighting the awareness gap for broader consumer markets.(Source: https://www.gizmochina.com)

Opportunities

Ultra-High Power Desktop Chargers for Power Users

Customers who require multiple high-wattage devices to be charged at the same time are increasing their demand, which is expected to drive growth in the coming years in GaN-powered chargers market. A monitors tablets and laptops. GaN enables small designs to efficiently manage heat while supporting high total output. These desktop chargers are ideal for gamers, creators, and multi-device professionals because they simplify cable clutter and combine power requirements.

- In June 2025, UGREEN launched the Nexode 500W 6-Port GaN Desktop fast Charger priced approx. $249.99 capable of powering up to six devices at once with safety features and high power output.(Source: https://www.prnewswire.com)

Compact Travel-Friendly Chargers with Display and Multiple Ports

Small, lightweight, and multipurpose chargers that are strong enough to charge several devices are what travelers desire. With GaN, manufacturers can fit more ports, more power, and extra features like digital displays for power voltage and current into smaller packages. This is useful for people who always have a phone, laptop, earbuds, etc with them. And the bulk of the adapter must be reduced.

- In September 2025, Baseus launched its PicoGo II Series, which includes compact GaN chargers (67W, 45W, 100W) with digital display versions, foldable plugs, andmultiple ports.

(Source: https://www.gizmochina.com)

Adoption of New Fast Charging and Wireless Charging Standards

New charging standards (wired and wireless) like Qi2, USB PD 3.1 UFCS (Universal Fast Charge Standard), etc., open doors for key players in the GaN-powered chargers market to integrate support, making their products more future-proof. Compliance with these standards makes the products more appealing globally, improving compatibility and consumer trust.

- In 2025, Belkin IFA 2025 introduced its BoostCharge Pro Dual USB-C GaN Wall Chargers (50W & 67W) and Qi2-certified UltraCharge magnetic wireless charger, aligning with newer wireless and fast-charging standards.(Source: https://www.fonearena.com)

Segmental Insights

Power Output Insights

Why Did the 30W-65W Segment Dominate the GaN-Powered Chargers Market in 2024?

The 30W-65W charger segments led the GaN-powered chargers market, as they are the most widely used across smartphones, tablets, and ultrabooks. Their popularity stems from the balance they offer between portability, efficiency, and cost, making them a preferred choice for everyday consumer electronics. These chargers are lightweight, easy to carry, and compatible with a variety of devices, which encourages repeat purchases and brand loyalty. Their widespread adoption also drives economies of scale, keeping prices relatively affordable and encouraging further market penetration.

65W-100W chargers are growing rapidly because more people are searching for multi-port fast charging solutions and using laptops and gaming devices. Their higher wattage accommodates devices that require a lot of power while keeping their designs small. Trends toward online learning and remote work, where users need dependable, quick charging for several devices at once, are also contributing to the growth. These chargers' sophisticated thermal management improves user safety and increases customer confidence.

Product Type Insights

Why Did Wall Chargers Dominate the GaN-Powered Chargers Market in 2024?

Wall chargers remain the most common form factor, often bundled with devices or used to replace OEM chargers. Their simplicity and compatibility with a wide range of devices make them the backbone of the GaN charger market. They are easy to use and require minimal setup, making them ideal for everyday consumers who prioritize convenience. Additionally, wall chargers are widely available through both online and offline channels, ensuring consistent demand across regions.

The multi-port chargers segment is growing rapidly in the GaN-powered chargers market due to the desire of consumers for unified charging solutions. The ability to charge multiple devices simultaneously with a single unit is becoming increasingly popular among users. Demand is accelerated by the rise in smart homes and the number of connected devices per household. These chargers provide effective power distribution for business setups, making them appealing to coworking and office spaces as well.

Device Compatibility Insights

Why Did the Smartphone Segment Dominate the GaN-Powered Chargers Market in 2024?

The smartphone segment dominated the GaN-powered chargers market because of its widespread use in high demand in both developed and emerging markets. The increasing use of smartphones in developing nations and frequent device upgrades serve to further support this market. Furthermore, major brands' smartphone-focused marketing campaigns increase consumer knowledge of and preference for GaN chargers.

The tablets & laptops segment is growing rapidly as users switch from silicon to GaN chargers. The requirement for higher wattage and universal USB-C PPD compliance is accelerating market adoption. Increased remote work, hybrid learning, and content production, all of which call for quick, dependable charging solutions, are driving the growth. High-end laptop models that come with GaN chargers are also promoting quicker uptake among tech-savvy customers.

Distribution Channel Insights

Why Did the Online Segment Dominate the GaN-Powered Chargers Market in 2024?

The online segment dominated the GaN-powered chargers market, backed by direct-to-consumer brands and online marketplaces such as Amazon and Alibaba. Online channels have become to go-to source for GaN chargers due to their convenience, increased product selection, and affordable prices. These platforms further aid consumer decision-making through product reviews, videos, and tutorials. E-commerce platforms, subscription services, and loyalty plans encourage recurring business in this market.

Offline channels are gaining traction through OEM partnerships. Companies such as Apple, Samsung, Dell, and Lenovo are increasingly bundling GaN chargers with devices, boosting adoption in physical retail and commercial stores. Brick and mortar stores also allow consumers to test products firsthand, enhancing trust in newer technologies like GaN. Retail expansion into tier 2 and tier 3 cities is increasing visibility and adoption rates.

End User Insights

Why Did the Residential/Consumer Segment Dominate the GaN-Powered Chargers Market in 2024?

The residential/consumer segment dominates the market, as GaN chargers are in constant demand due to the widespread use of smartphones, laptops, and other accessories in homes. GaN technology's efficiency and small size appeal to household consumers. Peer recommendations and social media influence also speed up adoption and awareness in this market.

The commercial segment is growing rapidly because they are quickly implementing docking and fast multi-port solutions. The growing dependence on high-performance devices in work settings is driving the growth. For numerous workstations, organizations are looking for dependable energy energy-efficient chargers. Multi-port GaN chargers are in high demand due to the growing popularity of hot desking and flexible office arrangements.

Material Technology Insights

Why Did the GaN-on-Silicon Segment Dominate the GaN-Powered Chargers Market in 2024?

GaN-on-silicon technology is the most common, offering a cost-effective solution with a mature supply chain. It supports a wide range of consumer devices at competitive prices. Manufacturers prefer this technology for its reliability, ease of integration, and scalability. Its performance meets most consumer needs while keeping the unit cost lower, helping brands target mass markets effectively.

GaN-on-SiC technology is expanding rapidly, offering higher efficiency at elevated voltages. It is particularly suited for high-wattage chargers and industrial-grade applications. GaN-on-SiC reduces heat dissipation challenges, making it ideal for multi-device, high-performance setups. Industrial and professional-grade devices are increasingly adopting this material for durability and performance consistency.

Regional Insights

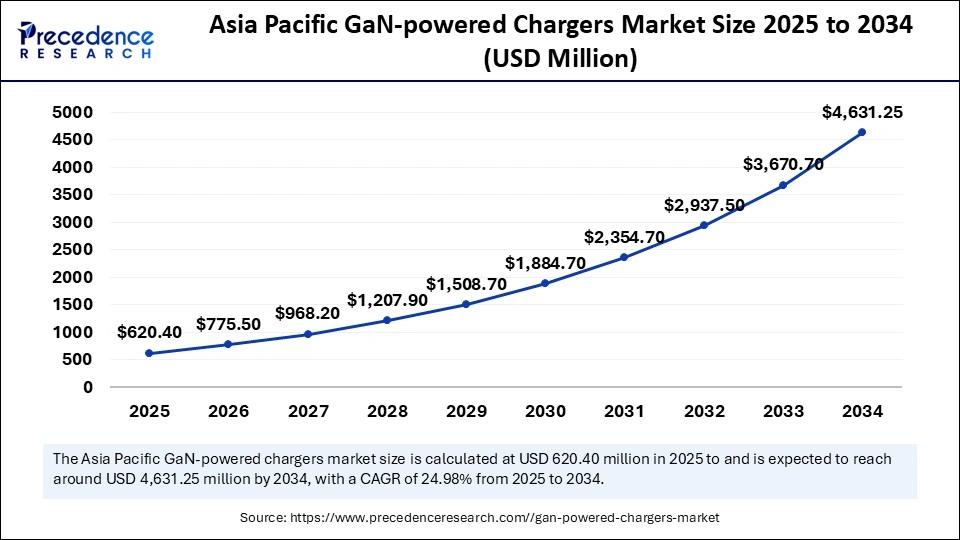

Asia Pacific GaN-powered Chargers Market Size and Growth 2025 to 2034

The Asia Pacific GaN-powered chargers market size was evaluated at USD 498.20 million in 2024 and is projected to be worth around USD 4.631.25 million by 2034, growing at a CAGR of 24.98% from 2025 to 2034.

Why Did Asia Pacific Dominate the GaN-Powered Chargers Market in 2024?

Asia Pacific led the GaN-powered chargers market, capturing the largest market share of 47% in 2024. The area benefits from established production and supply chains and is home to a significant number of GaN charger brands. The consistent use of GaN chargers is ensured by high consumer demand for laptops, smartphones, and accessories. Due to cost efficiencies brought about by the presence of large manufacturers, charges are now more reasonably priced and available to a wider range of consumers. Strong local distribution networks and alliances with OEMs also improve because of growing regional investments in R&D, solidifying its position as the industry leader worldwide.

North America is growing rapidly, fueled by the widespread use of fast-charging devices, high-end laptops, and collaborations with the expanding EV ecosystem. This region's tech-savvy consumers are receptive to using high-wattage high-performance chargers. Multi-port GaN charging stations are being installed in more corporate offices and coworking spaces, and online retail platforms are also hastening market penetration. Energy-efficient electronics are gaining popularity due to government initiatives and sustainability trends. There is a growing need for adaptable GaN charging solutions as smart homes and connected devices become increasingly prevalent.

GaN-powered Chargers Market Companies

- Anker Innovations Technology Co., Ltd.

- Belkin International, Inc.

- Xiaomi Corporation

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Huawei Technologies Co., Ltd.

- AUKEY Technology Co., Ltd.

- Baseus Technology

- Lenovo Group Ltd.

- Dell Technologies Inc.

- RAVPower (Sunvalley Group)

- Realme (BBK Electronics)

- Oppo Electronics Corp.

UGREEN Group Ltd. - Philips (Signify N.V.)

- Spigen Inc.

- Navitas Semiconductor Corporation

- GaN Systems Inc.

- Transphorm Inc.

- Innoscience Technology

Recent Developments

- In August 2025, Innergie launched the compact 100W C10 Duo GaN charger, designed to fast-charge two devices simultaneously with optimized power distribution. The charger features intelligent port allocation to prevent overloading, making it suitable for laptops and smartphones together.

(Source: https://www.forbes.com) - In October 2024, Google launched the 45W GaN Power Adapter (model G21JN), designed for efficient and fast charging of devices like laptops, tablets, and smartphones. The adapter offers enhanced energy efficiency and lower heat output compared to traditional chargers.

(Source: https://www.chargerlab.com)

Segments Covered in the Report

By Power Output

- Below 30W

- 30W–65W

- 65W–100W

- Above 100W

By Product Type

- Wall Chargers

- Multi-Port Chargers

- Car Chargers

- Wireless Chargers

- Docking Stations & Adapters

By Device Compatibility

- Smartphones

- Tablets & Laptops

- Wearables & Accessories

- Gaming Consoles & Devices

- Others (Cameras, IoT Devices)

By Distribution Channel

- Online (E-commerce, Direct-to-Consumer)

- Offline (Retail, Electronics Stores, OEM Partnerships)

By End-User

- Residential/Consumer

- Commercial (Offices, Co-working)

- Industrial/Professional Use

By Material Technology

- GaN-on-Silicon

- GaN-on-SiC (Silicon Carbide)

- Others (GaN-on-Sapphire)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting