What is Diaphragm Pumps Market Size?

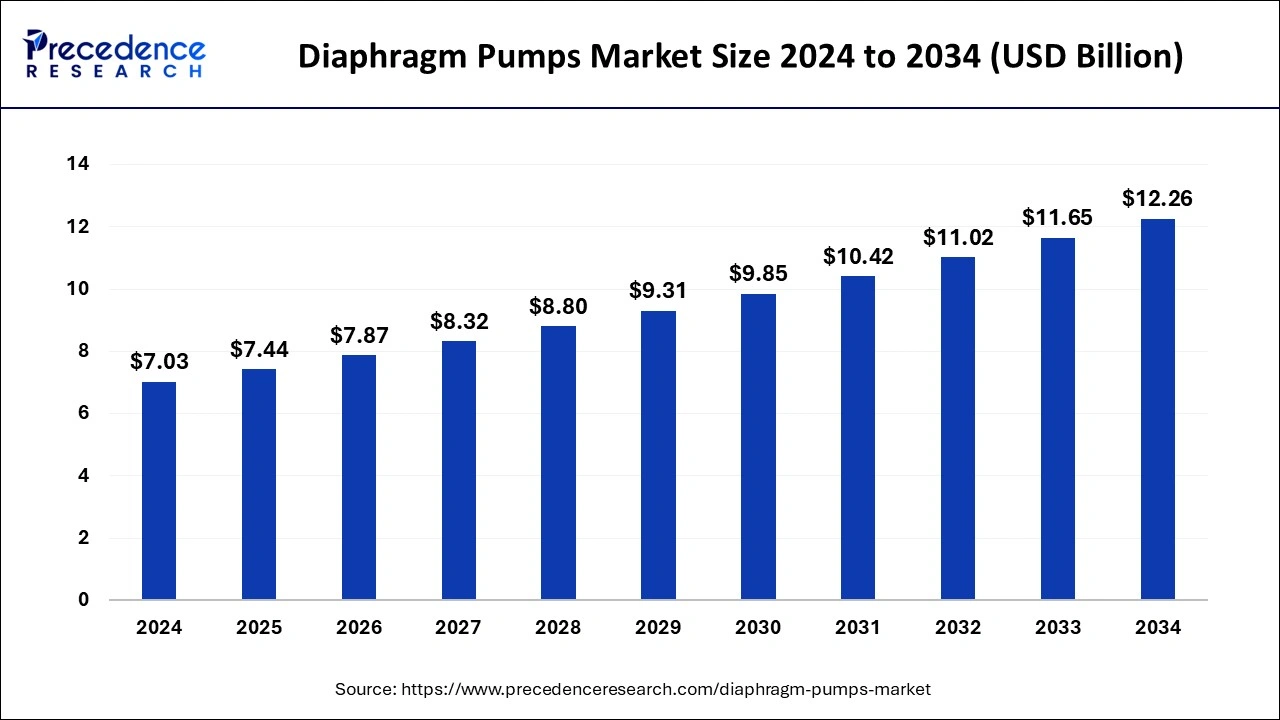

The global diaphragm pumps market size accounted for USD 7.44 billion in 2025, grew to USD 7.87 billion in 2026 and is projected to surpass around USD 12.26 billion by 2034, representing a healthy CAGR of 5.72% between 2024 and 2034.

Market Highlights

- Asia Pacific led the global market with the largest share in 2024.

- North America is expected to witness the fastest rate of growth in the diaphragm pumps market during the forecast period.

- By operation, the double segment held the largest share more than 70% in 2024.

- By mechanism, the air operated diaphragm pumps segment held the biggest market share of 65% in 2024.

- By mechanism, the electrically operated diaphragm pumps segment is expected to grow at a notable rate.

- By pressure, the up to 80 bar segment dominated the market in 2024.

- By pressure, the >200 bar diaphragm pumps segment is expected to grow at a notable rate.

- By end-use, the water & wastewater segment is observed to sustain the dominance throughout the forecast period.

Market Overview

The diaphragm pumps market is a dynamic sector within the broader pump industry that focuses on the production, distribution, and utilization of diaphragm pumps. It is also known as membrane pumps, are positive displacement pumps that use a flexible diaphragm to displace a fluid. These pumps are versatile and find application in various industries due to their ability to handle a wide range of fluids, including corrosive and abrasive substances.

The market for diaphragm pumps has witnessed significant growth in recent years, driven by increasing industrialization, stringent regulations regarding fluid handling, and a rising demand for reliable pumping solutions. These pumps are extensively used in industries such as chemicals, pharmaceuticals, water and wastewater treatment, oil and gas, and food and beverage. Their ability to handle sensitive fluids without contamination makes them essential in sectors where maintaining product purity is crucial.

Diaphragm Pumps Market Data and Statistics

- In November 2023, Lutz-Jesco GmbH, launched new generation of stepper motor diaphragm pumps, the MEMDOS Smart, for enterprises facing demanding and complex dosing tasks. It provides an asynchronous operation with variable speeds during discharge strokes and suction, allowing a pulsation-reduced dosing and homogeneous process.

Diaphragm Pumps MarketGrowth Factors

- Diaphragm pumps are known for their versatility and ability to handle a wide range of fluids, including corrosive, abrasive, and viscous substances. This versatility makes them suitable for applications across various industries, including chemicals, pharmaceuticals, water and wastewater treatment, oil and gas, and food and beverage.

- Increasing regulatory standards and stringent requirements for fluid handling in industries, especially in areas such as chemical processing and pharmaceutical manufacturing, drive the adoption of diaphragm pumps. These pumps offer a reliable and efficient solution for complying with industry-specific regulations and maintaining product purity.

- Ongoing advancements in diaphragm pump technology, materials, and design contribute to improved efficiency, durability, and performance. Manufacturers invest in research and development to introduce innovative features such as smart pumping systems, enhanced control mechanisms, and materials with improved chemical resistance, thereby attracting customers looking for cutting-edge solutions.

- The global emphasis on energy conservation and sustainability has led to a growing demand for energy-efficient pumping solutions. Diaphragm pumps, with their positive displacement design, can offer precise fluid control and metering, leading to improved energy efficiency compared to some alternative pump types.

- Diaphragm pumps are widely used for metering and dosing applications where accurate and precise fluid delivery is essential. The demand for such applications, particularly in industries like water treatment, pharmaceuticals, and chemical processing, contributes to the growth of the diaphragm pumps market.

- The ongoing industrialization and infrastructure development in emerging economies drive the demand for reliable pumping solutions. Diaphragm pumps play a crucial role in various industrial processes, making them integral to the growth of industries and economies.

- In the food and beverage industry, maintaining hygienic conditions during fluid handling is paramount. Diaphragm pumps, known for their ability to handle sensitive fluids without contamination, are increasingly adopted in this sector, contributing to market growth.

- The replacement of aging pumping infrastructure in industries and municipalities provides opportunities for diaphragm pump manufacturers. As outdated systems are upgraded for improved efficiency and reliability, diaphragm pumps become a preferred choice.

Recent Trends

- Smart and Connected Pumps: Diaphragm pumps are increasingly equipped with sensors and IoT connectivity, allowing real-time monitoring and predictive maintenance to prevent downtime.

- Advanced Materials and Designs: Manufacturers are using improved elastomers and PTFE composites, making pumps more durable and capable of handling harsh chemicals, slurries, and high pressures.

- Environmental and Regulatory Focus: Pumps that reduce leaks, energy use, and waste are gaining preference, particularly in water treatment, chemical, and pharmaceutical industries.

- New Applications and Regional Growth: Beyond traditional sectors, diaphragm pumps are being adopted in food & beverage, water & wastewater treatment, and other industries, with Asia-Pacific showing strong growth due to industrialization.

- Energy-Efficient Electric Models: Electrically driven diaphragm pumps are becoming more popular as they consume less energy, offer better control, and support the shift toward cleaner, smart industrial systems.

Market Outlook

- Industry Growth Overview: The diaphragm pump market is steadily growing, fueled by demand from the food and beverage, chemical, oil and gas, and water treatment industries. Market adoption is being accelerated by infrastructure improvements, more stringent regulations, and the demand for dependable fluid handling solutions in challenging environments.

- Sustainability Trends:Sustainability is becoming important, with manufacturers developing energy-efficient pumps, using environmentally friendly materials, and integrating sensors for predictive maintenance. These innovations reduce leaks, lower maintenance, and help companies meet environmental and regulatory goals.

- Global Expansion: Due to infrastructure development and industrial growth, the market is growing globally, with the Asia Pacific leading the way. Through the use of cutting-edge pump technologies and infrastructure improvements, North America and Europe are expanding steadily, creating opportunities in both developed and emerging markets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.44 Billion |

| Market Size in 2026 | USD 7.87 Billion |

| Market Size by 2034 | USD 12.26 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.72% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Operation, By Mechanism, By Pressure, and By End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased focus on water and wastewater treatment

- In December 2022, Graco Inc. introduced QUANTM electric-operated double diaphragm pump. It provides an innovative electric motor design that is up to 8X more efficient than a standard pneumatic pump. It is suitable for wide range of applications such as multiple industrial and hygienic applications, including food and beverage, pharmaceutical, water treatment, paint manufacturing, chemical processing, and others.

The increased global focus on water and wastewater treatment has become a significant driver for the diaphragm pumps market. As concerns over water scarcity and environmental pollution rise, municipalities and industries are investing in advanced water treatment technologies to ensure clean and safe water supply. Diaphragm pumps play a crucial role in this domain, particularly in metering and dosing applications where precision and reliability are paramount. These pumps facilitate the accurate delivery of chemicals and additives essential for effective water treatment processes, such as disinfection and pH control.

The versatility of diaphragm pumps in handling various chemicals, coupled with their ability to operate seamlessly in challenging conditions, positions them as indispensable components in water treatment plants. With infrastructure projects aimed at enhancing water management and quality, the demand for diaphragm pumps is expected to escalate. As governments and industries globally intensify efforts to address water-related challenges, the diaphragm pumps market stands to benefit significantly from the pivotal role these pumps play in ensuring efficient and sustainable water and wastewater treatment processes.

Restraint

Limited high-pressure capabilities

The diaphragm pumps market faces a potential restraint due to their limited high-pressure capabilities. While diaphragm pumps are renowned for their versatility and suitability for handling a wide range of fluids, they may not be the optimal choice for applications requiring extremely high pressures. In sectors such as certain industrial processes, oil and gas operations, or high-pressure cleaning systems, where elevated pressure levels are essential, alternative pump technologies like reciprocating pumps or multistage centrifugal pumps may be preferred.

The inherent design of diaphragm pumps, based on positive displacement, imposes constraints on achieving exceptionally high pressures efficiently. Industries necessitating substantial force for specific tasks may find diaphragm pumps less suited to their requirements, potentially leading to a decline in demand within these high-pressure applications. While diaphragm pumps excel in numerous scenarios, their limitations in managing extremely high pressures create opportunities for other pump types, emphasizing the importance of carefully matching pump characteristics with the specific demands of diverse industrial applications.

Opportunity

Emphasis on energy-efficient pumping solutions

The growing emphasis on energy-efficient solutions across industries has opened significant opportunities for the diaphragm pumps market. Diaphragm pumps, with their positive displacement design, offer inherent energy-saving advantages compared to certain alternative pump technologies. The precise fluid control and metering capabilities of diaphragm pumps contribute to operational efficiency, reducing energy consumption during fluid transfer processes. As industries increasingly prioritize sustainability and seek ways to minimize their environmental footprint, the energy-efficient nature of diaphragm pumps aligns well with these goals.

Additionally, the positive displacement mechanism allows for accurate dosing and metering, preventing wastage and optimizing resource utilization. The versatility of diaphragm pumps in handling various fluids and their adaptability to diverse industrial applications further enhance their appeal as energy-efficient pumping solutions. Manufacturers are capitalizing on this trend by incorporating advanced materials and technologies to improve pump efficiency and reliability. As industries seek to meet stringent environmental regulations and lower operating costs, the demand for energy-efficient diaphragm pumps is expected to rise. This presents a significant opportunity for diaphragm pump manufacturers to position their products as eco-friendly and cost-effective solutions, catering to the evolving needs of a sustainability-focused market.

Segment Insights

Operation Insights

The double segment dominated the diaphragm pumps market in 2024; the segment is observed to continue the trend throughout the forecast period and expected to grow at a significant rate throughout the forecast period. Double diaphragm pumps features two flexible diaphragms that move in tandem, creating a reciprocating pumping action. These pumps are often powered by compressed air, providing a pulsation-free flow. These pumps are widely used in applications requiring higher flow rates, variable pressure, and the ability to handle viscous or abrasive fluids. Industries such as chemical processing, paint and coatings, and mining commonly utilize AODD pumps due to their versatility and self-priming capabilities.

- In July 2023, Verder Liquids launched a hygienic double diaphragm pumps, Verderair HC-PURE series, for controlling hygienic applications. It offers uncompromising durability and efficient cleanability.

The single segment is anticipated to grow at a notable rate throughout the forecast period. Single diaphragm pumps, also known as simplex diaphragm pumps, consist of a single flexible diaphragm that moves back and forth to create suction and discharge cycles. The diaphragm is typically connected to a rod or a membrane that is actuated by a mechanical or pneumatic mechanism. It is suitable for various applications, including chemical transfer, metering, and dosing, where the fluid is handled in a pulsating manner. They are often chosen for scenarios where lower flow rates or pressure requirements are sufficient.

Mechanism Insights

The air-operated diaphragm pumps segment held the largest share of the diaphragm pumps market in 2024. Air operated diaphragm pumps are driven by compressed air or other gases. They typically feature a reciprocating diaphragm, and the movement is initiated by the alternating pressure created by the compressed air. These pumps are known for their simplicity, self-priming capabilities, and suitability for various applications. It is commonly used in industries such as chemicals, wastewater treatment, mining, and food processing. Their ability to handle abrasive and viscous fluids, as well as their self-priming nature, makes them versatile for a wide range of pumping tasks.

The electrically operated diaphragm pumps segment is expected to generate a notable revenue share in the market. Electrically operated diaphragm pumps are powered by electric motors. They utilize an electrically driven mechanism to move the diaphragm and create the pumping action. These pumps offer precise control over flow rates and are suitable for applications where a continuous and stable pumping process is required. These pumps find application in various industries, including pharmaceuticals, water treatment, and manufacturing. Their ability to provide consistent and controlled fluid transfer makes them suitable for tasks such as metering and dosing applications.

- In October 2019, Tapflo launched eco-friendly variety of the traditional Air-operated diaphragm pumps pump, an electrically operated double diaphragm pump (EODD) based on the original diaphragm pump technology. It is powered by an IE3 class (efficient electrical drive) and can distribute liquids with flow rates up to 220 l/min and temperatures of up to 110° C.

Pressure Insights

The up to 80 bar segment held the largest share of the diaphragm pumps market in 2024. Diaphragm pumps in this category are designed to operate effectively in applications requiring lower pressure ranges, typically up to 80 bar. These pumps are suitable for scenarios where moderate pressure is sufficient, such as in certain chemical transfer, water treatment, and general industrial processes. Common applications for diaphragm pumps with pressures up to 80 bar include metering, dosing, and transfer of fluids in industries where low to moderate pressures are applicable.

The >200 bar segment is expected to generate a notable revenue share in the market. Diaphragm pumps with pressure capacities greater than 200 bar are designed to handle extremely high-pressure applications. These pumps are engineered for industries where substantial force is crucial, such as in certain oil and gas exploration, industrial cleaning, and specialized manufacturing processes. These high-pressure diaphragm pumps find applications in scenarios requiring precise fluid control under extreme pressure conditions, making them suitable for critical tasks in specific industrial sectors.

End-Use Insights

The water and wastewater treatment segment is observed to sustain the dominating share of the diaphragm pumps market during the forecast period and expected to generate a notable revenue share in the market. Diaphragm pumps are widely utilized in the water and wastewater treatment sector due to their ability to handle various fluids and provide accurate metering. They play a vital role in processes such as chemical dosing, sludge handling, and water purification. Water and wastewater treatment plants use diaphragm pumps for applications such as adding coagulants, disinfectants, and pH-adjusting chemicals, contributing to the efficient treatment of water for municipal and industrial purposes.

Regional Insights

Asia-Pacific led the market with the biggest market share in 2024. due to various factors such as economic developments, regulatory changes, and technological advancements can influence the demand for diaphragm pumps in the Asia-Pacific region. Additionally, government initiatives related to water infrastructure, environmental protection, and industrial development can impact the demand for diaphragm pumps in the region. Moreover, Diaphragm pumps are utilized in the food and beverage industry for applications like transferring liquids and dosing ingredients. The growth of this sector in the region adds to the demand for diaphragm pumps.

North America is poised for rapid growth in the diaphragm pumps market due to it finds applications across various industries in North America, including chemicals, pharmaceuticals, oil and gas, water and wastewater treatment, and food and beverage. As industries in North America adopt advanced technologies, there is an opportunity for diaphragm pump manufacturers to introduce innovative and efficient pumping solutions.

Meanwhile, Europe is growing at a notable rate in the diaphragm pumps market. Diaphragm pumps are widely used across various industries in Europe, including chemicals, pharmaceuticals, water and wastewater treatment, food and beverage, and manufacturing. The emphasis on environmental sustainability and stringent water quality standards drives the demand for diaphragm pumps in water treatment plants and wastewater treatment facilities across Europe. Moreover, the pharmaceutical industry's need for precision in fluid handling makes diaphragm pumps essential in various manufacturing processes within Europe.

- In November 2023, Honeywell launched its 100% hydrogen-capable Honeywell E15 diaphragm gas meter for the European market. It is used for measuring both natural gas and hydrogen. The technology has been certified and tested by Physikalisch-Technische Bundesanstalt (PTB).

Value Chain Analysis

- R&D: Businesses are concentrating on creating diaphragm pumps that can improve accuracy and dependability while handling more difficult fluids such as corrosive, viscous, or shear-sensitive liquids. To enable predictive maintenance and improved process control, modern pumps are also being outfitted with intelligent features like IoT connectivity and performance sensors.

- Distribution to Hospitals, Pharmacies: OEMs, system integrators, and industrial suppliers are how diaphragm pumps are delivered to final consumers after production. For pharmaceutical and healthcare facilities that need pumps that adhere to stringent hygienic and legal requirements, effective logistics and regional distribution networks are essential to guarantee on-time delivery.

- Patient Support and Services:For pumps used in pharmaceutical manufacturing, ongoing services like calibration, maintenance, replacement of wear parts, and regulatory documentation are essential. These services ensure consistent product quality, reduce downtime, and indirectly enhance patient safety by supporting reliable drug production.

Diaphragm Pumps Market Companies

- IDEX Corporation (US)

- Yamada Corporation (Japan)

- Flowserve Corporation (US)

- Ingersoll Rand (Ireland)

- Grundfos Holding A/S(Denmark)

- Xylem Inc. (US)

- SPX Flow (US)

- Pump Solutions Group (US)

- LEWA GmbH (Germany)

- Verder International B.V. (The Netherlands)

- TAPFLO AB (Sweden)

- Leak-Proof Pumps Pvt. Ltd. (India)

- All-Flo Pump Co. (US)

- AxFlow Holding AB (Sweden)

- KNF Neuberger (Germany)

Recent Developments

- In January 2021, Wanner announced that it has been manufacturing and designing packing-less & seal-less positive displacement and hydraulically balanced diaphragm pumps, Hydra-Cell API 674, for the oil and gas industry. It provide a power fluid surface pump equipped with downhole jet pump technology for reliable and controllable production optimisation and solution.

- In November 2020, Blue-White introduced CD3 Dual Diaphragm Metering Pump designed for pumping gas-forming chemicals, such as sodium hypochlorite and peracetic acid. It is designed to accurately inject chemicals into systems.

- In August 2020, Almatec, launched of its new Air-Operated Double-Diaphragm (AODD) Pumps, ADX Series Stainless-Steel AODD for industrial applications. It offers enhanced cleaning, simplified maintenance, and improved safety.

Segments Covered in the Report

By Operation

- Single

- Double

By Mechanism

- Air Operated

- Electrically Operated

By Pressure

- Up to 80

- 80-200

- > 200 bar

By End-Use

- Oil & Gas

- Food & Beverages

- Water & Wastewater

- Chemicals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting