What is Generative AI in Drug Discovery Market Size?

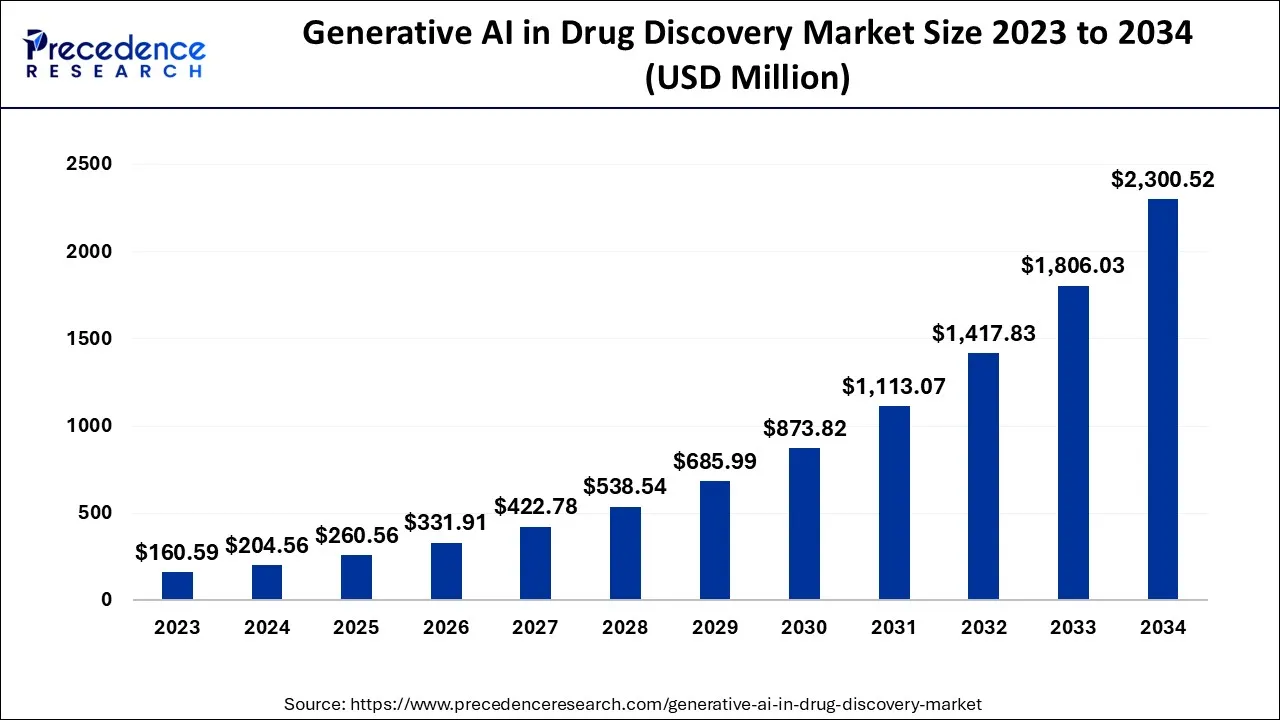

The global generative AI in drug discovery market size is worth around USD 260.56 million in 2025 and is anticipated to reach around USD 2,724.15 million by 2035, growing at a CAGR of 26.45% over the forecast period from 2026 to 2035.

Market Highlights

- North America contributed more than 50% of revenue share in 2025.

- By technology, the deep learning segment is expected to capture a significant market share over the forecast period.

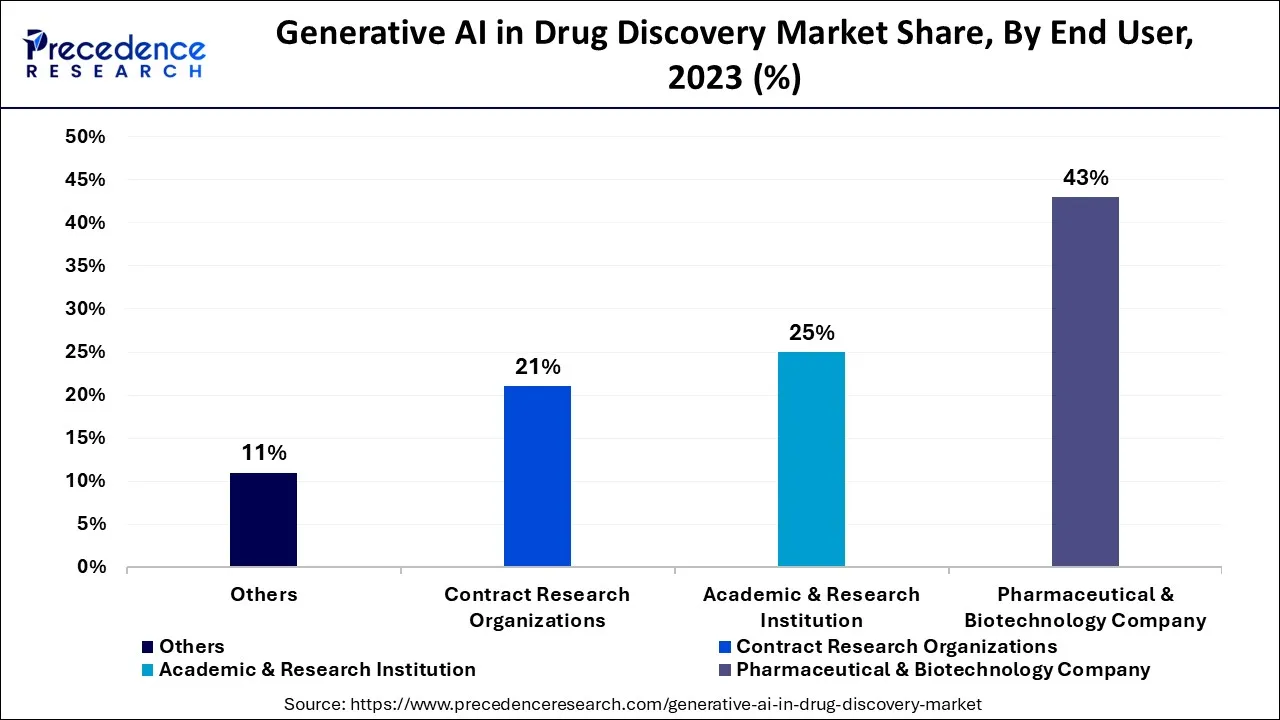

- By end user, the pharmaceutical & biotechnology company segment generated more than 43% of revenue share in 2025.

Strategic Overview of the Global Generative AI in Drug Discovery Industry

Generative AI in drug discovery refers to the application of artificial intelligence techniques, specifically generative models, in the process of discovering and designing new drugs. It combines the power of machine learning, computational chemistry, and large-scale data analysis to accelerate the drug discovery process and potentially revolutionize the pharmaceutical industry. Traditional drug discovery methods are often slow, costly, and prone to high failure rates. The development of new drugs typically involves extensive experimentation, screening of large chemical libraries, and optimization of molecular structures to achieve desired properties. Generative AI offers a novel approach by leveraging the capabilities of AI algorithms to generate and optimize new drug candidates more efficiently and systematically.

- According to secondary analysis, by 2028, it is anticipated that AI will save the pharmaceutical business $70 billion.

Generative AI in Drug Discovery Market Growth Factors

The generative AI in the drug discovery market is expected to witness substantial growth. Advancements in AI technologies, increasing computational power, and the growing availability of large-scale molecular datasets will contribute to the expansion of this sector. The integration of generative AI with other emerging technologies, such as quantum computing, could further accelerate the discovery of new drugs and transform the pharmaceutical industry.

Market Outlook

- Market Growth Overview: The generative AI in drug discovery market is expected to grow significantly between 2026 and 2035, driven by addressing complex diseases, data availability, and advancements in gene editing.

- Sustainability Trends: Sustainability trends involve minimizing the environmental footprint of R&D, addressing AI's own energy and carbon costs, and enhancing social sustainability through better access and outcomes.

- Major Investors: Major investors in the market include Eli Lilly, Novartis, Pfizer, Amgen, Bayer, Google, and NVIDIA.

- Startup Economy:The startup economy is focused on accelerating drug design, reducing timelines and cost, and focusing on AI science factories.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 260.56 Million |

| Market Size in 2026 | USD 331.91 Million |

| Market Size by 2035 | USD 2,724.15 Million |

| Growth Rate from 2026 to 2035 | CAGR of 26.45% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology and By End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of chronic disease

The prevalence of chronic diseases is increasing, including cancer, diabetes, coronary artery disease, hepatitis, arthritis, and chronic obstructive pulmonary disease (COPD). Six out of ten persons in the United States have a chronic condition, according to statistics from the CDC that was released in December 2022. Annually, 23.4 million new instances of cancer are anticipated to appear by 2030. Lung cancer is the most prevalent cancer kind that causes death in Asia-Pacific. In addition to cancer, the prevalence of several other diseases has grown over time. As a result, the increased frequency of chronic diseases is promoting the research and production of cutting-edge treatments and enhancing the use of generative AI in drug discovery.

Restraints

Validation and experimental confirmation

While generative AI models can generate potential drug candidates with desired properties, experimental validation and confirmation are essential steps in the drug discovery process. Experimental validation involves testing the generated molecules in vitro and in vivo to assess their efficacy, safety, and pharmacokinetics. The time, cost, and resources required for experimental validation pose challenges and limitations in the adoption of generative AI in drug discovery.

Opportunity

Growing collaborations among market players

The increasing collaboration in generative AI is expected to propel market growth during the forecast period. For instance, in April 2023, M2GEN, a bioinformatics oncology company with the most advanced lifetime-consented clinicogenomics recently announced a partnership to develop new cancer treatments and bring them to market with Absci Corporation, a generative AI drug creation company, To speed up the development of treatments for a variety of malignancies and patient profiles, Absci's generative AI drug creation platform will draw on M2GEN's clinical and molecular data set, ORIEN AVATAR (AVATAR), Thus, this is expected to offer a significant opportunity for market revenue growth during the forecast period.

Segment Insights

Technology Insights

Based on the technology, the global generative AI in drug discovery market is segmented into machine learning, reinforcement learning, deep learning, molecular docking and quantum computing. The deep learning segment is expected to capture a significant market share over the forecast period. Deep learning is a key technology within the generative AI in the drug discovery market. It plays a crucial role in analyzing molecular structures, predicting properties, and optimizing drug candidates. These are employed to generate novel molecules with desired properties. These algorithms learn from large datasets of chemical structures and properties to generate potential leads for drug development. Deep generative models, such as variational autoencoders (VAEs) and generative adversarial networks (GANs), are utilized to generate molecules with specific characteristics.

Moreover, these techniques are utilized for virtual screening, which involves analyzing large chemical libraries to identify molecules with high potential for activity against specific targets. Deep learning models can efficiently process and analyze molecular structures, allowing for effective screening and identification of promising compounds. Furthermore, deep learning algorithms assist in the optimization of existing drug candidates by generating novel derivatives or modifications. These algorithms learn from data on known drug candidates and their properties to generate improved versions of the molecules. Deep learning models can optimize drug candidates by predicting and optimizing properties such as efficacy, toxicity, and pharmacokinetics. Thereby, driving the segment growth during the forecast period.

End user Insights

Based on the end user, the global generative AI in drug discovery market is segmented into pharmaceutical & biotechnology companies, academic & research institutions, contract research organizations and others. The pharmaceutical & biotechnology companies segment is expected to dominate the market over the forecast period. The pharmaceutical & biotechnology companies utilize generative AI in various therapeutic areas including oncology, central nervous system disorder and infectious disease. Many pharmaceutical and biotechnology companies focus on applying generative AI in oncology drug discovery.

The ability of generative AI to generate novel molecules with desired properties, such as improved selectivity and efficacy against cancer targets, is particularly valuable in this therapeutic area. In addition, these companies also employ generative AI in the discovery and development of therapies for CNS disorders. Furthermore, generative AI also plays a role in the discovery of new antimicrobial agents and vaccines. Pharmaceutical and biotechnology companies leverage generative AI techniques to identify compounds with potential activity against infectious agents, aiding in the development of novel treatments. Therefore, the increasing utilization of generative AI in various therapeutic areas is expected to propel the segment expansion over the projected period.

Regional Insights

North America is expected to dominate the market over the forecast period. The growth in the region is owing to the prevalence of cancer. For instance, according to the American Cancer Society Journals, in 2022, 1,918,030 new cancer cases and 609,360 cancer deaths occurred in the United States. Moreover, the region has a well-established and thriving pharmaceutical industry and is home to numerous pharmaceutical companies, research institutions, and academic centers that are actively investing in AI technologies for drug discovery. These organizations recognize the potential of generative AI to enhance efficiency, reduce costs, and accelerate the drug discovery process. For instance, in May 2023, to use artificial intelligence (AI) for drug development, XtalPi partnered with US-based Eli Lilly. For the de novo creation and delivery of medication candidates for an unidentified target, the two businesses will leverage XtalPi's integrated robotics platform and AI capabilities.

The partnership will use an AI drug discovery tool to build a new chemical that Lilly will pursue through both clinical and commercial development. Furthermore, regulatory agencies in North America, such as the U.S. Food and Drug Administration (FDA) and Health Canada, have shown a willingness to embrace and support innovative technologies in drug discovery. They have recognized the potential of generative AI to improve the efficiency and success rate of drug development, leading to a favorable regulatory environment for the adoption of generative AI in the region. Thus, this is expected to drive the market growth in the region.

U.S. Generative AI in Drug Discovery Market Trends

U.S. shifted toward de novo molecule design and personalized medicine, significantly accelerating treatments for rare diseases. Consequently, strategic partnerships between tech giants and pharmaceutical leaders have moved from experimental phases to high-velocity, production-scale drug pipelines.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The regional growth is owing to the growing pharmaceutical industry along with the growing prevalence of cancer. The region has a rapidly expanding pharmaceutical industry, driven by factors such as increasing healthcare expenditures, a large patient population, and a rising demand for innovative therapies. The adoption of generative AI in drug discovery offers an opportunity to accelerate the development of new drugs and address unmet medical needs in the region.

China Generative AI in Drug Discovery Market Trends

China is rapidly emerging as a global leader in AI-driven drug discovery, propelled by a strong national strategy that prioritizes healthcare innovation and fosters investment hubs. The nation's leadership in generative AI patents underscores a robust R&D ecosystem, which has attracted significant validation through major international partnerships with global pharmaceutical giants.

How did Europe experience the notable growth in the Generative AI in Drug Discovery Market?

Europe's AI drug discovery sector is flourishing within a framework of innovation and strict governance, led by research powerhouses in the UK and Germany. The focus on "Ethical AI" aligns with the EU AI Act to ensure data quality and patient safety in personalized medicine.

Germany Generative AI in Drug Discovery Market Trends

Germany's accelerated and cost-effective research and development, focus on specific therapeutic areas, and AI is used to automate administrative and regulatory tasks, and integration of deep learning techniques, variational autoencoders, and generative adversarial networks.

Top Companies in the Generative AI in Drug Discovery Market & Their Offerings

- Insilico Medicine applies generative adversarial networks (GANs) to discover novel disease targets and design new drug molecules for those targets, significantly accelerating the early stages of drug development.

- Atomwise Inc. leverages deep learning to predict how small molecules will interact with proteins, using these predictions to identify potential new medicines and their therapeutic uses.

- BenevolentAI utilizes AI models to analyze vast biomedical data, proposing new drug targets and identifying existing drugs that can be repurposed for new treatments.

- XtalPi Inc. combines quantum physics, AI, and cloud computing to accurately predict the physicochemical properties of small-molecule drugs, streamlining the often-complex solid-form selection process in R&D.

- Numerate Inc. employed an AI-driven platform to rapidly evaluate and design novel drug candidates by predicting their biological activity and safety profiles, though it has since ceased operations.

- Cyclica Inc. uses a deep learning-based integrated platform to analyze how potential drug molecules interact with multiple proteins simultaneously, helping scientists predict a compound's efficacy and potential off-target side effects early in development.

Other Generative AI in Drug Discovery Market Companies

- BioSymetrics

- Variational AI Inc.

- Merck KGaA

- NVIDIA

Recent Development

- In March 2023, Mitsui & Co Ltd., a Japanese corporate giant announced their partnership with NVIDIA on Tokyo 1 to support the nation's pharmaceutical sector with technologies with generative AI models for drug development.

- In June 2023, University of Toronto, Foxconn and Insilico Medicine collaborated on a research study that aims to explore the utilization of hybrid quantum-classical generative adversarial networks for small molecule discovery. The small molecules developed with this technology are expected to be with better qualities than those of pure classical GANs.

- In May 2023, Google Cloud released two new AI-powered tools to assist pharmaceutical and biotech industries to accelerate their drug development and precision medicine production process. The tools are made to help businesses in forecasting protein structure, a crucial aspect of medication research.

Segments Covered in the Report

By Technology

- Machine Learning

- Reinforcement Learning

- Deep Learning

- Molecular Docking

- Quantum Computing

By End User

- Pharmaceutical & Biotechnology Company

- Academic & Research Institution

- Contract Research Organizations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting