Artificial Lights Market Size and Forecast 2025 to 2034

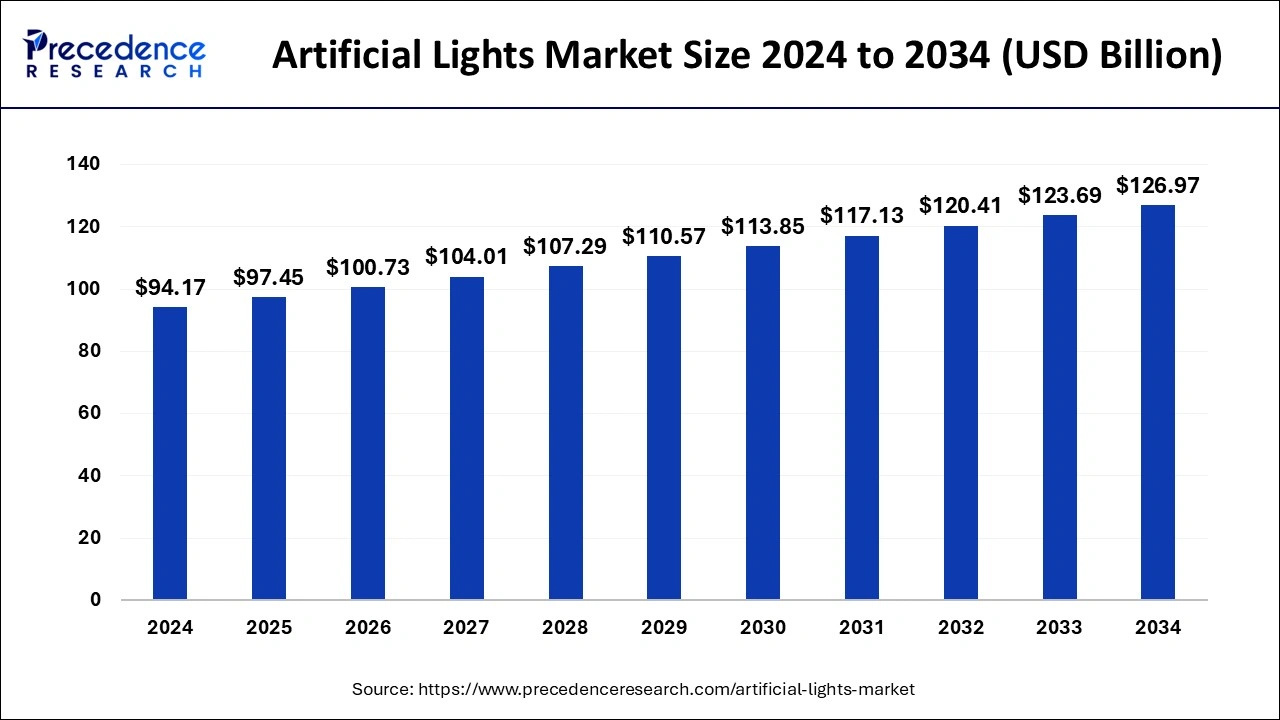

The global artificial lights market size was estimated at USD 94.17 billion in 2024 and is predicted to increase from USD 97.45 billion in 2025 to approximately USD 126.97 billion by 2034, expanding at a CAGR of 3.03% from 2025 to 2034.

Artificial Lights MarketKey Takeaways

- In terms of revenue, the global artificial lights market was valued at USD 94.17 billion in 2024.

- It is projected to reach USD 126.97billion by 2034.

- The market is expected to grow at a CAGR of 3.03% from 2025 to 2034.

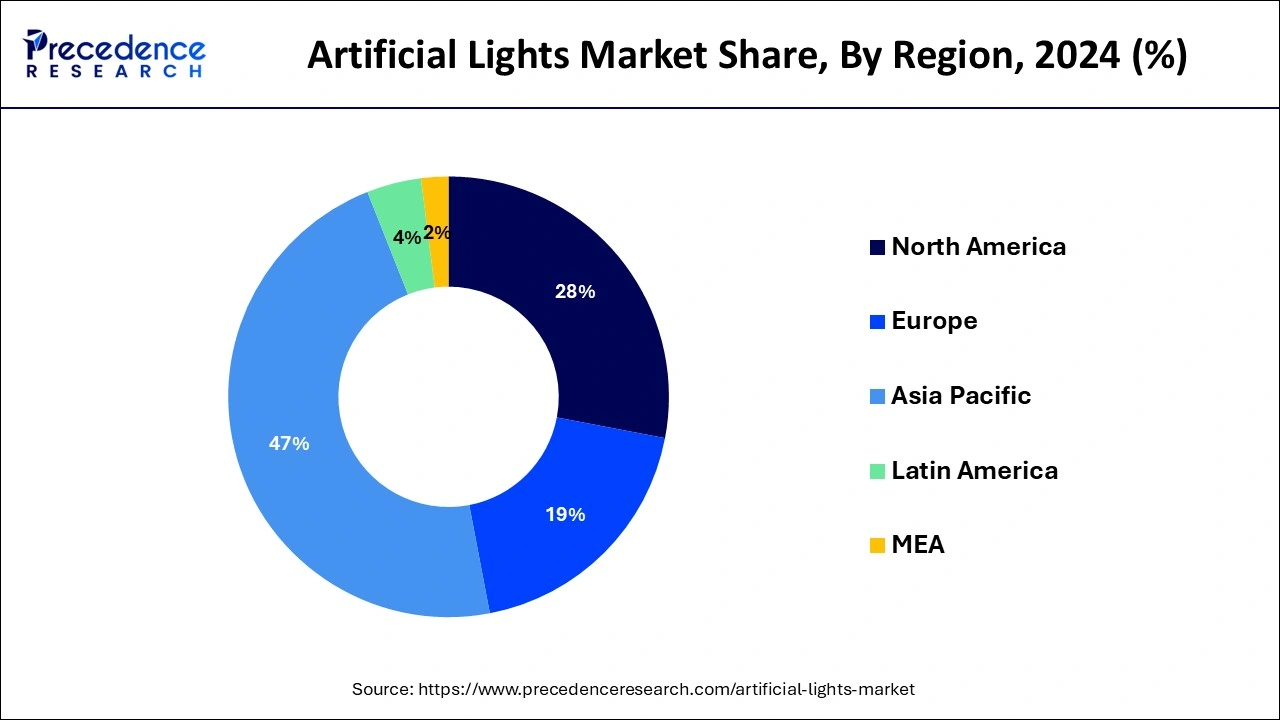

- Asia Pacific held the dominating share of the market of 47% in 2024.

- North America is observed to expand at a CAGR of 5.7% during the forecast period.

- By type, the LED lighting segment led the market with 32% of market share in 2024.

- By type, the halogen lighting segment is expected to witness a rapid growth with a CAGR of 4.9% over the forecast period.

- By application, the general lighting segment dominated the market with 41% of market share in 2024.

- By application, the automotive segment is expected to witness a significant growth rate of 5.6% during the forecast period.

- By end user, the residential segment held the dominating share of 54% in 2024.

- On the other hand, the commercial segment is expected to witness the fastest rate of growth at 3.9% during the forecast period.

Asia PacificArtificial Lights Market Size and Growth 2025 to 2034

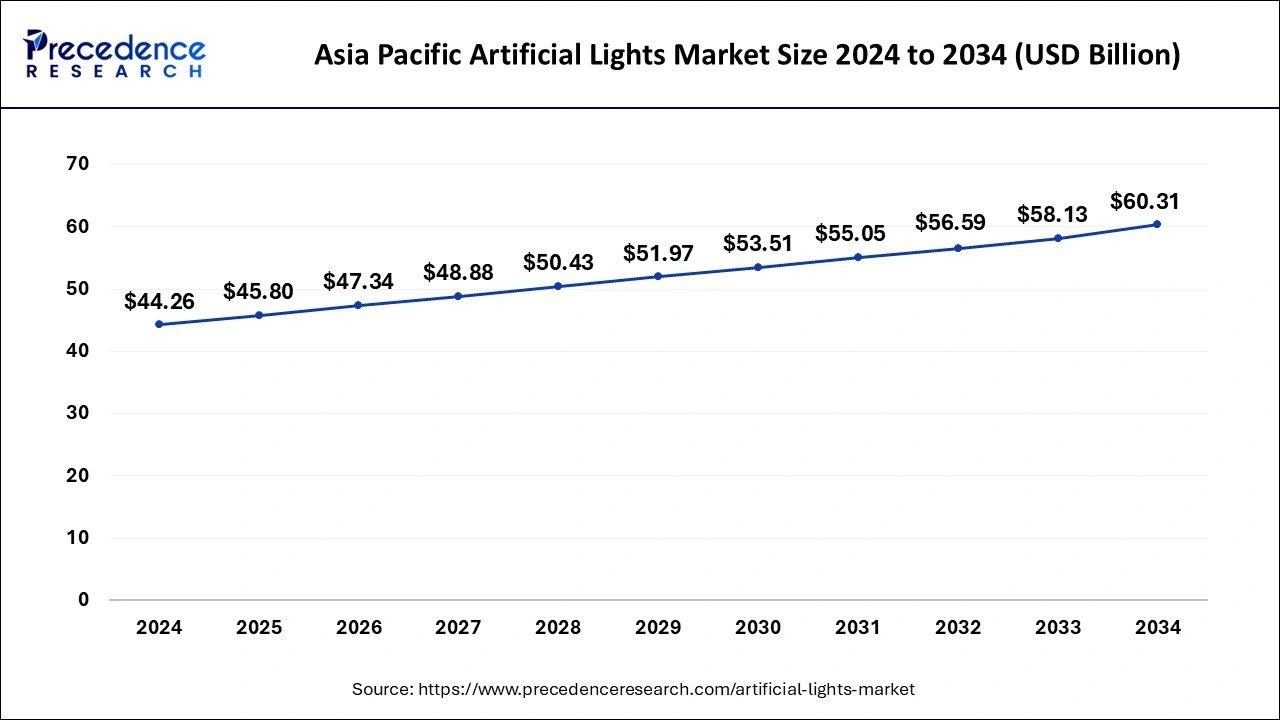

The Asia Pacific artificial lights market size was estimated at USD 44.26 billion in 2024 and is anticipated to reach around USD 60.31 billion by 2034, growing at a CAGR of 3.14% from 2025 to 2034.

Asia Pacific held the largest share of the artificial lights market while contributing 47% market share in 2024, with China emerging as a key player due to its extensive presence of both registered and unregistered market leaders. China, a dominant force in the region, boasts a robust manufacturing infrastructure and is a major exporter of various lighting products worldwide. The region's burgeoning population and rapid urbanization further fuel the demand for artificial lighting solutions, positioning Asia Pacific as the market leader, followed by Europe and North America.

Within Asia Pacific, China stands at the forefront of the artificial lights market, renowned as one of the globe's primary producers of lighting products encompassing diverse bulb types, fixtures, and LED lights. Leveraging advanced technologies and streamlined production processes, China has cultivated a vast network of factories dedicated to lighting production, solidifying its status as a global manufacturing hub. Urbanization and infrastructure expansion in China drive domestic demand for lighting solutions, buoyed by a burgeoning middle class and increased consumer spending.

In North America, the artificial lights market is expected to grow at a CAGR of 5.7% during the forecast period, propelled by the presence of numerous large-scale companies and a focus on urbanization, technological innovation, and energy-efficient products. Although the market landscape in North America is fragmented compared to other regions, factors such as population growth and aging demographics contribute to its moderate growth trajectory.

Market Overview

The artificial lights market refers to the industry involved in the manufacturing, distribution, and sale of lighting products designed to illuminate indoor and outdoor spaces using artificial sources of light. Artificial lighting encompasses a wide range of technologies, including incandescent bulbs, fluorescent tubes, LED lights, halogen lamps, and high-intensity discharge (HID) lamps. The market for artificial lighting is driven by various factors such as urbanization, industrialization, commercialization, and the need for illumination in residential, commercial, industrial, and public spaces. Advancements in lighting technology, energy efficiency regulations, and the growing demand for smart lighting solutions are also shaping the artificial light market. The artificial lights market plays a crucial role in enhancing visibility, safety, productivity, and aesthetics in various environments, driving its continued growth and evolution to meet the evolving needs of society.

Artificial Lights Market Data and Statistics

- In 2022, the US government took proactive measures to incentivize the adoption of energy-efficient lighting solutions through the enactment of the Inflation Reduction Acts of 2022. These acts introduced tax deductions aimed at encouraging homeowners, builders, and commercial businesses to opt for energy-efficient lighting options. By providing financial incentives and tax benefits, the government aims to accelerate the transition towards sustainable lighting technologies, reduce energy consumption, and mitigate the environmental impact associated with traditional lighting systems.

- In September 2021, the New York state government undertook a significant initiative to enhance energy efficiency by replacing 286,000 streetlights with modern LED lights. This initiative aligns with broader sustainability goals and aims to reduce energy consumption and carbon emissions associated with street lighting. Furthermore, New York State plans to continue its efforts by replacing an additional half a million streetlights with LED technology by the year 2025, demonstrating a strong commitment to energy conservation and environmental stewardship.

- The data provided by the European Commission underscores the significant role that lighting plays in global electricity consumption, with lights accounting for approximately 15% to 18% of total electricity usage. This highlights the importance of adopting energy-efficient lighting solutions to mitigate energy consumption and reduce environmental impact.

Artificial Lights MarketGrowth Factors

- Increasing awareness of energy conservation and environmental concerns has led to the implementation of stringent regulations promoting energy-efficient lighting solutions. Governments worldwide are implementing policies and standards to phase out inefficient lighting technologies, thereby driving the adoption of artificial lights.

- Rapid urbanization and infrastructure development projects in emerging economies create a demand for artificial lighting solutions in residential, commercial, and industrial sectors. Urban expansion and the construction of smart cities further fuel the growth of the artificial lights market.

- The rise of smart homes and smart buildings has surged the demand for intelligent lighting systems. Smart lighting solutions offer features like remote control, automation, energy monitoring, and integration with IoT (Internet of Things) devices, enhancing convenience and energy efficiency.

- Artificial lighting finds applications across diverse sectors such as residential, commercial, industrial, healthcare, agriculture, and automotive. The expanding application areas, driven by technological advancements, contribute to the market's growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 97.45 Billion |

| Market Size by 2034 | USD 126.97 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.03% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing emphasis on energy efficiency and sustainability

The artificial lights market is primarily driven by the rapid advancements in lighting technologies and the growing emphasis on energy efficiency and sustainability. As traditional lighting sources are gradually phased out due to their inefficiency and environmental impact, LED (Light-Emitting Diode) and OLED (Organic Light-Emitting Diode) technologies have emerged as key drivers of market growth. These technologies offer numerous advantages such as energy efficiency, longer lifespan, and reduced maintenance costs compared to conventional lighting solutions.

Additionally, stringent energy efficiency regulations and sustainability initiatives implemented by governments and regulatory bodies worldwide are accelerating the adoption of energy-efficient lighting technologies. These regulations aim to reduce carbon emissions, minimize energy consumption, and promote eco-friendly practices across various industries and sectors.

Moreover, the proliferation of smart lighting systems and the integration of lighting with IoT (Internet of Things) technology are reshaping the artificial lights market landscape. Smart lighting solutions offer features such as remote control, automation, and customization, providing users with enhanced convenience, flexibility, and energy savings. Furthermore, the increasing demand for artificial lighting across residential, commercial, industrial, and automotive sectors further propels market growth.

Urbanization, infrastructure development, and the construction of smart cities also contribute to the expansion of the artificial lights market as they drive the need for efficient and sustainable lighting solutions. the artificial lights market is driven by a combination of technological innovation, regulatory policies, consumer preferences, and urbanization trends, making it a dynamic and rapidly evolving industry poised for substantial growth in the coming years.

Restraint

High cost of adopting advanced lighting technologies

One prominent restraint is the initial high cost of adopting advanced lighting technologies such as LED and OLED. While these technologies offer long-term cost savings and energy efficiency benefits, the upfront investment required for installation and implementation can be substantial for some users, especially in developing regions or for small-scale applications. Additionally, concerns regarding the environmental impact of artificial lighting, particularly related to light pollution and its effects on ecosystems and human health, have emerged as significant constraints in recent years. Light pollution, characterized by the excessive or misdirected use of artificial light, can disrupt natural ecosystems, disturb wildlife behavior patterns, and contribute to adverse health effects in humans, such as sleep disorders and disruptions to circadian rhythms.

Furthermore, the disposal of lighting products at the end of their lifecycle presents another challenge for the artificial lights market. Proper disposal and recycling of lighting components, including LEDs and other electronic components, are essential to mitigate environmental pollution and reduce electronic waste. However, inadequate infrastructure and lack of awareness about responsible disposal practices may hinder efforts to manage the environmental impact of artificial lighting.

Hence, addressing these challenges and restraints requires collaborative efforts from industry stakeholders, regulatory bodies, and consumers to promote sustainable practices, develop cost-effective solutions, and raise awareness about the importance of energy-efficient and environmentally-friendly lighting technologies in mitigating the adverse effects of artificial light on the environment and human health.

Opportunity

Growing demand for soundproof transportation

Looking ahead, the artificial lights market presents promising growth opportunities primarily driven by the ongoing advancements in lighting technology, particularly in areas such as LED (Light Emitting Diode) and OLED (Organic Light Emitting Diode) lighting. These technologies offer significant advantages over traditional lighting sources, including higher energy efficiency, longer lifespan, and greater flexibility in design and application. Furthermore, the increasing emphasis on energy conservation and sustainability is expected to propel the adoption of energy-efficient lighting solutions across various sectors.

Government initiatives promoting energy-efficient lighting and regulations phasing out inefficient lighting technologies are likely to accelerate market growth and encourage the widespread adoption of artificial lighting solutions. Moreover, the growing awareness of the adverse environmental and health effects of light pollution is driving demand for lighting solutions that minimize light spillage and reduce environmental impact.

As a result, there is a rising demand for smart lighting systems equipped with advanced controls and sensors that enable precise light management and customization, contributing to energy savings and environmental sustainability. Another significant growth opportunity lies in the expanding applications of artificial lighting across diverse sectors such as residential, commercial, industrial, healthcare, and automotive. The increasing integration of lighting systems with smart technologies and Internet of Things (IoT) platforms is driving innovation and opening new avenues for intelligent lighting solutions that enhance user comfort, productivity, and safety.

Furthermore, the emergence of niche markets such as horticultural lighting for indoor farming and urban agriculture presents lucrative opportunities for artificial light manufacturers and suppliers. With the growing demand for locally sourced and sustainable food production, horticultural lighting solutions are becoming essential tools for optimizing plant growth, crop yields, and quality in controlled indoor environments. Hence, the combination of technological innovation, regulatory support, environmental awareness, and expanding applications is expected to fuel robust growth in the artificial lights market, offering significant opportunities for industry players to innovate, diversify, and capitalize on emerging trends and market dynamics.

Type Insights

The LED lighting segment dominated the artificial lights market with 32% of the market share in 2024., driven by its longer lifespan, brighter illumination, and durability. LED lights are known for their ability to withstand frequent switching and reduce electricity consumption, making them a popular choice for consumers seeking energy-efficient lighting solutions. The increasing demand for LED lighting, attributed to its energy-saving benefits compared to traditional options, contributes significantly to market growth. Furthermore, the growing preference for safer and cooler lighting options further amplifies the demand for LED technology worldwide.

The halogen lighting segment is observed to grow at a CAGR of 4.9% during the forecast period, primarily used in automobile headlights to enhance visibility for drivers, halogen lightings are being adopted at a notable rate. The adoption of halogen lighting is on the rise due to its ability to offer enhanced color clarity, improving the overall visual experience for users. This increased adoption of halogen lighting solutions contributes to the expansion of the market, particularly in applications where color accuracy and visual clarity are paramount.

Application Insights

The general lighting segment dominated the artificial lights market with 41% of the market share in 2024, primarily fueled by a surge in residential and commercial construction projects. The increasing construction activity necessitates the widespread adoption of lighting systems, thereby boosting the demand for general lighting solutions. Following closely is the automotive light segment, which holds a significant position in the market landscape.

The automotive segment is expected to grow at a CAGR of 5.6% during the forecast period, as the manufacturers are increasingly integrating LEDs and halogens into headlights to enhance visual quality and safety for drivers. This strategic focus on deploying innovative lighting technologies underscores the pivotal role of automotive lighting solutions in driving market growth. As car manufacturers continue to prioritize advancements in lighting technology, the automotive lighting segment is poised for further expansion and innovation.

End User Insights

The residential segment held the dominating share of 54% in 2024in the artificial lights market. Lighting solutions play a pivotal role in residential settings, facilitating various everyday activities such as reading, watching television, cooking, cleaning, and bathing. They are commonly installed in key areas like kitchens, living rooms, and bathrooms. Additionally, there is a surging demand for smart lighting options that seamlessly integrate with mobile devices, enhancing convenience and comfort within households. The trend is further fueled by the rapid development of smart cities worldwide, driving market growth in the residential segment.

The commercial segment is expected to witness the fastest growth at a CAGR of 3.9% during the forecasted period of 2025-2034. Commercial settings such as shopping malls, corporate offices, supermarkets, hospitals, restaurants, schools, and parks, lighting solutions with extended lifespans and higher efficacy are essential. The demand for efficient lighting in commercial spaces also stems from the need to enhance security and reduce instances of theft and burglary. Furthermore, the commercial segment, including warehouses, factories, and manufacturing plants, requires effective lighting solutions to improve worker safety and productivity. The increasing emphasis on creating well-lit and safe work environments contributes significantly to the growth of the industrial lighting segment.

Artificial Lights Market Companies

- GE Lighting (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Panasonic Corporation (Japan)

- OSRAM Licht AG (Germany)

- Schneider Electric SE (France)

- Cree, Inc. (U.S.)

- CITIZEN ELECTRONICS CO., LTD. (Japan)

- Lumerica (Canada)

- Havells India Ltd. (India)

- LEDtronics, Inc. (U.S.)

- Patriot LED (U.S.)

- Acuity Brands, Inc. (U.S.)

Recent Developments

- In February 2023, OSRAM GmbH (ams OSRAM AG), a prominent provider of optical solutions leveraging edge-emitting lasers (EELs) and vertical-cavity surface-emitting lasers (VCSELs) technology, revealed a collaboration with Cepton to deliver light detection and ranging (LiDAR) solutions for autonomous vehicles.

- In February 2022, GE Current, a US-based lighting firm, acquired Hubbell C&I Lighting, also based in the US, for an undisclosed sum. This acquisition aims to improve both companies' distribution networks and digital capabilities, enabling them to better address customer requirements with increased speed, efficiency, and convenience. Hubbell C&I Lighting specializes in general lighting solutions.

- In December 2021, Signify N.V. disclosed the acquisition of Fluence, a move aimed at expanding and enriching its agricultural lighting growth platform.

- In January 2021, Ushio Deutschland GmbH, the German branch of Ushio Europe, completed a merger with BLV Licht- und Vakuumtechnik GmbH, its sister company known for manufacturing horticultural lighting systems. Following the merger, the combined entity operates under the name Ushio Germany GmbH. Ushio Europe specializes in producing UV, visible, and infrared lighting solutions, boasting manufacturing and testing facilities.

Segments Covered in the Report

By Type

- LED

- CFL

- LFL

- HID

- Halogen

- Incandescent

By Application

- General Lighting

- Automotive Lighting

- Backlighting

- Others

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting