What is the Gas Processing Market Size?

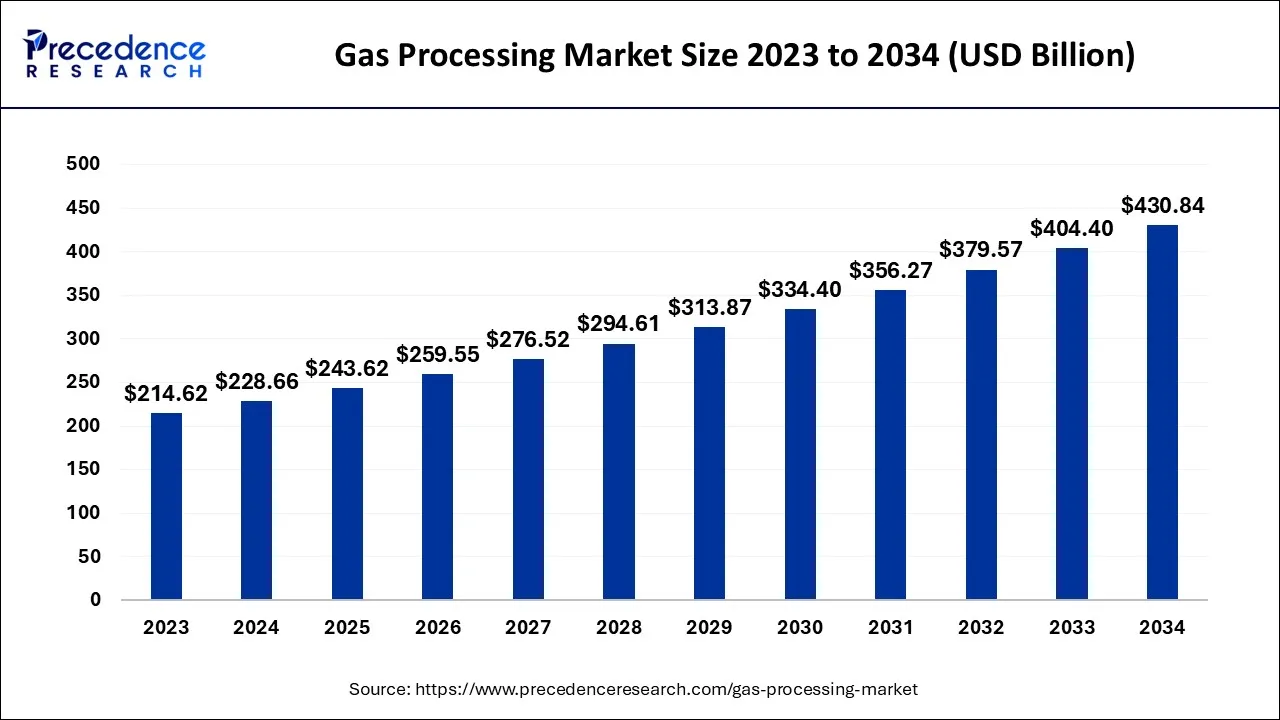

The global gas processing market size is accounted at USD 243.62 billion in 2025 and predicted to increase from USD 259.55 billion in 2026 to approximately USD 457.28 billion by 2035, representing a CAGR of 6.50% from 2026 to 2035.

Gas Processing Market Key Takeaways

- By Type, the dry gas segment generated more than 58 % of the revenue share in 2025.

- By Application, the acid gas removal segment is expected to generate for a maximum revenue share between 2026 and 2035.

- North America region captured to the biggest revenue share in 2025.

Market Overview

Natural gas collected from oil and gas wells is processed to separate the hydrocarbons and remove contaminants in order to produce value-added products like dry gas and NGL. Natural gas demand is rising, which is propelling the sector. Natural gas is necessary because of its quantity, adaptability, and ability to be cleaned up.

The increased usage of natural gas in transportation has increased the demand for natural gas. Another factor driving the growth of the business in emerging nations is the availability of natural gas for power generation. During the projection period, this rising natural gas consumption will help the global gas handling sector grow.

In order to produce dry natural gas of pipeline quality, a series of industrial processes known as gas processing must be used to remove pollutants, contaminants, and higher molecular-weight hydrocarbons from natural gas that is raw. Gas processing starts at the wellhead. The geology of the region, along with the kind, depth, and direction of the subsurface deposit, affect the natural gas in its raw form collected from producing wells. In the same reservoir, natural oil and gas are frequently discovered.

Gas Processing Market Growth Factors

Demand for natural gas has increased, which is driving the market. Due to its abundance, adaptability, and clean-burning qualities, natural gas is in high demand. The growth in natural gas use in the transportation sector has led to an increase in global natural gas consumption. The market is expanding as a result of the developing world's need for natural gas for electricity generation. Increased natural gas usage is anticipated to fuel the gas processing market's expansion in the ensuing years.

To increase the technical and financial feasibility of gas processing activities, numerous innovative technologies are being developed. These new technologies are designed to reduce energy use, which will result in significant financial savings for gas processing companies.

By bringing down the cost of gas-processing operations, new technologies are propelling the expansion of the global market for gas processing. The adoption of other energy sources, operational problems with gas processing, and changes in oil and gas prices are all likely to impede the market's expansion.

These factors are probably going to have a big impact on investors and upstream oil and gas companies, which could lead to a decrease in natural gas supplies if upstream investments decline. As a result, the growth of the global gas processing market will be constrained by these restrictions.

Market Outlook

- Industry Growth Overview: The gas processing market is experiencing steady growth, driven by rising global energy demand, the shift towards cleaner fuels, increased exploration, and expanding industrial applications.

- Major investors: The major investors and key players in the market include integrated global energy companies like Saudi Aramco, ExxonMobil, and Shell, as well as national and regional specialists such as GAIL Limited and Cheniere Energy.

- Global Expansion: The market is expanding due to rising energy demand, cleaner fuel needs, and technological advancements, with significant growth expected in Asia, driven by increased LNG imports and power generation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 243.62 Billion |

| Market Size by 2035 | USD 457.28 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.50% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing demand for natural gas

Crude oil wells, gas wells, and condensate wells are the three types of wells from which raw natural gas is predominantly derived. Associated gas is the common name for natural gas that originates from crude oil wells. This gas may have been dissolved in the crude oil and released as the pressure was dropped during production, or it may have been present as a gas cap above the crude oil in the subsurface reservoir.

Non-associated gas is natural gas that originates from gas wells and condensate wells where there is little to no crude oil present. While condensate wells also generate raw natural gas along with other low molecular weight hydrocarbons, gas wells normally only produce raw natural gas.

Restraints

Increasing competition from substitutes

Both fermentation procedures with ultimate carbon dioxide removal, which have been technically and commercially demonstrated at various biogas plants, and gas-conditioning of synthesis gases from coal or biomass gasification can be used to produce substitute natural gas. Regarding gas composition, the production of SNG from the biomass gasification product gas typically necessitates conditioning procedures including methanation, carbon dioxide removal, and hydrogen enrichment (COSR).

An exception is SNG production by AER gasification. SNG can be produced by methanation alone, without a separate carbon monoxide shift reaction and carbon dioxide removal, thanks to the H2-rich product gas from the AER process.

Opportunity

Discovery of new gas fields

In order to improve gas quality and protect the environment from pollution, a procedure known as gas treatment involves removing unwelcome gases from the air, natural gas, and freshwater by adding cleaning agents. These cleaning solutions work incredibly well to remove dangerous carbon and varnish buildup from the fuel system.

Gas treatment techniques, used in gas plants and refineries to eliminate acid gases like hydrogen sulphide and carbon dioxide gases, are employed in most traditional applications, including are additionally used in gas plants and refineries to eliminate acid gases like hydrogen sulphide and carbon dioxide gases, are employed in the majority of traditional applications, including such ammonia and synthesis gas plants and liquefied petroleum gas (LPG) facilities. In recent years, a number of businesses have introduced cutting-edge gas treatment technology.

Type Insights

The rapid increase of natural gas production, expanding NGL adoption initiatives, and rising demand for natural gas are some of the reasons propelling the worldwide gas processing market. Pressure-assisted stripping (PAS) technology increases the effectiveness of gas purification processes by more than 25% by reducing the demand for heat generation.

Similarly, by improving our understanding of the instability and operational failures of compressors during the acid-cleaning process, dynamic compressor model technology helps to lower operational expenses. These technological advancements in gas processing are viewed as crucial market trends for the industry and will help the market grow.

Natural gas use is expanding because its combustion results in fewer greenhouse gas emissions than that of other fossil fuels. Due to increased shale oil and gas drilling in the US and CBM and shale gas drilling in China, these two countries account for the majority of the world's natural gas production. As a result, the need for gas processing is increasing due to rising natural gas production as a result of increased investments and upstream oil and gas operations, which in turn is driving the market's rise.

Application Insights

Dehydration and acid gas removal are the two application-based segments of the global market for gas treatment. Due to the rising demand for natural gas as a cleaner energy source and the increased observance of environmental regulations by different enterprises, the acid gas removal segment is anticipated to account for a notably substantial revenue share throughout the projected period.

Acid gas removal is the process of eliminating carbon dioxide (CO2) and hydrogen sulfide (H2S) from vapour streams. Acid gas removal (AGR) units are a vital component of Integrated Gasification Combined Cycle (IGCC) power plants. The majority of gas processing plants feature an acid gas removal stage to get rid of carbon dioxide and hydrogen sulphide, which are acid gases.

During the course of the projected period, the dehydration segment is anticipated to experience consistent revenue growth. Dehydration is the process of taking moisture out of natural gas and gaseous mixtures. It frequently comes before either low-temperature gas processing or gas pipeline transportation.

Dehydration also reduces the possibility of hydrates cooling and producing ice blockages in the pipes, enabling uninterrupted operation of downstream process equipment and pipelines. Most dehydration techniques rely on either moisture absorption or moisture evaporation during gas cooling.

Regional Insights

The North America market accounted for the biggest revenue share in the worldwide gas treatment market in 2023, due to the rising demand for natural gas in nations across this region, especially in the U.S. and Canada. The United States consumed around 30.66 trillion cubic feet (Tcf) of natural gas in 2021, which is equal to 31.73 quadrillion British thermal units (quads) and 32% of the country's overall energy consumption. In the electric power industry, natural gas is used to produce valuable thermal output in addition to electricity. Around 37% of the natural gas consumed in the United States in 2021 was used for electric generation.

Natural gas is additionally utilised in the industrial sector as a fuel for combined heat and power systems, process heating, a raw material (feedstock) in the production of chemicals, fertiliser, and hydrogen, as well as a leasing and plant fuel. The industrial sector made up over 33% of all natural gas usage in the United States in 2021. Furthermore, the increased adoption of natural gas in power generation and industrial applications creates a high demand for gas processing and boosts revenue growth of the market in this region.

Asia Pacific Accelerates Ahead: The Fastest-Growing Powerhouse in the Global Gas Processing Industry

The Asia Pacific is expected to grow at the fastest rate over the forecast period. The growth of the region can be attributed to the extensive energy demand from industrialization & urbanization, and technological innovations in processing to fulfil power generation demands. In addition, emerging economies in the region are investing in gas infrastructure and imports to improve global supply shifts.

China Gas Processing Market Trends

In the Asia Pacific, China dominated the market owing to growing demand for cleaner energy and a surge in unconventional gas production. Ongoing urbanisation and an increasing middle class raise demand for energy in commercial, residential, and industrial sectors, leading to positive market growth soon.

Europe's Strategic Surge: Notable Growth Reshaping the Gas Processing Market

Europe is expected to grow at a notable rate over the forecast period. The growth of the region can be credited to its increasing emphasis on diversification of supply and energy security. Furthermore, there is a rising emphasis on the processing of low-emission gases like biomethane and hydrogen, leading to regional growth.

Germany Gas Processing Market Trends

The growth of the market in Germany can be driven by its strong commitment to green energy and favourable government policies promoting the sustainable use of energy. The country is also heavily investing in expanding its wide pipeline network to accommodate new import flows.

Gas Processing Market-Value Chain Analysis

- Feedstock Procurement

This process involves acquiring various raw materials, basically petroleum liquids and natural gas, to produce valuable products like petrochemicals.

Major Players: China National Petroleum, Royal Dutch Shell - Chemical Synthesis and Processing

It refers to the transformation of raw feedstock into high-value chemical products, fuels, and intermediates using different chemical processes.

Major Players: Gazprom, Exxon Mobil - Packaging and Labelling

It involves the specialized infrastructure and information protocols used to contain, identify, and distribute processed gases.

Major Players: BP, Chevron - Regulatory Compliance and Safety Monitoring

It comprises the regulatory framework and legal mandates used to protect personnel and the environment from the risky nature of gas.

Major Players: Statoil, Total

Top Companies in the Gas Processing Market & Their Offerings:

- Exxon Mobil Corporation: Offers a wide range of natural gas operations, including exploration, production, and an extensive global LNG footprint.

- BP Plc: Has a substantial reserve base and produces gas across multiple continents, with an emphasis on LNG as a strategic growth area.

Gas Processing Market Companies

- Gazprom

- Exxon Mobil

- China National Petroleum

- Royal Dutch Shell

- BP

- Chevron

- Total

- Statoil

- ConocoPhillips

- Eni

Recent Development

- By becoming the sole owner of the modest ING roloading station in Klaipeda, Lithuania, on April 1, 2020, Polskio Gornictwa Naftowe I Gazownictwo (PGNIG) gave the business access to Baltic Sea markets and simplified the logistics of supplying LNG to customers in northeastern Poland.

- BP expands into offshore wind after purchasing U.S. assets. The agreement represents BP's first foray into the offshore wind industry and is a key component of a new strategy that will see the British oil giant accelerate the transition away from fossil fuels in order to achieve its net-zero emissions targets.

- The acquisition of InterOil Corporation by ExxonMobil has been finalised. This deal was approved by Yukon's Supreme Court. In the transaction, ExxonMobil acquired all of InterOil's outstanding common shares. As a result of this agreement, ExxonMobil will be able to generate money for both its shareholders and the people of Papua New Guinea.

- A novel technique for extracting high-value natural gas products has been developed by BASF SE. This process includes purifying natural gas for pipeline transfer with the simultaneous recovery of valuable helium, liquid hydrocarbons, and purified CO2.

Segments Covered in the Report

By Type

- Dry Gas

- Natural Gas Liquid (NGL)

- Others

By Application

- Acid Gas Removal

- Dehydration

- Others

By Industry Vertical

- Metallurgy

- Healthcare

- Chemical

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting