What is the Generative AI in Insurance Market Size?

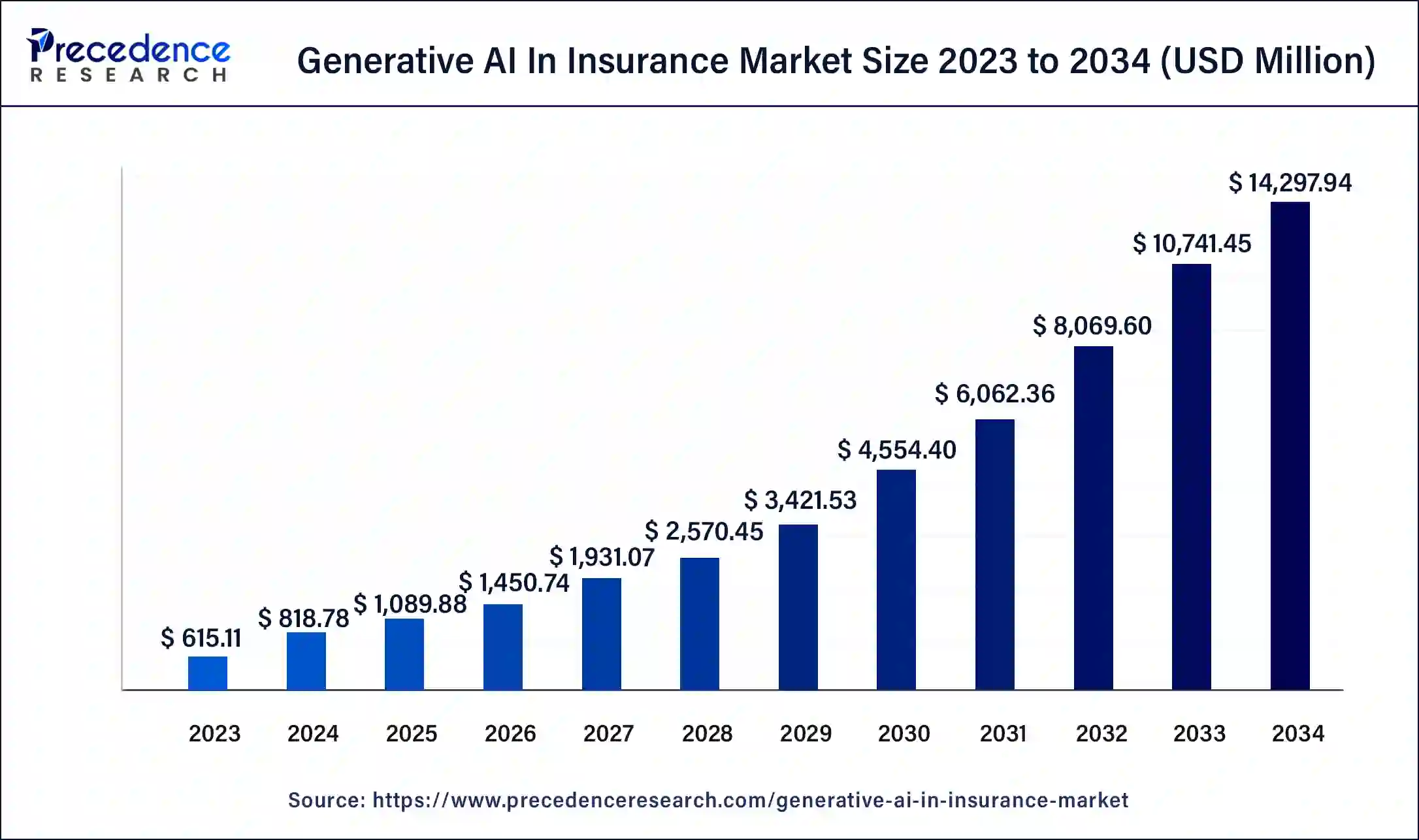

The global generative AI in insurance market size accounted at USD 1.09 billion in 2025 and is predicted to increase from USD 1.45 billion in 2026 to approximately USD 17.27 billion by 2035, at a CAGR of 31.82% from 2026 to 2035.

Generative AI In Insurance Market Key Takeaways

- In terms of revenue, the generative AI in insurance market is valued at $1.09 billion in 2025.

- It is projected to reach $17.27billion by 2035.

- The generative AI in insurance market is expected to grow at a CAGR of 31.82% from 2026 to 2035.

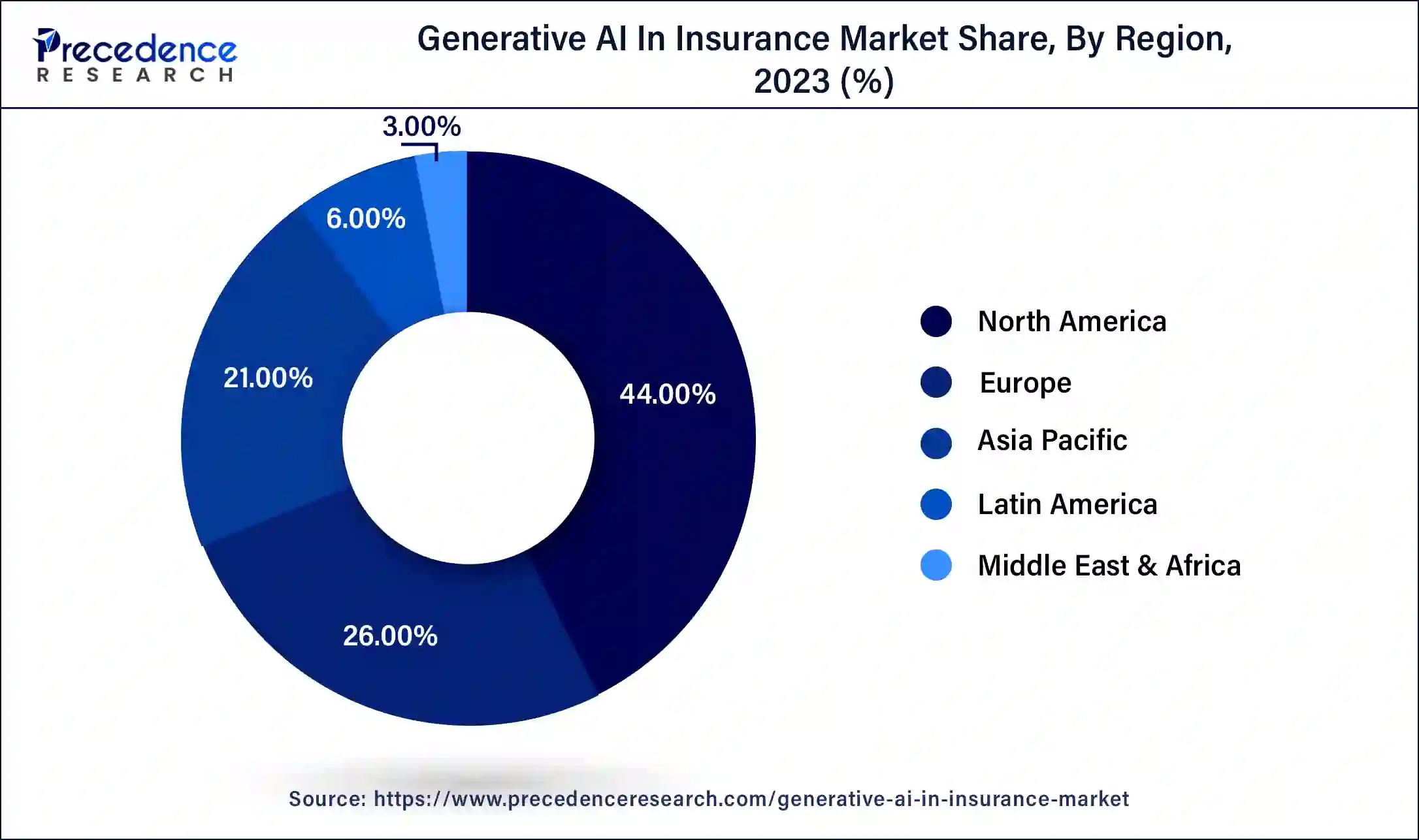

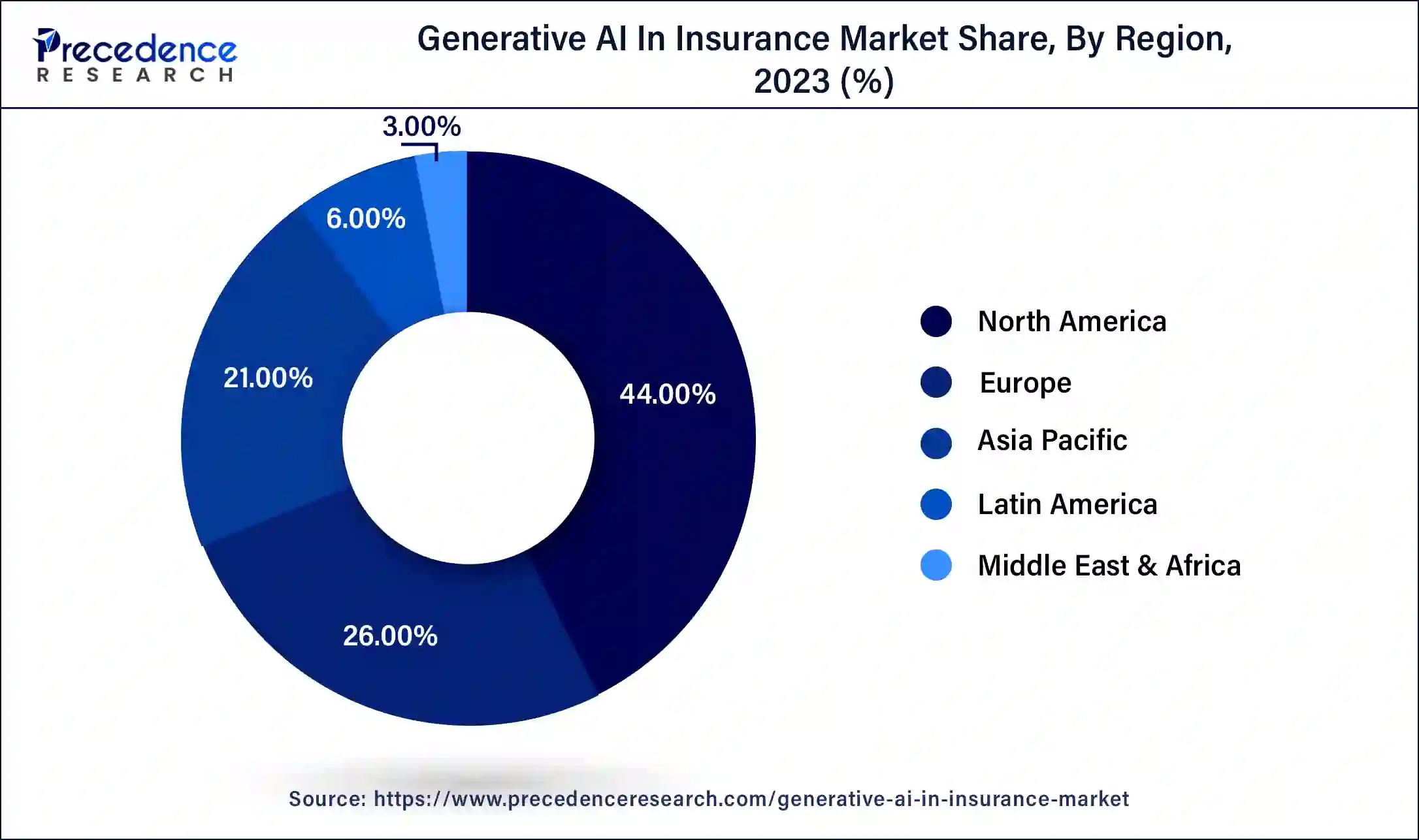

- North America dominated the market with the largest market share of 44% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR from 2026 to 2035.

- By deployment, the cloud segment is expected to hold the largest share of the market during the forecast period.

- By technology, the machine learning segment dominated the market with the highest market share in 2025.

- The natural language processing segment is expected to grow at a significant rate during the predicted timeframe.

- By application, fraud detection and credit analysis segment dominated the market with the largest market share in 2025.

What is Generative AI in Insurance?

Generative AI is the term used to describe a system with artificial intelligence that can analyze data and generate relative content in various forms to manage operations and enhance efficiency. It is able to provide pre-determined replies due to models that identify, map, and build meaning from patterns within the data inputs. The science behind the technology analyzes data from enormous datasets, gains expertise from past performance, and improves performance even with unorganized and unstructured data. Today, every sector of the economy is riding the success and efficiency of generative AI. Generative AI is observed to be useful for financial organizations, such as insurance companies, it helps the organization to understand the behavior of the clients. Generative AI helps to improve the services and products of the firm by analyzing consumer behavior and data.

Generative AI In Insurance Market Growth Factors

Generative AI is the latest emerging technology across the world. Generative AI is evolving in many industries such as automobiles, pharmaceuticals, telecommunication, etc., one in which generative AI is emerging in the field of insurance. Generative AI has the latest prospects in the insurance sector. Generative AI helps the process of insurance such as marketing and distribution, strategy and product design, pricing and underwriting the claims, and operations and governance. Generative AI can provide new efficiencies that can enhance the solution to transform the insurance business model. Generative AI can provide great services and insights to the customers of insurance companies. Considering such advantages of generative AI along with a substantial expansion of the finance and insurance sector, the market is anticipated to grow at a significant rate.

Generative AI provides better assistance to companies to improve their services and a better understanding of their clients. Generative AI combines the customers' information and generates customized solutions according to the need and requirements of the clients and enhances customer satisfaction. Considering another growth factor for the insurance sector, generative AI is expected to help in automating the task, providing ease in the claim process. These factors collectively would drive the growth of generative AI in the insurance market.

The Future of Artificial Intelligence in the Insurance Market: Innovations and Expanding Demand

The future of artificial intelligence in the insurance market is exciting and likely to grow at a rapid rate as transfer learning and generative AI are advancing rapidly. Recent technologies have enabled insurers to reduce time spent on claims processing, enhance fraud detection, and provide fully personalized policies. As their models become increasingly sophisticated, insurers can leverage AI for timely risk analysis, automated underwriting, and more natural engagement; all real-time engagement initiatives will add value to the consolidated AI innovations we believe have unlimited potential for insurers.

Market Outlook

- Industry Growth Overview: Generative AI in the insurance market is experiencing significant growth, driven by the fact that generative AI has the power to revolutionize the insurance industry by growing operational efficacy and creating innovation opportunities.

- Global Expansion: The generative AI in the insurance market expanded globally because generative AI-driven technology has the strength to quicken the digitization of insurance technology and outweigh the challenges. North America is dominant in the market due to the presence of supportive regulations and early adoption of progressive technology.

- Major investors: Major investors in generative AI in the insurance market include both large venture capital (VC) organizations and the corporate venture arms of reputable insurance companies. It includes SoftBank Vision Fund and Andreessen Horowitz.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.09 Billion |

| Market Size in 2026 | USD 1.45 Billion |

| Market Size by 2035 | USD 17.27 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 31.82% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Deployment, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Management of huge data

Insurance underwriting and other major responsibilities in the insurance field used to primarily rely on staff to analyze previous data and draw informed judgments. By providing machine learning algorithms that compile and make sense of vast quantities of data, intelligent process automation streamlines the underwriting procedure. Another area where generative AI is predicted to improve is by lowering the efforts of human agents in the insurance sector to lower risks and deliver value services to customers. Such algorithms are also capable of working with chaotic systems, processes, and workflows. One of the most prevalent applications of artificial intelligence in the insurance industry is to manage a large amount of unstructured data. In addition, generative AI improves rule speed, manages straight-through acceptance (STA) rates, and prevents application errors. All these factors are expected to contribute to the growth of generative AI in the insurance market.

Restraint

Expensive technology

Due to the necessary computational resources, generative AI technology may become costly and complicated to get transformed into. Enterprises may also encounter new difficulties when integrating generative AI with their existing technological infrastructures. IT executives or skilled personnel are required to choose whether to completely replace the old system or just integrate the new technology with it, which puts an additional cost on the companies. Considering the complications caused by the cost factor, the higher operational costs are likely to hamper the growth of the market. To address this restraint insurance companies will thus probably soon embrace generative AI using cloud APIs with little customization, this element is expected to lower the cost of transformation slightly as compared to the transformation into on-premises.

Opportunity

Digitization of insurance distribution

In the pre-digital era, clients or consumers used to prefer direct interaction with a financial advisor or visit a local provider to learn about coverage options. There would frequently be a dominant carrier for a certain product in a niche market. The carrier would perform underwriting activities and provide an insurance plan depending on the information the consumer provided while considering the client's requirements. This situation is currently reversed by digitalized insurance distribution techniques. Nowadays, practically every carrier has a website where clients may browse the available goods and services before making a decision. The insurance sector was significantly transformed as a result of this shift in customer behavior.

Generative AI has the potential to completely transform the sales and distribution phase of the insurance value chain by applying state-of-the-art AI algorithms that are already available. Algorithms of generative AI can reduce the intervention of human agents by analyzing data collected from consumers to generate a precise and unbiased insurance plan/service. This can reduce the time taken for the decision-making process and will also enhance the productivity of the operator. Thus, the rising shift towards digitization in the insurance distribution process is expected to open a plethora of opportunities for generative AI in the insurance market.

Segment Insights

Deployment Insights

The cloud segment dominated the market with the highest market share in 2024. The growth of the segment is attributed to the increasing use of cloud-based solutions by operators in the overall BFSI sector across the globe. Insurance companies are well-positioned to advance due to cloud-integrated products and AI-assisted client data collecting. The cloud enables insurers to collect client information for a comprehensive understanding of behavior, preferences, and risk level. Generative AI converts the data into useful insights that decision-makers at all levels, from agents to executives, may employ. Insurance companies can provide more individualized or personalized client experiences while making the best decisions along the whole value chain, from underwriting to the creation of new products with the help of cloud-based deployment that offers precise scalability and adaptability.

Technology Insights

The machine learning segment dominated the market with the largest market revenue in2024, the segment will continue to witness a significant growth rate during the forecast period. In the past few decades, cutting-edge technologies such as machine learning have been the most extensively adopted trend. Simply because of the operational advantages that businesses may get for their value chain, they have been embraced by the majority of firms across all industries. One sector that has benefited greatly from incorporating machine learning into its operations is the insurance sector.

Automating routine daily tasks and improving workflows are both possible with machine learning in the insurance industry. Additionally, these technologies may assist businesses in analyzing and using a wealth of consumer data to make smarter decisions and provide more lucrative and individualized insurance plans to their clients. Generative AI, when used by the technology of machine learning is capable of generating content in the form of text, images and even videos. This capability of machine learning offers unbiased outputs taken from original datasets.

Application Insights

The fraud detection and credit analysis segment dominated the market with the largest market share in2024. The growth of the segment is arising due to the increasing ratio of cybercrimes in insurance companies. Generative AI is capable of helping insurance company operators by detecting fraud by several software like SAS. SAS is software which provides predictive analysis to insurance companies to help them to detect the fraud process or unauthorized activities taking place. The predictive analysis process specifically helps health insurance companies to detect the fraud claim of insurance.

The generative AI algorithms analyze the discern data points and relate with the previous fraud attempts. An increasing number of financial fraud results in the higher demand of generative AI for fraud detection in the insurance market. On the other hand, generative AI chatbots are capable of analyzing the history of credit score for consumers to generate a precise service from the available insurance services.

Regional Insights

What is the U.S. Generative AI In Insurance Market Size?

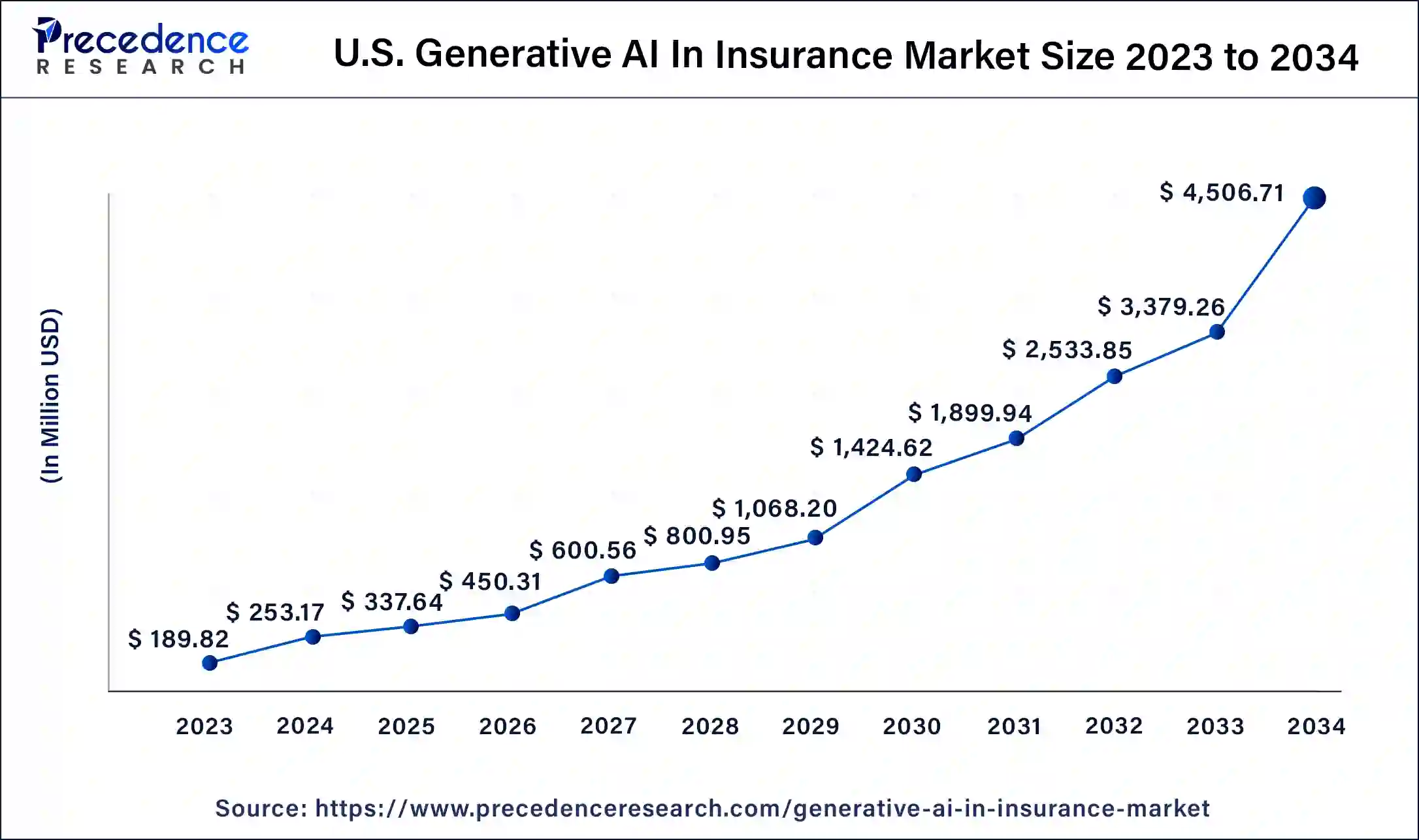

The U.S. generative AI in insurance market size was estimated at USD 337.64 million in 2025 and is predicted to be worth around USD 5,446.13 million by 2035, at a CAGR of 32.06% from 2026 to 2035.

Rising Number of Individual Policyholders to Boost Utilization of Gen AI in Insurance

North America dominated the market with the largest market size in 2024, the region is expected to maintain its dominance throughout the forecast period. The growth of the region is attributed to the presence of leading insurance companies in the region. The United States had the largest market in the insurance sector for the year 2024, the country will continue to contribute the largest share for the market in the upcoming years followed by Canada. In the United States, the insurance sector is led by Prudential Financial, MetLife, and Berkshire Hathaway. Health Insurance is the ever-expanding part of the insurance sector. The rising number of individual policyholders and emphasis on providing quicker services for consumers to stay competitive in the industry by insurance carriers promote the market's growth in North America.

U.S. Generative AI in the Insurance Market Trends

Artificial intelligence technology in insurance is an attractive, high-stakes, highly concentrated race dominated by a handful of U.S. carriers. Also, increasing interest and spending in generative AI, and insurance organizations use generative AI to reinvent their strategy to offer consumer service and create novel products, which drives the growth of the market.

Growing Population Fueling Demand for Gen AI in Insurance Operations

Asia Pacific is expected to register the fastest rate of growth during the predicted timeframe. The growth of the region is attributed to the rising population and increasing need for the protection of lives and the availability of cost-effective products or services for insurance. The rapid growth in the middle-class population across the region will directly propel the demand for the insurance plans in the region, the rise consumer base will subsequently promote the adoption of advanced generative solutions from the insurance company operators. The ageing population is fueling the demand for health insurance and related products in the Asia Pacific.

The potential to adopt advanced services for enhancing the operational efficiency of industries in countries of Asia Pacific highlights the growth of generative AI in the insurance market for the region. The growing risk of cybercrimes in the region also highlights the demand for effective risk management solutions. Moreover, substantial government support for the utilization of generative AI-based services in multiple industries is observed to supplement the growth of the market in Asia Pacific.

India Generative AI in the Insurance Market Trends

In India, the rising applications of generative AI are increasing operational efficacy, creating novel innovation opportunities, and deepening consumer relationships. India's exceptional response to Generative AI (GenAI), with 93 % of students and 83 % of employees aggressively engaging with the technology. GenAI has transformed the strategies and future of work, which drives the growth of the market.

Increasing Adoption of Generative AI in Insurance

Europe is expected to grow significantly in the generative AI in insurance market during the forecast period. The growing digitalization in Europe is increasing the adoption of generative AI in insurance. The increasing investments are also accelerating their development in compliance with the regulatory guidelines. Moreover, the government is also providing its support by investing in their development. Thus, this promotes the market growth.

The UK Generative AI in the Insurance Market Trends

UK insurers are experimenting with generative AI to tackle practical questions and assess challenges. Generative AI is materializing in additional targeted regions in the insurers' organisations and target operating models. Growing government support, such as in June 2025, the UK Financial Conduct Authority (FCA) announced the launch of its Supercharged Sandbox, developed in partnership with NVIDIA, as part of its AI Lab and in line with the FCA's approaches to foster economic growth.

Generative AI in Insurance Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Strong financial strength and massive |

In November 2025, Microsoft introduced Agent 365 as a novel control environment for building, deploying, and managing AI-driven agents in Microsoft 365, Azure, and Windows. |

|

|

United States |

Extensive global infrastructure and strong portfolio of services |

AWS delivers the most inclusive set of generative AI-driven capabilities and industry-leading foundation models for medical care and life sciences companies. |

|

|

IBM Corporation |

United States |

Strong brand reputation and global reach |

In November 2025, IBM and Unipol Assicurazioni, Europe's largest insurance group and leader in Italy in the non-life sector, are reintroducing their partnership to support the Company's digital transformation. |

|

Avaamo Inc |

United States |

Advanced voice AI capabilities |

In July 2025, Avaamo announced the launch of Avaamo Ambient, Outpatient Orders, a novel feature that automatically generates actionable orders in the electronic health record (EHR) systems based on real-time analysis of healthcare conversations. |

|

Cape Analytics LLC |

United States |

Actionable and predictive insights |

In January 2025, Moody's Corp. agreed to acquire CAPE Analytics, which offers geospatial AI intelligence for residential and commercial characteristics. |

Other Major Key Players

- MetLife

- Prudential Financial

- Wipro Limited

- ZhongAn

- Acko General Insurance

Recent Developments

- In May 2025, the Q1 2025 earnings report was released by Amazon.com Inc. A total of $155.7 billion was reported, which reflected a 10% year-over-year increase in revenue, where the foreign exchange rates were excluded. A strong financial performance was observed, where a 20% rise in year-over-year to $18.4 billion was noted for operating income. Moreover, a 17% increase in year-over-year revenue to $117 billion was reported for Amazon Web Services (AWS). Additionally, rather than any other quarter, several items were delivered on the same or the next day by the company, setting a new record in its history. Furthermore, strong growth was reported by Amazon's advertising revenue segment, as it showed 19% year-over-year growth, reaching $13.9 billion.

- In February 2025, the full-year 2024 results were released by MetLife, where the $4.2 billion net income and $5.94 net income per share were reported, reflecting growth compared to 2023. $5.8 billion and $8.15 billion were the reported adjusted earnings and adjusted earnings per share, respectively. The book value and adjusted book value were noted as $34.28 and $54.81 per share, respectively. Similarly, the 16.9% return on equity (ROE) and 15.2% adjusted ROE were reported. Furthermore, the target cash buffer of $3.0 - $4.0 billion was exceeded, where the holding company showed $5.1 billion in cash and liquid assets.

- In March 2025, Helport AI Limited, an AI technology company serving enterprise clients with intelligent customer communication software and services, announced the official launch of the latest upgraded version of Helport AI Insurance Edition, an AI-powered solution designed specifically for the insurance sector. The AI-powered platform is designed to improve policy recommendations, enhance operational efficiency, and provide real-time compliance monitoring, ultimately aiming to transform how insurance agencies interact with customers. (Source:https://www.globenewswire.com)

- In March 2025, Singlife, a leading homegrown financial services company, launched a generative artificial intelligence (AI) tool with Oracle Cloud Infrastructure (OCI) services. The AI tool aims to provide Singlife's financial advisors with real-time product information to enable them to serve their customers more efficiently. Singlife's financial advisors are able to leverage generative AI to automate the information search for all Singlife insurance products. This enables Singlife's financial advisors to quickly and efficiently respond to customer queries. (Source: https://www.oracle.com)

- In February 2025, Waterdrop Inc., a leading technology platform specializing in insurance and healthcare services with a positive social impact, announced its strategic integration of DeepSeek, marking a significant step forward in its AI-driven insurance ecosystem. The collaboration is to accelerate the Company's business growth, enabling innovative breakthroughs in the application of large-scale AI models across specialized insurance setups. (Source: https://ffnews.com)

- In June 2023, the CEO of InsuredMine and founder of PLANO Texas, United States Rustion Jaiswal announced the launch of its new AI features for the CRM's users. The team continuously works in improving and innovating the insurance CRM. The platform's built-in AI Text service allows agencies and agents to create compelling text content for text messages, emails, and campaigns effortlessly.

- In June 2023, Margalit Startup and Jerusalem Venture Partners announced the launch of a “ClimateTech insurance” partnership between New Zealand's largest general insurer IAG Firemark Venture and the corporate venture of Australia comes in collaboration to develop new technologies that could measure and mitigate the climate change risk.

Regional Insights

What is the U.S. Generative AI In Insurance Market Size?

The U.S. generative AI in insurance market size was estimated at USD 337.64 million in 2025 and is predicted to be worth around USD 5,446.13 million by 2035, at a CAGR of 32.06% from 2026 to 2035.

North America dominated the market with the largest market size in 2024, the region is expected to maintain its dominance throughout the forecast period. The growth of the region is attributed to the presence of leading insurance companies in the region. The United States had the largest market in the insurance sector for the year 2024, the country will continue to contribute the largest share for the market in the upcoming years followed by Canada. In the United States, the insurance sector is led by Prudential Financial, MetLife, and Berkshire Hathaway. Health Insurance is the ever-expanding part of the insurance sector. The rising number of individual policyholders and emphasis on providing quicker services for consumers to stay competitive in the industry by insurance carriers promote the market's growth in North America.

Asia Pacific is expected to register the fastest rate of growth during the predicted timeframe. The growth of the region is attributed to the rising population and increasing need for the protection of lives and the availability of cost-effective products or services for insurance. The rapid growth in the middle-class population across the region will directly propel the demand for the insurance plans in the region, the rise consumer base will subsequently promote the adoption of advanced generative solutions from the insurance company operators. The ageing population is fueling the demand for health insurance and related products in the Asia Pacific.

The potential to adopt advanced services for enhancing the operational efficiency of industries in countries of Asia Pacific highlights the growth of generative AI in the insurance market for the region. The growing risk of cybercrimes in the region also highlights the demand for effective risk management solutions. Moreover, substantial government support for the utilization of generative AI-based services in multiple industries is observed to supplement the growth of the market in Asia Pacific.

Europe is expected to grow significantly in the generative AI in insurance market during the forecast period. The growing digitalization in Europe is increasing the adoption of generative AI in insurance. The increasing investments are also accelerating their development in compliance with the regulatory guidelines. Moreover, the government is also providing its support by investing in their development. Thus, this promotes the market growth.

Segments Covered in the Report

By Deployment

- Cloud-based

- On-premise

By Technology

- Machine Learning

- Natural Language Processing

By Application

- Fraud Detection and Credit Analysis

- Customer Profiling and Segmentation

- Product and Policy Design

- Underwriting and Claims Assessment

- Chatbots

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting